Professional Documents

Culture Documents

Form No. 16: Details of Salary Paid and Any Other Income and Tax Deducted

Form No. 16: Details of Salary Paid and Any Other Income and Tax Deducted

Uploaded by

kalaputraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 16: Details of Salary Paid and Any Other Income and Tax Deducted

Form No. 16: Details of Salary Paid and Any Other Income and Tax Deducted

Uploaded by

kalaputraCopyright:

Available Formats

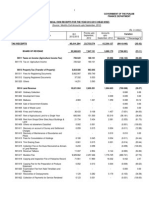

FORM NO.

16

[ See rule 31(1) (a) ] "ORIGINAL"

Certificate under section 203 of the Income-tax Act, 1961,

for tax deducted at source from income chargeable under the head "Salaries"

Name and address of the Employer Name and designation of the Employee

TATA CONSULTANCY SERVICES LTD. Mr/Ms: NITHIN FRANCIS MALOTH

8th Flr, Nirmal Bldg, Nariman Point Desig.: I.T. Analyst

Mumbai 400021 Emp #:00309471

Maharashtra

PAN No. of the Deductor TAN No. of the Deductor PAN No. of the Employee

AAACR4849R MUMT11446B AKNPM1249C

Acknowledgement Nos. of all quarterly statements of TDS under Period Assessment

sub-section (3) of section 200 as provided by TIN Facilitation Centre or year

NSDL web-site

Quarter Acknowledgement No. From To

1 (April - June) 030170200218830 01.04.2009 14.09.2009 2010-2011

2 (July - September) 030110500044111

3 (October - December)

4 (January - March)

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

Particulars Rs. Rs. Rs.

1. Gross salary

a) Salary as per provisions contained in section 17(1) 310780.02

b) Value of perquisites under section 17(2)

( as per Form No.12BA wherever applicable ) 0.00

c) Profits in lieu of salary under section 17(3)

( as per Form No.12BA wherever applicable ) 0.00

d) Total 310780.02

2. Less: Allowance to the extent exempt under section 10 14123.34

3. Balance(1-2) 296656.68

4. DEDUCTIONS:

(a) Entertainment allowance 0.00

(b) Tax on Employment 1250.00

5. Aggregate of 4 (a) to (b) 1250.00

6. INCOME CHARGEABLE UNDER THE HEAD "SALARIES"(3-5) 295406.68

7. Add: Any other Income reported by the employee 0.00

8. GROSS TOTAL INCOME (6+7) 295406.68

9. DEDUCTIONS UNDER CHAPTER VIA Gross amount Deductible amount

(A) sections 80C, 80CCC and 80CCD

(a) section 80C

i) Employeee Provident Fund 10824.00 10824.00 10824.00

(b) section 80CCC 0.00 0.00

(c) section 80CCD 0.00 0.00

Note : 1. aggregate amount deductible under section 80C shall not

exceed one lakh rupees

2. aggregate amount deductible under the three sections, i.e, 80C,

80CCC and 80CCD, shall not exceed one lakh rupees

(B) other sections (for e.g., 80E, 80G etc.) under Chapter VIA

(a) 80D(01) 3530.00 3530.00 3530.00

10. Aggregate of deductible amount under Chapter VI-A 14354.00

00309471 NITHIN FRANCIS MALOTH

11. Total income (8-10) 281050.00

12. Tax on total income 12105.00

13. Surcharge (on tax computed at S.No.12 ) 0.00

14. Education cess (on tax at S.No.12 and surcharge at S.No.13) 363.00

15. Tax payable (12+13+14) 12468.00

16. Relief under section 89 (attach details) 0.00

17. Tax payable (15-16) 12468.00

18. Less: a) Tax deducted at source u/s 192(1) 39170.00

b) Tax paid by the employer on behalf of the employee

u/s 192(1A) on perquisites u/s 17(2) 0.00 39170.00

19. Tax payable / refundable (17-18) -26702.00

00309471 NITHIN FRANCIS MALOTH

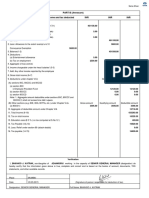

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

(The Employer is to provide transaction-wise details of tax deducted and deposited)

Sl. TDS Surcharge Education Total Tax Cheque /DD No. BSR Code of Date on which Transfer

No. Rs. Rs. Cess deposited (if any) Bank Branch Tax deposited voucher/Challan

Rs. (dd/mm/yy) Identification No.

001 6916.51 0.00 207.49 7124.00 00009127000590 0510308 07.05.2009 82007

002 6820.35 0.00 204.65 7025.00 00009156000381 0510308 05.06.2009 82007

003 6880.55 0.00 206.45 7087.00 00009188000479 0510308 07.07.2009 82068

004 10549.59 0.00 316.41 10866.00 00009217000526 0510308 05.08.2009 82001

005 6722.31 0.00 201.69 6924.00 00009250000508 0510308 07.09.2009 82001

006 139.87 0.00 4.13 144.00 00009280000652 0510308 07.10.2009 82030

_______________________________________________________________________________________________________________________________________________________________

I, BHIKHOO J. KATRAK, son/daughter of JEHANGIRJI working in the capacity of GENERAL MANAGER do hereby certify that

a sum of Rs 39170.00 [ Rupees THIRTY NINE THOUSAND ONE HUNDRED SEVENTY ]

has been deducted at source and paid to the credit of the Central Government. I further certify that the information given

above is true and correct based on the books of account, documents and other available records.

Place: MUMBAI ______________________________________________

Signature of the person responsible for deduction of tax

Date: 09.04.2010 for TATA CONSULTANCY SERVICES LTD.

Full name: BHIKHOO J. KATRAK

Designation: GENERAL MANAGER

Signature Not Verified

Digitally signed by Bhikhoo J

Katrak

Date: 2010.04.10 16:20:31 IST

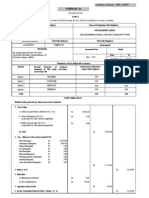

Annexure to Form No.16

Name: NITHIN FRANCIS MALOTH Emp No.: 00309471

Particulars Amount(Rs.)

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Emoluments paid

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Basic Salary 90200.00

Conveyance Allowance 4373.34

House Rent Allowance 45100.00

Leave Travel Allowance 7516.66

Medical Allowance 6833.34

Leave Encashment 9750.00

Food Coupons 2933.34

Personal Allowance 39633.34

Variable Allowance 104440.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Perks

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Gross emoluments 310780.02

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Income from other sources

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Total income from other sources 0.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Exemptions u/s 10

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Conveyance Exemption 4373.34

Leave Salary Exemption 9750.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Total Exemption 14123.34

Date: 09.04.2010 Full Name: BHIKHOO J. KATRAK

Place: MUMBAI Designation: GENERAL MANAGER

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisites, other fringe

benefits or amenities and profits in lieu of salary with value thereof

1) Name and address of employer :

TATA CONSULTANCY SERVICES LTD. , 8th Flr, Nirmal Bldg, Nariman Point Mumbai - 400021 , Maharashtra

2) TAN: MUMT11446B

3) TDS Assesment Range of the employer :

Circle TDS II(2), 10th floor, IT Office,Charni Road, Mumbai, , 400002,

4) Name, designation and PAN of employee :

Mr/Ms: NITHIN FRANCIS MALOTH , Desig.: I.T. Analyst , Emp #: 00309471 , PAN: AKNPM1249C

5) Is the employee a director or a person with substantial interest in

the company (where the employer is a company):

6) Income under the head "Salaries" of the employee : 295406.68

(other than from perquisites)

7) Financial year : 2009-2010

8) Valuation of Perquisites

S.No Nature of perquisite Value of perquisite Amount, if any, recovered Amount of perquisite

(see rule 3) as per rules (Rs.) from the employee (Rs.) chargeable to tax(Rs.)

(1) (2) (3) (4) Col(3)-Col(4) (5)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

3 Sweeper, gardener, watchman or 0.00 0.00 0.00

personal attendant

4 Gas, electricity, water

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday expenses

7 Free or concessional travel 0.00 0.00 0.00

8 Free meals

9 Free Education

10 Gifts, vouchers, etc. 0.00 0.00 0.00

11 Credit card expenses

12 Club expenses

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to employees 0.00 0.00 0.00

15 Value of any other benefit

/amenity/service/privilege

16 Stock options ( non-qualified options )

17 Other benefits or amenities 0.00 0.00 0.00

18 Total value of perquisites 0.00 0.00 0.00

19 Total value of profits in lieu of salary

as per section 17 (3)

9. Details of tax, -

(a) Tax deducted from salary of the employee under section 192(1) 39170.00

(b) Tax paid by employer on behalf of the employee under section192(1A) 0.00

(c) Total tax paid 39170.00

(d) Date of payment into Government treasury *

* Refer to page 3 of form 16 under Details of tax deducted and deposited into Central Government Account.

DECLARATION BY EMPLOYER

I, BHIKHOO J. KATRAK son/daughter of JEHANGIRJI working as GENERAL MANAGER (designation ) do hereby declare on behalf of

TATA CONSULTANCY SERVICES LTD. ( name of the employer ) that the information given above is based on the books of account,

documents and other relevant records or information available with us and the details of value of each such perquisite are in accordance with

section 17 and rules framed thereunder and that such information is true and correct.

Signature of the person responsible

for deduction of tax

Place: MUMBAI Full Name : BHIKHOO J. KATRAK

Date : 09.04.2010 Designation : GENERAL MANAGER

You might also like

- Salary Slip - Oct 09Document1 pageSalary Slip - Oct 09Danielle Morris0% (1)

- Salary Bill For Gazetted Government ServantsDocument2 pagesSalary Bill For Gazetted Government Servantsمحمد حمزة الشاذلي100% (2)

- Form 16Document5 pagesForm 16Shruti GuptaNo ratings yet

- LO4194 PayrollDocument431 pagesLO4194 Payrollhammad016No ratings yet

- TK 9012322500186 R PosDocument3 pagesTK 9012322500186 R PosRAJU JANANo ratings yet

- Form16Document10 pagesForm16anon-263698No ratings yet

- TSF 5108235026012090 R PosDocument3 pagesTSF 5108235026012090 R PosJoy MondalNo ratings yet

- TSF 5108235026014504 R PosDocument3 pagesTSF 5108235026014504 R PosJoy MondalNo ratings yet

- Itr - TCSDocument3 pagesItr - TCSsivaNo ratings yet

- Jio InvoiceDocument2 pagesJio InvoiceMd SerajNo ratings yet

- 780918722502314RPOSDocument2 pages780918722502314RPOSbroNo ratings yet

- Bayyaram Pay BillsDocument6 pagesBayyaram Pay BillsMatta Madhu Sudhana RaoNo ratings yet

- HTTP Punjab - Gov.pk Punjab - Gov.pk Q System Files mca0912RECDocument20 pagesHTTP Punjab - Gov.pk Punjab - Gov.pk Q System Files mca0912RECkhadimJilaniNo ratings yet

- 8778563Document4 pages8778563muthum44499335No ratings yet

- PART B (Annexure) Details of Salary Paid and Any Other Income and Tax Deducted INR Inr InrDocument3 pagesPART B (Annexure) Details of Salary Paid and Any Other Income and Tax Deducted INR Inr InrAshraf KhanNo ratings yet

- TUB710223500152RPOSDocument2 pagesTUB710223500152RPOSKaran KhatriNo ratings yet

- PayslipDocument3 pagesPayslipkarnancy100% (1)

- Rti FormDocument2 pagesRti FormKumar GauravNo ratings yet

- 103497Document5 pages103497Ashok PuttaparthyNo ratings yet

- TSD 426922500999 R PosDocument2 pagesTSD 426922500999 R Posvxryg557pfNo ratings yet

- PayslipDocument1 pagePaysliprustamazad80No ratings yet

- Aiatsl: (Wholly Owned Subsidiary of Air India Limited)Document1 pageAiatsl: (Wholly Owned Subsidiary of Air India Limited)Krishna Webkrishna100% (1)

- Phe Batagram Payroll 01-2021Document97 pagesPhe Batagram Payroll 01-2021Fayaz KhanNo ratings yet

- 769868623500714RPOSDocument2 pages769868623500714RPOSAman KumarNo ratings yet

- 0705910639101122112023Document2 pages0705910639101122112023blmaurya1984No ratings yet

- 4083753Document4 pages4083753hello8434No ratings yet

- Comp Ay 2022-23Document2 pagesComp Ay 2022-23Gideon DassNo ratings yet

- Form 16Document1 pageForm 16tdsbolluNo ratings yet

- 637917123500791rpos 1Document2 pages637917123500791rpos 1Ram KrishnaNo ratings yet

- Tax Invoice: Customer DetailDocument1 pageTax Invoice: Customer DetailDeepa AnkadNo ratings yet

- Modi 2328866 Econ ChainDocument64 pagesModi 2328866 Econ ChainGalaxy ShippingNo ratings yet

- 8764166245011395072RPOSDocument2 pages8764166245011395072RPOSakshay nagareNo ratings yet

- R PosDocument2 pagesR Posakshay nagareNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- UntitledDocument3 pagesUntitledDolos HecterNo ratings yet

- Kotaka Form16 41970Document4 pagesKotaka Form16 41970sai_gsrajuNo ratings yet

- Thirumoorthy Form16Document4 pagesThirumoorthy Form16sundar1111No ratings yet

- INFDocument4 pagesINFVijay AnandNo ratings yet

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaNo ratings yet

- THFHTHDocument3 pagesTHFHTHAll in One gamerNo ratings yet

- T91310720522154 RPsDocument2 pagesT91310720522154 RPsRahul 31No ratings yet

- Chinnaduran Form16Document4 pagesChinnaduran Form16sundar1111No ratings yet

- 1827 PDFDocument3 pages1827 PDFhelloitskalaiNo ratings yet

- Tax Computation-TemplateDocument70 pagesTax Computation-TemplatePadma SachithanandhamNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Ganaesmurthy Form16Document4 pagesGanaesmurthy Form16sundar1111No ratings yet

- Iphone 11 BillDocument4 pagesIphone 11 Bill26atom Fitness factoryNo ratings yet

- Form 16Document2 pagesForm 16Hari Krishnan ElangovanNo ratings yet

- R PosDocument2 pagesR PosMoh Zaid KhanNo ratings yet

- OriginalDocument9 pagesOriginalsudarsanNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- 8115674Document3 pages8115674sumit pandeyNo ratings yet

- 15973215079047531MDocument2 pages15973215079047531MRIMU INVESTMENTNo ratings yet

- Bill RPOSDocument3 pagesBill RPOSAditi KokaneNo ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- 9294343Document3 pages9294343AKHIL AHUJANo ratings yet

- 223957Document4 pages223957yuvionfireNo ratings yet

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryFrom EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- Electrical & Mechanical Components World Summary: Market Values & Financials by CountryFrom EverandElectrical & Mechanical Components World Summary: Market Values & Financials by CountryNo ratings yet