Professional Documents

Culture Documents

Form L: Reasons For Adjustment For Work Contract

Form L: Reasons For Adjustment For Work Contract

Uploaded by

murshadinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form L: Reasons For Adjustment For Work Contract

Form L: Reasons For Adjustment For Work Contract

Uploaded by

murshadinCopyright:

Available Formats

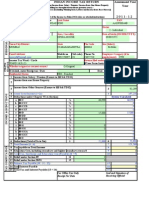

Form L [see rule 7(1)(e)] VALUE ADDED TAX MONTHLY RETURN Return to be filled by the dealer who has

opted to pay tax under section 6 / section 8 TIN 33851522330 Month MILLENIUM ASSOCIATES 04 Year 2009

Name of the Dealer : To

The Assessing Authority, 1 2 3(a) 3(b) Nature of business : Total turnover liable to tax : Tax due at Tax due under Sec. 12 on Rs. Rs . Rs . Total 3(c) 4 5 6 7 Total Adjustment, if any * Tax collected by the dealer ** Tax paid : Payment : Sl No Cheque Type 1 Cheque

T NAGAR (NORTH) Works contract

Circle.

126420 4 % / lumpsum 0 0 0 0 (D) (A) 5057 (D) - (A) 5057 @1% @4% @12.5% 5057 0 0 0 0 5057 0

Cheque No Cheque Date Bank Name 926868 19/05/2009 SOUTH INDIAN BANK

Branch Code 600059013

Amount 5057

* Reasons for adjustment ** for work contract Declaration 1. I/We N.GUNASEKARAN declare that to the best of my/our knowledge and belief the

information furnished in the above statement is true, correct and complete.

2. I/We

declare that to the best of my/our knowledge and belief the

information furnished in the above statement is true, correct and complete. Place : Date : Signature : Name : N.GUNASEKARAN

Status & relationship to the dealer :

You might also like

- Form 16Document2 pagesForm 16SIVA100% (1)

- Appendix Form No. 1 Return of Taxable Commodities TransactionsDocument3 pagesAppendix Form No. 1 Return of Taxable Commodities TransactionsYashu GoelNo ratings yet

- 1 - Form 16Document5 pages1 - Form 16premsccNo ratings yet

- PDF ReportsDocument3 pagesPDF ReportsSIVANo ratings yet

- ChallanDocument4 pagesChallanggrajeshNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- DSCR CalculationDocument16 pagesDSCR CalculationRajat RastogiNo ratings yet

- 1827 PDFDocument3 pages1827 PDFhelloitskalaiNo ratings yet

- Wage Register FTO 6Document14 pagesWage Register FTO 6Angad KamatNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Akhtar Tax ReturnDocument7 pagesAkhtar Tax Returnsyedfaisal_sNo ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- Cma of HostelDocument128 pagesCma of HostelkolnureNo ratings yet

- FORM 202: Popular EnterpriseDocument4 pagesFORM 202: Popular Enterprisesam3461No ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalNo ratings yet

- BIR Form 2551MDocument6 pagesBIR Form 2551MDeiv PaddyNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- Piece Rate Workers Bill: Booking NoDocument1 pagePiece Rate Workers Bill: Booking NoSivagnana IyappanNo ratings yet

- Basis Period For Taxation of Companies and Individual in NigeriaDocument2 pagesBasis Period For Taxation of Companies and Individual in Nigeriaprince oluwasegunNo ratings yet

- Singer BangladeshDocument16 pagesSinger BangladeshMahbubur RahmanNo ratings yet

- Quarterly Statement of Tax Collection at Source Under Section 206C of The I.T.Act, 1961 For The Quarter Ended September (Year) 2012Document7 pagesQuarterly Statement of Tax Collection at Source Under Section 206C of The I.T.Act, 1961 For The Quarter Ended September (Year) 2012amit22505No ratings yet

- IT Decl Form12BDocument3 pagesIT Decl Form12BPavan KumarNo ratings yet

- Form12B (Past Employer Salary Certificate)Document3 pagesForm12B (Past Employer Salary Certificate)Jackiee1983No ratings yet

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocument11 pagesITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNo ratings yet

- Gross Total Income (1+2c) 4: System CalculatedDocument3 pagesGross Total Income (1+2c) 4: System CalculatedDHARAMSONINo ratings yet

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- May 09Document1 pageMay 09tricone44No ratings yet

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarNo ratings yet

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediNo ratings yet

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Document3 pagesSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarNo ratings yet

- Consolidated Financial StatementsDocument40 pagesConsolidated Financial StatementsSandeep GunjanNo ratings yet

- Summary of Tax Deducted at Source: Part-ADocument5 pagesSummary of Tax Deducted at Source: Part-Achakrala_sirishNo ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- My BillDocument2 pagesMy BillMohammad AtifNo ratings yet

- Service TaxDocument2 pagesService TaxManoj BishtNo ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- 2551M Allan RossDocument2 pages2551M Allan RossGeox SalasNo ratings yet

- Speedo SensorDocument2 pagesSpeedo SensorShaik MastanNo ratings yet

- Medl 40579Document2 pagesMedl 40579Kasaram NaveenNo ratings yet

- (-) Rebate U/s 88D/88B/88C/88/10 (13A) /HBL Int. PaidDocument5 pages(-) Rebate U/s 88D/88B/88C/88/10 (13A) /HBL Int. PaidSomnath ChakrabortyNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- It 000018390637 2011 00Document1 pageIt 000018390637 2011 00AMMAR REHMANINo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Local Body Tax in Pune Municipal Corporation (LBT in PMC) - 0Document20 pagesLocal Body Tax in Pune Municipal Corporation (LBT in PMC) - 0nikhilpasariNo ratings yet

- Standalone Financial Results, Form B For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form B For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Mahadev Enterprises 442636 MvatDocument3 pagesMahadev Enterprises 442636 MvatKelly CarterNo ratings yet

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNo ratings yet

- Document Checklist - Sole-ProprietorDocument4 pagesDocument Checklist - Sole-ProprietorKarthik DeshapremiNo ratings yet

- 82202BIR Form 1702-MXDocument9 pages82202BIR Form 1702-MXRen A EleponioNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- Ghaziabad Telecom District: Account SummaryDocument1 pageGhaziabad Telecom District: Account SummaryShweta GuptaNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)