Professional Documents

Culture Documents

Tax Calculator 2010-11

Tax Calculator 2010-11

Uploaded by

LordEnigma18Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Calculator 2010-11

Tax Calculator 2010-11

Uploaded by

LordEnigma18Copyright:

Available Formats

tax clculator

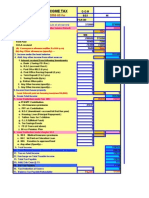

Income Tax Calculator for FY 2010-11

www.FinWinOnline.com

Birth date

Age 14-Dec-82 28 M 540,000 -9,600

Gross Annual Income/Salary (with all allowances) Less: Allowances exempt u/s 10(for Service Period)

(I) H.R.A. exemption City of Residence Basic Salary (Basic+DA) Rent Paid H.R.A received (II) Conveyance allowances(Max Rs.800/-p.m) (iii) Any Other Exempted Receipts/ allowances (iv) Professional Tax

Sex 540,000

0

M

540,000 ### 0 -54,000 0 0 9,600 9,600 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

530,400 0

Income under the head salaries Add: Any other income from other sources

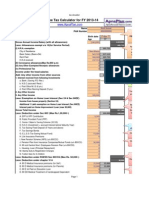

1. Interest received from following Investments a. Bank ( Saving /FD /Rec ) b. N.S.C.(accrued/ Recd ) c. Post Ofice M.I.S (6 yrs.) d. Post Office Recring Deposit (5 yrs.) e. Term Deposit (1 to 5 yrs.) f. Saving Bonds (6yrs.) g. Kishan Vikas patra 2. Any Other Income 3. Any Other Income

Income from house property

Less: Interest paid on housing loan(max150,000)

0 530,400

Gross Total Income Less: Deduction under Sec 80C (Max Rs.1,00,000/-)

a. PF&VPF Contribution b. Life Insurance premiums c. PPF a/c Contribution d. N.S.C (Investment +accrued Int first five year) e. Housing. Loan (Principal Repayment ) f. Tuition fees for 2 children g. E.L.S.S(Mutual Fund) h. Tax Savings Bonds I. FD (5 Years and above)

### -100,000 0 50,000 50,000 0 0 0 0 0 0

Page 1

tax clculator j. 80 ccc Pension Plan

0 0 0 0 0 0

0

Less: Deduction under chapter VI A

b. 80 D Medical Insurance premiums (for Self ) C. 80 D Medical Insurance premiums (for Parents) d. 80 E Int Paid on Education Loan e. 80G Donation to approved fund f. Any other

0 0

Less: Deducation of for Infrastructure Bond (20k Max) Total Income

Total Tax Payable Add; Edn Cess @ 3%

430,400 27,040 811

Net Tax Payable

Tax to Total Income Ratio

27,851

5%

Page 2

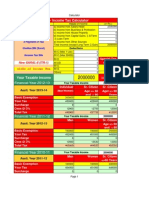

tax clculator

Income Tax for Men Tax Slabs Incremental Taxable Inc Tax Bracket ### 0 - 160000 ### ### 160001 - 300000 ### ### ### 300001 - 500000 ### ### ### 500001 + ### ### ### Total Tax Income Tax for women Tax Slabs Incremental Taxable Inc Tax Bracket ### 0 - 190000 ### ### 190001 - 300000 ### ### ### 300001 - 500000 ### ### ### 500001 + ### ### ### Total Tax Income Tax for Senior Citizen Tax Slabs Incremental Taxable Inc Tax Bracket ### 0 - 240000 ### ### 240001 - 300000 ### ### ### 300001 - 500000 ### ### ### 500001 + ### ### ### Total Tax

Page 3

tax clculator

Page 4

You might also like

- High Low Method ExercisesDocument4 pagesHigh Low Method ExercisesPhoebe Llamelo67% (12)

- Questionnaire ObjectiveDocument9 pagesQuestionnaire Objectiveprasadzinjurde100% (3)

- Synovate White Paper - Brand Value Creation - Communications and EquityDocument32 pagesSynovate White Paper - Brand Value Creation - Communications and EquityKrishna MallikNo ratings yet

- Study Questions - Blockchain and Money - Sloan School of Management - MIT OpenCourseWareDocument3 pagesStudy Questions - Blockchain and Money - Sloan School of Management - MIT OpenCourseWarecherrylifev1No ratings yet

- Income Tax Calculator FY 2012 13Document4 pagesIncome Tax Calculator FY 2012 13raattaiNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Income From House Property Income From Business or Profession Capital Gains Income From Other SourcesDocument4 pagesIncome From House Property Income From Business or Profession Capital Gains Income From Other SourcesPooja TanejaNo ratings yet

- Public Chapter 4Document19 pagesPublic Chapter 4samuel debebeNo ratings yet

- 2013 14 d156 Budget State Form 091013Document29 pages2013 14 d156 Budget State Form 091013api-233183949No ratings yet

- Ibps - Cwe - Clerks - VDocument2 pagesIbps - Cwe - Clerks - VJeganNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalNo ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Income Tax StatementDocument2 pagesIncome Tax StatementgdNo ratings yet

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledDocument2 pagesSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- Income Tax (Master)Document1 pageIncome Tax (Master)nareshjangra397No ratings yet

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- Tax CalculatorDocument10 pagesTax Calculatorgsagar879No ratings yet

- Annual Income Tax Statement For The Financial Year 2013Document4 pagesAnnual Income Tax Statement For The Financial Year 2013Manoj SankaranarayanaNo ratings yet

- TRA Taxes at Glance - 2016-17Document22 pagesTRA Taxes at Glance - 2016-17Timothy Rogatus67% (3)

- Income Tax Calculation Statement: (Financial Year 2013-2014, and The Assessment Year 2014 - 2015)Document17 pagesIncome Tax Calculation Statement: (Financial Year 2013-2014, and The Assessment Year 2014 - 2015)saravanand1983No ratings yet

- Best BudgetDocument31 pagesBest BudgetSyed Muhammad Ali SadiqNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- Form16Document10 pagesForm16anon-263698No ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Tax Slab RatesDocument12 pagesTax Slab RatesTony JosephNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Accounting For Payroll System: Ethiopian ContextDocument25 pagesAccounting For Payroll System: Ethiopian ContextGebremedihn Nigussu BirihanuNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Annexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologyDocument3 pagesAnnexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologySampath SanguNo ratings yet

- Ethiopian Tax SystemDocument26 pagesEthiopian Tax SystemAsfaw WossenNo ratings yet

- Tax Calculator 2012-13Document6 pagesTax Calculator 2012-13arijit_ghosh_18No ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- 1 PayrollDocument2 pages1 Payrollalum jacobNo ratings yet

- 5.income Tax On Salaries-Ppt5Document9 pages5.income Tax On Salaries-Ppt5Priyaprasad PandaNo ratings yet

- PracticeDocument17 pagesPracticeSmarty ShivamNo ratings yet

- Form 16Document1 pageForm 16Manish Varghese MathewNo ratings yet

- Taxation Review June2017Document9 pagesTaxation Review June2017Shaiful Alam FCANo ratings yet

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002No ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- Raja NoteDocument3 pagesRaja NoteKia PottsNo ratings yet

- Income Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxDocument16 pagesIncome Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxshikhaxohebkhanNo ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Salary1 2022 DisDocument45 pagesSalary1 2022 Disparinita raviNo ratings yet

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaNo ratings yet

- Taxation Full Test 1 Unscheduled May 2023 Solution 1677483923Document38 pagesTaxation Full Test 1 Unscheduled May 2023 Solution 1677483923Vinayak PoddarNo ratings yet

- Tax Calcuator Year WiseDocument5 pagesTax Calcuator Year WiseRajib MukherjeeNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- South Western Federal Taxation 2015 Corporations Partnerships Estates and Trusts 38Th Edition Hoffman Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2015 Corporations Partnerships Estates and Trusts 38Th Edition Hoffman Solutions Manual Full Chapter PDFfred.henderson352100% (16)

- Feb 1-3613311284991 - BM2233I010340187Document7 pagesFeb 1-3613311284991 - BM2233I010340187Jihoon BongNo ratings yet

- Monetary PolicyDocument35 pagesMonetary PolicyMegi EzugbaiaNo ratings yet

- Chapter Seven Risks of Financial IntermediationDocument15 pagesChapter Seven Risks of Financial IntermediationOsan JewelNo ratings yet

- Partnership Dissolution: QuizDocument8 pagesPartnership Dissolution: QuizLee SuarezNo ratings yet

- Preamble & The Origin of BDBL:: Bangladesh Development Bank Limited (BDBL) Is Fully State Owned CommercialDocument9 pagesPreamble & The Origin of BDBL:: Bangladesh Development Bank Limited (BDBL) Is Fully State Owned CommercialShamim KhanNo ratings yet

- Strama Case AnalysisDocument4 pagesStrama Case Analysiskororo mapaladNo ratings yet

- Tutorial 2Document5 pagesTutorial 2Azizki WanieNo ratings yet

- UntitledDocument22 pagesUntitledShivani KumariNo ratings yet

- The Effects of Monetary Policy On Inflation in Ghana.Document9 pagesThe Effects of Monetary Policy On Inflation in Ghana.Alexander DeckerNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementEvy Nonita AnggusNo ratings yet

- Solution Manual CH 08 FInancial Accounting Reporting and Analyzing Long-Term AssetsDocument54 pagesSolution Manual CH 08 FInancial Accounting Reporting and Analyzing Long-Term AssetsSherry AstroliaNo ratings yet

- Compound InterestDocument29 pagesCompound InterestNicole Roxanne RubioNo ratings yet

- Winburn Structurally Balanced BudgetDocument8 pagesWinburn Structurally Balanced BudgetCarl WeiserNo ratings yet

- Project Two Chainz (Dual Process - Marry or Stay Single)Document10 pagesProject Two Chainz (Dual Process - Marry or Stay Single)iron_buddhaNo ratings yet

- PNB v. Se DigestDocument3 pagesPNB v. Se DigestBinkee VillaramaNo ratings yet

- AIB Visa Corporate Business Card Additional UserDocument18 pagesAIB Visa Corporate Business Card Additional UserRafay HussainNo ratings yet

- 2018 UK Theatre Sales Data - Headline ReportDocument11 pages2018 UK Theatre Sales Data - Headline ReportKeira GreenNo ratings yet

- 3 Customs ActDocument26 pages3 Customs ActHaritaa Varshini BalakumaranNo ratings yet

- 12 V671 - Cadila Pharmaceutic Aar-Bn-511381 GSTDocument12 pages12 V671 - Cadila Pharmaceutic Aar-Bn-511381 GSTVivek SharmaNo ratings yet

- Instant Download PDF Advanced Accounting 12th Edition Beams Solutions Manual Full ChapterDocument53 pagesInstant Download PDF Advanced Accounting 12th Edition Beams Solutions Manual Full Chapterulfylaires100% (7)

- Time Value of Money NotesDocument22 pagesTime Value of Money NotesBeatrice Anne CanapiNo ratings yet

- Theoretical Framework Mutual Fund DefinedDocument14 pagesTheoretical Framework Mutual Fund Definedsheeba chigurupatiNo ratings yet

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- Flower Shop Business Plan ExampleDocument31 pagesFlower Shop Business Plan ExampleSantos, JobelleNo ratings yet

- EV Financing ReportDocument42 pagesEV Financing ReportSanapathi ManojNo ratings yet

- Chapter 12 Review Updated 11th EdDocument13 pagesChapter 12 Review Updated 11th Edangelsalvador05082006No ratings yet