Professional Documents

Culture Documents

Balance Sheet

Balance Sheet

Uploaded by

ayeshnaveedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet

Balance Sheet

Uploaded by

ayeshnaveedCopyright:

Available Formats

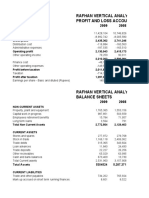

Balance Sheet

As at December 31, 2009

(Rs.in thousands)

2009 2008

Assets

Fixed Assets

Property, plant and equipment 4,736,619 4,428,278

Intangibles 2,433 7,303

Long term investments 95,202 95,202

Long term loans 98,117 120,545

Long term deposits and prepayments 392,896 540,027

Retirement benefit –prepayment 188,054 205,355

Total 5,513,321 5,396,120

Current-Assets

Stores and spares 265,420 241,753

Stock in trade 3,649,070 4,251,914

Trade debts 506,357 228,763

Loans and advances 131,852 123,904

Trade deposits and short term prepayments 682,949 516,443

Other receivables 82,141 218,329

Tax refund due from the Government 355,052 301,813

Cash and bank balances 239,553 106,789

5,912,394 5,989,708

Total Assets 11,425,715 11,386,418

Equity and Liabilities

(Rs. In thousands)

2009 2008

Capital and reserves

Share Capital 669,477 669,477

Reserves 2,621,643 1,546,281

3,291,120 2,215,758

Surplus on revaluation of fixed assets 12,965 13,613

Liabilities

Non-current Liabilities

Liabilities against assets subject to finance leases 56,762 77,327

Deferred taxation 636,130 369,653

Retirement benefit obligations 327,060 239,794

Current Liabilities

Trade and other payables 5,785,766 4,547,794

Accrued interest/markup 28,892 64,075

Short term borrowings 1,037,911 3,232,523

Current maturity of liabilities against finance- 28,419 32,322

Assets subjects to finance leases

Provisions 220,680 593,559

7,101,678 8, 4702,273

Total liabilities 8,121,630 9,157,047

Total equity and liabilities 11,425,715 11,386,418

Profit and Loss Account

(Rs. In thousands)

2009 2008

For the year ended December 31, 2009

Sales 38,187,582 30,956,839

Cost of sales (24,852,625) (20,219,184)

Gross profit 13,334,957 10,737,655

Distribution costs (7,179,694) (5,847,845)

Administrative expenses (1,030,478) (1,002,214)

Other operating expenses (373,785) (247,266)

Other operating income 192,313 239,918

4,943,313 3,880,248

Restructuring cost - (489,280)

Profit from operations 4,943,313 3,390,968

Finance costs (427,708) (466,166)

Profit before taxation 4,515,605 2,924,802

Taxation (1,459,865) (940,476)

Profit after taxation 3,055,740 1,984,326

Earnings per share (Rupees) 230 149

Cash Flow Statement

for the year ended December 31, 2009

(Rs. In thousands)

2009 2008

Profit before taxation 4,515,605 2,924,802

Adjustments for non-cash charges and other items

Depreciation 496,867 453,671

Amortisation of software 4,870 4,870

Loss / (Gain) on disposal of property, plant and equipment 8,901 (29,805)

Dividend income (12) (12)

Finance cost 427,708 466,166

Provision for staff retirement benefits 523,039 449,772

Return on savings accounts (993) (1,065)

1,460,380 1,343,597

Profit before working capital changes 5,975,985 4,268,399

Effect on cash flows due to working capital changes

Decrease / (Increase) in current assets

Stores and spares (23,667) (78,471)

Stock in trade 602,844 (1,525,850)

Trade debts (277,594) 10,550

Loans and advances (7,948) (1,016)

Trade deposits and short term prepayments (166,506) (280,379)

Other receivables 136,188 30,810

Sales tax refundable - 11,457

Increase / (Decrease) in current liabilities

Trade and other payables 1,264,662 (243,457)

Provisions (372,879) 222,532

891,783 (20,925)

1,155,100 (1,853,824)

Cash generated from operations (carried forward) 7,131,085 2,414,575

Cash generated from operations (brought forward) 7,131,085 2,414,575

Finance costs paid (462,891) (405,760)

Income tax paid (1,281,629) (1,066,274)

Retirement benefits obligations paid (418,472) (304,918)

Decrease / (Increase) in long term loans 22,428 (5,157)

Decrease / (Increase) in long term deposits and prepayments 147,131 (535,107)

Net cash from operating activities 5,137,652 97,359

Cash flows from investing activities

Purchase of property, plant and equipment (872,311) (1,369,388)

Sale proceeds of property, plant and equipment 62,155 120,630

Return received on savings accounts 993 2,180

Dividend received 12 12

Net cash used in investing activities (809,151) (1,246,566)

Cash flows from financing activities

Decrease in liabilities against assets subject to finance leases (28,421) (33,370)

Dividends paid (1,972,704) (1,708,282)

Net cash used in financing activities (2,001,125) (1,741,652)

Net increase / (decrease) in cash and cash equivalents 2,327,376 (2,890,859)

Cash and cash equivalents at the beginning of the year (3,125,734) (234,875)

Cash and cash equivalents at the end of the year (798,358) (3,125,734)

You might also like

- Soluzioni IngleseDocument239 pagesSoluzioni IngleseAxel BlazeNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- FMC Corporation and Ors Vs NATCO Pharma Limited 15DE202021072015105629COM998403Document32 pagesFMC Corporation and Ors Vs NATCO Pharma Limited 15DE202021072015105629COM998403Siddharth soniNo ratings yet

- OSS Double-Agent Operations in World War IIDocument12 pagesOSS Double-Agent Operations in World War IIoscarherradonNo ratings yet

- DG Cement Financial DataDocument4 pagesDG Cement Financial DataMuneeb AhmedNo ratings yet

- Assignment # 4Document9 pagesAssignment # 4Abdul BasitNo ratings yet

- Balance Sheet (December 31, 2008)Document6 pagesBalance Sheet (December 31, 2008)anon_14459No ratings yet

- Bangladesh Lamps 3rd Q 2010Document3 pagesBangladesh Lamps 3rd Q 2010Sopne Vasa PurushNo ratings yet

- Balance Sheet of Maple Leaf: AssetsDocument12 pagesBalance Sheet of Maple Leaf: Assets01290101002675No ratings yet

- Unaudited Financials BSX December 2023Document2 pagesUnaudited Financials BSX December 2023BernewsNo ratings yet

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Document2 pagesUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooNo ratings yet

- Research For OBUDocument14 pagesResearch For OBUM Burhan SafiNo ratings yet

- Hand Protection PLCDocument8 pagesHand Protection PLCasankaNo ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- Half Yearly Report As at 30 June 2010Document3 pagesHalf Yearly Report As at 30 June 2010Sopne Vasa PurushNo ratings yet

- ProntoForms 2023 Q2 FinancialsDocument18 pagesProntoForms 2023 Q2 Financialsprincehalder0027No ratings yet

- TeslaDocument5 pagesTeslaRajib ChatterjeeNo ratings yet

- Quiz RatiosDocument4 pagesQuiz RatiosAmmar AsifNo ratings yet

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhNo ratings yet

- IbfDocument9 pagesIbfMinhal-KukdaNo ratings yet

- Samsung Cash Flow and Fund Flow2Document14 pagesSamsung Cash Flow and Fund Flow2Suhas ChowdharyNo ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- CHAPTER 6-FA Questions - BAsicDocument3 pagesCHAPTER 6-FA Questions - BAsicHussna Al-Habsi حُسنى الحبسيNo ratings yet

- Crescent Steel and Allied Products LTD.: Balance SheetDocument14 pagesCrescent Steel and Allied Products LTD.: Balance SheetAsadvirkNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Vietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Document24 pagesVietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Như ThảoNo ratings yet

- Samsung RatiosDocument11 pagesSamsung RatiosjunaidNo ratings yet

- HOndaDocument8 pagesHOndaRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Ain 20201025074Document8 pagesAin 20201025074HAMMADHRNo ratings yet

- AssetsDocument3 pagesAssetsyasrab abbasNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- H. J. Heinz Company Statement of Cash Flows (In Thousands) For 2009Document4 pagesH. J. Heinz Company Statement of Cash Flows (In Thousands) For 2009Adoree RamosNo ratings yet

- FirstBank Unaudited Half Year Results For Period Ending June 2010Document1 pageFirstBank Unaudited Half Year Results For Period Ending June 2010Kunle AdegboyeNo ratings yet

- CF - Example1Document8 pagesCF - Example1BSHELTON8No ratings yet

- 1333 HK Full YrDocument38 pages1333 HK Full Yrwilliam zengNo ratings yet

- MicrosoftDocument11 pagesMicrosoftJannah Victoria AmoraNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- Gul Ahmed Quiz 2 QuesDocument5 pagesGul Ahmed Quiz 2 QuesTehreem SirajNo ratings yet

- The Group AssetsDocument46 pagesThe Group Assetsit4728No ratings yet

- Appendix 1 To 5Document13 pagesAppendix 1 To 5Adil SaleemNo ratings yet

- Fauji Fertilizer Company Limited: Income Statement As Per Year End 2009Document3 pagesFauji Fertilizer Company Limited: Income Statement As Per Year End 2009Ali KhanNo ratings yet

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Document15 pagesATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoNo ratings yet

- FS Annual 2009 English STCDocument25 pagesFS Annual 2009 English STCarkmaxNo ratings yet

- Financial PlanDocument25 pagesFinancial PlanAyesha KanwalNo ratings yet

- Rafhan Vertical Analysis Profit and Loss Accounts: Total Assets 5304524 5,287,371Document30 pagesRafhan Vertical Analysis Profit and Loss Accounts: Total Assets 5304524 5,287,371usmanazizbhattiNo ratings yet

- Tesla Inc Unsolved Model 330PMDocument61 pagesTesla Inc Unsolved Model 330PMAYUSH SHARMANo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- AirAsia Group BerhadDocument6 pagesAirAsia Group BerhadMUHAMMAD SYAFIQ SYAZWAN BIN ZAKARIA STUDENTNo ratings yet

- Increase in Long Term Loans and AdvancesDocument2 pagesIncrease in Long Term Loans and Advancesusama siddiquiNo ratings yet

- Balance Sheet: 2016 2017 2018 Assets Non-Current AssetsDocument6 pagesBalance Sheet: 2016 2017 2018 Assets Non-Current AssetsAhsan KamranNo ratings yet

- Financial+Statement+Analysis SolvedDocument5 pagesFinancial+Statement+Analysis SolvedMary JoyNo ratings yet

- Masteel 4Q 2023Document12 pagesMasteel 4Q 2023GZHNo ratings yet

- Unilever FM TermReportDocument8 pagesUnilever FM TermReportLuCiFeR GamingNo ratings yet

- FMDocument8 pagesFMesmailkarimi456No ratings yet

- Maple Leaf Cement Factory Limited.Document17 pagesMaple Leaf Cement Factory Limited.MubasharNo ratings yet

- 1321 Behroz TariqDocument11 pages1321 Behroz TariqBehroz Tariq 1321No ratings yet

- BSIS Tesla 2017 2021Document10 pagesBSIS Tesla 2017 2021Minh PhuongNo ratings yet

- Chapter 3 HomeworkDocument4 pagesChapter 3 HomeworkempersaNo ratings yet

- Annexure 4116790Document31 pagesAnnexure 4116790ayesha ansariNo ratings yet

- 2011 MAS Annual 2Document9 pages2011 MAS Annual 2Thaw ZinNo ratings yet

- ABS-CBN Corporation and Subsidiaries Consolidated Statements of Financial Position (Amounts in Thousands)Document10 pagesABS-CBN Corporation and Subsidiaries Consolidated Statements of Financial Position (Amounts in Thousands)Mark Angelo BustosNo ratings yet

- Deferred Tax Asset Retirement Benefit Assets: TotalDocument2 pagesDeferred Tax Asset Retirement Benefit Assets: TotalSrb RNo ratings yet

- PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. ROLANDO DE GRACIA, CHITO HENSON and JOHN DOES, Accused. ROLANDO DE GRACIA, Accused-AppellantDocument2 pagesPEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. ROLANDO DE GRACIA, CHITO HENSON and JOHN DOES, Accused. ROLANDO DE GRACIA, Accused-AppellantCharles Roger RayaNo ratings yet

- Vishnu - Reflections - Miyamoto Musashi - 21 Precepts For Attaining EnlightenmentDocument3 pagesVishnu - Reflections - Miyamoto Musashi - 21 Precepts For Attaining EnlightenmentGokula SwamiNo ratings yet

- Conference Interpreting in Diplomatic Settings - CL and CDA, GAO & WANG 2021Document19 pagesConference Interpreting in Diplomatic Settings - CL and CDA, GAO & WANG 2021Yixia LiangNo ratings yet

- Introduction To Business ManagementDocument15 pagesIntroduction To Business ManagementSandhiya SureshNo ratings yet

- Business CommunicationDocument3 pagesBusiness Communicationmalikatif42100% (1)

- CivilsyllDocument131 pagesCivilsyllYashwanth YashuNo ratings yet

- Boniao .Emmersion PaperDocument24 pagesBoniao .Emmersion PaperNathaniel AlobaNo ratings yet

- Alvin Bragg v. Jim JordanDocument50 pagesAlvin Bragg v. Jim JordanJackson SinnenbergNo ratings yet

- Final Agenda - South Asia Summit On Chronic Wound Management - 25th Nov - OnlineDocument6 pagesFinal Agenda - South Asia Summit On Chronic Wound Management - 25th Nov - OnlineBun BunNo ratings yet

- As Level English Language Coursework Style ModelsDocument8 pagesAs Level English Language Coursework Style Modelsafjwftijfbwmen100% (1)

- Vocabulary: Read The Speech Bubbles and Match The Adjectives To The PeopleDocument2 pagesVocabulary: Read The Speech Bubbles and Match The Adjectives To The PeoplebabetesNo ratings yet

- W Iser - Towards Literary AnthropologyDocument5 pagesW Iser - Towards Literary AnthropologyMaria Teresa De PalmaNo ratings yet

- 2020 Immediate Care of The Newborn 3Document56 pages2020 Immediate Care of The Newborn 3Ellah PerenioNo ratings yet

- The Destination HAS Called "The Capital of COOL."Document17 pagesThe Destination HAS Called "The Capital of COOL."Sem GacomsNo ratings yet

- Communicating Social Change Through ArchitectureDocument47 pagesCommunicating Social Change Through ArchitectureCarter MNo ratings yet

- Impacts of Imports, Exports and Foreign Direct Investment On The Gross Domestic Product (GDP) GrowthDocument2 pagesImpacts of Imports, Exports and Foreign Direct Investment On The Gross Domestic Product (GDP) Growthzee3000No ratings yet

- CBV Collections Notice of Demand To Cease and Desist To All CreditorsDocument3 pagesCBV Collections Notice of Demand To Cease and Desist To All CreditorskrystalmarienymannNo ratings yet

- Antwi V NTHCDocument17 pagesAntwi V NTHCHughes63% (8)

- Methods of Statistical SurveyDocument2 pagesMethods of Statistical Surveyshailesh67% (3)

- The Role of Humanity For Human LifeDocument102 pagesThe Role of Humanity For Human LifeMinhh TríNo ratings yet

- Valenzuela City Polytechnic College: Electrical Installation & MaintenanceDocument2 pagesValenzuela City Polytechnic College: Electrical Installation & MaintenanceMonnalou FarrellyNo ratings yet

- Revised Neurophysiology of Pain QuestionnaireDocument2 pagesRevised Neurophysiology of Pain QuestionnaireivanNo ratings yet

- Sydney Opera HouseDocument7 pagesSydney Opera HouseakosileeNo ratings yet

- Research ProposalDocument14 pagesResearch ProposalNiizamUddinBhuiyanNo ratings yet

- Terahertz Beam CollimationDocument9 pagesTerahertz Beam Collimation郭約No ratings yet

- 2 ND Bit Coin White PaperDocument17 pages2 ND Bit Coin White PaperReid DouthatNo ratings yet

- IttoDocument26 pagesIttoAnimorphsNo ratings yet