Professional Documents

Culture Documents

COYTAXEDUTAX

COYTAXEDUTAX

Uploaded by

Fadekemi Kotun0 ratings0% found this document useful (0 votes)

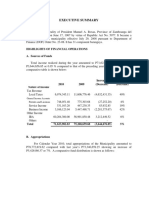

4 views2 pagesThis document is a 2010 year-end tax assessment for a company. It shows the company had a profit of ₦613,960,531.35 for the year. It calculates the assessable profit, capital allowance carried forward and back, taxable income, income tax owed at 30% of taxable income, education tax owed at 2% of assessable profit, and the tax payable after deducting withholding tax paid. The overall tax payable is ₦51,130,590.23.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a 2010 year-end tax assessment for a company. It shows the company had a profit of ₦613,960,531.35 for the year. It calculates the assessable profit, capital allowance carried forward and back, taxable income, income tax owed at 30% of taxable income, education tax owed at 2% of assessable profit, and the tax payable after deducting withholding tax paid. The overall tax payable is ₦51,130,590.23.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesCOYTAXEDUTAX

COYTAXEDUTAX

Uploaded by

Fadekemi KotunThis document is a 2010 year-end tax assessment for a company. It shows the company had a profit of ₦613,960,531.35 for the year. It calculates the assessable profit, capital allowance carried forward and back, taxable income, income tax owed at 30% of taxable income, education tax owed at 2% of assessable profit, and the tax payable after deducting withholding tax paid. The overall tax payable is ₦51,130,590.23.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

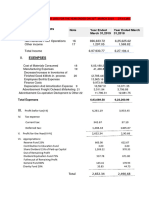

2010 Year of Assessment

₦

Profit for the Year

Add:

Depreciation 15,329,891.91

Tax Expense 9,689,932.20

25,019,824.11

Assessable Profit

Capital allowance B/F 18,923,941.85

Capital Allowance for the Year 65,272,524.40

84,196,466.25

Relieved in the Year (66.67% of Assess. Profit) - 84,196,466.24

Capital allowance C/F 0.01

Taxable Income

Tax @ 30%

Less WHT Paid

TAX PAYABLE

Education Tax @ 2% Assessable Profit

COMPUTATION OF COMPANY INCOME TAX AND EDUCATION TAX

₦

613,960,531.35

25,019,824.11

638,980,355.46

- 84,196,466.24

554,783,889.22

166,435,166.77

- 115,304,576.54

51,130,590.23

12,779,607.11

You might also like

- Navana CNG Limited IncomeDocument4 pagesNavana CNG Limited IncomeHridoyNo ratings yet

- Masbate-Executive-Summary-2023 SadiasaDocument8 pagesMasbate-Executive-Summary-2023 SadiasaFranz SyNo ratings yet

- Assignment: Dr. Gazi Mohammad Hasan Jamil SL No. Name Student IDDocument26 pagesAssignment: Dr. Gazi Mohammad Hasan Jamil SL No. Name Student IDMd. Tauhidur Rahman 07-18-45No ratings yet

- Verana Exhibit and SchedsDocument45 pagesVerana Exhibit and SchedsPrincess Dianne MaitelNo ratings yet

- Investor Presentation Mar21Document34 pagesInvestor Presentation Mar21Sanjay RainaNo ratings yet

- PrinceDocument2 pagesPrinceSandeep Kumar YadavNo ratings yet

- Bharat Hotels Annual Report 2020 2021Document232 pagesBharat Hotels Annual Report 2020 2021Sahjad Hashmi100% (1)

- Masbate City Executive Summary 2022Document5 pagesMasbate City Executive Summary 2022nicolegardia106No ratings yet

- 7 Ifmis Cash Flow Statement - National ConsolidatedDocument1 page7 Ifmis Cash Flow Statement - National ConsolidatedNagesso BesayeNo ratings yet

- Estimated Revenues, Profits and Expenditure For Next Three YearsDocument6 pagesEstimated Revenues, Profits and Expenditure For Next Three YearsRajeev Kumar GottumukkalaNo ratings yet

- Statement of Cash Flow 2021 Cash Flow From Operating Activities 2021 2020Document6 pagesStatement of Cash Flow 2021 Cash Flow From Operating Activities 2021 2020Rica CatanguiNo ratings yet

- Board's ReportDocument37 pagesBoard's ReportSanil FernandesNo ratings yet

- 08 PuertoPrincesaCity2019 Part1 FSDocument7 pages08 PuertoPrincesaCity2019 Part1 FSkQy267BdTKNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Axis Bank - AR21 - DRDocument17 pagesAxis Bank - AR21 - DRRakeshNo ratings yet

- UntitledDocument357 pagesUntitledAlexNo ratings yet

- Acivity 1 MidtermDocument1 pageAcivity 1 MidtermCristine villaflorNo ratings yet

- Group 11 - Mahindra and MahindraDocument10 pagesGroup 11 - Mahindra and Mahindrasovinahalli 1234No ratings yet

- Current Assets: (See Accompanying Notes To Financial Statements)Document7 pagesCurrent Assets: (See Accompanying Notes To Financial Statements)Alicia NhsNo ratings yet

- Metropolitan-Naga-Water-District-Camarines-Sur-Executive-Summary-2020Document6 pagesMetropolitan-Naga-Water-District-Camarines-Sur-Executive-Summary-2020Cham LantajoNo ratings yet

- Disscor Fs.02Document86 pagesDisscor Fs.02Ricardo DelacruzNo ratings yet

- Consolidated Statement of Financial Position: (With Comparative Figures For CY 2016)Document7 pagesConsolidated Statement of Financial Position: (With Comparative Figures For CY 2016)Alicia NhsNo ratings yet

- Lakh Datta Flour MillsDocument14 pagesLakh Datta Flour MillsjimmuNo ratings yet

- With Comparative Figures For CY 2019Document8 pagesWith Comparative Figures For CY 2019Leo SindolNo ratings yet

- Illustrative Full Set of IFRS For SME Financial StatementsDocument16 pagesIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashNo ratings yet

- 8 Computation of Total Income - AY 2019 20Document1 page8 Computation of Total Income - AY 2019 20karthikkarunanidhi180997No ratings yet

- Corporate ValuationDocument32 pagesCorporate ValuationNishant DhakalNo ratings yet

- Roxas ZDN ES2010Document7 pagesRoxas ZDN ES2010J JaNo ratings yet

- Chapter 6 Fs SingsonDocument9 pagesChapter 6 Fs SingsonDonna Mae SingsonNo ratings yet

- 03-RoxasCity2019 Executive SummaryDocument5 pages03-RoxasCity2019 Executive SummarykQy267BdTKNo ratings yet

- Analisa Eva Wacc SsmsDocument11 pagesAnalisa Eva Wacc SsmsAnggih Nur HamidahNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- Adesoye, Adeniji-Scena - CorrectDocument11 pagesAdesoye, Adeniji-Scena - CorrectAdesoye AdenijiNo ratings yet

- Directors' Report: Larsen & Toubro Infotech LimitedDocument33 pagesDirectors' Report: Larsen & Toubro Infotech LimitedNirmal Rintu RaviNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument8 pagesFinancial Statements, Cash Flow, and TaxesRaihan Eibna RezaNo ratings yet

- Income Statement FINALDocument2 pagesIncome Statement FINALLenard TaberdoNo ratings yet

- Sample Financial PlanDocument19 pagesSample Financial PlanAlexandria GonzalesNo ratings yet

- Guimbal Executive Summary 2019Document5 pagesGuimbal Executive Summary 2019AllynMae TurijaNo ratings yet

- Q4 2020 Revenue PerformanceDocument11 pagesQ4 2020 Revenue PerformanceVoiture GermanNo ratings yet

- Final IFRS For SMEs Illustrator ExampleDocument30 pagesFinal IFRS For SMEs Illustrator ExampleleekosalNo ratings yet

- Business Finance Quiz 3-SeratoDocument4 pagesBusiness Finance Quiz 3-SeratoDaryl SeratoNo ratings yet

- PalawanProv ES2019Document11 pagesPalawanProv ES2019Smile Laugh and Be InspiredNo ratings yet

- Invesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512Document5 pagesInvesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512KUNAL GUPTANo ratings yet

- Analisa Eva Wacc STTPDocument11 pagesAnalisa Eva Wacc STTPAnggih Nur HamidahNo ratings yet

- Beximco PHARMACEUTICALS LTD ISDocument2 pagesBeximco PHARMACEUTICALS LTD ISSuny ChowdhuryNo ratings yet

- Profit & Loss Account of Interglobe Aviation (In CR.)Document7 pagesProfit & Loss Account of Interglobe Aviation (In CR.)Sreyashi GhoshNo ratings yet

- 02 BacarraIN2020 FSDocument9 pages02 BacarraIN2020 FSRichard MendezNo ratings yet

- These Financial Statements Should Be Read in Conjunction With The Annexed NotesDocument10 pagesThese Financial Statements Should Be Read in Conjunction With The Annexed NotesSK. Al Mamun MamunNo ratings yet

- 09 Cuyo2021 - Part1 FSDocument6 pages09 Cuyo2021 - Part1 FSKebe VajionNo ratings yet

- Financial Statement PresentationDocument6 pagesFinancial Statement Presentationabitos210000001240No ratings yet

- Panda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)Document172 pagesPanda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)geniuskkNo ratings yet

- Part 3 FeasibDocument9 pagesPart 3 FeasibEats FoodieNo ratings yet

- Pilipinas Shell Petroleum Corpo RationDocument12 pagesPilipinas Shell Petroleum Corpo RationCario Mary Cris DaanoyNo ratings yet

- Donam Corporate FinanceDocument9 pagesDonam Corporate FinanceMAGOMU DAN DAVIDNo ratings yet

- Financial Analysis 2019Document27 pagesFinancial Analysis 2019Umer MalikNo ratings yet

- School of Business, Management and Accountancy: Aldersgate College, Inc. Solano, Nueva VizcayaDocument8 pagesSchool of Business, Management and Accountancy: Aldersgate College, Inc. Solano, Nueva Vizcayalorren ramiroNo ratings yet

- 2019 Proposed BudgetDocument91 pages2019 Proposed Budgetcharmaine vegaNo ratings yet

- Reformulated Income Statement of Century Ply: Operating RevenueDocument2 pagesReformulated Income Statement of Century Ply: Operating RevenueBhoomika GuptaNo ratings yet

- Analysis of Financial Statements - VICO Foods CorporationDocument19 pagesAnalysis of Financial Statements - VICO Foods CorporationHannah Bea LindoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet