Professional Documents

Culture Documents

Corporate Tax

Corporate Tax

Uploaded by

Prem shukla0 ratings0% found this document useful (0 votes)

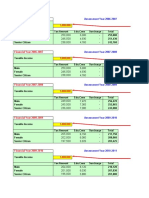

12 views2 pagesThis document contains financial information for a company across three financial years from 2007-2008 to 2009-2010. It includes the company's total income, tax calculations, book profits, tax liabilities, and MAT credit availment and carry forward amounts. The tax liabilities were higher when calculated on book profits versus total income for 2007-2008 and 2008-2009 but not for 2009-2010. MAT credit of 61,800 was available for set off in 2008-2009 and 154,500 was carried forward from 2008-2009 to 2009-2010.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains financial information for a company across three financial years from 2007-2008 to 2009-2010. It includes the company's total income, tax calculations, book profits, tax liabilities, and MAT credit availment and carry forward amounts. The tax liabilities were higher when calculated on book profits versus total income for 2007-2008 and 2008-2009 but not for 2009-2010. MAT credit of 61,800 was available for set off in 2008-2009 and 154,500 was carried forward from 2008-2009 to 2009-2010.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesCorporate Tax

Corporate Tax

Uploaded by

Prem shuklaThis document contains financial information for a company across three financial years from 2007-2008 to 2009-2010. It includes the company's total income, tax calculations, book profits, tax liabilities, and MAT credit availment and carry forward amounts. The tax liabilities were higher when calculated on book profits versus total income for 2007-2008 and 2008-2009 but not for 2009-2010. MAT credit of 61,800 was available for set off in 2008-2009 and 154,500 was carried forward from 2008-2009 to 2009-2010.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

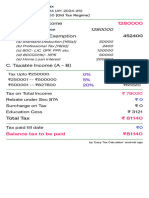

Company Total Income 15,000,000

Tax @ 30% 4,500,000

Surcharge 450,000

Education Cess @ 1% 49,500

H&SEC @ 2% 99,000

Previous Year Tax Profit 115 JB Profit

2007-08 300,000 2,000,000

2008-09 700,000 1,000,000

2009-10 1,000,000 800,000

Computaion of Tax Liability

Particulars Previous Year

2007-08 2008-09 2009-10

Total Income 300,000 700,000 1,000,000

Book Profit 2,000,000 1,000,000 800,000

Tax on Total Income 90,000 210,000 300,000

Tax on Book Profit 300,000 150,000 120,000

Tax Payable Heigher of abo 300,000 210,000 300,000

Add: Surcharge (TI less than 0 0 0

Tax Payable including Surch 300,000 210,000 300,000

Add: Education Cess @ 2% 6,000 4,200 6,000

Add: S&HE Cess @ 1% 3,000 2,100 3,000

Total Tax Payable 309,000 216,300 309,000

Less: MAT Credit 0 61,800 154,500

Net Tax Payable 309,000 154,500 154,500

MAT Credit Availabe 2007-08 2008-09 2009-10

Tax Payable under Book Prof 309,000 154,500 123,600

Tax payable on Tax Profit 92,700 216,300 309,000

MAT Credit Available 216,300 0 0

MAT Credit Availment 2007-08 2008-09 2009-10

MAT credit Available upto PY 216,300 154,500

Tax on Total Income + SC+EC+SHEC 216,300 309,000

Tax on Book Profit + SC+EC+SHEC 154,500 123,600

Difference = MAT for Current PY 61,800 0

MAT credit C/F 154,500 0

You might also like

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocument37 pagesIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalNo ratings yet

- CPAT Reviewer - TRAIN (Tax Reform) #1Document8 pagesCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnNo ratings yet

- Example of Tax PlanningDocument10 pagesExample of Tax PlanningGangothri Asok100% (1)

- Employment Income TaxDocument5 pagesEmployment Income TaxYehualashet MekonninNo ratings yet

- Tax Calucation Yearwise UpdatedDocument4 pagesTax Calucation Yearwise UpdatedkinnusinghNo ratings yet

- Income Tax SlabsDocument2 pagesIncome Tax SlabsGhulam AwaisNo ratings yet

- Lecture 3Document22 pagesLecture 3ahmed qazzafiNo ratings yet

- Business Taxation SolutionDocument3 pagesBusiness Taxation SolutionBillie MatchocaNo ratings yet

- Chapter 4 - Income Taxes Problems Luzon CorporationDocument8 pagesChapter 4 - Income Taxes Problems Luzon CorporationJohanna Raissa CapadaNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- SAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Document1 pageSAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Mharck Atienza100% (1)

- Salary Slip FormatDocument1 pageSalary Slip FormatDigvijay SinghNo ratings yet

- CorpoDocument2 pagesCorpoKhyle Ferrile EligioNo ratings yet

- Basic SolDocument3 pagesBasic SolADARSH MISHRANo ratings yet

- Income Tax in Myanmar LawDocument2 pagesIncome Tax in Myanmar LawICT MyanmarNo ratings yet

- Quikchex 2019 Tax Comparison PDFDocument5 pagesQuikchex 2019 Tax Comparison PDFGMFL MumbaiNo ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- Tax Reform Acceleration and InclusionDocument28 pagesTax Reform Acceleration and InclusionWilliam Alexander Matsuhara AlegreNo ratings yet

- Tax Calculator 2018-19 (Farrukh Iqbal Khan)Document2 pagesTax Calculator 2018-19 (Farrukh Iqbal Khan)FarrukhNo ratings yet

- M F S N: Make Sure That Status Has Been Selected CorrectlyDocument8 pagesM F S N: Make Sure That Status Has Been Selected Correctlysrinivasallam_259747No ratings yet

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Net Income 2,030,000 2,324,000 2,667,000 2,798,950 Changes 330,000Document5 pagesNet Income 2,030,000 2,324,000 2,667,000 2,798,950 Changes 330,000April SolimanNo ratings yet

- Income Tax FY 2020-21-2Document25 pagesIncome Tax FY 2020-21-2umeshapkNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- 12lpa Tax ComputationDocument1 page12lpa Tax ComputationSai KrishnaNo ratings yet

- Nama: Aldrin Arisko NIM: 222017040 MK: Aplikasi Komputer Daftar Gaji Pegawai PT - Maju MundurDocument2 pagesNama: Aldrin Arisko NIM: 222017040 MK: Aplikasi Komputer Daftar Gaji Pegawai PT - Maju MundurAldrin AriskoNo ratings yet

- Tax SolutionDocument4 pagesTax Solutiongen eyesNo ratings yet

- Trần Hoài Anh Hs150639 Ib1602Document3 pagesTrần Hoài Anh Hs150639 Ib1602Vũ Nhi AnNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN)Document187 pagesTax Reform For Acceleration and Inclusion (TRAIN)Janna GunioNo ratings yet

- Bai Tap - IAS 12 - Tu LuanDocument14 pagesBai Tap - IAS 12 - Tu LuanTrần Nguyễn Tuệ MinhNo ratings yet

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776No ratings yet

- Difference Between Accounting Rules and Tax RulesDocument18 pagesDifference Between Accounting Rules and Tax RulesCezar Rishane Mae SaligueNo ratings yet

- 5 Year Financial ProjectionsDocument2 pages5 Year Financial ProjectionsCedric JohnsonNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDocument5 pagesProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- AfstDocument15 pagesAfstAEDRIAN LEE DERECHONo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- Exercises - Individual IT - TLDocument1 pageExercises - Individual IT - TLClyde SaulNo ratings yet

- Plas Mech BS 07-08Document32 pagesPlas Mech BS 07-08plasmechNo ratings yet

- Tax Computation - 2019 PDFDocument1 pageTax Computation - 2019 PDFJurex JustinianNo ratings yet

- Income Tax Rates, Rebates & DeductionsDocument35 pagesIncome Tax Rates, Rebates & DeductionsMaryam IkhlaqeNo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableMarian's PreloveNo ratings yet

- Tax Calculation FY 2024 25 OldRegimeDocument2 pagesTax Calculation FY 2024 25 OldRegimemohangboxNo ratings yet

- Salary Structure CalculatorDocument7 pagesSalary Structure CalculatorMakesh Gopalakrishnan0% (1)

- Taxation in EthiopiaDocument7 pagesTaxation in EthiopiaLeulNo ratings yet

- Easy TaxDocument1 pageEasy TaxSiva GaneshNo ratings yet

- Basic Concepts - QuestionsDocument6 pagesBasic Concepts - QuestionsbadalNo ratings yet

- Principle and Practice of TaxationDocument5 pagesPrinciple and Practice of TaxationAgyeiNo ratings yet

- Contemporary Taxation: COMSATS University IslamabadDocument4 pagesContemporary Taxation: COMSATS University IslamabadRabia EmanNo ratings yet

- Written Report Week 8 Income TaxDocument16 pagesWritten Report Week 8 Income Taxdevy mar topiaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet