Professional Documents

Culture Documents

Causes of Material Price Variance

Causes of Material Price Variance

Uploaded by

shayne_waiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Causes of Material Price Variance

Causes of Material Price Variance

Uploaded by

shayne_waiCopyright:

Available Formats

Causes of material price variance:

1. There could have been recent changes in purchase price of materials.

2. Price variance can be due to substituting raw materials different from the original material specification.

3. Price variance can be attributed to the non availability of cash discounts which was originally anticipated at the

time of setting the price standards.

4. Changes in transportation costs and storekeeping costs can also be contributing factors to material price

variance.

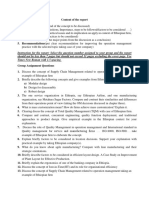

Reasons for direct cost variances

Price

Efficiency Variance

Variance

Unreasonable materials price standard Unreasonable materials quantity standard

(unreasonable SP). (unreasonable SQ).

Change in purchase price (e.g. new supplier, Change in the quantity of spoiled materials due to the

change in quantity of materials purchased, changes in quality / equipment / technology,

Direct change in purchase discount). equipment malfunction, worker damage, etc.

Materials

Accounting error (in the actual price of materials). Accounting error (in quantity of materials used).

Normal fluctuation in the usage of materials.

Change in production processes.

Theft of raw materials.

Unreasonable labor price standard. Unreasonable labor hours standard.

Changes in average wages paid to employees Change in the average labor hours due to the changes

(e.g. changes in workers’ experience and skills, in workers’ experience and skills, in production

in the minimum wage rate, labor union strikes). processes or equipment, intentional workers’

Direct slowdown, etc.

Labor

Accounting error (in the actual price of direct Accounting error (in the actual quantity of labor hours).

labor).

Overtime hours (unanticipated). Normal fluctuation in labor hours.

Underreporting of labor hours.

As we can see from the table above, there are many reasons for direct cost variances. It is important for management

to analyze such reasons and take action. For example, when cost standards are unreasonable, they could cause

unfavorable variances. In such a case, management should review and change cost standards.

Variance analysis can be performed not only to calculate and interpret direct cost variances, but it can also be used

to monitor factory overhead costs.

You might also like

- MGT 490 Final QuestionDocument6 pagesMGT 490 Final QuestionIqbal Hossain NoyonNo ratings yet

- Microeconomic AssignmentDocument6 pagesMicroeconomic Assignmentapi-288160336100% (1)

- AD2 - Managing Risks in Supply Chains - Case Study and QuestionsDocument4 pagesAD2 - Managing Risks in Supply Chains - Case Study and Questionsdanibgg823No ratings yet

- IMVDocument8 pagesIMVAzril InzaghiNo ratings yet

- 1TESCODocument2 pages1TESCOCF Wong50% (2)

- Acma List of PublicationsDocument1 pageAcma List of PublicationsAnonymous Nl41INVNo ratings yet

- Stability, Conglomerate Strategy and VariantsDocument13 pagesStability, Conglomerate Strategy and VariantssukruthiNo ratings yet

- Case FrameworksDocument14 pagesCase FrameworksVaishnaviNo ratings yet

- a4d405cd-e4e8-497f-8bcc-b9e08e416ef8.docxDocument2 pagesa4d405cd-e4e8-497f-8bcc-b9e08e416ef8.docxAshish BhallaNo ratings yet

- Chap 10 IM Common Stock ValuationDocument97 pagesChap 10 IM Common Stock ValuationHaziq Shoaib MirNo ratings yet

- SWOT AnalysisDocument2 pagesSWOT AnalysisRosi HappiNo ratings yet

- Supply Chain - Push-Pull BoundaryDocument12 pagesSupply Chain - Push-Pull BoundaryMaka Vempati100% (2)

- CH - 1 Nature of SMDocument8 pagesCH - 1 Nature of SMAbhishek Kumar SahayNo ratings yet

- Competitive Analysis of RelianceDocument15 pagesCompetitive Analysis of Reliancearka85No ratings yet

- SCM Unit 2 NotesDocument16 pagesSCM Unit 2 NotesNisha PradeepaNo ratings yet

- TATA Steels Sales ForecastDocument30 pagesTATA Steels Sales ForecastVishalNo ratings yet

- Walton Company Group 10Document9 pagesWalton Company Group 10MD. JULFIKER HASANNo ratings yet

- SMGT Notes On Some TopicsDocument30 pagesSMGT Notes On Some TopicsKritika Chauhan100% (1)

- The Implication of MIS in A Banking SystemDocument9 pagesThe Implication of MIS in A Banking SystemSAMUEL KIMANINo ratings yet

- Market Analysis - Steel Industry - EgyptDocument6 pagesMarket Analysis - Steel Industry - EgyptgokulNo ratings yet

- Trade War Between US&ChinaDocument21 pagesTrade War Between US&ChinaRosetta RennerNo ratings yet

- Recession FinalDocument40 pagesRecession FinalMehwish JavedNo ratings yet

- Cravens Strategic Marketing 9eDocument13 pagesCravens Strategic Marketing 9eumair baigNo ratings yet

- Market Research For Matador in Indonesia: Date of Submission: 17 December, 2014Document23 pagesMarket Research For Matador in Indonesia: Date of Submission: 17 December, 2014Tithi HossainNo ratings yet

- Analyzing The Competitive Forces For WalMartDocument4 pagesAnalyzing The Competitive Forces For WalMartsiang_lui0% (1)

- 2.BMMF5103 - EQ Formattedl May 2012Document7 pages2.BMMF5103 - EQ Formattedl May 2012thaingtNo ratings yet

- Chapter 1-5 PDFDocument180 pagesChapter 1-5 PDFdcold6100% (1)

- Economics II All Units HSK1 PDFDocument63 pagesEconomics II All Units HSK1 PDFPrajwalNo ratings yet

- Marketing Management AssignmentDocument3 pagesMarketing Management AssignmentSheryar NaeemNo ratings yet

- Probability and Statistics AssignmentDocument12 pagesProbability and Statistics AssignmentPhan Hoang Thuy (K14 HCM)No ratings yet

- Universal Print System LTD.: Vrushank Raut Rahul Satpute Milind Thakur Swapnil WaghDocument15 pagesUniversal Print System LTD.: Vrushank Raut Rahul Satpute Milind Thakur Swapnil WaghMilind ThakurNo ratings yet

- Chap012 - Aggregate PlanningDocument29 pagesChap012 - Aggregate PlanningAgentSkySkyNo ratings yet

- TESCODocument9 pagesTESCOMike BreeNo ratings yet

- Comparative Vs Competitive AdvantageDocument19 pagesComparative Vs Competitive AdvantageSuntari CakSoenNo ratings yet

- FINAL EXAM and CASE STUDY Sy 2018 19Document3 pagesFINAL EXAM and CASE STUDY Sy 2018 19Ryan Jay MatulacNo ratings yet

- IBM - Unit - IIDocument61 pagesIBM - Unit - IIYuvaraj d100% (2)

- Big Data Analytics in Developing Countries Implications and ChallengesDocument7 pagesBig Data Analytics in Developing Countries Implications and ChallengesRobert MuneneNo ratings yet

- A Case Study On Financial Performance in IT Sector in IndiaDocument86 pagesA Case Study On Financial Performance in IT Sector in Indiafactree09No ratings yet

- Group Assignment Questions For OM-Mgmt Sec.1Document1 pageGroup Assignment Questions For OM-Mgmt Sec.1Yonatan0% (1)

- Ap - Starting A BusinessDocument13 pagesAp - Starting A BusinessBoni AminNo ratings yet

- Marks and Spencers CaseDocument6 pagesMarks and Spencers Casechinu7101987100% (1)

- Chapter Three External Strategic Management Audit: Also CalledDocument27 pagesChapter Three External Strategic Management Audit: Also Calledtsegab bekeleNo ratings yet

- SNGPLDocument26 pagesSNGPLmismailtajNo ratings yet

- Coca Cola 2009 Case StudyDocument29 pagesCoca Cola 2009 Case StudyfahdtNo ratings yet

- Team No. 11 Section 3 NAB - THE PLANNING TEMPLATEDocument11 pagesTeam No. 11 Section 3 NAB - THE PLANNING TEMPLATEPRAVESH TRIPATHINo ratings yet

- HOSSAINDocument26 pagesHOSSAINMohammad HossainNo ratings yet

- Operations Management NotesDocument34 pagesOperations Management NotesMona AgarwalNo ratings yet

- Strategic Analysis: BAT Nestle GPDocument26 pagesStrategic Analysis: BAT Nestle GPAbul HasnatNo ratings yet

- MNC and OutsourcingDocument52 pagesMNC and OutsourcingsudeendraNo ratings yet

- 1 Case StudyDocument14 pages1 Case StudySäì ÀdïtyâNo ratings yet

- Monopolistic CompetitionDocument3 pagesMonopolistic CompetitionAkshay RathiNo ratings yet

- Group Assignment s1, 2019Document4 pagesGroup Assignment s1, 2019Navinesh Nand100% (1)

- Market Segmentation AssignmentDocument18 pagesMarket Segmentation AssignmentVrindha Vijayan100% (1)

- Abyssinia Bank 2019Document104 pagesAbyssinia Bank 2019abushaltaye9No ratings yet

- Case Study On E-Supply ChainsDocument14 pagesCase Study On E-Supply ChainsTabeer HashmiNo ratings yet

- What Is A Perceptual MapDocument6 pagesWhat Is A Perceptual MapFaidz FuadNo ratings yet

- NokiaDocument11 pagesNokiaȘtefan Dănilă100% (1)

- A Sample Case Study On Contemporary Issue by Global Assignment HelpDocument21 pagesA Sample Case Study On Contemporary Issue by Global Assignment HelpInstant Essay WritingNo ratings yet

- New Paradigm of Industrial Relationship in IndiaDocument4 pagesNew Paradigm of Industrial Relationship in IndiasettiNo ratings yet

- Financial Management 2Document159 pagesFinancial Management 2Ivani Katal0% (2)

- Market Structure & CompetitionDocument19 pagesMarket Structure & CompetitionVaibhav YadavNo ratings yet

- 26560standard Costing and Variance AnalysisDocument2 pages26560standard Costing and Variance AnalysisTalha HanifNo ratings yet

- Variance AnalysisDocument31 pagesVariance AnalysisGift ChaliNo ratings yet

- FIN450 - Portfolio Analysis: Suggested MaterialsDocument3 pagesFIN450 - Portfolio Analysis: Suggested MaterialsGia MinhNo ratings yet

- Solved Perry Chandler A Broker With Caveat Emptor LTD Offers FreeDocument1 pageSolved Perry Chandler A Broker With Caveat Emptor LTD Offers FreeM Bilal SaleemNo ratings yet

- Toyota & GM - Group 1Document12 pagesToyota & GM - Group 1Aditi MurarkaNo ratings yet

- Speech by He Roeland Van de Geer Research and Education Announcement May 11Document3 pagesSpeech by He Roeland Van de Geer Research and Education Announcement May 11Anonymous zPUXs8aONo ratings yet

- Subiecte 2009 ScrisDocument197 pagesSubiecte 2009 ScrischelbasNo ratings yet

- Costanza, R., Stewardship For A Full WorldDocument6 pagesCostanza, R., Stewardship For A Full WorldkethilinNo ratings yet

- FORECASTING-REVENUES Week13Document17 pagesFORECASTING-REVENUES Week13Honey Grace Dela CernaNo ratings yet

- An Exploration of The Quantitative Revolution in "A Beautiful Mind": A Film AnalysisDocument14 pagesAn Exploration of The Quantitative Revolution in "A Beautiful Mind": A Film AnalysisTim ShahNo ratings yet

- The Relationships Between Microfinance, Capital Flows, Growth, and Poverty AlleviationDocument3 pagesThe Relationships Between Microfinance, Capital Flows, Growth, and Poverty AlleviationPierre Raymond BossaleNo ratings yet

- ch08Document186 pagesch08100ajdinNo ratings yet

- Strategic Management: Karakteristik Manajemen StrategiDocument22 pagesStrategic Management: Karakteristik Manajemen StrategiPutri AnisaNo ratings yet

- Managerial Economics (Chapter 1)Document61 pagesManagerial Economics (Chapter 1)api-370372488% (17)

- Capital Budgeting Techniques IRRDocument12 pagesCapital Budgeting Techniques IRRraza572hammadNo ratings yet

- CSUSB Syllabus Fin 3002 Shelton Fall 2021 Section 61 ONLINEDocument12 pagesCSUSB Syllabus Fin 3002 Shelton Fall 2021 Section 61 ONLINEIggo NziokiNo ratings yet

- Economics (49) : NtroductionDocument25 pagesEconomics (49) : NtroductionAmandeep Singh MankuNo ratings yet

- Smarter Faster Better The Secrets of Being Productive in Life and Business by Charles DuhiggDocument8 pagesSmarter Faster Better The Secrets of Being Productive in Life and Business by Charles DuhiggsimasNo ratings yet

- Factors Influencing The Construction Cost of Industrialised Building System (IBS) ProjectsDocument8 pagesFactors Influencing The Construction Cost of Industrialised Building System (IBS) ProjectsNeha Tajve100% (1)

- Supply Chain Management of Amul - ReportDocument23 pagesSupply Chain Management of Amul - ReportShabbir AkhtarNo ratings yet

- Fuel Subsidy - Impact On Oil Stocks On NSEDocument2 pagesFuel Subsidy - Impact On Oil Stocks On NSEProshareNo ratings yet

- Auditoria II 2021 OkDocument67 pagesAuditoria II 2021 OkDark BrownNo ratings yet

- Minesight Schedule Optimizer - A New Tool: Global Mining Software Solutions Since 1970Document28 pagesMinesight Schedule Optimizer - A New Tool: Global Mining Software Solutions Since 1970Ricardo Contreras BNo ratings yet

- CVDocument8 pagesCVJoeNo ratings yet

- Final PPT Brand ValuationDocument26 pagesFinal PPT Brand ValuationPradeep Choudhary50% (2)

- Economic Agents: Why Is Switzerland So Developed & Economically RichDocument4 pagesEconomic Agents: Why Is Switzerland So Developed & Economically Richkhush1802No ratings yet

- ResultDocument1 pageResultRakesh KumarNo ratings yet

- Ped Worksheet 2 AnswersDocument3 pagesPed Worksheet 2 Answersapi-505089065No ratings yet

- Seminar Questions: General Term Structure and Interest RatesDocument3 pagesSeminar Questions: General Term Structure and Interest RatesAranSinghKailaNo ratings yet