Professional Documents

Culture Documents

Bharat Sanchar Nigam LTD (BSNL), The Corporate Version of Erstwhile DOT

Bharat Sanchar Nigam LTD (BSNL), The Corporate Version of Erstwhile DOT

Uploaded by

Rohit YadavCopyright:

Available Formats

You might also like

- Brand Management ProjectDocument37 pagesBrand Management Projectanindya_kundu67% (6)

- Managed Services - Nilfisk Full Case Study - Solunus - 2Document3 pagesManaged Services - Nilfisk Full Case Study - Solunus - 2api-482448129No ratings yet

- Barcode MGDocument16 pagesBarcode MGarjunachu81100% (1)

- Swot Analysis of BSNLDocument6 pagesSwot Analysis of BSNLprayag_duttNo ratings yet

- Bharat Sanchar Niigam LimitedDocument10 pagesBharat Sanchar Niigam Limitedshalinibabu8790No ratings yet

- Swot1 IntroductionDocument4 pagesSwot1 Introductionsmblacksmith11No ratings yet

- BSNL SwotDocument13 pagesBSNL SwotAbhishek Chaudhary100% (1)

- Product and Brand Management Project On BSNL Company: by Group 5Document18 pagesProduct and Brand Management Project On BSNL Company: by Group 5Lalit SapkaleNo ratings yet

- Product and Brand Management Project On BSNL Company: by Group 5Document17 pagesProduct and Brand Management Project On BSNL Company: by Group 5Lalit SapkaleNo ratings yet

- PaperDocument22 pagesPapernishant_singhal_4No ratings yet

- Project:-: Analysis of Telecom Sector Players According To Their Marketing StrategiesDocument45 pagesProject:-: Analysis of Telecom Sector Players According To Their Marketing StrategiesnawaljainNo ratings yet

- Strategy Formulation of BSNLDocument9 pagesStrategy Formulation of BSNLriyasacademicNo ratings yet

- Bav Assignment TelecomDocument36 pagesBav Assignment Telecomudit singhNo ratings yet

- Research Report by Shailesh KR Singh (Sc-2) Ss 2009-11Document61 pagesResearch Report by Shailesh KR Singh (Sc-2) Ss 2009-119899866563No ratings yet

- Advertising Effectiveness On Telecom Ind - ProjectDocument51 pagesAdvertising Effectiveness On Telecom Ind - Projecttina_18No ratings yet

- STT - Group 9Document7 pagesSTT - Group 9ganeshNo ratings yet

- Connecting The WorldDocument27 pagesConnecting The Worldaa_04No ratings yet

- 3cet ReportDocument27 pages3cet Reportsaxenasai0% (1)

- Analysis of Vodafone Essar IndiaDocument34 pagesAnalysis of Vodafone Essar IndiaSantosh SamNo ratings yet

- Final ReportDocument51 pagesFinal ReportNaveen Kumar VenigallaNo ratings yet

- Financial Analysis of Telecommunication IndustryDocument7 pagesFinancial Analysis of Telecommunication IndustryPreethi VenkataramanNo ratings yet

- Strategic Outsourcing at Bharti Airtel LimitedDocument6 pagesStrategic Outsourcing at Bharti Airtel LimitedAnna Marie Mccurdy FitzgeraldNo ratings yet

- A Presentation On Organization Study: Bharat Sanchar Nigam Limited (BSNL), SirsaDocument17 pagesA Presentation On Organization Study: Bharat Sanchar Nigam Limited (BSNL), SirsaKapil SethiNo ratings yet

- Indian Tele ContextDocument31 pagesIndian Tele ContextSadhna MishraNo ratings yet

- BSNLDocument6 pagesBSNLHarsh ParekhNo ratings yet

- BSNL Strategic PlanningDocument93 pagesBSNL Strategic PlanningRowdy HbkNo ratings yet

- BSNLDocument17 pagesBSNLNagaveni Gl100% (4)

- Airtel Strategic ManagementDocument29 pagesAirtel Strategic ManagementSandeep George80% (5)

- Executive Summary: Company ProfileDocument4 pagesExecutive Summary: Company ProfilemahadevayyaNo ratings yet

- Table of Content: Particulars Page NoDocument19 pagesTable of Content: Particulars Page NofarahmemonNo ratings yet

- Report - Contemporary IssuesDocument5 pagesReport - Contemporary IssuesNiha SayyadNo ratings yet

- DTH Services in Meerut: (Competition in The Skies)Document46 pagesDTH Services in Meerut: (Competition in The Skies)Amit Rashmi MishraNo ratings yet

- Key Highlights of The NASSCOM - IDC Study On The Domestic Services (IT - ITES) Market OpportunityDocument6 pagesKey Highlights of The NASSCOM - IDC Study On The Domestic Services (IT - ITES) Market OpportunityshashankrandevNo ratings yet

- Company Analysis Report On AirtelDocument39 pagesCompany Analysis Report On AirtelSUDEEP KUMAR69% (13)

- Strategic Audit of BSNLDocument42 pagesStrategic Audit of BSNLNishant Ahuja0% (1)

- IETE Technical Review BSNL Journey in TeDocument12 pagesIETE Technical Review BSNL Journey in Techandrashekar_ganesanNo ratings yet

- TSM Assignment 2 Sarthak BansalDocument21 pagesTSM Assignment 2 Sarthak BansalSarthak BansalNo ratings yet

- Strategic Analysis of Bharti Airtel: Prof. Koushik DuttaDocument6 pagesStrategic Analysis of Bharti Airtel: Prof. Koushik DuttaSundeep YadavNo ratings yet

- Company Analysistata CommunicationsDocument3 pagesCompany Analysistata Communicationsjagan jackNo ratings yet

- Final BSNL BudgetDocument72 pagesFinal BSNL BudgetMohit Agarwal100% (1)

- BSNLDocument5 pagesBSNLSejal DagaNo ratings yet

- Strategic Audit of BSNLDocument42 pagesStrategic Audit of BSNLNishant AhujaNo ratings yet

- BSNL - An Intensive SWOT Analysis.: Mahesh PatilDocument8 pagesBSNL - An Intensive SWOT Analysis.: Mahesh PatilMahesh PatilNo ratings yet

- Project On TATA IndicomDocument106 pagesProject On TATA IndicomVikas KaushikNo ratings yet

- Idea Customer Satisfaction ReportDocument85 pagesIdea Customer Satisfaction Reportjkd4550% (6)

- Marketing Management: On Airtel - Magic'Document6 pagesMarketing Management: On Airtel - Magic'Rahul RavindranathanNo ratings yet

- Kuldeep Singh CMD, MTNLDocument36 pagesKuldeep Singh CMD, MTNLEN KietNo ratings yet

- Telecom BSNLDocument21 pagesTelecom BSNLTajudheen TajNo ratings yet

- A Term Project On GSCMDocument33 pagesA Term Project On GSCMIndrajit Indrani BanerjeeNo ratings yet

- CommunicationanalysisbsnlDocument72 pagesCommunicationanalysisbsnlmanwanimuki12No ratings yet

- Telecommunication Industry: by Kalpana Dwivedi Taduri Srilatha Arnab Dawn Tushar ShuklaDocument27 pagesTelecommunication Industry: by Kalpana Dwivedi Taduri Srilatha Arnab Dawn Tushar ShuklaArnab DawnNo ratings yet

- Index: Executive Summary 2Document60 pagesIndex: Executive Summary 2imadNo ratings yet

- AirtelDocument31 pagesAirtelRajiv KeshriNo ratings yet

- Kinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghDocument39 pagesKinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghKanchan VardhaniNo ratings yet

- Minor ProjectDocument9 pagesMinor ProjectShrishti JainNo ratings yet

- Telecom Industry - SectorsDocument9 pagesTelecom Industry - Sectors10902738No ratings yet

- Market Survey of AirtelDocument77 pagesMarket Survey of AirtelAnkit Singhvi0% (1)

- Sector Analysis - TechnologyDocument3 pagesSector Analysis - TechnologyShambhavi Jha 2027734No ratings yet

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyFrom EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNo ratings yet

- LTE Self-Organising Networks (SON): Network Management Automation for Operational EfficiencyFrom EverandLTE Self-Organising Networks (SON): Network Management Automation for Operational EfficiencySeppo HämäläinenNo ratings yet

- Faculty of Commerce: B. Com. (Hons.)Document4 pagesFaculty of Commerce: B. Com. (Hons.)Zeeshan AhmedNo ratings yet

- DimitrakopoulosDocument6 pagesDimitrakopoulosManolo Ericson GutiNo ratings yet

- Report and Financial Statements: Holdings PLCDocument42 pagesReport and Financial Statements: Holdings PLCEmily Bre MNo ratings yet

- Pivot Point Trading StrategyDocument8 pagesPivot Point Trading StrategyBadrul 'boxer' Hisham50% (4)

- Ram NavmiDocument419 pagesRam NavmisaraswatiNo ratings yet

- GESITS Business Meeting For AsbumpiDocument18 pagesGESITS Business Meeting For AsbumpiDon Mintapraja100% (1)

- Perpetual AccountingDocument12 pagesPerpetual AccountingNovelyn Gamboa100% (1)

- Factors Influencing The Quay Efficiency of Container TerminalsDocument16 pagesFactors Influencing The Quay Efficiency of Container TerminalsMuhammad Mirza AriestantyoNo ratings yet

- Alcoholic Drinks in ChinaDocument110 pagesAlcoholic Drinks in Chinavokey89No ratings yet

- SW2 and Q2 PDFDocument7 pagesSW2 and Q2 PDFRyan De GuzmanNo ratings yet

- Tutorial Sheet-1 PDFDocument2 pagesTutorial Sheet-1 PDFJapanjOt SinGhNo ratings yet

- Arts and Design - Leadership and Management in Different Arts Fields CGDocument10 pagesArts and Design - Leadership and Management in Different Arts Fields CGKarl Winn Liang100% (1)

- DACHL Guide 2016 - Firmen in MoldovaDocument61 pagesDACHL Guide 2016 - Firmen in MoldovaCristi Rotari0% (1)

- Unilever Group in Beauty and Personal Care (World)Document55 pagesUnilever Group in Beauty and Personal Care (World)Huy PhanNo ratings yet

- 10 of The Cheapest Suburbs & Towns in AustraliaDocument5 pages10 of The Cheapest Suburbs & Towns in Australiaganguly147147No ratings yet

- Preteen Market-The Right Place To Be in For Cell Phone Providers?Document3 pagesPreteen Market-The Right Place To Be in For Cell Phone Providers?amara0550% (2)

- Mohammad Abu Taher: Apply For: QA/QC (Senior Piping Welding Inspector) Personal DetailsDocument10 pagesMohammad Abu Taher: Apply For: QA/QC (Senior Piping Welding Inspector) Personal DetailsRajkumar ANo ratings yet

- Cadenas Drives USADocument238 pagesCadenas Drives USAsagit1758No ratings yet

- W4 NewProductLaunch ScenarioAnalysisDocument83 pagesW4 NewProductLaunch ScenarioAnalysisChip choiNo ratings yet

- Week 3 BTYD Model Fader Et Al MKSC 10Document23 pagesWeek 3 BTYD Model Fader Et Al MKSC 10jaiwarwick1No ratings yet

- FGD InstallationsDocument6 pagesFGD InstallationsdsoNo ratings yet

- Account Statement 28-11-2023T02 21 53Document1 pageAccount Statement 28-11-2023T02 21 53ali hamzaNo ratings yet

- Introduction of Derivatives: Types of Derivative ContractsDocument4 pagesIntroduction of Derivatives: Types of Derivative Contracts007nitin007No ratings yet

- Taco Bout ItDocument14 pagesTaco Bout Itapi-248790355No ratings yet

- Ent Pp1 S.6Document3 pagesEnt Pp1 S.6SadaticloNo ratings yet

- Enterprise Applications: Case 1Document42 pagesEnterprise Applications: Case 1will willNo ratings yet

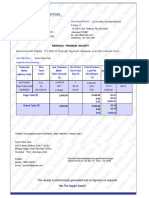

- Received With Thanks ' 3,008.20 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 3,008.20 Through Payment Gateway Over The Internet FromSyed Talha ZaidNo ratings yet

- Jessica Chong CV - Sep 2018Document1 pageJessica Chong CV - Sep 2018Anonymous H5Ru4rvuHNo ratings yet

Bharat Sanchar Nigam LTD (BSNL), The Corporate Version of Erstwhile DOT

Bharat Sanchar Nigam LTD (BSNL), The Corporate Version of Erstwhile DOT

Uploaded by

Rohit YadavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bharat Sanchar Nigam LTD (BSNL), The Corporate Version of Erstwhile DOT

Bharat Sanchar Nigam LTD (BSNL), The Corporate Version of Erstwhile DOT

Uploaded by

Rohit YadavCopyright:

Available Formats

INTRODUCTION

Bharat Sanchar Nigam Ltd (BSNL), the corporate version of erstwhile DOT,

came to existence on 1st October 2000. Ever since the formation of BSNL, the Indian

telecommunications scenario has been transforming itself into a multi-player, multi-

product market with varied market sizes and segments. Within the basic phone service

the value chain has split into Basic services, long distance players, and international long

distance players.

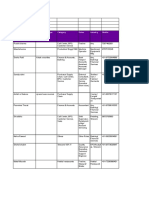

BSNL’s POSITIONING IN TELECOM INDUSTRY

To understand and suggest – how strategic management can help BSNL – the

first thing is to understand the Telecom industry environment and the stakeholders

involved. Apart from having to cope with the change in structure and culture

(government to corporate), BSNL has had to gear itself to meet competition in various

segments – basic services, long distance (LD), and International Long Distance (ILD),

and Internet Service Provision (ISP), and Mobile services. With the advent of

competition the private operators have been impacting the strategic matrix by

influencing regulatory bodies, adopting intelligent media strategies, and by targeting

the creamy layer of customers. While, political control over the public sector remains a

contentious strategic issue in the country; with the formation of a company, the internal

strategy of the BSNL board will be of gaining considerable autonomy. Labour unions

are powerful internal stakeholders, as are the middle managers/ other staff that have the

primary responsibility for customer care. The following stakeholders diagram gives an

insight about the changing telecom industry environment for BSNL

FIG 1 - STAKEHOLDERS IN BSNL’s STRATEGIC MANAGEMENT

Minist

Minist

ITU, ryry

ofof

ITU, Comm

Intern

Intern Comm

unicati Other

Other

Others ational

ational unicati

Othersteleco onon

&& Private

Private

–– teleco ITIT operat

mm operat

media,

media, orsors BSNL’

BSNL’

genera industr s s

genera industr

y

l l y custom

custom

public,

public, ersers

&&

channe

channe BSN consu

consu

l l BSN mer

LL mer

partne

partne organi

organi

IT,IT, Manuf

Manuf

BSNL

rs, BSNL

rs, zations

zations

Insura

Insura acture

acture

Emplo

PCOs Emplo

PCOs nce,

nce, rsrsofof

yees

etc &&

yees

etc Railwa

Railwa teleco

teleco

labor

labor ys,ys, mm

unions

unions Regula

Regula Bankin goods

Bankin goods

tors,

tors, g etc.

g etc.

TRAI

TRAI industr

industr

y using

y using

teleco

teleco

mm

backbo

backbo

nene

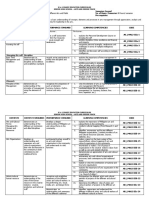

BSNL’s SWOT ANALYSIS

The changing external environment for BSNL can be well captured by the

Potter’s model diagram which shows that the industry structure has become bit

unfavorable (Pl. refer exhibit- 1)

In such an environment BSNL definitely requires to redefine its strategies. What is

required is to identify the potential opportunities and threats implied by this changing

environment for the BSNL. In changing trends, situations, and events gaining an

accurate understanding of BSNL’s strengths and limitations will help in better strategic

management of organization. The SWOT analysis for BSNL is as follows –

BSNL – SWOT ANALYSIS

STRENTHS WEAKNESSES

• Pan-India reach • Non-optimization of network capabilities

• Experienced telecom service provider • Poor marketing strategy

• Total telecom service provider • Bureaucratic organizational set up

• Huge Resources (financial & technical pool) • Inflexibility in mindset (DOT period

• Huge customer base legacies)

• Most trusted telecom brand • Limited number of value added services

• Transparency in billing • Poor franchisee network

• Easy deployment of new services • Legacy of poor service image

• Copper in last mile can be used for easy • Huge and aged manpower

broadband deployment • Procedural delays

• Huge Optical Fibre network and associated • Lack of strategic alliances

bandwidth • Problems associated with incumbency like

outdated technologies, unproductive rural

assets, social obligations, political

interference,

• Poor IT penetration within organization

• Poor knowledge Management

OPPORTUNITIES THREATS

• Tremendous market growing at 20 lac • Competition from private operators

customers per month • Keeping pace with fast technological

• Untapped broadband services changes

• Untouched international market • Market maturity in basic telephone segment

• Can capitalize on public sector image to • Manpower churning

grab government’s ICT initiatives • Multinational eyeing Indian telecom market

• ITEB service markets • Private operators demand for sharing last

• Diversification of business to turn-key mile

projects • Decreasing per line revenues due to

• Leveraging the brand image to source funds competitive pricing

• Almost un-invaded VSAT market • Private operators demand to do away with

• Fuller utilization of slack resources ADC can seriously effect revenues

• Can make a kill through deep penetration • Populist policies of government like

and low cost advantage “OneIndia” rates

• Broaden market expected from convergence

of broadcasting, telecom and entertainment

industry

You might also like

- Brand Management ProjectDocument37 pagesBrand Management Projectanindya_kundu67% (6)

- Managed Services - Nilfisk Full Case Study - Solunus - 2Document3 pagesManaged Services - Nilfisk Full Case Study - Solunus - 2api-482448129No ratings yet

- Barcode MGDocument16 pagesBarcode MGarjunachu81100% (1)

- Swot Analysis of BSNLDocument6 pagesSwot Analysis of BSNLprayag_duttNo ratings yet

- Bharat Sanchar Niigam LimitedDocument10 pagesBharat Sanchar Niigam Limitedshalinibabu8790No ratings yet

- Swot1 IntroductionDocument4 pagesSwot1 Introductionsmblacksmith11No ratings yet

- BSNL SwotDocument13 pagesBSNL SwotAbhishek Chaudhary100% (1)

- Product and Brand Management Project On BSNL Company: by Group 5Document18 pagesProduct and Brand Management Project On BSNL Company: by Group 5Lalit SapkaleNo ratings yet

- Product and Brand Management Project On BSNL Company: by Group 5Document17 pagesProduct and Brand Management Project On BSNL Company: by Group 5Lalit SapkaleNo ratings yet

- PaperDocument22 pagesPapernishant_singhal_4No ratings yet

- Project:-: Analysis of Telecom Sector Players According To Their Marketing StrategiesDocument45 pagesProject:-: Analysis of Telecom Sector Players According To Their Marketing StrategiesnawaljainNo ratings yet

- Strategy Formulation of BSNLDocument9 pagesStrategy Formulation of BSNLriyasacademicNo ratings yet

- Bav Assignment TelecomDocument36 pagesBav Assignment Telecomudit singhNo ratings yet

- Research Report by Shailesh KR Singh (Sc-2) Ss 2009-11Document61 pagesResearch Report by Shailesh KR Singh (Sc-2) Ss 2009-119899866563No ratings yet

- Advertising Effectiveness On Telecom Ind - ProjectDocument51 pagesAdvertising Effectiveness On Telecom Ind - Projecttina_18No ratings yet

- STT - Group 9Document7 pagesSTT - Group 9ganeshNo ratings yet

- Connecting The WorldDocument27 pagesConnecting The Worldaa_04No ratings yet

- 3cet ReportDocument27 pages3cet Reportsaxenasai0% (1)

- Analysis of Vodafone Essar IndiaDocument34 pagesAnalysis of Vodafone Essar IndiaSantosh SamNo ratings yet

- Final ReportDocument51 pagesFinal ReportNaveen Kumar VenigallaNo ratings yet

- Financial Analysis of Telecommunication IndustryDocument7 pagesFinancial Analysis of Telecommunication IndustryPreethi VenkataramanNo ratings yet

- Strategic Outsourcing at Bharti Airtel LimitedDocument6 pagesStrategic Outsourcing at Bharti Airtel LimitedAnna Marie Mccurdy FitzgeraldNo ratings yet

- A Presentation On Organization Study: Bharat Sanchar Nigam Limited (BSNL), SirsaDocument17 pagesA Presentation On Organization Study: Bharat Sanchar Nigam Limited (BSNL), SirsaKapil SethiNo ratings yet

- Indian Tele ContextDocument31 pagesIndian Tele ContextSadhna MishraNo ratings yet

- BSNLDocument6 pagesBSNLHarsh ParekhNo ratings yet

- BSNL Strategic PlanningDocument93 pagesBSNL Strategic PlanningRowdy HbkNo ratings yet

- BSNLDocument17 pagesBSNLNagaveni Gl100% (4)

- Airtel Strategic ManagementDocument29 pagesAirtel Strategic ManagementSandeep George80% (5)

- Executive Summary: Company ProfileDocument4 pagesExecutive Summary: Company ProfilemahadevayyaNo ratings yet

- Table of Content: Particulars Page NoDocument19 pagesTable of Content: Particulars Page NofarahmemonNo ratings yet

- Report - Contemporary IssuesDocument5 pagesReport - Contemporary IssuesNiha SayyadNo ratings yet

- DTH Services in Meerut: (Competition in The Skies)Document46 pagesDTH Services in Meerut: (Competition in The Skies)Amit Rashmi MishraNo ratings yet

- Key Highlights of The NASSCOM - IDC Study On The Domestic Services (IT - ITES) Market OpportunityDocument6 pagesKey Highlights of The NASSCOM - IDC Study On The Domestic Services (IT - ITES) Market OpportunityshashankrandevNo ratings yet

- Company Analysis Report On AirtelDocument39 pagesCompany Analysis Report On AirtelSUDEEP KUMAR69% (13)

- Strategic Audit of BSNLDocument42 pagesStrategic Audit of BSNLNishant Ahuja0% (1)

- IETE Technical Review BSNL Journey in TeDocument12 pagesIETE Technical Review BSNL Journey in Techandrashekar_ganesanNo ratings yet

- TSM Assignment 2 Sarthak BansalDocument21 pagesTSM Assignment 2 Sarthak BansalSarthak BansalNo ratings yet

- Strategic Analysis of Bharti Airtel: Prof. Koushik DuttaDocument6 pagesStrategic Analysis of Bharti Airtel: Prof. Koushik DuttaSundeep YadavNo ratings yet

- Company Analysistata CommunicationsDocument3 pagesCompany Analysistata Communicationsjagan jackNo ratings yet

- Final BSNL BudgetDocument72 pagesFinal BSNL BudgetMohit Agarwal100% (1)

- BSNLDocument5 pagesBSNLSejal DagaNo ratings yet

- Strategic Audit of BSNLDocument42 pagesStrategic Audit of BSNLNishant AhujaNo ratings yet

- BSNL - An Intensive SWOT Analysis.: Mahesh PatilDocument8 pagesBSNL - An Intensive SWOT Analysis.: Mahesh PatilMahesh PatilNo ratings yet

- Project On TATA IndicomDocument106 pagesProject On TATA IndicomVikas KaushikNo ratings yet

- Idea Customer Satisfaction ReportDocument85 pagesIdea Customer Satisfaction Reportjkd4550% (6)

- Marketing Management: On Airtel - Magic'Document6 pagesMarketing Management: On Airtel - Magic'Rahul RavindranathanNo ratings yet

- Kuldeep Singh CMD, MTNLDocument36 pagesKuldeep Singh CMD, MTNLEN KietNo ratings yet

- Telecom BSNLDocument21 pagesTelecom BSNLTajudheen TajNo ratings yet

- A Term Project On GSCMDocument33 pagesA Term Project On GSCMIndrajit Indrani BanerjeeNo ratings yet

- CommunicationanalysisbsnlDocument72 pagesCommunicationanalysisbsnlmanwanimuki12No ratings yet

- Telecommunication Industry: by Kalpana Dwivedi Taduri Srilatha Arnab Dawn Tushar ShuklaDocument27 pagesTelecommunication Industry: by Kalpana Dwivedi Taduri Srilatha Arnab Dawn Tushar ShuklaArnab DawnNo ratings yet

- Index: Executive Summary 2Document60 pagesIndex: Executive Summary 2imadNo ratings yet

- AirtelDocument31 pagesAirtelRajiv KeshriNo ratings yet

- Kinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghDocument39 pagesKinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghKanchan VardhaniNo ratings yet

- Minor ProjectDocument9 pagesMinor ProjectShrishti JainNo ratings yet

- Telecom Industry - SectorsDocument9 pagesTelecom Industry - Sectors10902738No ratings yet

- Market Survey of AirtelDocument77 pagesMarket Survey of AirtelAnkit Singhvi0% (1)

- Sector Analysis - TechnologyDocument3 pagesSector Analysis - TechnologyShambhavi Jha 2027734No ratings yet

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyFrom EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNo ratings yet

- LTE Self-Organising Networks (SON): Network Management Automation for Operational EfficiencyFrom EverandLTE Self-Organising Networks (SON): Network Management Automation for Operational EfficiencySeppo HämäläinenNo ratings yet

- Faculty of Commerce: B. Com. (Hons.)Document4 pagesFaculty of Commerce: B. Com. (Hons.)Zeeshan AhmedNo ratings yet

- DimitrakopoulosDocument6 pagesDimitrakopoulosManolo Ericson GutiNo ratings yet

- Report and Financial Statements: Holdings PLCDocument42 pagesReport and Financial Statements: Holdings PLCEmily Bre MNo ratings yet

- Pivot Point Trading StrategyDocument8 pagesPivot Point Trading StrategyBadrul 'boxer' Hisham50% (4)

- Ram NavmiDocument419 pagesRam NavmisaraswatiNo ratings yet

- GESITS Business Meeting For AsbumpiDocument18 pagesGESITS Business Meeting For AsbumpiDon Mintapraja100% (1)

- Perpetual AccountingDocument12 pagesPerpetual AccountingNovelyn Gamboa100% (1)

- Factors Influencing The Quay Efficiency of Container TerminalsDocument16 pagesFactors Influencing The Quay Efficiency of Container TerminalsMuhammad Mirza AriestantyoNo ratings yet

- Alcoholic Drinks in ChinaDocument110 pagesAlcoholic Drinks in Chinavokey89No ratings yet

- SW2 and Q2 PDFDocument7 pagesSW2 and Q2 PDFRyan De GuzmanNo ratings yet

- Tutorial Sheet-1 PDFDocument2 pagesTutorial Sheet-1 PDFJapanjOt SinGhNo ratings yet

- Arts and Design - Leadership and Management in Different Arts Fields CGDocument10 pagesArts and Design - Leadership and Management in Different Arts Fields CGKarl Winn Liang100% (1)

- DACHL Guide 2016 - Firmen in MoldovaDocument61 pagesDACHL Guide 2016 - Firmen in MoldovaCristi Rotari0% (1)

- Unilever Group in Beauty and Personal Care (World)Document55 pagesUnilever Group in Beauty and Personal Care (World)Huy PhanNo ratings yet

- 10 of The Cheapest Suburbs & Towns in AustraliaDocument5 pages10 of The Cheapest Suburbs & Towns in Australiaganguly147147No ratings yet

- Preteen Market-The Right Place To Be in For Cell Phone Providers?Document3 pagesPreteen Market-The Right Place To Be in For Cell Phone Providers?amara0550% (2)

- Mohammad Abu Taher: Apply For: QA/QC (Senior Piping Welding Inspector) Personal DetailsDocument10 pagesMohammad Abu Taher: Apply For: QA/QC (Senior Piping Welding Inspector) Personal DetailsRajkumar ANo ratings yet

- Cadenas Drives USADocument238 pagesCadenas Drives USAsagit1758No ratings yet

- W4 NewProductLaunch ScenarioAnalysisDocument83 pagesW4 NewProductLaunch ScenarioAnalysisChip choiNo ratings yet

- Week 3 BTYD Model Fader Et Al MKSC 10Document23 pagesWeek 3 BTYD Model Fader Et Al MKSC 10jaiwarwick1No ratings yet

- FGD InstallationsDocument6 pagesFGD InstallationsdsoNo ratings yet

- Account Statement 28-11-2023T02 21 53Document1 pageAccount Statement 28-11-2023T02 21 53ali hamzaNo ratings yet

- Introduction of Derivatives: Types of Derivative ContractsDocument4 pagesIntroduction of Derivatives: Types of Derivative Contracts007nitin007No ratings yet

- Taco Bout ItDocument14 pagesTaco Bout Itapi-248790355No ratings yet

- Ent Pp1 S.6Document3 pagesEnt Pp1 S.6SadaticloNo ratings yet

- Enterprise Applications: Case 1Document42 pagesEnterprise Applications: Case 1will willNo ratings yet

- Received With Thanks ' 3,008.20 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 3,008.20 Through Payment Gateway Over The Internet FromSyed Talha ZaidNo ratings yet

- Jessica Chong CV - Sep 2018Document1 pageJessica Chong CV - Sep 2018Anonymous H5Ru4rvuHNo ratings yet