Professional Documents

Culture Documents

Fomc 0315

Fomc 0315

Uploaded by

arborjimbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fomc 0315

Fomc 0315

Uploaded by

arborjimbCopyright:

Available Formats

FOMC STATEMENTS: SIDE-BY-SIDE

March 15 Text January 26 Text

Information received since the Federal Information received since the Federal

Open Market Committee met in January suggests Open Market Committee met in December confirms

that the economic recovery is on a firmer that the economic recovery is continuing,

footing, and overall conditions in the labor though at a rate that has been insufficient to

market appear to be improving gradually. bring about a significant improvement in labor

Household spending and business investment in market conditions. Growth in household

equipment and software continue to expand. spending picked up late last year, but remains

However, investment in nonresidential constrained by high unemployment, modest

structures is still weak, and the housing income growth, lower housing wealth, and tight

sector continues to be depressed. Commodity credit. Business spending on equipment and

prices have risen significantly since the software is rising, while investment in

summer, and concerns about global supplies of nonresidential structures is still weak.

crude oil have contributed to a sharp run-up Employers remain reluctant to add to payrolls.

in oil prices in recent weeks. Nonetheless, The housing sector continues to be depressed.

longer-term inflation expectations have Although commodity prices have risen, longer-

remained stable, and measures of underlying term inflation expectations have remained

inflation have been subdued. stable, and measures of underlying inflation

have been trending downward.

Consistent with its statutory mandate, Consistent with its statutory mandate,

the Committee seeks to foster maximum the Committee seeks to foster maximum

employment and price stability. Currently, the employment and price stability. Currently, the

unemployment rate remains elevated, and unemployment rate is elevated, and measures of

measures of underlying inflation continue to underlying inflation are somewhat low,

be somewhat low, relative to levels that the relative to levels that the Committee judges

Committee judges to be consistent, over the to be consistent, over the longer run, with

longer run, with its dual mandate. The recent its dual mandate. Although the Committee

increases in the prices of energy and other anticipates a gradual return to higher levels

commodities are currently putting upward of resource utilization in a context of price

pressure on inflation. The Committee expects stability, progress toward its objectives has

these effects to be transitory, but it will been disappointingly slow.

pay close attention to the evolution of

inflation and inflation expectations. The To promote a stronger pace of economic

Committee continues to anticipate a gradual recovery and to help ensure that inflation,

return to higher levels of resource over time, is at levels consistent with its

utilization in a context of price stability. mandate, the Committee decided today to

continue expanding its holdings of securities

To promote a stronger pace of economic as announced in November. In particular, the

recovery and to help ensure that inflation, Committee is maintaining its existing policy

over time, is at levels consistent with its of reinvesting principal payments from its

mandate, the Committee decided today to securities holdings and intends to purchase

continue expanding its holdings of securities $600 billion of longer-term Treasury

as announced in November. In particular, the securities by the end of the second quarter of

Committee is maintaining its existing policy 2011. The Committee will regularly review the

of reinvesting principal payments from its pace of its securities purchases and the

securities holdings and intends to purchase overall size of the asset-purchase program in

$600 billion of longer-term Treasury light of incoming information and will adjust

securities by the end of the second quarter of the program as needed to best foster maximum

2011. The Committee will regularly review the employment and price stability.

pace of its securities purchases and the

overall size of the asset-purchase program in The Committee will maintain the target

light of incoming information and will adjust range for the federal funds rate at 0 to 1/4

the program as needed to best foster maximum percent and continues to anticipate that

employment and price stability. economic conditions, including low rates of

resource utilization, subdued inflation

trends, and stable inflation expectations, are

The Committee will maintain the target

likely to warrant exceptionally low levels for

range for the federal funds rate at 0 to 1/4

the federal funds rate for an extended period.

percent and continues to anticipate that

economic conditions, including low rates of

The Committee will continue to monitor

resource utilization, subdued inflation

the economic outlook and financial

trends, and stable inflation expectations, are

developments and will employ its policy tools

likely to warrant exceptionally low levels for

as necessary to support the economic recovery

the federal funds rate for an extended period.

and to help ensure that inflation, over time,

is at levels consistent with its mandate.

The Committee will continue to monitor Voting for the FOMC monetary policy

the economic outlook and financial action were: Ben S. Bernanke, Chairman;

developments and will employ its policy tools William C. Dudley, Vice Chairman; Elizabeth A.

as necessary to support the economic recovery Duke; Charles L. Evans; Richard W. Fisher;

and to help ensure that inflation, over time, Narayana Kocherlakota; Charles I. Plosser;

is at levels consistent with its mandate. Sarah Bloom Raskin; Daniel K. Tarullo; Kevin

M. Warsh; and Janet L. Yellen.

Voting for the FOMC monetary policy

action were: Ben S. Bernanke, Chairman;

William C. Dudley, Vice Chairman; Elizabeth A.

Duke; Charles L. Evans; Richard W. Fisher;

Narayana Kocherlakota; Charles I. Plosser;

Sarah Bloom Raskin; Daniel K. Tarullo; and

Janet L. Yellen.

You might also like

- Eli Goldratt - The Goal - SummaryDocument6 pagesEli Goldratt - The Goal - SummaryGuldeep Singh KhokharNo ratings yet

- Personal Sample of Legal OpinionDocument2 pagesPersonal Sample of Legal Opinionbloome9ceeNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- 2010-09-21 - Fed Side by Side StatementsDocument2 pages2010-09-21 - Fed Side by Side Statementsglerner133926No ratings yet

- January - March FOMC Statement ComparisonDocument1 pageJanuary - March FOMC Statement Comparisonshawn2207No ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- FOMC0810Document2 pagesFOMC0810arborjimbNo ratings yet

- FOMC RedLineDocument2 pagesFOMC RedLineEduardo VinanteNo ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- Fed Statements Side by SideDocument1 pageFed Statements Side by SideTaylor CottamNo ratings yet

- FOMC Rate Decision 04.25.12Document1 pageFOMC Rate Decision 04.25.12Pensford FinancialNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- Fed Statement June 2009Document2 pagesFed Statement June 2009andrewbloggerNo ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- FOMCstatementDocument2 pagesFOMCstatementCBNo ratings yet

- Oct FOMC RedlineDocument2 pagesOct FOMC RedlineZerohedgeNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- Fed TalkDocument2 pagesFed TalkTelegraphUKNo ratings yet

- Sidebyside 08092011Document1 pageSidebyside 08092011andrewbloggerNo ratings yet

- FOMC Redline MarchDocument2 pagesFOMC Redline MarchZerohedgeNo ratings yet

- December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-SettonDocument3 pagesDecember 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Settonapi-273992067No ratings yet

- Fomc Statements - Side-By-sideDocument2 pagesFomc Statements - Side-By-sideurbanovNo ratings yet

- FOMC Word For Word Changes. 05.01.13Document2 pagesFOMC Word For Word Changes. 05.01.13Pensford FinancialNo ratings yet

- Fomc StatmentDocument1 pageFomc Statmentapi-280585983No ratings yet

- Press Release: For Release at 2:00 P.M. EDTDocument2 pagesPress Release: For Release at 2:00 P.M. EDTTREND_7425No ratings yet

- FOMC Word For Word Changes 03.20.13Document2 pagesFOMC Word For Word Changes 03.20.13Pensford FinancialNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument2 pagesFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Fomc Pres Conf 20240501Document4 pagesFomc Pres Conf 20240501gustavo.kahilNo ratings yet

- Press ReleaseDocument2 pagesPress Releaseapi-26018528No ratings yet

- 2018.01.31 FED Press ReleaseDocument2 pages2018.01.31 FED Press ReleaseTREND_7425No ratings yet

- Yellen TestimonyDocument7 pagesYellen TestimonyZerohedgeNo ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- Fomc Septiembre 2015Document2 pagesFomc Septiembre 2015cocoNo ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- US Fed FOMC Press Conference 18 September 2013 No TaperDocument26 pagesUS Fed FOMC Press Conference 18 September 2013 No TaperJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- FedDocument4 pagesFedandre.torresNo ratings yet

- FOMCpresconf 20210922Document26 pagesFOMCpresconf 20210922marcoNo ratings yet

- Fed Redline FebruaryDocument2 pagesFed Redline FebruaryPradeep SolankiNo ratings yet

- Fomc Pres Conf 20231101Document26 pagesFomc Pres Conf 20231101Quynh Le Thi NhuNo ratings yet

- Transcript of Chair Powell's Press Conference Opening Statement March 20, 2024Document4 pagesTranscript of Chair Powell's Press Conference Opening Statement March 20, 2024andre.torresNo ratings yet

- Fomc Pres Conf 20141217Document23 pagesFomc Pres Conf 20141217JoseLastNo ratings yet

- FOMCpresconf20240501Document26 pagesFOMCpresconf20240501David SimõesNo ratings yet

- Monetarypolicy 2007-08Document2 pagesMonetarypolicy 2007-08twinkle_ind22No ratings yet

- Comptabilité Tle G3 Et G2Document24 pagesComptabilité Tle G3 Et G2albertvalk2.0No ratings yet

- 2018.09.26 FED Press ReleaseDocument1 page2018.09.26 FED Press ReleaseTREND_7425No ratings yet

- FOMCpresconf 20220615Document27 pagesFOMCpresconf 20220615S CNo ratings yet

- Conférence de Presse BCE JanvierDocument2 pagesConférence de Presse BCE JanvierToroloNo ratings yet

- PowellDocument4 pagesPowellandre.torresNo ratings yet

- Monetary 20240501 A 1Document4 pagesMonetary 20240501 A 1gustavo.kahilNo ratings yet

- resconfDocument4 pagesresconfgothurded24No ratings yet

- FOMCpresconf 20230614Document5 pagesFOMCpresconf 20230614Jhony SmithYTNo ratings yet

- Peso Balanced Fund: Investment ObjectiveDocument10 pagesPeso Balanced Fund: Investment ObjectiveErwin Dela CruzNo ratings yet

- Fomc Pres Conf 20230614Document26 pagesFomc Pres Conf 20230614LAKHAN TRIVEDINo ratings yet

- Jerome Powell's Written TestimonyDocument5 pagesJerome Powell's Written TestimonyTim MooreNo ratings yet

- G20: ST Petersburg Action Plan Sept 2013Document11 pagesG20: ST Petersburg Action Plan Sept 2013slshaw066893No ratings yet

- Interpret The Tone-FOMC Statements Answer Key: Advance Your CareerDocument3 pagesInterpret The Tone-FOMC Statements Answer Key: Advance Your CareerTarun TiwariNo ratings yet

- Transcript of Chairman Bernanke's Press Conference April 25, 2012Document23 pagesTranscript of Chairman Bernanke's Press Conference April 25, 2012CoolidgeLowNo ratings yet

- FOMCpresconf 20220316Document26 pagesFOMCpresconf 20220316marchmtetNo ratings yet

- FOMCpresconf 20230920Document4 pagesFOMCpresconf 20230920KHAIRULNo ratings yet

- FOMCpresconf20230503 PDFDocument4 pagesFOMCpresconf20230503 PDFJavierNo ratings yet

- China Economics 09192011Document3 pagesChina Economics 09192011andrewbloggerNo ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- Crox 20110728Document2 pagesCrox 20110728andrewbloggerNo ratings yet

- Historical Unemployment Recent Unemployment: Productivity and CostsDocument4 pagesHistorical Unemployment Recent Unemployment: Productivity and CostsandrewbloggerNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- China Eco StatsDocument4 pagesChina Eco StatsandrewbloggerNo ratings yet

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- Commodity Chartbook 20110802Document9 pagesCommodity Chartbook 20110802andrewbloggerNo ratings yet

- Retail Same Store Sales 20110901Document2 pagesRetail Same Store Sales 20110901andrewbloggerNo ratings yet

- Sidebyside 08092011Document1 pageSidebyside 08092011andrewbloggerNo ratings yet

- Commodity Chartbook 09302011Document9 pagesCommodity Chartbook 09302011andrewbloggerNo ratings yet

- SPRD 08152011Document1 pageSPRD 08152011andrewbloggerNo ratings yet

- China Eco 1Document1 pageChina Eco 1andrewbloggerNo ratings yet

- Retail Same Store SalesDocument2 pagesRetail Same Store SalesandrewbloggerNo ratings yet

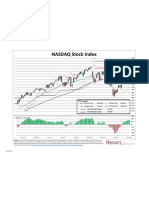

- NASDAQ Stock Index: Chart LegendDocument1 pageNASDAQ Stock Index: Chart LegendandrewbloggerNo ratings yet

- WMT 20110330Document2 pagesWMT 20110330andrewbloggerNo ratings yet

- Commodity Chartbook: April 6, 2011Document8 pagesCommodity Chartbook: April 6, 2011andrewbloggerNo ratings yet

- Silver COT 20110510Document1 pageSilver COT 20110510andrewbloggerNo ratings yet

- Apple Conference Call Notes 3Q 2011Document6 pagesApple Conference Call Notes 3Q 2011andrewbloggerNo ratings yet

- Oil COT 20110510Document1 pageOil COT 20110510andrewbloggerNo ratings yet

- Retail Same Store Sales 20110516Document2 pagesRetail Same Store Sales 20110516andrewbloggerNo ratings yet

- CTRP Earnings Worksheet: Actual 0.24 $ 124.32 $ Surprise 12.68% 11.75%Document4 pagesCTRP Earnings Worksheet: Actual 0.24 $ 124.32 $ Surprise 12.68% 11.75%andrewbloggerNo ratings yet

- Major Index TrendsDocument9 pagesMajor Index TrendsandrewbloggerNo ratings yet

- TSL04132011Document2 pagesTSL04132011andrewbloggerNo ratings yet

- S&P 500 Stock Index: Chart LegendDocument1 pageS&P 500 Stock Index: Chart LegendandrewbloggerNo ratings yet

- VZ 20110330Document2 pagesVZ 20110330andrewbloggerNo ratings yet

- Xom 20110330Document2 pagesXom 20110330andrewbloggerNo ratings yet

- TRV 20110330Document2 pagesTRV 20110330andrewbloggerNo ratings yet

- Utx 20110330Document2 pagesUtx 20110330andrewbloggerNo ratings yet

- Abayan Position PaperDocument8 pagesAbayan Position PaperRoy PersonalNo ratings yet

- CONTRACT OF AGENCY (EDITED) Summarised DocumentDocument10 pagesCONTRACT OF AGENCY (EDITED) Summarised DocumentShubham PhophaliaNo ratings yet

- The ABC's of Interviewing: A Is For AttitudeDocument5 pagesThe ABC's of Interviewing: A Is For AttitudeSnehal PatilNo ratings yet

- Essentials of HRMDocument4 pagesEssentials of HRMVinitaNo ratings yet

- Concept of Employee SelectionDocument5 pagesConcept of Employee SelectionSusmita AcharyaNo ratings yet

- Payguides - MA000004 - 1 July 2023Document57 pagesPayguides - MA000004 - 1 July 2023kjemalspamNo ratings yet

- BSCI Code of ConductDocument1 pageBSCI Code of ConductNafizAlamNo ratings yet

- OSHA Safety GuidelinesDocument40 pagesOSHA Safety GuidelinesAnonNo ratings yet

- Narayana Engineering College: WWW - Necg.ac - inDocument12 pagesNarayana Engineering College: WWW - Necg.ac - inLocalBoy MohammadNo ratings yet

- Benefits of Trade - WorksheetDocument2 pagesBenefits of Trade - Worksheetrahil shahNo ratings yet

- CS Form 6 NewDocument2 pagesCS Form 6 NewMICHAEL ANGELO MAYORDONo ratings yet

- Pension Mathematics With Numerical Illustrations: Second EditionDocument13 pagesPension Mathematics With Numerical Illustrations: Second EditionG.k. FlorentNo ratings yet

- Labor Problems in The PhilippinesDocument2 pagesLabor Problems in The PhilippinesOya Kapunan80% (5)

- Rotman Career Services Employment and Salary Report 2021Document17 pagesRotman Career Services Employment and Salary Report 2021Dean WinchesterNo ratings yet

- Unit 2Document22 pagesUnit 2Thu NguyenthanhNo ratings yet

- Benedicto Cajucom VII Vs TPI Philippines Cement Corp Et AlDocument9 pagesBenedicto Cajucom VII Vs TPI Philippines Cement Corp Et AlEzra Dan BelarminoNo ratings yet

- RKS FORM 5 Termination Report FormDocument1 pageRKS FORM 5 Termination Report FormMoniqueLeeNo ratings yet

- Interpersonal Roles: 2 Marks 1. What Are The Functions of Manager?Document21 pagesInterpersonal Roles: 2 Marks 1. What Are The Functions of Manager?Manoj KumarNo ratings yet

- Questions HrisDocument2 pagesQuestions HrisCharmi PoraniyaNo ratings yet

- Professional EthicsDocument12 pagesProfessional EthicsFiona UsherNo ratings yet

- National Policy On Commuted Overtime For Medical & Dental PersonnelDocument13 pagesNational Policy On Commuted Overtime For Medical & Dental PersonnelNopepsi SobetwaNo ratings yet

- Social Cost of Educated Youth Unemployment in Ghana and Its Implications For Education John Anaesi Yarquah Stephen Baafi-FrimpongDocument23 pagesSocial Cost of Educated Youth Unemployment in Ghana and Its Implications For Education John Anaesi Yarquah Stephen Baafi-FrimpongAyogu ThomasNo ratings yet

- MCS Weekly Paper - Control Tightness and Control Cost System KP YDocument25 pagesMCS Weekly Paper - Control Tightness and Control Cost System KP YJorgi PurnomoNo ratings yet

- Labor Dispute SettlementDocument8 pagesLabor Dispute SettlementChieney AguhobNo ratings yet

- Memorandum of UnderstandingDocument6 pagesMemorandum of Understandingkondwani B J MandaNo ratings yet

- Sexual Harassment RA 7877 v. Safe Spaces Act RA 11313Document7 pagesSexual Harassment RA 7877 v. Safe Spaces Act RA 11313Janina AbarquezNo ratings yet

- Deped K To 12 Technology and Livelihood Education - Tile SettingDocument9 pagesDeped K To 12 Technology and Livelihood Education - Tile Settingyachiru121100% (1)

- Employees' State Insurance CorporationDocument39 pagesEmployees' State Insurance CorporationArjun VermaNo ratings yet