Professional Documents

Culture Documents

Department of Financial Institutions of BB

Department of Financial Institutions of BB

Uploaded by

adnan04Copyright:

Available Formats

You might also like

- Write A Minimum 1200 Words Research Paper On The Financial Services Regulations in CanadaDocument7 pagesWrite A Minimum 1200 Words Research Paper On The Financial Services Regulations in Canadadummy flashNo ratings yet

- AML KYC Mock Test - Practice TestsDocument16 pagesAML KYC Mock Test - Practice Testsdev100% (1)

- SBP Guidelines On Outsourcing ArrangementDocument13 pagesSBP Guidelines On Outsourcing ArrangementTayyab IqbalNo ratings yet

- Merchant Banking and Financial ServicesDocument41 pagesMerchant Banking and Financial ServicesSb KarthickNo ratings yet

- Audit of Banks 1 2Document10 pagesAudit of Banks 1 2Khrisstal BalatbatNo ratings yet

- Module 8 Monpol&cenbanDocument6 pagesModule 8 Monpol&cenbanfranz mallariNo ratings yet

- Cross Border - Malaysia WNPDocument6 pagesCross Border - Malaysia WNPRazman RuzaimiNo ratings yet

- Centrum Broking Limited: Anti Money Laundering Policy (Extract of Version 7.0) 1. BackgroundDocument8 pagesCentrum Broking Limited: Anti Money Laundering Policy (Extract of Version 7.0) 1. BackgroundGeorgio RomaniNo ratings yet

- ReportDocument15 pagesReportFlorameRojasTanNo ratings yet

- Credit Report On MCBDocument16 pagesCredit Report On MCBuzmabhatti34No ratings yet

- South Indian BankDocument12 pagesSouth Indian BankAnupriya RajendranNo ratings yet

- The Financial System of Bangladesh Is Comprised of Three Broad Fragmented SectorsDocument3 pagesThe Financial System of Bangladesh Is Comprised of Three Broad Fragmented SectorsNur Mohammed Khan Sabbir100% (1)

- This Is The Link of The PDF Not Responding.: Why Disclosure and Transparency MatterDocument11 pagesThis Is The Link of The PDF Not Responding.: Why Disclosure and Transparency Matteryatinjpatel_licNo ratings yet

- Module 3Document10 pagesModule 3Kim EllaNo ratings yet

- SECPDocument19 pagesSECPHashir Khan100% (1)

- Mod 2 IBCDocument8 pagesMod 2 IBCSakshi SinghNo ratings yet

- Legal AspectsDocument38 pagesLegal AspectsAravind JayanNo ratings yet

- Assignment of Bank ManagementDocument24 pagesAssignment of Bank ManagementShifat Rahman PrantoNo ratings yet

- 01 Task Performance 1 - AuditingDocument6 pages01 Task Performance 1 - AuditingMillania ThanaNo ratings yet

- Outsourcing PolicyDocument13 pagesOutsourcing PolicyShahzad SalimNo ratings yet

- RBI Circular On VigilanceDocument8 pagesRBI Circular On VigilanceBhaskar Garimella100% (1)

- Financial RegulationDocument22 pagesFinancial RegulationNana OpokuNo ratings yet

- Credit Appraisal in MuthootDocument30 pagesCredit Appraisal in MuthootNISHI1994100% (1)

- Merchant BankingDocument6 pagesMerchant BankingVivek TathodNo ratings yet

- Chapter 1 - Overview of Corporate FinanceDocument26 pagesChapter 1 - Overview of Corporate Finance21124014No ratings yet

- IOSCOPD167Document14 pagesIOSCOPD167marouane.zwNo ratings yet

- Differentation - Between - FINANCIAL INSTITUTIONS - REGULATORY BODIESDocument5 pagesDifferentation - Between - FINANCIAL INSTITUTIONS - REGULATORY BODIESGOURAV MISHRANo ratings yet

- Coventure Management, LLC: Form Adv Part 2ADocument18 pagesCoventure Management, LLC: Form Adv Part 2Ahult.elliot90No ratings yet

- Anti Money Laundering AMLPolicyDocument9 pagesAnti Money Laundering AMLPolicyAkash GhodkeNo ratings yet

- Bim 3Document9 pagesBim 3Manas MohapatraNo ratings yet

- Monetary Authority of SingaporeDocument29 pagesMonetary Authority of Singaporerahulchoudhury32No ratings yet

- CH 6 Investor Protection in Hong KongDocument5 pagesCH 6 Investor Protection in Hong KongwinfldNo ratings yet

- Ia FunctionDocument17 pagesIa FunctioncyrosemtNo ratings yet

- Case Study 4Document12 pagesCase Study 4mahmoud lasheenNo ratings yet

- Business Finance - Q1Document3 pagesBusiness Finance - Q1Kathleen Kaye Louise C. EnesimoNo ratings yet

- Ksfe Organisation StudyDocument71 pagesKsfe Organisation StudyKrishna Priya100% (7)

- Bwbb2013 Topic 2Document22 pagesBwbb2013 Topic 2myteacheroht.managementNo ratings yet

- Internal Control and Fraud PreventionDocument247 pagesInternal Control and Fraud Preventiondiana_mensah1757100% (3)

- Module 2 - Finance - CompleteDocument48 pagesModule 2 - Finance - CompleteNikhil ChaudharyNo ratings yet

- How To Prevent Fraud in MSMEDocument16 pagesHow To Prevent Fraud in MSMEsidh0987No ratings yet

- Topik 1 Rangka Kerja PerundanganDocument28 pagesTopik 1 Rangka Kerja PerundanganBenjamin Goo KWNo ratings yet

- A. Nature of Operations (PSA 315 A22)Document8 pagesA. Nature of Operations (PSA 315 A22)HUERTAZUELA ARANo ratings yet

- NBFC OutsourcingDocument13 pagesNBFC OutsourcingAbin MukhopadhyayNo ratings yet

- wk3 Tutorial 3 SolutionDocument4 pageswk3 Tutorial 3 SolutionStylez 2707No ratings yet

- Navigating The Financial LandscapeDocument7 pagesNavigating The Financial Landscapejimslabrador3No ratings yet

- The Impact of Government Policy and Regulation On BankingDocument15 pagesThe Impact of Government Policy and Regulation On BankingAmna Nasser100% (1)

- Manual 2022 90000583 LCPC PDFDocument145 pagesManual 2022 90000583 LCPC PDFBharat AllahanNo ratings yet

- CCODocument10 pagesCCOTanveen KaurNo ratings yet

- Chapter-01 Financial System of BangladeshDocument13 pagesChapter-01 Financial System of BangladeshbishwajitNo ratings yet

- Basic Features of The Microcredit Regulatory Authority Act, 2006Document10 pagesBasic Features of The Microcredit Regulatory Authority Act, 2006Asif Hasan DhimanNo ratings yet

- Pub Considering Charter Apps From Fin Tech CoDocument20 pagesPub Considering Charter Apps From Fin Tech CoimshwetaNo ratings yet

- PWC - Myanmar - A Road Map For Financial ServicesDocument12 pagesPWC - Myanmar - A Road Map For Financial Servicesmarcmyomyint1663No ratings yet

- Understanding OFR, A Guide To Florida's Office of Financial RegulationDocument23 pagesUnderstanding OFR, A Guide To Florida's Office of Financial RegulationNeil GillespieNo ratings yet

- Borrowing Powers of Directors of Public Limited CompaniesDocument14 pagesBorrowing Powers of Directors of Public Limited CompaniesMuhammad Saeed BabarNo ratings yet

- JAIIB Paper 1 CAPSULE PDF Principles Practices of Banking PDFDocument269 pagesJAIIB Paper 1 CAPSULE PDF Principles Practices of Banking PDFLatha Mypati100% (1)

- BNMDocument47 pagesBNMHyun爱纶星No ratings yet

- Audit of BankDocument23 pagesAudit of BankSai Naveen KumarNo ratings yet

- Auditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlFrom EverandAuditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlNo ratings yet

- (A) There Is Bonafide Business Relationship Between The Remitter(s) and The Supplier(s)Document1 page(A) There Is Bonafide Business Relationship Between The Remitter(s) and The Supplier(s)adnan04No ratings yet

- E Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVDocument1 pageE Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVadnan04No ratings yet

- Table of ContentDocument2 pagesTable of Contentadnan04No ratings yet

- Foreign Exchange Policy Department: Bangladesh BankDocument1 pageForeign Exchange Policy Department: Bangladesh Bankadnan04No ratings yet

- Foreign Exchange Policy Department: Enhancement of Loan Limit From Export Development FundDocument1 pageForeign Exchange Policy Department: Enhancement of Loan Limit From Export Development Fundadnan04No ratings yet

- Demutualization Act 2013Document16 pagesDemutualization Act 2013adnan04No ratings yet

- Evsjv 'K E VSK: Cöavb KVH©VJQDocument1 pageEvsjv 'K E VSK: Cöavb KVH©VJQadnan04No ratings yet

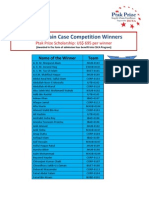

- Ptak Prize - 70 - Scholarship Winners ListDocument5 pagesPtak Prize - 70 - Scholarship Winners Listadnan04No ratings yet

- Sports Bar Business PlanDocument13 pagesSports Bar Business Planadnan04No ratings yet

- Presentation CanadaDocument15 pagesPresentation Canadaadnan04No ratings yet

- Housing Market in CanadaDocument7 pagesHousing Market in Canadaadnan04No ratings yet

- Guidelines To Write An Internship ReportDocument2 pagesGuidelines To Write An Internship Reportadnan04No ratings yet

- Mr. Pervez Said. Handbook of Islamic Banking Products & Services.Document138 pagesMr. Pervez Said. Handbook of Islamic Banking Products & Services.akram_tkdNo ratings yet

- Basel 3Document18 pagesBasel 3adnan04No ratings yet

- Role of Treasury FunctionDocument4 pagesRole of Treasury Functionadnan040% (1)

- PHONE EtiquetteDocument14 pagesPHONE Etiquetteroziahzailan100% (1)

- Chapter 11Document6 pagesChapter 11adnan04No ratings yet

Department of Financial Institutions of BB

Department of Financial Institutions of BB

Uploaded by

adnan04Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Department of Financial Institutions of BB

Department of Financial Institutions of BB

Uploaded by

adnan04Copyright:

Available Formats

Department of Financial Institutions & Markets (DFIM)

The key functions of this department are addressed bellow:

1. Issuance of licenses to appropriate institutions under the Financial Institutions Act, 1993

& the Financial Institutions Regulation, 1994.

Process of Issuance of licenses

What are the requirements to get licenses/ what are the factors they consider

before Issuance of licenses to appropriate institutions?

2. Formulating policy guidelines/directives/circulars for ensuring the soundness of Financial

Institutions in Bangladesh.

Who formulate policy guidelines/directives/circulars and how?

3. Conducting off-site supervision on financial institutions through collecting, analyzing and

monitoring various data/information on regular basis to ensure compliance of the existing

policies, regulations and practices by them.

4. Assessing financial and managerial soundness of financial institutions through CAMEL

rating.

How they prepare CAMEL Rating?

5. Assessing and approving the issuance of Zero Coupon Bonds, Asset backed

Securitization Bonds, factoring etc. by different banks and financial institutions.

Process of approving the issuance of Zero Coupon Bonds, Asset backed

Securitization Bonds, factoring etc

6. Conducting special inspection on core risk management issues (Asset-liability

Management, Credit Risk Management, Internal Control & Compliance, and Information

& Communication Technology Management).

Try to know the information about Asset-liability Management and Information &

Communication Technology Management

Presently, the department supervises 29 NBFIs (Non-bank Financial Institutions), of which one

is fully Government-owned, 15 joint venture and the rest 13 are locally private-owned financial

institutions.

- Try to know the the update information and the name of those institutions.

You might also like

- Write A Minimum 1200 Words Research Paper On The Financial Services Regulations in CanadaDocument7 pagesWrite A Minimum 1200 Words Research Paper On The Financial Services Regulations in Canadadummy flashNo ratings yet

- AML KYC Mock Test - Practice TestsDocument16 pagesAML KYC Mock Test - Practice Testsdev100% (1)

- SBP Guidelines On Outsourcing ArrangementDocument13 pagesSBP Guidelines On Outsourcing ArrangementTayyab IqbalNo ratings yet

- Merchant Banking and Financial ServicesDocument41 pagesMerchant Banking and Financial ServicesSb KarthickNo ratings yet

- Audit of Banks 1 2Document10 pagesAudit of Banks 1 2Khrisstal BalatbatNo ratings yet

- Module 8 Monpol&cenbanDocument6 pagesModule 8 Monpol&cenbanfranz mallariNo ratings yet

- Cross Border - Malaysia WNPDocument6 pagesCross Border - Malaysia WNPRazman RuzaimiNo ratings yet

- Centrum Broking Limited: Anti Money Laundering Policy (Extract of Version 7.0) 1. BackgroundDocument8 pagesCentrum Broking Limited: Anti Money Laundering Policy (Extract of Version 7.0) 1. BackgroundGeorgio RomaniNo ratings yet

- ReportDocument15 pagesReportFlorameRojasTanNo ratings yet

- Credit Report On MCBDocument16 pagesCredit Report On MCBuzmabhatti34No ratings yet

- South Indian BankDocument12 pagesSouth Indian BankAnupriya RajendranNo ratings yet

- The Financial System of Bangladesh Is Comprised of Three Broad Fragmented SectorsDocument3 pagesThe Financial System of Bangladesh Is Comprised of Three Broad Fragmented SectorsNur Mohammed Khan Sabbir100% (1)

- This Is The Link of The PDF Not Responding.: Why Disclosure and Transparency MatterDocument11 pagesThis Is The Link of The PDF Not Responding.: Why Disclosure and Transparency Matteryatinjpatel_licNo ratings yet

- Module 3Document10 pagesModule 3Kim EllaNo ratings yet

- SECPDocument19 pagesSECPHashir Khan100% (1)

- Mod 2 IBCDocument8 pagesMod 2 IBCSakshi SinghNo ratings yet

- Legal AspectsDocument38 pagesLegal AspectsAravind JayanNo ratings yet

- Assignment of Bank ManagementDocument24 pagesAssignment of Bank ManagementShifat Rahman PrantoNo ratings yet

- 01 Task Performance 1 - AuditingDocument6 pages01 Task Performance 1 - AuditingMillania ThanaNo ratings yet

- Outsourcing PolicyDocument13 pagesOutsourcing PolicyShahzad SalimNo ratings yet

- RBI Circular On VigilanceDocument8 pagesRBI Circular On VigilanceBhaskar Garimella100% (1)

- Financial RegulationDocument22 pagesFinancial RegulationNana OpokuNo ratings yet

- Credit Appraisal in MuthootDocument30 pagesCredit Appraisal in MuthootNISHI1994100% (1)

- Merchant BankingDocument6 pagesMerchant BankingVivek TathodNo ratings yet

- Chapter 1 - Overview of Corporate FinanceDocument26 pagesChapter 1 - Overview of Corporate Finance21124014No ratings yet

- IOSCOPD167Document14 pagesIOSCOPD167marouane.zwNo ratings yet

- Differentation - Between - FINANCIAL INSTITUTIONS - REGULATORY BODIESDocument5 pagesDifferentation - Between - FINANCIAL INSTITUTIONS - REGULATORY BODIESGOURAV MISHRANo ratings yet

- Coventure Management, LLC: Form Adv Part 2ADocument18 pagesCoventure Management, LLC: Form Adv Part 2Ahult.elliot90No ratings yet

- Anti Money Laundering AMLPolicyDocument9 pagesAnti Money Laundering AMLPolicyAkash GhodkeNo ratings yet

- Bim 3Document9 pagesBim 3Manas MohapatraNo ratings yet

- Monetary Authority of SingaporeDocument29 pagesMonetary Authority of Singaporerahulchoudhury32No ratings yet

- CH 6 Investor Protection in Hong KongDocument5 pagesCH 6 Investor Protection in Hong KongwinfldNo ratings yet

- Ia FunctionDocument17 pagesIa FunctioncyrosemtNo ratings yet

- Case Study 4Document12 pagesCase Study 4mahmoud lasheenNo ratings yet

- Business Finance - Q1Document3 pagesBusiness Finance - Q1Kathleen Kaye Louise C. EnesimoNo ratings yet

- Ksfe Organisation StudyDocument71 pagesKsfe Organisation StudyKrishna Priya100% (7)

- Bwbb2013 Topic 2Document22 pagesBwbb2013 Topic 2myteacheroht.managementNo ratings yet

- Internal Control and Fraud PreventionDocument247 pagesInternal Control and Fraud Preventiondiana_mensah1757100% (3)

- Module 2 - Finance - CompleteDocument48 pagesModule 2 - Finance - CompleteNikhil ChaudharyNo ratings yet

- How To Prevent Fraud in MSMEDocument16 pagesHow To Prevent Fraud in MSMEsidh0987No ratings yet

- Topik 1 Rangka Kerja PerundanganDocument28 pagesTopik 1 Rangka Kerja PerundanganBenjamin Goo KWNo ratings yet

- A. Nature of Operations (PSA 315 A22)Document8 pagesA. Nature of Operations (PSA 315 A22)HUERTAZUELA ARANo ratings yet

- NBFC OutsourcingDocument13 pagesNBFC OutsourcingAbin MukhopadhyayNo ratings yet

- wk3 Tutorial 3 SolutionDocument4 pageswk3 Tutorial 3 SolutionStylez 2707No ratings yet

- Navigating The Financial LandscapeDocument7 pagesNavigating The Financial Landscapejimslabrador3No ratings yet

- The Impact of Government Policy and Regulation On BankingDocument15 pagesThe Impact of Government Policy and Regulation On BankingAmna Nasser100% (1)

- Manual 2022 90000583 LCPC PDFDocument145 pagesManual 2022 90000583 LCPC PDFBharat AllahanNo ratings yet

- CCODocument10 pagesCCOTanveen KaurNo ratings yet

- Chapter-01 Financial System of BangladeshDocument13 pagesChapter-01 Financial System of BangladeshbishwajitNo ratings yet

- Basic Features of The Microcredit Regulatory Authority Act, 2006Document10 pagesBasic Features of The Microcredit Regulatory Authority Act, 2006Asif Hasan DhimanNo ratings yet

- Pub Considering Charter Apps From Fin Tech CoDocument20 pagesPub Considering Charter Apps From Fin Tech CoimshwetaNo ratings yet

- PWC - Myanmar - A Road Map For Financial ServicesDocument12 pagesPWC - Myanmar - A Road Map For Financial Servicesmarcmyomyint1663No ratings yet

- Understanding OFR, A Guide To Florida's Office of Financial RegulationDocument23 pagesUnderstanding OFR, A Guide To Florida's Office of Financial RegulationNeil GillespieNo ratings yet

- Borrowing Powers of Directors of Public Limited CompaniesDocument14 pagesBorrowing Powers of Directors of Public Limited CompaniesMuhammad Saeed BabarNo ratings yet

- JAIIB Paper 1 CAPSULE PDF Principles Practices of Banking PDFDocument269 pagesJAIIB Paper 1 CAPSULE PDF Principles Practices of Banking PDFLatha Mypati100% (1)

- BNMDocument47 pagesBNMHyun爱纶星No ratings yet

- Audit of BankDocument23 pagesAudit of BankSai Naveen KumarNo ratings yet

- Auditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlFrom EverandAuditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlNo ratings yet

- (A) There Is Bonafide Business Relationship Between The Remitter(s) and The Supplier(s)Document1 page(A) There Is Bonafide Business Relationship Between The Remitter(s) and The Supplier(s)adnan04No ratings yet

- E Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVDocument1 pageE Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVadnan04No ratings yet

- Table of ContentDocument2 pagesTable of Contentadnan04No ratings yet

- Foreign Exchange Policy Department: Bangladesh BankDocument1 pageForeign Exchange Policy Department: Bangladesh Bankadnan04No ratings yet

- Foreign Exchange Policy Department: Enhancement of Loan Limit From Export Development FundDocument1 pageForeign Exchange Policy Department: Enhancement of Loan Limit From Export Development Fundadnan04No ratings yet

- Demutualization Act 2013Document16 pagesDemutualization Act 2013adnan04No ratings yet

- Evsjv 'K E VSK: Cöavb KVH©VJQDocument1 pageEvsjv 'K E VSK: Cöavb KVH©VJQadnan04No ratings yet

- Ptak Prize - 70 - Scholarship Winners ListDocument5 pagesPtak Prize - 70 - Scholarship Winners Listadnan04No ratings yet

- Sports Bar Business PlanDocument13 pagesSports Bar Business Planadnan04No ratings yet

- Presentation CanadaDocument15 pagesPresentation Canadaadnan04No ratings yet

- Housing Market in CanadaDocument7 pagesHousing Market in Canadaadnan04No ratings yet

- Guidelines To Write An Internship ReportDocument2 pagesGuidelines To Write An Internship Reportadnan04No ratings yet

- Mr. Pervez Said. Handbook of Islamic Banking Products & Services.Document138 pagesMr. Pervez Said. Handbook of Islamic Banking Products & Services.akram_tkdNo ratings yet

- Basel 3Document18 pagesBasel 3adnan04No ratings yet

- Role of Treasury FunctionDocument4 pagesRole of Treasury Functionadnan040% (1)

- PHONE EtiquetteDocument14 pagesPHONE Etiquetteroziahzailan100% (1)

- Chapter 11Document6 pagesChapter 11adnan04No ratings yet