Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsProb5 Auditing

Prob5 Auditing

Uploaded by

gian0123This document lists various equity and retained earnings accounts for a company including:

- Issued no-par common stock at P100 and P80 per share

- Treasury stock of no-par common acquired at P100 per share

- Preferred stock of P2,000 par value for 500 shares of Class A and 50,000 shares of Class B

- Various appropriated retained earnings accounts including reserves for taxes, losses, inventory declines, and dividends

- Common stock dividend declared, loss on assets sold, unamortized expenses, inventory declines, beginning retained earnings, and current year profit.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You might also like

- Quiz - Investment, Part 2 ANSWERDocument4 pagesQuiz - Investment, Part 2 ANSWERJaylord Reyes100% (1)

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamNo ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- SheDocument5 pagesSheLorie Jae Domalaon0% (1)

- Two Approaches in Determining IncomeDocument14 pagesTwo Approaches in Determining IncomeAnDrea ChavEzNo ratings yet

- Mid Year AcqusitionDocument4 pagesMid Year AcqusitionOmolaja IbukunNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- ACC401-Goodwill and Conso SOCIEDocument3 pagesACC401-Goodwill and Conso SOCIEOhene Asare PogastyNo ratings yet

- Acctg 13 - Unit Test Final Answer KeyDocument4 pagesAcctg 13 - Unit Test Final Answer Keyjohn.18.wagasNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Lesson 5c Pro-Forma Statement of EquityDocument3 pagesLesson 5c Pro-Forma Statement of EquityBEN CLADONo ratings yet

- Consolidation BasicsDocument5 pagesConsolidation Basicspoonamemrith22No ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- Akl Soal 3 Kelompok 2Document9 pagesAkl Soal 3 Kelompok 2dikaNo ratings yet

- 6938 - Operating, Investisng and Financing ActivitiesDocument2 pages6938 - Operating, Investisng and Financing ActivitiesAljur SalamedaNo ratings yet

- Oria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?Document52 pagesOria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?May OriaNo ratings yet

- 1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Document9 pages1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Maulana AmriNo ratings yet

- Febbinia Dwigna P - Week7 AKL 1Document5 pagesFebbinia Dwigna P - Week7 AKL 1febbiniaNo ratings yet

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFDocument3 pagesQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasNo ratings yet

- P 1Document13 pagesP 1Ryan Joseph Agluba DimacaliNo ratings yet

- CorpoDocument16 pagesCorpoErica JoannaNo ratings yet

- Drill 4 AK FSUU AccountingDocument10 pagesDrill 4 AK FSUU AccountingRobert CastilloNo ratings yet

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Document9 pagesCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Chapter 4Document4 pagesChapter 4Grecian DiazNo ratings yet

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloNo ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Loss of ControlDocument7 pagesLoss of ControlZiyi ChenNo ratings yet

- Direct LaborDocument8 pagesDirect LaborAreli DuyoNo ratings yet

- Name: - Prefinal Examination - Financial Accounting & Reporting Part 3Document3 pagesName: - Prefinal Examination - Financial Accounting & Reporting Part 3acctg2012No ratings yet

- DUAZO - 6th EXAM SIM ANSWERSDocument7 pagesDUAZO - 6th EXAM SIM ANSWERSJeric TorionNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Abuscom Journal EntriesDocument27 pagesAbuscom Journal EntriesMac b IBANEZNo ratings yet

- Assignment Akl Bab 4 (Kel. 7)Document5 pagesAssignment Akl Bab 4 (Kel. 7)Nadiyah ShofwahNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Balucan InAcc 3 Week2 Part 2Document2 pagesBalucan InAcc 3 Week2 Part 2Luigi Enderez BalucanNo ratings yet

- Prac. 1Document15 pagesPrac. 1Lalaine De JesusNo ratings yet

- AP 2007 (Shareholder's Equity) v.20Document4 pagesAP 2007 (Shareholder's Equity) v.20jalrestauroNo ratings yet

- Finman 108 (Quiz 4) ...Document6 pagesFinman 108 (Quiz 4) ...CHARRYSAH TABAOSARESNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Ap She Exam ProbDocument3 pagesAp She Exam Problois martinNo ratings yet

- Name: Avishchal Shivneel Chand Student ID: S11171687Document3 pagesName: Avishchal Shivneel Chand Student ID: S11171687Avishchal ChandNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Cababahay - 6th Exam Topic - SIM ANSWERSDocument7 pagesCababahay - 6th Exam Topic - SIM ANSWERSJeric TorionNo ratings yet

- Batch 18 Final Preboard (P1)Document16 pagesBatch 18 Final Preboard (P1)Mike Oliver NualNo ratings yet

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekDocument23 pagesCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BNo ratings yet

- Difficult Level Corpo-Drill3Document4 pagesDifficult Level Corpo-Drill3julsNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- Ac6 ProblemsDocument21 pagesAc6 ProblemsLysss EpssssNo ratings yet

- Business Combination-Intercompany Sale of InventoriesDocument2 pagesBusiness Combination-Intercompany Sale of InventoriesMixx MineNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

Prob5 Auditing

Prob5 Auditing

Uploaded by

gian01230 ratings0% found this document useful (0 votes)

3 views2 pagesThis document lists various equity and retained earnings accounts for a company including:

- Issued no-par common stock at P100 and P80 per share

- Treasury stock of no-par common acquired at P100 per share

- Preferred stock of P2,000 par value for 500 shares of Class A and 50,000 shares of Class B

- Various appropriated retained earnings accounts including reserves for taxes, losses, inventory declines, and dividends

- Common stock dividend declared, loss on assets sold, unamortized expenses, inventory declines, beginning retained earnings, and current year profit.

Original Description:

Original Title

Prob5 auditing

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document lists various equity and retained earnings accounts for a company including:

- Issued no-par common stock at P100 and P80 per share

- Treasury stock of no-par common acquired at P100 per share

- Preferred stock of P2,000 par value for 500 shares of Class A and 50,000 shares of Class B

- Various appropriated retained earnings accounts including reserves for taxes, losses, inventory declines, and dividends

- Common stock dividend declared, loss on assets sold, unamortized expenses, inventory declines, beginning retained earnings, and current year profit.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesProb5 Auditing

Prob5 Auditing

Uploaded by

gian0123This document lists various equity and retained earnings accounts for a company including:

- Issued no-par common stock at P100 and P80 per share

- Treasury stock of no-par common acquired at P100 per share

- Preferred stock of P2,000 par value for 500 shares of Class A and 50,000 shares of Class B

- Various appropriated retained earnings accounts including reserves for taxes, losses, inventory declines, and dividends

- Common stock dividend declared, loss on assets sold, unamortized expenses, inventory declines, beginning retained earnings, and current year profit.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 2

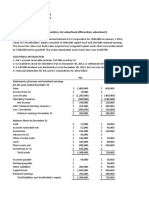

GONZALES, JOANNE MAI S.

PROBLEM 5

No-par common stock, issued at P100

No-par common stock, issued at P80

Treasury stock, no-par common, acquired at P100

Capital stock, P2,000 preferred A, 500 shares

Capital stock, P2,000 preferred B, 50,000 shares

Class A preferred; authorized,1,000 shares P2,000

Class A preferred; unissued,500 shares

Share Premium from

Class B preferred; authorized, 500 shares

Class B preferred; unisssued

Appropriated retained earnings

Reserved for income taxes(set up current year)

Reserved for loss on accounts(P60,000 set up current year)

Reserved for reduction of December 31 inventory to market(a revenue charge)

Reserved for possible future inventory declines(set up in current year)

Reserved for preferred dividends declared(a revenue charge)

Reserved for common stock dividends to be declared (a revenue charge)

Common stock dividend of 7,300 shares declared on common

of record as January 2 next year(a revenue charge for cuurrent year)

Loss on sale of fixed assets

Organizational expense unamotized

Bond discount unamortized

Loss on inventory decline in current year

Retained Earnings, beg

Profit of current year

The remaining accounts comprimise the following:

Cash, receivebles, inventories, and fixed assets

Accounts, notes and bonds payable

No-par common stock; authorized 1,000 shares P2,000 par value

100,000

3,040,000

(300,000)

1,100,000

940,000

2,000,000

(1,000,000) 1,000,000

1,000,000

-

-

928,000

144,000

182,000

200,000

55,000

146,000 1,655,000

146,000

(80,000)

(50,000)

(68,000)

(182,000)

(441,400)

3,250,000

11,109,600

You might also like

- Quiz - Investment, Part 2 ANSWERDocument4 pagesQuiz - Investment, Part 2 ANSWERJaylord Reyes100% (1)

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamNo ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- SheDocument5 pagesSheLorie Jae Domalaon0% (1)

- Two Approaches in Determining IncomeDocument14 pagesTwo Approaches in Determining IncomeAnDrea ChavEzNo ratings yet

- Mid Year AcqusitionDocument4 pagesMid Year AcqusitionOmolaja IbukunNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- ACC401-Goodwill and Conso SOCIEDocument3 pagesACC401-Goodwill and Conso SOCIEOhene Asare PogastyNo ratings yet

- Acctg 13 - Unit Test Final Answer KeyDocument4 pagesAcctg 13 - Unit Test Final Answer Keyjohn.18.wagasNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Lesson 5c Pro-Forma Statement of EquityDocument3 pagesLesson 5c Pro-Forma Statement of EquityBEN CLADONo ratings yet

- Consolidation BasicsDocument5 pagesConsolidation Basicspoonamemrith22No ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- Akl Soal 3 Kelompok 2Document9 pagesAkl Soal 3 Kelompok 2dikaNo ratings yet

- 6938 - Operating, Investisng and Financing ActivitiesDocument2 pages6938 - Operating, Investisng and Financing ActivitiesAljur SalamedaNo ratings yet

- Oria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?Document52 pagesOria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?May OriaNo ratings yet

- 1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Document9 pages1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Maulana AmriNo ratings yet

- Febbinia Dwigna P - Week7 AKL 1Document5 pagesFebbinia Dwigna P - Week7 AKL 1febbiniaNo ratings yet

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFDocument3 pagesQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasNo ratings yet

- P 1Document13 pagesP 1Ryan Joseph Agluba DimacaliNo ratings yet

- CorpoDocument16 pagesCorpoErica JoannaNo ratings yet

- Drill 4 AK FSUU AccountingDocument10 pagesDrill 4 AK FSUU AccountingRobert CastilloNo ratings yet

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Document9 pagesCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Chapter 4Document4 pagesChapter 4Grecian DiazNo ratings yet

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloNo ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Loss of ControlDocument7 pagesLoss of ControlZiyi ChenNo ratings yet

- Direct LaborDocument8 pagesDirect LaborAreli DuyoNo ratings yet

- Name: - Prefinal Examination - Financial Accounting & Reporting Part 3Document3 pagesName: - Prefinal Examination - Financial Accounting & Reporting Part 3acctg2012No ratings yet

- DUAZO - 6th EXAM SIM ANSWERSDocument7 pagesDUAZO - 6th EXAM SIM ANSWERSJeric TorionNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Abuscom Journal EntriesDocument27 pagesAbuscom Journal EntriesMac b IBANEZNo ratings yet

- Assignment Akl Bab 4 (Kel. 7)Document5 pagesAssignment Akl Bab 4 (Kel. 7)Nadiyah ShofwahNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Balucan InAcc 3 Week2 Part 2Document2 pagesBalucan InAcc 3 Week2 Part 2Luigi Enderez BalucanNo ratings yet

- Prac. 1Document15 pagesPrac. 1Lalaine De JesusNo ratings yet

- AP 2007 (Shareholder's Equity) v.20Document4 pagesAP 2007 (Shareholder's Equity) v.20jalrestauroNo ratings yet

- Finman 108 (Quiz 4) ...Document6 pagesFinman 108 (Quiz 4) ...CHARRYSAH TABAOSARESNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Ap She Exam ProbDocument3 pagesAp She Exam Problois martinNo ratings yet

- Name: Avishchal Shivneel Chand Student ID: S11171687Document3 pagesName: Avishchal Shivneel Chand Student ID: S11171687Avishchal ChandNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Cababahay - 6th Exam Topic - SIM ANSWERSDocument7 pagesCababahay - 6th Exam Topic - SIM ANSWERSJeric TorionNo ratings yet

- Batch 18 Final Preboard (P1)Document16 pagesBatch 18 Final Preboard (P1)Mike Oliver NualNo ratings yet

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekDocument23 pagesCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BNo ratings yet

- Difficult Level Corpo-Drill3Document4 pagesDifficult Level Corpo-Drill3julsNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- Ac6 ProblemsDocument21 pagesAc6 ProblemsLysss EpssssNo ratings yet

- Business Combination-Intercompany Sale of InventoriesDocument2 pagesBusiness Combination-Intercompany Sale of InventoriesMixx MineNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet