Professional Documents

Culture Documents

SEBI

SEBI

Uploaded by

Apurva DipnaikCopyright:

Available Formats

You might also like

- Project On SebiDocument15 pagesProject On SebiVrushti Parmar88% (17)

- Legal Aspects of Business Transactions: A Complete Guide to the Law Governing Business Organization, Financing, Transactions, and GovernanceFrom EverandLegal Aspects of Business Transactions: A Complete Guide to the Law Governing Business Organization, Financing, Transactions, and GovernanceNo ratings yet

- SEBIDocument2 pagesSEBIAkash ShrivastavaNo ratings yet

- C C CM: MMMMMMDocument4 pagesC C CM: MMMMMMGaurav RauthanNo ratings yet

- History: Government of India Indian Parliament Bandra Kurla Complex Mumbai New Delhi Kolkata Chennai AhmedabadDocument2 pagesHistory: Government of India Indian Parliament Bandra Kurla Complex Mumbai New Delhi Kolkata Chennai AhmedabadVishal SharmaNo ratings yet

- Introductio 1Document2 pagesIntroductio 1Anil ShelarNo ratings yet

- INTRODUCTIONDocument48 pagesINTRODUCTIONtanisq10100% (2)

- Securities and Exchange Board of IndiaDocument21 pagesSecurities and Exchange Board of IndiaDeepa A PoojaryNo ratings yet

- Sebi Power and FunctionDocument13 pagesSebi Power and Functionaman kadriNo ratings yet

- Role of SEBI in Capital MarketDocument6 pagesRole of SEBI in Capital MarketShashank HatleNo ratings yet

- Securities and Exchange Board of India: Regulator Securities SEBI Act, 1992Document6 pagesSecurities and Exchange Board of India: Regulator Securities SEBI Act, 1992Pawan LohanaNo ratings yet

- Topic: Sebi As A Regulatory Authority On Companies: Company LawDocument21 pagesTopic: Sebi As A Regulatory Authority On Companies: Company LawsrivarshiniNo ratings yet

- Securities and Exchange Board of IndiaDocument32 pagesSecurities and Exchange Board of IndiaMohan kashyapNo ratings yet

- Securities and Exchange Board of IndiaDocument73 pagesSecurities and Exchange Board of IndiaSurya ParkashNo ratings yet

- Investment Law PresentationDocument11 pagesInvestment Law PresentationNanda SurajNo ratings yet

- Investment and Securities AssignmentDocument16 pagesInvestment and Securities Assignmentkhusboo kharbandaNo ratings yet

- Securities and Exchange Board of IndiaDocument6 pagesSecurities and Exchange Board of IndiaSiddhi PatwaNo ratings yet

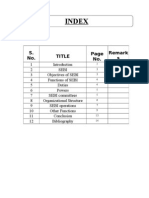

- Index: S. No. Title No. Remark SDocument17 pagesIndex: S. No. Title No. Remark SSiddhi PatwaNo ratings yet

- Securities and Exchange Board of IndiaDocument10 pagesSecurities and Exchange Board of IndiajaseelekaNo ratings yet

- Securities and Exchange Board of IndiaDocument5 pagesSecurities and Exchange Board of IndiaKanna RajeshNo ratings yet

- Name-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)Document6 pagesName-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)MechiluhoNo ratings yet

- Assignment On SebiDocument17 pagesAssignment On SebiSUFIYAN SIDDIQUINo ratings yet

- Capital Market and SEBIDocument4 pagesCapital Market and SEBINishant GoyalNo ratings yet

- SEBIDocument8 pagesSEBIanandminz35No ratings yet

- Ifm AssignmentDocument15 pagesIfm AssignmentRockstar KshitijNo ratings yet

- Securities and Exchange Board of India: Navigation SearchDocument7 pagesSecurities and Exchange Board of India: Navigation SearchAshish ThengariNo ratings yet

- Sebi Upsc Notes 45Document4 pagesSebi Upsc Notes 45tipuchouhan3No ratings yet

- Corporate Social ResponsibilityDocument9 pagesCorporate Social Responsibilityperumbhuduru manoharNo ratings yet

- Functional Report of SEBIDocument9 pagesFunctional Report of SEBIAMIT K SINGH100% (1)

- Financial Management Regulation PROJECTDocument25 pagesFinancial Management Regulation PROJECTraj vardhan agarwalNo ratings yet

- History: The Securities and Exchange Board of India Act, 1992Document4 pagesHistory: The Securities and Exchange Board of India Act, 1992Arulmani MurugesanNo ratings yet

- Securities and Exchange Board of IndiaDocument13 pagesSecurities and Exchange Board of Indiasonal jainNo ratings yet

- Sebi'S Background: Securities and Exchange Board of IndiaDocument15 pagesSebi'S Background: Securities and Exchange Board of IndiaAnjaliNo ratings yet

- Upendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesDocument4 pagesUpendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesAbhishek ShuklaNo ratings yet

- Module 04 Investment N Securities Law-6Document76 pagesModule 04 Investment N Securities Law-6Kirti DNo ratings yet

- Dodgy Transaction: Powers of SEBIDocument11 pagesDodgy Transaction: Powers of SEBIJesse JhangraNo ratings yet

- Securities and Exchange Board of India: SEBI - A Brief IntroductionDocument37 pagesSecurities and Exchange Board of India: SEBI - A Brief IntroductionBhushan KharatNo ratings yet

- Anurag ProjectDocument6 pagesAnurag ProjectAnurag LahaneNo ratings yet

- Securities and Exchange Board of India (SEBI)Document10 pagesSecurities and Exchange Board of India (SEBI)Utkarsh SethiNo ratings yet

- Difference Between Money Markets and Capital MarketsDocument4 pagesDifference Between Money Markets and Capital MarketsSachin TiwariNo ratings yet

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalNo ratings yet

- Arnav 245 (Sebi)Document14 pagesArnav 245 (Sebi)ArnavNo ratings yet

- SEBI PPT III BADocument15 pagesSEBI PPT III BAKeerthi RajeshNo ratings yet

- Internal Backlog Company Law Role of Sebi in Stock ExchangeDocument9 pagesInternal Backlog Company Law Role of Sebi in Stock ExchangeApoorv SrivastavaNo ratings yet

- SEBI AssignmentDocument12 pagesSEBI Assignmentxakij19914No ratings yet

- Financial Regulatory Bodies in India: Market ParticipantsDocument8 pagesFinancial Regulatory Bodies in India: Market ParticipantsAnonymous aAMqLLNo ratings yet

- SebiDocument26 pagesSebikhilchiadilNo ratings yet

- Ministry of Corporate AffairsDocument10 pagesMinistry of Corporate AffairsAzim SamnaniNo ratings yet

- Labour Law AssignmentDocument8 pagesLabour Law AssignmentTanya SinghNo ratings yet

- Regulators of IndiaDocument29 pagesRegulators of IndiaPoonam KumariNo ratings yet

- Role of S.E.B.I. As A Regulatory Authority: AbhinavDocument5 pagesRole of S.E.B.I. As A Regulatory Authority: AbhinavRahul JagwaniNo ratings yet

- Sebi Functional ReportDocument7 pagesSebi Functional ReportRohan Pawar61% (18)

- Investment Law ProjectDocument22 pagesInvestment Law ProjectAnjali SinhaNo ratings yet

- 1.7 Business Legal Systems: Mfa 1 SemesterDocument53 pages1.7 Business Legal Systems: Mfa 1 SemesterSoumyaparna SinghaNo ratings yet

- Amity Law SchoolDocument12 pagesAmity Law SchoolIshaan TandonNo ratings yet

- SebiDocument2 pagesSebiT MnNo ratings yet

- Co Law IiDocument15 pagesCo Law IiRitik SharmaNo ratings yet

- SECPDocument18 pagesSECPAli JumaniNo ratings yet

- Summary of Stefan Loesch's A Guide to Financial Regulation for Fintech EntrepreneursFrom EverandSummary of Stefan Loesch's A Guide to Financial Regulation for Fintech EntrepreneursNo ratings yet

SEBI

SEBI

Uploaded by

Apurva DipnaikOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SEBI

SEBI

Uploaded by

Apurva DipnaikCopyright:

Available Formats

SEBI is the regulator for the Securities Market in India.

It was formed officially by the

Government of India in 1992 with SEBI Act 1992 being passed by the Indian Parliament.

Chaired by C B Bhave, SEBI is headquartered in the popular business district of Bandra-

Kurla complex in Mumbai, and has Northern, Eastern, Southern and Western regional

offices in New Delhi, Kolkata, Chennai and Ahmedabad.

Organization Structure

Chandrasekhar Bhaskar Bhave is the sixth chairman of the Securities Market Regulator.

Prior to taking charge as Chairman SEBI, he had been the chairman of NSDL (National

Securities Depository Limited) ushering in paperless securities. Prior to his stint at

NSDL, he had served SEBI as a Senior Executive Director. He is a former Indian

Administrative Service officer of the 1975 batch.

Preamble

The Preamble of the Securities and Exchange Board of India describes the basic

functions of the Securities and Exchange Board of India as”. to protect the interests of

investors in securities and to promote the development of, and to regulate the securities

market and for matters connected therewith or incidental thereto”

Functions and Responsibilities

SEBI has to be responsive to the needs of three groups, which constitute the market:

• the issuers of securities

• the investors

• the market intermediaries.

SEBI has three functions rolled into one body quasi-legislative, quasi-judicial and quasi-

executive. It drafts regulations in its legislative capacity, it conducts investigation and

enforcement action in its executive function and it passes rulings and orders in its judicial

capacity. Though this makes it very powerful, there is an appeals process to create

accountability. There is a Securities Appellate Tribunal which is a three member tribunal

and is presently headed by a former Chief Justice of a High court - Mr. Justice NK Sodhi.

A second appeal lies directly to the Supreme Court.

SEBI has enjoyed success as a regulator by pushing systemic reforms aggressively and

successively (e.g. the quick movement towards making the markets electronic and

paperless rolling settlement on T+2 basis). SEBI has been active in setting up the

regulations as required under law.

You might also like

- Project On SebiDocument15 pagesProject On SebiVrushti Parmar88% (17)

- Legal Aspects of Business Transactions: A Complete Guide to the Law Governing Business Organization, Financing, Transactions, and GovernanceFrom EverandLegal Aspects of Business Transactions: A Complete Guide to the Law Governing Business Organization, Financing, Transactions, and GovernanceNo ratings yet

- SEBIDocument2 pagesSEBIAkash ShrivastavaNo ratings yet

- C C CM: MMMMMMDocument4 pagesC C CM: MMMMMMGaurav RauthanNo ratings yet

- History: Government of India Indian Parliament Bandra Kurla Complex Mumbai New Delhi Kolkata Chennai AhmedabadDocument2 pagesHistory: Government of India Indian Parliament Bandra Kurla Complex Mumbai New Delhi Kolkata Chennai AhmedabadVishal SharmaNo ratings yet

- Introductio 1Document2 pagesIntroductio 1Anil ShelarNo ratings yet

- INTRODUCTIONDocument48 pagesINTRODUCTIONtanisq10100% (2)

- Securities and Exchange Board of IndiaDocument21 pagesSecurities and Exchange Board of IndiaDeepa A PoojaryNo ratings yet

- Sebi Power and FunctionDocument13 pagesSebi Power and Functionaman kadriNo ratings yet

- Role of SEBI in Capital MarketDocument6 pagesRole of SEBI in Capital MarketShashank HatleNo ratings yet

- Securities and Exchange Board of India: Regulator Securities SEBI Act, 1992Document6 pagesSecurities and Exchange Board of India: Regulator Securities SEBI Act, 1992Pawan LohanaNo ratings yet

- Topic: Sebi As A Regulatory Authority On Companies: Company LawDocument21 pagesTopic: Sebi As A Regulatory Authority On Companies: Company LawsrivarshiniNo ratings yet

- Securities and Exchange Board of IndiaDocument32 pagesSecurities and Exchange Board of IndiaMohan kashyapNo ratings yet

- Securities and Exchange Board of IndiaDocument73 pagesSecurities and Exchange Board of IndiaSurya ParkashNo ratings yet

- Investment Law PresentationDocument11 pagesInvestment Law PresentationNanda SurajNo ratings yet

- Investment and Securities AssignmentDocument16 pagesInvestment and Securities Assignmentkhusboo kharbandaNo ratings yet

- Securities and Exchange Board of IndiaDocument6 pagesSecurities and Exchange Board of IndiaSiddhi PatwaNo ratings yet

- Index: S. No. Title No. Remark SDocument17 pagesIndex: S. No. Title No. Remark SSiddhi PatwaNo ratings yet

- Securities and Exchange Board of IndiaDocument10 pagesSecurities and Exchange Board of IndiajaseelekaNo ratings yet

- Securities and Exchange Board of IndiaDocument5 pagesSecurities and Exchange Board of IndiaKanna RajeshNo ratings yet

- Name-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)Document6 pagesName-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)MechiluhoNo ratings yet

- Assignment On SebiDocument17 pagesAssignment On SebiSUFIYAN SIDDIQUINo ratings yet

- Capital Market and SEBIDocument4 pagesCapital Market and SEBINishant GoyalNo ratings yet

- SEBIDocument8 pagesSEBIanandminz35No ratings yet

- Ifm AssignmentDocument15 pagesIfm AssignmentRockstar KshitijNo ratings yet

- Securities and Exchange Board of India: Navigation SearchDocument7 pagesSecurities and Exchange Board of India: Navigation SearchAshish ThengariNo ratings yet

- Sebi Upsc Notes 45Document4 pagesSebi Upsc Notes 45tipuchouhan3No ratings yet

- Corporate Social ResponsibilityDocument9 pagesCorporate Social Responsibilityperumbhuduru manoharNo ratings yet

- Functional Report of SEBIDocument9 pagesFunctional Report of SEBIAMIT K SINGH100% (1)

- Financial Management Regulation PROJECTDocument25 pagesFinancial Management Regulation PROJECTraj vardhan agarwalNo ratings yet

- History: The Securities and Exchange Board of India Act, 1992Document4 pagesHistory: The Securities and Exchange Board of India Act, 1992Arulmani MurugesanNo ratings yet

- Securities and Exchange Board of IndiaDocument13 pagesSecurities and Exchange Board of Indiasonal jainNo ratings yet

- Sebi'S Background: Securities and Exchange Board of IndiaDocument15 pagesSebi'S Background: Securities and Exchange Board of IndiaAnjaliNo ratings yet

- Upendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesDocument4 pagesUpendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesAbhishek ShuklaNo ratings yet

- Module 04 Investment N Securities Law-6Document76 pagesModule 04 Investment N Securities Law-6Kirti DNo ratings yet

- Dodgy Transaction: Powers of SEBIDocument11 pagesDodgy Transaction: Powers of SEBIJesse JhangraNo ratings yet

- Securities and Exchange Board of India: SEBI - A Brief IntroductionDocument37 pagesSecurities and Exchange Board of India: SEBI - A Brief IntroductionBhushan KharatNo ratings yet

- Anurag ProjectDocument6 pagesAnurag ProjectAnurag LahaneNo ratings yet

- Securities and Exchange Board of India (SEBI)Document10 pagesSecurities and Exchange Board of India (SEBI)Utkarsh SethiNo ratings yet

- Difference Between Money Markets and Capital MarketsDocument4 pagesDifference Between Money Markets and Capital MarketsSachin TiwariNo ratings yet

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalNo ratings yet

- Arnav 245 (Sebi)Document14 pagesArnav 245 (Sebi)ArnavNo ratings yet

- SEBI PPT III BADocument15 pagesSEBI PPT III BAKeerthi RajeshNo ratings yet

- Internal Backlog Company Law Role of Sebi in Stock ExchangeDocument9 pagesInternal Backlog Company Law Role of Sebi in Stock ExchangeApoorv SrivastavaNo ratings yet

- SEBI AssignmentDocument12 pagesSEBI Assignmentxakij19914No ratings yet

- Financial Regulatory Bodies in India: Market ParticipantsDocument8 pagesFinancial Regulatory Bodies in India: Market ParticipantsAnonymous aAMqLLNo ratings yet

- SebiDocument26 pagesSebikhilchiadilNo ratings yet

- Ministry of Corporate AffairsDocument10 pagesMinistry of Corporate AffairsAzim SamnaniNo ratings yet

- Labour Law AssignmentDocument8 pagesLabour Law AssignmentTanya SinghNo ratings yet

- Regulators of IndiaDocument29 pagesRegulators of IndiaPoonam KumariNo ratings yet

- Role of S.E.B.I. As A Regulatory Authority: AbhinavDocument5 pagesRole of S.E.B.I. As A Regulatory Authority: AbhinavRahul JagwaniNo ratings yet

- Sebi Functional ReportDocument7 pagesSebi Functional ReportRohan Pawar61% (18)

- Investment Law ProjectDocument22 pagesInvestment Law ProjectAnjali SinhaNo ratings yet

- 1.7 Business Legal Systems: Mfa 1 SemesterDocument53 pages1.7 Business Legal Systems: Mfa 1 SemesterSoumyaparna SinghaNo ratings yet

- Amity Law SchoolDocument12 pagesAmity Law SchoolIshaan TandonNo ratings yet

- SebiDocument2 pagesSebiT MnNo ratings yet

- Co Law IiDocument15 pagesCo Law IiRitik SharmaNo ratings yet

- SECPDocument18 pagesSECPAli JumaniNo ratings yet

- Summary of Stefan Loesch's A Guide to Financial Regulation for Fintech EntrepreneursFrom EverandSummary of Stefan Loesch's A Guide to Financial Regulation for Fintech EntrepreneursNo ratings yet