Professional Documents

Culture Documents

GAAP Diff

GAAP Diff

Uploaded by

Sapna Sisodia0 ratings0% found this document useful (0 votes)

11 views1 pageIndian GAAP and US GAAP differ in several key ways:

1. Indian GAAP requires conservatism and anticipating losses, while US GAAP does not if it leads to understatements.

2. Financial statements formats differ, with Indian GAAP requiring a specific format and US GAAP requiring only SEC disclosure compliance.

3. Cash flow statements are mandatory only for certain companies under Indian GAAP but are mandatory for all entities under US GAAP.

Original Description:

Original Title

GAAP diff

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIndian GAAP and US GAAP differ in several key ways:

1. Indian GAAP requires conservatism and anticipating losses, while US GAAP does not if it leads to understatements.

2. Financial statements formats differ, with Indian GAAP requiring a specific format and US GAAP requiring only SEC disclosure compliance.

3. Cash flow statements are mandatory only for certain companies under Indian GAAP but are mandatory for all entities under US GAAP.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views1 pageGAAP Diff

GAAP Diff

Uploaded by

Sapna SisodiaIndian GAAP and US GAAP differ in several key ways:

1. Indian GAAP requires conservatism and anticipating losses, while US GAAP does not if it leads to understatements.

2. Financial statements formats differ, with Indian GAAP requiring a specific format and US GAAP requiring only SEC disclosure compliance.

3. Cash flow statements are mandatory only for certain companies under Indian GAAP but are mandatory for all entities under US GAAP.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

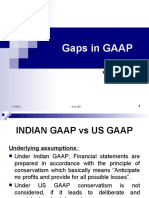

Comparison between Indian GAAP and US GAAP

Indian GAAP US GAAP

Under Indian GAAP, Financial

statements are prepared in

Under US GAAP conservatism is not

1.Underlying accordance with the principle of

considered, if it leads to deliberate and

assumptions: conservatism which basically

consistent understatements

means “Anticipate no profits and

provide for all possible losses”.

Financial statements prepared as per

Under Indian GAAP, financial US GAAP are not required to be

2.Presentation of statements are prepared in prepared under any specific format as

financial accordance with the presentation long as they comply with the

statements requirements of Schedule VI to disclosure requirements of US SEC

the Companies Act, 1956. (Securities and Exchange Commission)

and US GAAP.

Mandatory only for listed

3. Cash flow companies and companies

Mandatory for all entities.

Statement meeting certain turnover

conditions.

Under US GAAP, Goodwill and

intangible assets that have indefinite

Under the Indian GAAP

useful lives are not amortized ,but they

goodwill is capitalized and

4. Goodwill: are tested at least annually for

charged to earnings over 5 to 10

impairment using a process that begins

years period.

with an estimation of the fair value of a

reporting unit.

Under Indian GAAP , there is no

such requirement and hence the Under US GAAP , the current portion

5. Long term

interest accrued on such long of long term debt is classified as

Debts:

term debt in not taken as current current liability

liability

Under Indian GAAP, provision

Under US GAAP, provision for leave

for leave encashment is

encashment is accounted on actual

accounted based n actuarial

6.Employee basis. Compensation towards

valuation. Compensation to

benefits: voluntary retirement scheme is to be

employees who opt for voluntary

charged in the year in which the

retirement scheme can be

employees accept the offer.

amortized over 60 months.

Under the Indian GAAP,

US GAAP , depreciation has to be

depreciation is provided based

7.Depreciation: provided over the estimated useful life

on rates prescribed by the

of the asset,

Companies Act, 1956.

You might also like

- Case Study of IKEADocument2 pagesCase Study of IKEAEhtusham100% (1)

- Environmental Factors Affecting Entrepreneurial DevelopmentDocument30 pagesEnvironmental Factors Affecting Entrepreneurial DevelopmentFaraz Ali55% (11)

- PAS 1 Presentation of Financial StatementsDocument4 pagesPAS 1 Presentation of Financial StatementsLary Lou Ventura100% (15)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Circular Flow Model WorksheetDocument2 pagesCircular Flow Model Worksheetapi-320972635No ratings yet

- ERP Implementation at NestleDocument6 pagesERP Implementation at NestleKumar SaurabhNo ratings yet

- Impact of Fiscal Policy On Indian EconomyDocument24 pagesImpact of Fiscal Policy On Indian EconomyAzhar Shokin75% (8)

- Difference Between Indian Gaap and Us GaapDocument2 pagesDifference Between Indian Gaap and Us Gaapdeepakarora201188No ratings yet

- Basis of Differences USGAAP - Indian GAAPDocument2 pagesBasis of Differences USGAAP - Indian GAAPIlavarasan PrinceNo ratings yet

- Gaps in GAAPDocument9 pagesGaps in GAAPaathi sivakumarNo ratings yet

- GAAP (India V/s US)Document17 pagesGAAP (India V/s US)rochu88No ratings yet

- Differences Between US GAAP and Indian GAAPDocument8 pagesDifferences Between US GAAP and Indian GAAPViveka SanghviNo ratings yet

- Overview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPDocument16 pagesOverview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPreenuramanNo ratings yet

- Final Presentation IfrsDocument10 pagesFinal Presentation IfrsPankajNo ratings yet

- IFRS Assignment 4Document3 pagesIFRS Assignment 4Sandeep BodduNo ratings yet

- Afm 1Document20 pagesAfm 1antrikshaagrawalNo ratings yet

- Ifrs vs. Indian GaapDocument4 pagesIfrs vs. Indian GaapPankaj100% (1)

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAPDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAPishakc20070% (1)

- National Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPDocument10 pagesNational Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPEshetieNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSrajdeeppawarNo ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting StandardsDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting Standardsjoy26iNo ratings yet

- Samester - 1 SET - 1 & 2 Subject Code: MB0041 Subject Financial Management & AccountingDocument37 pagesSamester - 1 SET - 1 & 2 Subject Code: MB0041 Subject Financial Management & AccountingajaykumartiwariNo ratings yet

- IFRS - A Comparison With Indian Generally Accepted Accounting PrinciplesDocument47 pagesIFRS - A Comparison With Indian Generally Accepted Accounting PrinciplesEshetieNo ratings yet

- Gaap vs. IfrsDocument5 pagesGaap vs. Ifrsمحاسب.أحمد شعبانNo ratings yet

- 28 Diff Bet Usgaap Igaap IfrsDocument7 pages28 Diff Bet Usgaap Igaap IfrsRohit BeniwalNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSfenildivyaNo ratings yet

- Final DT 100 Important Questions Final Audit Practice Questions Financial Reporting Conceptual NotesDocument14 pagesFinal DT 100 Important Questions Final Audit Practice Questions Financial Reporting Conceptual NotesDheeraj TurpunatiNo ratings yet

- Differences Between US GAAP, Indian GAAP and International Accounting StandardsDocument7 pagesDifferences Between US GAAP, Indian GAAP and International Accounting StandardsAmitesh PandeyNo ratings yet

- The Five Financial Statements (FS)Document8 pagesThe Five Financial Statements (FS)Marlyn LotivioNo ratings yet

- CMA - IFRS Versus GAAPDocument10 pagesCMA - IFRS Versus GAAPGladys QuimpoNo ratings yet

- U.S. GAAP vs. IFRS: Business Combinations: Prepared byDocument5 pagesU.S. GAAP vs. IFRS: Business Combinations: Prepared bygabiNo ratings yet

- Shareholder Value & Global Reporting. Reconciliation of Indian GAAP Financial Statements With US/International GAAPSDocument15 pagesShareholder Value & Global Reporting. Reconciliation of Indian GAAP Financial Statements With US/International GAAPSvdforeNo ratings yet

- Subject Ifrs Us Gaap Indian Accounting StandardsDocument5 pagesSubject Ifrs Us Gaap Indian Accounting Standardslakshya khandelwalNo ratings yet

- Differences Between US GAAP, Indian GAAP and IFRSDocument7 pagesDifferences Between US GAAP, Indian GAAP and IFRSRendy MokogintaNo ratings yet

- Introduction To IFRSDocument33 pagesIntroduction To IFRSmikirichaNo ratings yet

- 29 Session1 Indasgym SPK2Document23 pages29 Session1 Indasgym SPK2AMIRKHAN BUDESABNo ratings yet

- AFAR-22 (Full PFRS vs. PFRS for SMEs)Document2 pagesAFAR-22 (Full PFRS vs. PFRS for SMEs)Ide VelcoNo ratings yet

- ASB Nepal - Decision On Carve Outs On NFRSDocument5 pagesASB Nepal - Decision On Carve Outs On NFRSNirmal ThapaNo ratings yet

- Gaap Vs IfrsDocument12 pagesGaap Vs IfrsAnonymous Q3J7APoNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSMichael HillNo ratings yet

- Far0 ReviewerDocument5 pagesFar0 ReviewerAshianna KimNo ratings yet

- 10 Ifrs 5Document6 pages10 Ifrs 5Nafiul IslamNo ratings yet

- Final AccountsDocument10 pagesFinal AccountsBhartiya PandeyNo ratings yet

- GN Draft Exposure Capital ReserveDocument8 pagesGN Draft Exposure Capital ReserveMURALI jNo ratings yet

- International Financial Accounting Standards (IFRS)Document5 pagesInternational Financial Accounting Standards (IFRS)reetutrNo ratings yet

- Chamber's Journal January 06 PDFDocument6 pagesChamber's Journal January 06 PDFManisha SinghNo ratings yet

- Financial InstrumentsDocument1 pageFinancial Instrumentsarmor.coverNo ratings yet

- Compendium of New Standards Issued by The IASB - IfRS 15,9, 16Document14 pagesCompendium of New Standards Issued by The IASB - IfRS 15,9, 16Adegbite Olusegun JamesNo ratings yet

- Compendium of New Standards Issued by The IASB (IFRS 15,9 & 16)Document13 pagesCompendium of New Standards Issued by The IASB (IFRS 15,9 & 16)Adegbite Olusegun JamesNo ratings yet

- Auditing in Specialized Industries (Notes)Document10 pagesAuditing in Specialized Industries (Notes)Jene LmNo ratings yet

- 1 - Financial AccountingDocument92 pages1 - Financial Accountingajbebera1999No ratings yet

- IAS Ch02Document19 pagesIAS Ch02d.pagkatoytoyNo ratings yet

- IFRS 9 Financial InstrumentsDocument29 pagesIFRS 9 Financial InstrumentsPrincess Corine BurgosNo ratings yet

- 1.1 PAS 1 Chapter 2 Summary (SFP)Document2 pages1.1 PAS 1 Chapter 2 Summary (SFP)Deviane CalabriaNo ratings yet

- Analysis of Financial Statements: International Financial Reporting StandardsDocument22 pagesAnalysis of Financial Statements: International Financial Reporting Standardsvvs176975No ratings yet

- Auditing in Specialized Industries CompressDocument10 pagesAuditing in Specialized Industries CompressLea Fe Sobrera GuillermoNo ratings yet

- Shiwan IDocument3 pagesShiwan IAmit PrabhuNo ratings yet

- 1.formatted Notes - NewestDocument2 pages1.formatted Notes - Newestaarti bhangadiyaNo ratings yet

- PFRS 12 MergedDocument45 pagesPFRS 12 MergedRojie Ann AmorNo ratings yet

- International Financial Reporting Standards: Part IIDocument38 pagesInternational Financial Reporting Standards: Part IIJuliaMaiLeNo ratings yet

- Guide Sheet: Generally Accepted Accounting Principles (GAAP)Document2 pagesGuide Sheet: Generally Accepted Accounting Principles (GAAP)CARLOS DELIGERO III (Caloy)No ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- Smart: Sensex - 20000 & Nifty - 6000 ConqueredDocument12 pagesSmart: Sensex - 20000 & Nifty - 6000 ConqueredSai VaasavNo ratings yet

- Ap12-Ev04 - Ingles - "Politicas Ambiente Laboral"Document8 pagesAp12-Ev04 - Ingles - "Politicas Ambiente Laboral"Cindy Tatiana Gaviria RiosNo ratings yet

- AMEX - Glossary (ENG-SPA) - 1686735355Document8 pagesAMEX - Glossary (ENG-SPA) - 1686735355RAUL RAMIREZNo ratings yet

- Module 4 - Commodities Derivatives TradingDocument71 pagesModule 4 - Commodities Derivatives TradingLMT indiaNo ratings yet

- Balance Sheet Britannia Industries LTD (BRIT IN) - StandardizedDocument12 pagesBalance Sheet Britannia Industries LTD (BRIT IN) - Standardizedarchit sahayNo ratings yet

- PF PFi Terms and ConditionsDocument20 pagesPF PFi Terms and ConditionsAzeizulNo ratings yet

- Conclusion of Any Banking Thesis ReportDocument3 pagesConclusion of Any Banking Thesis ReportAnwarHossainNo ratings yet

- IBFT - Member Bank Account Number FormatDocument1 pageIBFT - Member Bank Account Number FormatSyed Shah Jehan GillaniNo ratings yet

- Tailoring UnitDocument8 pagesTailoring UnitSuresh sureshNo ratings yet

- Dubai Silicon Oasis Authority Signs Agreement With International Free Zone AuthoDocument4 pagesDubai Silicon Oasis Authority Signs Agreement With International Free Zone AuthoKommu RohithNo ratings yet

- Samara University College of Business and Economics: Department of Management EntrepreneurshipDocument54 pagesSamara University College of Business and Economics: Department of Management Entrepreneurshipfentaw melkie100% (1)

- Macro Essential QuestionsDocument3 pagesMacro Essential QuestionsChinmay PanhaleNo ratings yet

- Market SegmentationDocument54 pagesMarket SegmentationLagnajit Ayaskant Sahoo100% (2)

- The Nogo RailroadDocument8 pagesThe Nogo RailroadMarilou GabayaNo ratings yet

- Hyundai Motor India ParkDocument30 pagesHyundai Motor India ParkMir HassanNo ratings yet

- HSBC Global Emerging Markets EM Banks JPDocument166 pagesHSBC Global Emerging Markets EM Banks JPdouglas_ferrisNo ratings yet

- CB Abacus vs. Manila BankDocument2 pagesCB Abacus vs. Manila BankClarissa Beth DegamoNo ratings yet

- Canadian National Railway Company (SAP Business Transformation Study)Document16 pagesCanadian National Railway Company (SAP Business Transformation Study)Abhishek ThakurNo ratings yet

- Literature Review On Economic CrisisDocument7 pagesLiterature Review On Economic Crisisequnruwgf100% (1)

- BE Report Group members: Hồ Xuân Phát, Trần Minh Quân, Đỗ Hoàng Nam, Nguyễn Hùng Sơn, Bùi Thanh Uyên 1) IntroductionDocument3 pagesBE Report Group members: Hồ Xuân Phát, Trần Minh Quân, Đỗ Hoàng Nam, Nguyễn Hùng Sơn, Bùi Thanh Uyên 1) IntroductionHồ Xuân PhátNo ratings yet

- Efficiency: in The WorkplaceDocument16 pagesEfficiency: in The WorkplaceceojiNo ratings yet

- Talent Management AnalyticsDocument8 pagesTalent Management AnalyticsAshutoshNo ratings yet

- 2-Stress-Test Your Strategy The 7 Questions To AskDocument9 pages2-Stress-Test Your Strategy The 7 Questions To AskMalaika KhanNo ratings yet

- LK Spto 2018 - Q4Document104 pagesLK Spto 2018 - Q4siput_lembekNo ratings yet

- OM27 Sesions1-4Document39 pagesOM27 Sesions1-4Sai KNo ratings yet