Professional Documents

Culture Documents

US Internal Revenue Service: F1040as1 - 1991

US Internal Revenue Service: F1040as1 - 1991

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: F1040as1 - 1991

US Internal Revenue Service: F1040as1 - 1991

Uploaded by

IRSCopyright:

Available Formats

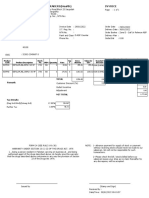

Schedule 1 Department of the Treasury—Internal Revenue Service

(Form 1040A) Interest and Dividend Income

for Form 1040A Filers 1991 OMB No. 1545-0085

Name(s) shown on Form 1040A Your social security number

Part I Complete this part and attach Schedule 1 to Form 1040A if:

● You have over $400 in taxable interest, or

Interest

● You are claiming the exclusion of interest from series EE U.S. savings bonds issued after 1989.

income

If you are claiming the exclusion or you received, as a nominee, interest that actually

(See pages 26 belongs to another person, see page 50.

and 50.) Note: If you received a Form 1099–INT, Form 1099–OID, or substitute statement, from a

brokerage firm, enter the firm’s name and the total interest shown on that form.

1 List name of payer Amount

1

2 Add the amounts on line 1. 2

3 Enter the excludable savings bond interest, if any, from Form

8815, line 14. Attach Form 8815 to Form 1040A. 3

4 Subtract line 3 from line 2. Enter the result here and on Form

1040A, line 8a. 4

Part II Complete this part and attach Schedule 1 to Form 1040A if you received over $400 in dividends.

If you received, as a nominee, dividends that actually belong to another person, see page 51.

Dividend

Note: If you received a Form 1099–DIV, or substitute statement, from a brokerage firm, enter

income

the firm’s name and the total dividends shown on that form.

(See pages 26

5 List name of payer Amount

and 51.)

5

6 Add the amounts on line 5. Enter the total here and on Form

1040A, line 9. 6

For Paperwork Reduction Act Notice, see Form 1040A instructions. Cat. No. 12075R Schedule 1 (Form 1040A) 1991

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Getting Paid Math 2.3.9.A1Document3 pagesGetting Paid Math 2.3.9.A1Lyndsey BridgersNo ratings yet

- Assesment Notice 2017Document1 pageAssesment Notice 2017Shounak KossambeNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- US Internal Revenue Service: F1040as1 - 1998Document1 pageUS Internal Revenue Service: F1040as1 - 1998IRSNo ratings yet

- US Internal Revenue Service: F1040as1 - 1993Document1 pageUS Internal Revenue Service: F1040as1 - 1993IRSNo ratings yet

- US Internal Revenue Service: F1040as1 - 2003Document2 pagesUS Internal Revenue Service: F1040as1 - 2003IRSNo ratings yet

- US Internal Revenue Service: F1040as1 - 2004Document2 pagesUS Internal Revenue Service: F1040as1 - 2004IRSNo ratings yet

- Form 1040A or 1040Document2 pagesForm 1040A or 1040Vita Volunteers WebmasterNo ratings yet

- Schedule 1 Interest and Ordinary Dividends For Form 1040A FilersDocument2 pagesSchedule 1 Interest and Ordinary Dividends For Form 1040A FilersIRSNo ratings yet

- US Internal Revenue Service: F1040as1 - 1999Document1 pageUS Internal Revenue Service: F1040as1 - 1999IRSNo ratings yet

- Interest and Ordinary DividendsDocument1 pageInterest and Ordinary DividendsJuanDickinsonNo ratings yet

- Schedule BDocument2 pagesSchedule Bapi-3507963220% (1)

- Interest and Ordinary DividendsDocument1 pageInterest and Ordinary DividendsBetty Ann LegerNo ratings yet

- Form 1040 Schedule BDocument1 pageForm 1040 Schedule BGwo GwppyNo ratings yet

- F 1040 SBDocument2 pagesF 1040 SBapi-333587870No ratings yet

- Interest and Ordinary DividendsDocument1 pageInterest and Ordinary DividendsMihaela PrunaNo ratings yet

- US Internal Revenue Service: f8815 - 1995Document2 pagesUS Internal Revenue Service: f8815 - 1995IRSNo ratings yet

- US Internal Revenue Service: f8815 - 1996Document2 pagesUS Internal Revenue Service: f8815 - 1996IRSNo ratings yet

- US Internal Revenue Service: f8815 - 1994Document2 pagesUS Internal Revenue Service: f8815 - 1994IRSNo ratings yet

- US Internal Revenue Service: f8815 - 1992Document2 pagesUS Internal Revenue Service: f8815 - 1992IRSNo ratings yet

- Interest and Ordinary DividendsDocument2 pagesInterest and Ordinary DividendsSarah KuldipNo ratings yet

- US Internal Revenue Service: f8812 - 2005Document2 pagesUS Internal Revenue Service: f8812 - 2005IRSNo ratings yet

- Interest and Ordinary DividendsDocument2 pagesInterest and Ordinary DividendsDunkMe100% (1)

- US Internal Revenue Service: f8812 - 1999Document2 pagesUS Internal Revenue Service: f8812 - 1999IRSNo ratings yet

- US Internal Revenue Service: f8815 - 1993Document2 pagesUS Internal Revenue Service: f8815 - 1993IRSNo ratings yet

- US Internal Revenue Service: F1040sab - 1992Document2 pagesUS Internal Revenue Service: F1040sab - 1992IRSNo ratings yet

- US Internal Revenue Service: f8815 - 1997Document2 pagesUS Internal Revenue Service: f8815 - 1997IRSNo ratings yet

- US Internal Revenue Service: f8861 - 2005Document3 pagesUS Internal Revenue Service: f8861 - 2005IRSNo ratings yet

- Instructions For Schedule A (Form 990) : Internal Revenue ServiceDocument8 pagesInstructions For Schedule A (Form 990) : Internal Revenue ServiceIRSNo ratings yet

- US Internal Revenue Service: f5884 - 2003Document3 pagesUS Internal Revenue Service: f5884 - 2003IRSNo ratings yet

- US Internal Revenue Service: F940ez - 1999Document2 pagesUS Internal Revenue Service: F940ez - 1999IRSNo ratings yet

- Part III-Investment Interest Expense Deduction: Form 4952 (2009)Document1 pagePart III-Investment Interest Expense Deduction: Form 4952 (2009)Afzal ImamNo ratings yet

- 1099 BPSealDocument1 page1099 BPSealahmed adlyNo ratings yet

- US Internal Revenue Service: f940 - 1999Document2 pagesUS Internal Revenue Service: f940 - 1999IRSNo ratings yet

- US Internal Revenue Service: f8812 - 2000Document2 pagesUS Internal Revenue Service: f8812 - 2000IRSNo ratings yet

- US Internal Revenue Service: I941 - 2004Document4 pagesUS Internal Revenue Service: I941 - 2004IRSNo ratings yet

- US Internal Revenue Service: f8812 - 2001Document2 pagesUS Internal Revenue Service: f8812 - 2001IRSNo ratings yet

- US Internal Revenue Service: f8861 - 2004Document3 pagesUS Internal Revenue Service: f8861 - 2004IRSNo ratings yet

- US Internal Revenue Service: f8839 - 2004Document2 pagesUS Internal Revenue Service: f8839 - 2004IRSNo ratings yet

- US Internal Revenue Service: fw4s - 1999Document2 pagesUS Internal Revenue Service: fw4s - 1999IRSNo ratings yet

- US Internal Revenue Service: f8814 - 1997Document2 pagesUS Internal Revenue Service: f8814 - 1997IRSNo ratings yet

- IRS Form 843 InstructionsDocument4 pagesIRS Form 843 Instructionsl33tbobNo ratings yet

- Instructions For Schedule A (Form 990) : Internal Revenue ServiceDocument8 pagesInstructions For Schedule A (Form 990) : Internal Revenue ServiceIRSNo ratings yet

- US Internal Revenue Service: f5329 - 1995Document2 pagesUS Internal Revenue Service: f5329 - 1995IRSNo ratings yet

- US Internal Revenue Service: f5329 - 2004Document2 pagesUS Internal Revenue Service: f5329 - 2004IRSNo ratings yet

- Limitation On Business LossesDocument1 pageLimitation On Business Lossesdouglas jonesNo ratings yet

- US Internal Revenue Service: f8844 - 2005Document4 pagesUS Internal Revenue Service: f8844 - 2005IRSNo ratings yet

- Instructions For Schedule A (Form 990 or 990-EZ) : Pager/SgmlDocument14 pagesInstructions For Schedule A (Form 990 or 990-EZ) : Pager/SgmlIRSNo ratings yet

- US Internal Revenue Service: f1045 - 2005Document4 pagesUS Internal Revenue Service: f1045 - 2005IRSNo ratings yet

- US Internal Revenue Service: F940ez - 1998Document2 pagesUS Internal Revenue Service: F940ez - 1998IRSNo ratings yet

- US Internal Revenue Service: I5500sp - 2003Document1 pageUS Internal Revenue Service: I5500sp - 2003IRSNo ratings yet

- Schedule A-Itemized DeductionsDocument4 pagesSchedule A-Itemized DeductionsSyed Aziz HussainNo ratings yet

- F 1040 SabDocument2 pagesF 1040 SabIRSNo ratings yet

- US Internal Revenue Service: f8861 - 2003Document3 pagesUS Internal Revenue Service: f8861 - 2003IRSNo ratings yet

- US Internal Revenue Service: f1045 - 2004Document4 pagesUS Internal Revenue Service: f1045 - 2004IRSNo ratings yet

- US Internal Revenue Service: f2210f - 1995Document2 pagesUS Internal Revenue Service: f2210f - 1995IRSNo ratings yet

- US Internal Revenue Service: f8882 - 2005Document3 pagesUS Internal Revenue Service: f8882 - 2005IRS100% (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- Taxation Chapter 3 RMH1Document22 pagesTaxation Chapter 3 RMH1Fahim Ashab Chowdhury0% (1)

- P 50Document2 pagesP 50Emily DeerNo ratings yet

- Form No 15GDocument4 pagesForm No 15GFinance & Health ExpressNo ratings yet

- CREATE Zalamea Briefing + RRsDocument76 pagesCREATE Zalamea Briefing + RRsGerryNo ratings yet

- 839 DhirajDocument1 page839 DhirajjordanchaliawalaNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDWorkingNo ratings yet

- ABS CBN V CTA Exception To The Rule On Erroneous Executive ConstructionDocument2 pagesABS CBN V CTA Exception To The Rule On Erroneous Executive ConstructionprincessmagpatocNo ratings yet

- PERA - RMC No. 139-2020Document5 pagesPERA - RMC No. 139-2020Denden GajudoNo ratings yet

- 2022 Victor Tamayo YourDocument9 pages2022 Victor Tamayo YourCiber 13100% (3)

- Accounting VoucherDocument1 pageAccounting VoucherDeepak SinghNo ratings yet

- 2ND MEETING Business Taxation NotesDocument3 pages2ND MEETING Business Taxation NotesIT GAMINGNo ratings yet

- Required File Structure For Summary Alphalist of Withholding Taxes (Sawt)Document2 pagesRequired File Structure For Summary Alphalist of Withholding Taxes (Sawt)annNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- Test Bank For Intermediate Accounting Volume 2 12th Canadian by Kieso DownloadDocument65 pagesTest Bank For Intermediate Accounting Volume 2 12th Canadian by Kieso Downloadjasondaviskpegzdosmt100% (26)

- Combine PDFDocument3 pagesCombine PDFKaye ApostolNo ratings yet

- RMC No. 51-2018Document1 pageRMC No. 51-2018Atty. Jackelyn Joy Pernitez0% (1)

- Assam State Budget 2024 25Document16 pagesAssam State Budget 2024 25Partha DasNo ratings yet

- @canotescommunity GST Nov22Document21 pages@canotescommunity GST Nov22Gomtesh BhatiNo ratings yet

- M A Economics-10 PDFDocument44 pagesM A Economics-10 PDFshubham kharateNo ratings yet

- Russel Head For Plano City Council Talking PointsDocument2 pagesRussel Head For Plano City Council Talking PointsDallas Morning News Plano BlogNo ratings yet

- San Francisco Budget BasicsDocument6 pagesSan Francisco Budget Basicsadmin5057No ratings yet

- PdataDocument6 pagesPdataRazor11111No ratings yet

- Introduction To Business FinanceDocument14 pagesIntroduction To Business Financesohail janNo ratings yet

- Example of Tax Research LetterDocument3 pagesExample of Tax Research LetterGrace Ann Aceveda QuinioNo ratings yet

- Taxes in Canada-Final 2011Document145 pagesTaxes in Canada-Final 2011Dayarayan CanadaNo ratings yet

- TVC ElectronicsDocument3 pagesTVC ElectronicsBala_9990No ratings yet

- TDS Late Fee (Or GST Late Fee) Is An Allowable ExpenditureDocument5 pagesTDS Late Fee (Or GST Late Fee) Is An Allowable ExpenditureDivyaNo ratings yet

- SaifDocument20 pagesSaifSaif Ur RehmanNo ratings yet