Professional Documents

Culture Documents

Appl 2

Appl 2

Uploaded by

aayush-the devilish angelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appl 2

Appl 2

Uploaded by

aayush-the devilish angelCopyright:

Available Formats

appl

Input interpretation:

Apple HAAPLL

Latest trade:

$352.07 H . 1284.34L HAAPL È NASDAQ È Saturday 1:08:31 am GST È 2 days 1 hr agoL

Fundamentals and financials:

market cap $324.3 billion

revenue $76.28 billion

employees 49 400

revenue employee $1.544 million

net income $16.64 billion

shares outstanding 921.3 million

annual earnings share $18.20

PE ratio 19.34

annual dividends share

dividend yield 0%

Hbased on trailing 12-month totals, last close price and annual employeesL

Generated by Wolfram|Alpha (www.wolframalpha.com) on March 13, 2011 from Champaign, IL.

1

© Wolfram Alpha LLC—A Wolfram Research Company

appl

Recent returns:

day month YTD year 5 year

-0.14% -0.72% +9.12% +56.55% +435.92%

Price history:

$350

$300

$250

Apr Jul Oct Jan

daily closing prices

minimum average maximum

$222.25 $285.81 $363.13

HFriday, Mar 19, 2010L HWednesday, Feb 16, 2011L

Analyst ratings:

strong buy Hmean score: 1.23L HFriday, March 11, 2011L

H46 analystsL

Generated by Wolfram|Alpha (www.wolframalpha.com) on March 13, 2011 from Champaign, IL.

2

© Wolfram Alpha LLC—A Wolfram Research Company

appl

Performance comparisons:

average daily return daily volatility annual return annual volatility

AAPL +0.175% 1.58% +56.55% 25.27%

IBM +0.106% 1.1% +31.17% 17.7%

HPQ -0.08% 1.67% -18.56% 26.8%

SP500 +0.049% 1.09% +13.5% 17.54%

bonds +0.005% 0.25% +1.36% 4.02%

T-bills +0.0005% 0% +0.13% 0%

80%

60%

realized return

AAPL

40% IBM

20%

bonds SP500

0%

T-bills

-20% HPQ

0% 5% 10% 15% 20% 25% 30%

volatility

Generated by Wolfram|Alpha (www.wolframalpha.com) on March 13, 2011 from Champaign, IL.

3

© Wolfram Alpha LLC—A Wolfram Research Company

appl

Correlation matrix:

AAPL IBM HPQ SP500

AAPL 1 0.565 0.543 0.69

IBM 0.565 1 0.54 0.695

HPQ 0.543 0.54 1 0.677

SP500 0.69 0.695 0.677 1

Daily return analysis:

return histograms

1 day 5 days 20 days

-5% +2% +8% -10% +2% +14% -12% +7% +26%

50 days 100 days 250 days

-12% +14% +40% -3% +37% +77% +36% +79% +122%

Generated by Wolfram|Alpha (www.wolframalpha.com) on March 13, 2011 from Champaign, IL.

4

© Wolfram Alpha LLC—A Wolfram Research Company

appl

Projections:

$1000

$800

$600

$400

$200

$0

2011 2012

50% range, 1 month $349.32 H-0.8%L to $387.69 H+10.1%L

95% range, 1 month $316.30 H-10.1%L to $428.16 H+21.6%L

50% range, 1 year $500.29 H+42.1%L to $717.29 H+103.8%L

95% range, 1 year $354.91 H+0.8%L to $1011.11 H+187.3%L

Hlog-normal random walks based on historical parametersL

Generated by Wolfram|Alpha (www.wolframalpha.com) on March 13, 2011 from Champaign, IL.

5

© Wolfram Alpha LLC—A Wolfram Research Company

appl

Daily returns versus S&P 500:

AAPL

+10%

SP500

-10% -5% +5% +10% +15%

-10%

alpha 45.68%

beta 0.970

R2 0.372

Company information:

company name Apple

sector computer hardware

location Cupertino, California, United States

website www.apple.com

Generated by Wolfram|Alpha (www.wolframalpha.com) on March 13, 2011 from Champaign, IL.

6

© Wolfram Alpha LLC—A Wolfram Research Company

You might also like

- ACC 550 SyllabusDocument8 pagesACC 550 Syllabusjvj1234No ratings yet

- By The Sea Biscuit Company - Case Analysis - Group 6 - Section G - PGDM 1Document12 pagesBy The Sea Biscuit Company - Case Analysis - Group 6 - Section G - PGDM 1Pranav Dev SinghNo ratings yet

- FAR09 Biological Assets - With AnswerDocument9 pagesFAR09 Biological Assets - With AnswerAJ Cresmundo50% (4)

- Sri Lanka Automobile Demand Assignment PDFDocument2 pagesSri Lanka Automobile Demand Assignment PDFAmanda HerathNo ratings yet

- H H H H: Apple Microsoft Adobe GoogleDocument7 pagesH H H H: Apple Microsoft Adobe Googledjscribble2No ratings yet

- Wolfram - Alpha MSFT YHOO GOOG ReportDocument7 pagesWolfram - Alpha MSFT YHOO GOOG ReportDvNetNo ratings yet

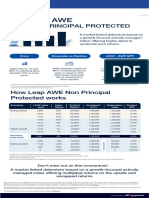

- LEAP Beta 1 PagerDocument1 pageLEAP Beta 1 PagerDheeraj SharmaNo ratings yet

- INFO 210.502: Spring 2008Document10 pagesINFO 210.502: Spring 2008ryandman89No ratings yet

- Analysis of Financial Performance For AlphabetDocument6 pagesAnalysis of Financial Performance For AlphabetPham Ha AnNo ratings yet

- LEAP AWE NPP - FinalDocument1 pageLEAP AWE NPP - Finalvikyraj0420No ratings yet

- Dashboard Working by JaffarDocument28 pagesDashboard Working by Jaffarmuhammad arshad100% (1)

- 4q18 Presentation Final v1 LightDocument24 pages4q18 Presentation Final v1 LightRicardo Javier PlasenciaNo ratings yet

- Trade Finance StrategyDocument11 pagesTrade Finance Strategysuvarna27No ratings yet

- LEAP AWE PP - FinalDocument1 pageLEAP AWE PP - Finalvikyraj0420No ratings yet

- Apple Amazon GoogleDocument19 pagesApple Amazon GooglescottabellNo ratings yet

- Skema TeknikalDocument4 pagesSkema TeknikalBastian Calvin DeranggaNo ratings yet

- BetterInvesting Weekly Stock Screen 4-16-18Document1 pageBetterInvesting Weekly Stock Screen 4-16-18BetterInvestingNo ratings yet

- Bessemer Benchmarks: Plot Your Way To The Next MilestoneDocument10 pagesBessemer Benchmarks: Plot Your Way To The Next MilestoneNathan YehNo ratings yet

- Aapl +0 08 $195 99Document1 pageAapl +0 08 $195 99Gisnelly LucianoNo ratings yet

- KPI Green EnergyDocument34 pagesKPI Green EnergyRJNo ratings yet

- Group - Karthike, Sashi, Tushar, YogeshDocument14 pagesGroup - Karthike, Sashi, Tushar, YogeshTushar SharmaNo ratings yet

- Chapter 6 - Risk and Return Self Test ST1 Year Ra RB rAB A B ABDocument17 pagesChapter 6 - Risk and Return Self Test ST1 Year Ra RB rAB A B ABDiva Tertia AlmiraNo ratings yet

- AFM WorkingDocument7 pagesAFM Workingsairad1999No ratings yet

- Tata CommunicationDocument5 pagesTata CommunicationkmmohammedroshanNo ratings yet

- Analyst Revision Trends - June 3, 2011Document18 pagesAnalyst Revision Trends - June 3, 2011Stephen CastellanoNo ratings yet

- Equit Alpha Bofa 1julDocument12 pagesEquit Alpha Bofa 1julgerrich rusNo ratings yet

- Elpro International LTDDocument3 pagesElpro International LTDHimanshuNo ratings yet

- Case Study 3: Alok Industries: Business ValuationDocument6 pagesCase Study 3: Alok Industries: Business Valuationsairad1999No ratings yet

- FactorRegression_20240605151951Document17 pagesFactorRegression_20240605151951Gadha IndustryNo ratings yet

- Payout Details DCF Final Grid - DCF - 27.05.2024Document5 pagesPayout Details DCF Final Grid - DCF - 27.05.2024MILAN BEHERANo ratings yet

- Tutorial - 1: Corporate Finance (Sec E & F)Document16 pagesTutorial - 1: Corporate Finance (Sec E & F)Vivekananda RNo ratings yet

- Financial Model of New RestaurantDocument42 pagesFinancial Model of New RestaurantPrabhdeep Dadyal0% (1)

- Derivative 10 SepDocument3 pagesDerivative 10 SepMansukh Investment & Trading SolutionsNo ratings yet

- Rediff Moneywiz - My Portfolio(s)Document3 pagesRediff Moneywiz - My Portfolio(s)Vikramjit ਮਿਨਹਾਸNo ratings yet

- Dashboard DropshippingDocument7 pagesDashboard DropshippingOk NawaNo ratings yet

- Equity Market Reports For The Week (18th - 22nd April 11)Document6 pagesEquity Market Reports For The Week (18th - 22nd April 11)Dasher_No_1No ratings yet

- TIF D&I Exercise v24.0Document13 pagesTIF D&I Exercise v24.0GDoingThings YTNo ratings yet

- CasesDocument74 pagesCasesPollsNo ratings yet

- Analysis On Derivative Trading by Mansukh Investment & Trading Solutions 04/08/2010Document3 pagesAnalysis On Derivative Trading by Mansukh Investment & Trading Solutions 04/08/2010MansukhNo ratings yet

- Fall 2017 HW5 ArDocument7 pagesFall 2017 HW5 ArmudawisuoodNo ratings yet

- Wolfram Alpha AnnvssksvsgymbDocument4 pagesWolfram Alpha AnnvssksvsgymbenrokNo ratings yet

- Basic Comps - BLANKDocument3 pagesBasic Comps - BLANKkiasha3496No ratings yet

- 2.A) Network Bonus For BA (Min 100cv) and Have Lines: L2: Infinity 2% 4 8 InfinityDocument3 pages2.A) Network Bonus For BA (Min 100cv) and Have Lines: L2: Infinity 2% 4 8 InfinityShermaine SuahNo ratings yet

- Bonds - February 28 2021Document3 pagesBonds - February 28 2021Lisle Daverin BlythNo ratings yet

- Life Partners Holdings, Inc. (LPHI)Document6 pagesLife Partners Holdings, Inc. (LPHI)MLastTryNo ratings yet

- Ascendere Daily Update - January 27, 2011 - Companies With Expanding ROIC Tend To Surprise To The UpsideDocument16 pagesAscendere Daily Update - January 27, 2011 - Companies With Expanding ROIC Tend To Surprise To The UpsideStephen CastellanoNo ratings yet

- Stonehill College BUS320-4bDocument33 pagesStonehill College BUS320-4bsuck my cuntNo ratings yet

- Mahindra Manulife MF - Market OutlookDocument1 pageMahindra Manulife MF - Market OutlookYasahNo ratings yet

- Trend AnalysisDocument1 pageTrend Analysisapi-385117572No ratings yet

- FINC3014 Topic 8 SolutionsDocument5 pagesFINC3014 Topic 8 Solutionssuitup100No ratings yet

- TIF D&I Solution v24.0Document13 pagesTIF D&I Solution v24.0GDoingThings YTNo ratings yet

- A11 IndustryInputs Module4Document5 pagesA11 IndustryInputs Module4Ranga SenthilNo ratings yet

- 815e9 Motilal Oswal SP Bse Value Etf Index Fund PPT Presentation Sep 2023Document64 pages815e9 Motilal Oswal SP Bse Value Etf Index Fund PPT Presentation Sep 2023kishore13No ratings yet

- Karur Vysya Bank Is A Scheduled Commercial BankDocument4 pagesKarur Vysya Bank Is A Scheduled Commercial BankMamtha KumarNo ratings yet

- Financial Models - 2022Document9 pagesFinancial Models - 2022Hamza AsifNo ratings yet

- 2.2 Financial InformationDocument43 pages2.2 Financial Informationmanjusri SrilalNo ratings yet

- Net Revenue Cost of Sales Gross Profit Ebit - Operating Result Ebitda Net IncomeDocument15 pagesNet Revenue Cost of Sales Gross Profit Ebit - Operating Result Ebitda Net IncomevhibeeNo ratings yet

- KF Vs Kalbe Syndicate Group 4 - FixDocument15 pagesKF Vs Kalbe Syndicate Group 4 - FixFadhila Nurfida HanifNo ratings yet

- Finding Alphas: A Quantitative Approach to Building Trading StrategiesFrom EverandFinding Alphas: A Quantitative Approach to Building Trading StrategiesRating: 4 out of 5 stars4/5 (1)

- Naked Managementgames Executives PlayDocument445 pagesNaked Managementgames Executives Playthepretender100% (2)

- Scarlett Tax Policy and Economic Growth in Jamaica FinalDocument28 pagesScarlett Tax Policy and Economic Growth in Jamaica FinalBrandon KnightNo ratings yet

- Shree Cement 2Document100 pagesShree Cement 2vikassharma958100% (1)

- SBI Cards IPO Note PDFDocument1 pageSBI Cards IPO Note PDFchaltrikNo ratings yet

- RTP June 2018 QnsDocument14 pagesRTP June 2018 QnsbinuNo ratings yet

- B - Fund - Acc - 1 & 2Document248 pagesB - Fund - Acc - 1 & 2newaybeyene5No ratings yet

- Ubs Equity Style Investing Growth On SaleDocument10 pagesUbs Equity Style Investing Growth On SaleSusan LaskoNo ratings yet

- Financial Management Full NotesDocument30 pagesFinancial Management Full Notessaadsaaid0% (1)

- Issue of SharesDocument14 pagesIssue of SharesSenelwa AnayaNo ratings yet

- Horngren ch03 PDFDocument40 pagesHorngren ch03 PDFNaveed Mughal AcmaNo ratings yet

- My Mkt624 Quiz 3 File by SobanDocument6 pagesMy Mkt624 Quiz 3 File by SobanMuhammad SobanNo ratings yet

- IFRS Edition-2nd: Conceptual Framework For Financial ReportingDocument30 pagesIFRS Edition-2nd: Conceptual Framework For Financial ReportingAhmed SroorNo ratings yet

- By Laws Stock CorporationDocument10 pagesBy Laws Stock CorporationPatrick BacongalloNo ratings yet

- Income Tax Summary TulibasDocument66 pagesIncome Tax Summary TulibasVan DahuyagNo ratings yet

- Reason-Rupe April 2014 National Telephone PollDocument10 pagesReason-Rupe April 2014 National Telephone PollEmily McClintock EkinsNo ratings yet

- Demand and Supply ReviewerDocument6 pagesDemand and Supply ReviewerArlene DaroNo ratings yet

- AFA1-3C - Assignment 2Document10 pagesAFA1-3C - Assignment 2Segarambal MasilamoneyNo ratings yet

- Chapter 5 Double Entry Bookkeeping For A Service ProviderDocument8 pagesChapter 5 Double Entry Bookkeeping For A Service ProviderPaw Verdillo100% (1)

- CorporationDocument225 pagesCorporationhbacolod70100% (1)

- QUIZ in AUDIT OF SHAREHOLDERS EQUITYDocument2 pagesQUIZ in AUDIT OF SHAREHOLDERS EQUITYLugh Tuatha DeNo ratings yet

- Partnership - Case Digests (Thyrz)Document15 pagesPartnership - Case Digests (Thyrz)Pearl Angeli Quisido CanadaNo ratings yet

- Declaration of Roy Thomas Mould in Support of Special Motion To Strike The ComplaintDocument25 pagesDeclaration of Roy Thomas Mould in Support of Special Motion To Strike The Complaintmarket-abuseNo ratings yet

- Gulf Capital: The Case For Middle Market Structured CapitalDocument8 pagesGulf Capital: The Case For Middle Market Structured CapitalAgeNo ratings yet

- FA MCQ On PrinciplesDocument9 pagesFA MCQ On Principlestiwariarad100% (1)

- Denver City Council Bill 625Document26 pagesDenver City Council Bill 625Michael_Lee_RobertsNo ratings yet

- Macabacus Fundamentals Demo - BlankDocument16 pagesMacabacus Fundamentals Demo - BlankSaleh Raouf100% (1)

- Financial Management:: Stock ValuationDocument57 pagesFinancial Management:: Stock ValuationSarah SaluquenNo ratings yet

- The Consolidated Statement of Financial Position For Mic As atDocument1 pageThe Consolidated Statement of Financial Position For Mic As atTaimur TechnologistNo ratings yet