Professional Documents

Culture Documents

RPT VATMonthly Returnnew

RPT VATMonthly Returnnew

Uploaded by

vrsapthagiriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RPT VATMonthly Returnnew

RPT VATMonthly Returnnew

Uploaded by

vrsapthagiriCopyright:

Available Formats

FORM I

[see Rule 7(1)

VALUE ADDED TAX MONTHLY RETURN

Name of the dealer:

SRIMADHI TRADERS

To

The Assessing Authority, ARISIPALAYAM Circle, TIN 33202844361 Month 01 Year 2011

INPUT TAX CREDIT TAX PAYABLE

1 Input Tax Credit carry-forward (Rs.) (A) #Error 1 Purchase turnover under Sec. 12 0.00 Tax due 0.00

(No input tax credit of capital goods to be included here) (Rs.) Rs.(A1)

INPUT ITEMS Purchase value during Input Tax credit OUTPUT ITEMS Sales turnover/ value

the month(Rs.) (VAT paid)(Rs.) inside the State(Rs.)

(First schedule goods) (Input Tax Credit allowable) VAT due (Rs.)

(a) Goods taxable at 1% 0.00 0.00 (a) Local sales at 1% 0.00 0.00

(a) Goods taxable at 2% 0.00 0.00 (a) Local sales at 2% 0.00 0.00

(b) Goods taxable at 4% 0.00 0.00 (b) Local sales at 4% 0.00 0.00

(c) Goods taxable at 12.5% 0.00 0.00 (c) Local Sales at 12.5% 0.00 0.00

(d) Purchase under Sec. 12 0.00 0.00 Total 0.00 0.00

d1)Tax paid under sec.12 <---No--->

Total 0.00 0.00 2 Less: Sales return/Unfructified sales 0.00 0.00

2 Less : Reverse Credit* 0.00 0.00 Total (F) 0.00 (F1) 0.00

TOTAL (NET) (B) 0.00 (B1) 0.00 Zero rate sales 0.00

Goods exempted 50,500.00 1. Adjustment of advance tax 0.00

2. Entry tax paid, if any 0.00

Less: Total (1+2) (H1) 0

Net tax payable (T1) = (F1) - (H1) 0.00

(T2) = (T1) 0.00

OUTPUT ITEMS

(Input Tax Credit not all allowable)

Eligible Input Tax

CAPITAL GOODS Credit (Rs.) Exempt sales 53,500.00

(a) Upto previous month 0.00 0.00 Less: Sales return/Unfructified sales 0

(b) during the month 0.00 0.00 Total (J) 53,500.00

3 Total 0.00 0.00

Less : Reverse Credit* 0.00 0.00 3 Sales Under Sec. 10 (S) 0.00 (S1) 0

TOTAL (NET) (C) 0.00 (C1) 0.00 1. Adjustment of advance tax 0.00

2. Entry tax pid, TDS, refund, if any 0.00

Less: Total (1+2) (T3) 0.00

4 Total Input Tax Credit (D) = (A+B1+C1) #Error

Total TurnOver (F)+(J)+(S) 53,500.00 Net tax payable (T4) 0.00

* vide Sec 19 = (T2+S1)-(T3)

You might also like

- TicketDocument5 pagesTicketponmaga100% (1)

- Payslip 2142Document1 pagePayslip 2142Kanakapriya VenkatesanNo ratings yet

- Teamviewer 1988209925Document1 pageTeamviewer 1988209925Kunda MalleshNo ratings yet

- France PestelDocument4 pagesFrance PestelJenab Pathan94% (16)

- RPT VATMonthly ReturnnewDocument1 pageRPT VATMonthly ReturnnewchandhiranNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAmit GolaNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsRyan VillamorNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAmit GolaNo ratings yet

- GSTR3B 09gurps0376c2z3 122018Document3 pagesGSTR3B 09gurps0376c2z3 122018Yogesh YadavNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsrj aNo ratings yet

- GSTR3B 09gurps0376c2z3 012019Document3 pagesGSTR3B 09gurps0376c2z3 012019Yogesh YadavNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BthomasNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BBHANU PRATAP AGARWALNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAmit GolaNo ratings yet

- LOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetDocument5 pagesLOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetJomidy Midtanggal100% (1)

- GSTR3B Dec2018Document3 pagesGSTR3B Dec2018Gowri ShankarNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BJaideep MishraNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bprashant patilNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BShorya JainNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyNo ratings yet

- GSTR3B 27aaufr3550j1zn 072017 PDFDocument3 pagesGSTR3B 27aaufr3550j1zn 072017 PDFNiraj KulkarniNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BShivam KathuriyaNo ratings yet

- Page 4 ItrDocument1 pagePage 4 ItrariannemungcalcpaNo ratings yet

- GSTR3B 09hbjps0079a1zi 092021Document3 pagesGSTR3B 09hbjps0079a1zi 092021birpal singhNo ratings yet

- Ki GST 3B Oct 18 PDFDocument3 pagesKi GST 3B Oct 18 PDFPreethi LoansNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyNo ratings yet

- GSTR3B April 2020Document3 pagesGSTR3B April 2020srinivasa annamayyaNo ratings yet

- GSTR3B 27afxpr6875g1ze 082020Document3 pagesGSTR3B 27afxpr6875g1ze 082020fintrustbankingNo ratings yet

- 1701 P4.1Document2 pages1701 P4.1asteriaswan14No ratings yet

- GSTR3B 27aaufr3550j1zn 032018 PDFDocument3 pagesGSTR3B 27aaufr3550j1zn 032018 PDFNiraj KulkarniNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bhussain28097373No ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bsiva kumarNo ratings yet

- GSTR3B 04agfps2208h1zo 042020Document3 pagesGSTR3B 04agfps2208h1zo 042020Aditya AroraNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BRahul AgarwalNo ratings yet

- GSTR3B 10JHBPS7007C2ZQ 092020 PDFDocument3 pagesGSTR3B 10JHBPS7007C2ZQ 092020 PDFkaranNo ratings yet

- GSTR3B 27aaufr3550j1zn 022018 PDFDocument3 pagesGSTR3B 27aaufr3550j1zn 022018 PDFNiraj KulkarniNo ratings yet

- GSTR3B 02beepk0612k1z1 012020 PDFDocument3 pagesGSTR3B 02beepk0612k1z1 012020 PDFArun VeeraniNo ratings yet

- GSTR3B 19aznpb2145b1zr 072020Document3 pagesGSTR3B 19aznpb2145b1zr 072020Ar Arka Prava BarikNo ratings yet

- GSTR3B 27agypd6805a1zf 012019-1Document3 pagesGSTR3B 27agypd6805a1zf 012019-1dinowinsonNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bkits ekatraNo ratings yet

- GSTR3B 05DWLPK5919J1Z3 112020Document3 pagesGSTR3B 05DWLPK5919J1Z3 112020ashraf khanNo ratings yet

- GSTR3B 18aeopf0315h1zr 072020Document3 pagesGSTR3B 18aeopf0315h1zr 072020lokesh agarwalNo ratings yet

- GSTR3B 29acfpv8957q2z5 012019Document3 pagesGSTR3B 29acfpv8957q2z5 012019Bankloan easyNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Binfinity associatesNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bsiva kumarNo ratings yet

- GSTR3B 19aznpb2145b1zr 042020Document3 pagesGSTR3B 19aznpb2145b1zr 042020Ar Arka Prava BarikNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAr Arka Prava BarikNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bamershareef337No ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bsiva kumarNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bsiva kumarNo ratings yet

- GSTR3B 33bqnpa3008c1zl 032020Document3 pagesGSTR3B 33bqnpa3008c1zl 032020Balasubramanian CNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BameygandhiNo ratings yet

- GSTR3B 04agfps2208h1zo 072020Document3 pagesGSTR3B 04agfps2208h1zo 072020Aditya AroraNo ratings yet

- GSTR3B 24cirpp4542d1z5 092020Document3 pagesGSTR3B 24cirpp4542d1z5 092020Bhaumik PatelNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BABCNo ratings yet

- GSTR3B 19aznpb2145b1zr 032020Document3 pagesGSTR3B 19aznpb2145b1zr 032020Ar Arka Prava BarikNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BsamaadhuNo ratings yet

- GSTR3B 09hbjps0079a1zi 122021Document3 pagesGSTR3B 09hbjps0079a1zi 122021birpal singhNo ratings yet

- Feasibility Study To The Establishment of Corn Processing Plant in EthiopiaDocument7 pagesFeasibility Study To The Establishment of Corn Processing Plant in EthiopiaEphremNo ratings yet

- Wood Painting DupaDocument2 pagesWood Painting DupaJhongz Masing ApolinariaNo ratings yet

- Test Bank For Corporate Finance 2nd Canadian Edition BerkDocument14 pagesTest Bank For Corporate Finance 2nd Canadian Edition BerkmessiphatwtpwNo ratings yet

- 74101747-Strategic Analysis of Marriot and Starwood MergerDocument15 pages74101747-Strategic Analysis of Marriot and Starwood MergerRaghdaa Raafat100% (2)

- One Nation, One Tax: Goods and Services Tax (GST)Document13 pagesOne Nation, One Tax: Goods and Services Tax (GST)Karan SharmaNo ratings yet

- Tax Syllabus W CasesDocument221 pagesTax Syllabus W CasesSidney Nicole LiquiganNo ratings yet

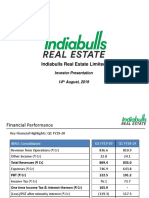

- Indiabulls Real Estate Limited: Investor Presentation 14 August, 2019Document41 pagesIndiabulls Real Estate Limited: Investor Presentation 14 August, 2019slohariNo ratings yet

- Audit Report InvestmentDocument5 pagesAudit Report InvestmentSL News OnlineNo ratings yet

- NJ Privatization Task Force Final ReportDocument61 pagesNJ Privatization Task Force Final ReportThe Jersey City IndependentNo ratings yet

- Project Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Document20 pagesProject Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Arun OusephNo ratings yet

- Circular No - 99 Dated 01.06.2023Document2 pagesCircular No - 99 Dated 01.06.2023vijay_prasad_asnNo ratings yet

- CM HW1Document1 pageCM HW1Yanahcute WattpadNo ratings yet

- H. Basic Principles of A Sound Tax SystemDocument6 pagesH. Basic Principles of A Sound Tax SystemMichael Ang SauzaNo ratings yet

- Negotiation Case - Buyer - 2017Document6 pagesNegotiation Case - Buyer - 2017yoki000No ratings yet

- Public FinanceDocument8 pagesPublic FinanceSuan Judy Ann A.No ratings yet

- Batson InternationalDocument24 pagesBatson InternationalAnand DedhiaNo ratings yet

- BPLSDocument41 pagesBPLSRonnie TambalNo ratings yet

- Income Tax Law & PracticeDocument60 pagesIncome Tax Law & Practicesebastianks94% (17)

- Lecture 4 - Export and Import TaxDocument27 pagesLecture 4 - Export and Import TaxHai Bui thiNo ratings yet

- Title Seven: Chapter Two Malfeasance and Misfeasance in OfficeDocument29 pagesTitle Seven: Chapter Two Malfeasance and Misfeasance in Officefrancis ian NaritNo ratings yet

- JHFJFDocument23 pagesJHFJFajay negiNo ratings yet

- Amendment 64 121712 TaskforceDocument14 pagesAmendment 64 121712 TaskforceSam LevinNo ratings yet

- Sneha ProjectDocument55 pagesSneha Projectabhipshadas55No ratings yet

- Basic Concepts of Income TaxDocument14 pagesBasic Concepts of Income TaxSaraf KushalNo ratings yet

- Tax Remedies (Reviewer)Document2 pagesTax Remedies (Reviewer)Equi TinNo ratings yet

- Essay 1Document6 pagesEssay 1Ludmila DorojanNo ratings yet