Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 views#280 BBB 08-26-10 101

#280 BBB 08-26-10 101

Uploaded by

bmoakThousands of Mississippi charities are at risk of losing their tax-exempt status if they do not file tax returns by October 15th under a new IRS program. Over 2,800 charities in Mississippi must file returns or automatically lose their tax-exempt status, which could severely impact future fundraising efforts and potentially lead to tax liability. The list of at-risk organizations that have not filed returns for the past three years includes many small, community organizations and groups.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Gifts To Reduce Illinois Estate TaxesDocument5 pagesGifts To Reduce Illinois Estate Taxesrobertkolasa100% (1)

- 0 Asset Protection BasicsDocument43 pages0 Asset Protection Basicspwilkers36100% (1)

- #280 BBB 08-26-10 139Document1 page#280 BBB 08-26-10 139bmoakNo ratings yet

- #280 BBB 08-26-10 76Document1 page#280 BBB 08-26-10 76bmoakNo ratings yet

- #280 BBB 08-26-10 87Document1 page#280 BBB 08-26-10 87bmoakNo ratings yet

- #280 BBB 08-26-10 141Document1 page#280 BBB 08-26-10 141bmoakNo ratings yet

- #280 BBB 08-26-10 51Document1 page#280 BBB 08-26-10 51bmoakNo ratings yet

- #280 BBB 08-26-10 75Document1 page#280 BBB 08-26-10 75bmoakNo ratings yet

- 280 BBB 11-25-09 66Document1 page280 BBB 11-25-09 66bmoakNo ratings yet

- Tax ArticleDocument8 pagesTax Articlecanuck1234No ratings yet

- "An Analysis of Corporate Sponsorship of Tax-Exempt Organizations and The Unrelated Business Income Tax" Brian K. LeonardDocument14 pages"An Analysis of Corporate Sponsorship of Tax-Exempt Organizations and The Unrelated Business Income Tax" Brian K. LeonardNasrullah Djamil, SE, M.Si, Akt, CANo ratings yet

- Tax Benefits For Donations - Top RankedDocument3 pagesTax Benefits For Donations - Top RankedMatias HermosillaNo ratings yet

- PRO Taxing The ChurchDocument5 pagesPRO Taxing The ChurchLhem-Mari Japos NavalNo ratings yet

- #280 BBB 09-24-09 38Document1 page#280 BBB 09-24-09 38bmoakNo ratings yet

- US Internal Revenue Service: Ir-04-081Document17 pagesUS Internal Revenue Service: Ir-04-081IRSNo ratings yet

- IRS - Tax Guide For ChurchesDocument28 pagesIRS - Tax Guide For ChurchesTim McGheeNo ratings yet

- CTM2021MIDocument6 pagesCTM2021MIRanderson NevesNo ratings yet

- Not Indicate That The Organizations Have LostDocument1 pageNot Indicate That The Organizations Have LostIRSNo ratings yet

- Tax Exempt Orgs Form 990Document1 pageTax Exempt Orgs Form 990Claudric AdamsNo ratings yet

- #280 BBB 10-29-09 55Document1 page#280 BBB 10-29-09 55bmoakNo ratings yet

- Compliance Guide For Public CharitiesDocument28 pagesCompliance Guide For Public CharitiesPov TsheejNo ratings yet

- The American Families Plan Tax Compliance AgendaDocument24 pagesThe American Families Plan Tax Compliance AgendaForkLogNo ratings yet

- Offshore Tax 20090508Document9 pagesOffshore Tax 20090508bgkelleyNo ratings yet

- REBA Estate Planning Using LLC As Single Member For TaxesDocument14 pagesREBA Estate Planning Using LLC As Single Member For Taxesmatthew.b.lane01No ratings yet

- BBB Offers Checklist Response To Charity Telemarketing StateDocument1 pageBBB Offers Checklist Response To Charity Telemarketing StatebmoakNo ratings yet

- This Content Downloaded From 27.54.123.95 On Sat, 24 Apr 2021 20:17:37 UTCDocument28 pagesThis Content Downloaded From 27.54.123.95 On Sat, 24 Apr 2021 20:17:37 UTCkhizar ahmadNo ratings yet

- Qualified Pass-Through Entities Include:: Some Significant Elements of The Tax Cuts and Jobs ActDocument2 pagesQualified Pass-Through Entities Include:: Some Significant Elements of The Tax Cuts and Jobs Actanon_435247981No ratings yet

- Tax Evasion and Tax AvoidanceDocument14 pagesTax Evasion and Tax AvoidanceGarySinyangweNo ratings yet

- #280 BBB 04-29-10 177Document1 page#280 BBB 04-29-10 177bmoakNo ratings yet

- Factiva 20191022 1018 PDFDocument3 pagesFactiva 20191022 1018 PDFAnonymous tTk3g8No ratings yet

- April05.2014 Bsolon Pushes For Incentives For MSMEs To Boost Economic GrowthDocument1 pageApril05.2014 Bsolon Pushes For Incentives For MSMEs To Boost Economic Growthpribhor2No ratings yet

- US Internal Revenue Service: I1040gi - 2006Document87 pagesUS Internal Revenue Service: I1040gi - 2006IRS100% (1)

- House Hearing, 112TH Congress - Markup of The Small Business Administration Fiscal Year 2012 BudgetDocument33 pagesHouse Hearing, 112TH Congress - Markup of The Small Business Administration Fiscal Year 2012 BudgetScribd Government DocsNo ratings yet

- 080123NP Biz PlanDocument35 pages080123NP Biz PlanKbNo ratings yet

- Tax-Free Billions: Australia's Largest Companies Haven't Paid Corporate Tax in 10 Years - ABC News (Document6 pagesTax-Free Billions: Australia's Largest Companies Haven't Paid Corporate Tax in 10 Years - ABC News (Noodle Republic0% (1)

- This Self-Help Guide Is Geared Towards "Charitable" Organizations But May BeDocument11 pagesThis Self-Help Guide Is Geared Towards "Charitable" Organizations But May Bevipul.sachdeva6947No ratings yet

- Tax Churches DebateDocument19 pagesTax Churches DebateAnonymous lTXTx1fNo ratings yet

- Iff Analysis h0045 2015 PDFDocument1 pageIff Analysis h0045 2015 PDFDustinHurstNo ratings yet

- Policy Matters Ohio - Tax Breaks For Wealthy and Special InterestsDocument4 pagesPolicy Matters Ohio - Tax Breaks For Wealthy and Special InterestsProgressOhio251No ratings yet

- How The IRS Works: Functions and Audits: Internal Revenue ServiceDocument4 pagesHow The IRS Works: Functions and Audits: Internal Revenue ServiceRohit BajpaiNo ratings yet

- Transforming The Internal Revenue ServiceDocument20 pagesTransforming The Internal Revenue ServiceCato InstituteNo ratings yet

- 154.taxing The Hard To Tax - bdb.07.28.10Document2 pages154.taxing The Hard To Tax - bdb.07.28.10aefNo ratings yet

- IRS Issues Guidance and Updates Frequently Asked Questions Related To The New Clean Vehicle Critical Mineral and Battery ComponentsDocument1 pageIRS Issues Guidance and Updates Frequently Asked Questions Related To The New Clean Vehicle Critical Mineral and Battery ComponentsIrvanNo ratings yet

- Nonprofit Organizations Update Summer 2007Document6 pagesNonprofit Organizations Update Summer 2007Arnstein & Lehr LLP100% (1)

- Tax Collection Methods: Understanding Business Tax Collection and The Psyche of EvasionDocument28 pagesTax Collection Methods: Understanding Business Tax Collection and The Psyche of EvasionElizabeth CasabarNo ratings yet

- In The Financial IndustryDocument2 pagesIn The Financial IndustrySoninder KaurNo ratings yet

- #280 BBB 12-31-09 38Document1 page#280 BBB 12-31-09 38bmoakNo ratings yet

- 06-36 Let's Talk Tax.09-19-06.Taxation of Cooperatives - RPCDocument3 pages06-36 Let's Talk Tax.09-19-06.Taxation of Cooperatives - RPCPrincess SalvadorNo ratings yet

- Business ArticleDocument5 pagesBusiness ArticleKissel Jade Barsalote SarnoNo ratings yet

- Impact of Recent Tax Reform On CharitiesDocument6 pagesImpact of Recent Tax Reform On CharitiesZacharyEJWilliamsNo ratings yet

- Factiva 20191022 1023 PDFDocument2 pagesFactiva 20191022 1023 PDFAnonymous tTk3g8No ratings yet

- Clarion 26 FinalDocument2 pagesClarion 26 Finalapi-259871011No ratings yet

- IRS LetterDocument5 pagesIRS LetterJames LynchNo ratings yet

- Non-Profit Distinction: Organization Charitable Organizations Trade Unions ArtsDocument16 pagesNon-Profit Distinction: Organization Charitable Organizations Trade Unions ArtszdnacarioNo ratings yet

- 5013c Filing ProcedureDocument8 pages5013c Filing ProcedureOretha Brown-JohnsonNo ratings yet

- IRS Complaint Against NH District Corporation 11-18-19Document26 pagesIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanNo ratings yet

- Nonprofit Law in PhilippinesDocument22 pagesNonprofit Law in PhilippinesPaul Mark PilarNo ratings yet

- Dirty Dozen: Watch Out For Offer in Compromise Mills' Where Promoters Claim Their Services Are Needed To Settle IRS DebtsDocument2 pagesDirty Dozen: Watch Out For Offer in Compromise Mills' Where Promoters Claim Their Services Are Needed To Settle IRS DebtsIrvanNo ratings yet

- Letter To Janet YellenDocument7 pagesLetter To Janet YellenGeorge ShalhoubNo ratings yet

- #280 BBB 04-29-10 188Document1 page#280 BBB 04-29-10 188bmoakNo ratings yet

- #280 BBB 12-30-10 21Document1 page#280 BBB 12-30-10 21bmoakNo ratings yet

- #280 BBB 12-30-10 59Document1 page#280 BBB 12-30-10 59bmoakNo ratings yet

- #280 BBB 12-30-10 67Document1 page#280 BBB 12-30-10 67bmoakNo ratings yet

- #280 BBB 12-30-10 100Document1 page#280 BBB 12-30-10 100bmoakNo ratings yet

- #280 BBB 12-30-10 99Document1 page#280 BBB 12-30-10 99bmoakNo ratings yet

- #280 BBB 12-30-10 141Document1 page#280 BBB 12-30-10 141bmoakNo ratings yet

- #280 BBB 12-30-10 215Document1 page#280 BBB 12-30-10 215bmoakNo ratings yet

- #280 BBB 12-30-10 218Document1 page#280 BBB 12-30-10 218bmoakNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- 2016 Bar Exam Suggested AnswersDocument17 pages2016 Bar Exam Suggested AnswersAnonymous WJT0oARK5No ratings yet

- FederalDocument20 pagesFederalKim Cyrell DanilaNo ratings yet

- Pleased To Meet You Won'T You Guess My Name?Document24 pagesPleased To Meet You Won'T You Guess My Name?LuluNo ratings yet

- Sample Agreement: Allocation of Costs and Reimbursement of Expenses Between 501 (C) (3) and 501 (C)Document5 pagesSample Agreement: Allocation of Costs and Reimbursement of Expenses Between 501 (C) (3) and 501 (C)Rayan SantosNo ratings yet

- Taxation of Individuals QuizzerDocument37 pagesTaxation of Individuals QuizzerCharry Ramos62% (13)

- Smith-Bell Co. Vs CIRDocument1 pageSmith-Bell Co. Vs CIRAthena SantosNo ratings yet

- Bir LectureDocument4 pagesBir LectureClarisaJoy SyNo ratings yet

- 194-Applied Foods Ingredients Co. v. CIR G.R. No. 184266 November 11, 2013Document5 pages194-Applied Foods Ingredients Co. v. CIR G.R. No. 184266 November 11, 2013Jopan SJNo ratings yet

- 2017 Form 760 InstructionsDocument56 pages2017 Form 760 InstructionsicanadaaNo ratings yet

- BIR Rulings Compilation On Income TaxationDocument36 pagesBIR Rulings Compilation On Income Taxationvelasquez0731No ratings yet

- CIR V Suter 27 Scra 152Document5 pagesCIR V Suter 27 Scra 152Reuben EscarlanNo ratings yet

- Commissioner V Hypermix FeedsDocument36 pagesCommissioner V Hypermix FeedsEunice SerneoNo ratings yet

- Sole Survivorship 3Document5 pagesSole Survivorship 3Troy-Steven : NellNo ratings yet

- Notes On Registration of Book of AccountsDocument3 pagesNotes On Registration of Book of AccountsDenzel Edward CariagaNo ratings yet

- 2005-2006 Tax Bar Q&ADocument22 pages2005-2006 Tax Bar Q&AIrin200No ratings yet

- CIR v. ArieteDocument4 pagesCIR v. ArieteMJ Cems100% (2)

- CUNY Standard Verification WorksheetDocument3 pagesCUNY Standard Verification Worksheethicu0No ratings yet

- CIR vs. Transfield - Tax Amnesty - 2019Document23 pagesCIR vs. Transfield - Tax Amnesty - 2019Victoria aytonaNo ratings yet

- The Holy Grail of TaxDocument182 pagesThe Holy Grail of TaxJay FollowellNo ratings yet

- Cases JloDocument10 pagesCases JloOwen DefuntaronNo ratings yet

- Case Digests On Tax Remedies and JurisdictionsDocument36 pagesCase Digests On Tax Remedies and JurisdictionsNurul-Izza A. Sangcopan100% (2)

- U.S. Income Tax Return For Certain Political Organizations: Sign HereDocument6 pagesU.S. Income Tax Return For Certain Political Organizations: Sign HereManikanta Sai KumarNo ratings yet

- Calasanz V CIRDocument6 pagesCalasanz V CIRevelyn b t.No ratings yet

- Statutory ClaimDocument44 pagesStatutory ClaimLeonora Sekhmet Ntwea100% (1)

- 112 Mandanas v. Executive Secretary OchoaDocument2 pages112 Mandanas v. Executive Secretary OchoaMikaela PamatmatNo ratings yet

- Peter W. Defelice and Norma G. Defelice v. Commissioner of Internal Revenue, 386 F.2d 704, 10th Cir. (1967)Document9 pagesPeter W. Defelice and Norma G. Defelice v. Commissioner of Internal Revenue, 386 F.2d 704, 10th Cir. (1967)Scribd Government DocsNo ratings yet

- Tax - First Preboard QuestionnaireDocument14 pagesTax - First Preboard QuestionnairewithyouidkNo ratings yet

- Nonprofit GuidebookDocument29 pagesNonprofit Guidebookdbruce37211No ratings yet

#280 BBB 08-26-10 101

#280 BBB 08-26-10 101

Uploaded by

bmoak0 ratings0% found this document useful (0 votes)

11 views1 pageThousands of Mississippi charities are at risk of losing their tax-exempt status if they do not file tax returns by October 15th under a new IRS program. Over 2,800 charities in Mississippi must file returns or automatically lose their tax-exempt status, which could severely impact future fundraising efforts and potentially lead to tax liability. The list of at-risk organizations that have not filed returns for the past three years includes many small, community organizations and groups.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThousands of Mississippi charities are at risk of losing their tax-exempt status if they do not file tax returns by October 15th under a new IRS program. Over 2,800 charities in Mississippi must file returns or automatically lose their tax-exempt status, which could severely impact future fundraising efforts and potentially lead to tax liability. The list of at-risk organizations that have not filed returns for the past three years includes many small, community organizations and groups.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views1 page#280 BBB 08-26-10 101

#280 BBB 08-26-10 101

Uploaded by

bmoakThousands of Mississippi charities are at risk of losing their tax-exempt status if they do not file tax returns by October 15th under a new IRS program. Over 2,800 charities in Mississippi must file returns or automatically lose their tax-exempt status, which could severely impact future fundraising efforts and potentially lead to tax liability. The list of at-risk organizations that have not filed returns for the past three years includes many small, community organizations and groups.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

MAGNOLIA

CLIPPING SERVICE

(601) 856·0911 I (205) 758·8610

DEMOCRAT

SENATOBIA, MS

Circulation =3948

WEEKLY

08/03/2010

1111111111111111111111111111111111111

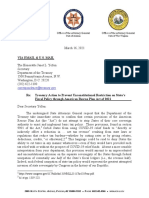

Thousands of Mississippi

c:~!rHies may lose status

small, community-based exempt status. After Oct.

BILL MOAK

organizations, including 15, the IRS will automati

More than 2,800 Mis many service clubs, foun cally revoke tax-exempt

sissippi charities are at risk dations, and faith-based status for the organiza

of losing their tax-exempt ministries. tion, and will publish a list

status if they don't file tax "This is potentially the of those organizations in

returns by Oct. 15 under a biggest threat to the exis early 2011. Donors who

new program announced tence of small charities that give to those organizations

recently by the Internal has ever occurred," said will be protected until the

Revenue Service (IRS). Bill Moak, President of list is published, meaning

According to the IRS, the Better Business Bureau that they may still deduct

2,824 charities named in (BBB) Serving Missis contributions made before

a special list must file re sippi. The B~B maintains publication of the list.

turns by Oct. 15, or they standards for charitable To list of at-risk orga

will automatically lose accountability, and evalu nizations may be viewed

their status as tax-exempt ates charities against those at http://www.irs.gov/pub/

organizations, a develop standards. "It's important irs-tege/ms.pdf. The IRS

ment which could cripple that charities file their re has information about this

future fundraising efforts turns to avoid loss of their issue on its website at http://

and entail possible tax li tax exemption." www.irs.gov/charities/

ability. The IRS has issued a artic1e/0"id=225705,00.

The list includes or "One-Time Filing Relief' html.

ganizations which have which gives charities an

not filed returns for the extended time to file re Article taken from ms

past three years. Most are turns to avoid loss of tax- digitaldaily.com

You might also like

- Gifts To Reduce Illinois Estate TaxesDocument5 pagesGifts To Reduce Illinois Estate Taxesrobertkolasa100% (1)

- 0 Asset Protection BasicsDocument43 pages0 Asset Protection Basicspwilkers36100% (1)

- #280 BBB 08-26-10 139Document1 page#280 BBB 08-26-10 139bmoakNo ratings yet

- #280 BBB 08-26-10 76Document1 page#280 BBB 08-26-10 76bmoakNo ratings yet

- #280 BBB 08-26-10 87Document1 page#280 BBB 08-26-10 87bmoakNo ratings yet

- #280 BBB 08-26-10 141Document1 page#280 BBB 08-26-10 141bmoakNo ratings yet

- #280 BBB 08-26-10 51Document1 page#280 BBB 08-26-10 51bmoakNo ratings yet

- #280 BBB 08-26-10 75Document1 page#280 BBB 08-26-10 75bmoakNo ratings yet

- 280 BBB 11-25-09 66Document1 page280 BBB 11-25-09 66bmoakNo ratings yet

- Tax ArticleDocument8 pagesTax Articlecanuck1234No ratings yet

- "An Analysis of Corporate Sponsorship of Tax-Exempt Organizations and The Unrelated Business Income Tax" Brian K. LeonardDocument14 pages"An Analysis of Corporate Sponsorship of Tax-Exempt Organizations and The Unrelated Business Income Tax" Brian K. LeonardNasrullah Djamil, SE, M.Si, Akt, CANo ratings yet

- Tax Benefits For Donations - Top RankedDocument3 pagesTax Benefits For Donations - Top RankedMatias HermosillaNo ratings yet

- PRO Taxing The ChurchDocument5 pagesPRO Taxing The ChurchLhem-Mari Japos NavalNo ratings yet

- #280 BBB 09-24-09 38Document1 page#280 BBB 09-24-09 38bmoakNo ratings yet

- US Internal Revenue Service: Ir-04-081Document17 pagesUS Internal Revenue Service: Ir-04-081IRSNo ratings yet

- IRS - Tax Guide For ChurchesDocument28 pagesIRS - Tax Guide For ChurchesTim McGheeNo ratings yet

- CTM2021MIDocument6 pagesCTM2021MIRanderson NevesNo ratings yet

- Not Indicate That The Organizations Have LostDocument1 pageNot Indicate That The Organizations Have LostIRSNo ratings yet

- Tax Exempt Orgs Form 990Document1 pageTax Exempt Orgs Form 990Claudric AdamsNo ratings yet

- #280 BBB 10-29-09 55Document1 page#280 BBB 10-29-09 55bmoakNo ratings yet

- Compliance Guide For Public CharitiesDocument28 pagesCompliance Guide For Public CharitiesPov TsheejNo ratings yet

- The American Families Plan Tax Compliance AgendaDocument24 pagesThe American Families Plan Tax Compliance AgendaForkLogNo ratings yet

- Offshore Tax 20090508Document9 pagesOffshore Tax 20090508bgkelleyNo ratings yet

- REBA Estate Planning Using LLC As Single Member For TaxesDocument14 pagesREBA Estate Planning Using LLC As Single Member For Taxesmatthew.b.lane01No ratings yet

- BBB Offers Checklist Response To Charity Telemarketing StateDocument1 pageBBB Offers Checklist Response To Charity Telemarketing StatebmoakNo ratings yet

- This Content Downloaded From 27.54.123.95 On Sat, 24 Apr 2021 20:17:37 UTCDocument28 pagesThis Content Downloaded From 27.54.123.95 On Sat, 24 Apr 2021 20:17:37 UTCkhizar ahmadNo ratings yet

- Qualified Pass-Through Entities Include:: Some Significant Elements of The Tax Cuts and Jobs ActDocument2 pagesQualified Pass-Through Entities Include:: Some Significant Elements of The Tax Cuts and Jobs Actanon_435247981No ratings yet

- Tax Evasion and Tax AvoidanceDocument14 pagesTax Evasion and Tax AvoidanceGarySinyangweNo ratings yet

- #280 BBB 04-29-10 177Document1 page#280 BBB 04-29-10 177bmoakNo ratings yet

- Factiva 20191022 1018 PDFDocument3 pagesFactiva 20191022 1018 PDFAnonymous tTk3g8No ratings yet

- April05.2014 Bsolon Pushes For Incentives For MSMEs To Boost Economic GrowthDocument1 pageApril05.2014 Bsolon Pushes For Incentives For MSMEs To Boost Economic Growthpribhor2No ratings yet

- US Internal Revenue Service: I1040gi - 2006Document87 pagesUS Internal Revenue Service: I1040gi - 2006IRS100% (1)

- House Hearing, 112TH Congress - Markup of The Small Business Administration Fiscal Year 2012 BudgetDocument33 pagesHouse Hearing, 112TH Congress - Markup of The Small Business Administration Fiscal Year 2012 BudgetScribd Government DocsNo ratings yet

- 080123NP Biz PlanDocument35 pages080123NP Biz PlanKbNo ratings yet

- Tax-Free Billions: Australia's Largest Companies Haven't Paid Corporate Tax in 10 Years - ABC News (Document6 pagesTax-Free Billions: Australia's Largest Companies Haven't Paid Corporate Tax in 10 Years - ABC News (Noodle Republic0% (1)

- This Self-Help Guide Is Geared Towards "Charitable" Organizations But May BeDocument11 pagesThis Self-Help Guide Is Geared Towards "Charitable" Organizations But May Bevipul.sachdeva6947No ratings yet

- Tax Churches DebateDocument19 pagesTax Churches DebateAnonymous lTXTx1fNo ratings yet

- Iff Analysis h0045 2015 PDFDocument1 pageIff Analysis h0045 2015 PDFDustinHurstNo ratings yet

- Policy Matters Ohio - Tax Breaks For Wealthy and Special InterestsDocument4 pagesPolicy Matters Ohio - Tax Breaks For Wealthy and Special InterestsProgressOhio251No ratings yet

- How The IRS Works: Functions and Audits: Internal Revenue ServiceDocument4 pagesHow The IRS Works: Functions and Audits: Internal Revenue ServiceRohit BajpaiNo ratings yet

- Transforming The Internal Revenue ServiceDocument20 pagesTransforming The Internal Revenue ServiceCato InstituteNo ratings yet

- 154.taxing The Hard To Tax - bdb.07.28.10Document2 pages154.taxing The Hard To Tax - bdb.07.28.10aefNo ratings yet

- IRS Issues Guidance and Updates Frequently Asked Questions Related To The New Clean Vehicle Critical Mineral and Battery ComponentsDocument1 pageIRS Issues Guidance and Updates Frequently Asked Questions Related To The New Clean Vehicle Critical Mineral and Battery ComponentsIrvanNo ratings yet

- Nonprofit Organizations Update Summer 2007Document6 pagesNonprofit Organizations Update Summer 2007Arnstein & Lehr LLP100% (1)

- Tax Collection Methods: Understanding Business Tax Collection and The Psyche of EvasionDocument28 pagesTax Collection Methods: Understanding Business Tax Collection and The Psyche of EvasionElizabeth CasabarNo ratings yet

- In The Financial IndustryDocument2 pagesIn The Financial IndustrySoninder KaurNo ratings yet

- #280 BBB 12-31-09 38Document1 page#280 BBB 12-31-09 38bmoakNo ratings yet

- 06-36 Let's Talk Tax.09-19-06.Taxation of Cooperatives - RPCDocument3 pages06-36 Let's Talk Tax.09-19-06.Taxation of Cooperatives - RPCPrincess SalvadorNo ratings yet

- Business ArticleDocument5 pagesBusiness ArticleKissel Jade Barsalote SarnoNo ratings yet

- Impact of Recent Tax Reform On CharitiesDocument6 pagesImpact of Recent Tax Reform On CharitiesZacharyEJWilliamsNo ratings yet

- Factiva 20191022 1023 PDFDocument2 pagesFactiva 20191022 1023 PDFAnonymous tTk3g8No ratings yet

- Clarion 26 FinalDocument2 pagesClarion 26 Finalapi-259871011No ratings yet

- IRS LetterDocument5 pagesIRS LetterJames LynchNo ratings yet

- Non-Profit Distinction: Organization Charitable Organizations Trade Unions ArtsDocument16 pagesNon-Profit Distinction: Organization Charitable Organizations Trade Unions ArtszdnacarioNo ratings yet

- 5013c Filing ProcedureDocument8 pages5013c Filing ProcedureOretha Brown-JohnsonNo ratings yet

- IRS Complaint Against NH District Corporation 11-18-19Document26 pagesIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanNo ratings yet

- Nonprofit Law in PhilippinesDocument22 pagesNonprofit Law in PhilippinesPaul Mark PilarNo ratings yet

- Dirty Dozen: Watch Out For Offer in Compromise Mills' Where Promoters Claim Their Services Are Needed To Settle IRS DebtsDocument2 pagesDirty Dozen: Watch Out For Offer in Compromise Mills' Where Promoters Claim Their Services Are Needed To Settle IRS DebtsIrvanNo ratings yet

- Letter To Janet YellenDocument7 pagesLetter To Janet YellenGeorge ShalhoubNo ratings yet

- #280 BBB 04-29-10 188Document1 page#280 BBB 04-29-10 188bmoakNo ratings yet

- #280 BBB 12-30-10 21Document1 page#280 BBB 12-30-10 21bmoakNo ratings yet

- #280 BBB 12-30-10 59Document1 page#280 BBB 12-30-10 59bmoakNo ratings yet

- #280 BBB 12-30-10 67Document1 page#280 BBB 12-30-10 67bmoakNo ratings yet

- #280 BBB 12-30-10 100Document1 page#280 BBB 12-30-10 100bmoakNo ratings yet

- #280 BBB 12-30-10 99Document1 page#280 BBB 12-30-10 99bmoakNo ratings yet

- #280 BBB 12-30-10 141Document1 page#280 BBB 12-30-10 141bmoakNo ratings yet

- #280 BBB 12-30-10 215Document1 page#280 BBB 12-30-10 215bmoakNo ratings yet

- #280 BBB 12-30-10 218Document1 page#280 BBB 12-30-10 218bmoakNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- 2016 Bar Exam Suggested AnswersDocument17 pages2016 Bar Exam Suggested AnswersAnonymous WJT0oARK5No ratings yet

- FederalDocument20 pagesFederalKim Cyrell DanilaNo ratings yet

- Pleased To Meet You Won'T You Guess My Name?Document24 pagesPleased To Meet You Won'T You Guess My Name?LuluNo ratings yet

- Sample Agreement: Allocation of Costs and Reimbursement of Expenses Between 501 (C) (3) and 501 (C)Document5 pagesSample Agreement: Allocation of Costs and Reimbursement of Expenses Between 501 (C) (3) and 501 (C)Rayan SantosNo ratings yet

- Taxation of Individuals QuizzerDocument37 pagesTaxation of Individuals QuizzerCharry Ramos62% (13)

- Smith-Bell Co. Vs CIRDocument1 pageSmith-Bell Co. Vs CIRAthena SantosNo ratings yet

- Bir LectureDocument4 pagesBir LectureClarisaJoy SyNo ratings yet

- 194-Applied Foods Ingredients Co. v. CIR G.R. No. 184266 November 11, 2013Document5 pages194-Applied Foods Ingredients Co. v. CIR G.R. No. 184266 November 11, 2013Jopan SJNo ratings yet

- 2017 Form 760 InstructionsDocument56 pages2017 Form 760 InstructionsicanadaaNo ratings yet

- BIR Rulings Compilation On Income TaxationDocument36 pagesBIR Rulings Compilation On Income Taxationvelasquez0731No ratings yet

- CIR V Suter 27 Scra 152Document5 pagesCIR V Suter 27 Scra 152Reuben EscarlanNo ratings yet

- Commissioner V Hypermix FeedsDocument36 pagesCommissioner V Hypermix FeedsEunice SerneoNo ratings yet

- Sole Survivorship 3Document5 pagesSole Survivorship 3Troy-Steven : NellNo ratings yet

- Notes On Registration of Book of AccountsDocument3 pagesNotes On Registration of Book of AccountsDenzel Edward CariagaNo ratings yet

- 2005-2006 Tax Bar Q&ADocument22 pages2005-2006 Tax Bar Q&AIrin200No ratings yet

- CIR v. ArieteDocument4 pagesCIR v. ArieteMJ Cems100% (2)

- CUNY Standard Verification WorksheetDocument3 pagesCUNY Standard Verification Worksheethicu0No ratings yet

- CIR vs. Transfield - Tax Amnesty - 2019Document23 pagesCIR vs. Transfield - Tax Amnesty - 2019Victoria aytonaNo ratings yet

- The Holy Grail of TaxDocument182 pagesThe Holy Grail of TaxJay FollowellNo ratings yet

- Cases JloDocument10 pagesCases JloOwen DefuntaronNo ratings yet

- Case Digests On Tax Remedies and JurisdictionsDocument36 pagesCase Digests On Tax Remedies and JurisdictionsNurul-Izza A. Sangcopan100% (2)

- U.S. Income Tax Return For Certain Political Organizations: Sign HereDocument6 pagesU.S. Income Tax Return For Certain Political Organizations: Sign HereManikanta Sai KumarNo ratings yet

- Calasanz V CIRDocument6 pagesCalasanz V CIRevelyn b t.No ratings yet

- Statutory ClaimDocument44 pagesStatutory ClaimLeonora Sekhmet Ntwea100% (1)

- 112 Mandanas v. Executive Secretary OchoaDocument2 pages112 Mandanas v. Executive Secretary OchoaMikaela PamatmatNo ratings yet

- Peter W. Defelice and Norma G. Defelice v. Commissioner of Internal Revenue, 386 F.2d 704, 10th Cir. (1967)Document9 pagesPeter W. Defelice and Norma G. Defelice v. Commissioner of Internal Revenue, 386 F.2d 704, 10th Cir. (1967)Scribd Government DocsNo ratings yet

- Tax - First Preboard QuestionnaireDocument14 pagesTax - First Preboard QuestionnairewithyouidkNo ratings yet

- Nonprofit GuidebookDocument29 pagesNonprofit Guidebookdbruce37211No ratings yet