Professional Documents

Culture Documents

Pakistan Market Statistics - Apr13 2011

Pakistan Market Statistics - Apr13 2011

Uploaded by

Tughral HilalyCopyright:

Available Formats

You might also like

- Accounting Voucher PDFDocument2 pagesAccounting Voucher PDFVenky SamNo ratings yet

- JS Market Wrap Mar11 2020Document1 pageJS Market Wrap Mar11 2020Ali HasanNo ratings yet

- Pakistan Market Statistics - Jun16 2010Document1 pagePakistan Market Statistics - Jun16 2010Saqib YaseenNo ratings yet

- Js Market Wrap Js Market Wrap Js Market Wrap Js Market WrapDocument1 pageJs Market Wrap Js Market Wrap Js Market Wrap Js Market WrapSHAHZAIB -No ratings yet

- JPMorgan Chase & Co. (JPM) Stock Price, News, Quote & History - Yahoo FinanceDocument3 pagesJPMorgan Chase & Co. (JPM) Stock Price, News, Quote & History - Yahoo FinanceamirlinNo ratings yet

- Adani Green Share Price Live Today - Why Adani Green Share Price Is Falling by 5% Today - Adani Green Share Price Analysis - ETMarketsDocument7 pagesAdani Green Share Price Live Today - Why Adani Green Share Price Is Falling by 5% Today - Adani Green Share Price Analysis - ETMarketsUdar SubediNo ratings yet

- Jkload 2Document3 pagesJkload 2Jay OsloNo ratings yet

- Alfalah Fund Super Market: Analysis of Open-End FundsDocument2 pagesAlfalah Fund Super Market: Analysis of Open-End FundsadeelngNo ratings yet

- Ind Nifty CPSEDocument1 pageInd Nifty CPSEAnjalidevi TNo ratings yet

- ValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08Document4 pagesValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08pqwertyNo ratings yet

- Jkload 4Document3 pagesJkload 4Jay OsloNo ratings yet

- Fertilizer - Sector Update - GlobalDocument1 pageFertilizer - Sector Update - Globalmuddasir1980No ratings yet

- Jamna Auto Share Price, Jamna Auto Stock Price, JDocument2 pagesJamna Auto Share Price, Jamna Auto Stock Price, Jmuthu27989No ratings yet

- Key Performance Indicators - Friday, August 6, 2021Document10 pagesKey Performance Indicators - Friday, August 6, 2021Shan SNo ratings yet

- Oil and Gas Sector Update: SOGT Finally Awarded? - 01/09/2010Document3 pagesOil and Gas Sector Update: SOGT Finally Awarded? - 01/09/2010Rhb InvestNo ratings yet

- Weekly Stock Focus - 29102021Document10 pagesWeekly Stock Focus - 29102021Lafri AhmedNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Sahil SharmaNo ratings yet

- Kload 1Document3 pagesKload 1Jay OsloNo ratings yet

- ValueResearchFundcard JMCore11Fund DirectPlan 2017dec07Document4 pagesValueResearchFundcard JMCore11Fund DirectPlan 2017dec07Jayab JunkNo ratings yet

- ValueResearchFundcard RelianceTaxSaver 2010dec24Document6 pagesValueResearchFundcard RelianceTaxSaver 2010dec24Kumar DeepanshuNo ratings yet

- Kencana Petroleum Berhad: Follow Up - 23/6/2010Document2 pagesKencana Petroleum Berhad: Follow Up - 23/6/2010Rhb InvestNo ratings yet

- Canara Robeco Liquid RegularDocument4 pagesCanara Robeco Liquid RegularYogi173No ratings yet

- Jkload 5Document3 pagesJkload 5Jay OsloNo ratings yet

- Timber Sector - Japan Housing Starts Improved Due To Low Base Effect - 21/6/2010Document4 pagesTimber Sector - Japan Housing Starts Improved Due To Low Base Effect - 21/6/2010Rhb InvestNo ratings yet

- Value Research Fundcard SBI Small & Midcap Fund Direct Plan 2018 Mar 24Document4 pagesValue Research Fundcard SBI Small & Midcap Fund Direct Plan 2018 Mar 24hotalamNo ratings yet

- Top Stories:: ACEN: ACEN Acquires Solar Philippines Unit CEB: CEB Plans Start of Stock Rights Offering in FebDocument4 pagesTop Stories:: ACEN: ACEN Acquires Solar Philippines Unit CEB: CEB Plans Start of Stock Rights Offering in FebJajahinaNo ratings yet

- Daily Market Report: Surveillance, Supervision and Enforcement DepartmentDocument1 pageDaily Market Report: Surveillance, Supervision and Enforcement DepartmentĀżiżNo ratings yet

- ValueResearchFundcard ReligareContra 2010dec12Document6 pagesValueResearchFundcard ReligareContra 2010dec12Sivaraman SenapathiNo ratings yet

- ValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11Document4 pagesValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11asddsffdsfNo ratings yet

- Skyworks Solutions, Inc.: Price, Consensus & SurpriseDocument1 pageSkyworks Solutions, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Indices Other Stories:: FRI 23 DEC 2016Document3 pagesIndices Other Stories:: FRI 23 DEC 2016JajahinaNo ratings yet

- Top Stories:: WED 12 JULY 2017Document7 pagesTop Stories:: WED 12 JULY 2017JNo ratings yet

- Eastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Document3 pagesEastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Rhb InvestNo ratings yet

- Kotak Small Cap Fund - 20220201190020276Document1 pageKotak Small Cap Fund - 20220201190020276Kunal SinhaNo ratings yet

- Daily Market Update 21.01Document1 pageDaily Market Update 21.01Inde Pendent LkNo ratings yet

- Ind Nifty CPSEDocument1 pageInd Nifty CPSEPrabhakar DalviNo ratings yet

- Timber Sector Update: Positive Signs of Recovery-07/09/2010Document5 pagesTimber Sector Update: Positive Signs of Recovery-07/09/2010Rhb InvestNo ratings yet

- ValueResearchFundcard ICICIPrudentialGrowthInstI 2011mar14Document6 pagesValueResearchFundcard ICICIPrudentialGrowthInstI 2011mar14Ravindra MisalNo ratings yet

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNo ratings yet

- BHEL - Rock Solid - RBS - Jan2011Document8 pagesBHEL - Rock Solid - RBS - Jan2011Jitender KumarNo ratings yet

- Oil and Gas - Taking A More Cautious View - 10/6/2010Document9 pagesOil and Gas - Taking A More Cautious View - 10/6/2010Rhb InvestNo ratings yet

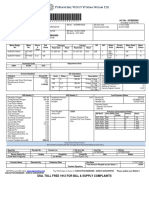

- Credit Note: (Original For Recipient)Document3 pagesCredit Note: (Original For Recipient)syamakantadasiNo ratings yet

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pagePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsVinayak ChaturvediNo ratings yet

- Oil and Gas Sector Update: Petronas' 1QFY11 Net Profit Up - 05/10/2010Document4 pagesOil and Gas Sector Update: Petronas' 1QFY11 Net Profit Up - 05/10/2010Rhb InvestNo ratings yet

- Portfolio - Home 15 OctoberDocument3 pagesPortfolio - Home 15 OctobermukeshinsaaNo ratings yet

- Timber: Prospects Are Looking Better-17/03/2010Document5 pagesTimber: Prospects Are Looking Better-17/03/2010Rhb InvestNo ratings yet

- Perhitungan Tingkat Diskonto Per Tanggal 26 April 2016: Boim (Ke We) + (KD WD) Ke KRF + Beta KM + SPDocument34 pagesPerhitungan Tingkat Diskonto Per Tanggal 26 April 2016: Boim (Ke We) + (KD WD) Ke KRF + Beta KM + SPIndra GunawanstNo ratings yet

- ValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Document4 pagesValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Chiman RaoNo ratings yet

- All RM PerformanceDocument9 pagesAll RM PerformancesoniaNo ratings yet

- Ind Nifty EnergyDocument2 pagesInd Nifty EnergySudarshan AgnihotriNo ratings yet

- Kayhian: Thailand DailyDocument5 pagesKayhian: Thailand Dailyapi-28341169No ratings yet

- SynopsisDocument1 pageSynopsisntkmistryNo ratings yet

- Top Story:: Consumer Sector: Consumer Companies Deliver Mixed Results in 1Q21Document9 pagesTop Story:: Consumer Sector: Consumer Companies Deliver Mixed Results in 1Q21JajahinaNo ratings yet

- Indonesia Daily: UpdateDocument7 pagesIndonesia Daily: UpdateyolandaNo ratings yet

- 28 Generation Cost April 2023Document1 page28 Generation Cost April 2023sinnyen.hengNo ratings yet

- Est 021645Document1 pageEst 021645astortech360No ratings yet

- ValueResearchFundcard AIGIndiaEquityReg 2011may02Document6 pagesValueResearchFundcard AIGIndiaEquityReg 2011may02Chetan SinhaNo ratings yet

- Top Story:: ACEN: Positives Already Priced In, Share Dilution To Drag Short-Term EPSDocument5 pagesTop Story:: ACEN: Positives Already Priced In, Share Dilution To Drag Short-Term EPSJajahinaNo ratings yet

- View PDFServletDocument1 pageView PDFServletriteshNo ratings yet

Pakistan Market Statistics - Apr13 2011

Pakistan Market Statistics - Apr13 2011

Uploaded by

Tughral HilalyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pakistan Market Statistics - Apr13 2011

Pakistan Market Statistics - Apr13 2011

Uploaded by

Tughral HilalyCopyright:

Available Formats

8 8 7.71 7.71 7.71 7.

71

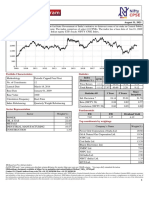

April 13, 2011

Pakistan PAKISTAN MARKET STATISTICS

Key Information Regarding Today's Market

JS Research

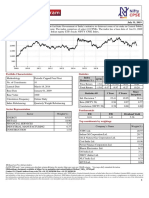

KSE - 100 Index Top Gainers in KSE-100 Price Price ∆ %∆ Open tstand April Contract

KSE-100 Index (Apr 13, 2011) 11,734.72 G Gharibwal Cement Ltd. 7.37 0.50 7.28% Interest h Today's Previous Today's Previous

Change from last closing (61.37) S Sui Northern Gas Ltd. 20.00 0.37 1.88% Details ol. al. Vol.(mn) Vol.(mn) Val.(mn) Val.(mn)

Change from last closing (%) -0.52% P Pace (Pak) Ltd. 3.49 0.06 1.75% POL-APR # # 1.29 1.32 419.92 427.94

YTD (Since Dec 31, 2010) -2.39% N New Jubilee Insurance Co. Ltd. 73.46 1.26 1.75% ENGRO-APR # # 1.12 1.04 228.21 212.29

12 Month High (Jan 17, 2011) 12,681.94 A Atlas Honda Limited 141.40 2.41 1.73% LUCK-APR # # 2.42 2.42 159.05 159.15

12 Month Low (Jun 14, 2010) 0.2714 9,229.60 B Bank Al-Falah Limited 10.83 0.17 1.59% DGKC-APR # # 5.30 5.29 131.67 131.43

12 Month Average 10,805.36 A Abbot Laboratories (Pakistan) Ltd. 86.27 1.27 1.49% MCB-APR # # 0.63 0.63 125.09 125.10

NBP-APR # # 2.15 2.17 124.15 125.36

KSE Market Capitalization Top Losers in KSE-100 Price Price ∆ %∆ UBL-APR # # 1.92 1.91 114.07 113.54

KSE Market Capitalization (Apr 13, 2011)(Rs. bn) 3,129.51 P Pakistan Telephone Cables Ltd. 2.50 (0.25) -9.09% PPL-APR # # 0.36 0.37 75.97 77.30

KSE Market Capitalization (US$ bn) 37.02 P Pak Elektron Ltd. 11.51 (0.99) -7.92% FFBL-APR # # 1.64 1.61 67.84 66.89

Change from last closing (%) -0.49% ID Indus Dyeing Manufacturing Co. Ltd. 288.35 (15.11) -4.98% NML-APR # # 0.70 0.71 45.43 45.85

YTD (Since Dec 31, 2010) -4.27% N NIB Bank Limited 1.96 (0.05) -2.49% FFC-APR # # 0.31 0.33 42.67 44.94

12 Month High (Jan 17, 2011)(Rs. bn) 3,430.38 P Pakistan Refinery Ltd. 88.20 (2.09) -2.31% ATRL-APR # # 0.20 0.20 25.61 26.01

12 Month Low (Jun 14, 2010)(Rs. bn) 2,598.66 B Bank Al-Habib Limited 29.37 (0.59) -1.97% PTC-APR # # 0.23 0.23 3.98 3.98

12 Month Average (Rs. bn) 2,976.87 D Dawood Hercules Chemicals Ltd. 65.97 (1.27) -1.89% HUBC-APR # # 0.02 0.01 0.69 0.62

#N/A # # #N/A #N/A #N/A #N/A

KSE Ready Turnover KSE Futures Today's Previous Today's Previous Today's TOTAL ## ## 18.29 18.24 1,564.34 1,560.40

Total Volume (Apr 13, 2011)(Shares mn) 45.82 Details Vol.(mn) Vol.(mn) Val.(mn) Val.(mn) Spread

Total Value (Rs. bn) 2.12 POL-APR 0.39 0.39 127.47 128.11 10.85% View from the Desk

Total Value (US$ mn) 25.05 ENGRO-APR 0.53 0.21 106.14 42.16 10.86% The KSE 100 index witnessed yet another day of correction with major Oil,

12 Month Avg. Daily Vol. (Shares mn) 104.27 PPL-APR 0.08 0.09 17.03 19.54 10.86% Fertilizer & Banking stocks receiving heavy battering. Market lost 61 points

12 Month Avg. Daily Value (Rs. bn) 3.98 ATRL-APR 0.10 0.11 12.66 14.02 8.45% with volumes of 46mn shares over IMF‘s concerns that a delayed approach

12 Month Avg. Daily Value (US$ mn) 46.62 FFC-APR 0.08 0.06 11.46 7.57 5.45% to the structural reforms programme could pose a severe threat to the

NBP-APR 0.15 0.27 8.33 15.23 7.25% country’s macros. Fertilizers came under an immense pressure during the

KSE - 30 Index MCB-APR 0.03 0.03 6.90 6.52 10.10% early trading hours with the news of Engro’s plant, along with others, facing

KSE-30 Index (Apr 13, 2011) 11,438.33 NML-APR 0.09 0.08 5.82 5.06 11.79% complete gas curtailment from SNGPL. This was even more worrisome for

investors as the plant has not achieved CoD yet. Foreigners were rumored

Change from last closing (71.98) LUCK-APR 0.08 0.14 5.35 9.68 6.10%

sellers, while local institutions were key participants today.

YTD (Since Dec 31, 2010) -1.29% FFBL-APR 0.13 0.02 5.13 0.95 11.98%

12 Month High (Jan 17, 2011) 12,476.12 TOTAL 1.91 2.58 314.54 279.64 10.49%

12 Month Low (Jun 15, 2010) 9,104.25

12 Month Average 10,585.30 KSE Valuation Price PE11E PE12F Div.Yield 11 Div.Yield 12

OGDC 130.54 8.86 8.42 4.98% 7.66%

Regional Markets Today's Previous %∆ YTD PTC 16.58 11.13 10.21 9.65% 10.25% mujtaba.barakzai@js.com

China (SSEA) 3,050.40 3,021.37 0.96% 8.63% NBP 55.90 5.21 4.60 13.42% 14.31%

India (BSESN) 19,696.86 19,262.54 2.25% -3.96% PSO 274.57 3.80 4.25 4.16% 11.76% JS Global Capital Limited

Indonesia (JKSE) 3,734.41 3,719.23 0.41% 0.83% MCB 204.71 8.90 7.98 5.86% 6.11% 6th Floor, Faysal House, Main Shahrah-e-Faisal, Karachi

Korea (KOSPI) 2,121.92 2,089.40 1.56% 3.46% FFC 137.44 9.11 7.62 10.76% 12.85% Research: Report compiled by:

Malaysia (KLSE) 1,535.59 1,525.92 0.63% 1.10% POL 325.11 7.62 6.85 10.15% 11.69% Email: js.research@js.com Email: adeel.jafri@js.com

Philippines (PSI) 4,203.68 4,199.48 0.10% 0.06% LUCK 69.71 6.42 5.58 7.17% 8.61% Fax: 92 (21) 32800163 Tel: +92 (21) 111-574-111

Taiwan (TWII) 8,780.20 8,732.59 0.55% -2.14% JS Universe 7.57 6.67 6.88% 8.54% JS RESEARCH IS AVAILABLE ON BLOOMBERG, THOMSON REUTERS & CAPITAL IQ

This report has been prepared for information purposes by the Research Department of JS Global Capital Limited. The information and data on which this report is based are obtained from sources which we believe to be reliable but we do not guarantee that it is accurate or complete. In particular, the report takes no account of the investment objectives, financial

situation and particular needs of investors who should seek further professional advice or rely upon their own judgment and acumen before making any investment. This report should also not be considered as a reflection on the concerned company’s management and its performances or ability, or appreciation or criticism, as to the affairs or operations of such

company or institution. Warning: This report may not be reproduced, distributed or published by any person for any purpose whatsoever. Action will be taken for unauthorized reproduction, distribution or publication.

You might also like

- Accounting Voucher PDFDocument2 pagesAccounting Voucher PDFVenky SamNo ratings yet

- JS Market Wrap Mar11 2020Document1 pageJS Market Wrap Mar11 2020Ali HasanNo ratings yet

- Pakistan Market Statistics - Jun16 2010Document1 pagePakistan Market Statistics - Jun16 2010Saqib YaseenNo ratings yet

- Js Market Wrap Js Market Wrap Js Market Wrap Js Market WrapDocument1 pageJs Market Wrap Js Market Wrap Js Market Wrap Js Market WrapSHAHZAIB -No ratings yet

- JPMorgan Chase & Co. (JPM) Stock Price, News, Quote & History - Yahoo FinanceDocument3 pagesJPMorgan Chase & Co. (JPM) Stock Price, News, Quote & History - Yahoo FinanceamirlinNo ratings yet

- Adani Green Share Price Live Today - Why Adani Green Share Price Is Falling by 5% Today - Adani Green Share Price Analysis - ETMarketsDocument7 pagesAdani Green Share Price Live Today - Why Adani Green Share Price Is Falling by 5% Today - Adani Green Share Price Analysis - ETMarketsUdar SubediNo ratings yet

- Jkload 2Document3 pagesJkload 2Jay OsloNo ratings yet

- Alfalah Fund Super Market: Analysis of Open-End FundsDocument2 pagesAlfalah Fund Super Market: Analysis of Open-End FundsadeelngNo ratings yet

- Ind Nifty CPSEDocument1 pageInd Nifty CPSEAnjalidevi TNo ratings yet

- ValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08Document4 pagesValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08pqwertyNo ratings yet

- Jkload 4Document3 pagesJkload 4Jay OsloNo ratings yet

- Fertilizer - Sector Update - GlobalDocument1 pageFertilizer - Sector Update - Globalmuddasir1980No ratings yet

- Jamna Auto Share Price, Jamna Auto Stock Price, JDocument2 pagesJamna Auto Share Price, Jamna Auto Stock Price, Jmuthu27989No ratings yet

- Key Performance Indicators - Friday, August 6, 2021Document10 pagesKey Performance Indicators - Friday, August 6, 2021Shan SNo ratings yet

- Oil and Gas Sector Update: SOGT Finally Awarded? - 01/09/2010Document3 pagesOil and Gas Sector Update: SOGT Finally Awarded? - 01/09/2010Rhb InvestNo ratings yet

- Weekly Stock Focus - 29102021Document10 pagesWeekly Stock Focus - 29102021Lafri AhmedNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Sahil SharmaNo ratings yet

- Kload 1Document3 pagesKload 1Jay OsloNo ratings yet

- ValueResearchFundcard JMCore11Fund DirectPlan 2017dec07Document4 pagesValueResearchFundcard JMCore11Fund DirectPlan 2017dec07Jayab JunkNo ratings yet

- ValueResearchFundcard RelianceTaxSaver 2010dec24Document6 pagesValueResearchFundcard RelianceTaxSaver 2010dec24Kumar DeepanshuNo ratings yet

- Kencana Petroleum Berhad: Follow Up - 23/6/2010Document2 pagesKencana Petroleum Berhad: Follow Up - 23/6/2010Rhb InvestNo ratings yet

- Canara Robeco Liquid RegularDocument4 pagesCanara Robeco Liquid RegularYogi173No ratings yet

- Jkload 5Document3 pagesJkload 5Jay OsloNo ratings yet

- Timber Sector - Japan Housing Starts Improved Due To Low Base Effect - 21/6/2010Document4 pagesTimber Sector - Japan Housing Starts Improved Due To Low Base Effect - 21/6/2010Rhb InvestNo ratings yet

- Value Research Fundcard SBI Small & Midcap Fund Direct Plan 2018 Mar 24Document4 pagesValue Research Fundcard SBI Small & Midcap Fund Direct Plan 2018 Mar 24hotalamNo ratings yet

- Top Stories:: ACEN: ACEN Acquires Solar Philippines Unit CEB: CEB Plans Start of Stock Rights Offering in FebDocument4 pagesTop Stories:: ACEN: ACEN Acquires Solar Philippines Unit CEB: CEB Plans Start of Stock Rights Offering in FebJajahinaNo ratings yet

- Daily Market Report: Surveillance, Supervision and Enforcement DepartmentDocument1 pageDaily Market Report: Surveillance, Supervision and Enforcement DepartmentĀżiżNo ratings yet

- ValueResearchFundcard ReligareContra 2010dec12Document6 pagesValueResearchFundcard ReligareContra 2010dec12Sivaraman SenapathiNo ratings yet

- ValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11Document4 pagesValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11asddsffdsfNo ratings yet

- Skyworks Solutions, Inc.: Price, Consensus & SurpriseDocument1 pageSkyworks Solutions, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Indices Other Stories:: FRI 23 DEC 2016Document3 pagesIndices Other Stories:: FRI 23 DEC 2016JajahinaNo ratings yet

- Top Stories:: WED 12 JULY 2017Document7 pagesTop Stories:: WED 12 JULY 2017JNo ratings yet

- Eastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Document3 pagesEastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Rhb InvestNo ratings yet

- Kotak Small Cap Fund - 20220201190020276Document1 pageKotak Small Cap Fund - 20220201190020276Kunal SinhaNo ratings yet

- Daily Market Update 21.01Document1 pageDaily Market Update 21.01Inde Pendent LkNo ratings yet

- Ind Nifty CPSEDocument1 pageInd Nifty CPSEPrabhakar DalviNo ratings yet

- Timber Sector Update: Positive Signs of Recovery-07/09/2010Document5 pagesTimber Sector Update: Positive Signs of Recovery-07/09/2010Rhb InvestNo ratings yet

- ValueResearchFundcard ICICIPrudentialGrowthInstI 2011mar14Document6 pagesValueResearchFundcard ICICIPrudentialGrowthInstI 2011mar14Ravindra MisalNo ratings yet

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNo ratings yet

- BHEL - Rock Solid - RBS - Jan2011Document8 pagesBHEL - Rock Solid - RBS - Jan2011Jitender KumarNo ratings yet

- Oil and Gas - Taking A More Cautious View - 10/6/2010Document9 pagesOil and Gas - Taking A More Cautious View - 10/6/2010Rhb InvestNo ratings yet

- Credit Note: (Original For Recipient)Document3 pagesCredit Note: (Original For Recipient)syamakantadasiNo ratings yet

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pagePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsVinayak ChaturvediNo ratings yet

- Oil and Gas Sector Update: Petronas' 1QFY11 Net Profit Up - 05/10/2010Document4 pagesOil and Gas Sector Update: Petronas' 1QFY11 Net Profit Up - 05/10/2010Rhb InvestNo ratings yet

- Portfolio - Home 15 OctoberDocument3 pagesPortfolio - Home 15 OctobermukeshinsaaNo ratings yet

- Timber: Prospects Are Looking Better-17/03/2010Document5 pagesTimber: Prospects Are Looking Better-17/03/2010Rhb InvestNo ratings yet

- Perhitungan Tingkat Diskonto Per Tanggal 26 April 2016: Boim (Ke We) + (KD WD) Ke KRF + Beta KM + SPDocument34 pagesPerhitungan Tingkat Diskonto Per Tanggal 26 April 2016: Boim (Ke We) + (KD WD) Ke KRF + Beta KM + SPIndra GunawanstNo ratings yet

- ValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Document4 pagesValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Chiman RaoNo ratings yet

- All RM PerformanceDocument9 pagesAll RM PerformancesoniaNo ratings yet

- Ind Nifty EnergyDocument2 pagesInd Nifty EnergySudarshan AgnihotriNo ratings yet

- Kayhian: Thailand DailyDocument5 pagesKayhian: Thailand Dailyapi-28341169No ratings yet

- SynopsisDocument1 pageSynopsisntkmistryNo ratings yet

- Top Story:: Consumer Sector: Consumer Companies Deliver Mixed Results in 1Q21Document9 pagesTop Story:: Consumer Sector: Consumer Companies Deliver Mixed Results in 1Q21JajahinaNo ratings yet

- Indonesia Daily: UpdateDocument7 pagesIndonesia Daily: UpdateyolandaNo ratings yet

- 28 Generation Cost April 2023Document1 page28 Generation Cost April 2023sinnyen.hengNo ratings yet

- Est 021645Document1 pageEst 021645astortech360No ratings yet

- ValueResearchFundcard AIGIndiaEquityReg 2011may02Document6 pagesValueResearchFundcard AIGIndiaEquityReg 2011may02Chetan SinhaNo ratings yet

- Top Story:: ACEN: Positives Already Priced In, Share Dilution To Drag Short-Term EPSDocument5 pagesTop Story:: ACEN: Positives Already Priced In, Share Dilution To Drag Short-Term EPSJajahinaNo ratings yet

- View PDFServletDocument1 pageView PDFServletriteshNo ratings yet