Professional Documents

Culture Documents

Custom Tarif Ammendments

Custom Tarif Ammendments

Uploaded by

Shahid MehmoodOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Custom Tarif Ammendments

Custom Tarif Ammendments

Uploaded by

Shahid MehmoodCopyright:

Available Formats

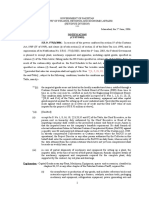

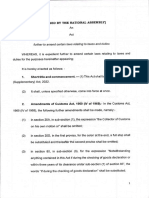

THE SCHEDULE [See clause 2( 9 )] AMENDMENT IN THE CUSTOMS ACT, 1969 (IV OF 1969) In the Customs Act, 1969

(IV of 1969), in the First Schedule, for the PCT Code, "Description" and "CD%" specified in columns (1), (2) and (3) appearing in chapter 1 to 99, following PCT Code, "Description" and "CD%" specified in columns (1), (2) and (3) of the Table below and the corresponding entries relating thereto shall be substituted, namely :"TABLE PCT CODE (1) 2923.9010 2930.9060 74.04 7404.0010 7404.0090

7407.1010 7407.2100

DESCRIPTION (2) - - - Betaine - - - O.O. diethyl O-(3,5,6-trichloro 2-pyridyl) phosphorothioate Copper waste and scrap. - - -Brass scrap - - -Other

- - - Bars - - Of copper-zinc base alloys (brass)

CD% (3) 5 5

0 0

5 5

87.10

8710.0010 8710.0090 9918

Tanks and other armoured fighting vehicles, motorised, whether or not fitted with weapons, and parts of such vehicles. - - -Armoured cash carrying vehicles - - -Other

Machinery not produced or manufactured in Pakistan which is re-imported by industrial concerns after having been exported and have not undergone any process outside Pakistan since their exportation. In case the machinery has undergone any alterations, renovations, addition or repairs prior to its reimport into Pakistan, the cost incurred on such alterations, renovations, additions or repairs (excluding the element of freight and other incidentals) shall be liable to duty as leviable under its respective PCT heading determined at the time of original import provided the machinery was exported under a contract of alteration, renovation, adddition or repairs and that the supplier and the receiver as well as the make, model, weight and other specifications remain the same as were at the time of the original import of the machinery.

20 20 0"

You might also like

- Sample Ashgal Specs Electrical PDFDocument41 pagesSample Ashgal Specs Electrical PDFNATHANNo ratings yet

- Cement Industry Cost StructureDocument27 pagesCement Industry Cost StructureAshok Verma83% (6)

- Preparation of Bills of QuantitiesDocument29 pagesPreparation of Bills of QuantitiesJanesha100% (1)

- Item Description Unit Qty Rate Amount (RM) : Page BQ1 1/1Document31 pagesItem Description Unit Qty Rate Amount (RM) : Page BQ1 1/1vani2620No ratings yet

- Scheduled Industries (Submission of Production Returns) Rules, 1979Document3 pagesScheduled Industries (Submission of Production Returns) Rules, 1979Latest Laws TeamNo ratings yet

- Scheduled Industries (Submission of Production Returns) Rules, 1979Document3 pagesScheduled Industries (Submission of Production Returns) Rules, 1979Latest Laws TeamNo ratings yet

- Recent MoEF NotificationDocument31 pagesRecent MoEF NotificationPuneet KumarNo ratings yet

- PWD Sor R&B Wef 15-04-09Document96 pagesPWD Sor R&B Wef 15-04-09Pranjal Agrawal40% (5)

- Finance Bill 2023-24Document121 pagesFinance Bill 2023-24Hussain AfzalNo ratings yet

- The Annaul Finance-Bill 2023 of PakistanDocument123 pagesThe Annaul Finance-Bill 2023 of PakistanJasmin NabeelNo ratings yet

- PO1660 (Oil Filtration)Document68 pagesPO1660 (Oil Filtration)anuragpugaliaNo ratings yet

- CGPWD Road Sor 2015Document92 pagesCGPWD Road Sor 2015Dileep Sharma67% (3)

- Finance BillDocument128 pagesFinance BillonepakistancomNo ratings yet

- QCS2010 - 01 IntroductionDocument8 pagesQCS2010 - 01 IntroductionChristopher Hor FHNo ratings yet

- Anti-Dumping Chapter 72Document105 pagesAnti-Dumping Chapter 72retrogradesNo ratings yet

- Anti Dump CH 72.pdf JsessionidDocument97 pagesAnti Dump CH 72.pdf JsessionidprasadNo ratings yet

- Government of India Ministry of Finance (Department of Revenue)Document5 pagesGovernment of India Ministry of Finance (Department of Revenue)patelpratik1972No ratings yet

- BT Renewal Model Estimate With Sor 2014 15Document102 pagesBT Renewal Model Estimate With Sor 2014 15Anand Kumar Pandiri100% (1)

- Hazardous Wastes Rules EngDocument9 pagesHazardous Wastes Rules EngAnirudh GargNo ratings yet

- Section-XXI Chapter-98Document10 pagesSection-XXI Chapter-98శ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Qcs 2010 Part 1.01 IntroductionDocument8 pagesQcs 2010 Part 1.01 IntroductionRotsapNayrbNo ratings yet

- Section 1 PDFDocument299 pagesSection 1 PDFIbrahim KhalifaNo ratings yet

- Cement Industry Analysis in PakistanDocument28 pagesCement Industry Analysis in PakistanAtif RehmanNo ratings yet

- Shedule of Dimensions2Document4 pagesShedule of Dimensions2Gnanasekar SNo ratings yet

- QCS-2010 Section 1 Part 01 IntroductionDocument8 pagesQCS-2010 Section 1 Part 01 Introductionbryanpastor106No ratings yet

- Technical Specification Combustiom Modifications Lot 1 For TenderDocument184 pagesTechnical Specification Combustiom Modifications Lot 1 For TendervrajtilakNo ratings yet

- Presenration TAX LAW (AMENDMENT) ORDINANCE, 2020Document49 pagesPresenration TAX LAW (AMENDMENT) ORDINANCE, 2020Asad Abbas MalikNo ratings yet

- Sro 575 Updated 200313Document40 pagesSro 575 Updated 200313Asaad ZahirNo ratings yet

- Finance Act2005Document20 pagesFinance Act2005kagronNo ratings yet

- Sro 575 (I) 2006Document38 pagesSro 575 (I) 2006sehrish23No ratings yet

- 1st Addenda Corrigendum Vol-III Road Bridge Works Schedule 2014Document5 pages1st Addenda Corrigendum Vol-III Road Bridge Works Schedule 2014sanandaNo ratings yet

- Escc Construction Spec For Dev 08Document122 pagesEscc Construction Spec For Dev 08p_mincher5209No ratings yet

- HR Chapter 19Document44 pagesHR Chapter 19andresboy123No ratings yet

- Supplemental Specs For Ag RoadsDocument42 pagesSupplemental Specs For Ag Roadsluismarcial01No ratings yet

- Prasarana ImaDocument97 pagesPrasarana Imamyvi317No ratings yet

- Second Schedule (Fifth Schedule)Document95 pagesSecond Schedule (Fifth Schedule)Adnan KhanNo ratings yet

- SOR Road Works1!4!10Document95 pagesSOR Road Works1!4!10gagajainNo ratings yet

- 1574 03 Vol 2B DS PackageDocument69 pages1574 03 Vol 2B DS PackageZahoor AhmedNo ratings yet

- Industrial Drawbacks RegulationsDocument5 pagesIndustrial Drawbacks RegulationsPsalmist EddieNo ratings yet

- Income Tax Department Depreciation RateDocument16 pagesIncome Tax Department Depreciation RatejiviNo ratings yet

- 0775 31072006 Ipo PDFDocument80 pages0775 31072006 Ipo PDFsadafNo ratings yet

- TheFinanace (Supplementary) Act2022Document24 pagesTheFinanace (Supplementary) Act2022Syed Adnan raza ShahNo ratings yet

- PWD Sor R B Wef 15 04 09 PDFDocument96 pagesPWD Sor R B Wef 15 04 09 PDFGauravtripathi8580% (1)

- Government of Pakistan Ministry of Finance, Revenue and Economic Affairs (Revenue Division) Notification (Customs/Sales Tax)Document5 pagesGovernment of Pakistan Ministry of Finance, Revenue and Economic Affairs (Revenue Division) Notification (Customs/Sales Tax)MOHSINNo ratings yet

- Industrial Drawbacks RegulationsDocument5 pagesIndustrial Drawbacks RegulationsBewovicNo ratings yet

- Finance Bill 2013Document65 pagesFinance Bill 2013amars25No ratings yet

- CustomsandExciseAct10of1978 Subsidiary PDFDocument421 pagesCustomsandExciseAct10of1978 Subsidiary PDFEmeka NkemNo ratings yet

- Ministry of Indsuustrial Development & Company AffairsDocument18 pagesMinistry of Indsuustrial Development & Company AffairsSANDY111186No ratings yet

- CP2 Technical SpecificationsDocument438 pagesCP2 Technical SpecificationsHarry BasadaNo ratings yet

- 3rd Amendment RulesDocument9 pages3rd Amendment RulessachinismuNo ratings yet

- ADD Chapter-73Document22 pagesADD Chapter-73Admin- ArgentiumNo ratings yet

- Part-Ii: Corporate Law Autority NofitifcationDocument27 pagesPart-Ii: Corporate Law Autority NofitifcationAltaf Hussain 17BNCIV0950No ratings yet

- Gabion Wall Bro TenderDocument28 pagesGabion Wall Bro TenderBIJAY KRISHNA DASNo ratings yet

- Railway CrossingDocument8 pagesRailway CrossingLe Anh TuanNo ratings yet

- No - TCR/1078/2007/3. New Delhi, Dated 01.07.2008 The Chief Commercial Managers, All Indian RailwaysDocument7 pagesNo - TCR/1078/2007/3. New Delhi, Dated 01.07.2008 The Chief Commercial Managers, All Indian RailwayspassitsNo ratings yet

- Rates of DepreciationDocument22 pagesRates of DepreciationBalaKumar MurugadossNo ratings yet

- 2010 ADA Standards for Accessible DesignFrom Everand2010 ADA Standards for Accessible DesignRating: 3 out of 5 stars3/5 (1)

- Trunk Roads Act, 1936 [1 Edw. 8. & 1 Geo 6. Ch. 5.]From EverandTrunk Roads Act, 1936 [1 Edw. 8. & 1 Geo 6. Ch. 5.]No ratings yet

![Trunk Roads Act, 1936 [1 Edw. 8. & 1 Geo 6. Ch. 5.]](https://imgv2-1-f.scribdassets.com/img/word_document/577524737/149x198/da0c2c9e40/1654689309?v=1)