Professional Documents

Culture Documents

Rastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09

Rastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09

Uploaded by

gonenp10 ratings0% found this document useful (0 votes)

33 views1 pageRastriya Banijya Bank Limited reported its unaudited financial results for the first quarter of the fiscal year 2008-09. Some key highlights include:

- Total capital and liabilities were Rs. 70,559,035 thousand as of the end of the quarter, an increase from Rs. 60,163,727 thousand in the previous quarter.

- Deposits decreased slightly to Rs. 56,747,143 thousand from Rs. 57,970,844 thousand in the previous quarter.

- Net profit for the quarter was Rs. 374,332 thousand, higher than the Rs. 162,848 thousand profit reported in the corresponding quarter of the previous year.

- The ratio

Original Description:

Original Title

2065-1e

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRastriya Banijya Bank Limited reported its unaudited financial results for the first quarter of the fiscal year 2008-09. Some key highlights include:

- Total capital and liabilities were Rs. 70,559,035 thousand as of the end of the quarter, an increase from Rs. 60,163,727 thousand in the previous quarter.

- Deposits decreased slightly to Rs. 56,747,143 thousand from Rs. 57,970,844 thousand in the previous quarter.

- Net profit for the quarter was Rs. 374,332 thousand, higher than the Rs. 162,848 thousand profit reported in the corresponding quarter of the previous year.

- The ratio

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

33 views1 pageRastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09

Rastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09

Uploaded by

gonenp1Rastriya Banijya Bank Limited reported its unaudited financial results for the first quarter of the fiscal year 2008-09. Some key highlights include:

- Total capital and liabilities were Rs. 70,559,035 thousand as of the end of the quarter, an increase from Rs. 60,163,727 thousand in the previous quarter.

- Deposits decreased slightly to Rs. 56,747,143 thousand from Rs. 57,970,844 thousand in the previous quarter.

- Net profit for the quarter was Rs. 374,332 thousand, higher than the Rs. 162,848 thousand profit reported in the corresponding quarter of the previous year.

- The ratio

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

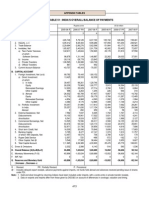

RASTRIYA BANIJYA BANK LIMITED

SINGHDURBAR PLAZA, KATHMANDU

UNAUDITED FINANCIAL RESULTS (QUARTERLY)

AS AT 1ST QUARTER OF FISCAL YEAR 2008-09

Rs. In '000

PREVIOUS YEAR

PREVIOUS

S.N. Particulars THIS QUARTER CORRESPONDIN

QUARTER

G QUARTER

1. Total Capital and Liabilities (1.1 to 1.7) 70,559,035 60,163,727 58,578,578

1.1 Paid Up Capital 1,172,300 1,172,300 1,172,300

1.2 Reserve and Surplus (16,304,311) (16,678,617) (18,233,557)

1.3 Debenture and bond - - -

1.4 Borrowings 2,638,760 2,517,009 2,204,284

1.5 Deposits(a+b) 56,747,143 57,970,844 53,192,811

a. Domestic Currency 56,450,881 57,000,764 52,016,977

b. Foreign Currency 296,262 970,080 1,175,834

1.6 Income Tax Liabilities - - -

1.7 Other Liabilities 26,305,143 15,182,192 20,242,739

2

2. Total Assets (2

(2.1

1 to 22.7)

7) 70 559 035

70,559,035 60 163 727

60,163,727 58 578 578

58,578,578

2.1 Cash and Bank Balance 8,748,837 9,269,348 5,958,379

2.2 Money at Call and Short Notice 2,130,000 550,000 950,000

2.3 Investment 17,179,841 14,543,141 13,972,030

2.4 Loan and Advances 26,758,536 27,524,922 23,936,918

2.5 Fixed Assets 759,176 756,832 715,874

2.6 Non Banking Assets 303,303 305,920 311,942

2.7 Other Assets 14,679,342 7,213,564 12,733,437

3. Profit and Loss Account UPTO PREVIOUS

UP TO THIS UPTO PREVIOUS YEAR

QUARTER QUARTER CORRESPONDIN

G QUARTER

3.1 Interest Income 606,661 2,703,846 527,861

3.2 Interest Expense 223,037 1,019,340 205,283

A. Net interest Income (3.1-3.2) 383,625 1,684,506 322,578

3.3 Fees, Commission and Discount 85,914 393,072 82,104

3.4 Other Operating Income 25,609 155,514 33,768

3.5 Foreign Exchange Gain/Loss (Net) 87,450 17,637 7,037

B. Total Operating Income (A.+3.3+3.4+3.5) 582,599 2,250,728 445,487

3 6 St

3.6 Staff

ff E

Expenses 247

247,220

220 872

872,093

093 235,017

235 017

3.7 Other Operating Expenses 66,872 338,706 76,624

C. Operating Profit Before Provision (B.-3.6-3.7) 268,506 1,039,929 133,846

3.8 Provision for Possible Losses 66,843 428,137 -

D. Operating Profit (C.-3.8) 201,664 611,792 133,846

3.9 Non Operating Income/Expenses (Net) 4,040 13,872 1,387

3.10 Write Back Provision for Possible Loss 101,895 1,134,516 39,256

E. Profit from Regular Activities (D+3.9+3.10) 307,599 1,760,180 174,489

3.11 Extraordinary Income/ Expenses (Net) 66,733 152,018 (11,640)

F. Profit before Bonus and Taxes ((E.+3.11)) ,

374,332 , ,

1,912,198 ,

162,848

3.1 Provision for Staff Bonus - 141,644 -

3.1 Provision for Tax - - -

G. Net Profit/Loss (F.-3.12-3.13) 374,332 1,770,554 162,848

PREVIOUS YEAR

PREVIOUS

4. Ratios THIS QUARTER CORRESPONDIN

QUARTER

G QUARTER

4.1 Capital Fund to RWA -25.20% -36.56% -39.93%

4.2 Non Performing Loan (NPL) To Total Loan 21.58% 21.63% 28.56%

4.3 Total Loan Loss Provision to Total NPL 113.87% 111.62% 114.83%

You might also like

- Merger of Banks - BLACK BOOK 158Document56 pagesMerger of Banks - BLACK BOOK 158AJ-ay SH-ah100% (5)

- Love Verma Ceres Gardening SubmissionDocument8 pagesLove Verma Ceres Gardening Submissionlove vermaNo ratings yet

- Huerta Alba Resort V CADocument2 pagesHuerta Alba Resort V CAsinisteredgirl100% (1)

- Writing Samples Summit 1 I5-I8Document8 pagesWriting Samples Summit 1 I5-I8modelcp100% (1)

- Letter of Credit TemplateDocument3 pagesLetter of Credit TemplateAnis Inayah100% (1)

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly) ProvisionalDocument3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly) ProvisionalaNo ratings yet

- Unaudited Financial Results (Quarterly) : CF J @) &&÷& SF) T) F) Q) DFL S ljj/0fDocument1 pageUnaudited Financial Results (Quarterly) : CF J @) &&÷& SF) T) F) Q) DFL S ljj/0fjth55936zwohocomNo ratings yet

- Unaudited Financial Results (Quarterly)Document1 pageUnaudited Financial Results (Quarterly)Rubin PoudelNo ratings yet

- Ashwin 2070Document2 pagesAshwin 2070nayanghimireNo ratings yet

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly)Document3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly)sanjiv sahNo ratings yet

- Audited - Balance - Sheet - of Integrated PheripheralsDocument6 pagesAudited - Balance - Sheet - of Integrated PheripheralsP VENKATA HARSHA VARDHAN REDDYNo ratings yet

- 4th-Quarter-report-FY-2079-80 (2)Document1 page4th-Quarter-report-FY-2079-80 (2)laapulgamessi103010No ratings yet

- Q4-Ashadh-Document31 pagesQ4-Ashadh-r56408456No ratings yet

- NCC Urban May Fair - Financial Statements - Dec 31, 2023Document5 pagesNCC Urban May Fair - Financial Statements - Dec 31, 2023sri rajani swarna lathaNo ratings yet

- ' in LakhsDocument53 pages' in LakhsParthNo ratings yet

- 91invuf 2Document1 page91invuf 2Mahamadali DesaiNo ratings yet

- Title Design Final - CDR AkDocument9 pagesTitle Design Final - CDR AkLeo SaimNo ratings yet

- Appendix Table 8: India'S Overall Balance of PaymentsDocument1 pageAppendix Table 8: India'S Overall Balance of PaymentsPandu PrasadNo ratings yet

- Trade and PaymentsDocument17 pagesTrade and PaymentsmazamniaziNo ratings yet

- UBL Annual Report 2018-129Document1 pageUBL Annual Report 2018-129IFRS LabNo ratings yet

- Mahindra & Mahindra Limited: Rs. in CroresDocument4 pagesMahindra & Mahindra Limited: Rs. in CroresGeorge Chalissery RajuNo ratings yet

- The Bank of Punjab: Interim Condensed Balance Sheet As at September 30, 2008Document13 pagesThe Bank of Punjab: Interim Condensed Balance Sheet As at September 30, 2008Javed MuhammadNo ratings yet

- 1609913324.QCI Financials FY 2019-20 Final SignedDocument14 pages1609913324.QCI Financials FY 2019-20 Final SignedHari OmNo ratings yet

- Income StatementDocument3 pagesIncome StatementcenterwabeNo ratings yet

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Document13 pagesIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89No ratings yet

- 1st Qtr.2021 ReportDocument31 pages1st Qtr.2021 ReportMurad HasanNo ratings yet

- Rafiki MFB Audited Financials FY 2022 31.03.2023Document1 pageRafiki MFB Audited Financials FY 2022 31.03.2023EdwinNo ratings yet

- Bop PDFDocument1 pageBop PDFLoknadh ReddyNo ratings yet

- 63 Moon Q3 ResultsDocument16 pages63 Moon Q3 Resultsdownloads.xaNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- Reg30LODR QFR LRReport 31dec2020 WebsiteDocument15 pagesReg30LODR QFR LRReport 31dec2020 WebsiteAnveshNo ratings yet

- No. 42: India's Overall Balance of Payments: Current StatisticsDocument6 pagesNo. 42: India's Overall Balance of Payments: Current StatisticsReuben RichardNo ratings yet

- Britannia Annual Report 2007-2008: Balance SheetDocument10 pagesBritannia Annual Report 2007-2008: Balance Sheet22165228No ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadNo ratings yet

- Interim Financial Statement Fourth Quarter1628837418Document34 pagesInterim Financial Statement Fourth Quarter1628837418Apex BasnetNo ratings yet

- Fauji Food 30 June 2023Document3 pagesFauji Food 30 June 2023mrordinaryNo ratings yet

- Consolidated Financial Statements of ICICI Bank Limited and Its SubsidiariesDocument56 pagesConsolidated Financial Statements of ICICI Bank Limited and Its SubsidiariesKartikeya Shedhani VijayvargiyaNo ratings yet

- NIB Financial Statements 2017Document12 pagesNIB Financial Statements 2017rahim Abbas aliNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Audited Financials Dec 2022Document1 pageAudited Financials Dec 2022EdwinNo ratings yet

- Chapter 5Document12 pagesChapter 5Arjun Singh ANo ratings yet

- 547 Abr 0000000083Document6 pages547 Abr 0000000083BERNACRIS REYESNo ratings yet

- BANK BUMI ARTHA - LFR DES2022 (Audited)Document114 pagesBANK BUMI ARTHA - LFR DES2022 (Audited)wendy.indraNo ratings yet

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Document13 pagesSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimNo ratings yet

- FR 09112023Document10 pagesFR 09112023vikramgandhi89No ratings yet

- Capital Alliance PLC: Interim Financial StatementsDocument10 pagesCapital Alliance PLC: Interim Financial Statementskasun witharanaNo ratings yet

- Interim Financial Statements - English q2Document12 pagesInterim Financial Statements - English q2yanaNo ratings yet

- Axis Bank - AR21 - Consolidated Financial StatementsDocument48 pagesAxis Bank - AR21 - Consolidated Financial StatementsRakeshNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Ifii 2017Document53 pagesIfii 2017Gracellyn AlexaNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- JM Financial: L Indi N L 1 LDocument9 pagesJM Financial: L Indi N L 1 LPiyush LuthraNo ratings yet

- BSRM Steels Limited Balance Sheet (Unaudited)Document4 pagesBSRM Steels Limited Balance Sheet (Unaudited)azadbdNo ratings yet

- 31 March 2020Document8 pages31 March 2020lojanbabunNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Audited Financial Results For The Quarter and Financial Year Ended 31st March 2021Document12 pagesAudited Financial Results For The Quarter and Financial Year Ended 31st March 2021Abhilash ABNo ratings yet

- Financial Statement For The FY 2023 2024 BudgetDocument5 pagesFinancial Statement For The FY 2023 2024 BudgetkarthanzewNo ratings yet

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDocument7 pagesSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaNo ratings yet

- Q4 - Interim Financial StatementsDocument20 pagesQ4 - Interim Financial Statementsshresthanikhil078No ratings yet

- PICT Accounts 2018-2019Document8 pagesPICT Accounts 2018-2019Ibrahim SamiNo ratings yet

- I Fitness Venture StandaloneDocument15 pagesI Fitness Venture StandaloneThe keyboard PlayerNo ratings yet

- 15.401 Recitation 15.401 Recitation: 1: Present ValueDocument18 pages15.401 Recitation 15.401 Recitation: 1: Present ValueDahagam SaumithNo ratings yet

- Housing Development Finance Corporation Limited or HDFC Is An IndianDocument33 pagesHousing Development Finance Corporation Limited or HDFC Is An IndianPari ShahNo ratings yet

- Balance Sheet of Cadbury IndiaDocument1 pageBalance Sheet of Cadbury IndiaNiks Dujaniya100% (1)

- Sotu 2012Document15 pagesSotu 2012Peggy W SatterfieldNo ratings yet

- Notes On Local Government TaxationDocument12 pagesNotes On Local Government TaxationJosa Deinla100% (1)

- Bank Challan FormDocument1 pageBank Challan Formakangsha dekaNo ratings yet

- Internship Report NIGARISHDocument33 pagesInternship Report NIGARISHAon SyedNo ratings yet

- Framework of Economic Resilience Analysis: From Enigma To Solution Proposals by Musoko KayembeDocument10 pagesFramework of Economic Resilience Analysis: From Enigma To Solution Proposals by Musoko KayembeKayembeNo ratings yet

- LK Spto 2019 - Q1Document80 pagesLK Spto 2019 - Q1siput_lembekNo ratings yet

- Government Borrowing From The Banking System: Implications For Monetary and Financial StabilityDocument26 pagesGovernment Borrowing From The Banking System: Implications For Monetary and Financial StabilitySana NazNo ratings yet

- Income Tax (1) - FinalDocument50 pagesIncome Tax (1) - FinalMay Encarnina P. Gaoiran100% (5)

- UMD BMGT220 Accounting NotesDocument6 pagesUMD BMGT220 Accounting NotesDale ParkNo ratings yet

- Chapter IvDocument15 pagesChapter IvIndhuja MNo ratings yet

- CA B. Hari Gopal: AS 17 - Segment ReportingDocument54 pagesCA B. Hari Gopal: AS 17 - Segment Reportingvarunmonga90No ratings yet

- Dimensions of Working Capital ManagementDocument22 pagesDimensions of Working Capital ManagementRamana Rao V GuthikondaNo ratings yet

- Revenue Leakage-How To PlugDocument18 pagesRevenue Leakage-How To Plugakshat nagarNo ratings yet

- Contoh InvoiceDocument1 pageContoh InvoiceChiska TiwieNo ratings yet

- (IPS Brief) State of Pakistan EconomyDocument4 pages(IPS Brief) State of Pakistan EconomyInstitute of Policy Studies100% (1)

- Retirement WorkbookDocument31 pagesRetirement WorkbookRunita ShahNo ratings yet

- DSC1630 2018 TL 201 1 eDocument21 pagesDSC1630 2018 TL 201 1 eAmos MikeNo ratings yet

- Federal Bank Process ImprovementDocument13 pagesFederal Bank Process ImprovementSujayRawatNo ratings yet

- Special Address D P Jhawar EdelweissDocument4 pagesSpecial Address D P Jhawar EdelweissOlivia JacksonNo ratings yet

- South Carolina Deficiency Judgments in Foreclosure ActionsDocument7 pagesSouth Carolina Deficiency Judgments in Foreclosure ActionskwillsonNo ratings yet

- Equip. Note PDFDocument16 pagesEquip. Note PDFhailush girmay100% (1)

- Basics of Islamic BankingDocument6 pagesBasics of Islamic BankingMnk BhkNo ratings yet

- Promopedia 2021 22 (Part II)Document233 pagesPromopedia 2021 22 (Part II)adithyavardhanmNo ratings yet