Professional Documents

Culture Documents

Demat

Demat

Uploaded by

rashmineogOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Demat

Demat

Uploaded by

rashmineogCopyright:

Available Formats

Holding mutual funds in a demat account

investors can now hold their mutual fund units in dematerialised form. Investor who own a demat

account can use it to hold mutual fund units. It is however not mandatory to convert units into demat

form. Investors can also use the electronic platforms of stock exchanges to transact in their mutual

fund units through the brokers of the stock exchange.

For this, investors have to use a standard form specified by the depository (CDSL or NSDL) called the

conversion request form ( CRF )) or destatementisation request form (DRF). This form is available

with the depository participant (DP). The completed form, along with the statement of account (SoA)

which shows the unit holdings of the investor, has to be submitted to the DP. The DP will verify and

forward it to the registrar and transfer agent, who in turn will confirm the details of units held in the

SoA. Units will be credited to the demat account after this confirmation.

1. ISIN: Each mutual fund is assigned an ISIN ( International Security Identification Number )). It can

be obtained from NSDL or CSDL and has to be included in the CRF/DRF.

2. Details: The details of each scheme with respect to scheme name, ISIN and number of units held

should be correctly mentioned in the CRF/DRF and should tally with the SoA being attached.

3. Holding Pattern

The holding pattern of the mutual fund folios and that of the demat account should be the same, and

in the same order.

4. Free & Lock-in Units

Mutual fund units such as those of tax-saving schemes may be subject to lock-in. Different forms have

to be used for free and locked-in units of the same scheme even if held under the same folio.

Points to note

Signatures: The CRF/DRF has to be signed by all the unit holders of the folio, irrespective of the

mode of operation of the folio.

Transacting with the mutual fund: Once units are dematerialised, investors cannot transact in them

directly with the mutual fund or investor service centres. Transactions are routed through the stock

exchange platform or through the DP.

Re-materialsation of units: Investors can also make an application for re-materialisation of the

dematerialised units and only then transact with the mutual fund.

You might also like

- Chapter-I: DefinitionDocument36 pagesChapter-I: Definitionajay_sanala100% (1)

- Liquidbeesbuybackprocess PDFDocument2 pagesLiquidbeesbuybackprocess PDFgoud mahendharNo ratings yet

- NISM VA - Short Notes - Bullet PointsDocument14 pagesNISM VA - Short Notes - Bullet PointsHarshida ParmarNo ratings yet

- DematdownloadDocument8 pagesDematdownloadankit_47369No ratings yet

- Derivatives NotesDocument81 pagesDerivatives NotespritamNo ratings yet

- Reliance Fixed Horizon Fund XIXSeries 20Document5 pagesReliance Fixed Horizon Fund XIXSeries 20srikanth131No ratings yet

- FMM Mutual FundDocument26 pagesFMM Mutual FundYashshviNo ratings yet

- Depository SystemDocument4 pagesDepository SystemShubhanjaliNo ratings yet

- Suyash Kumar Gupta 12019547Document20 pagesSuyash Kumar Gupta 12019547suyashNo ratings yet

- Facility For Redemption of Fractional Units of Nippon India Etf Liquid BeesDocument1 pageFacility For Redemption of Fractional Units of Nippon India Etf Liquid BeespadmaniaNo ratings yet

- Chapter-2 Review of LiteratureDocument54 pagesChapter-2 Review of Literaturebalki123No ratings yet

- Central Depository Act, 1997Document6 pagesCentral Depository Act, 1997Syed Mujtaba Hassan100% (1)

- Executive Summary Investor Preferences 22233Document5 pagesExecutive Summary Investor Preferences 22233Vishnu SharmaNo ratings yet

- Depository SystemDocument24 pagesDepository SystemDileep SinghNo ratings yet

- Mutual Fund Service System (MFSS) For Investors: Frequently Asked QuestionDocument7 pagesMutual Fund Service System (MFSS) For Investors: Frequently Asked QuestionAJAY KUMAR TALATHOTANo ratings yet

- FAQs On Mutual Fund Service System (MFSS) For InvestorsrDocument7 pagesFAQs On Mutual Fund Service System (MFSS) For InvestorsrRajeshkanna PNo ratings yet

- Circular - Operational, Prudential and Reporting Norms For AIFsDocument13 pagesCircular - Operational, Prudential and Reporting Norms For AIFsRajesh AroraNo ratings yet

- Mutual FundsDocument5 pagesMutual FundsParthNo ratings yet

- Courtesy WWW - Sebi.gov - inDocument31 pagesCourtesy WWW - Sebi.gov - inVinod GudimaniNo ratings yet

- Courtesy WWW - Sebi.gov - inDocument30 pagesCourtesy WWW - Sebi.gov - inVinod GudimaniNo ratings yet

- Annexure I PDFDocument7 pagesAnnexure I PDFRenjithNo ratings yet

- Chapter 35 Depository SystemDocument6 pagesChapter 35 Depository SystemRegi CABNo ratings yet

- Depository SystemDocument20 pagesDepository SystemSuhail AkhterNo ratings yet

- Scheme Information Document (SID) : Continuous Offer of Units at NAV Based Prices Scheme Reopened On August 8, 2007Document24 pagesScheme Information Document (SID) : Continuous Offer of Units at NAV Based Prices Scheme Reopened On August 8, 2007sgr1009No ratings yet

- Advantages of The Depository SystemDocument16 pagesAdvantages of The Depository SystemKARISHMAATA2No ratings yet

- Fas133 FASB Derivatives Hedge Accounting RulesDocument22 pagesFas133 FASB Derivatives Hedge Accounting Rulesswinki3100% (1)

- MF Module 1Document75 pagesMF Module 1Gouri K MakatiNo ratings yet

- Selection PPP Facilities For 2015Document4 pagesSelection PPP Facilities For 2015PaulaRaposoNo ratings yet

- Mutual Funds at KarvyDocument77 pagesMutual Funds at KarvyNaveen KumarNo ratings yet

- NSDL (National Securities Depositories Limited)Document9 pagesNSDL (National Securities Depositories Limited)Dhavalsinh BariaNo ratings yet

- Chapter 5 1 CDSLDocument61 pagesChapter 5 1 CDSLPratik ShendeNo ratings yet

- Demat Simplified: A Guide To Dealing in Dematerialised SecuritiesDocument2 pagesDemat Simplified: A Guide To Dealing in Dematerialised SecuritiesBalraj PadmashaliNo ratings yet

- Last Module Accounting For Securities FinancingDocument12 pagesLast Module Accounting For Securities FinancingShibla RazakNo ratings yet

- The Versatility of Mutual FundsDocument13 pagesThe Versatility of Mutual FundsHimansu S MNo ratings yet

- Functions of Mutual Funds-PraveenDocument11 pagesFunctions of Mutual Funds-PraveenFairooz AliNo ratings yet

- PORTFOLIO InvestementsDocument12 pagesPORTFOLIO InvestementsganeshkingofeeeNo ratings yet

- FinalDocument13 pagesFinalashishrajmakkarNo ratings yet

- Sid - Sbi Focused Equity FundDocument93 pagesSid - Sbi Focused Equity FundGourab BhattacharjeeNo ratings yet

- Iare FD Notes PDFDocument86 pagesIare FD Notes PDFNANDIKANTI SRINIVASNo ratings yet

- MutualFunds - Regulations and GuidelinesDocument14 pagesMutualFunds - Regulations and Guidelinesmuneebmateen01No ratings yet

- Reliance Mutual FundDocument54 pagesReliance Mutual FundAnil MakvanaNo ratings yet

- MFSSDocument2 pagesMFSSLaharii MerugumallaNo ratings yet

- Financial Market PresentationDocument15 pagesFinancial Market PresentationAashray PandeyNo ratings yet

- Ma'Cellus: Marcellus Investment Managers Private LimitedDocument8 pagesMa'Cellus: Marcellus Investment Managers Private LimitedRaghav ArroraNo ratings yet

- Mutual Funds FaqDocument9 pagesMutual Funds Faqgopi_ggg20016099No ratings yet

- Depository SystemDocument47 pagesDepository Systemsanyogeeta sahooNo ratings yet

- Chapter No. Title Weights (%) : Fund SchemeDocument18 pagesChapter No. Title Weights (%) : Fund SchemeNidheesh BabuNo ratings yet

- Mutual FundsDocument8 pagesMutual FundsHarmanSinghNo ratings yet

- Mutual FundsDocument9 pagesMutual Fundskoon00721No ratings yet

- CCP Fee Change SetDocument5 pagesCCP Fee Change SetRaghav ArroraNo ratings yet

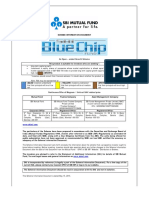

- Bluechip FundDC58F14BAF2FDocument56 pagesBluechip FundDC58F14BAF2Fharpreet singhNo ratings yet

- Depository ActDocument11 pagesDepository ActMonika GuraiyaNo ratings yet

- Concept, Principles and Models of TakafulDocument30 pagesConcept, Principles and Models of Takafulchao yang100% (1)

- Chapter 5: Investment CompaniesDocument16 pagesChapter 5: Investment CompaniesHossain RajuNo ratings yet

- Frequently Asked Questions: Exchange Traded Fund (ETF) SpecificDocument10 pagesFrequently Asked Questions: Exchange Traded Fund (ETF) SpecificmanishkhabarNo ratings yet

- MTF FaqDocument7 pagesMTF FaqSHREYNo ratings yet

- Shareholders ReferencerDocument13 pagesShareholders ReferencerneerajabcNo ratings yet

- Sid Parag Parikh Dynamic Asset Allocation FundDocument121 pagesSid Parag Parikh Dynamic Asset Allocation FundMONEY MINDED MILLENNIALNo ratings yet

- Chapter 5: Investment Companies: DefinitionDocument16 pagesChapter 5: Investment Companies: Definitiontjarnob13100% (1)