Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

16 viewsNo.35 - A S - 1 - Disclosure of Accounting Policies

No.35 - A S - 1 - Disclosure of Accounting Policies

Uploaded by

SrithajanThis document contains a checklist for assessing the disclosure of accounting policies in financial statements. It contains 8 items to check if the significant accounting policies adopted have been disclosed, if there have been any changes to accounting policies, and if the fundamental accounting assumptions have been followed. It also checks if any specific exemptions given to the company regarding accounting policies or assumptions have been adequately disclosed. The checklist aims to ensure that the financial statements clearly disclose all significant accounting policies and assumptions in a complete and transparent manner.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- Module - 1 & 2Document330 pagesModule - 1 & 2Swatantra KumarNo ratings yet

- WintergreenDocument10 pagesWintergreenPeter Lim Cheng Teik100% (1)

- Financial Accounting 2020 June - July Exam Question PaperDocument16 pagesFinancial Accounting 2020 June - July Exam Question PaperLaston Milanzi50% (2)

- Acc - 565 - PH Fed12 Corp Partnr EstDocument160 pagesAcc - 565 - PH Fed12 Corp Partnr EstLaKessica B. Kates-CarterNo ratings yet

- 14 As ExDocument116 pages14 As ExJAGADEESHNo ratings yet

- Amendments To PAS 1 and PS 2 - PrefaceDocument23 pagesAmendments To PAS 1 and PS 2 - PrefaceSofia Mae AlbercaNo ratings yet

- AS 1 Disclosure of Accounting PoliciesDocument6 pagesAS 1 Disclosure of Accounting PoliciesAnanya SharmaNo ratings yet

- Disclosure of Accounting Policies: ObjectivesDocument8 pagesDisclosure of Accounting Policies: ObjectivesrazorNo ratings yet

- AS 1 Disclosure of Accounting PoliciesDocument9 pagesAS 1 Disclosure of Accounting PoliciesRENU PALINo ratings yet

- As-1: Disclosure of Accounting Policies: ObjectivesDocument58 pagesAs-1: Disclosure of Accounting Policies: ObjectivesAshutosh SinghNo ratings yet

- Accounting PoliciesDocument11 pagesAccounting PoliciesValerie WNo ratings yet

- As 1Document4 pagesAs 1abhishekkapse654No ratings yet

- ACS ProjectDocument31 pagesACS Projectshanker_kNo ratings yet

- As 1Document4 pagesAs 1krithika vasanNo ratings yet

- IndAS8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument19 pagesIndAS8 Accounting Policies, Changes in Accounting Estimates and Errorsajayaju005No ratings yet

- Chap2 As 1 Disclosure of Accounting PoliciesDocument3 pagesChap2 As 1 Disclosure of Accounting PoliciesAashutosh PatodiaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument32 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita TamangNo ratings yet

- Module 014 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and ErrorsDocument9 pagesModule 014 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and Errorsman ibeNo ratings yet

- Accounting Standard: 1: Disclosure of Accounting PoliciesDocument6 pagesAccounting Standard: 1: Disclosure of Accounting PoliciesAbhinav AggarwalNo ratings yet

- Accounts Nitin SirDocument11 pagesAccounts Nitin Sirpuneet.sharma1493No ratings yet

- Ias 8 EnglezaDocument9 pagesIas 8 EnglezaTatiana LupuNo ratings yet

- Pas 8 SuperfinalDocument16 pagesPas 8 SuperfinalmattNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument9 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsMaruf HossainNo ratings yet

- As-1 Disclosure of Accounting PoliciesDocument7 pagesAs-1 Disclosure of Accounting PoliciesPrakash_Tandon_583No ratings yet

- 1 of 4 Covid - 19 Project For Accountants: ST ND RD THDocument4 pages1 of 4 Covid - 19 Project For Accountants: ST ND RD THMakoy BixenmanNo ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesgimmyjoyNo ratings yet

- As1 CaDocument2 pagesAs1 CaĐėvıł ĶıñgNo ratings yet

- Disclosure of Accounting PoliciesDocument8 pagesDisclosure of Accounting Policiesabdullah0331No ratings yet

- Circumstances For EOM OM by JADocument2 pagesCircumstances For EOM OM by JAAhmed NisarNo ratings yet

- Audit of Consolidated Financial StatementsDocument7 pagesAudit of Consolidated Financial StatementsDheeraj VermaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument20 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsMa Precylla Cerraine FloresNo ratings yet

- 8 Policy, Estimate, ErrorDocument16 pages8 Policy, Estimate, ErrorChelsea Anne VidalloNo ratings yet

- PAS 8 Accounting PoliciesDocument7 pagesPAS 8 Accounting PoliciesrandyNo ratings yet

- Audited FS IllustrationDocument123 pagesAudited FS IllustrationEphraim MandalNo ratings yet

- CFAS SummaryDocument5 pagesCFAS SummaryMichael Jack SalvadorNo ratings yet

- 21.0 NAS 8 - SetPasswordDocument9 pages21.0 NAS 8 - SetPasswordDhruba AdhikariNo ratings yet

- Chapter 3 Audit Report Isa 700 and Isa 705 Dpa50153Document48 pagesChapter 3 Audit Report Isa 700 and Isa 705 Dpa50153黄勇添No ratings yet

- In Audit Importance Financial Reporting NoexpDocument6 pagesIn Audit Importance Financial Reporting Noexpanandgupta.mkdNo ratings yet

- AS-1 Disclosure of Accounting Policies: CMA S. BaskaranDocument11 pagesAS-1 Disclosure of Accounting Policies: CMA S. BaskaranS. BaskaranNo ratings yet

- Ias 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesIas 8 Accounting Policies, Changes in Accounting Estimates and Errorsmusic niNo ratings yet

- PAS 01 Presentation of FSDocument12 pagesPAS 01 Presentation of FSRia GayleNo ratings yet

- Primary Objective: Philippine Accounting Standards 1 Presentation of Financial StatementsDocument2 pagesPrimary Objective: Philippine Accounting Standards 1 Presentation of Financial StatementsTrisha AlaNo ratings yet

- Chapter 14 Financial StatementsDocument82 pagesChapter 14 Financial StatementsKate CuencaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument18 pagesAccounting Policies, Changes in Accounting Estimates and ErrorscindhyNo ratings yet

- Accounting Standard 1Document7 pagesAccounting Standard 1api-3828505No ratings yet

- 11 Ias 8Document5 pages11 Ias 8Irtiza AbbasNo ratings yet

- Basic Financial Statement AnalysisDocument34 pagesBasic Financial Statement AnalysisArpit SidhuNo ratings yet

- Session 3 - Financial Statments & FRC RegulationDocument46 pagesSession 3 - Financial Statments & FRC Regulationripandhali87No ratings yet

- Chapter 3 - Accounting PrinciplesDocument23 pagesChapter 3 - Accounting PrinciplesVivek GargNo ratings yet

- Bms 1a Parangat Kapur 18100Document24 pagesBms 1a Parangat Kapur 18100Parangat KapurNo ratings yet

- Full Pfrs Pfrs For Sme Pfrs For Small Entities ComparisonDocument33 pagesFull Pfrs Pfrs For Sme Pfrs For Small Entities ComparisonJOY YangcoNo ratings yet

- Chapter 30 AnswerDocument15 pagesChapter 30 AnswerMjVerbaNo ratings yet

- 13.2 AS 1 Disclosure of Accounting PoliciesDocument4 pages13.2 AS 1 Disclosure of Accounting PoliciesRohith KumarNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument25 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAshish agrawalNo ratings yet

- Going Concern Material Uncertainty Relating To Going ConcernDocument5 pagesGoing Concern Material Uncertainty Relating To Going ConcernJoel LaguitaoNo ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesSatesh Kumar KonduruNo ratings yet

- Unit - 6 Accounting Policies: Learning OutcomesDocument4 pagesUnit - 6 Accounting Policies: Learning OutcomesTanyaNo ratings yet

- IAS1 Presentation of FSDocument6 pagesIAS1 Presentation of FSIrishLove Alonzo BalladaresNo ratings yet

- Differences in Ind As and Existing AsDocument32 pagesDifferences in Ind As and Existing AsSanket DandawateNo ratings yet

- As 1Document4 pagesAs 1Sri AssociatesNo ratings yet

- Finance Project PrintDocument23 pagesFinance Project PrintYash ParekhNo ratings yet

- East Asia and Pacific Economic Update October 2014: Enhancing Competitiveness in an Uncertain WorldFrom EverandEast Asia and Pacific Economic Update October 2014: Enhancing Competitiveness in an Uncertain WorldNo ratings yet

- EXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinDocument12 pagesEXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinNikky Bless LeonarNo ratings yet

- Synthesis - Aud Prob (A)Document5 pagesSynthesis - Aud Prob (A)Joyce Marie SablayanNo ratings yet

- TATA Docomo OoferDocument4 pagesTATA Docomo Ooferktarag0rnNo ratings yet

- Business Plan For Smart BoutiqueDocument25 pagesBusiness Plan For Smart BoutiqueAnonymous NM7hmMfNo ratings yet

- Case Study 3Document29 pagesCase Study 3Divya Nandini0% (1)

- WEF EntrepreneurialEcosystems Report 2013 PDFDocument36 pagesWEF EntrepreneurialEcosystems Report 2013 PDFMaria de los Ángeles Jiménez RojasNo ratings yet

- Raising Dough IntroductionDocument10 pagesRaising Dough IntroductionChelsea Green PublishingNo ratings yet

- Portfolio ManagementDocument27 pagesPortfolio Managementsachin sainiNo ratings yet

- Vehicle Insurance Policy Format - Vehicle Insurance - Liability Insurance PDFDocument10 pagesVehicle Insurance Policy Format - Vehicle Insurance - Liability Insurance PDFRajasekar GanapathyNo ratings yet

- 12 Accountancy Lyp 2020 s1Document59 pages12 Accountancy Lyp 2020 s1Anushka JhaNo ratings yet

- Crocs Case StudyDocument15 pagesCrocs Case StudyNida Amri100% (1)

- Types of Budgeting Techniques: Topic 4Document59 pagesTypes of Budgeting Techniques: Topic 4Sullivan LyaNo ratings yet

- Local Housing Board As Presented by Dir. Alvin T. Claridades of HUDCCDocument50 pagesLocal Housing Board As Presented by Dir. Alvin T. Claridades of HUDCCAlvin Claridades100% (5)

- Hyundai Motor India (Hmil) Interview Call LetterDocument3 pagesHyundai Motor India (Hmil) Interview Call LetterJaydeep PawarNo ratings yet

- 05 - Receivable Financing and Notes ReceivableDocument2 pages05 - Receivable Financing and Notes Receivableralphalonzo100% (3)

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- Modulo Iscrizione TERZA EDIZIONE CORTONA - It.enDocument3 pagesModulo Iscrizione TERZA EDIZIONE CORTONA - It.enRexel ReedusNo ratings yet

- 4ac3 - Advanced Financial Acctg. Chapter 2: Investments in Equity SecuritiesDocument10 pages4ac3 - Advanced Financial Acctg. Chapter 2: Investments in Equity SecuritiesAuzair AnwarNo ratings yet

- Pricing Convertible BondDocument31 pagesPricing Convertible BondMaxNo ratings yet

- Radha Soami Satsang Beas - 1579191276861 PDFDocument1 pageRadha Soami Satsang Beas - 1579191276861 PDFsamkooolNo ratings yet

- Automatic Account DeterminationDocument8 pagesAutomatic Account DeterminationVishnu Kumar SNo ratings yet

- IC Accounts Payable Ledger 9467Document2 pagesIC Accounts Payable Ledger 9467Rahul BadaikNo ratings yet

- PDF 2 International BankingDocument70 pagesPDF 2 International BankingshubhamNo ratings yet

- Experience Leadership in Financial ServicesDocument18 pagesExperience Leadership in Financial ServicesCleber FerreiraNo ratings yet

- Policy ScheduleDocument4 pagesPolicy ScheduleacrajeshNo ratings yet

- Hester Bank StatementDocument4 pagesHester Bank Statementjohn yorkNo ratings yet

No.35 - A S - 1 - Disclosure of Accounting Policies

No.35 - A S - 1 - Disclosure of Accounting Policies

Uploaded by

Srithajan0 ratings0% found this document useful (0 votes)

16 views2 pagesThis document contains a checklist for assessing the disclosure of accounting policies in financial statements. It contains 8 items to check if the significant accounting policies adopted have been disclosed, if there have been any changes to accounting policies, and if the fundamental accounting assumptions have been followed. It also checks if any specific exemptions given to the company regarding accounting policies or assumptions have been adequately disclosed. The checklist aims to ensure that the financial statements clearly disclose all significant accounting policies and assumptions in a complete and transparent manner.

Original Description:

Original Title

Doc No.35 - A S - 1 - Disclosure of Accounting Policies

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a checklist for assessing the disclosure of accounting policies in financial statements. It contains 8 items to check if the significant accounting policies adopted have been disclosed, if there have been any changes to accounting policies, and if the fundamental accounting assumptions have been followed. It also checks if any specific exemptions given to the company regarding accounting policies or assumptions have been adequately disclosed. The checklist aims to ensure that the financial statements clearly disclose all significant accounting policies and assumptions in a complete and transparent manner.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views2 pagesNo.35 - A S - 1 - Disclosure of Accounting Policies

No.35 - A S - 1 - Disclosure of Accounting Policies

Uploaded by

SrithajanThis document contains a checklist for assessing the disclosure of accounting policies in financial statements. It contains 8 items to check if the significant accounting policies adopted have been disclosed, if there have been any changes to accounting policies, and if the fundamental accounting assumptions have been followed. It also checks if any specific exemptions given to the company regarding accounting policies or assumptions have been adequately disclosed. The checklist aims to ensure that the financial statements clearly disclose all significant accounting policies and assumptions in a complete and transparent manner.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

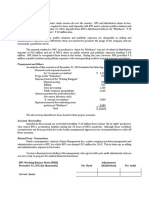

AS – 1- Disclosure of Accounting Policies

Sr. DESCRIPTION YES NO N/A REMARKS

No.

1. Whether all the significant accounting policies

adopted in the preparation and presentation of

financial statements have been disclosed?

2. Whether the disclosure of the significant

accounting policies as such forms part of the

financial statements?

3. Whether all the significant accounting policies

have been disclosed at one place?

4. Whether all the change in the accounting policies

which has a material effect in the current period

has been disclosed?

5. Where the change in the accounting policies is

reasonably expected to have a material effect in

later periods, whether the fact of such change has

been appropriately disclosed in the period of

adoption of change?

6. In the case of a change in accounting policies

which has a material effect in the current period:

(i) Whether the amount by which any item in the

financial statements is affected by such

change has been ascertained and disclosed?

(ii) Where such amount is not ascertainable,

wholly or in part, whether such fact has been

indicated?

7. (i) Where the fundamental accounting

assumption of ‘going concern’ has not been

followed whether the fact has been

disclosed?

(ii) Where the fundamental accounting

assumption of ‘consistency’ has not been

followed whether the fact has been

disclosed?

(iii)Where the fundamental accounting

assumption of ‘accrual’ has not been

followed, whether the fact has been

disclosed?

8. Announcement

Where a company has been given specific

exemption regarding any of the following matters,

whether the fact of such exemption has been

adequately disclosed in the accounts?

(i) Accounting policies required to be disclosed

under Schedule VI or any other provisions of

the Companies Act, 1956.

Sr. DESCRIPTION YES NO N/A REMARKS

No.

(ii) Accounts have to be prepared on accrual

basis.

(iii) The fundamental accounting assumption of

going concern has not been followed and

such fact has to be disclosed in the financial

statements.

(iv) Proper disclosures regarding change in the

accounting policies have to be made.

You might also like

- Module - 1 & 2Document330 pagesModule - 1 & 2Swatantra KumarNo ratings yet

- WintergreenDocument10 pagesWintergreenPeter Lim Cheng Teik100% (1)

- Financial Accounting 2020 June - July Exam Question PaperDocument16 pagesFinancial Accounting 2020 June - July Exam Question PaperLaston Milanzi50% (2)

- Acc - 565 - PH Fed12 Corp Partnr EstDocument160 pagesAcc - 565 - PH Fed12 Corp Partnr EstLaKessica B. Kates-CarterNo ratings yet

- 14 As ExDocument116 pages14 As ExJAGADEESHNo ratings yet

- Amendments To PAS 1 and PS 2 - PrefaceDocument23 pagesAmendments To PAS 1 and PS 2 - PrefaceSofia Mae AlbercaNo ratings yet

- AS 1 Disclosure of Accounting PoliciesDocument6 pagesAS 1 Disclosure of Accounting PoliciesAnanya SharmaNo ratings yet

- Disclosure of Accounting Policies: ObjectivesDocument8 pagesDisclosure of Accounting Policies: ObjectivesrazorNo ratings yet

- AS 1 Disclosure of Accounting PoliciesDocument9 pagesAS 1 Disclosure of Accounting PoliciesRENU PALINo ratings yet

- As-1: Disclosure of Accounting Policies: ObjectivesDocument58 pagesAs-1: Disclosure of Accounting Policies: ObjectivesAshutosh SinghNo ratings yet

- Accounting PoliciesDocument11 pagesAccounting PoliciesValerie WNo ratings yet

- As 1Document4 pagesAs 1abhishekkapse654No ratings yet

- ACS ProjectDocument31 pagesACS Projectshanker_kNo ratings yet

- As 1Document4 pagesAs 1krithika vasanNo ratings yet

- IndAS8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument19 pagesIndAS8 Accounting Policies, Changes in Accounting Estimates and Errorsajayaju005No ratings yet

- Chap2 As 1 Disclosure of Accounting PoliciesDocument3 pagesChap2 As 1 Disclosure of Accounting PoliciesAashutosh PatodiaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument32 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita TamangNo ratings yet

- Module 014 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and ErrorsDocument9 pagesModule 014 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and Errorsman ibeNo ratings yet

- Accounting Standard: 1: Disclosure of Accounting PoliciesDocument6 pagesAccounting Standard: 1: Disclosure of Accounting PoliciesAbhinav AggarwalNo ratings yet

- Accounts Nitin SirDocument11 pagesAccounts Nitin Sirpuneet.sharma1493No ratings yet

- Ias 8 EnglezaDocument9 pagesIas 8 EnglezaTatiana LupuNo ratings yet

- Pas 8 SuperfinalDocument16 pagesPas 8 SuperfinalmattNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument9 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsMaruf HossainNo ratings yet

- As-1 Disclosure of Accounting PoliciesDocument7 pagesAs-1 Disclosure of Accounting PoliciesPrakash_Tandon_583No ratings yet

- 1 of 4 Covid - 19 Project For Accountants: ST ND RD THDocument4 pages1 of 4 Covid - 19 Project For Accountants: ST ND RD THMakoy BixenmanNo ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesgimmyjoyNo ratings yet

- As1 CaDocument2 pagesAs1 CaĐėvıł ĶıñgNo ratings yet

- Disclosure of Accounting PoliciesDocument8 pagesDisclosure of Accounting Policiesabdullah0331No ratings yet

- Circumstances For EOM OM by JADocument2 pagesCircumstances For EOM OM by JAAhmed NisarNo ratings yet

- Audit of Consolidated Financial StatementsDocument7 pagesAudit of Consolidated Financial StatementsDheeraj VermaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument20 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsMa Precylla Cerraine FloresNo ratings yet

- 8 Policy, Estimate, ErrorDocument16 pages8 Policy, Estimate, ErrorChelsea Anne VidalloNo ratings yet

- PAS 8 Accounting PoliciesDocument7 pagesPAS 8 Accounting PoliciesrandyNo ratings yet

- Audited FS IllustrationDocument123 pagesAudited FS IllustrationEphraim MandalNo ratings yet

- CFAS SummaryDocument5 pagesCFAS SummaryMichael Jack SalvadorNo ratings yet

- 21.0 NAS 8 - SetPasswordDocument9 pages21.0 NAS 8 - SetPasswordDhruba AdhikariNo ratings yet

- Chapter 3 Audit Report Isa 700 and Isa 705 Dpa50153Document48 pagesChapter 3 Audit Report Isa 700 and Isa 705 Dpa50153黄勇添No ratings yet

- In Audit Importance Financial Reporting NoexpDocument6 pagesIn Audit Importance Financial Reporting Noexpanandgupta.mkdNo ratings yet

- AS-1 Disclosure of Accounting Policies: CMA S. BaskaranDocument11 pagesAS-1 Disclosure of Accounting Policies: CMA S. BaskaranS. BaskaranNo ratings yet

- Ias 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesIas 8 Accounting Policies, Changes in Accounting Estimates and Errorsmusic niNo ratings yet

- PAS 01 Presentation of FSDocument12 pagesPAS 01 Presentation of FSRia GayleNo ratings yet

- Primary Objective: Philippine Accounting Standards 1 Presentation of Financial StatementsDocument2 pagesPrimary Objective: Philippine Accounting Standards 1 Presentation of Financial StatementsTrisha AlaNo ratings yet

- Chapter 14 Financial StatementsDocument82 pagesChapter 14 Financial StatementsKate CuencaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument18 pagesAccounting Policies, Changes in Accounting Estimates and ErrorscindhyNo ratings yet

- Accounting Standard 1Document7 pagesAccounting Standard 1api-3828505No ratings yet

- 11 Ias 8Document5 pages11 Ias 8Irtiza AbbasNo ratings yet

- Basic Financial Statement AnalysisDocument34 pagesBasic Financial Statement AnalysisArpit SidhuNo ratings yet

- Session 3 - Financial Statments & FRC RegulationDocument46 pagesSession 3 - Financial Statments & FRC Regulationripandhali87No ratings yet

- Chapter 3 - Accounting PrinciplesDocument23 pagesChapter 3 - Accounting PrinciplesVivek GargNo ratings yet

- Bms 1a Parangat Kapur 18100Document24 pagesBms 1a Parangat Kapur 18100Parangat KapurNo ratings yet

- Full Pfrs Pfrs For Sme Pfrs For Small Entities ComparisonDocument33 pagesFull Pfrs Pfrs For Sme Pfrs For Small Entities ComparisonJOY YangcoNo ratings yet

- Chapter 30 AnswerDocument15 pagesChapter 30 AnswerMjVerbaNo ratings yet

- 13.2 AS 1 Disclosure of Accounting PoliciesDocument4 pages13.2 AS 1 Disclosure of Accounting PoliciesRohith KumarNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument25 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAshish agrawalNo ratings yet

- Going Concern Material Uncertainty Relating To Going ConcernDocument5 pagesGoing Concern Material Uncertainty Relating To Going ConcernJoel LaguitaoNo ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesSatesh Kumar KonduruNo ratings yet

- Unit - 6 Accounting Policies: Learning OutcomesDocument4 pagesUnit - 6 Accounting Policies: Learning OutcomesTanyaNo ratings yet

- IAS1 Presentation of FSDocument6 pagesIAS1 Presentation of FSIrishLove Alonzo BalladaresNo ratings yet

- Differences in Ind As and Existing AsDocument32 pagesDifferences in Ind As and Existing AsSanket DandawateNo ratings yet

- As 1Document4 pagesAs 1Sri AssociatesNo ratings yet

- Finance Project PrintDocument23 pagesFinance Project PrintYash ParekhNo ratings yet

- East Asia and Pacific Economic Update October 2014: Enhancing Competitiveness in an Uncertain WorldFrom EverandEast Asia and Pacific Economic Update October 2014: Enhancing Competitiveness in an Uncertain WorldNo ratings yet

- EXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinDocument12 pagesEXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinNikky Bless LeonarNo ratings yet

- Synthesis - Aud Prob (A)Document5 pagesSynthesis - Aud Prob (A)Joyce Marie SablayanNo ratings yet

- TATA Docomo OoferDocument4 pagesTATA Docomo Ooferktarag0rnNo ratings yet

- Business Plan For Smart BoutiqueDocument25 pagesBusiness Plan For Smart BoutiqueAnonymous NM7hmMfNo ratings yet

- Case Study 3Document29 pagesCase Study 3Divya Nandini0% (1)

- WEF EntrepreneurialEcosystems Report 2013 PDFDocument36 pagesWEF EntrepreneurialEcosystems Report 2013 PDFMaria de los Ángeles Jiménez RojasNo ratings yet

- Raising Dough IntroductionDocument10 pagesRaising Dough IntroductionChelsea Green PublishingNo ratings yet

- Portfolio ManagementDocument27 pagesPortfolio Managementsachin sainiNo ratings yet

- Vehicle Insurance Policy Format - Vehicle Insurance - Liability Insurance PDFDocument10 pagesVehicle Insurance Policy Format - Vehicle Insurance - Liability Insurance PDFRajasekar GanapathyNo ratings yet

- 12 Accountancy Lyp 2020 s1Document59 pages12 Accountancy Lyp 2020 s1Anushka JhaNo ratings yet

- Crocs Case StudyDocument15 pagesCrocs Case StudyNida Amri100% (1)

- Types of Budgeting Techniques: Topic 4Document59 pagesTypes of Budgeting Techniques: Topic 4Sullivan LyaNo ratings yet

- Local Housing Board As Presented by Dir. Alvin T. Claridades of HUDCCDocument50 pagesLocal Housing Board As Presented by Dir. Alvin T. Claridades of HUDCCAlvin Claridades100% (5)

- Hyundai Motor India (Hmil) Interview Call LetterDocument3 pagesHyundai Motor India (Hmil) Interview Call LetterJaydeep PawarNo ratings yet

- 05 - Receivable Financing and Notes ReceivableDocument2 pages05 - Receivable Financing and Notes Receivableralphalonzo100% (3)

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- Modulo Iscrizione TERZA EDIZIONE CORTONA - It.enDocument3 pagesModulo Iscrizione TERZA EDIZIONE CORTONA - It.enRexel ReedusNo ratings yet

- 4ac3 - Advanced Financial Acctg. Chapter 2: Investments in Equity SecuritiesDocument10 pages4ac3 - Advanced Financial Acctg. Chapter 2: Investments in Equity SecuritiesAuzair AnwarNo ratings yet

- Pricing Convertible BondDocument31 pagesPricing Convertible BondMaxNo ratings yet

- Radha Soami Satsang Beas - 1579191276861 PDFDocument1 pageRadha Soami Satsang Beas - 1579191276861 PDFsamkooolNo ratings yet

- Automatic Account DeterminationDocument8 pagesAutomatic Account DeterminationVishnu Kumar SNo ratings yet

- IC Accounts Payable Ledger 9467Document2 pagesIC Accounts Payable Ledger 9467Rahul BadaikNo ratings yet

- PDF 2 International BankingDocument70 pagesPDF 2 International BankingshubhamNo ratings yet

- Experience Leadership in Financial ServicesDocument18 pagesExperience Leadership in Financial ServicesCleber FerreiraNo ratings yet

- Policy ScheduleDocument4 pagesPolicy ScheduleacrajeshNo ratings yet

- Hester Bank StatementDocument4 pagesHester Bank Statementjohn yorkNo ratings yet