Professional Documents

Culture Documents

Tables

Tables

Uploaded by

Armelia CododCopyright:

Available Formats

You might also like

- Orifice Tables PDFDocument35 pagesOrifice Tables PDFAli RazzaqNo ratings yet

- Withholding Tax RateDocument1 pageWithholding Tax RateJamie Jimenez CerreroNo ratings yet

- For The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"Document1 pageFor The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"yousefNo ratings yet

- Effective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Document1 pageEffective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Vita DepanteNo ratings yet

- Withholding Tax Table 1Document1 pageWithholding Tax Table 1Jhon Karl AndalNo ratings yet

- T de StudentDocument1 pageT de StudentjuanNo ratings yet

- Home+Financing i+Instalment+TableDocument1 pageHome+Financing i+Instalment+TableSyafi'ah BakaruddinNo ratings yet

- Home Financing-I Repayment Schedule (Normal) : Instalments For Completed / Under Construction / RefinancingDocument1 pageHome Financing-I Repayment Schedule (Normal) : Instalments For Completed / Under Construction / RefinancingMila AnnNo ratings yet

- ANSI Pipe ScheduleDocument2 pagesANSI Pipe ScheduleamevaluacionesNo ratings yet

- Witholding TaxDocument33 pagesWitholding TaxBfp Basud Camarines NorteNo ratings yet

- Budget Statistics 2005 - 2011: Ministry of Finance Republic of IndonesiaDocument16 pagesBudget Statistics 2005 - 2011: Ministry of Finance Republic of IndonesiaSurjadiNo ratings yet

- T de StudentDocument2 pagesT de StudentYOSSELYN NOHEMI RIVERA MEJIANo ratings yet

- Revised Withholding Tax TablesDocument2 pagesRevised Withholding Tax TablesShairaCerenoNo ratings yet

- New India Asha Kiran Policy Premium ChartDocument2 pagesNew India Asha Kiran Policy Premium Chartpratikwagh112002No ratings yet

- 5.lampiran LampiranDocument16 pages5.lampiran LampiranPranis PulungNo ratings yet

- Jadual+bayaran+bulanan+normal+ (Kas+3 00) +pri+&+seDocument1 pageJadual+bayaran+bulanan+normal+ (Kas+3 00) +pri+&+seTaqi DinNo ratings yet

- Tabla IV T-StudentDocument1 pageTabla IV T-StudentFran ViscontiNo ratings yet

- Tax Rate 2022Document16 pagesTax Rate 2022Dyna May PaduaNo ratings yet

- Lampiran - Data Interval Jawaban Responden Menggunakan Metode Succesive IntervalDocument9 pagesLampiran - Data Interval Jawaban Responden Menggunakan Metode Succesive IntervalDeni ArifyansyahNo ratings yet

- CarstelDocument18 pagesCarstelfadson sakalaNo ratings yet

- Neu Example CmoDocument33 pagesNeu Example Cmotesttest1No ratings yet

- Cash CollectionsDocument3 pagesCash CollectionsHabtamu TesfayeNo ratings yet

- Pembiayaan Peribadi Awam GLC (DC) PDFDocument1 pagePembiayaan Peribadi Awam GLC (DC) PDFismadiNo ratings yet

- Pembiayaan Peribadi Awam GLCDocument1 pagePembiayaan Peribadi Awam GLCAzmi_ainaNo ratings yet

- Withholding TaxDocument46 pagesWithholding TaxDura LexNo ratings yet

- Sept. 2019 Projected Revenue: SEPTEMBER, 2019Document8 pagesSept. 2019 Projected Revenue: SEPTEMBER, 2019Jacky PararuanNo ratings yet

- PB1MAT+Tabel Z Dan Tabel T 2Document2 pagesPB1MAT+Tabel Z Dan Tabel T 2Adi NugrahaNo ratings yet

- Anexe: Du e ZDocument7 pagesAnexe: Du e ZStan AnaNo ratings yet

- Sii Smith International Inc. (713) 443 - 3370: DrilcoDocument27 pagesSii Smith International Inc. (713) 443 - 3370: DrilcoIvan Dario Benavides BonillaNo ratings yet

- (Ons-Cleared) - Tables 1-3 Attachment To PR On 2022 COD - As of 31 March 2023 - ONSDocument7 pages(Ons-Cleared) - Tables 1-3 Attachment To PR On 2022 COD - As of 31 March 2023 - ONSSheryll Elaine RiguaNo ratings yet

- Rate Chart-Chola Super Topup InsuranceDocument19 pagesRate Chart-Chola Super Topup InsuranceShivam Shiddharth SinghNo ratings yet

- Withholding Tax From BIR WebsiteDocument37 pagesWithholding Tax From BIR Websitepeanut47No ratings yet

- Tabela T StudentDocument1 pageTabela T StudentMaykJoaquimDosSantosNo ratings yet

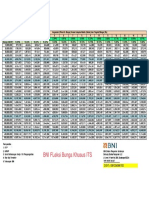

- Top TIER ITSDocument1 pageTop TIER ITSCandra IrawanNo ratings yet

- Payment Schedule Personal Financing-I Public ENGLISH SALARY TRANSFERDocument1 pagePayment Schedule Personal Financing-I Public ENGLISH SALARY TRANSFERMohd. Zazaruddin HarunNo ratings yet

- UntitledDocument52 pagesUntitledFrank ChavezNo ratings yet

- Total Compensation Framework Template (Annex A)Document2 pagesTotal Compensation Framework Template (Annex A)Noreen Boots Gocon-GragasinNo ratings yet

- Table Angsuran Griya 2020 SiaminDocument1 pageTable Angsuran Griya 2020 Siaminimam asqNo ratings yet

- Tabla T Student 2Document2 pagesTabla T Student 2Manuela RomeroNo ratings yet

- Flyers - BSN PF Rate Campaign - A5 - Skap - en - March 2024Document3 pagesFlyers - BSN PF Rate Campaign - A5 - Skap - en - March 2024michael radziNo ratings yet

- Aga TableDocument35 pagesAga TableilublessingNo ratings yet

- Revised Withholding Tax TablesDocument2 pagesRevised Withholding Tax TablesReylan San PascualNo ratings yet

- Tables For ExamDocument5 pagesTables For ExamCecilia Veronica RañaNo ratings yet

- Temporary Best of Best Til NOV 2021Document6 pagesTemporary Best of Best Til NOV 2021DAFIT MAULANANo ratings yet

- Tabla T StudentDocument1 pageTabla T StudentCeciliaNo ratings yet

- JadualTransaksiSelangor2020Document53 pagesJadualTransaksiSelangor2020Venice ChenNo ratings yet

- Pii-2006600-Sf PurDocument2 pagesPii-2006600-Sf PurSayyid AzzamNo ratings yet

- Mil Pay Table 1991Document2 pagesMil Pay Table 1991ASiCNo ratings yet

- 4 Selangor PDFDocument14 pages4 Selangor PDFJoo LimNo ratings yet

- Phụ Lục 1: Bảng Phân Phối Chuẩn (Z)Document19 pagesPhụ Lục 1: Bảng Phân Phối Chuẩn (Z)Nguyen Duy AnhNo ratings yet

- Tabel Angsuran Pag NovDocument1 pageTabel Angsuran Pag NovDean MaharaniNo ratings yet

- Tabla de Cuantiles de La Distribución T de StudentDocument1 pageTabla de Cuantiles de La Distribución T de StudentkeilaNo ratings yet

- E275 AWG TablesDocument11 pagesE275 AWG TablesAdrian GarciaNo ratings yet

- Circular Mils - AWG-Tables PDFDocument11 pagesCircular Mils - AWG-Tables PDFRichard TorrivillaNo ratings yet

- Tabele 1Document8 pagesTabele 1NedelcuAlexNo ratings yet

- Valorile Funcţiei LaplaceDocument8 pagesValorile Funcţiei LaplaceAlexandruNedelcuNo ratings yet

- ARCE Wage Scale 2013Document1 pageARCE Wage Scale 2013Сергей ЯковлевNo ratings yet

- Status Gizi Balita Eppgbm2019 GiziDocument7 pagesStatus Gizi Balita Eppgbm2019 GiziRama GrivandoNo ratings yet

- 2021-2024 (4 Year) Planner (Printable Version)From Everand2021-2024 (4 Year) Planner (Printable Version)Rating: 5 out of 5 stars5/5 (1)

Tables

Tables

Uploaded by

Armelia CododOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tables

Tables

Uploaded by

Armelia CododCopyright:

Available Formats

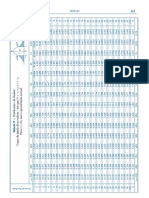

Withholding Tax Table effective January 1, 2009

(CURRENT)

Source: BIR Revenue Regulations No. 10-2008, July 08, 2008

WEEKLY 1 2 3 4 5 6 7 8

Bracket WTAX 0.00 0.00 9.62 48.08 163.46 432.69 961.54 2,403.85

+0% +5% +10% +15% +20% +25% +30% +32%

Status Exemption

over over over over over over over over

A. Table for employees without qualified dependent

1. Z 0 0 0 192 577 1,346 2,692 4,808 9,615

2. S 0 0 962 1,154 1,538 2,308 3,654 5,769 10,577

2. ME 0 0 962 1,154 1,538 2,308 3,654 5,769 10,577

B. Table for single/married employee with dependent child(ren)

1. S1 0 0 1,442 1,635 2,019 2,788 4,135 6,250 11,058

2. S2 0 0 1,923 2,115 2,500 3,269 4,615 6,731 11,538

3. S3 0 0 2,404 2,596 2,981 3,750 5,096 7,212 12,019

4. S4 0 0 2,885 3,077 3,462 4,231 5,577 7,692 12,500

1. ME1 0 0 1,442 1,635 2,019 2,788 4,135 6,250 11,058

2. ME2 0 0 1,923 2,115 2,500 3,269 4,615 6,731 11,538

3. ME3 0 0 2,404 2,596 2,981 3,750 5,096 7,212 12,019

4. ME4 0 0 2,885 3,077 3,462 4,231 5,577 7,692 12,500

You might also like

- Orifice Tables PDFDocument35 pagesOrifice Tables PDFAli RazzaqNo ratings yet

- Withholding Tax RateDocument1 pageWithholding Tax RateJamie Jimenez CerreroNo ratings yet

- For The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"Document1 pageFor The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"yousefNo ratings yet

- Effective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Document1 pageEffective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Vita DepanteNo ratings yet

- Withholding Tax Table 1Document1 pageWithholding Tax Table 1Jhon Karl AndalNo ratings yet

- T de StudentDocument1 pageT de StudentjuanNo ratings yet

- Home+Financing i+Instalment+TableDocument1 pageHome+Financing i+Instalment+TableSyafi'ah BakaruddinNo ratings yet

- Home Financing-I Repayment Schedule (Normal) : Instalments For Completed / Under Construction / RefinancingDocument1 pageHome Financing-I Repayment Schedule (Normal) : Instalments For Completed / Under Construction / RefinancingMila AnnNo ratings yet

- ANSI Pipe ScheduleDocument2 pagesANSI Pipe ScheduleamevaluacionesNo ratings yet

- Witholding TaxDocument33 pagesWitholding TaxBfp Basud Camarines NorteNo ratings yet

- Budget Statistics 2005 - 2011: Ministry of Finance Republic of IndonesiaDocument16 pagesBudget Statistics 2005 - 2011: Ministry of Finance Republic of IndonesiaSurjadiNo ratings yet

- T de StudentDocument2 pagesT de StudentYOSSELYN NOHEMI RIVERA MEJIANo ratings yet

- Revised Withholding Tax TablesDocument2 pagesRevised Withholding Tax TablesShairaCerenoNo ratings yet

- New India Asha Kiran Policy Premium ChartDocument2 pagesNew India Asha Kiran Policy Premium Chartpratikwagh112002No ratings yet

- 5.lampiran LampiranDocument16 pages5.lampiran LampiranPranis PulungNo ratings yet

- Jadual+bayaran+bulanan+normal+ (Kas+3 00) +pri+&+seDocument1 pageJadual+bayaran+bulanan+normal+ (Kas+3 00) +pri+&+seTaqi DinNo ratings yet

- Tabla IV T-StudentDocument1 pageTabla IV T-StudentFran ViscontiNo ratings yet

- Tax Rate 2022Document16 pagesTax Rate 2022Dyna May PaduaNo ratings yet

- Lampiran - Data Interval Jawaban Responden Menggunakan Metode Succesive IntervalDocument9 pagesLampiran - Data Interval Jawaban Responden Menggunakan Metode Succesive IntervalDeni ArifyansyahNo ratings yet

- CarstelDocument18 pagesCarstelfadson sakalaNo ratings yet

- Neu Example CmoDocument33 pagesNeu Example Cmotesttest1No ratings yet

- Cash CollectionsDocument3 pagesCash CollectionsHabtamu TesfayeNo ratings yet

- Pembiayaan Peribadi Awam GLC (DC) PDFDocument1 pagePembiayaan Peribadi Awam GLC (DC) PDFismadiNo ratings yet

- Pembiayaan Peribadi Awam GLCDocument1 pagePembiayaan Peribadi Awam GLCAzmi_ainaNo ratings yet

- Withholding TaxDocument46 pagesWithholding TaxDura LexNo ratings yet

- Sept. 2019 Projected Revenue: SEPTEMBER, 2019Document8 pagesSept. 2019 Projected Revenue: SEPTEMBER, 2019Jacky PararuanNo ratings yet

- PB1MAT+Tabel Z Dan Tabel T 2Document2 pagesPB1MAT+Tabel Z Dan Tabel T 2Adi NugrahaNo ratings yet

- Anexe: Du e ZDocument7 pagesAnexe: Du e ZStan AnaNo ratings yet

- Sii Smith International Inc. (713) 443 - 3370: DrilcoDocument27 pagesSii Smith International Inc. (713) 443 - 3370: DrilcoIvan Dario Benavides BonillaNo ratings yet

- (Ons-Cleared) - Tables 1-3 Attachment To PR On 2022 COD - As of 31 March 2023 - ONSDocument7 pages(Ons-Cleared) - Tables 1-3 Attachment To PR On 2022 COD - As of 31 March 2023 - ONSSheryll Elaine RiguaNo ratings yet

- Rate Chart-Chola Super Topup InsuranceDocument19 pagesRate Chart-Chola Super Topup InsuranceShivam Shiddharth SinghNo ratings yet

- Withholding Tax From BIR WebsiteDocument37 pagesWithholding Tax From BIR Websitepeanut47No ratings yet

- Tabela T StudentDocument1 pageTabela T StudentMaykJoaquimDosSantosNo ratings yet

- Top TIER ITSDocument1 pageTop TIER ITSCandra IrawanNo ratings yet

- Payment Schedule Personal Financing-I Public ENGLISH SALARY TRANSFERDocument1 pagePayment Schedule Personal Financing-I Public ENGLISH SALARY TRANSFERMohd. Zazaruddin HarunNo ratings yet

- UntitledDocument52 pagesUntitledFrank ChavezNo ratings yet

- Total Compensation Framework Template (Annex A)Document2 pagesTotal Compensation Framework Template (Annex A)Noreen Boots Gocon-GragasinNo ratings yet

- Table Angsuran Griya 2020 SiaminDocument1 pageTable Angsuran Griya 2020 Siaminimam asqNo ratings yet

- Tabla T Student 2Document2 pagesTabla T Student 2Manuela RomeroNo ratings yet

- Flyers - BSN PF Rate Campaign - A5 - Skap - en - March 2024Document3 pagesFlyers - BSN PF Rate Campaign - A5 - Skap - en - March 2024michael radziNo ratings yet

- Aga TableDocument35 pagesAga TableilublessingNo ratings yet

- Revised Withholding Tax TablesDocument2 pagesRevised Withholding Tax TablesReylan San PascualNo ratings yet

- Tables For ExamDocument5 pagesTables For ExamCecilia Veronica RañaNo ratings yet

- Temporary Best of Best Til NOV 2021Document6 pagesTemporary Best of Best Til NOV 2021DAFIT MAULANANo ratings yet

- Tabla T StudentDocument1 pageTabla T StudentCeciliaNo ratings yet

- JadualTransaksiSelangor2020Document53 pagesJadualTransaksiSelangor2020Venice ChenNo ratings yet

- Pii-2006600-Sf PurDocument2 pagesPii-2006600-Sf PurSayyid AzzamNo ratings yet

- Mil Pay Table 1991Document2 pagesMil Pay Table 1991ASiCNo ratings yet

- 4 Selangor PDFDocument14 pages4 Selangor PDFJoo LimNo ratings yet

- Phụ Lục 1: Bảng Phân Phối Chuẩn (Z)Document19 pagesPhụ Lục 1: Bảng Phân Phối Chuẩn (Z)Nguyen Duy AnhNo ratings yet

- Tabel Angsuran Pag NovDocument1 pageTabel Angsuran Pag NovDean MaharaniNo ratings yet

- Tabla de Cuantiles de La Distribución T de StudentDocument1 pageTabla de Cuantiles de La Distribución T de StudentkeilaNo ratings yet

- E275 AWG TablesDocument11 pagesE275 AWG TablesAdrian GarciaNo ratings yet

- Circular Mils - AWG-Tables PDFDocument11 pagesCircular Mils - AWG-Tables PDFRichard TorrivillaNo ratings yet

- Tabele 1Document8 pagesTabele 1NedelcuAlexNo ratings yet

- Valorile Funcţiei LaplaceDocument8 pagesValorile Funcţiei LaplaceAlexandruNedelcuNo ratings yet

- ARCE Wage Scale 2013Document1 pageARCE Wage Scale 2013Сергей ЯковлевNo ratings yet

- Status Gizi Balita Eppgbm2019 GiziDocument7 pagesStatus Gizi Balita Eppgbm2019 GiziRama GrivandoNo ratings yet

- 2021-2024 (4 Year) Planner (Printable Version)From Everand2021-2024 (4 Year) Planner (Printable Version)Rating: 5 out of 5 stars5/5 (1)