Professional Documents

Culture Documents

Transaction Slip

Transaction Slip

Uploaded by

Cavikram JainCopyright:

Available Formats

You might also like

- ENtrepreneurship Multiple Choice QuestionsDocument24 pagesENtrepreneurship Multiple Choice Questionsashish_phad88% (103)

- Indian Bank RTGS FormDocument1 pageIndian Bank RTGS Formbharathtp60% (47)

- Practice Exercis1Document1 pagePractice Exercis1Joana TrinidadNo ratings yet

- Summer Internship Program Project Proposal: Name: Probal Sarkar Enrollment No.: 10BSPHH010896 Mobile No.: 8017494214Document4 pagesSummer Internship Program Project Proposal: Name: Probal Sarkar Enrollment No.: 10BSPHH010896 Mobile No.: 8017494214Probal Sarkar50% (2)

- Email FormDocument2 pagesEmail Formajaynigam25No ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- Transaction Slip: E-154428 ARN-110547Document1 pageTransaction Slip: E-154428 ARN-110547Money Manager OnlineNo ratings yet

- CTF BlankDocument1 pageCTF BlankMoney Manager OnlineNo ratings yet

- Sip Multiple FormDocument2 pagesSip Multiple FormAmit SharmaNo ratings yet

- HDFC Sip CancellationDocument1 pageHDFC Sip CancellationMaluNo ratings yet

- Common Transaction FormDocument2 pagesCommon Transaction FormKamleshNo ratings yet

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- 1710494246-ITI MF Change of Tax Status FormDocument2 pages1710494246-ITI MF Change of Tax Status FormKaushalNo ratings yet

- Resident To Nro Conversion FormDocument3 pagesResident To Nro Conversion FormAbhiruchiNo ratings yet

- Mirae Asset MF Common & SIPDocument5 pagesMirae Asset MF Common & SIPMadhu SudhananNo ratings yet

- Transaction Form: Sole/First Unit Holder PANDocument2 pagesTransaction Form: Sole/First Unit Holder PANSilparajaNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/Otherseenasrinivas113No ratings yet

- Sip Registration Mandate Form ICICIDocument2 pagesSip Registration Mandate Form ICICIManish SinhaNo ratings yet

- Common Transaction FormDocument2 pagesCommon Transaction FormSuhasNo ratings yet

- Commen Trasaction FormDocument1 pageCommen Trasaction Formsandip vishwakarmaNo ratings yet

- Term Deposit Related RequestsDocument2 pagesTerm Deposit Related Requestskumar281472No ratings yet

- Kotak Mahindra Bank Rtgs Neft FormDocument1 pageKotak Mahindra Bank Rtgs Neft Formlandb1No ratings yet

- JM Finance MF - Sip NachDocument1 pageJM Finance MF - Sip NacharunimaapkNo ratings yet

- Application Form STP / SWP: Distributor InformationDocument1 pageApplication Form STP / SWP: Distributor InformationSatya Prakash TrivediNo ratings yet

- Comprehensive Portfolio Management Services: State Bank of IndiaDocument13 pagesComprehensive Portfolio Management Services: State Bank of IndiaGreen Sustain EnergyNo ratings yet

- Zero Only: Application For Funds Transfer Under Rtgs/NeftDocument1 pageZero Only: Application For Funds Transfer Under Rtgs/NeftHemanth KumarNo ratings yet

- KotakDocument2 pagesKotakRandhir RanaNo ratings yet

- Systematic Investment Plan S I P: SIP Enrolment FormDocument4 pagesSystematic Investment Plan S I P: SIP Enrolment FormRahul SinghNo ratings yet

- NACH V1.3 - 29122017 - For Preferred DateDocument2 pagesNACH V1.3 - 29122017 - For Preferred DateMadhumita DuttaNo ratings yet

- Term Deposit Related Requests FormDocument2 pagesTerm Deposit Related Requests Formmabu5No ratings yet

- Service Request FormDocument2 pagesService Request FormRS Consultants100% (1)

- UTI - New Editable Transaction Application Form For Purchase Redemption and SwitchDocument2 pagesUTI - New Editable Transaction Application Form For Purchase Redemption and SwitchAnilmohan Sreedharan0% (1)

- Common Transaction Form: First Unitholder Second Unitholder Third UnitholderDocument1 pageCommon Transaction Form: First Unitholder Second Unitholder Third UnitholderKailash VijayvargiaNo ratings yet

- Systematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationDocument2 pagesSystematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationAnonymous MAQrYFQDzVNo ratings yet

- NEFT MandateDocument1 pageNEFT MandateAyan ParuiNo ratings yet

- Common Transaction Form Financial Transaction Kk3i5z51Document8 pagesCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNo ratings yet

- Reliance SIP AutoDebit FormDocument2 pagesReliance SIP AutoDebit FormsurajsroyNo ratings yet

- One Time Mandate FormDocument4 pagesOne Time Mandate FormAshishNo ratings yet

- 1702642454-Common Transaction Form Dec 2023Document2 pages1702642454-Common Transaction Form Dec 2023KaushalNo ratings yet

- Auto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Document2 pagesAuto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Dhruv SekhriNo ratings yet

- Enrolment Form For SIP/ Micro SIPDocument4 pagesEnrolment Form For SIP/ Micro SIPmeatulNo ratings yet

- SBI MF SIP ECS FormDocument1 pageSBI MF SIP ECS FormSHIRISH1973No ratings yet

- Neft Form.Document1 pageNeft Form.Amit AroraNo ratings yet

- Pay-Out Request Form Ver1.1Document2 pagesPay-Out Request Form Ver1.1Mahendra AsawaleNo ratings yet

- Common Transaction Slip 12 06 2017 PDFDocument3 pagesCommon Transaction Slip 12 06 2017 PDFvenkatnimmsNo ratings yet

- Term Deposit FormDocument2 pagesTerm Deposit FormVishnu VNo ratings yet

- Sip Enrolment FormDocument1 pageSip Enrolment FormYankit SoniNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherVIkashNo ratings yet

- Resident To Nro Conversion FormDocument2 pagesResident To Nro Conversion Formsagaralva7373No ratings yet

- Allahabad Bank RtgsDocument1 pageAllahabad Bank Rtgsmeraj alamNo ratings yet

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocument2 pages(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- Fixed Deposit FormDocument2 pagesFixed Deposit FormNikita JainNo ratings yet

- Sip Enrollment DetailsDocument2 pagesSip Enrollment DetailsDBCGNo ratings yet

- Account Opening FormDocument22 pagesAccount Opening FormTarun BhardwajNo ratings yet

- Common Transaction FormDocument7 pagesCommon Transaction FormSSE CNCNo ratings yet

- Rtgs and Neft FormDocument1 pageRtgs and Neft FormAmruta patilNo ratings yet

- LATESTNRI Scheme CIF Conversion Cum Upgrade-DowngradeLATESTDocument1 pageLATESTNRI Scheme CIF Conversion Cum Upgrade-DowngradeLATESTemailmetomymailNo ratings yet

- Yes Bank Rtgs FormDocument1 pageYes Bank Rtgs Formsaurabh100% (2)

- DCB Neft FormDocument1 pageDCB Neft Formsandeeppatil22No ratings yet

- Reliance Mutual Funds Compelete Application FormDocument10 pagesReliance Mutual Funds Compelete Application FormARVINDNo ratings yet

- Shubharambh SIP TISDocument2 pagesShubharambh SIP TISirfan_bsnlNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Investors: 169 Lackawanna Avenue, Parsippany, NJDocument37 pagesInvestors: 169 Lackawanna Avenue, Parsippany, NJamitkumarnamaNo ratings yet

- Terminal Cash FlowDocument9 pagesTerminal Cash FlowKazzandraEngallaPaduaNo ratings yet

- JD RM CampusDocument5 pagesJD RM CampusSayantika BeraNo ratings yet

- FSDR 2021Document209 pagesFSDR 2021Austin DeneanNo ratings yet

- Bhavya Lall - MACR MinorDocument6 pagesBhavya Lall - MACR MinorBhavya LallNo ratings yet

- Comparative Statement Analysis of Select Paint PDFDocument8 pagesComparative Statement Analysis of Select Paint PDFMerajud DinNo ratings yet

- Ch01. Intro. To Financial ManagementDocument16 pagesCh01. Intro. To Financial ManagementSHAFA SAJIDANo ratings yet

- Assigment Account FullDocument16 pagesAssigment Account FullFaid AmmarNo ratings yet

- ACRON HELVETIA VII Verkaufsbroschuere EnglischDocument84 pagesACRON HELVETIA VII Verkaufsbroschuere EnglischpierrefrancNo ratings yet

- Aptitude - Bankers-DiscountDocument6 pagesAptitude - Bankers-DiscountsatyaNo ratings yet

- Solution Manual For Advanced Accounting 4th Edition Jeter, ChaneyDocument7 pagesSolution Manual For Advanced Accounting 4th Edition Jeter, ChaneyAlif Nurjanah0% (2)

- Corporate BondDocument9 pagesCorporate BondAJ SerbolNo ratings yet

- Chapter 12Document31 pagesChapter 12REEMA BNo ratings yet

- Average Return Sum of Returns/Number of ReturnsDocument3 pagesAverage Return Sum of Returns/Number of ReturnsHoàng Anh NguyễnNo ratings yet

- Acct 2251 Enlarged Review Qs Final ExamW07Document9 pagesAcct 2251 Enlarged Review Qs Final ExamW07hatanolove100% (1)

- Option Chain Part-3Document3 pagesOption Chain Part-3ramyatan SinghNo ratings yet

- LEAP OfferingsDocument42 pagesLEAP Offeringssanaa.kanjianiNo ratings yet

- BACHRACH Vs Seifert G.R. No. L-2659Document1 pageBACHRACH Vs Seifert G.R. No. L-2659Val UyNo ratings yet

- Adv Excel Practice 5 PageSetup 04nov2023Document1 pageAdv Excel Practice 5 PageSetup 04nov2023Sakshi Marwah ChamolaNo ratings yet

- Accounting For Investment in Associates (Part 4) : Helping Our Clients Increase ValueDocument2 pagesAccounting For Investment in Associates (Part 4) : Helping Our Clients Increase ValueNguyen Binh MinhNo ratings yet

- PHMBWWdTQKpWgkF8LNtH The Extraordinary Crypto OpportunityDocument18 pagesPHMBWWdTQKpWgkF8LNtH The Extraordinary Crypto OpportunityEKart. clubNo ratings yet

- The Abraaj Group Partners With Leading Turkish Logistics Company Netlog 1 2Document4 pagesThe Abraaj Group Partners With Leading Turkish Logistics Company Netlog 1 2AhmedNo ratings yet

- Conceptual Frame WorkDocument62 pagesConceptual Frame WorkKavyaNo ratings yet

- Chapter 10Document20 pagesChapter 10Fernando III PerezNo ratings yet

- Note On Leveraged BuyoutDocument2 pagesNote On Leveraged BuyoutTamim HasanNo ratings yet

- Tutorial 7: Capital Budgeting and Valuation With Leverage: Alter The Firm's Debt-Equity RatioDocument8 pagesTutorial 7: Capital Budgeting and Valuation With Leverage: Alter The Firm's Debt-Equity RatioYovna SarayeNo ratings yet

- Capital Asset Pricing Model (Ch-6)Document15 pagesCapital Asset Pricing Model (Ch-6)Neha SinghNo ratings yet

Transaction Slip

Transaction Slip

Uploaded by

Cavikram JainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transaction Slip

Transaction Slip

Uploaded by

Cavikram JainCopyright:

Available Formats

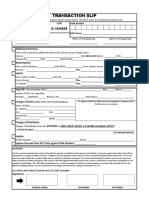

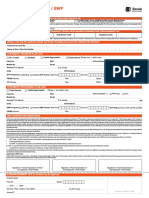

Reliance Capital Asset Management Limited

A Reliance Capital Company

APP No.:

TRANSACTION SLIP

Please use separate transaction slip for each scheme. This Form is for use of Existing Investors only. To be filled in CAPITAL LETTERS

DISTRIBUTOR / BROKER INFORMATION Folio/Account No:

Name & Broker Code / ARN Sub Broker / Sub Agent Code Upfront commission shall be paid directly by the investor to the AMFI

registered Distributors based on the investors' assessment of various

factors including the service rendered by the distributor

Investor Details

Name of First / Sole applicant [Are you KYC Compliant Please ( ) Yes or No ] PAN No.

Name of Guardian (In case of Minor) [Are you KYC Compliant Please ( ) Yes or No ] PAN No.

Name of Second Applicant [Are you KYC Compliant Please ( ) Yes or No ] PAN No.

Name of Third Applicant [Are you KYC Compliant Please ( ) Yes or No ] PAN No.

Additional Purchase

Cheque/ DD No. Cheque/ DD Date DD Charge Rs. Cheque/ DD Net Amount Rs.

Bank Name: Branch: City

Scheme Plan Option

Redemption

Amount: Rs or Units: or All Units

Scheme Plan Option

Switch

Amount: Rs or Units: or All Units

From Scheme Plan Option

To Scheme Plan Option

Change of Address ((With effect from Feburary 1, 2008, Change of address request has to be submitted at POS of CVL using “KYC Details Changes” Form, If you are KYC compliant)

Add1

Add2 City

District State PIN*

Tel. No. STD Code Office Residence Fax Mobile

Email Communication

E-mail I N B L O C K L E T T E R S

Investors providing Email Id would mandatorily receive only E - Statement of Accounts in lieu of physical Statement of Accounts.

Change of Bank Details (Please attach Old & New Bank Proof as per Addendum No. 64)

Bank Account No: A/c Type SB CA NRE NRO FCNR

Bank Name:

Branch & Address:

City PIN* 9 Digit MICR No. M a n d a t o r y

IFSC/NEFT Code Payable City:

PAN & KYC Updation (Please Tick) Photocopy(ies) of PAN Card(s) Submited herewith Photocopy(ies) of KYC letter(s) enclosed herewith

Disclaimer

I/We would like to invest in Reliance_____________________________subject to terms of the Statement of Additional Information (SAI) and Scheme Information Document (SID) and

subsequent amendments thereto. I/We have read, understood (before filling application form) and is/are bound to the details of the SAI and SID including details relating to various services

including but not limited to ATM/ Debit Card. I/We have not received nor been induced by any rebate or gifts, directly or indirectly, in making this investment. I accept and agree to be bound by

the said Terms and Conditions including those excluding/ limiting the Reliance Capital Asset Managements Limited (RCAM) liability. I understand that the RCAM may, at its absolute discretion,

discontinue any of the services completely or partially without any prior notice to me. I agree RCAM can debit from my folio for the service charges as applicable from time to time. The ARN

holder has disclosed to me/us all the commissions (in the form of trail commission or any other mode), payable to him for the different competing Schemes of various Mutual Funds from amongst

which the Scheme is being recommended to me/us. I hereby declare that the above information is given by the undersigned and particulars given by me/us are correct and complete. Applicable

for NRI Investors: I confirm that I am resident of India. I/We confirm that I am/We are Non-Resident of Indian Nationality/Origin and I/We hereby confirm that the funds for subscription have

been remitted from abroad through normal banking channels or from funds in my/our Non-Resident External / Ordinary Account/FCNR Account. I/We undertake that all additional purchases

made under this folio will also be from funds received from abroad through approved banking channels or from funds in my/ our NRE/FCNR Account.

SIGNATURE/S

Sole / 1st applicant/Guardian/ Authorised Signatory 2nd applicant 3rd applicant

ACKNOWLEDGEMENT SLIP (To be filled by the investor)

Folio/Account No:

Received from Mr./Mrs.

Additional Purchase Redemption Switch Change of Address Change of Bank Account PAN & KYC Updation Email Communication

INSTRUCTIONS

1. Please read the Scheme Information Document (SID) and Statement of compliance may be rejected. Provided further, where it is not possible to

Additional Information (SAI) carefully before investing / switching to other verify the KYC Compliance status of the investor at the time of allotment

schemes for risk factors & terms applicable to Schemes / Plans. of units, the Trustee/AMC shall verify the KYC compliance status of the

2. For additional purchase, the cheque / Demand Draft should be drawn in investor within a reasonable time after the allotment of units. In the

favour of the name of the scheme (e.g. Reliance Equity Fund) and crossed A/c event of non compliance of KYC requirements, the Trustee/AMC reserves

Payee and payable locally at the place of the ISC, where the application is the right to freeze the folio of the investor(s) and affect mandatory

being submitted. Outstation cheque / DD will not be accepted. redemption of unit holdings of the investors at the applicable NAV, subject

If the Scheme name on the application form and on the cheque is different,

to payment of exit load, if any.All investors (both individual and non-

then the units will be alloted as per the Scheme name mentioned in the

individual) can apply for KYC compliance. However, applications should

application form.

note that minors cannot apply for KYC compliance and any investment in

PAYMENT BY CASH IS NOT PERMITTED.

the name of minors should be through a Guardian, who should be KYC

3. In case of multiple holders, the dividend (where applicable) & redemption compliant for the purpose of investing with a Mutual Fund. Also

amount, will be paid to the first units holder. applicants/ unit holders intending, to apply for units currently holding

4. BANK DETAILS: units and operating their Mutual Fund folios through a Power of Attorney

As per the SEBI guidelines, it is mandatory for investors to mention their bank (PoA) must ensure that the issue of PoA and the holder of the PoA must

account details in the application form. In the absence of the bank details the mention their KYC compliance status at the time of investment, if such

application form will be rejected. Wherever possible / availability of investment(s) are above the prescribed threshold limit.PoA holders are not

electronic credit service, RMF will give instruction to the investor’s bank for permitted to apply for KYC compliance on behalf of the issuer of the PoA,

direct / electronic credit for dividend / redemption payments and such Separate procedures are prescribed for change in name, address, and other

instructions will be adequate discharge of RMF towards the said payment. In KYC related details, should the applicant desire to change such

case the credit is not affected by the unitholder’s banker for any reason RMF

information, POS will extend the services of effecting such changes.*

reserves the right to make the payment by a cheque / DD, in case it is not

Valid only where investors who have already obtained the erstwhile

possible to make the payment through electronic credit. If the electronic

credit is delayed or not affected or credited to a wrong account, on account of Mutual Fund Identification Number (MIN) by submitting the PAN copy as

incomplete or incorrect information, RMF will not be held responsible. Please the proof of identity.For details on “Prevention of Money Laundering &

provide the MICR Code/IFSC code on the right bottom of your Cheque for us Know Your Customer” please refer to SAI and SID.

to help you in future for ECS/NEFT credit of dividend and redemption payout. 8. Communication for the investors.

5. DIRECT CREDIT OF REDEMPTION / DIVIDEND PROCEEDS / REFUND - IF If the investor(s) has/have provided his/their email address in the

ANY RMF will endeavour to provide payment of Dividend / Redemption / application form or any subsequent communication in any of the folio

Refund(If any) through ECS,NEFT, Cheque, Demand Draft or Direct Credit into belonging to the investor(s), RMF / Asset Management Company reserves

investors bank account wherever possible.

the right to use Electronic Mail (email) as a default mode to send various

6. Permanent Account Number (PAN) communication which include account statements for transactions done

As per SEBI circular number MRD/DoP/Cir- 05/2007 dated April 27, 2007, by the investor(s).

PAN shall be the sole identification number for all participants transacting in The investor(s) may request for a physical account statement by writing or

the securities market, irrespective of the amount of transaction w.e.f. July 2, calling RMF's Investor Service Center/ Registrar & Transfer Agent. In case

2007. of specific request received from the investor(s), RMF shall endeavor to

Accordingly, it is mandatory for investor’s to provide their PAN alongwith a provide the account statement to the investor(s) within 5 working days

self attested copy of PAN card. from the receipt of such request. RMF shall comply with SEBI Circular No.

If the investment is being made on behalf of a minor, the PAN of the minor or IMD/CIR/12/80083/2006 dates November 20, 2006 with respect to

father or mother or the guardian, who represents the minor, should be dispatch of the account statement.

provided.

9. The Fund may close an investor’s account and the units will be redeemed

Applications received without PAN/PAN card copy will be rejected. at applicable NAV, if the balance falls below the minium prescribed limits

Note: Pursuant to SEBI letter dated June 19, 2009 addressed to AMFI, and in as per SAI and SID or if the Plan fails to fulfill SEBI Requlations viz., Each

compliance with AMFI Guidelines dated July 14, 2009 , investment in Micro Scheme / Plan should have a minimum of 20 investors and no single

Schemes such as Systematic Investment Plan (SIP) where aggregate of investor should account for more than 25% of the corpus of such Scheme

installments in a rolling 12 months period or in a financial year i.e. April to / Plan All further communication in connection with these units should be

March does not exceed Rs 50,000 per year per investor ( hereinafter referred

addressed to the Registrar, quoting scheme name and Folio / Account

as "Micro SIP"), will be exempted from the requirement of Permanent

Number at the following address.

Account Number (PAN) with effect from August 01, 2009.

Karvy Computershare Pvt. Ltd., Municipal No 1-9/13/C, Plot No. 13 &

Investors may please note that this transaction slip is not applicable for

investments in Micro SIP. 13 C, Survey No.74 & 75, Madhapur Village, Serlingampally Mandal &

Municipality, R.R. District, Hyderabad, Andhra Pradesh 500 081.

7. Prevention of Money Laundering & Know Your Customer (KYC): W.e.f 01st

Tel - 040-44338100 Fax: 040-23394828 Website:

Feb 2008 it is mandatory for all applications for subscription of value of

Rs.50,000/- above to quote the KYC Compliance Status of each applicant www.reliancemutual.com,

(guardian in case of minor) in the application for subscriptionand attach proof E-mail: customer_care@reliancemutual.com,

of KYC Compliance viz. KYC Acknowledgement Letter (or the erstwhile Call: Toll free 1800-300-11111 or 30301111

Mutual Fund * Prefix the STD code of your city, if you are calling from a Mobile Phone.

Identification Number* (MIN) Allotment Letter). The KYC Status will be * If you are calling from a MTNL or BSNL phone lines,

validated with the records of the Central Agency before allotting the units. Please dial 022-30301111

Reliance Mutual Fund will not be held responsible and /or liable for

rejection of KYC Form, if any, by the Central Agency. Applications for

subscriptions of Value of Rs. 50,000/- and above without a valid KYC

Ver.1.0/01/10/09

ACKNOWLEDGMENT SLIP (To be filled in by the Applicant)

11th floor & 12th floor, One Indiabulls Centre, Tower 1, Jupiter Mills Compound,

841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Tollfree: 1800-300-11111 | www.reliancemutual.com

You might also like

- ENtrepreneurship Multiple Choice QuestionsDocument24 pagesENtrepreneurship Multiple Choice Questionsashish_phad88% (103)

- Indian Bank RTGS FormDocument1 pageIndian Bank RTGS Formbharathtp60% (47)

- Practice Exercis1Document1 pagePractice Exercis1Joana TrinidadNo ratings yet

- Summer Internship Program Project Proposal: Name: Probal Sarkar Enrollment No.: 10BSPHH010896 Mobile No.: 8017494214Document4 pagesSummer Internship Program Project Proposal: Name: Probal Sarkar Enrollment No.: 10BSPHH010896 Mobile No.: 8017494214Probal Sarkar50% (2)

- Email FormDocument2 pagesEmail Formajaynigam25No ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- Transaction Slip: E-154428 ARN-110547Document1 pageTransaction Slip: E-154428 ARN-110547Money Manager OnlineNo ratings yet

- CTF BlankDocument1 pageCTF BlankMoney Manager OnlineNo ratings yet

- Sip Multiple FormDocument2 pagesSip Multiple FormAmit SharmaNo ratings yet

- HDFC Sip CancellationDocument1 pageHDFC Sip CancellationMaluNo ratings yet

- Common Transaction FormDocument2 pagesCommon Transaction FormKamleshNo ratings yet

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- 1710494246-ITI MF Change of Tax Status FormDocument2 pages1710494246-ITI MF Change of Tax Status FormKaushalNo ratings yet

- Resident To Nro Conversion FormDocument3 pagesResident To Nro Conversion FormAbhiruchiNo ratings yet

- Mirae Asset MF Common & SIPDocument5 pagesMirae Asset MF Common & SIPMadhu SudhananNo ratings yet

- Transaction Form: Sole/First Unit Holder PANDocument2 pagesTransaction Form: Sole/First Unit Holder PANSilparajaNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/Otherseenasrinivas113No ratings yet

- Sip Registration Mandate Form ICICIDocument2 pagesSip Registration Mandate Form ICICIManish SinhaNo ratings yet

- Common Transaction FormDocument2 pagesCommon Transaction FormSuhasNo ratings yet

- Commen Trasaction FormDocument1 pageCommen Trasaction Formsandip vishwakarmaNo ratings yet

- Term Deposit Related RequestsDocument2 pagesTerm Deposit Related Requestskumar281472No ratings yet

- Kotak Mahindra Bank Rtgs Neft FormDocument1 pageKotak Mahindra Bank Rtgs Neft Formlandb1No ratings yet

- JM Finance MF - Sip NachDocument1 pageJM Finance MF - Sip NacharunimaapkNo ratings yet

- Application Form STP / SWP: Distributor InformationDocument1 pageApplication Form STP / SWP: Distributor InformationSatya Prakash TrivediNo ratings yet

- Comprehensive Portfolio Management Services: State Bank of IndiaDocument13 pagesComprehensive Portfolio Management Services: State Bank of IndiaGreen Sustain EnergyNo ratings yet

- Zero Only: Application For Funds Transfer Under Rtgs/NeftDocument1 pageZero Only: Application For Funds Transfer Under Rtgs/NeftHemanth KumarNo ratings yet

- KotakDocument2 pagesKotakRandhir RanaNo ratings yet

- Systematic Investment Plan S I P: SIP Enrolment FormDocument4 pagesSystematic Investment Plan S I P: SIP Enrolment FormRahul SinghNo ratings yet

- NACH V1.3 - 29122017 - For Preferred DateDocument2 pagesNACH V1.3 - 29122017 - For Preferred DateMadhumita DuttaNo ratings yet

- Term Deposit Related Requests FormDocument2 pagesTerm Deposit Related Requests Formmabu5No ratings yet

- Service Request FormDocument2 pagesService Request FormRS Consultants100% (1)

- UTI - New Editable Transaction Application Form For Purchase Redemption and SwitchDocument2 pagesUTI - New Editable Transaction Application Form For Purchase Redemption and SwitchAnilmohan Sreedharan0% (1)

- Common Transaction Form: First Unitholder Second Unitholder Third UnitholderDocument1 pageCommon Transaction Form: First Unitholder Second Unitholder Third UnitholderKailash VijayvargiaNo ratings yet

- Systematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationDocument2 pagesSystematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationAnonymous MAQrYFQDzVNo ratings yet

- NEFT MandateDocument1 pageNEFT MandateAyan ParuiNo ratings yet

- Common Transaction Form Financial Transaction Kk3i5z51Document8 pagesCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNo ratings yet

- Reliance SIP AutoDebit FormDocument2 pagesReliance SIP AutoDebit FormsurajsroyNo ratings yet

- One Time Mandate FormDocument4 pagesOne Time Mandate FormAshishNo ratings yet

- 1702642454-Common Transaction Form Dec 2023Document2 pages1702642454-Common Transaction Form Dec 2023KaushalNo ratings yet

- Auto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Document2 pagesAuto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Dhruv SekhriNo ratings yet

- Enrolment Form For SIP/ Micro SIPDocument4 pagesEnrolment Form For SIP/ Micro SIPmeatulNo ratings yet

- SBI MF SIP ECS FormDocument1 pageSBI MF SIP ECS FormSHIRISH1973No ratings yet

- Neft Form.Document1 pageNeft Form.Amit AroraNo ratings yet

- Pay-Out Request Form Ver1.1Document2 pagesPay-Out Request Form Ver1.1Mahendra AsawaleNo ratings yet

- Common Transaction Slip 12 06 2017 PDFDocument3 pagesCommon Transaction Slip 12 06 2017 PDFvenkatnimmsNo ratings yet

- Term Deposit FormDocument2 pagesTerm Deposit FormVishnu VNo ratings yet

- Sip Enrolment FormDocument1 pageSip Enrolment FormYankit SoniNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherVIkashNo ratings yet

- Resident To Nro Conversion FormDocument2 pagesResident To Nro Conversion Formsagaralva7373No ratings yet

- Allahabad Bank RtgsDocument1 pageAllahabad Bank Rtgsmeraj alamNo ratings yet

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocument2 pages(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- Fixed Deposit FormDocument2 pagesFixed Deposit FormNikita JainNo ratings yet

- Sip Enrollment DetailsDocument2 pagesSip Enrollment DetailsDBCGNo ratings yet

- Account Opening FormDocument22 pagesAccount Opening FormTarun BhardwajNo ratings yet

- Common Transaction FormDocument7 pagesCommon Transaction FormSSE CNCNo ratings yet

- Rtgs and Neft FormDocument1 pageRtgs and Neft FormAmruta patilNo ratings yet

- LATESTNRI Scheme CIF Conversion Cum Upgrade-DowngradeLATESTDocument1 pageLATESTNRI Scheme CIF Conversion Cum Upgrade-DowngradeLATESTemailmetomymailNo ratings yet

- Yes Bank Rtgs FormDocument1 pageYes Bank Rtgs Formsaurabh100% (2)

- DCB Neft FormDocument1 pageDCB Neft Formsandeeppatil22No ratings yet

- Reliance Mutual Funds Compelete Application FormDocument10 pagesReliance Mutual Funds Compelete Application FormARVINDNo ratings yet

- Shubharambh SIP TISDocument2 pagesShubharambh SIP TISirfan_bsnlNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Investors: 169 Lackawanna Avenue, Parsippany, NJDocument37 pagesInvestors: 169 Lackawanna Avenue, Parsippany, NJamitkumarnamaNo ratings yet

- Terminal Cash FlowDocument9 pagesTerminal Cash FlowKazzandraEngallaPaduaNo ratings yet

- JD RM CampusDocument5 pagesJD RM CampusSayantika BeraNo ratings yet

- FSDR 2021Document209 pagesFSDR 2021Austin DeneanNo ratings yet

- Bhavya Lall - MACR MinorDocument6 pagesBhavya Lall - MACR MinorBhavya LallNo ratings yet

- Comparative Statement Analysis of Select Paint PDFDocument8 pagesComparative Statement Analysis of Select Paint PDFMerajud DinNo ratings yet

- Ch01. Intro. To Financial ManagementDocument16 pagesCh01. Intro. To Financial ManagementSHAFA SAJIDANo ratings yet

- Assigment Account FullDocument16 pagesAssigment Account FullFaid AmmarNo ratings yet

- ACRON HELVETIA VII Verkaufsbroschuere EnglischDocument84 pagesACRON HELVETIA VII Verkaufsbroschuere EnglischpierrefrancNo ratings yet

- Aptitude - Bankers-DiscountDocument6 pagesAptitude - Bankers-DiscountsatyaNo ratings yet

- Solution Manual For Advanced Accounting 4th Edition Jeter, ChaneyDocument7 pagesSolution Manual For Advanced Accounting 4th Edition Jeter, ChaneyAlif Nurjanah0% (2)

- Corporate BondDocument9 pagesCorporate BondAJ SerbolNo ratings yet

- Chapter 12Document31 pagesChapter 12REEMA BNo ratings yet

- Average Return Sum of Returns/Number of ReturnsDocument3 pagesAverage Return Sum of Returns/Number of ReturnsHoàng Anh NguyễnNo ratings yet

- Acct 2251 Enlarged Review Qs Final ExamW07Document9 pagesAcct 2251 Enlarged Review Qs Final ExamW07hatanolove100% (1)

- Option Chain Part-3Document3 pagesOption Chain Part-3ramyatan SinghNo ratings yet

- LEAP OfferingsDocument42 pagesLEAP Offeringssanaa.kanjianiNo ratings yet

- BACHRACH Vs Seifert G.R. No. L-2659Document1 pageBACHRACH Vs Seifert G.R. No. L-2659Val UyNo ratings yet

- Adv Excel Practice 5 PageSetup 04nov2023Document1 pageAdv Excel Practice 5 PageSetup 04nov2023Sakshi Marwah ChamolaNo ratings yet

- Accounting For Investment in Associates (Part 4) : Helping Our Clients Increase ValueDocument2 pagesAccounting For Investment in Associates (Part 4) : Helping Our Clients Increase ValueNguyen Binh MinhNo ratings yet

- PHMBWWdTQKpWgkF8LNtH The Extraordinary Crypto OpportunityDocument18 pagesPHMBWWdTQKpWgkF8LNtH The Extraordinary Crypto OpportunityEKart. clubNo ratings yet

- The Abraaj Group Partners With Leading Turkish Logistics Company Netlog 1 2Document4 pagesThe Abraaj Group Partners With Leading Turkish Logistics Company Netlog 1 2AhmedNo ratings yet

- Conceptual Frame WorkDocument62 pagesConceptual Frame WorkKavyaNo ratings yet

- Chapter 10Document20 pagesChapter 10Fernando III PerezNo ratings yet

- Note On Leveraged BuyoutDocument2 pagesNote On Leveraged BuyoutTamim HasanNo ratings yet

- Tutorial 7: Capital Budgeting and Valuation With Leverage: Alter The Firm's Debt-Equity RatioDocument8 pagesTutorial 7: Capital Budgeting and Valuation With Leverage: Alter The Firm's Debt-Equity RatioYovna SarayeNo ratings yet

- Capital Asset Pricing Model (Ch-6)Document15 pagesCapital Asset Pricing Model (Ch-6)Neha SinghNo ratings yet