Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsUS Internal Revenue Service: f6112 Accessible

US Internal Revenue Service: f6112 Accessible

Uploaded by

IRSThis document is an order form for requesting prior year tax forms from the IRS. It instructs the user to provide their name and mailing address in fields 1 through 5. In fields 6 through 9, the user is prompted to check boxes indicating if instructions are needed and to write in the form number, tax year, and quantity for each form they need from past years, such as Form 1040, Schedule A, Schedule C, and Form 1040X. The completed form should then be mailed to the IRS National Distribution Center.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- DT-1016 De-Activation and Re-ActivationDocument2 pagesDT-1016 De-Activation and Re-ActivationIsaka Isse100% (3)

- Sue's Market (83-2020164) - EIN RegistrationDocument2 pagesSue's Market (83-2020164) - EIN RegistrationDoo Soo Kim100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Ultimate DIY BIR Tax Compliance Guide For Freelancers - November 2020 Version - 5 PDFDocument56 pagesThe Ultimate DIY BIR Tax Compliance Guide For Freelancers - November 2020 Version - 5 PDFKathrina BangayanNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- US Internal Revenue Service: f8819 AccessibleDocument2 pagesUS Internal Revenue Service: f8819 AccessibleIRSNo ratings yet

- US Internal Revenue Service: f8849 - 2003Document3 pagesUS Internal Revenue Service: f8849 - 2003IRSNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterpdizypdizyNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiNo ratings yet

- Irs Instructions Residency FormDocument4 pagesIrs Instructions Residency FormmaxpendriskyNo ratings yet

- Application For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inDocument2 pagesApplication For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inIRSNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterTony MillerNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrancis Wolfgang UrbanNo ratings yet

- Main - Irs Form 8944 Preparer e File Hardship Waiver RequestDocument3 pagesMain - Irs Form 8944 Preparer e File Hardship Waiver RequestAndre LeeNo ratings yet

- F 941 SsDocument4 pagesF 941 SsBilboDBagginsNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamNo ratings yet

- 2019 CorporateDocument32 pages2019 Corporateapi-167637329No ratings yet

- ACC 105 Lesson 4 Assignment 1 3-11bDocument4 pagesACC 105 Lesson 4 Assignment 1 3-11bJennifer BaileyNo ratings yet

- 3911 Taxpayer Statement Regarding Refund: Section IDocument2 pages3911 Taxpayer Statement Regarding Refund: Section IWanda NesbethNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- In Case of Additional Business Line TAXDocument2 pagesIn Case of Additional Business Line TAXdeosa villamonteNo ratings yet

- 2013 - Form 990Document30 pages2013 - Form 990Fred MednickNo ratings yet

- Order For Tax Forms Outlet Program (TFOP)Document3 pagesOrder For Tax Forms Outlet Program (TFOP)redhighlanderNo ratings yet

- Avaaz Foundation - 2022 Form 990Document49 pagesAvaaz Foundation - 2022 Form 990falconson.bNo ratings yet

- Form - BIR Form 1905Document4 pagesForm - BIR Form 1905ibangpassword50% (2)

- Attention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsDocument3 pagesAttention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsJoshua Sygnal Gutierrez100% (1)

- Information Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (Document2 pagesInformation Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (IRSNo ratings yet

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- Request For Public Inspection or Copy of Exempt or Political Organization IRS FormDocument2 pagesRequest For Public Inspection or Copy of Exempt or Political Organization IRS FormIRS100% (1)

- Paper Filing Instructions - Spouse ITIN Cases & Joint Declaration StatementDocument4 pagesPaper Filing Instructions - Spouse ITIN Cases & Joint Declaration StatementKarthik NieNo ratings yet

- ELA Request Transcript of Tax Ret 4506CDocument1 pageELA Request Transcript of Tax Ret 4506CTerre ChilicasNo ratings yet

- IVES Request For Transcript of Tax Return: First)Document2 pagesIVES Request For Transcript of Tax Return: First)GlendaNo ratings yet

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- f4506c AccessibleDocument2 pagesf4506c AccessibleRoberto Monterrosa100% (1)

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelNo ratings yet

- 941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnDocument4 pages941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnFrancis Wolfgang UrbanNo ratings yet

- Mrs M Altman 2019-20 Tax ReturnDocument22 pagesMrs M Altman 2019-20 Tax Returnyochanan altman100% (1)

- US Internal Revenue Service: p967Document7 pagesUS Internal Revenue Service: p967IRSNo ratings yet

- Application For Permanent Account Number (Pan) : IndividualsDocument3 pagesApplication For Permanent Account Number (Pan) : IndividualsBharat PangeniNo ratings yet

- Questionnaire and Supporting Documentation Form 1040 Schedule C (Profit or Loss From Business)Document1 pageQuestionnaire and Supporting Documentation Form 1040 Schedule C (Profit or Loss From Business)troubledcutie1987No ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- Patricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Document16 pagesPatricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Maria Valentina Neira GonzalezNo ratings yet

- US Internal Revenue Service: p967 - 2004Document6 pagesUS Internal Revenue Service: p967 - 2004IRSNo ratings yet

- DT-1001 Ind RegDocument4 pagesDT-1001 Ind RegMugabi EltonbenNo ratings yet

- I 8802Document13 pagesI 8802ccshanNo ratings yet

- Us Tax ReturnDocument41 pagesUs Tax Returnapi-208686780No ratings yet

- Form 4506 CDocument2 pagesForm 4506 CKabano CoNo ratings yet

- F 3911Document2 pagesF 3911Sergio Andrés Garavito NavarroNo ratings yet

- Attention Filers of Form 1096:: Employer and Information ReturnsDocument3 pagesAttention Filers of Form 1096:: Employer and Information ReturnsMd AhmedNo ratings yet

- QC 16757 Download PDFDocument5 pagesQC 16757 Download PDFEricChanNo ratings yet

- US Internal Revenue Service: p967 - 2003Document6 pagesUS Internal Revenue Service: p967 - 2003IRSNo ratings yet

- US Internal Revenue Service: F8453ol - 2001Document2 pagesUS Internal Revenue Service: F8453ol - 2001IRSNo ratings yet

- US Internal Revenue Service: f8879c - 2003Document2 pagesUS Internal Revenue Service: f8879c - 2003IRSNo ratings yet

- US Internal Revenue Service: F940ez - 1995Document4 pagesUS Internal Revenue Service: F940ez - 1995IRSNo ratings yet

- BilndDocument3 pagesBilndxabehe6146No ratings yet

- Attention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsDocument3 pagesAttention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsMikhael Yah-Shah Dean: Veilour100% (1)

- View Tax Return PDFDocument14 pagesView Tax Return PDFEmil AndriesNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterFrancis Wolfgang UrbanNo ratings yet

- Payroll Accounting 2014 Form1040 Ch4Document4 pagesPayroll Accounting 2014 Form1040 Ch4DanCoppeNo ratings yet

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

US Internal Revenue Service: f6112 Accessible

US Internal Revenue Service: f6112 Accessible

Uploaded by

IRS0 ratings0% found this document useful (0 votes)

15 views1 pageThis document is an order form for requesting prior year tax forms from the IRS. It instructs the user to provide their name and mailing address in fields 1 through 5. In fields 6 through 9, the user is prompted to check boxes indicating if instructions are needed and to write in the form number, tax year, and quantity for each form they need from past years, such as Form 1040, Schedule A, Schedule C, and Form 1040X. The completed form should then be mailed to the IRS National Distribution Center.

Original Description:

Original Title

US Internal Revenue Service: f6112 accessible

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is an order form for requesting prior year tax forms from the IRS. It instructs the user to provide their name and mailing address in fields 1 through 5. In fields 6 through 9, the user is prompted to check boxes indicating if instructions are needed and to write in the form number, tax year, and quantity for each form they need from past years, such as Form 1040, Schedule A, Schedule C, and Form 1040X. The completed form should then be mailed to the IRS National Distribution Center.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views1 pageUS Internal Revenue Service: f6112 Accessible

US Internal Revenue Service: f6112 Accessible

Uploaded by

IRSThis document is an order form for requesting prior year tax forms from the IRS. It instructs the user to provide their name and mailing address in fields 1 through 5. In fields 6 through 9, the user is prompted to check boxes indicating if instructions are needed and to write in the form number, tax year, and quantity for each form they need from past years, such as Form 1040, Schedule A, Schedule C, and Form 1040X. The completed form should then be mailed to the IRS National Distribution Center.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

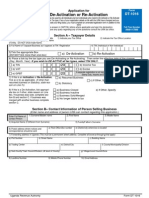

Prior Year Tax Forms Order

For faster service, go to* www.irs.gov/formspubs

Print the name and mailing address to which orders are to be mailed.

1. Name or Name of Company

2. Attention (if applicable)

3. Mailing address

4a. City 4b. State 4c. ZIP Code

5. Foreign Country (if applicable)

6. Inst. 7. Tax Year and Quantities Requested

Form Number

Form 1040

Form 1040 Sch. A & B

Form 1040 Sch. C

Form 1040 Sch. C-EZ

(N/A prior to 1992)

Form 1040 Sch. EIC

(N/A prior to 1991)

Form 1040 Sch. SE

Form 1040 A

Form 1040 EZ

(N/A prior to 1982)

8. Form 1040 X (indicate needed quantity)

Write-ins are allowed. Important: Check “Inst.” box if tax form instructions are needed.

9. Form Number Inst. Tax Year Quantity Form Number Inst. Tax Year Quantity

Instructions for completing Form 6112

1. to 5. Self explanatory

6. Check “Inst.” box if instructions are needed with the forms.

7. Enter the Tax Year required in the appropriate box, i.e., 2000, and enter the quantity in the corresponding box.

8. Indicate quantity of 1040 X, if needed. No year required.

9. Write in additional forms needed in the write-in section and check “Inst.” box for instructions, if needed.

Mail completed form to:

Internal Revenue Service

National Distribution Center

P. O. Box 8903

Bloomington, IL 61702-8903

Form 6112 (Rev. 8-2006) www.irs.gov Catalog Number 24412C Department of the Treasury–Internal Revenue Service

You might also like

- DT-1016 De-Activation and Re-ActivationDocument2 pagesDT-1016 De-Activation and Re-ActivationIsaka Isse100% (3)

- Sue's Market (83-2020164) - EIN RegistrationDocument2 pagesSue's Market (83-2020164) - EIN RegistrationDoo Soo Kim100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Ultimate DIY BIR Tax Compliance Guide For Freelancers - November 2020 Version - 5 PDFDocument56 pagesThe Ultimate DIY BIR Tax Compliance Guide For Freelancers - November 2020 Version - 5 PDFKathrina BangayanNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- US Internal Revenue Service: f8819 AccessibleDocument2 pagesUS Internal Revenue Service: f8819 AccessibleIRSNo ratings yet

- US Internal Revenue Service: f8849 - 2003Document3 pagesUS Internal Revenue Service: f8849 - 2003IRSNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterpdizypdizyNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiNo ratings yet

- Irs Instructions Residency FormDocument4 pagesIrs Instructions Residency FormmaxpendriskyNo ratings yet

- Application For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inDocument2 pagesApplication For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inIRSNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterTony MillerNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrancis Wolfgang UrbanNo ratings yet

- Main - Irs Form 8944 Preparer e File Hardship Waiver RequestDocument3 pagesMain - Irs Form 8944 Preparer e File Hardship Waiver RequestAndre LeeNo ratings yet

- F 941 SsDocument4 pagesF 941 SsBilboDBagginsNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamNo ratings yet

- 2019 CorporateDocument32 pages2019 Corporateapi-167637329No ratings yet

- ACC 105 Lesson 4 Assignment 1 3-11bDocument4 pagesACC 105 Lesson 4 Assignment 1 3-11bJennifer BaileyNo ratings yet

- 3911 Taxpayer Statement Regarding Refund: Section IDocument2 pages3911 Taxpayer Statement Regarding Refund: Section IWanda NesbethNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- In Case of Additional Business Line TAXDocument2 pagesIn Case of Additional Business Line TAXdeosa villamonteNo ratings yet

- 2013 - Form 990Document30 pages2013 - Form 990Fred MednickNo ratings yet

- Order For Tax Forms Outlet Program (TFOP)Document3 pagesOrder For Tax Forms Outlet Program (TFOP)redhighlanderNo ratings yet

- Avaaz Foundation - 2022 Form 990Document49 pagesAvaaz Foundation - 2022 Form 990falconson.bNo ratings yet

- Form - BIR Form 1905Document4 pagesForm - BIR Form 1905ibangpassword50% (2)

- Attention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsDocument3 pagesAttention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsJoshua Sygnal Gutierrez100% (1)

- Information Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (Document2 pagesInformation Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (IRSNo ratings yet

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- Request For Public Inspection or Copy of Exempt or Political Organization IRS FormDocument2 pagesRequest For Public Inspection or Copy of Exempt or Political Organization IRS FormIRS100% (1)

- Paper Filing Instructions - Spouse ITIN Cases & Joint Declaration StatementDocument4 pagesPaper Filing Instructions - Spouse ITIN Cases & Joint Declaration StatementKarthik NieNo ratings yet

- ELA Request Transcript of Tax Ret 4506CDocument1 pageELA Request Transcript of Tax Ret 4506CTerre ChilicasNo ratings yet

- IVES Request For Transcript of Tax Return: First)Document2 pagesIVES Request For Transcript of Tax Return: First)GlendaNo ratings yet

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- f4506c AccessibleDocument2 pagesf4506c AccessibleRoberto Monterrosa100% (1)

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelNo ratings yet

- 941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnDocument4 pages941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnFrancis Wolfgang UrbanNo ratings yet

- Mrs M Altman 2019-20 Tax ReturnDocument22 pagesMrs M Altman 2019-20 Tax Returnyochanan altman100% (1)

- US Internal Revenue Service: p967Document7 pagesUS Internal Revenue Service: p967IRSNo ratings yet

- Application For Permanent Account Number (Pan) : IndividualsDocument3 pagesApplication For Permanent Account Number (Pan) : IndividualsBharat PangeniNo ratings yet

- Questionnaire and Supporting Documentation Form 1040 Schedule C (Profit or Loss From Business)Document1 pageQuestionnaire and Supporting Documentation Form 1040 Schedule C (Profit or Loss From Business)troubledcutie1987No ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- Patricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Document16 pagesPatricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Maria Valentina Neira GonzalezNo ratings yet

- US Internal Revenue Service: p967 - 2004Document6 pagesUS Internal Revenue Service: p967 - 2004IRSNo ratings yet

- DT-1001 Ind RegDocument4 pagesDT-1001 Ind RegMugabi EltonbenNo ratings yet

- I 8802Document13 pagesI 8802ccshanNo ratings yet

- Us Tax ReturnDocument41 pagesUs Tax Returnapi-208686780No ratings yet

- Form 4506 CDocument2 pagesForm 4506 CKabano CoNo ratings yet

- F 3911Document2 pagesF 3911Sergio Andrés Garavito NavarroNo ratings yet

- Attention Filers of Form 1096:: Employer and Information ReturnsDocument3 pagesAttention Filers of Form 1096:: Employer and Information ReturnsMd AhmedNo ratings yet

- QC 16757 Download PDFDocument5 pagesQC 16757 Download PDFEricChanNo ratings yet

- US Internal Revenue Service: p967 - 2003Document6 pagesUS Internal Revenue Service: p967 - 2003IRSNo ratings yet

- US Internal Revenue Service: F8453ol - 2001Document2 pagesUS Internal Revenue Service: F8453ol - 2001IRSNo ratings yet

- US Internal Revenue Service: f8879c - 2003Document2 pagesUS Internal Revenue Service: f8879c - 2003IRSNo ratings yet

- US Internal Revenue Service: F940ez - 1995Document4 pagesUS Internal Revenue Service: F940ez - 1995IRSNo ratings yet

- BilndDocument3 pagesBilndxabehe6146No ratings yet

- Attention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsDocument3 pagesAttention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsMikhael Yah-Shah Dean: Veilour100% (1)

- View Tax Return PDFDocument14 pagesView Tax Return PDFEmil AndriesNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterFrancis Wolfgang UrbanNo ratings yet

- Payroll Accounting 2014 Form1040 Ch4Document4 pagesPayroll Accounting 2014 Form1040 Ch4DanCoppeNo ratings yet

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet