Professional Documents

Culture Documents

Chapter 11: The Cost of Capital Solutions To Problems

Chapter 11: The Cost of Capital Solutions To Problems

Uploaded by

jhoana_seseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 11: The Cost of Capital Solutions To Problems

Chapter 11: The Cost of Capital Solutions To Problems

Uploaded by

jhoana_seseCopyright:

Available Formats

Chapter 11: The Cost of Capital

Solutions to Problems

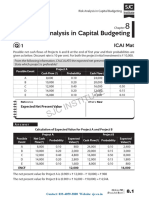

P11-17. LG 4, 5, 6: Integrative–WACC, WMCC, and IOS

Challenge

(a) Breaking Points and Ranges:

Source Cost Range of Breaking Range of Total

of Capital % New Financing Point New Financing

Long-term debt 6 $0$320,000 $320,000 0.40 $800,000 $0$800,000

8 $320,001 Greater than

and above $800,000

Preferred stock 17 $0 and above Greater than $0

Common stock 20 $0$200,000 $200,000 0.40 $500,000 $0$500,000

equity 24 $200,001 Greater than

and above $500,000

(b) WACC will change at $500,000 and $800,000.

(c) WACC

Source of Target Weighted Cost

Range of Total Capital Proportion Cost % (2) (3)

New Financing (1) (2) (3) (4)

$0$500,000 Debt 0.40 6 2.40%

Preferred 0.20 17 3.40%

Common 0.40 20 8.00%

WACC 13.80%

$500,000$800,000 Debt 0.40 6% 2.40%

Preferred 0.20 17% 3.40%

Common 0.40 24% 9.60%

WACC 15.40%

Greater than Debt 0.40 8% 3.20%

$800,000 Preferred 0.20 17% 3.40%

Common 0.40 24 9.60%

WACC 16.20%

(d) IOS Data for Graph

Initial Cumulative

Investment IRR Investment Investment

E 23% $200,000 $200,000

C 22 100,000 300,000

G 21 300,000 600,000

A 19 200,000 800,000

H 17 100,000 900,000

I 16 400,000 1,300,000

B 15 300,000 1,600,000

D 14 600,000 2,200,000

F 13 100,000 2,300,000

24

23 IOS and WMCC

22

21

20

Weighted Average 19

Cost of 18

Capital/Return (%) 17

16

15

14

13

12

0 300 600 900 1200 1500 1800 2100 2400 2700

Total New Financing or Investment (000)

(e) The firm should accept investments E, C, G, A, and H, since for each of these, the internal

rate of return (IRR) on the marginal investment exceeds the weighted marginal cost of capital

(WMCC). The next project (i.e., I) cannot be accepted since its return of 16% is below the

weighted marginal cost of the available funds of 16.2%.

You might also like

- AfarDocument128 pagesAfarlloyd77% (57)

- Mathematics A (4MA1) Paper 1H RMSDocument25 pagesMathematics A (4MA1) Paper 1H RMSsparkgalaxy085No ratings yet

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Chapter 11Document17 pagesChapter 11mark lee100% (1)

- Solution in Partnership Liquidation LumpsumDocument4 pagesSolution in Partnership Liquidation LumpsumNikki GarciaNo ratings yet

- Accounting - Week 2 - Syndicate 3 - CVP Excel DemoDocument3 pagesAccounting - Week 2 - Syndicate 3 - CVP Excel DemoKrishna Rai0% (1)

- Neurology - Anatomy Stuff UAWDocument329 pagesNeurology - Anatomy Stuff UAWNabeel Shahzad100% (1)

- Business Analyst ProjectDocument2 pagesBusiness Analyst ProjectMinh Phương NguyễnNo ratings yet

- 600 Case Problem 7.1 QSO 600Document3 pages600 Case Problem 7.1 QSO 600casey100% (1)

- Ambati Meharish - Classwork - 11 May 2021Document9 pagesAmbati Meharish - Classwork - 11 May 2021विशाल कुमारNo ratings yet

- Accounting For Special Transactions and Business CombinationsDocument3 pagesAccounting For Special Transactions and Business CombinationsJustine Reine CornicoNo ratings yet

- AE 315 Case Study 1 Curt Manufacturing Solution Support MJBTDocument4 pagesAE 315 Case Study 1 Curt Manufacturing Solution Support MJBTArly Kurt TorresNo ratings yet

- This Study Resource Was: Cash Out Lear Flows FlowsDocument7 pagesThis Study Resource Was: Cash Out Lear Flows FlowsLayNo ratings yet

- Advanced Accounting 1: Chapter 3 - Dissolution, Problem 5Document3 pagesAdvanced Accounting 1: Chapter 3 - Dissolution, Problem 5isay floresNo ratings yet

- Case StudyDocument5 pagesCase Studyphượng nguyễn thị minhNo ratings yet

- Retirement of PartnerDocument6 pagesRetirement of Partneradithyaravikumar2000No ratings yet

- Liverage Brigham Case SolutionDocument8 pagesLiverage Brigham Case SolutionShahid Mehmood100% (1)

- 95 AFAR Final Preboard SolutionsDocument10 pages95 AFAR Final Preboard Solutions20100723No ratings yet

- Topic 7 Capital Structure & Dividend ImputationDocument53 pagesTopic 7 Capital Structure & Dividend Imputationsir bookkeeperNo ratings yet

- Afar PDFDocument128 pagesAfar PDFMelyn Bustamante100% (1)

- Quiz Liquidation SolutionDocument8 pagesQuiz Liquidation SolutionGrace RoqueNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Bustax Very Easy Quiz1Document9 pagesBustax Very Easy Quiz1GianJoshuaDayritNo ratings yet

- Reviewer 47 PDF Free HelpfulDocument153 pagesReviewer 47 PDF Free HelpfulVon Rother Celoso DiazNo ratings yet

- Problem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Document6 pagesProblem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Vincent FrancoNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- Financial Management AssignmentDocument4 pagesFinancial Management AssignmentMoe ChannelNo ratings yet

- 10 Financial Leverage and Capital Structure Policy (Session 22, 23)Document22 pages10 Financial Leverage and Capital Structure Policy (Session 22, 23)creamellzNo ratings yet

- LE3 - Finance ModuleDocument5 pagesLE3 - Finance ModuleSafraz BacchusNo ratings yet

- Null 316 346Document13 pagesNull 316 346Samson JamesNo ratings yet

- SW# 3 CHAPTER 13 PROB 4 - GOZUNKAYE - XLSX - Sheet1Document8 pagesSW# 3 CHAPTER 13 PROB 4 - GOZUNKAYE - XLSX - Sheet1kaye gozunNo ratings yet

- Partnership Dissolution: National College of Business and ArtsDocument5 pagesPartnership Dissolution: National College of Business and ArtsKate Jezel SantoniaNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Eps Calculation and Value of FirmDocument5 pagesEps Calculation and Value of Firmrangamkumar99No ratings yet

- Chapter 1Document5 pagesChapter 1Anh Thu VuNo ratings yet

- AFAR Stock Aquisition GarrisonDocument16 pagesAFAR Stock Aquisition GarrisonjajajaredredNo ratings yet

- Isc Mock 2Document14 pagesIsc Mock 2anshikajain3474No ratings yet

- Quiz in Safe Payment and Cash Priority Program With Answer Keys Part 2Document4 pagesQuiz in Safe Payment and Cash Priority Program With Answer Keys Part 2caraaatbongNo ratings yet

- Description: Tags: 668appgDocument2 pagesDescription: Tags: 668appganon-829526No ratings yet

- CH 12 Excel (Students)Document9 pagesCH 12 Excel (Students)Daniela VelezNo ratings yet

- GEN4Document7 pagesGEN4Mylene HeragaNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationJessica C. Dela CruzNo ratings yet

- AnswerSheet SpecialTransactionDocument7 pagesAnswerSheet SpecialTransactionEs ToryahieeNo ratings yet

- Construction 2020-AnskeyDocument23 pagesConstruction 2020-AnskeyElvira AriolaNo ratings yet

- Total Assets Total Liabilities Net IncomeDocument3 pagesTotal Assets Total Liabilities Net IncomeAllen BabasaNo ratings yet

- Risk Analysis (Divya Jadi Booti)Document48 pagesRisk Analysis (Divya Jadi Booti)Michael AdhikariNo ratings yet

- EXERCISE 12-2 (15 Minutes)Document9 pagesEXERCISE 12-2 (15 Minutes)Mari Louis Noriell MejiaNo ratings yet

- Chapter 13 Prob 1,3,4Document6 pagesChapter 13 Prob 1,3,4geyb awayNo ratings yet

- 21PGDM089 SumanRoy Financial ManagementDocument4 pages21PGDM089 SumanRoy Financial ManagementTriparna PaulNo ratings yet

- Example: Compute EVA Abstract of The Revenue Statement Particulars Year 2016 2015Document3 pagesExample: Compute EVA Abstract of The Revenue Statement Particulars Year 2016 2015Muhammad Hamza HaroonNo ratings yet

- Aminul Islam 2016209690 EMB-660-Assignment-2Document35 pagesAminul Islam 2016209690 EMB-660-Assignment-2Aminul Islam 2016209690No ratings yet

- Capital StructureDocument13 pagesCapital Structureruchit guptaNo ratings yet

- Partnership Dissolution - 2Document27 pagesPartnership Dissolution - 2Trisha GarciaNo ratings yet

- 014 @ImTgLoki Profit & Loss Practice Sheet With Solution @TgLokiiDocument14 pages014 @ImTgLoki Profit & Loss Practice Sheet With Solution @TgLokiiRanjan RajNo ratings yet

- September 08 - Chapter 6-Capital Gains Taxation (Assignment)Document3 pagesSeptember 08 - Chapter 6-Capital Gains Taxation (Assignment)anitaNo ratings yet

- CSEC POA January 2018 P1Document10 pagesCSEC POA January 2018 P1Boppy VevoNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- IR400 Data SheetDocument2 pagesIR400 Data Sheetdarkchess76No ratings yet

- Manifesto of Yog-SothotheryDocument22 pagesManifesto of Yog-SothotheryHowlerNo ratings yet

- UserManual (EziSERVO PlusR) - Communication Function - Ver6 (Eng)Document124 pagesUserManual (EziSERVO PlusR) - Communication Function - Ver6 (Eng)Rorisvon AlmeidaNo ratings yet

- FC ReagentDocument17 pagesFC ReagentKommineni Gopi KrishnaNo ratings yet

- Sa2 3rd MathsDocument5 pagesSa2 3rd Mathsrunit waykarNo ratings yet

- Operation Guide 3437: About This ManualDocument5 pagesOperation Guide 3437: About This ManualRica TheSickNo ratings yet

- Lagrangian InterpolationDocument24 pagesLagrangian InterpolationManuel GarzaNo ratings yet

- GL 117Document14 pagesGL 117Luiz CarlosNo ratings yet

- HighPurity H2 PDFDocument5 pagesHighPurity H2 PDFpearlcityrjtNo ratings yet

- Low Voltage Switchgears in Wind Turbines COMLVP75 EN (Web)Document12 pagesLow Voltage Switchgears in Wind Turbines COMLVP75 EN (Web)somae AbbasNo ratings yet

- Contact: ULVAC, IncDocument8 pagesContact: ULVAC, Inc黄爱明No ratings yet

- 1819 G-L Final Timetable T2 (Manama) UpdatedDocument2 pages1819 G-L Final Timetable T2 (Manama) Updatedelena123456elena123456No ratings yet

- Experiment No. 1 - Strain GaugesDocument7 pagesExperiment No. 1 - Strain GaugesA_saravanavelNo ratings yet

- Almanac Data For IRNSSDocument2 pagesAlmanac Data For IRNSSBaka NuduNo ratings yet

- Project STA108Document25 pagesProject STA108meliszaNo ratings yet

- Project On The Design of An Inertial Measurement Unit To Be Used in Aerospace VehiclesDocument96 pagesProject On The Design of An Inertial Measurement Unit To Be Used in Aerospace VehiclesmiguelNo ratings yet

- Short Travel Keyboards: TKS-088a-TB38-MODULDocument2 pagesShort Travel Keyboards: TKS-088a-TB38-MODULboba78No ratings yet

- Anatomy and Physiology Questions For UnderstandingDocument6 pagesAnatomy and Physiology Questions For UnderstandingChikaNo ratings yet

- LVL Hip Rafter DesignDocument5 pagesLVL Hip Rafter DesignDavid Shanks 1No ratings yet

- Nitrogen Gas Charging InstructionsDocument5 pagesNitrogen Gas Charging InstructionsnelsonyNo ratings yet

- Activity No.1 Setting Up and Programming ControllersDocument13 pagesActivity No.1 Setting Up and Programming ControllersRUEL ALEJANDRONo ratings yet

- Inverter FR-HC2 Instruction ManualDocument203 pagesInverter FR-HC2 Instruction ManualErnesto JimenezNo ratings yet

- Module 1: Routing Concepts: Switching, Routing, and Wireless Essentials v7.0 (SRWE)Document26 pagesModule 1: Routing Concepts: Switching, Routing, and Wireless Essentials v7.0 (SRWE)Richard CheccaNo ratings yet

- Birch-Murnaghan Equation of State Slab in RDocument2 pagesBirch-Murnaghan Equation of State Slab in RRicardo García CárcamoNo ratings yet

- SequencesDocument16 pagesSequencesAnjali BodaniNo ratings yet

- Generator & AuxDocument27 pagesGenerator & AuxK R Kumar RanjanNo ratings yet