Professional Documents

Culture Documents

Bc1 - Handy Hardware LTD Mall Store Financial Summary / Ratio Analysis

Bc1 - Handy Hardware LTD Mall Store Financial Summary / Ratio Analysis

Uploaded by

Joel Almario Atienza0 ratings0% found this document useful (0 votes)

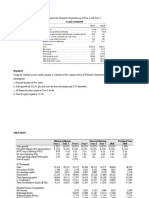

75 views2 pagesThis document contains financial statements and ratio analyses for Handy Hardware Ltd. over a five year period from 2003 to 2007. It includes income statements showing sales, costs, expenses, earnings and taxes. It also includes balance sheets showing assets, liabilities and equity. Financial ratios are provided for gross margin, current ratio, inventory turnover, debt to equity, times interest earned, profit margin, return on assets, return on equity and total assets turnover.

Original Description:

Original Title

BC1prior

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains financial statements and ratio analyses for Handy Hardware Ltd. over a five year period from 2003 to 2007. It includes income statements showing sales, costs, expenses, earnings and taxes. It also includes balance sheets showing assets, liabilities and equity. Financial ratios are provided for gross margin, current ratio, inventory turnover, debt to equity, times interest earned, profit margin, return on assets, return on equity and total assets turnover.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

75 views2 pagesBc1 - Handy Hardware LTD Mall Store Financial Summary / Ratio Analysis

Bc1 - Handy Hardware LTD Mall Store Financial Summary / Ratio Analysis

Uploaded by

Joel Almario AtienzaThis document contains financial statements and ratio analyses for Handy Hardware Ltd. over a five year period from 2003 to 2007. It includes income statements showing sales, costs, expenses, earnings and taxes. It also includes balance sheets showing assets, liabilities and equity. Financial ratios are provided for gross margin, current ratio, inventory turnover, debt to equity, times interest earned, profit margin, return on assets, return on equity and total assets turnover.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 2

A B C D E F

1 BC1 - HANDY HARDWARE LTD

2 MALL STORE FINANCIAL SUMMARY / RATIO ANALYSIS

3 CGA-CANADA

4

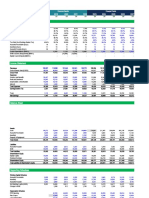

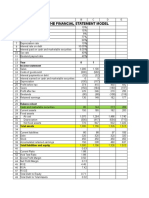

5 FIVE YEAR SUMMARY 2007 2006 2005 2004 2003

6

7 Income Statement:

8 Sales 825,117 875,817 821,157 745,732 ###

9 Cost of goods sold 545,679 597,733 562,475 515,278 ###

10 Interest expense 12,000 13,542 17,542 16,549 14,274

11 Pre-tax earnings 51,315 49,247 44,537 42,130 35,607

12 Income taxes 19,500 18,714 16,924 16,009 13,531

13 Net earnings (loss) 31,815 30,533 27,613 26,121 22,076

14

15 Balance Sheet:

16 Current assets 111,267 127,339 101,617 102,533 ###

17 Inventory 91,683 103,459 93,082 72,062 87,531

18 Capital assets (net) 107,716 101,530 103,188 110,206 ###

19

20 Total assets 310,666 332,328 297,887 284,801 ###

21

22 Current liabilities 99,559 107,419 103,234 100,074 ###

23 Long-term liabilities 115,314 123,266 115,181 113,181 ###

24 Shareholders' equity 95,793 101,643 79,472 71,546 73,854

25

26 Total liabilities and equit Err:520 Err:520 Err:520 Err:520 Err:520

27

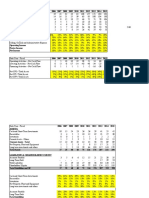

28 FINANCIAL RATIO ANALYSIS

29 2007 2006 2005 2004 2003

30 Gross margin

31 Current ratio

32 Inventory turnover

33 Total debt to equity

34 Times interest earned

35 Profit margin (profit on sales)

36 Return on assets

37 Return on equity

38 Total assets turnover

A B C D E F

1 BC1 - HANDY HARDWARE LTD

2 MALL STORE FINANCIAL SUMMARY / RATIO ANALYSIS

3 CGA-CANADA

4

5 FIVE YEAR SUMMARY 2007 2006 2005 2004 2003

6

7 Income Statement:

8 Sales 825,117 875,817 821,157 745,732 ###

9 Cost of goods sold 545,679 597,733 562,475 515,278 ###

10 Interest expense 12,000 13,542 17,542 16,549 14,274

11 Pre-tax earnings 51,315 49,247 44,537 42,130 35,607

12 Income taxes 19,500 18,714 16,924 16,009 13,531

13 Net earnings (loss) 31,815 30,533 27,613 26,121 22,076

14

15 Balance Sheet:

16 Current assets 111,267 127,339 101,617 102,533 ###

17 Inventory 91,683 103,459 93,082 72,062 87,531

18 Capital assets (net) 107,716 101,530 103,188 110,206 ###

19

20 Total assets 310,666 332,328 297,887 284,801 ###

21

22 Current liabilities 99,559 107,419 103,234 100,074 ###

23 Long-term liabilities 115,314 123,266 115,181 113,181 ###

24 Shareholders' equity 95,793 101,643 79,472 71,546 73,854

25

26 Total liabilities and eq Err:520 Err:520 Err:520 Err:520 Err:520

27

28 FINANCIAL RATIO ANALYSIS

29 2007 2006 2005 2004 2003

30 Gross margin 33.87% 31.75% 31.50% 30.90% 29.01%

31 Current ratio 1.12 1.19 0.98 1.02 0.99

32 Inventory turnover 5.59 6.08 6.81 6.46 6.02

33 Total debt to equity 2.24 2.27 2.75 2.98 3.00

34 Times interest earned 5.28 4.64 3.54 3.55 3.49

35 Profit margin (profit on 3.86% 3.49% 3.36% 3.50% 2.97%

36 Return on assets 0.10 0.10 0.09 0.09 0.07

37 Return on equity 0.32 0.34 0.37 0.36 0.30

38 Total assets turnover 2.57 2.78 2.82 2.57 2.51

You might also like

- Alliance Concrete Case ExcelDocument14 pagesAlliance Concrete Case ExcelKelsey McMillanNo ratings yet

- (Shared) Day5 Harmonic Hearing Co. - 4271Document17 pages(Shared) Day5 Harmonic Hearing Co. - 4271DamTokyo0% (2)

- 8e Ch3 Mini Case MaterialityDocument8 pages8e Ch3 Mini Case MaterialityAnonymous Ul3litq0% (9)

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- Comprehensive Problem For Fundamentals of AccountingDocument19 pagesComprehensive Problem For Fundamentals of Accountingjojie dador100% (3)

- Case Study On Financial Risk AnalysisDocument6 pagesCase Study On Financial Risk AnalysisolafedNo ratings yet

- RequiredDocument3 pagesRequiredKplm StevenNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Financial Management Solved ProblemsDocument50 pagesFinancial Management Solved ProblemsAnonymous RaQiBV75% (4)

- IFRS Short Requiremnts Diagram PDFDocument62 pagesIFRS Short Requiremnts Diagram PDFTamirat Eshetu WoldeNo ratings yet

- Liston Mechanic CorporationDocument14 pagesListon Mechanic CorporationKunal MehtaNo ratings yet

- FS AaplDocument20 pagesFS AaplReza FachrizalNo ratings yet

- PPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Document47 pagesPPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Syed Ameer Ali ShahNo ratings yet

- PPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Document46 pagesPPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996José Carlos GBNo ratings yet

- Tutorial 07Document3 pagesTutorial 07yalom85292No ratings yet

- Hypothesis For 2003 and 2004: Profit and Loss Stateme Real Forecast Forecast 2002 2003 2004Document12 pagesHypothesis For 2003 and 2004: Profit and Loss Stateme Real Forecast Forecast 2002 2003 2004FeRnanda GisselaNo ratings yet

- Mercury Action Athletic Synergies & AssumptionsDocument10 pagesMercury Action Athletic Synergies & AssumptionsSimón SegoviaNo ratings yet

- Fiscal Year Ending December 31 2020 2019 2018 2017 2016Document22 pagesFiscal Year Ending December 31 2020 2019 2018 2017 2016Wasif HossainNo ratings yet

- Blaine Kitchenware: Case Exhibit 1Document15 pagesBlaine Kitchenware: Case Exhibit 1Fahad AliNo ratings yet

- Balance SheetDocument9 pagesBalance SheetSheheryar KhanNo ratings yet

- DCF 3 CompletedDocument3 pagesDCF 3 CompletedPragathi T NNo ratings yet

- Case IDocument20 pagesCase ICherry KanjanapornsinNo ratings yet

- Financial Report - ShyamDocument14 pagesFinancial Report - ShyamYaswanth MaripiNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- AOFSDocument15 pagesAOFS1abd1212abdNo ratings yet

- Part 4 - Topic Part: CSR of IbblDocument38 pagesPart 4 - Topic Part: CSR of IbblfahadNo ratings yet

- Hitung ProyeksiDocument3 pagesHitung ProyeksiDwinanda HarsaNo ratings yet

- Pinancle FinancialsDocument6 pagesPinancle FinancialsJhorghe GonzalezNo ratings yet

- Mercury Case ExhibitsDocument10 pagesMercury Case ExhibitsjujuNo ratings yet

- Caterpillar IndicadoresDocument24 pagesCaterpillar IndicadoresChris Fernandes De Matos BarbosaNo ratings yet

- Assignment 5cDocument7 pagesAssignment 5cAnisa Septiana DewiNo ratings yet

- INS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Document4 pagesINS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Thảo Thiên ChiNo ratings yet

- Sub: Financial Accounting Sub: Financial AccountingDocument14 pagesSub: Financial Accounting Sub: Financial AccountingMilan PateliyaNo ratings yet

- Cap 1 TablasDocument18 pagesCap 1 TablasWILDER ENRIQUEZ POCOMONo ratings yet

- Germany: Retail Petrol Stations During 2006-2009Document17 pagesGermany: Retail Petrol Stations During 2006-2009jlambiotteNo ratings yet

- FM Sy 2Document13 pagesFM Sy 2s.zaidi5699No ratings yet

- Exhibit in ExcelDocument8 pagesExhibit in ExcelAdrian WyssNo ratings yet

- DCF Model - Blank: Strictly ConfidentialDocument5 pagesDCF Model - Blank: Strictly ConfidentialaeqlehczeNo ratings yet

- Last Five Years Financial Performance 2021Document1 pageLast Five Years Financial Performance 2021Md AzizNo ratings yet

- Last Five Years Financial Performance 2021Document1 pageLast Five Years Financial Performance 2021rahman.mahfuz9966No ratings yet

- Mercury Athletic Historical Income StatementsDocument18 pagesMercury Athletic Historical Income StatementskarthikawarrierNo ratings yet

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princeNo ratings yet

- Excel Files For Case 12 Value PublishingDocument12 pagesExcel Files For Case 12 Value PublishingOmer KhanNo ratings yet

- Excel Files For Case 12 - Value PublishinDocument12 pagesExcel Files For Case 12 - Value PublishinGerry RuntukahuNo ratings yet

- Financial Statements and Ratios Flashcards QuizletDocument14 pagesFinancial Statements and Ratios Flashcards QuizletDanish HameedNo ratings yet

- Balance Sheet: Sources of FundsDocument14 pagesBalance Sheet: Sources of FundsJayesh RodeNo ratings yet

- Add Dep Less Tax OCF Change in Capex Change in NWC FCFDocument5 pagesAdd Dep Less Tax OCF Change in Capex Change in NWC FCFGullible KhanNo ratings yet

- Financial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Document1 pageFinancial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)saifrahmanNo ratings yet

- Financial Modeling - Benninga - Chap 3Document21 pagesFinancial Modeling - Benninga - Chap 3Hira HasanNo ratings yet

- Aztecsoft Financial Results Q2 09Document5 pagesAztecsoft Financial Results Q2 09Mindtree LtdNo ratings yet

- Chapter - 3 HW 3 - Apple RatiosDocument4 pagesChapter - 3 HW 3 - Apple RatiosSubhash MishraNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- DCF Case Sample 1Document4 pagesDCF Case Sample 1Gaurav SethiNo ratings yet

- ProblemsDocument6 pagesProblemsAarti SaxenaNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Book 1Document4 pagesBook 1vineetchahar0210No ratings yet

- ENTI Ver 1Document72 pagesENTI Ver 1krishna chaitanyaNo ratings yet

- VerticalDocument2 pagesVerticalPatricia PeñaNo ratings yet

- Project Report PDFDocument13 pagesProject Report PDFMan KumaNo ratings yet

- OVL English Annual Report 19-20-24!11!2020Document394 pagesOVL English Annual Report 19-20-24!11!2020hitstonecoldNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Adjusting Journal EntriesDocument9 pagesAdjusting Journal EntriesJoana TrinidadNo ratings yet

- Fabm1q2 Wk6aa (2023)Document113 pagesFabm1q2 Wk6aa (2023)merdeka esmaldeNo ratings yet

- Soal Uts Lab Ak. KeuanganDocument3 pagesSoal Uts Lab Ak. KeuanganAltaf HauzanNo ratings yet

- Afar Notes by DR Ferrer Summary Bs AccountancyDocument22 pagesAfar Notes by DR Ferrer Summary Bs AccountancyAnne Echavez Pasco100% (2)

- 2016 Vol 3 CH 6 AnsDocument6 pages2016 Vol 3 CH 6 Ansjohn lloyd JoseNo ratings yet

- FR Ind As 101Document55 pagesFR Ind As 101Dheeraj TurpunatiNo ratings yet

- Assignment 3.1Document8 pagesAssignment 3.1Jules AguilarNo ratings yet

- Financial Statements: BAO6504 Accounting For ManagementDocument20 pagesFinancial Statements: BAO6504 Accounting For ManagementDaud SulaimanNo ratings yet

- P2i Ask Groups Approach Q and S 2012Document12 pagesP2i Ask Groups Approach Q and S 2012hassanatcamsNo ratings yet

- 15 16Document12 pages15 16ashish bhardwajNo ratings yet

- Self-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachDocument2 pagesSelf-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachTeodorico PelenioNo ratings yet

- Vietti SOlution Full CycleDocument8 pagesVietti SOlution Full CycleShaina AragonNo ratings yet

- Journal Entries: Edgar DetoyaDocument17 pagesJournal Entries: Edgar DetoyaAntonNo ratings yet

- Advanced Accounting Chapter 16Document3 pagesAdvanced Accounting Chapter 16sutan fanandiNo ratings yet

- Intermediate Accounting Reporting and Analysis 1st Edition Wahlen Test Bank DownloadDocument109 pagesIntermediate Accounting Reporting and Analysis 1st Edition Wahlen Test Bank DownloadEdna Nunez100% (18)

- Assignment Sem III 2021-22Document4 pagesAssignment Sem III 2021-22rtluck9 002No ratings yet

- Statement of Cash Flows: HOSP 2110 (Management Acct) Learning CentreDocument6 pagesStatement of Cash Flows: HOSP 2110 (Management Acct) Learning CentrePrima Rosita AriniNo ratings yet

- Partnership Operations Lecture Problem and QuizzerPDFDocument6 pagesPartnership Operations Lecture Problem and QuizzerPDFjanefern49No ratings yet

- D. YFC UPSALE Sample FInancial Statement FormatDocument9 pagesD. YFC UPSALE Sample FInancial Statement FormatEmmanuel Mary Angelo ChuaNo ratings yet

- Lecture 03Document108 pagesLecture 03Masood AliNo ratings yet

- Chapter 1 PFRS 1 AnswerDocument1 pageChapter 1 PFRS 1 Answer03LJNo ratings yet

- Chapter 3 - Brief Exercises - SolutionsDocument4 pagesChapter 3 - Brief Exercises - SolutionsHa Dang Huynh NhuNo ratings yet

- Financial Accounting & Reporting 1Document232 pagesFinancial Accounting & Reporting 1Its Ahmed100% (1)

- CRA Journal Entries Internal ReconstructionDocument6 pagesCRA Journal Entries Internal Reconstructioncharmi vaghelaNo ratings yet

- BFAR 11-04-2022 The Accounting Cycle 3 Adjusting EntriesDocument4 pagesBFAR 11-04-2022 The Accounting Cycle 3 Adjusting EntriesSheryl cornelNo ratings yet