Professional Documents

Culture Documents

Fault Lines - A Summary

Fault Lines - A Summary

Uploaded by

shipra_mahajanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fault Lines - A Summary

Fault Lines - A Summary

Uploaded by

shipra_mahajanCopyright:

Available Formats

Fault lines – How hidden fractures still threaten the world economy

In 2005, a man was roundly scoffed at by a group of luminaries who had gathered to celebrate Alan

Greenspan’s legacy. His crime? In those heydays of financial prosperity, he claimed that the world was

headed for financial disaster. As it turned out two years later, he was right. This man was none other

than Raghuram Rajan, the current economic advisor to the Prime Minister of India.

Through his latest book ‘Fault Lines’, Raghuram Rajan argues that the roots of the calamity can be traced

back to three sets of fault lines. The first set of fault lines stems from domestic political pressures,

especially in the United States. Under this, the author talks about the rising income inequality in the

United States. The rising inequality combined with poor safety net creates pressures on politicians.

However, instead of improving the competitiveness of labor force, the government has chosen the

easier option of enabling credit to sub-prime borrowers. So, the first set of fault lines leads to easy credit

to fuel consumption. The second set of fault lines emanates from trade imbalances between countries.

Here the author focuses on trade surplus countries, such as Germany, Japan and China. These countries

rely on exports for growth and so are excessively dependent on the foreign consumer. Now this excess

supply is absorbed by the borrowers in US, UK and Greece which results in a bubble. The indebtedness

grows to the point where these countries cannot afford any further spending and the bubble bursts. The

third and final set of fault lines develops when different types of financial systems come into contact to

finance these trade imbalances. In this case the foreign investors into US implicitly assumed that the US

government would back the mortgage agencies like Fannie Mae and Freddie Mac. Consequently, the

funds from the foreign private sector flowed into the highly rated mortgage-backed securities. Finally,

you bring these three dots together and this is how the story goes - United States is politically

predisposed towards stimulating consumption, the surplus countries depend on foreign consumption

for growth and finally, investors from developing countries finance sub-prime mortgages. So,

consumption in US increases till it is no longer affordable. The bubble bursts and crisis precipitates.

To summarize, the book traces the crisis to three sets of fault lines – domestic political pressures, trade

imbalances and incompatible financial systems. At the end of it all, you might not agree with every single

point that the book makes but the book will definitely make you think and question your biases against

particular countries.

You might also like

- Chapter 9 TestbankDocument34 pagesChapter 9 Testbankvx8550_373384312100% (5)

- Our Government Has Run Out of MoneyDocument10 pagesOur Government Has Run Out of MoneykakeroteNo ratings yet

- America CLDocument11 pagesAmerica CLkakeroteNo ratings yet

- Summary On Bloomberg Business Week MagazineDocument5 pagesSummary On Bloomberg Business Week MagazineAbhishek RaneNo ratings yet

- Martin Wolf ColumnDocument6 pagesMartin Wolf Columnpriyam_22No ratings yet

- America AlDocument12 pagesAmerica AlkakeroteNo ratings yet

- The Debt Bomb: Arron S OverDocument7 pagesThe Debt Bomb: Arron S Overrtibbits1234No ratings yet

- Government Austerity Measures Next StepDocument10 pagesGovernment Austerity Measures Next StepkakeroteNo ratings yet

- America in PerilDocument12 pagesAmerica in PerilkakeroteNo ratings yet

- US Debt Ceiling Battle - 1Document4 pagesUS Debt Ceiling Battle - 1Spencer1234556789No ratings yet

- Our Government Has Run Out of MoneyDocument10 pagesOur Government Has Run Out of MoneykakeroteNo ratings yet

- Government Austerity Measures Next StepDocument9 pagesGovernment Austerity Measures Next StepkakeroteNo ratings yet

- The U.S. Economic Crisis: Causes and Solutions: by Fred MoseleyDocument3 pagesThe U.S. Economic Crisis: Causes and Solutions: by Fred MoseleySirbu CatalinNo ratings yet

- The Economist - Finacial CrisisDocument4 pagesThe Economist - Finacial CrisisEnzo PitonNo ratings yet

- CFR Insiders Confirm That An Alarming Economic Crisis in The US Is ImminentDocument12 pagesCFR Insiders Confirm That An Alarming Economic Crisis in The US Is ImminentJeremy JamesNo ratings yet

- Government Austerity Measures Next StepDocument10 pagesGovernment Austerity Measures Next StepkakeroteNo ratings yet

- Another Financial Meltdown Is Closer Than It Appears.: Source: FREDDocument14 pagesAnother Financial Meltdown Is Closer Than It Appears.: Source: FREDVidit HarsulkarNo ratings yet

- Running on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItFrom EverandRunning on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItRating: 3.5 out of 5 stars3.5/5 (22)

- CLA2 - $20 Trillion An Indebted StoryDocument8 pagesCLA2 - $20 Trillion An Indebted StoryRobertRaisbeckNo ratings yet

- The Truth About Trade: What Critics Get Wrong About The Global EconomyDocument8 pagesThe Truth About Trade: What Critics Get Wrong About The Global EconomyMirjamNo ratings yet

- Fault Lines SummaryDocument6 pagesFault Lines SummaryEdward Essau FyittaNo ratings yet

- Textos Desafios InglesDocument20 pagesTextos Desafios InglesVanderson Souza PinhoNo ratings yet

- MARKETS CRISIS EURO US Will The U.S. and Europe Rise Again - or Sink Together - Wharton Oct 2011 2866Document3 pagesMARKETS CRISIS EURO US Will The U.S. and Europe Rise Again - or Sink Together - Wharton Oct 2011 2866Julie OneillNo ratings yet

- International Finance: Trade Deficits: Bad or Good?Document12 pagesInternational Finance: Trade Deficits: Bad or Good?Yuri Walter AkiateNo ratings yet

- CA Newsletter July 28 To 03 AugDocument15 pagesCA Newsletter July 28 To 03 AugAshish DeshpandeNo ratings yet

- Who Owns The Pbublic DebtDocument4 pagesWho Owns The Pbublic DebtEhud No-bloombergNo ratings yet

- History in The Making: Lessons and Legacies of The Financial CrisisDocument11 pagesHistory in The Making: Lessons and Legacies of The Financial Crisissouravkiller4uNo ratings yet

- Aydin Free Market Madness and Human Nature FINAL June 25Document25 pagesAydin Free Market Madness and Human Nature FINAL June 25Kind MidoNo ratings yet

- Never Accept Economic Truths Merely Because Somebody Said SoDocument3 pagesNever Accept Economic Truths Merely Because Somebody Said SoARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanNo ratings yet

- Keynesian Economics Doesn't WorkDocument9 pagesKeynesian Economics Doesn't WorkkakeroteNo ratings yet

- Trinity 2012Document23 pagesTrinity 2012Ling JiaNo ratings yet

- United States Debt CrisisDocument2 pagesUnited States Debt CrisisSatish SonawaleNo ratings yet

- ME Repot RahulDocument13 pagesME Repot RahulAshfak ShaikhNo ratings yet

- 01-15-09 Nation-The Crisis Is Global by William GreiderDocument2 pages01-15-09 Nation-The Crisis Is Global by William GreiderMark WelkieNo ratings yet

- A Baffling Global EconomyDocument8 pagesA Baffling Global EconomyEdgar Cherubini LecunaNo ratings yet

- Crisis Financiera UsaDocument10 pagesCrisis Financiera UsaRox BenaducciNo ratings yet

- Daily Tel ObamaDocument4 pagesDaily Tel ObamaDonato PaglionicoNo ratings yet

- A Spectre Is Rising. To Bury It Again, Barack Obama Needs To Take The LeadDocument5 pagesA Spectre Is Rising. To Bury It Again, Barack Obama Needs To Take The Leadirfan shafiqueNo ratings yet

- Spill-Over Effects of Mortgage Credit Crisis in USA On EuropeDocument15 pagesSpill-Over Effects of Mortgage Credit Crisis in USA On EuropeUsman SansiNo ratings yet

- The Future of The US DollarDocument10 pagesThe Future of The US Dollar11duongso9No ratings yet

- Economics ProjectDocument34 pagesEconomics ProjectNagin RajNo ratings yet

- Donald's DefaultDocument12 pagesDonald's DefaultCenter for American ProgressNo ratings yet

- National Debt ThesisDocument6 pagesNational Debt Thesisbrandygranttallahassee100% (2)

- Rising Inequality As A Cause of The Present CrisisDocument24 pagesRising Inequality As A Cause of The Present CrisisRobert McKeeNo ratings yet

- SubmittedeconpaperDocument7 pagesSubmittedeconpaperapi-207294683No ratings yet

- Red Flag. 2001.06. 2Document2 pagesRed Flag. 2001.06. 2Hazar YükselNo ratings yet

- Final ExamDocument4 pagesFinal ExamLeticia ScheinkmanNo ratings yet

- No Tranquility - Iturbe, MassaDocument3 pagesNo Tranquility - Iturbe, MassaooofireballoooNo ratings yet

- Remembering The Global Financial CrisisDocument2 pagesRemembering The Global Financial Crisisandreeagabriela0910No ratings yet

- Keynesian Economics Doesn't WorkDocument8 pagesKeynesian Economics Doesn't WorkkakeroteNo ratings yet

- Capitalism After The Crisis: Luigi ZingalesDocument14 pagesCapitalism After The Crisis: Luigi ZingalesrzbassoNo ratings yet

- Four Nations Four LessonsDocument3 pagesFour Nations Four Lessonsnaveen261084No ratings yet

- Why Rigged Capitalism Is Damaging Liberal DemocracyDocument11 pagesWhy Rigged Capitalism Is Damaging Liberal DemocracyLuanaBessaNo ratings yet

- 3qep1 PDFDocument7 pages3qep1 PDFAadi AnandNo ratings yet

- Bad History, Worse Policy: How a False Narrative about the Financial Crisis led to the Dodd-Frank ActFrom EverandBad History, Worse Policy: How a False Narrative about the Financial Crisis led to the Dodd-Frank ActNo ratings yet

- 21st Century Global EconomicsDocument9 pages21st Century Global EconomicsMary M HuberNo ratings yet

- MBA Final Year ReportDocument9 pagesMBA Final Year ReportmmddugkyfinanceNo ratings yet

- Lucies Farm Data Protection ComplaintDocument186 pagesLucies Farm Data Protection ComplaintcraigwalshNo ratings yet

- Chapter 4 - Group 3 - Behavioral Processes in Marketing ChannelsDocument26 pagesChapter 4 - Group 3 - Behavioral Processes in Marketing ChannelsJanine Mariel LedesmaNo ratings yet

- Nec 2018Document33 pagesNec 2018Abraham AnaelyNo ratings yet

- User Manual 13398Document44 pagesUser Manual 13398Diy DoeNo ratings yet

- Caro PresentationDocument33 pagesCaro PresentationVIJAY GARGNo ratings yet

- Hots Advance MiraeDocument36 pagesHots Advance MiraeHabibie BoilerNo ratings yet

- Max WeberDocument11 pagesMax WeberPKBM AL MUTHINo ratings yet

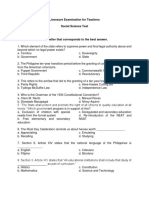

- Licensure Examination For TeachersDocument14 pagesLicensure Examination For Teachersonin saspaNo ratings yet

- Intelligence Test: Three YearsDocument4 pagesIntelligence Test: Three YearsAnshuman TewaryNo ratings yet

- (G.R. No. 136448. November 3, 1999.) Lim Tong Lim, Petitioner, V. Philippine Fishing Gear Industries, Inc, Respondent. DecisionDocument23 pages(G.R. No. 136448. November 3, 1999.) Lim Tong Lim, Petitioner, V. Philippine Fishing Gear Industries, Inc, Respondent. Decisionalay orejudosNo ratings yet

- Detention Pond Design Excel PDFDocument31 pagesDetention Pond Design Excel PDFRenukadevi Rpt100% (1)

- Cordlife BrochureDocument16 pagesCordlife BrochureMelodie YlaganNo ratings yet

- Infosys Verification FormDocument6 pagesInfosys Verification Formamanueljoseph1310No ratings yet

- DLL - Co.q2 Science IVDocument16 pagesDLL - Co.q2 Science IVAllyn MadeloNo ratings yet

- Marketing Rule BookDocument20 pagesMarketing Rule BookAnn Holman75% (4)

- Market Analysis On Tata IndicaDocument47 pagesMarket Analysis On Tata Indicasnehasis nandyNo ratings yet

- Physiology of LactationDocument29 pagesPhysiology of Lactationcorzpun16867879% (14)

- Squirrels of Indian SubcontinentDocument14 pagesSquirrels of Indian SubcontinentAkshay MotiNo ratings yet

- Land Titles and DeedsDocument1 pageLand Titles and DeedsIanLightPajaroNo ratings yet

- Consultancy Management (Recovered)Document30 pagesConsultancy Management (Recovered)Gilbert G. Asuncion Jr.No ratings yet

- Vu+Premium+2K+TV Specification 32UADocument2 pagesVu+Premium+2K+TV Specification 32UAMr jhonNo ratings yet

- Wastestation Compact: Transport SavingDocument2 pagesWastestation Compact: Transport Savingaamogh.salesNo ratings yet

- Shashikala SummaryDocument2 pagesShashikala SummaryKhushbakht FarrukhNo ratings yet

- Curriculum OF Environmental Science BS/MS: (Revised 2013)Document120 pagesCurriculum OF Environmental Science BS/MS: (Revised 2013)Jamal Ud Din QureshiNo ratings yet

- Bbyct 131 em 2024 MPDocument26 pagesBbyct 131 em 2024 MPDanish AfrozNo ratings yet

- Swelling Properties of Chitosan Hydrogels: David R Rohindra, Ashveen V Nand, Jagjit R KhurmaDocument4 pagesSwelling Properties of Chitosan Hydrogels: David R Rohindra, Ashveen V Nand, Jagjit R KhurmaSeptian Perwira YudhaNo ratings yet

- Billing Reports Export 1702384478083Document82 pagesBilling Reports Export 1702384478083vinjamuriraviteja123No ratings yet

- The Hand Test FinalDocument22 pagesThe Hand Test Finaltaylor alison swiftNo ratings yet