Professional Documents

Culture Documents

STD Miscellaneous Events Sales Tax Form FS-32

STD Miscellaneous Events Sales Tax Form FS-32

Uploaded by

Michele RossOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

STD Miscellaneous Events Sales Tax Form FS-32

STD Miscellaneous Events Sales Tax Form FS-32

Uploaded by

Michele RossCopyright:

Available Formats

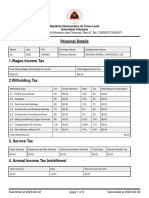

FORM FS-32 (Rev 10/07)

Georgia Department of Revenue

Bart L Graham Compliance Division Edward M. Many

Commissioner Rome Regional Office Deputy Commissioner

1401 Dean Street, Suite E for Tax Administration

P O Box 1777

Rome, GA 30162-1777

MISCELLANEOUS EVENTS

VENDOR

ADDRESS

NAME OF EVENT DATE OF EVENT

INSTRUCTIONS FOR VENDOR:

1) Complete vendor name, address and name of event information.

2) Report the amount of taxable sales (even if zero sales).

3) Collect Georgia Sales Tax at the rate that applies to the county in which the event is held.

4) Report the amount of sales tax collected.

5) Pay to the GEORGIA DEPARTMENT OF REVENUE, by check or money order, the amount of sales tax collected.

6) If you are registered with the STATE OF GEORGIA for SALES AND USE TAX and will include these sales on your regular

form, please provide tax number: __ __ __ -- __ __ __ __ __ __.

COUNTY TAX RATE

4% BRACKET 5% BRACKET 6% BRACKET 7% BRACKET 8% BRACKET

Amount of Sale Tax Amount of Sale Tax Amount of Sale Tax Amount of Sale Tax Amount of Sale Tax

.01 - .12 No tax .01 - .09 No tax .01 - .08 No tax .01 - .07 No tax .01 - .06 No tax

.13 - .37 .01 .10 - .29 .01 .09 - .24 .01 .08 - .21 .01 .07 - .18 .01

.38 - .62 .02 .30 - .49 .02 .25 - .41 .02 .22 - .35 .02 .19 - .31 .02

.63 - .87 .03 .50 - .69 .03 .42 - .58 .03 .36 - .49 .03 .32 - .43 .03

.88 – 1.00 .04 .70 - .89 .04 .59 - .74 .04 .50 - .64 .04 .44 - .56 .04

.90 –1.00 .05 .75 - .91 .05 .65 - .78 .05 .57 - .68 .05

.92 - 1.00 .06 .79 - .92 .06 .69 - .81 .06

.93 - 1.00 .07 .82 - .93 .07

.94 - 1.00 .08

TAXABLE SALES TAX COLLECTED

AT THE CLOSE OF THE EVENT, THIS FORM WITH TAX COLLECTED SHOULD BE

RETURNED TO THE ADDRESS LISTED BELOW.

Should you have any questions, please contact: FOR REVENUE USE ONLY

I.D. NUMBER -00000-

Georgia Department of Revenue CHECK NAME

MISCELLANEOUS TAX STATE TAX

P. O. Box 1777 MARTA

Rome, GA 30162 LOCAL OPTION

OTHER LOCAL OPTION

_______________________________________________

SPECIAL

Authorized Agent for State Revenue Commissioner

EDUCATIONAL

TELEPHONE NUMBER: 706-295-6061 FAX NUMBER: 706-295-6744 HOMESTEAD

DATE: TOTAL TAX

You might also like

- Total Amount Due: $30,826.00: Harvard UniversityDocument1 pageTotal Amount Due: $30,826.00: Harvard UniversityMiguel VelozaNo ratings yet

- Payslip - 2023 01 31Document1 pagePayslip - 2023 01 31mateivalentin94No ratings yet

- SSP Form United KingdomDocument2 pagesSSP Form United KingdomEduard Tirziu100% (1)

- PEZA Cost Benefit Analysis FormDocument2 pagesPEZA Cost Benefit Analysis FormMark Kevin SamsonNo ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- GST Collection From The New Zealand Property Sector: Iris ClausDocument14 pagesGST Collection From The New Zealand Property Sector: Iris ClausAli NadafNo ratings yet

- Comp 22 23Document2 pagesComp 22 23mexop31426No ratings yet

- Statement For Contract # 1019396517: Rana Shameem AkhtarDocument4 pagesStatement For Contract # 1019396517: Rana Shameem AkhtarZeshan Khan jeeNo ratings yet

- DRC07 Order ZD0704240448938 20240420014439Document4 pagesDRC07 Order ZD0704240448938 20240420014439aman.corpvidhyaNo ratings yet

- Ostrea Mineral - Yellow For FileDocument7 pagesOstrea Mineral - Yellow For FileJaime II LustadoNo ratings yet

- Ajio 1706695192988Document1 pageAjio 1706695192988shaelkmr550No ratings yet

- Duty SheetDocument525 pagesDuty Sheetrafi ud dinNo ratings yet

- Rizal Commercial Banking Corporation vs. Commissioner of Internal Revenue, 657 SCRA 70, September 07, 2011Document16 pagesRizal Commercial Banking Corporation vs. Commissioner of Internal Revenue, 657 SCRA 70, September 07, 2011j0d3No ratings yet

- 1Document2 pages1asad khokharNo ratings yet

- 1Document2 pages1asad khokharNo ratings yet

- View FileDocument4 pagesView FileRomain RemondNo ratings yet

- Account Statement As at 16.07.2018Document2 pagesAccount Statement As at 16.07.2018stephgate87No ratings yet

- Bassett - Mulhall Homestead Fraud ComplaintDocument116 pagesBassett - Mulhall Homestead Fraud Complaintreef_galNo ratings yet

- April Debit NoteDocument3 pagesApril Debit NoteVishalNo ratings yet

- The Remaining Reports and KPIsDocument11 pagesThe Remaining Reports and KPIsElie DiabNo ratings yet

- Payment Advices Detail ReportDocument1 pagePayment Advices Detail Reportrowena dela cruzNo ratings yet

- Palmobile Web - e 000 800001000283824 - 02feb2020 PDFDocument1 pagePalmobile Web - e 000 800001000283824 - 02feb2020 PDFThea Faye Buncad CahuyaNo ratings yet

- Monthly Report 157150Document2 pagesMonthly Report 157150Martins MartinsNo ratings yet

- 01Document2 pages01wilfredo selcedaNo ratings yet

- Recibo 2019-2020Document2 pagesRecibo 2019-2020Bruno SouzaNo ratings yet

- LTRMH 240Document1 pageLTRMH 240anil.chauhanNo ratings yet

- Mufticeleb Receipt 123417764004Document2 pagesMufticeleb Receipt 123417764004Shreya ShahNo ratings yet

- TFSPH Leased To Rosinni Ann Bernardo Magboo-AppliDocument1 pageTFSPH Leased To Rosinni Ann Bernardo Magboo-Applilei barrozoNo ratings yet

- DRC07 Order ZD181223066048F 20231231023238Document4 pagesDRC07 Order ZD181223066048F 20231231023238tuensangnagaland2018No ratings yet

- Palweb E-000-000000007401474 06may2018 PDFDocument1 pagePalweb E-000-000000007401474 06may2018 PDFVideo TimeNo ratings yet

- DT Tax Laws 2021Document1,060 pagesDT Tax Laws 2021Aluma MuzamilNo ratings yet

- Fashion Tech Industries: Commercial InvoiceDocument1 pageFashion Tech Industries: Commercial InvoiceMODERN FASHIONSNo ratings yet

- 0 - Income-Tax-Calculator-FY-2018-19 Final ProformaaDocument9 pages0 - Income-Tax-Calculator-FY-2018-19 Final ProformaaSrinivas PulimamidiNo ratings yet

- VAT in Oracle EBSDocument8 pagesVAT in Oracle EBSAbhishek IyerNo ratings yet

- BillingDocument1,151 pagesBillingmarie marcelinoNo ratings yet

- Q2 State Tax CollectionsDocument2 pagesQ2 State Tax CollectionswagnebNo ratings yet

- DR R K Sharma 13 FebDocument1 pageDR R K Sharma 13 FebVinay SharmaNo ratings yet

- Gas Taxes in FloridaDocument9 pagesGas Taxes in FloridaGary DetmanNo ratings yet

- S0380S222311180Document1 pageS0380S222311180Sai Rahul2222No ratings yet

- reprintHOReceipt PDFDocument1 pagereprintHOReceipt PDFAlen Matthew AndradeNo ratings yet

- reprintHOReceipt PDFDocument1 pagereprintHOReceipt PDFAlen Matthew AndradeNo ratings yet

- Tax Clearance CertificateDocument1 pageTax Clearance CertificateRahul SahaniNo ratings yet

- TAX Invoice: SR Description Hour Rate Amount Tax Amount TAX Rate Total Amount (DHS)Document1 pageTAX Invoice: SR Description Hour Rate Amount Tax Amount TAX Rate Total Amount (DHS)MUJAHIDNo ratings yet

- Soa 0020230786687 (3525)Document1 pageSoa 0020230786687 (3525)Ave de GuzmanNo ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- Rakesh Pareek Aug22Document1 pageRakesh Pareek Aug22Raghvendra Singh JadounNo ratings yet

- Statement For Contract # 1025374208: Muhammad Haroon KhanDocument7 pagesStatement For Contract # 1025374208: Muhammad Haroon KhanMuhammad JameelNo ratings yet

- At&t 2018 Ip7 PlusDocument1 pageAt&t 2018 Ip7 Plusadnan aliNo ratings yet

- La Maison Expense 2018Document25 pagesLa Maison Expense 2018JC Kent ArdeñaNo ratings yet

- Palmobile Web - e 000 800001000559955 - 07oct2023Document1 pagePalmobile Web - e 000 800001000559955 - 07oct2023jamihjeromeNo ratings yet

- Dear Seller,: 1. Commission Invoice Fee DetailsDocument4 pagesDear Seller,: 1. Commission Invoice Fee DetailsMILAN SWAINNo ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- Ajio 1709203435283Document1 pageAjio 1709203435283pranshu.jain1975No ratings yet

- Oddo Brothers Cpas: William & Regina LittleDocument30 pagesOddo Brothers Cpas: William & Regina Littlebill littleNo ratings yet

- 2022 Property Tax BillDocument1 page2022 Property Tax BillDjibzlaeNo ratings yet

- Invoice E1123052311128037791Document1 pageInvoice E1123052311128037791aamirshaikh6695No ratings yet

- SNAPONDocument2 pagesSNAPONMaree AlShehriNo ratings yet

- Irpf A 2022 2021 RecDocument3 pagesIrpf A 2022 2021 RecandersonNo ratings yet

- VAHAN 4.0 (Citizen Services) Onlineapp02 150 8015Document1 pageVAHAN 4.0 (Citizen Services) Onlineapp02 150 8015akashak808182No ratings yet

- Acdms 0300616965Document2 pagesAcdms 0300616965TicketsNtrips BhubaneswarNo ratings yet

- IC Google Expense Report TemplateDocument10 pagesIC Google Expense Report TemplateNarendraNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- BG3 - Tax Evasion or AvoidanceDocument6 pagesBG3 - Tax Evasion or AvoidanceRhea SharmaNo ratings yet

- Public Education Finances: 2015 Economic Reimbursable Surveys Division Reports Issued June 2017Document65 pagesPublic Education Finances: 2015 Economic Reimbursable Surveys Division Reports Issued June 2017FOX45No ratings yet

- Broad Band INV-TG-B1-70666689-101354947646-July-2023Document5 pagesBroad Band INV-TG-B1-70666689-101354947646-July-2023bhargavaNo ratings yet

- SAP MM: To Activate CIN Menu Path in SAPDocument2 pagesSAP MM: To Activate CIN Menu Path in SAPBala RanganathNo ratings yet

- Bill 10352986Document1 pageBill 10352986Sunil NainNo ratings yet

- PressRelease Last Date For Linking of PAN Aadhaar Extended 28 3 23Document1 pagePressRelease Last Date For Linking of PAN Aadhaar Extended 28 3 23Faisal SaeedNo ratings yet

- Cma Final Group3 All MCQDocument135 pagesCma Final Group3 All MCQtusharjaipur7No ratings yet

- Group 1: Fiscal Policy FormulationDocument9 pagesGroup 1: Fiscal Policy Formulationaige mascodNo ratings yet

- Slide MathDocument3 pagesSlide MathFAIZYATUL SYAMIMIE BINTI ARMAN MoeNo ratings yet

- Role of TaxationDocument5 pagesRole of TaxationCarlo Francis Palma100% (1)

- DM - Answersheet DTDocument20 pagesDM - Answersheet DTtholsjk14No ratings yet

- Law of Taxation and The Constitution of India - IpleadersDocument1 pageLaw of Taxation and The Constitution of India - Ipleadersannpurna pathakNo ratings yet

- Swaroop Enterprises 11.02.2019Document2 pagesSwaroop Enterprises 11.02.2019Sunil AlandNo ratings yet

- 23072600198046KVBL ChallanReceiptDocument2 pages23072600198046KVBL ChallanReceiptNaveen SNo ratings yet

- T.Y.B.a. Economics (Credits) FinalDocument16 pagesT.Y.B.a. Economics (Credits) FinalsmitaNo ratings yet

- TaxDocument196 pagesTaxFarah Khan Yousfzai100% (1)

- Net Pay: Stone Productions Contracts LTD, 119A ST John's Hill, London, SW11 1SZDocument1 pageNet Pay: Stone Productions Contracts LTD, 119A ST John's Hill, London, SW11 1SZ13KARATNo ratings yet

- GST Refund 26102015 NewDocument30 pagesGST Refund 26102015 NewNikhil SinghalNo ratings yet

- Wa0001.Document1 pageWa0001.Digvijay tembhareNo ratings yet

- Payslip Apr2020Document1 pagePayslip Apr2020Pinki Mitra DasNo ratings yet

- Model Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsDocument25 pagesModel Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsShyam Prasad100% (1)

- IGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Document4 pagesIGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Rainy GoodwillNo ratings yet

- GaneshDocument1 pageGaneshganeshtambre747No ratings yet

- 100 Ways To Save Tax in Malaysia For Small BusinessesDocument1 page100 Ways To Save Tax in Malaysia For Small BusinessesAztec MayanNo ratings yet

- SalarySlip MarchDocument1 pageSalarySlip MarchS S ENTERPRISESNo ratings yet

- Talenta Payslip PT Personel Alih Daya TBK Jun 2023 MUHAMAD SUKRON FARIDDocument1 pageTalenta Payslip PT Personel Alih Daya TBK Jun 2023 MUHAMAD SUKRON FARIDAhmad SukronNo ratings yet