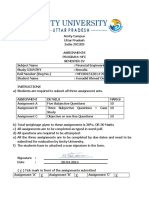

Professional Documents

Culture Documents

Managing Foreign Exchange Risk: International Service Centre

Managing Foreign Exchange Risk: International Service Centre

Uploaded by

nadeenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managing Foreign Exchange Risk: International Service Centre

Managing Foreign Exchange Risk: International Service Centre

Uploaded by

nadeenaCopyright:

Available Formats

International Service Centre

Managing Foreign Exchange Risk

As evidenced in recent years, the value of the Canadian dollar is unpredictable over time. The profitability of exporters and importers has taken a hit from the loonies fluctuations. However, the impact our dollar has on business profitability can be reduced by what is referred to as foreign exchange risk management. In fact, numerous trends are increasingly forcing Canadians to consider foreign exchange risk management, notably, globalization and market interdependence. The first should come as no surprise given that in the past, few companies had the opportunity to open their doors to the rest of the world. Today, a vast number of them are doing business internationally. Such is the case for many SMEs, which are trying to leverage free trade between Canada, the U.S. and Mexico. Indeed, these SMEs are growing faster by selling goods and services abroad or by importing less costly raw materials and better quality parts. Consequently, since the early 90s, Canadian businesses have become more interested in international currency trading. The second trend, market interdependence, is due to the fact that currency markets can generate chain reactions that affect the value of the Canadian dollar. The perfect example is rising oil prices caused by widespread and excessive uncertainty and speculation about the U.S. dollar. Since Canada has little influence on the level of confidence of the main players on the international monetary market, it is therefore wise for Canadian companies to take control of foreign exchange risk. The purpose of this guide is to familiarize you with this risk and explain the various hedging options available to offset it. The Desjardins International Service Centre can help you develop strategies in this regard. The last section provides the contact information for the international services development managers in the different regions of Canada.

Foreign exchange risk management Policy compliance Policy definition and implementation Knowledge of available instruments

Caisse Centrale Desjardins is a member of SWIFT CCDQCAMM

International Service Centre

STEP 1: Defining your needs

Based on the situation, you will have to determine whether you need to hedge and, if so, which instrument is the most appropriate. Answering the following questions may make it easier for you to decide: In relation to sales, what percentage of your receivables and/or payables is in foreign currency? How sensitive is your company to foreign exchange fluctuations, and at which point will the exchange rate affect your profitability? Can you match the due dates of your receivables and payables in a given currency? Are your export amounts and dates totally accurate? Can you pass on a currency loss to your customers by increasing prices? Do you have major investments to make in the short term (Do you need a stable cash flow?) or will you be making equipment or other purchases abroad in the short term? Can you reach an agreement with your customers to share foreign exchange risk both in terms of losses and gains?

Based on your answers to these questions, go to Step 2 to decide what is right for you.

STEP 2: Hedging overview

Managing foreign exchange risk involves taking the appropriate measures to eliminate or hedge against these risks. You can therefore choose one of the following three policies based on the needs defined in Step 1. No hedging You decide not to act and accept the foreign exchange risk. However, in so doing, you are adopting a potentially risky position. For a company, not hedging is generally based on a misunderstanding of the risk or on the hope that it will gain from it. This lack of control (deliberate or not) can have unfortunate consequences on the companys profitability. Of course, hedging is not necessary if international transactions make up just a small part of your business. In short, if the percentage of your foreign currency receivables and/or payables is very low in relation to sales, or if, for example, you can match the due date of your receivables and payables in a given currency, you do not need to think about hedging.

International Service Centre

Selective hedging In this case, you adopt a policy that sets out when and how you hedge against foreign exchange risk; for instance, you decide to hedge only some of your foreign transactions. This policy assumes that you have determined your risk tolerance and that you have an idea as to the direction the currency in question will take. You can also adopt the principle that any hedging resulting in a plus or minus value of x dollars must be closed (profits or losses taken). Selective hedging can be illustrated with the following example. Let us assume 80% of your revenues or receivables are generated in the U.S. In this case, you could decide to hedge only half of these accounts with a hedging strategy. One of the reasons for doing so might be your expectations regarding short-term exchange rates. In fact, assuming that all your receivables are due within the next three months and that your foreign exchange expectations for the same period are to your advantage, you could decide to cover only half of these receivables. Here again, this strategy depends on the business needs defined in Step 1. Systematic hedging

This involves automatically hedging as soon as foreign currency commitments or assets are involved. In reality, very few companies fully hedge their position. As a general rule, the more a company relies on foreign exchange cash flow to grow or pay its debts, the more it will hedge against risk.

STEP 3: Selecting currency instruments

The following is a brief description of the various instruments that exist to reduce the impact of foreign exchange fluctuations.

A) Natural position

The natural position is the company's fundamental position. It determines the companys exposure to a certain currency. Every company that conducts business transactions in a foreign currency has a natural position. However, natural hedging is a situation in which the companys operations are covered against foreign exchange risk. For example, this type of risk is not a factor when a company uses an inflow of U.S. currency to pay a supplier the equivalent amount in the same currency.

International Service Centre

B) Forward contracts: foreign exchange forward contracts and swaps

The forward contract is an instrument of choice for hedging against foreign exchange risk, offering flexibility and liquidity in the current currencies. The amount and dates can be matched with a commercial transaction, thus eliminating any residual risk. Conversely, forward contracts do not allow a company to benefit from favourable currency moves. 1) The foreign exchange forward contract is an agreement to convert one currency into another. The amount of the transaction, the exchange rate used for the conversion and the future date on which the conversion will be made are fixed when the contract is purchased. Certain contracts allow partial deliveries made during an optional period that can reach 30 days. 2) The swap involves simultaneous spot and period transactions of one currency against another. This type of currency transaction is frequently used by companies with receivables and payables in the same currency, but whose due dates are not matched.

C) Call and put options

By paying a premium, the option gives you the right but not the obligation to buy or sell currencies at a predetermined date and rate. The option (used for hedging and not speculative purposes) acts as a form of insurance policy, allowing you to make a profit when exchange rates shift in your favour and protect you when the opposite occurs. 1) Call option: Two scenarios are possible with call options. In the first, the exchange rate when the option expires is above the strike price, and the option holder can therefore exercise his right and purchase the currency at the predetermined advantageous rate. In the second scenario, the exchange rate on expiration of the option is below the strike price, and the holder therefore has no advantage in exercising this right, because he can purchase the currency at a lower price on the market. As a result, he only loses the premium paid when purchasing the option.

2) Put option: Two scenarios are also possible with put options. In the first, the

exchange rate when the option expires is above the strike price, and the holder has no interest in selling at the strike price because he can do better on the market. The premium he paid initially is therefore lost. In the second, the exchange rate on expiration of the option is below the strike price, and it is therefore in the holders interest to exercise this option, because he can sell the currency at the strike price, which is advantageous.

International Service Centre

D) Other options Other options are available and are offered by our currency traders. In fact, a varied range of options adapted to the needs of each company is available. The advantage of foreign exchange risk hedging products is their flexibility. A customized strategy is always possible, and there are no limits to the possibilities. Here are a few examples of options available on the market. Collar: A collar is a combination of two contracts to obtain a very specific profit diagram. There are two ways to create a collar. The first involves buying a call option and selling a put option, while the second involves buying a put option and selling a call option. In both cases, the company guarantees that its purchase or selling price of U.S. currency will not go beyond a range between the two strike prices of the options in the collar. The price of this structure is generally equivalent to the amount paid to buy one of the options less the price received for selling the second option. Zero cost collar: This is the same principle as a regular collar but the structure is redesigned to ensure that the price of the option is zero. However, to do so, the holder must sacrifice a part of the potential gain so as to receive a greater premium on the option sold. Consequently, the holder guarantees that his exchange rate will be limited to a certain range, but the potential gain will be lower. Example of a zero cost collar: A company exporting medications to Europe wishes to protect itself against a depreciation of the euro but does not want to disburse any funds. This company has a variable amount of euros in its portfolio. Assume that the euro is currently trading at 1.45 for the purpose of the example. To meet its specific requirements, the company decides to use a zero cost collar as the hedging strategy. It purchases a three-month put option at a strike price of 1.4350 and sells a three-month call option to the Caisse centrale Desjardins at a strike price of 1.4650. The premium on the option purchased is $1,500, and the premium received on the option sold is $1,500. Consequently, the structure entails zero cost for the company. The company therefore succeeds in guaranteeing that the selling price of the euros will not go beyond the range of (1.4350-1.4650) for a period of three months, thus eliminating a source of risk. Barrier options: These options have the same characteristics as standard options but include barriers. The barrier can be above or below the actual currency price and may be knock-in or knock-out. Knock-in: A knock-in feature causes the option to become effective only if the currency price first reaches a specified barrier level.

International Service Centre

Knock-out: A knock-out feature causes the option to immediately terminate if the currency price reaches a specified barrier level. In both cases, the currency price can reach or exceed the barrier anytime before expiry to knock in/knock out the option.

Table 1: Pros and cons of forward exchange contracts and options Forward Exchange Contract

Pros / Benefits

Price known at time of hedging $20,000 minimum Minimal cost Hedging periods of two days to one year (longer term possible)

Swap

Allows you to match inflows and outflows in a given currency Minimal cost $20,000 minimum

Option

Insurance policy: allows you to hedge against risk while benefiting from a favourable currency move $20,000 minimum

Cons / Risks

Cannot benefit from a favourable currency move Guarantees may be required Cannot be cancelled except by taking a reverse position

Cannot benefit from a favourable currency move Guarantees may be required Cannot be cancelled except by taking a reverse position

Premium required: varies based on such factors as the option term and foreign exchange volatility

Table 2: Pros and cons of other options Collar

Pros / Benefits

Strong gain potential Limited loss potential Lower premium than when only one option is considered

Zero-cost collar

Good gain potential Limited loss potential No premium to pay

Barrier options

Same pros as a standard option Lower premium

Cons / Risks

Capped gain potential Guarantees may be required

Capped gain potential Guarantees may be required

Imperfect hedging

International Service Centre

Strategy options

Depending on the answers you gave in Step 1, the financial situation of your company (ability to take risks) and your own risk tolerance, here are a few examples of generic strategies. Other more complex strategies, as seen in point D, are also available to meet specific situations.

Table 3: Examples of possible strategies Corporate Objective

Setting the future price of my currencies today. Optimize the management of my multi-currency cash flow. Ensure a minimum/maximum price while benefiting from a favourable currency move. Ensure a ceiling and floor price on the currency in order to effectively manage my cash flow.

Desjardins Suggests

Forward contract Swap Currency option Collar

STEP 4: Keeping your strategy up-to-date

Once you have determined the right instruments for your needs, you need to decide on the hedge period. Three months is usually sufficient, but you may feel that one year is more appropriate. Here again, it is up to you to determine the period that will be covered by your foreign exchange risk hedging strategy. However, you should know that any strategy you devise may need redesigning. The data used to establish your strategy will change over time. For example, your receivables and payables may no longer be the same, you may now have a better natural hedge, or you may have a different attitude to risk. In any case, a winning strategy must be revisited as often as possible to make sure it remains focused on your growth objectives, cash flow management and the current situation.

International Service Centre

Desjardins at your service

The foreign exchange risk hedging products presented in this document are but a few of the many options available. The Caisse centrale Desjardins also offers many other possibilities not covered in this reference guide. We develop customized solutions because we know that each companys financial situation is unique. The Desjardins International Service Centre and its team of international service development managers are here to handle your requests and answer your questions on this topic. Our team of currency traders is another important resource to help you find the right solution. Desjardins provides you with all the tools you need to make smart decisions that will help your company succeed. Below is the contact information for our international services development offices and financial risk management advisers for international operations.

Desjardins International Service Centre

MONTREAL

300 Lo-Pariseau, 18th floor Montral, Qubec H2X 4B3 Tel.: 514-281-2818 option 1-3-1 Toll free: 1-800-707-2305 option 1-3-1

QUBEC CITY

5600 Boulevard des Galeries, Suite 140 Qubec City, Qubec G2K 2H6 Tel.: 418-634-5775 Toll free: 1-866-634-5775 option 3

TROIS-RIVIRES

2000 Boulevard des Rcollets P.O. Box 1000 Trois-Rivires, Qubec G9A 5K3 Tel.: 819-374-3594 extension 202 Toll free: 1-800-567-294 extension 202

You might also like

- FEDocument20 pagesFEKenadid Ahmed Osman100% (1)

- Investments Workbook: Principles of Portfolio and Equity AnalysisFrom EverandInvestments Workbook: Principles of Portfolio and Equity AnalysisRating: 4 out of 5 stars4/5 (1)

- Foreign Exchange Exposures - IFMDocument7 pagesForeign Exchange Exposures - IFMDivya SindheyNo ratings yet

- Effects On Time Value of MoneyDocument6 pagesEffects On Time Value of MoneyAnonymous 1iQ7G7ENo ratings yet

- Foreign Exchange Risk ManagementDocument5 pagesForeign Exchange Risk Managementpriya JNo ratings yet

- FX Business Payments White PaperDocument7 pagesFX Business Payments White PapermovizepNo ratings yet

- Two Marks Question: 1. What Is Hedging?Document6 pagesTwo Marks Question: 1. What Is Hedging?akshataNo ratings yet

- Literature Review Currency HedgingDocument8 pagesLiterature Review Currency Hedgingfvf8gc78100% (1)

- MTM ValuationDocument4 pagesMTM Valuationkshitij-mehta-4210No ratings yet

- Solutions Chapters 10 & 11 Transactions and Economic ExposureDocument46 pagesSolutions Chapters 10 & 11 Transactions and Economic ExposureJoão Côrte-Real Rodrigues50% (2)

- Derivatives and RMDocument35 pagesDerivatives and RMMichael WardNo ratings yet

- Homework 6Document4 pagesHomework 6Chang Chun-MinNo ratings yet

- Ims3310 Group 10 Dealing With Transaction RiskDocument8 pagesIms3310 Group 10 Dealing With Transaction Riskapi-250771392No ratings yet

- Exposure MGTDocument9 pagesExposure MGThansdeep479No ratings yet

- Questions CH 10Document4 pagesQuestions CH 10Maria DevinaNo ratings yet

- What Are Your Hedging Options?: Executive SummaryDocument3 pagesWhat Are Your Hedging Options?: Executive SummarytrevinooscarNo ratings yet

- ch10 Kopie PDFDocument19 pagesch10 Kopie PDFaadt91No ratings yet

- Foreign Exchange Risk Management - International Financial Environment, International Business - EduRev NotesDocument8 pagesForeign Exchange Risk Management - International Financial Environment, International Business - EduRev Notesswatisin93No ratings yet

- FRM Group 1 Assignment 3Document4 pagesFRM Group 1 Assignment 3Ridhi MusaddiNo ratings yet

- Risk ManagementDocument5 pagesRisk ManagementAlejandra CastillaNo ratings yet

- Introduction To Hedging (Notes)Document8 pagesIntroduction To Hedging (Notes)t6s1z7No ratings yet

- An Introduction To HedgingDocument21 pagesAn Introduction To HedgingJayveer VoraNo ratings yet

- Financial Glossary: Submitted in Partial Fulfilment of The Requirements For Post Graduate Diploma in Management (PGDM)Document27 pagesFinancial Glossary: Submitted in Partial Fulfilment of The Requirements For Post Graduate Diploma in Management (PGDM)Anchit AgrawalNo ratings yet

- Chapter 10 SolutionsDocument19 pagesChapter 10 Solutionsabhijeet_rahate36No ratings yet

- General Risk Disclosure: Updated On 6.9.2018Document6 pagesGeneral Risk Disclosure: Updated On 6.9.2018የኛ TubeNo ratings yet

- Preguntas Orientadoras Guia 3Document20 pagesPreguntas Orientadoras Guia 3camilo muñozNo ratings yet

- MS 509 - IFM - Foreign Exchange Risk Exposure - GSKDocument6 pagesMS 509 - IFM - Foreign Exchange Risk Exposure - GSKShaaz AdnanNo ratings yet

- The Management of Foreign Exchange RiskDocument98 pagesThe Management of Foreign Exchange RisknandiniNo ratings yet

- Currency DerivativesDocument28 pagesCurrency DerivativesChetan Patel100% (1)

- IFM Chapter 11 AnswersDocument6 pagesIFM Chapter 11 AnswersPatty CherotschiltschNo ratings yet

- 2020 ExamDocument6 pages2020 Examroxana.kazemiNo ratings yet

- Thesis Credit Default SwapsDocument7 pagesThesis Credit Default Swapsjessicaoatisneworleans100% (2)

- The Clearing and Settlement Process Is A Series of Complex TasksDocument2 pagesThe Clearing and Settlement Process Is A Series of Complex TasksHanzo vargasNo ratings yet

- Swati Anand - FRMcaseDocument5 pagesSwati Anand - FRMcaseBhavin MohiteNo ratings yet

- (A) Risk Associated With Future Contract: LeverageDocument3 pages(A) Risk Associated With Future Contract: LeverageSaadMehmoodNo ratings yet

- Solutions Chapters 10 & 11 Transactions and Economic ExposureDocument46 pagesSolutions Chapters 10 & 11 Transactions and Economic Exposurerakhiitsme83% (6)

- Transaction Risk: Statistic, 2014)Document1 pageTransaction Risk: Statistic, 2014)Rubab KanwalNo ratings yet

- The Management of Foreign Exchange RiskDocument97 pagesThe Management of Foreign Exchange RiskVajira Weerasena100% (1)

- The Best Instrument Against Currency Risk.Document13 pagesThe Best Instrument Against Currency Risk.Hanane KoyakoNo ratings yet

- HedgingDocument28 pagesHedgingNadeem AhmadNo ratings yet

- Hedging Process Step by Step Guide PDFDocument10 pagesHedging Process Step by Step Guide PDFAbhijeet JacksonNo ratings yet

- Topic 5 Types of RisksDocument11 pagesTopic 5 Types of Riskskenedy simwingaNo ratings yet

- Switch Trading OverviewDocument3 pagesSwitch Trading OverviewpoojaNo ratings yet

- The Foreign Exchange Market: International Trade GuidesDocument6 pagesThe Foreign Exchange Market: International Trade GuidesehabmicNo ratings yet

- Exchange Risk MNGTDocument28 pagesExchange Risk MNGTHassaniNo ratings yet

- FINC6013 Workshop 5 Questions & SolutionsDocument6 pagesFINC6013 Workshop 5 Questions & SolutionsJoel Christian MascariñaNo ratings yet

- Chapter Five: Financial Risk ManagementDocument26 pagesChapter Five: Financial Risk ManagementJerome MogaNo ratings yet

- International Trade Logistics Project: Made By: Group 9Document7 pagesInternational Trade Logistics Project: Made By: Group 9Prathamesh Rajaykumar DahakeNo ratings yet

- SolutionDocument4 pagesSolutionCR7pNo ratings yet

- Foreign Exchange Risk Management AnalysisDocument12 pagesForeign Exchange Risk Management AnalysisPrashant AgarkarNo ratings yet

- WLH Finance CompilationDocument58 pagesWLH Finance CompilationSandhya S 17240No ratings yet

- Chapter 13 AnswersDocument5 pagesChapter 13 Answersvandung19No ratings yet

- Topic 2 Introduction To Trade Risk and Risk AssessmentDocument6 pagesTopic 2 Introduction To Trade Risk and Risk AssessmentNicole Alyssa GarciaNo ratings yet

- MBF NotesDocument14 pagesMBF NotesMelanie MolloNo ratings yet

- Chatham Financial Counterparty Risk and Collateral ProtectDocument8 pagesChatham Financial Counterparty Risk and Collateral ProtectjitenparekhNo ratings yet

- Derivatives and Risk Management: Answers To Beginning-Of-Chapter QuestionsDocument13 pagesDerivatives and Risk Management: Answers To Beginning-Of-Chapter QuestionsRiri FahraniNo ratings yet

- Financial Management: International FinanceDocument22 pagesFinancial Management: International Financetushar1daveNo ratings yet

- Objectives of Receivables Management: Standards, Length of Credit Period, Cash Discount, Discount Period EtcDocument8 pagesObjectives of Receivables Management: Standards, Length of Credit Period, Cash Discount, Discount Period EtcRekha SoniNo ratings yet

- OPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)From EverandOPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)No ratings yet