Professional Documents

Culture Documents

Banking Risks

Banking Risks

Uploaded by

Nilutpal BharaliOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Risks

Banking Risks

Uploaded by

Nilutpal BharaliCopyright:

Available Formats

BANKING RISKS

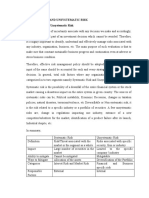

The major risks in banking business are

Credit Risk: Default by the borrower to repay the borrowings

Market Risk: Volatility in the banks’ portfolio due to change in market factors.

Operational risk: Risk arising out of banks’ inefficient internal processes, systems,

people or external events like natural disasters, robbery etc

Liquidity risk: Arises from funding of long term assets by short term liabilities

Interest rate risk: Exposure of a bank`s financial conditions to adverse movements in

interest rates.

Management of Risks

It begins with identification and its quantification. It is only after risks are

identified and measured we may decide to accept the risk or to accept the

risk at a reduced level by undertaking steps to mitigate the risk, either fully

or partially. In addition pricing of the transaction should be in accordance

with the risk content of the transaction. Management of risks may be sub

divided into following five processes.

Risk identification

Risk measurement

Risk pricing

Risk monitoring and control

Risk mitigation

The Indian Economy is booming on the back of strong economic policies and a

healthy regulatory management. The effects of this are far-reaching and have the

potential to ultimately achieve the high growth rates that the country is yearning for.

The banking system lies at the nucleus of a country’s development robust reforms

are needed in India’s case to fulfill that. The BASEL II accord from the Bank of

International Settlements attempts to put in place sound frameworks of measuring

and quantifying the risks associated with banking operations

Banks need risk management packages not only to adhere Basel II, also for

effective risk management and mitigation, effective capital allocation, gain

competitive advantage, develop the robust system and process, improve

reporting systems and transparency, and cost reduction through detailed data

analysis.

You might also like

- SynopsisDocument17 pagesSynopsisHarini Bhandaru100% (1)

- Risk Management in Banks 2Document56 pagesRisk Management in Banks 2Aquib KhanNo ratings yet

- Banking RiskDocument12 pagesBanking RiskBadshahNo ratings yet

- MFS - Risk Management in Banks MuskanDocument54 pagesMFS - Risk Management in Banks Muskansangambhardwaj64No ratings yet

- BbaDocument13 pagesBbaBadshahNo ratings yet

- Risk Management Systems in Banks Genesis, Significance and ImplementationDocument32 pagesRisk Management Systems in Banks Genesis, Significance and Implementationmahajan87No ratings yet

- Dissertation Main - Risk Management in BanksDocument87 pagesDissertation Main - Risk Management in Banksjesenku100% (1)

- The Measurement and Management of Risks in BanksDocument21 pagesThe Measurement and Management of Risks in BanksGaurav GehlotNo ratings yet

- Oriental Bank of Commerce,: Head Office, DelhiDocument32 pagesOriental Bank of Commerce,: Head Office, DelhiAkshat SinghalNo ratings yet

- Banks Are in The Business of Managing Risk, Not Avoiding It ..Document9 pagesBanks Are in The Business of Managing Risk, Not Avoiding It ..Usaama AbdilaahiNo ratings yet

- Dissertation Project Report On Risk Management in BanksDocument38 pagesDissertation Project Report On Risk Management in BanksKelly HamiltonNo ratings yet

- Risk Management in Banks Under Basel NormsDocument53 pagesRisk Management in Banks Under Basel NormsSahni SahniNo ratings yet

- Unit 12 Risk Management: An Overview: ObjectivesDocument33 pagesUnit 12 Risk Management: An Overview: ObjectivesSiva Venkata RamanaNo ratings yet

- Risk Management in Indian Banking Sector and The Role of RBIDocument6 pagesRisk Management in Indian Banking Sector and The Role of RBIPooja GarhwalNo ratings yet

- Risk Management Policy Summary VersionDocument23 pagesRisk Management Policy Summary VersionMehr Aamir MaqsoodNo ratings yet

- Risk Management in Indian Banks: Some Emerging Issues: Dr. Krishn A.Goyal, Int. Eco. J. Res., 2010 1 (1) 102-109Document8 pagesRisk Management in Indian Banks: Some Emerging Issues: Dr. Krishn A.Goyal, Int. Eco. J. Res., 2010 1 (1) 102-109Shukla JineshNo ratings yet

- Risk Management in Banking Sector - An Empirical Study: Thirupathi Kanchu M. Manoj KumarDocument9 pagesRisk Management in Banking Sector - An Empirical Study: Thirupathi Kanchu M. Manoj KumarKunTal MoNdalNo ratings yet

- Objectives of Credit Risk Management in BanksDocument2 pagesObjectives of Credit Risk Management in BankscostaNo ratings yet

- Comprehensive Risk Management ProgramDocument11 pagesComprehensive Risk Management Programarefayne wodajoNo ratings yet

- Risk Management in Banking CompaniesDocument2 pagesRisk Management in Banking CompaniesPrashanth NaraenNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummaryArin ChattopadhyayNo ratings yet

- Analysis of Risk Management in Financial InstitutionsDocument22 pagesAnalysis of Risk Management in Financial Institutionsalifahadmz04No ratings yet

- Credit Risk Management With Reference of State Bank of IndiaDocument85 pagesCredit Risk Management With Reference of State Bank of IndiakkvNo ratings yet

- Deb Ashish 1Document119 pagesDeb Ashish 1Somnath DasNo ratings yet

- Liquidity Risks Management Practices by Commercial Banks in Bangladesh: An Empirical StudyDocument26 pagesLiquidity Risks Management Practices by Commercial Banks in Bangladesh: An Empirical StudyOve Kabir Eon 1731923No ratings yet

- ShradhaDocument19 pagesShradhakkvNo ratings yet

- FMTD - RIsk Management in BanksDocument6 pagesFMTD - RIsk Management in Banksajay_chitreNo ratings yet

- Sustainable Risk Management in Banking Sector: International Journal of Advanced Research and DevelopmentDocument3 pagesSustainable Risk Management in Banking Sector: International Journal of Advanced Research and DevelopmentManjula DissanayakeNo ratings yet

- 09 TASK PERFORMANCE 1 - GovDocument2 pages09 TASK PERFORMANCE 1 - GovJen DeloyNo ratings yet

- Topic 6 Risk ManagementDocument45 pagesTopic 6 Risk Managementcaroon keowNo ratings yet

- Risk Management Systems in Banks Genesis, Significance and ImplementationDocument20 pagesRisk Management Systems in Banks Genesis, Significance and Implementationrajajee43No ratings yet

- Credit Risk ManagementDocument16 pagesCredit Risk Managementkrishnalohia9No ratings yet

- Background: Types of RisksDocument7 pagesBackground: Types of Risksnandish30No ratings yet

- Risk Management in BanksDocument57 pagesRisk Management in BanksSunil Rawat100% (1)

- Risk Management-Indian BankingDocument15 pagesRisk Management-Indian BankingSachin GhagareNo ratings yet

- Risk Management FinalDocument26 pagesRisk Management FinalGinu TharianNo ratings yet

- Risk 2Document55 pagesRisk 2venkatesh pkNo ratings yet

- PROJECT REPORT (Risk Management) Santu - Docx 111111111111Document71 pagesPROJECT REPORT (Risk Management) Santu - Docx 111111111111Sami ZamaNo ratings yet

- Credit Risk Mgmt. at ICICIDocument60 pagesCredit Risk Mgmt. at ICICIRikesh Daliya100% (1)

- Online Test Series: Jaiib Caiib Mock Test & Study Materias PageDocument83 pagesOnline Test Series: Jaiib Caiib Mock Test & Study Materias PageabhiNo ratings yet

- Term PaperDocument21 pagesTerm PaperPooja JainNo ratings yet

- Systematic and Unsystematic Risk 4.1 Systematic and Unsystematic RiskDocument7 pagesSystematic and Unsystematic Risk 4.1 Systematic and Unsystematic RiskSanjeev JayaratnaNo ratings yet

- Credit Risk ManagementDocument13 pagesCredit Risk ManagementVallabh UtpatNo ratings yet

- Chapter-I Introduction and Design of The StudyDocument28 pagesChapter-I Introduction and Design of The StudyShabreen SultanaNo ratings yet

- Banking Presentation Final - 4Document34 pagesBanking Presentation Final - 4Ganesh Nair100% (1)

- Theory of RiskDocument6 pagesTheory of Riskvicent johnNo ratings yet

- Risk Management in BanksDocument26 pagesRisk Management in BanksDivya Keswani0% (1)

- Unit II 20 02 2023Document65 pagesUnit II 20 02 2023Anurag VarmaNo ratings yet

- Article On Risk Management in BankDocument7 pagesArticle On Risk Management in Bankraihan175No ratings yet

- Bank Risk Management Is Used Mostly in The FinancialDocument9 pagesBank Risk Management Is Used Mostly in The FinancialYash PratapNo ratings yet

- FIN644 Risk SummaryDocument2 pagesFIN644 Risk Summarysayma.sheikhNo ratings yet

- Good Articke On Credit RiskDocument3 pagesGood Articke On Credit Riskumesh31027No ratings yet

- Managing Intragroup and Insurance Risk - Q5 - 2Document43 pagesManaging Intragroup and Insurance Risk - Q5 - 2andriyas1234No ratings yet

- RiskMgtFuidelineKenya5 PDFDocument57 pagesRiskMgtFuidelineKenya5 PDFidolhevevNo ratings yet

- Chapter - 1: 0781913905 Risk Management at Centeral Bank of IndiaDocument60 pagesChapter - 1: 0781913905 Risk Management at Centeral Bank of IndiaRachna DidwaniaNo ratings yet

- Risk Management in Commercial BanksDocument17 pagesRisk Management in Commercial BanksUsaama AbdilaahiNo ratings yet

- Market Riask of Ambee PharmaDocument12 pagesMarket Riask of Ambee PharmaSabbir ZamanNo ratings yet

- Mastering Financial Risk Management : Strategies for SuccessFrom EverandMastering Financial Risk Management : Strategies for SuccessNo ratings yet