Professional Documents

Culture Documents

Financials: The Walt Disney Company (Dis.N) : Revenue

Financials: The Walt Disney Company (Dis.N) : Revenue

Uploaded by

Kimberly DyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financials: The Walt Disney Company (Dis.N) : Revenue

Financials: The Walt Disney Company (Dis.N) : Revenue

Uploaded by

Kimberly DyCopyright:

Available Formats

FINANCIALS: THE WALT DISNEY COMPANY (DIS.

N)

DIS.N on New York Stock Exchange

37.58USD

18 Nov 2010

Price Change (% chg)

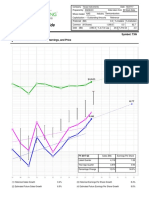

REVENUE

Periods 2008 2009 2010

December 10452.0 9599.0 9739.0

March 8710.0 8087.0 8580.0

June 9236.0 8596.0 10002.0

September 9445.0 9867.0 9742.0

Note: Units in Millions of U.S. Dollars

EARNINGS PER SHARE

Periods 2008 2009 2010

December 0.63097 0.45139 0.44351

March 0.58112 0.32816 0.48302

June 0.66237 0.50907 0.6729

September 0.39937 0.4748 0.43019

Note: Units in U.S. Dollars

CONSENSUS ESTIMATES ANALYSIS

# of Estimates Mean High Low 1 Year Ago

SALES (in millions)

Quarter Ending Dec-10 20 10,559.80 11,315.30 10,362.00 10,050.80

Quarter Ending Mar-11 20 9,114.77 9,707.00 8,656.04 9,095.46

Year Ending Sep-10 25 38,301.20 39,113.70 37,684.80 --

Year Ending Sep-11 26 40,639.90 41,687.00 40,023.00 39,119.60

Year Ending Sep-12 20 42,897.10 44,205.00 42,059.00 42,495.40

EARNINGS (per share)

Quarter Ending Dec-10 22 0.55 0.58 0.50 0.49

Quarter Ending Mar-11 21 0.55 0.67 0.51 0.54

Year Ending Sep-10 28 2.09 2.15 2.02 --

Year Ending Sep-11 29 2.42 2.61 2.28 2.15

Year Ending Sep-12 21 2.79 3.06 2.54 2.60

LT Growth Rate (%) 13 11.89 28.40 5.00 8.22

Sales and Earnings Figures in U.S. Dollars (USD)

VALUATION RATIOS

Company Industry Sector S&P 500

P/E Ratio (TTM) 18.52 14.06 12.08 17.48

P/E High - Last 5 Yrs. NA 15.73 0.20 19.05

P/E Low - Last 5 Yrs. NA 2.77 0.04 4.85

Beta 1.12 1.33 0.96 1.27

Price to Sales (TTM) 1.87 1.40 2.14 2.05

Price to Book (MRQ) 1.90 1.67 0.88 2.78

Price to Tangible Book (MRQ) 20.00 8.09 1.06 18.33

Price to Cash Flow (TTM) 11.83 10.00 5.66 10.24

Price to Free Cash Flow (TTM) 15.95 16.93 7.05 46.58

% Owned Institutions -- -- -- --

DIVIDENDS

Company Industry Sector S&P 500

Dividend Yield 0.93 1.28 1.04 1.70

Dividend Yield - 5 Year Avg. -- 0.61 1.35 2.47

Dividend 5 Year Growth Rate -- 1.73 2.02 -6.56

Payout Ratio(TTM) -- 15.64 12.66 39.83

GROWTH RATES

Company Industry Sector S&P 500

Sales (MRQ) vs Qtr. 1 Yr. Ago -1.27 3.03 5.37 9.33

Sales (TTM) vs TTM 1 Yr. Ago 5.29 5.27 7.34 8.81

Sales - 5 Yr. Growth Rate 3.94 3.45 9.62 9.86

EPS (MRQ) vs Qtr. 1 Yr. Ago -9.40 12.48 232.15 5.64

EPS (TTM) vs TTM 1 Yr. Ago 15.10 -- -- --

EPS - 5 Yr. Growth Rate 11.37 5.08 2.13 6.96

Capital Spending - 5 Yr. Growth Rate 2.97 -2.17 4.93 4.86

FINANCIAL STRENGTH

Company Industry Sector S&P 500

Quick Ratio (MRQ) 0.98 1.35 0.59 0.67

Current Ratio (MRQ) 1.11 1.59 0.76 0.99

LT Debt to Equity (MRQ) 27.00 48.80 25.90 119.06

Total Debt to Equity (MRQ) 33.26 51.24 38.91 173.79

Interest Coverage (TTM) -- -1.70 0.31 19.00

PROFITABILITY RATIOS

Company Industry Sector S&P 500

Gross Margin (TTM) 17.67 34.50 11.94 32.82

Gross Margin - 5 Yr. Avg. 17.69 24.68 24.33 29.11

EBITD Margin (TTM) 21.83 -- -- --

EBITD - 5 Yr. Avg 21.76 11.18 10.41 18.52

Operating Margin (TTM) 17.41 15.47 -2.81 --

Operating Margin - 5 Yr. Avg. 18.06 8.07 5.45 16.27

Pre-Tax Margin (TTM) 17.41 13.62 -2.84 15.00

Pre-Tax Margin - 5 Yr. Avg. 18.06 8.72 5.31 15.88

Net Profit Margin (TTM) 11.33 9.69 -3.61 11.13

Net Profit Margin - 5 Yr. Avg. 11.58 6.00 3.58 11.65

Effective Tax Rate (TTM) 34.92 26.12 15.60 50.45

Effecitve Tax Rate - 5 Yr. Avg. 35.88 22.75 32.55 25.24

EFFICIENCY

Company Industry Sector S&P 500

Revenue/Employee (TTM) -- 976,700 21,585,874 673,907

Net Income/Employee (TTM) -- -13,971 1,085,352 84,639

Receivable Turnover (TTM) 7.16 5.74 17.49 10.53

Inventory Turnover (TTM) 23.10 16.70 4.39 6.75

Asset Turnover (TTM) 0.58 0.57 0.39 0.55

MANAGEMENT EFFECTIVENESS

Company Industry Sector S&P 500

Return on Assets (TTM) 6.52 5.69 1.73 6.00

Return on Assets - 5 Yr. Avg. 6.82 3.19 3.53 5.75

Return on Investment (TTM) 7.92 6.95 2.60 7.70

Return on Investment - 5 Yr. Avg. 8.45 3.87 6.21 7.43

Return on Equity (TTM) 11.12 12.39 5.21 18.05

Return on Equity - 5 Yr. Avg. 12.26 6.09 9.08 8.97

GROWTH FOR THE WALT DISNEY COMPANY

1 Year 3 Years 5 Years

Sales % 5.29 2.34 3.94

EPS % 15.35 -3.22 11.37

Dividend % -- -- --

PERFORMANCE FOR THE WALT DISNEY COMPANY

% % vs. Rank In Industry

Period Actual S&P 500 Industry Rank

4 Week 7.51 7.47 95 36

13 Week 9.76 1.89 73 70

26 Week 11.47 5.46 82 61

52 Week 20.57 13.58 76 50

YTD 15.41 9.20 73 56

INSTITUTIONAL HOLDERS

% Shares Owned: 66.76%

# of Holders: 1,312

Total Shares Held: 1,276,930,146

3 Mo. Net Change: -39,826,924

# New Positions: 61

# Closed Positions: 44

# Increased Positions: 423

# Reduced Positions: 596

# Net Buyers: -173

You might also like

- Case Worksheet Volkswagen AGDocument3 pagesCase Worksheet Volkswagen AGDavid50% (2)

- VedantaDocument45 pagesVedantajackkapupara100% (1)

- M&I Merger-Model-GuideDocument66 pagesM&I Merger-Model-GuideSai Allu100% (1)

- Consensus Estimates AnalysisDocument12 pagesConsensus Estimates Analysisdc batallaNo ratings yet

- SynopsisDocument1 pageSynopsisntkmistryNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- Key Ratios: Years Mar-09 Mar-08 Mar-07 Mar-06 Mar-05Document3 pagesKey Ratios: Years Mar-09 Mar-08 Mar-07 Mar-06 Mar-05md_ali19862968No ratings yet

- Key Performance Indicators - Friday, August 6, 2021Document10 pagesKey Performance Indicators - Friday, August 6, 2021Shan SNo ratings yet

- Progress Report For The of June, 2022Document133 pagesProgress Report For The of June, 2022YeshiwondimNo ratings yet

- Wright Quality RatingDocument14 pagesWright Quality RatingSweetyg GuptaNo ratings yet

- ValueResearchFundcard KotakGiltInvestmentRegular 2010nov24Document6 pagesValueResearchFundcard KotakGiltInvestmentRegular 2010nov24zankurNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Wipro, Ltd. WIT Azim H. Premji 119,491 AD Development, Infrastructure Outsourcing and Business Consulting ServicesDocument4 pagesWipro, Ltd. WIT Azim H. Premji 119,491 AD Development, Infrastructure Outsourcing and Business Consulting ServicespalsarajNo ratings yet

- ValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Document6 pagesValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Prakash SainiNo ratings yet

- Vodafone Idea LTD.: Detailed QuotesDocument21 pagesVodafone Idea LTD.: Detailed QuotesVachi VidyarthiNo ratings yet

- AHSLDocument1 pageAHSLUmema UsmanNo ratings yet

- Book 1Document2 pagesBook 1Parul RajpalNo ratings yet

- Listed Companies Highlights: Financial FocusDocument1 pageListed Companies Highlights: Financial FocusT'Tee MiniOns'TmvsNo ratings yet

- IDEA One PagerDocument6 pagesIDEA One PagerdidwaniasNo ratings yet

- Stock Selection Guide: Symbol: TXNDocument2 pagesStock Selection Guide: Symbol: TXNMayank PatelNo ratings yet

- Financial HighlightsDocument3 pagesFinancial HighlightsSalman SaeedNo ratings yet

- Reliance Relative ValuationDocument15 pagesReliance Relative ValuationHEM BANSALNo ratings yet

- HDFC EquityDocument6 pagesHDFC EquityDarshan ShettyNo ratings yet

- Vardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGDocument5 pagesVardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGshyamalmishra1988No ratings yet

- Tata ResearchDocument5 pagesTata ResearchSuzäxs BäRunNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Company Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PriceDocument23 pagesCompany Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PricenkmpatnaNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsDocument4 pages(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanNo ratings yet

- Kavveri TelecomDocument1 pageKavveri TelecomrohitbhuraNo ratings yet

- DLF Announces Annual Results For FY10: HistoryDocument7 pagesDLF Announces Annual Results For FY10: HistoryShalinee SinghNo ratings yet

- Titan Company by Anuj GuptaDocument25 pagesTitan Company by Anuj GuptaHIMANSHU RAWATNo ratings yet

- Dominic InterpretationDocument11 pagesDominic Interpretationdominic wurdaNo ratings yet

- Polaroid Corporation ENGLISHDocument14 pagesPolaroid Corporation ENGLISHAtul AnandNo ratings yet

- The Gordon Model Cost of EquityDocument35 pagesThe Gordon Model Cost of EquityMahmood AhmadNo ratings yet

- Skyworks Solutions, Inc.: Price, Consensus & SurpriseDocument1 pageSkyworks Solutions, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- GHCL One PagerDocument1 pageGHCL One PagerdidwaniasNo ratings yet

- Company Analysis Steven Pratama, S.T, M.TDocument11 pagesCompany Analysis Steven Pratama, S.T, M.TSteven PratamaNo ratings yet

- Weekly Stock Focus - 10.02.2023Document10 pagesWeekly Stock Focus - 10.02.2023hvalolaNo ratings yet

- SFE Gold Fever R100 2018 2020Document15 pagesSFE Gold Fever R100 2018 2020ief zzieNo ratings yet

- Stock Price Calculator TWIDocument14 pagesStock Price Calculator TWIicdiazNo ratings yet

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNo ratings yet

- Jupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFDocument4 pagesJupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFSaif MonajedNo ratings yet

- Fundcard: Axis Long Term Equity FundDocument4 pagesFundcard: Axis Long Term Equity FundprashokkumarNo ratings yet

- WACC KEBUN 23 JAN 14 IvanDocument44 pagesWACC KEBUN 23 JAN 14 IvanAgusFahriNo ratings yet

- Tyson Foods Inc Class A TSN: Growth Rates (Compound Annual)Document1 pageTyson Foods Inc Class A TSN: Growth Rates (Compound Annual)garikai masawiNo ratings yet

- Kossan 2Q10Document3 pagesKossan 2Q10limml63No ratings yet

- TM-20 Apr 2018Document4 pagesTM-20 Apr 2018Anonymous 9xAmuLRrdyNo ratings yet

- PRIL - Investor Update - Q3 FY 2011Document6 pagesPRIL - Investor Update - Q3 FY 2011ankigoelNo ratings yet

- CVR - Case - Excel FileDocument7 pagesCVR - Case - Excel FileVinay JajuNo ratings yet

- OMSEC Morning Note 13 09 2022Document6 pagesOMSEC Morning Note 13 09 2022Ropafadzo KwarambaNo ratings yet

- Tables Bond MarketDocument4 pagesTables Bond MarketIshwar ChhedaNo ratings yet

- Weekly Economic Update 37 - 2019Document4 pagesWeekly Economic Update 37 - 2019jyl12No ratings yet

- Skipper LTD: WebsiteDocument4 pagesSkipper LTD: WebsiteAbi TestNo ratings yet

- Sustainable Growth Analysis of Under Armour Inc. 2009 - 2013Document9 pagesSustainable Growth Analysis of Under Armour Inc. 2009 - 2013Maria Camila CadavidNo ratings yet

- TVS Motors Credit Risk AnalysisDocument21 pagesTVS Motors Credit Risk AnalysisBharat ChaudharyNo ratings yet

- Daftar Koleksi Saham Dan Strategi Investasi: Roe Eps PBV P/E CR Der Dy GepsDocument14 pagesDaftar Koleksi Saham Dan Strategi Investasi: Roe Eps PBV P/E CR Der Dy GepsGiyantoNo ratings yet

- Growth, Profitability, and Financial Ratios For Citra Marga Nusaphala Persada TBK (CMNP) FromDocument1 pageGrowth, Profitability, and Financial Ratios For Citra Marga Nusaphala Persada TBK (CMNP) FromadjipramNo ratings yet

- Polaroid 1996 CalculationDocument8 pagesPolaroid 1996 CalculationDev AnandNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Asian Paints: Prepared byDocument54 pagesAsian Paints: Prepared bylaxmi joshiNo ratings yet

- TRPR 82222 693Document4 pagesTRPR 82222 693Reiza AlbarnNo ratings yet

- Chapter 3 Lecture Hand-Outs - Problem SolvingDocument5 pagesChapter 3 Lecture Hand-Outs - Problem SolvingLuzz LandichoNo ratings yet

- Solutions Chap010 Rates of ReturnDocument25 pagesSolutions Chap010 Rates of ReturnMaybelle BernalNo ratings yet

- MRP Final ReportDocument114 pagesMRP Final Reportjohn_muellorNo ratings yet

- CRG Ambhit CapitalDocument25 pagesCRG Ambhit Capitalsidhanti26No ratings yet

- Weekly Market RecapDocument2 pagesWeekly Market RecapAlex SmithNo ratings yet

- This Week in Earnings 18Q3 - Nov. 30Document21 pagesThis Week in Earnings 18Q3 - Nov. 30Anonymous RNlI6gcWNo ratings yet

- 2Document36 pages2Amit PoddarNo ratings yet

- Assgmnt 2 Finance 1122702644Document7 pagesAssgmnt 2 Finance 1122702644Nurul Yastainn Abdul AzizNo ratings yet

- Ca Final SFM (New Scheme) Dawn 2022 - Equity ValuationDocument55 pagesCa Final SFM (New Scheme) Dawn 2022 - Equity Valuationanand kachwaNo ratings yet

- MS - ThemathofvalueandgrowthDocument13 pagesMS - ThemathofvalueandgrowthmilandeepNo ratings yet

- Profitability RatiosDocument9 pagesProfitability RatiosfasmekbakerNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- Ratio Analysis For CADocument7 pagesRatio Analysis For CAShahid MahmudNo ratings yet

- Fundamental Analysis of Stocks Quick GuideDocument13 pagesFundamental Analysis of Stocks Quick GuidejeevandranNo ratings yet

- F&N and NestleDocument16 pagesF&N and Nestlekalahoney83% (6)

- Answer The Following Multiple Choice Questions A in 2007 and 2Document1 pageAnswer The Following Multiple Choice Questions A in 2007 and 2M Bilal SaleemNo ratings yet

- Etisalat - MENACORP Report 11092012Document16 pagesEtisalat - MENACORP Report 11092012mrbubosNo ratings yet

- Zanger 1998-04-26Document1 pageZanger 1998-04-26Harvey DychiaoNo ratings yet

- 3-Smallcap-Revival-Stocks-report Research ReportDocument45 pages3-Smallcap-Revival-Stocks-report Research ReportKOUSHIKNo ratings yet

- Chapter 6 Set 4 The Procter & Gamble Company AnalysisDocument29 pagesChapter 6 Set 4 The Procter & Gamble Company AnalysisNick HaldenNo ratings yet

- Rishabh Goyal - Investment ManagementDocument9 pagesRishabh Goyal - Investment ManagementRishabh GoyalNo ratings yet

- Introduction To Business ValuationDocument13 pagesIntroduction To Business ValuationSunanda Joshi100% (1)

- Bharat ForgeDocument5 pagesBharat ForgeJj KumarNo ratings yet

- Report On Valuation of Rangpur Dairy & Food Product LTDDocument31 pagesReport On Valuation of Rangpur Dairy & Food Product LTDFarzana Fariha LimaNo ratings yet

- AndersonmiquelawrittenreportprojectstockvaluationDocument4 pagesAndersonmiquelawrittenreportprojectstockvaluationapi-631992517No ratings yet