Professional Documents

Culture Documents

KYC Documents Requirements

KYC Documents Requirements

Uploaded by

Jayesh Bheda0 ratings0% found this document useful (0 votes)

17 views1 pageKYC (Know Your Customer) norms are for banks to comply! They have to come forward to collect documents! So if you receive KYC letter, call your bankers to collect them from your premises, they have to come to collect!!

Copyright

© Public Domain

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentKYC (Know Your Customer) norms are for banks to comply! They have to come forward to collect documents! So if you receive KYC letter, call your bankers to collect them from your premises, they have to come to collect!!

Copyright:

Public Domain

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

17 views1 pageKYC Documents Requirements

KYC Documents Requirements

Uploaded by

Jayesh BhedaKYC (Know Your Customer) norms are for banks to comply! They have to come forward to collect documents! So if you receive KYC letter, call your bankers to collect them from your premises, they have to come to collect!!

Copyright:

Public Domain

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 1

RBI GUIDELINES ON KNOW YOUR CUSTOMER (KYC) NORMS

The guidelines issued by Reserve bank of India (RBI) relating to “Know Your Customer” (KY

norms, mandates Banks to periodically update records with current information relating to custom:

identity and address. We regret to advice that your account with us is not “KYC” compliant as per stands

prescribed by RBI.

You are, therefore requested to kindly call on us along with the documents from the list belo

recent photographs on any working day during office hours on or before 31/05/2011 so as to enable w:

make your account with KYC complaint. If the same is not received within 30 days from the receipt of :

letter by you, we will be constrained to/ to restrict operation in the account immediately and thereafte:

may have no option but to close your account for want of KYC compliance in terms of RBI guidelines

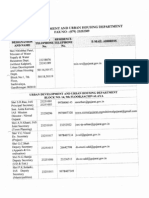

Documents accepted as proof of identity | Documents accepted as proof of recidence

@ Passport @ Credit Card Statement

(ii) Voter ID Card (ii) Salary slip “

(ii), PAN Card | Gi) Income/Wealth tax assessment

(iv) Government/Defence ID Card (iv) Electricity Bill

(v) ID cards of reputed employers | @®) Telephone Bill

(vi) Driving Lincence (vi) Bank account statement

(vii) Pension Payment Orders (Govt. / (vii) Letter from reputed employer

PSUs) (viii) Ration Card

(viti) Photo ID cards issued by Post Office | (ix) Letter from any recognized public

(ix) Photo identity cards issued to authority

bonafied students of universities/ |" (x). Pension Payment Orders (Govt. /

institutes approved by UGC/AICTE PSUs)

(xi) Voter ID Cards

(sii) Copies-of Registered Leave and

License agreement/sale deed/lease

__| agreement

Kindly treat this as most urgent

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Outstate Farmer Gujarat High Court JudgmentDocument36 pagesOutstate Farmer Gujarat High Court JudgmentJayesh Bheda100% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Application For Issuance of Certificate of Practice Under Bar Council of India Rules, 2014Document2 pagesApplication For Issuance of Certificate of Practice Under Bar Council of India Rules, 2014Jayesh BhedaNo ratings yet

- Photography Club of Gandhidham - Trip Report - Palar DhunaDocument13 pagesPhotography Club of Gandhidham - Trip Report - Palar DhunaJayesh Bheda100% (1)

- Civil Servants Cannot Function On The Basis of Verbal or Oral Instructions, Orders, Suggestions, Proposals (Full Judgment)Document21 pagesCivil Servants Cannot Function On The Basis of Verbal or Oral Instructions, Orders, Suggestions, Proposals (Full Judgment)Jayesh BhedaNo ratings yet

- Gujarat High Court Case Flow Management (Subordinate Courts) Rules, 2016Document14 pagesGujarat High Court Case Flow Management (Subordinate Courts) Rules, 2016Jayesh Bheda0% (1)

- Not Necessary To Declare Religion On FormDocument11 pagesNot Necessary To Declare Religion On FormJayesh BhedaNo ratings yet

- Negotiable Instruments (Amendment) Ordinance, 2015Document3 pagesNegotiable Instruments (Amendment) Ordinance, 2015Latest Laws Team100% (1)

- Only One Motilal C. Setalvad, Never A Second Again - R.K. GargDocument23 pagesOnly One Motilal C. Setalvad, Never A Second Again - R.K. GargJayesh BhedaNo ratings yet

- Photography Club of Gandhidham - Modvadar - Trip ReportDocument14 pagesPhotography Club of Gandhidham - Modvadar - Trip ReportJayesh BhedaNo ratings yet

- RTI Notification For Senior Citizen and Physically ChallengedDocument1 pageRTI Notification For Senior Citizen and Physically ChallengedJayesh BhedaNo ratings yet

- Photography Club of Gandhidham - Bhimasar Trip ReportDocument11 pagesPhotography Club of Gandhidham - Bhimasar Trip ReportJayesh BhedaNo ratings yet

- Gujarat Municipality Act, Chapter 13 in Gujarati LanguageDocument5 pagesGujarat Municipality Act, Chapter 13 in Gujarati LanguageJayesh Bheda100% (4)

- Gujarat BJP Manifesto For Assembly Election 2012 in Gujarati LanguageDocument14 pagesGujarat BJP Manifesto For Assembly Election 2012 in Gujarati LanguageJayesh BhedaNo ratings yet

- Ground Rent of Gandhidham - Notification of TAMP - 2012Document22 pagesGround Rent of Gandhidham - Notification of TAMP - 2012Jayesh BhedaNo ratings yet

- State of Gujarat Versus Gaurang Mathurbhai LeuvaDocument7 pagesState of Gujarat Versus Gaurang Mathurbhai LeuvaJayesh BhedaNo ratings yet

- Manifesto of Gujarat BJP For Assembly Election 2012 in English Language.Document9 pagesManifesto of Gujarat BJP For Assembly Election 2012 in English Language.Jayesh Bheda100% (1)

- Birds-Animals Have Fundamental Right To Live FreelyDocument8 pagesBirds-Animals Have Fundamental Right To Live FreelyJayesh BhedaNo ratings yet

- H.M.Maharao Shri Madansinhji Saheb of Kutch Versus State of GujaratDocument8 pagesH.M.Maharao Shri Madansinhji Saheb of Kutch Versus State of GujaratJayesh BhedaNo ratings yet

- Supreme Court On Justice, Courts and DelaysDocument17 pagesSupreme Court On Justice, Courts and DelaysJayesh BhedaNo ratings yet

- Lessons From Penalties Imposed On PIO by Central Information Commission Under RTIDocument9 pagesLessons From Penalties Imposed On PIO by Central Information Commission Under RTIJayesh BhedaNo ratings yet

- Contact Details of GUDCDocument5 pagesContact Details of GUDCJayesh BhedaNo ratings yet

- RTI Blank Form-English-gujaratiDocument2 pagesRTI Blank Form-English-gujaratiJayesh Bheda100% (12)

- Public Purpose Plots Allotted To Gandhidham Municipality by SRCDocument2 pagesPublic Purpose Plots Allotted To Gandhidham Municipality by SRCJayesh BhedaNo ratings yet