Professional Documents

Culture Documents

Blackstone - Performance Report

Blackstone - Performance Report

Uploaded by

Bay Area Equity Group, LLCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blackstone - Performance Report

Blackstone - Performance Report

Uploaded by

Bay Area Equity Group, LLCCopyright:

Available Formats

First-Year Performance Projection

19701 Blackstone

View Map View Comps Export to Excel

Detroit, MI 48219

3-bedroom 2-bath

Square Feet 1,100

Purchase Price $28,995

Initial Market Value $28,995

Downpayment $28,995

Loan Origination Fees $0

Depreciable Closing Costs $1,500

Other Closing Costs and Fixup $0

Initial Cash Invested $30,495

Cost per Square Foot $26

Monthly Rent per Square Foot $0.64

Income Monthly Annual Mortgage Info First Second

Gross Rent $700 $8,400 Loan-to-Value Ratio 0% 0%

Vacancy Losses $0 $0 Loan Amount --- ---

Operating Income $700 $8,400 Monthly Payment --- ---

Loan Type --- ---

Expenses Monthly Annual Term --- ---

Property Taxes ($111) ($1,335) Interest Rate --- ---

Insurance ($50) ($600) Monthly PMI ---

Management Fees ($70) ($840)

Leasing/Advertising Fees $0 $0 Financial Indicators

Association Fees $0 $0 Debt Coverage Ratio N/A

Maintenance $0 $0 Annual Gross Rent Multiplier 3

Other $0 $0 Monthly Gross Rent Multiplier 41

Operating Expenses ($231) ($2,775) Capitalization Rate 19.4%

Cash on Cash Return 18%

Net Performance Monthly Annual Total Return on Investment 18%

Net Operating Income $469 $5,625 Total ROI with Tax Savings 18%

- Mortgage Payments $0 $0

= Cash Flow $469 $5,625 Assumptions

+ Principal Reduction $0 $0 Real Estate Appreciation Rate %

+ First-Year Appreciation $0 $0 Vacancy Rate %

= Gross Equity Income $469 $5,625 Management Fee 10%

+ Tax Savings $0 $0 Maintenance Percentage %

= GEI w/Tax Savings $469 $5,625 Equity Share Percentage 100%

© 2004-2011 PropertyTracker.com Terms of Service Privacy Policy

www.bayareaequitygroup.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pre-Commissioning & Commissioning For ETPDocument28 pagesPre-Commissioning & Commissioning For ETPprasad reddy100% (2)

- Nebosh Igc 2Document27 pagesNebosh Igc 2narendra16118890% (40)

- Hydraulic Axial Piston Eaton Vickers PVB Pump: - Basic CharacteristicsDocument13 pagesHydraulic Axial Piston Eaton Vickers PVB Pump: - Basic Characteristicsjose alberto olvera gomezNo ratings yet

- Speed NetworkingDocument2 pagesSpeed NetworkingBay Area Equity Group, LLCNo ratings yet

- 7803 Stahelin - Performance ReportDocument1 page7803 Stahelin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 7242 Montrose - Performance ReportDocument1 page7242 Montrose - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9941 Mansfield - Performance ReportDocument1 page9941 Mansfield - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9926 Archdale ST - Performance ReportDocument1 page9926 Archdale ST - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 6693 Baldwin - Performance ReportDocument1 page6693 Baldwin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Joann - Performance ReportDocument1 pageJoann - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 9926 Archdale - Performance ReportDocument1 page9926 Archdale - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Ellsworth - Performance ReportDocument1 pageEllsworth - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Rutland - Performance ReportDocument1 pageRutland - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 6100 Greenview - Performance ReportDocument1 page6100 Greenview - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Maddelein - Performance ReportDocument1 pageMaddelein - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 5790 Guilford - Performance ReportDocument1 page5790 Guilford - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Phason FHC1D User ManualDocument16 pagesPhason FHC1D User Manuale-ComfortUSANo ratings yet

- Fiberdyne G.652.D Single Mode Fiber SpecificationsDocument1 pageFiberdyne G.652.D Single Mode Fiber SpecificationsjunedNo ratings yet

- Electrical and Electronic Troubleshooting For Industrial EnginesDocument25 pagesElectrical and Electronic Troubleshooting For Industrial EnginespanddyanNo ratings yet

- Microbiology 101: Laboratory Exercise #22: Carbohydrate MetabolismDocument16 pagesMicrobiology 101: Laboratory Exercise #22: Carbohydrate Metabolismmaraki998No ratings yet

- Discard ManagementDocument9 pagesDiscard ManagementDevvrath SinghNo ratings yet

- S100X220YAJ Panduit Datasheet 5314981Document2 pagesS100X220YAJ Panduit Datasheet 5314981Ilham MaurizaNo ratings yet

- Manual de Mantenimieno Cilindros Redondos Series MMB - HY07 - 1215 - M2 - UKDocument8 pagesManual de Mantenimieno Cilindros Redondos Series MMB - HY07 - 1215 - M2 - UKMiguel Angel LopezNo ratings yet

- VBIED Attack July 31, 2007Document1 pageVBIED Attack July 31, 2007Rhonda NoldeNo ratings yet

- Workload ManagementDocument25 pagesWorkload Managementdex adecNo ratings yet

- Case Study On A Highway Project: Environmental Impact AssesmentDocument10 pagesCase Study On A Highway Project: Environmental Impact AssesmentSRUTHI FRANCIS M.Tech Environmental Engineering 2020-2022No ratings yet

- Inorganic Chemistry HomeworkDocument3 pagesInorganic Chemistry HomeworkAlpNo ratings yet

- Benzene - It'S Characteristics and Safety in Handling, Storing & TransportationDocument6 pagesBenzene - It'S Characteristics and Safety in Handling, Storing & TransportationEhab SaadNo ratings yet

- Bossing Nicole PDFDocument47 pagesBossing Nicole PDFMark CastilloNo ratings yet

- Proforma A1: Residential/Domicile CertificateDocument6 pagesProforma A1: Residential/Domicile CertificateSamim ParvezNo ratings yet

- CM07 Sphere ConstructionDocument146 pagesCM07 Sphere ConstructionHuy Thieu Bui100% (1)

- Compact Evaporators: New Buffalo Trident GaccDocument16 pagesCompact Evaporators: New Buffalo Trident GaccPreeti gulatiNo ratings yet

- ..Document11 pages..Rizka Nur FadhilahNo ratings yet

- Seed Extraction MethodsDocument3 pagesSeed Extraction MethodsPreetam NayakNo ratings yet

- Promotion Letter ShwetaDocument2 pagesPromotion Letter ShwetayogeshNo ratings yet

- Lock Out Tag Out: Review QuestionsDocument37 pagesLock Out Tag Out: Review QuestionsMansoor AliNo ratings yet

- Weekly Report ExampleDocument3 pagesWeekly Report Examplewawan setiawanNo ratings yet

- Emotional IntelligenceDocument43 pagesEmotional IntelligenceMelody ShekharNo ratings yet

- CHINT Installation Operation Manual For Inverter of 50-60KTLDocument98 pagesCHINT Installation Operation Manual For Inverter of 50-60KTLr.pimentel.souzaNo ratings yet

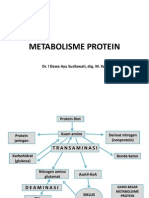

- Metabolisme Protein: Dr. I Dewa Ayu Susilawati, Drg. M. KesDocument31 pagesMetabolisme Protein: Dr. I Dewa Ayu Susilawati, Drg. M. KesMelisa Novitasari100% (2)

- MCN KweenDocument4 pagesMCN KweenAngelo SigueNo ratings yet

- Soil Acidity and LimingDocument12 pagesSoil Acidity and LimingEloi Carlos GoveNo ratings yet