Professional Documents

Culture Documents

Worksheet Financial Math Name

Worksheet Financial Math Name

Uploaded by

caroline_amideast8101Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worksheet Financial Math Name

Worksheet Financial Math Name

Uploaded by

caroline_amideast8101Copyright:

Available Formats

WORKSHEET FINANCIAL MATH

NAME: _____________________________ DATE: 25/5/2011

1.

(i) Celia has $ 20 000 to invest. There are two different options that she can

choose.

Option 1: The investment grows at a rate of 3.5 % compound interest

each year.

Option 2: The total value of the investment increases by $ 800 each

year.

The money is to be invested for 15 years.

(a) Copy and complete the table below giving the values of the

investments to the nearest dollar for the first 4 years.

Year 0 1 2 3 4

Option 1 20 000 20 700

Option 2 20 000 20 800

(b) Calculate the values of each investment at the end of 15 years.

(c) If Option 1 is chosen find the total number of complete years

before the values of the investment is first greater than $ 25 000.

(d) If Option 2 is chosen calculate the percentage increase in the

investment for the final year.

(ii) Two more Options are available to Celia. After 7 years she can change

the investment conditions.

Option 3: If Celia has chosen Option 1 she can change and then

receives $800 each year until the end of the 15 years.

Option 4: If Celia has chosen Option 2 she can change and then

receive 3.5 % interest compounded annually.

If Celia wishes to receive the maximum amount of money at the end of

the 15 years which option should she choose?

2.

Kurt wants to invest 2000 Euros in a savings account for his new grandson.

(a) Calculate the value of Kurt's investment based on a simple interest

rate of 4% per annum, after 18 years.

Inge tells Kurt about a better account which offers interest at a rate of 3.6%

per annum, compounding monthly.

(b) Giving your answer to the nearest Euro, calculate the value of Kurt's

investment after 18 years if he follows Inge's advice.

3. Hassan invested 10 000 CHF at the end of 1971. The interest rate was 5% per

annum. How much interest in total would Hassan have earned at the end of

the year 1999 if

(a) he had removed the interest from his account at the end of each year;

(b) he had not removed the interest from his account at the end of each

year.

4.

John invests X USD in a bank. The bank's stated rate of interest is 6% per

annum, compounded monthly.

(a) Write down, in terms of X, an expression for the value of John's

investment after one year.

(b) What rate of interest, when compounded annually (instead of monthly) will

give the same value of John's investment as in part (a)? Give your answer

correct to three significant figures

5.

Keisha had 10 000 USD to invest. She invested m USD at the Midland Bank,

which gave her 8% annual interest. She invested f USD at the First National

Bank, which gave 6% annual interest. She received a total of 640 USD in interest

at the end of the year.

(a) Write two equations that represent this information.

(b) Find the amount of money Keisha invested at each bank.

6. The following is a currency conversion table:

FFR USD JPY GBP

French Francs 1 p q 0.101

(FFR)

US Dollars 6.289 1 111.111 0.631

(USD)

Japanese Yen 0.057 0.009 1 0.006

(JPY)

British Pounds 9.901 1.585 166.667 1

(GBP)

For example, from the table 1 USD = 0.631 GBP. Use the table to answer

the following questions.

(a) Find the values of p and q.

(b) Mireille wants to change money at a bank in London.

(i) How many French Francs (FFR) will she have to change to

receive 140 British Pounds (GBP)?

(ii) The bank charges a 2.4% commission on all transactions. If she

makes this transaction, how many British Pounds will Mireille

actually receive from the bank?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Import Export Documentation Procedure Project ReportDocument55 pagesImport Export Documentation Procedure Project ReportManish Diehard82% (39)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- GCHP 12Document11 pagesGCHP 12caroline_amideast8101No ratings yet

- 3D GeometryDocument11 pages3D Geometrycaroline_amideast8101No ratings yet

- Exam Revision NAME: - 2 BimesterDocument8 pagesExam Revision NAME: - 2 Bimestercaroline_amideast8101No ratings yet

- Exponents Review WorksheetDocument2 pagesExponents Review Worksheetcaroline_amideast8101No ratings yet

- Enzymes: Diploma Program Group 4: Experimental Sciences Biology CourseDocument16 pagesEnzymes: Diploma Program Group 4: Experimental Sciences Biology Coursecaroline_amideast8101No ratings yet

- Worksheet LogDocument6 pagesWorksheet Logcaroline_amideast8101No ratings yet

- Currency ConversionDocument3 pagesCurrency Conversioncaroline_amideast8101No ratings yet

- Worksheet QuintoDocument4 pagesWorksheet Quintocaroline_amideast8101No ratings yet

- Lesson 9-2: Prisms and PyramidsDocument6 pagesLesson 9-2: Prisms and Pyramidscaroline_amideast8101No ratings yet

- Worksheet 1 Financial MathDocument8 pagesWorksheet 1 Financial Mathcaroline_amideast8101No ratings yet

- Worksheet Arithmetic SeqDocument4 pagesWorksheet Arithmetic Seqcaroline_amideast8101No ratings yet

- Activity ExcelDocument9 pagesActivity Excelcaroline_amideast8101No ratings yet

- HW Exam Number2Document1 pageHW Exam Number2caroline_amideast8101No ratings yet

- The Following Diagram Is A Box and Whisker Plot For A Set of DataDocument1 pageThe Following Diagram Is A Box and Whisker Plot For A Set of Datacaroline_amideast8101No ratings yet

- Arithmetic Seq and SeriesDocument6 pagesArithmetic Seq and Seriescaroline_amideast8101No ratings yet

- Project 2Document2 pagesProject 2caroline_amideast8101No ratings yet

- Arithmetic SequencesDocument8 pagesArithmetic Sequencescaroline_amideast8101No ratings yet

- Project 2Document2 pagesProject 2caroline_amideast8101No ratings yet

- Mensuration: 3D GeometryDocument13 pagesMensuration: 3D Geometrycaroline_amideast8101No ratings yet

- HW 22Document2 pagesHW 22caroline_amideast8101No ratings yet

- HW 1Document1 pageHW 1caroline_amideast8101No ratings yet

- ProjectsDocument3 pagesProjectscaroline_amideast8101No ratings yet

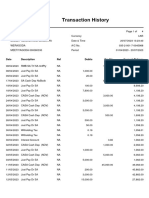

- Transaction History: Ref Date Debits Description Credits Account BalanceDocument4 pagesTransaction History: Ref Date Debits Description Credits Account Balancethiwankaashi531No ratings yet

- The Market For Foreign Exchange: Chapter FiveDocument30 pagesThe Market For Foreign Exchange: Chapter FiveshouqNo ratings yet

- 4 Managerial EconomicsDocument8 pages4 Managerial EconomicsBoSs GamingNo ratings yet

- UntitledDocument2 pagesUntitledAna marie PaetNo ratings yet

- Assessment To Introduction To Cost AccountingDocument3 pagesAssessment To Introduction To Cost AccountingOBEÑA, John Rhey E.No ratings yet

- Calculations - Mr. Prem Ranjan & SudhaDocument72 pagesCalculations - Mr. Prem Ranjan & SudhaVinay Kumar100% (1)

- A3 - T4 Matematiques Financeres Exercicis AvaluablesDocument25 pagesA3 - T4 Matematiques Financeres Exercicis AvaluablesjoanNo ratings yet

- Chapter 06 International Trade Theory: Answer KeyDocument81 pagesChapter 06 International Trade Theory: Answer KeyCHAU Nguyen Ngoc BaoNo ratings yet

- Managing Transaction ExposureDocument14 pagesManaging Transaction ExposureVarun KumarNo ratings yet

- Jbptunikompp GDL Nureffendi 23781 3 Ch08Document24 pagesJbptunikompp GDL Nureffendi 23781 3 Ch08May JangkumNo ratings yet

- Cafe Monte Bianco Case AnalysisDocument2 pagesCafe Monte Bianco Case AnalysisScribdTranslationsNo ratings yet

- 6 Incomplete RecordsDocument17 pages6 Incomplete Recordssana.ibrahimNo ratings yet

- A-1 Fence Products Company Pvt. LTDDocument1 pageA-1 Fence Products Company Pvt. LTDadipur aartiNo ratings yet

- Controlling NotesDocument30 pagesControlling NotestomoNo ratings yet

- Gen Math: AnnyeongDocument16 pagesGen Math: AnnyeongZaldy Emmanuel MendozaNo ratings yet

- Charges InformationDocument3 pagesCharges InformationNikhil RathiNo ratings yet

- Finance Assignment' 1Document13 pagesFinance Assignment' 1Daichi FaithNo ratings yet

- Defining GlobalizationDocument40 pagesDefining GlobalizationChar Momozo0% (1)

- Big BazaarDocument6 pagesBig BazaaraniketsangodcarNo ratings yet

- Accounting 9th Edition Hoggett Test BankDocument21 pagesAccounting 9th Edition Hoggett Test Bankalanquangfmrw100% (28)

- Khilji Co Rate Card 2021 22Document14 pagesKhilji Co Rate Card 2021 22Khalid ButtNo ratings yet

- Project On Growth of Retail Sector in IndiaDocument103 pagesProject On Growth of Retail Sector in Indiaashish301182% (11)

- Melamine - Chemical Economics Handbook - SRI ConsultingDocument2 pagesMelamine - Chemical Economics Handbook - SRI ConsultingChirag DaveNo ratings yet

- FAR.3408 2017-06 PAS 2 16 and 40 - Accounting For Collector S ItemsDocument4 pagesFAR.3408 2017-06 PAS 2 16 and 40 - Accounting For Collector S ItemsMonica GarciaNo ratings yet

- Kolkata Presentation Cap GoodsDocument102 pagesKolkata Presentation Cap Goodsfaleela IsmailNo ratings yet

- Furlenco InvoiceDocument2 pagesFurlenco InvoiceRohit PatnalaNo ratings yet

- Export ProcedureDocument51 pagesExport ProcedureSyed MuzammilNo ratings yet

- Credit Control Methods of RBIDocument2 pagesCredit Control Methods of RBIchiku singNo ratings yet

- Metatrade EnglishDocument24 pagesMetatrade EnglishSindhu ThomasNo ratings yet