Professional Documents

Culture Documents

Model Portfolio 4-3-05 - 06

Model Portfolio 4-3-05 - 06

Uploaded by

rohitkakati0 ratings0% found this document useful (0 votes)

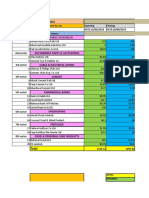

31 views2 pagesThis document summarizes the performance of a model portfolio from March 4, 2005 to March 3, 2006. The portfolio was diversified across various sectors including agriculture, banking, cement, engineering, FMCG, hotels, pharmaceuticals, power, textiles, and miscellaneous. Over this one year period, the model portfolio generated returns of 54.4% compared to returns of 54.7% for the SENSEX index. Since inception, the model portfolio has achieved returns of 63.3% versus 37.4% for the SENSEX. The portfolio started at a total value of Rs. 1,500,157.50 and increased to a current value of Rs. 23,168,44.25 over this

Original Description:

Original Title

Model Portfolio 4-3-05_06

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the performance of a model portfolio from March 4, 2005 to March 3, 2006. The portfolio was diversified across various sectors including agriculture, banking, cement, engineering, FMCG, hotels, pharmaceuticals, power, textiles, and miscellaneous. Over this one year period, the model portfolio generated returns of 54.4% compared to returns of 54.7% for the SENSEX index. Since inception, the model portfolio has achieved returns of 63.3% versus 37.4% for the SENSEX. The portfolio started at a total value of Rs. 1,500,157.50 and increased to a current value of Rs. 23,168,44.25 over this

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

31 views2 pagesModel Portfolio 4-3-05 - 06

Model Portfolio 4-3-05 - 06

Uploaded by

rohitkakatiThis document summarizes the performance of a model portfolio from March 4, 2005 to March 3, 2006. The portfolio was diversified across various sectors including agriculture, banking, cement, engineering, FMCG, hotels, pharmaceuticals, power, textiles, and miscellaneous. Over this one year period, the model portfolio generated returns of 54.4% compared to returns of 54.7% for the SENSEX index. Since inception, the model portfolio has achieved returns of 63.3% versus 37.4% for the SENSEX. The portfolio started at a total value of Rs. 1,500,157.50 and increased to a current value of Rs. 23,168,44.25 over this

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

TM

Angel Broking Much Beyond Broking

March 04, 2006

Model Portfolio Performance

Model Portfolio Initiated on March 4, 2005 & Terminated on March 3, 2006

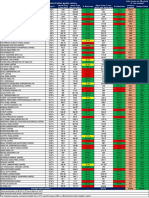

Sectors Companies Div Qty Price 4/3/2005 Value CMP Div Amt CURRENT

(Rs) (Rs) (Rs) (Rs) (Rs) VALUE (Rs.)

Agriculture/RELATED Escorts 500 90.2 45085 80.4 40200

Swaraj Engines 15 200 400.6 80120 445.35 3000 89070

Punjab Tractor 5.5 200 184.9 36980 234.75 1100 46950

GSFC 1.5 200 115.1 23020 186.55 300 37310

Zuari Industries 1.8 500 76.9 38450 186.85 900 93425

Finolex ind. 3 1000 74.9 74900 73.25 1500 73250

Bank/Finance South India bank 200 65.7 13140 66.55 13310

Lic Housing Finance 5 75 257.6 19320 202.25 375 15168.75

Cement India Cement 750 68.3 51225 152.7 114525

Madras Cement 14 100 1067.7 106770 2099.25 1400 209925

Engineering Cummins 6 500 130.1 65065 242.6 3000 121300

KSB Pumps 4 100 245.0 24500 416.1 400 41610

ESAB India 100 160.0 16000 454.4 45440

FMCG Gillette 8.5 100 631.2 63120 944.05 850 94405

Britannia 14 100 903.5 90345 1687 1400 168700

Essel propack 19 100 303.5 30350 378.8 1900 37880

Hotels Eih 9 100 303.3 30330 690.55 900 69055

Pharma/Chemical JB Chem. 12 50 431.1 21555 619 600 30950

Merck 100 409.4 40940 567.15 56715

Biocon 2 200 465.7 93140 465.1 400 93020

Wyeth Lederle 20 100 490.3 49030 650.05 2000 65005

Tata Chemicals 6.5 200 171.8 34350 246 1300 49200

Zandu 35 20 2395.0 47900 3879.4 700 77588

BASF 6 100 199.4 19940 237.6 600 23760

Paper Ballarpur 1.25 300 106.7 32010 126.65 375 37995

Power /Related Finolex cables 4.5 250 180.2 45050 340.65 1125 85162.5

Textiles Rajasthan Spinning 2.2 100 104.4 10440 124.2 220 12420

Mahavir spinning 4.5 75 306.7 23002.5 533 337.5 39975

Sutlej ind 3.75 100 167.3 16730 288.5 375 28850

Rajapalayam Mills 2.5 75 337.0 25275 555 187.5 41625

Media Crest 200 106.4 21280 136.4 27280

Miscellaneous Atlas Cycle 200 137.4 27480 124.05 24810

Asian paints 9.5 100 400.0 40000 679.95 950 67995

Castrol 8.3 100 222.4 22235 248.9 830 24890

Shrenuj 3 100 68.2 6820 193.75 300 19375

Goodyear 100 84.8 8480 68.3 6830

Pidilite 10 100 511.1 51105 956.5 1000 95650

Thomas 100 456.8 45675 589 58900

CASH 9000 9000

28325 2288519.25

Total Value of the Portfolio 1,500,157.50 2316844.25

Returns (%)

1 Year 2 Year Since Inception

Model Portfolio 54.4 70.7 63.3

SENSEX 54.7 46.4 37.4

For Private Circulation Only 6

Angel Broking Ltd : BSE Sebi Registration No : INB 010996539 / CDSL Regn No : IN - DP - CDSL - 234 - 2004 Angel Capital & Debt Market Ltd: NSE Cash: INB 230600236 / NSE FNO: INF 231134331

March 04, 2006

Model Portfolio

Model Portfolio Initiated on March 4, 2006

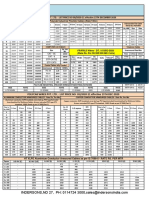

Sectors Companies Qty Price 3/3/2006 Value (Rs)

Agriculture/Related Escorts 200 80.40 16080

Swaraj Engines 100 148.45 14845

Coromandel 300 80.75 24225

Tata Chemicals 100 246.00 24600

Nagarjuna 1000 14.20 14200

Finolex ind. 200 73.25 14650

Bank/Finance South India bank 100 66.55 6655

IDBI 200 82.00 16400

Cement India Cement 200 152.70 30540

Madras Cement 50 2099.25 104962.5

Education Related Navneet 100 295.50 29550

FMCG/Related Essel propack 100 378.80 37880

Agrotech 100 129.30 12930

Heritage food 100 171.85 17185

ITC 200 174.35 34870

Hotels/Tourism related Eih 100 690.55 69055

Int Travel House 100 156.90 15690

Pharma/Chemical Merck 100 567.15 56715

Pfizer 50 1050.25 52512.5

JB chem 100 123.80 12380

Novartis 50 544.90 27245

Themis Medicare 100 246.75 24675

Wyeth Lederle 50 650.05 32502.5

Zandu 10 3879.40 38794

BASF 50 237.60 11880

Paper Ballarpur 200 126.65 25330

Textiles Rajasthan Spinning 200 124.20 24840

Lakshmi mills 10 1578.95 15789.5

Telecom/Technology Avaya 100 463.40 46340

Igate Global 100 254.80 25480

Zensar 200 198.85 39770

Media Crest 100 136.40 13640

Transportation Related Atlas Cycle 100 124.05 12405

Castrol 100 248.90 24890

Goodyear 200 68.30 13660

Miscellaneous Gulf oil 25 705.70 17642.5

Total Value of the Portfolio 1,000,808.50

For Private Circulation Only 7

Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 0220 / FMC Regn No: NCDEX / TCM / CORP / 0302

You might also like

- AP EngDocument34 pagesAP EngNail KayaNo ratings yet

- Fo MktlotsDocument3 pagesFo MktlotsApnaYoutube SkoolNo ratings yet

- Kirloskar Brothers LP Motors W e F 1 March 2014Document13 pagesKirloskar Brothers LP Motors W e F 1 March 2014durgaNo ratings yet

- FP Portfolio - 5julyDocument1 pageFP Portfolio - 5julyJeevan Kumar maniNo ratings yet

- Time (Minudistance (CM) 0 0 1 5 2 10 3 15 4 20 5 25Document15 pagesTime (Minudistance (CM) 0 0 1 5 2 10 3 15 4 20 5 25Viraj PatelNo ratings yet

- Revised+MRP+16th+April+2021 UpdatedDocument8 pagesRevised+MRP+16th+April+2021 Updatedgokul saravananNo ratings yet

- Portfolio-1 With February 2022 CE Writting OpportunityDocument5 pagesPortfolio-1 With February 2022 CE Writting OpportunityPravin SinghNo ratings yet

- Compounding Machine Portfolio (4) - 1Document3 pagesCompounding Machine Portfolio (4) - 1rafeekmekgceNo ratings yet

- My PortfolioDocument11 pagesMy PortfolioSk nouman Sid 2012No ratings yet

- Private Markets Quote As On 14th Augst 2021Document1 pagePrivate Markets Quote As On 14th Augst 2021Siddharth Rai SuranaNo ratings yet

- Maintenance Sehedule DEC - 2022Document6 pagesMaintenance Sehedule DEC - 2022sivaNo ratings yet

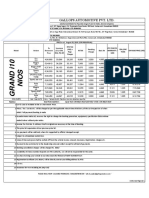

- Grand I10 Nios IndDocument1 pageGrand I10 Nios IndmanbirsinghNo ratings yet

- FCL Price List W.E.F.03.12.2021Document1 pageFCL Price List W.E.F.03.12.2021SATISH MORENo ratings yet

- Ashoka Enterprises (India) : POLYCAB WIRES PVT. LTD. - LIST PRICE NO-05/2020-21 Effective 15TH DEC-2020Document1 pageAshoka Enterprises (India) : POLYCAB WIRES PVT. LTD. - LIST PRICE NO-05/2020-21 Effective 15TH DEC-2020Shakthi RamNo ratings yet

- Deogiri-583112, Sandur, Bellary, Karnataka.: (ML No. 2580 & ML No. 2581)Document30 pagesDeogiri-583112, Sandur, Bellary, Karnataka.: (ML No. 2580 & ML No. 2581)Biju SebastianNo ratings yet

- Polycab LP 1635 Dated 16.04.2024Document1 pagePolycab LP 1635 Dated 16.04.2024radhika DangiNo ratings yet

- Sanofi India Limited, Ankleshwar: SR - No. Location Chamber Pipe Dia Pipe Length Sump Capacity (KLD) Pump Capacity (m3/hr)Document5 pagesSanofi India Limited, Ankleshwar: SR - No. Location Chamber Pipe Dia Pipe Length Sump Capacity (KLD) Pump Capacity (m3/hr)Jatin WadiaNo ratings yet

- 192.168.9.12 Techexcel Railo Tomcat Webapps ROOT Reports History PDF 84 001088 24072023 11485151584670 114955Document1 page192.168.9.12 Techexcel Railo Tomcat Webapps ROOT Reports History PDF 84 001088 24072023 11485151584670 114955Arjun LoharNo ratings yet

- Size of CB Protecting of MotorDocument4 pagesSize of CB Protecting of MotorjigarNo ratings yet

- AH EngDocument22 pagesAH EngcoachanzaiNo ratings yet

- CommercialDocument2 pagesCommercialankan2881No ratings yet

- Finance Project SampleDocument9 pagesFinance Project SampleBILAL KHANNo ratings yet

- FleetA Aug08 PDFDocument3 pagesFleetA Aug08 PDFAlex BurcăNo ratings yet

- Polycab Price List 1ST APRIL 2021Document3 pagesPolycab Price List 1ST APRIL 2021Kagitha TirumalaNo ratings yet

- Correias Sincronizadoras 5M: em Borracha Neoprene Com Cordonéis em Fibra de VidroDocument2 pagesCorreias Sincronizadoras 5M: em Borracha Neoprene Com Cordonéis em Fibra de VidroJoãoNo ratings yet

- Compiled ReportDocument24 pagesCompiled ReportkartikNo ratings yet

- Compounding Machine Portfolio (1) - 1Document3 pagesCompounding Machine Portfolio (1) - 1Nddd NnbNo ratings yet

- Analytics - Derivative-1Document1 pageAnalytics - Derivative-1phaniNo ratings yet

- Cash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. MDocument26 pagesCash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. Mangg4interNo ratings yet

- F&O Stocks With Lot SizeDocument22 pagesF&O Stocks With Lot SizeAditya GuptaNo ratings yet

- Business PlanningDocument12 pagesBusiness PlanningSadia Khalid ReetiNo ratings yet

- Pinbush - Tyre Coupling 2014Document4 pagesPinbush - Tyre Coupling 2014Priyam NandwanaNo ratings yet

- Building Wire 09: Price List HOUSE WIRE W.e.f: (20.11.2020) Industrial Telephone CableDocument1 pageBuilding Wire 09: Price List HOUSE WIRE W.e.f: (20.11.2020) Industrial Telephone CableMathavan RajamanickamNo ratings yet

- Teh Hsin BrochureDocument10 pagesTeh Hsin Brochurelitecounter1111No ratings yet

- Reliable. Economical. Total Solution.: Greaves Cotton LimitedDocument2 pagesReliable. Economical. Total Solution.: Greaves Cotton LimitedarunNo ratings yet

- Daftar Harga Fitting Injection HDPE Import ExportDocument4 pagesDaftar Harga Fitting Injection HDPE Import Exporthafidz cayroNo ratings yet

- Cash Flow2ADocument1 pageCash Flow2AFurquan KhanNo ratings yet

- Electrical Wires - Cables - Pricelist 2021Document1 pageElectrical Wires - Cables - Pricelist 2021Sridhara MunimakulaNo ratings yet

- CASHFLOW PROJECTS-Frognal TRDDocument5 pagesCASHFLOW PROJECTS-Frognal TRDIsaac MangochiNo ratings yet

- Large Axial Fans: Dimensions (MM)Document1 pageLarge Axial Fans: Dimensions (MM)Pradeep JhaNo ratings yet

- Polycab Wires Pvt. LTD.: LDC List Price No. 05/2015-16 Effective 1st Sept 2015Document16 pagesPolycab Wires Pvt. LTD.: LDC List Price No. 05/2015-16 Effective 1st Sept 2015Senathirajah SatgunarajahNo ratings yet

- Bea Rings: Price-ListDocument1 pageBea Rings: Price-ListGautam YᗩᗪᑌᐯᗩᑎᔕᕼINo ratings yet

- P& L Statement 2008-09Document3 pagesP& L Statement 2008-09sweetybwnNo ratings yet

- PSX Sectors and CompaniesDocument11 pagesPSX Sectors and CompaniesSpace DriveNo ratings yet

- ADVANCE Valves Prices - 15.10.19Document3 pagesADVANCE Valves Prices - 15.10.19Amit GoyalNo ratings yet

- Lubricants Rate SheetDocument1 pageLubricants Rate Sheetkapil.daveNo ratings yet

- Net Worth 176,929.95 104,870.00 79,783.00 7,723.05Document3 pagesNet Worth 176,929.95 104,870.00 79,783.00 7,723.05Monik ShahNo ratings yet

- Analytics - Derivative-2Document1 pageAnalytics - Derivative-2phaniNo ratings yet

- PrabhatCables Listprice ConsolidatedDocument4 pagesPrabhatCables Listprice ConsolidatedNitin KhodifadNo ratings yet

- Willcox HosesDocument6 pagesWillcox Hosesbunyamin.bangbenNo ratings yet

- Wheel Hub Bearings CatalogueDocument30 pagesWheel Hub Bearings CatalogueeCommerce SAJID AutoNo ratings yet

- Depreciation Calculatoin As Per Companies Act 2013-14-15Document6 pagesDepreciation Calculatoin As Per Companies Act 2013-14-15ROHIT KUMARNo ratings yet

- UntitledDocument1 pageUntitledSunena SahuNo ratings yet

- Saa Inv 101110Document4 pagesSaa Inv 101110saeed abbasiNo ratings yet

- Estimate Sheet Jobert L. Escoreal3Document1 pageEstimate Sheet Jobert L. Escoreal3Jeneveb NebatoNo ratings yet

- Ford NH 2016 PDFDocument193 pagesFord NH 2016 PDFValbertgNo ratings yet

- Saa Inv 101129Document4 pagesSaa Inv 101129saeed abbasiNo ratings yet

- ACC SUPERACingDocument1 pageACC SUPERACingUmar MajeedNo ratings yet

- MDMDK EngDocument22 pagesMDMDK EngcoachanzaiNo ratings yet