Professional Documents

Culture Documents

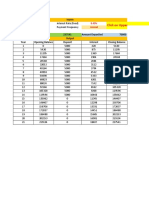

Tax Calculation For 2008-09

Tax Calculation For 2008-09

Uploaded by

ksanjay650 ratings0% found this document useful (0 votes)

30 views2 pages1. The document shows tax calculations for two individuals for the year 2008-09, including their salaries, allowances, perks, exemptions, deductions, and total tax payable.

2. Individual 1's gross salary including perks was Rs. 10,512,56 and total tax payable was Rs. 222,260.

3. Individual 2's gross salary including perks was Rs. 11,39,044 and total tax payable was Rs. 253,522.

Original Description:

Original Title

Tax Calculation for 2008-09

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document shows tax calculations for two individuals for the year 2008-09, including their salaries, allowances, perks, exemptions, deductions, and total tax payable.

2. Individual 1's gross salary including perks was Rs. 10,512,56 and total tax payable was Rs. 222,260.

3. Individual 2's gross salary including perks was Rs. 11,39,044 and total tax payable was Rs. 253,522.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

30 views2 pagesTax Calculation For 2008-09

Tax Calculation For 2008-09

Uploaded by

ksanjay651. The document shows tax calculations for two individuals for the year 2008-09, including their salaries, allowances, perks, exemptions, deductions, and total tax payable.

2. Individual 1's gross salary including perks was Rs. 10,512,56 and total tax payable was Rs. 222,260.

3. Individual 2's gross salary including perks was Rs. 11,39,044 and total tax payable was Rs. 253,522.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 2

Tax Calculation for the Year 2008-09

Sr No Head Payment From BRPL Payment from Adani

1 Basic Salary 133124 333336

2 House Rent Allowance 56404 0

3 Spl Allowance 64444 230896

4 One Time Spl Payment 54000 0

5 Enforcement Incentive 65772 0

6 Bonus 0 27768

7 Superannuation Allowance 0 50000

Site Allowance

8 Total 373744 642000

9 Value of Perks@10% 0 64200

10 Grand Total 373744 706200

11 Exemption

HRA Exemption 28688 0

12 Gross Salary incl. Perks 345056 706200

13 Deduction Under 16(1)

Professional Tax 0 1600

Income Chrgeable Under

14 Head `Salaries` 434444 704600

15 Other Income

Pension

Bank Interest

16 Total inclusive all Income

17 Rebate u\s VI-A

18 Taxable Income

Tax Calculation

Up to 150000 Nil

Above 150000 uo to 300000 10%

Above 300000 uo to 500000 20%

Above 500000 30%

19 Total Tax

20 Education Cess @ 3%

Surcharge @ 10 %( on Tax

21 of Rs 35602/-

22 Net Tax Payable

23 Tax Deducted at source 28988

24 Tax - Self assessment 26666

APL2M 434444

Payment from PLL Total 240000

199952 466460 83334 566421

129969 56404 0 89969

88519 295340 57724 1330834

72223 54000 0 1230834

0 65772 0

0 27768 6942

0 50000 12500

75758 0

566421 1015744 0

64200 16050

1079944 0

0

28688 0

1051256 0

0

1600 600 219250.2

1049656 1139044 177150

0

69996 69996

20000 20000

1135602 1229040

100000 100000

1035602 1124990

0

15000 15000 15000

40000 40000 40000

160681 187497 219251

215681 242497 274251

6471 7275 8227.53

108 3750 282478.53

222260 253522 94064

28988 188414.53

224534

You might also like

- The Valuation and Financing of Lady M Case StudyDocument4 pagesThe Valuation and Financing of Lady M Case StudyUry Suryanti Rahayu100% (3)

- The Valuation and Financing of Lady M Case StudyDocument4 pagesThe Valuation and Financing of Lady M Case StudyUry Suryanti RahayuNo ratings yet

- Internship Report On Tirupur Textile IndustryDocument39 pagesInternship Report On Tirupur Textile IndustryShruthika R90% (31)

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Real CKA Exam Questions 2021Document11 pagesReal CKA Exam Questions 2021CKA DumpsIT.com0% (3)

- Boston Beer ExcelDocument6 pagesBoston Beer ExcelNarinderNo ratings yet

- Solution Capital Budgeting AssignmentDocument8 pagesSolution Capital Budgeting AssignmentAryamanNo ratings yet

- Personal FinanceDocument4 pagesPersonal FinanceparambhaiofficialNo ratings yet

- Mudaladwani 10 LakhDocument6 pagesMudaladwani 10 LakhManju MysoreNo ratings yet

- JUDocument1 pageJUIndra ChoudhuryNo ratings yet

- Compration 12-13, 13-14 & 14-15Document4 pagesCompration 12-13, 13-14 & 14-15Rajeshbabhu RajeshbabhuNo ratings yet

- Cuentas Del Mayor Saldos Cargas Transferidas Inventario Debe Haber Deudor Acreedor Debe Haber ActivoDocument5 pagesCuentas Del Mayor Saldos Cargas Transferidas Inventario Debe Haber Deudor Acreedor Debe Haber ActivoLeysi Arista IngaNo ratings yet

- Life Goal PlannerDocument13 pagesLife Goal PlannerRahul AnandNo ratings yet

- Sukanya Calculator-Monthly, Quarterly Etc.Document2 pagesSukanya Calculator-Monthly, Quarterly Etc.Prasanna KumarNo ratings yet

- Indigo-Leverage AnalysisDocument3 pagesIndigo-Leverage Analysisgokul9rovNo ratings yet

- DSCR Gaurang Singh & Govardhan SinghDocument6 pagesDSCR Gaurang Singh & Govardhan SinghPriya KalraNo ratings yet

- Budget Analysis: by Department Period: Desember 2019 002-Asia Sumedang/FDocument10 pagesBudget Analysis: by Department Period: Desember 2019 002-Asia Sumedang/Flank4 pissNo ratings yet

- Solution Example Topic 6Document2 pagesSolution Example Topic 60162700100zarNo ratings yet

- Assignement of IctDocument6 pagesAssignement of IctZoya Raza KhanNo ratings yet

- Modern DairiesDocument4 pagesModern Dairiessurprise MFNo ratings yet

- Money Back 165Document3 pagesMoney Back 165Harish ChandNo ratings yet

- Muhammad Usman 2077 Cert 4 AccountingDocument10 pagesMuhammad Usman 2077 Cert 4 AccountinggazanNo ratings yet

- Updated PPF Calculator-Monthly, Quarterly Etc.Document4 pagesUpdated PPF Calculator-Monthly, Quarterly Etc.Ganeshan SekarNo ratings yet

- Home Buying Feasibility Study Income Tax Sec 24Document5 pagesHome Buying Feasibility Study Income Tax Sec 24NKNo ratings yet

- Ramco Cement BsDocument6 pagesRamco Cement BsBharathNo ratings yet

- PPF CalculatorDocument2 pagesPPF CalculatorshashanamouliNo ratings yet

- Sales Expected To Increase by 8%Document11 pagesSales Expected To Increase by 8%WiSeVirGoNo ratings yet

- Calculo de NominaDocument6 pagesCalculo de NominaingenierofavianNo ratings yet

- Fathom Example Import FileDocument4 pagesFathom Example Import FileSaravananNo ratings yet

- Payroll Period: Number of Working Days:: October 1-15, 2020 11Document3 pagesPayroll Period: Number of Working Days:: October 1-15, 2020 11Nikki OloanNo ratings yet

- Sukanya Calculator-Monthly, Quarterly EtcDocument2 pagesSukanya Calculator-Monthly, Quarterly Etcasfdsf shagsdgNo ratings yet

- Parcial Final Alberto Osorio Murillo..Document5 pagesParcial Final Alberto Osorio Murillo..Fray RomeroNo ratings yet

- Additional Budget-Funds RequirementDocument2 pagesAdditional Budget-Funds RequirementTYCS35 SIDDHESH PENDURKARNo ratings yet

- ZYBEAK Balance SheetDocument1 pageZYBEAK Balance SheetVidhya SelvamNo ratings yet

- Case 8-Group 16Document14 pagesCase 8-Group 16reza041No ratings yet

- Fin 534Document6 pagesFin 534Puteri NinaNo ratings yet

- 05-03-22 Focal Cma DataDocument6 pages05-03-22 Focal Cma DataShivam SharmaNo ratings yet

- Tahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanDocument9 pagesTahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanElis Lisa Pantolosang RegelNo ratings yet

- Book1 (Version 3)Document4 pagesBook1 (Version 3)Benhazen Lynn DeirdreNo ratings yet

- Single Plan For PensionDocument2 pagesSingle Plan For PensionHarish ChandNo ratings yet

- GCMMF Balance Sheet 1994 To 2009Document37 pagesGCMMF Balance Sheet 1994 To 2009Tapankhamar100% (1)

- Income Statement Format (KTV) To Ediiiiittttttt DarleneDocument25 pagesIncome Statement Format (KTV) To Ediiiiittttttt DarleneDarlene Jade Butic VillanuevaNo ratings yet

- Eduardo Export 231023135842Document2 pagesEduardo Export 231023135842baselzayied23No ratings yet

- ATC Valuation - Solution Along With All The ExhibitsDocument20 pagesATC Valuation - Solution Along With All The ExhibitsAbiNo ratings yet

- Financial Profile Region4aDocument1 pageFinancial Profile Region4aJose ManaloNo ratings yet

- PRC Calculation 2021 NewDocument3 pagesPRC Calculation 2021 NewPraneeth SarkarNo ratings yet

- PRC Calculation 2021 NewDocument3 pagesPRC Calculation 2021 NewPraneeth SarkarNo ratings yet

- Ws9 Soln FinalDocument14 pagesWs9 Soln FinaltwofortheNo ratings yet

- Sworojgar Laghu Bitta Bikas Bank Limited Valid/Invalid Applicants List (Kitta Wise)Document30 pagesSworojgar Laghu Bitta Bikas Bank Limited Valid/Invalid Applicants List (Kitta Wise)Sahil NepaliNo ratings yet

- Christ University Christ UniversityDocument7 pagesChrist University Christ UniversityBharathNo ratings yet

- Income StatementDocument2 pagesIncome StatementawaischeemaNo ratings yet

- PAGE No.11 Cash Flow Chart in Respect of Muhammad Mussa S/o Muhammad SharifDocument2 pagesPAGE No.11 Cash Flow Chart in Respect of Muhammad Mussa S/o Muhammad SharifSafdar AbbasNo ratings yet

- Years Education Residual Plot: Regression StatisticsDocument12 pagesYears Education Residual Plot: Regression StatisticsManoj JosephNo ratings yet

- Safari 3Document4 pagesSafari 3Bharti SutharNo ratings yet

- The Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Document4 pagesThe Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Rahul VenugopalanNo ratings yet

- Lady M SolutionDocument4 pagesLady M SolutionRahul VenugopalanNo ratings yet

- Model 2 TDocument6 pagesModel 2 TVidhi PatelNo ratings yet

- R K DSR (New) - 2022Document8 pagesR K DSR (New) - 2022Md.Yousuf AkashNo ratings yet

- Saving For Retirement (Model 1) : InputsDocument8 pagesSaving For Retirement (Model 1) : InputsZeusNo ratings yet

- Coret - Coretan Audit ManajemenDocument8 pagesCoret - Coretan Audit ManajemenChristoper RamosNo ratings yet

- Assignment 3-IndividualDocument5 pagesAssignment 3-IndividualAva MedNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Oxford Dissertation DatabaseDocument4 pagesOxford Dissertation DatabaseWritingContentNewYork100% (1)

- Peraturan Salinan TranskripDocument2 pagesPeraturan Salinan TranskripWan Muhammad AriefNo ratings yet

- ResearchDocument41 pagesResearchAbubeker KasimNo ratings yet

- Accounting System in SpainDocument5 pagesAccounting System in SpainHailee HayesNo ratings yet

- Leading The Mobility's RevolutionDocument18 pagesLeading The Mobility's RevolutionfabriNo ratings yet

- PPSA and PPSA Rules PDFDocument5 pagesPPSA and PPSA Rules PDFTricia Montoya0% (1)

- Setting Up Air Compressor & Power Tools Components (NEW KNJTC)Document6 pagesSetting Up Air Compressor & Power Tools Components (NEW KNJTC)mohdhidzwanNo ratings yet

- Overview of AuditingDocument7 pagesOverview of Auditingharley_quinn11No ratings yet

- Omar - Confidentiality ActivityDocument6 pagesOmar - Confidentiality ActivityOMAR ID-AGRAMNo ratings yet

- Customer Care (South) - Electricity Bill Collection CentresDocument14 pagesCustomer Care (South) - Electricity Bill Collection CentresRahul JaiswarNo ratings yet

- Banking FraudsDocument17 pagesBanking FraudsVandana gupta100% (1)

- Chapter 2-Weberian BureaucracyDocument16 pagesChapter 2-Weberian BureaucracyIra Nazirah100% (1)

- Code of ConductDocument8 pagesCode of Conductyulyana90No ratings yet

- BOP SlideDocument19 pagesBOP SlidePrajesh CalicutNo ratings yet

- Lip Plumper Plump It! Instant Results - Plump It!Document1 pageLip Plumper Plump It! Instant Results - Plump It!Alghala AlyassiNo ratings yet

- Topic 3 BMF1014Document28 pagesTopic 3 BMF1014Yeh WeeNo ratings yet

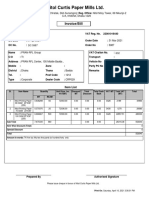

- Nitol Curtis Paper Mills LTD.: Invoice/BillDocument1 pageNitol Curtis Paper Mills LTD.: Invoice/BillMd. Tanvir RahmanNo ratings yet

- A Research Proposal On: C.K.Pithawala Institute of Management, SuratDocument4 pagesA Research Proposal On: C.K.Pithawala Institute of Management, SuratDharmesh88No ratings yet

- 14 Fab New StatementDocument15 pages14 Fab New StatementSumit SinghNo ratings yet

- Guide Questions: 1. Declared Policies of AMLA - : Amended By: R.A. No. 9194 R.A. No. 10167Document21 pagesGuide Questions: 1. Declared Policies of AMLA - : Amended By: R.A. No. 9194 R.A. No. 10167Shyrine EjemNo ratings yet

- The Biologist's Imagination - Innovation in The Biosciences-Oxford University Press (2014)Document305 pagesThe Biologist's Imagination - Innovation in The Biosciences-Oxford University Press (2014)brancobraeNo ratings yet

- Amazon Case StudyDocument1 pageAmazon Case StudyMuneebNo ratings yet

- Null 8Document4 pagesNull 8Baqar BaigNo ratings yet

- 1411 2782 1 SMDocument27 pages1411 2782 1 SMYulindo Laksa DiartaNo ratings yet

- Rico 29319100 Corporate Strategy Case IndofoodDocument4 pagesRico 29319100 Corporate Strategy Case IndofoodMifta ZanariaNo ratings yet

- Rolls Royce TranscriptionDocument9 pagesRolls Royce TranscriptionDr-Akash SanthoshNo ratings yet

- JKSQM 48 2 309Document20 pagesJKSQM 48 2 309rickrochaso1No ratings yet