Professional Documents

Culture Documents

Final: Side 01 Side 01

Final: Side 01 Side 01

Uploaded by

asimfarrukhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final: Side 01 Side 01

Final: Side 01 Side 01

Uploaded by

asimfarrukhCopyright:

Available Formats

61

61

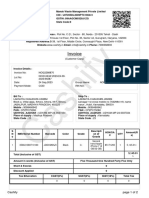

ENERGY FUTURES PRODUCTS

Side 01

Side 01

2011 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin. CME Group Inc. A

CME/Chicago Board of Trade/NYMEX Company. 20 South Wacker Drive, Chicago, Illinois 60606-7499.

Customer Service: (800) 331-3332 Fax: (312) 930-8203 E-Mail: info@cmegroup.com

FINAL

ENERGY FUTURES PRODUCTS

PG61 BULLETIN # 15@

Mon, Jan 24, 2011

PG61

THE CME GROUP DAILY BULLETIN ONLY DISPLAYS THOSE PRODUCTS/CONTRACT MONTHS THAT HAVE VOLUME AND/OR OPEN INTEREST. VOLUME INCLUDES GLOBEX

(ELECTRONIC), OPEN OUTCRY (TRADING FLOOR) AND PRIVATELY NEGOTIATED TRANSACTIONS (PNT) THAT INCLUDE CME CLEARPORT ACTIVITY. VOLUME OR OPEN

INTEREST CHANGES (BOTH BEFORE AND AFTER THE LAST DAY OF TRADING) MAY BE AFFECTED BY: PRIVATELY NEGOTIATED TRANSACTIONS, PRIOR DAY CLEARED

TRADES, POSITION ADJUSTMENTS, DELIVERIES, CASH SETTLEMENTS, OPTION EXERCISES OR ASSIGNMENTS.

PRICE INDICATOR KEY

R= RECORD VOLUME OR OPEN INTEREST, B= BID, A=ASK, P= POST SETTLEMENT SESSION,N= NOMINAL CLOSE, WHICH DESIGNATES THAT THE CONTRACT DID

NOT TRADE DURING THE RTH SESSION AND NO BETTER BID OR BETTER OFFER OCCURRED DURING THE RTH CLOSING RANGE TIME PERIOD. IN ALL INSTANCES,

THE NOMINAL PRICE IS THE PREVIOUS DAYS SETTLEMENT PRICE.

CORE FUTURES PRODUCTS

GLOBEX

OPEN

GLOBEX

HIGH/LOW

OPEN

OUTCRY

HIGH/LOW

OPEN

OUTCRY

CLOSE RANGE

SETT. PRICE

& PT. CHGE

OPEN

OUTCRY

VOLUME

GLOBEX PNT

VOLUME VOLUME

OPEN

INTEREST

NYMEX CRUDE OIL (PHYSICAL)

CL FUT

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

JUL12

AUG12

SEP12

OCT12

NOV12

DEC12

JAN13

FEB13

MAR13

APR13

MAY13

JUN13

JUL13

AUG13

SEP13

OCT13

NOV13

DEC13

JAN14

FEB14

MAR14

APR14

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JUN15

SEP15

DEC15

JUN16

DEC16

JUN17

DEC17

DEC18

DEC19

---89.26

90.80

92.20

93.11

94.13

94.52

94.32

95.35

95.79

95.80

95.24

95.02

---------95.50

---------------95.74

---------------------------------95.22

---------------------------------95.00

------95.20

---96.30

---96.81

97.41

----

TOTAL

CL FUT

---87.65

-------------------------------------------------------------------------------------------------------------------------------------------------------------------

---89.63 /87.27

91.21 /88.97

92.62 /90.50

93.62B/91.57

94.13 /92.55

94.52 /93.00

94.32 /93.30

95.37 /93.77

95.79 /94.00

96.03 /94.27

95.37 /94.75

95.02 /94.95

94.64A

94.89A

95.48A

95.70 /95.00

---------------96.26B/94.73A

---------------------------------95.66B/94.34A

---------------------------------95.50 /94.29A

------95.90B/94.67

---96.30 /95.62A

---96.81 /96.81

97.41 /97.03

----

---87.65 /87.65

-------------------------------------------------------------------------------------------------------------------------------------------------------------------

---87.65

90.63N

92.04N

93.07N

93.80N

94.24N

94.58N

94.89N

95.17N

95.43N

95.56N

95.61N

95.65N

95.68N

95.72N

95.76N

95.71N

95.67N

95.64N

95.63N

95.63N

95.69N

95.60N

95.51N

95.44N

95.36N

95.28N

95.21N

95.19N

95.18N

95.18N

95.19N

95.21N

95.23N

95.20N

95.17N

95.15N

95.13N

95.12N

95.11N

95.10N

95.10N

95.11N

95.13N

95.16N

95.20N

95.42N

95.57N

95.76N

96.05N

96.44N

96.79N

97.15N

97.94N

98.76N

88.86

87.87

89.53

91.02

92.07

92.82

93.29

93.67

94.03

94.37

94.69

94.84

94.92

94.98

95.02

95.08

95.14

95.11

95.08

95.04

95.04

95.06

95.12

95.04

94.96

94.89

94.81

94.73

94.66

94.64

94.63

94.64

94.65

94.67

94.70

94.66

94.63

94.60

94.58

94.56

94.54

94.53

94.52

94.52

94.53

94.56

94.60

94.80

94.95

95.12

95.43

95.85

96.23

96.61

97.40

98.24

+

-

UNCH

1.24

1.10

1.02

1.00

0.98

0.95

0.91

0.86

0.80

0.74

0.72

0.69

0.67

0.66

0.64

0.62

0.60

0.59

0.60

0.59

0.57

0.57

0.56

0.55

0.55

0.55

0.55

0.55

0.55

0.55

0.54

0.54

0.54

0.53

0.54

0.54

0.55

0.55

0.56

0.57

0.57

0.58

0.59

0.60

0.60

0.60

0.62

0.62

0.64

0.62

0.59

0.56

0.54

0.54

0.52

---1119

2007

34

963

---20

75

15

20

665

---------------------------------------------------------------------42

----------------------------------------------------------------

4960

---349953

136882

91283

83934

30104

15914

13303

8135

4874

41510

7044

3067

1448

303

175

4686

2745

809

8

55

55

7384

---------------258

---------------3216

---------------------------------1037

------784

---17

---12

12

---809007

0

409644 +

118324 +

95642 +

114429 +

60321 +

35064 +

33619 +

25459 +

21339 +

176735 +

31611 10644 +

12793 5132 +

7183 51131 +

8188 +

5527 +

7355 +

3361 +

4677 114204 6473

1968

3110

1263

607

13672 +

748

747

3520

537

513

48644 +

163

153

3

200

10

4056

3

7

3

3

5

28841 189

1

20174 139

9287 +

8

3664 +

1878 +

37

25716 1503008 +

21572

43863

18762

8688

10270

2843

1454

1721

593

360

2322

529

20

---------5

---------------------113002

37444 106092 +

42089 +

22952 34799 +

11808 8449 +

9015 4493 5226 +

19662 +

3647 +

843 +

711

215

182

4888 +

363

102

244

27

14

1461

5

15182 314731 +

---5013

2742

1748

4949

200

5

367

25

---4107

---------------525

---400

---------1469

---------------------------------2816

---------------------------------500

------250

---300

------300

----

UNCH

4268

471

5655

4251

837

769

1218

1796

631

3632

501

577

315

5

34

744

862

818

3

49

37

243

UNCH

UNCH

UNCH

UNCH

UNCH

142

UNCH

UNCH

UNCH

UNCH

UNCH

1456

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

71

UNCH

UNCH

498

UNCH

304

UNCH

3

300

UNCH

27092

NYMEX HEATING OIL (PHYSICAL)

HO FUT

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

JUL12

AUG12

SEP12

OCT12

NOV12

DEC12

JAN13

2.6560

2.6588

2.6600

2.6450

2.6401

2.6573

2.6557

2.6838

2.6900

2.7038

2.7290

2.7225

-------------------------------------

TOTAL

HO FUT

2.6480

----------------------------------------------------------------------

2.6788 /2.6147

2.6808 /2.6183

2.6688 /2.6097

2.6586 /2.6033

2.6540 /2.6025

2.6573 /2.6115A

2.6659B/2.6223A

2.6839 /2.6379A

2.6950B/2.6552A

2.7101B/2.6723A

2.7290 /2.6901

2.7375 /2.7075

2.7116A

2.7071A

------2.6688A

----------------------

2.6480 /2.6480

----------------------------------------------------------------------

2.6480

2.6543N

2.6448N

2.6360N

2.6341N

2.6421N

2.6520N

2.6661N

2.6814N

2.6977N

2.7111N

2.7243N

2.7273N

2.7183N

2.6978N

2.6813N

2.6708N

2.6738N

2.6828N

2.6953N

2.7088N

2.7218N

2.7348N

2.7493N

2.6193

2.6231

2.6151

2.6095

2.6101

2.6196

2.6309

2.6466

2.6634

2.6806

2.6946

2.7076

2.7111

2.7026

2.6821

2.6656

2.6551

2.6581

2.6671

2.6796

2.6931

2.7061

2.7191

2.7336

0.0315

0.0312

0.0297

0.0265

0.0240

0.0225

0.0211

0.0195

0.0180

0.0171

0.0165

0.0167

0.0162

0.0157

0.0157

0.0157

0.0157

0.0157

0.0157

0.0157

0.0157

0.0157

0.0157

0.0157

72

56

15

---50

---20

16

16

20

-------------------------------------------

265

6601

3314

1876

550

884

---500

---------1207

---------------250

----------------------

6531

5582

2122

526

506

77

249

76

19

50

780

377

6

UNCH

UNCH

UNCH

250

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

2693

NYMEX NY HARBOR GAS (RBOB) (PHY)

RB FUT

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

OPEN

OUTCRY

OPEN RANGE

2.4585

2.4750

2.5916

2.6093

2.5976

2.5966

2.5791

2.5802

2.4318

----------------------------

2.4751 /2.4083

2.4979 /2.4324

2.6061B/2.5488

2.6093 /2.5589

2.6084B/2.5610

2.5985B/2.5545

2.5864B/2.5439A

2.5802 /2.5254A

2.4348B/2.4307A

----------------------------

2.4589N

2.4785N

2.5892N

2.5964N

2.5959N

2.5890N

2.5764N

2.5574N

2.4505N

2.4132

2.4379

2.5549

2.5636

2.5648

2.5596

2.5487

2.5311

2.4255

0.0457

0.0406

0.0343

0.0328

0.0311

0.0294

0.0277

0.0263

0.0250

154

150

------50

-------------

18123

41937

16966

9205

8091

3418

3491

951

495

5602

2453

1833

300

400

---500

---150

28687

97285

39905

25645

27226

10619

6922

5477

5439

THE INFORMATION CONTAINED IN THIS REPORT IS COMPILED FOR THE CONVENIENCE OF THE USER AND IS FURNISHED WITHOUT RESPONSIBILITY FOR ACCURACY OR CONTENT.

ACCEPTED BY THE USER ON THE CONDITION THAT ERRORS OR OMISSIONS SHALL NOT BE MADE THE BASIS FOR ANY CLAIM, DEMAND, OR CAUSE FOR ACTION.

Copyright CME Group Inc. A CME/Chicago Board of Trade/NYMEX Company. All rights reserved.

+

+

+

+

+

9380

1411

1962

1123

76

192

671

45

120

IT IS

61

61

ENERGY FUTURES PRODUCTS

Side 02

Side 02

2011 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin. CME Group Inc. A

CME/Chicago Board of Trade/NYMEX Company. 20 South Wacker Drive, Chicago, Illinois 60606-7499.

Customer Service: (800) 331-3332 Fax: (312) 930-8203 E-Mail: info@cmegroup.com

FINAL

ENERGY FUTURES PRODUCTS

PG61 BULLETIN # 15@

GLOBEX

OPEN

GLOBEX

HIGH/LOW

OPEN

OUTCRY

HIGH/LOW

OPEN

OUTCRY

CLOSE RANGE

SETT. PRICE

& PT. CHGE

OPEN

OUTCRY

VOLUME

GLOBEX PNT

VOLUME VOLUME

PG61

OPEN

INTEREST

NYMEX NY HARBOR GAS (RBOB) (PHY)

RB FUT

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

JUL12

AUG12

SEP12

OCT12

NOV12

DEC12

2.4200

2.4344

-------------------------------------

TOTAL

RB FUT

-------------------------------------------

2.4200 /2.4119A

2.4354 /2.3905

-------------------------------------

-------------------------------------------

2.4295N

2.4208N

2.4311N

2.4466N

2.4621N

2.5651N

2.5716N

2.5716N

2.5661N

2.5563N

2.5405N

2.4370N

2.4233N

2.4183N

2.4065

2.3990

2.4100

2.4270

2.4435

2.5500

2.5570

2.5580

2.5535

2.5432

2.5269

2.4229

2.4087

2.4032

0.0230

0.0218

0.0211

0.0196

0.0186

0.0151

0.0146

0.0136

0.0126

0.0131

0.0136

0.0141

0.0146

0.0151

-------------------------------------------

354

351

1656

86

82

90

107

32

17

------------------105098

11366

106282

81271

35888

18071

7517

7508

2883

2641

15643

4509

3757

6659

1217

1360

1075

100

30

29

12

16

381

72

97

90

---5

3

6

---------1

4

---6

------4

4

5

-------------------------------------------------------------------------------------------------------------------------------------------------------

8991

2164

350

1800

600

800

---500

550

100

300

400

---300

---------100

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

---128

-------------------------------------

1799 19946 2823 +

1672 +

1813 1249 +

77 +

2827

131

2

1195

42

42

1978

282801 -

34

338

10

10

17

53

20

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

10974

NATURAL GAS HENRY HUB (PHYSICAL)

NG FUT

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

JUL12

AUG12

SEP12

OCT12

NOV12

DEC12

JAN13

FEB13

MAR13

APR13

MAY13

JUN13

JUL13

AUG13

SEP13

OCT13

NOV13

DEC13

JAN14

FEB14

MAR14

APR14

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JAN15

FEB15

MAR15

APR15

MAY15

JUN15

JUL15

AUG15

SEP15

OCT15

NOV15

DEC15

JAN16

FEB16

MAR16

APR16

MAY16

JUN16

JUL16

AUG16

SEP16

OCT16

NOV16

DEC16

JAN17

FEB17

MAR17

APR17

MAY17

JUN17

JUL17

AUG17

SEP17

OCT17

DEC17

JAN18

FEB18

MAR18

APR18

MAY18

JUN18

JUL18

AUG18

OPEN

OUTCRY

OPEN RANGE

Mon, Jan 24, 2011

4.802

4.796

4.800

4.804

4.837

4.930

4.890

4.888

4.950

5.050

5.240

5.368

5.327

5.224

4.917

4.900

4.920

4.960

4.980

4.995

5.050

5.201

5.385

5.517

---5.323

5.030

5.060

---------5.190

5.200

------------------5.190

-------------------------------------------------------------------------------------------------------------------------------------------------------

---------------4.820

---------------------------------------------------5.500

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

4.879 /4.557

4.823 /4.576

4.800 /4.573

4.822 /4.610

4.850 /4.653A

4.930 /4.700

4.896 /4.723A

4.888 /4.724A

4.950 /4.767A

5.050 /4.917A

5.268 /5.128

5.375 /5.252

5.327 /5.211

5.224 /5.118A

4.940B/4.884A

4.940B/4.885

4.959B/4.911A

4.997B/4.951A

5.013B/4.972A

5.018B/4.980A

5.082B/5.036A

5.211B/5.169A

5.396B/5.366

5.517 /5.485

---5.323 /5.323

5.030 /5.030

5.060 /5.030

---------5.190 /5.190

5.200 /5.200

---5.519A

5.670A

---------5.190 /5.190

-------------------------------------------------------------------------------------------------------------------------------------------------------

---------------4.820 /4.820

---------------------------------------------------5.500 /5.500

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

4.736N

4.743N

4.720N

4.753N

4.787N

4.820

4.856N

4.856N

4.900N

5.023N

5.219N

5.338N

5.293N

5.190N

4.932N

4.933N

4.954N

4.989N

5.012N

5.017N

5.077N

5.205N

5.395N

5.500

5.475N

5.345N

5.065N

5.059N

5.079N

5.114N

5.144N

5.154N

5.220N

5.355N

5.560N

5.685N

5.645N

5.515N

5.225N

5.215N

5.235N

5.275N

5.312N

5.330N

5.402N

5.547N

5.757N

5.892N

5.852N

5.707N

5.412N

5.402N

5.422N

5.464N

5.501N

5.519N

5.592N

5.750N

5.962N

6.112N

6.072N

5.927N

5.617N

5.607N

5.627N

5.669N

5.709N

5.729N

5.804N

5.962N

6.174N

6.324N

6.284N

6.124N

5.799N

5.784N

5.814N

5.856N

5.899N

5.919N

5.994N

6.364N

6.514N

6.469N

6.309N

5.974N

5.954N

5.987N

6.031N

6.078N

4.580

4.598

4.595

4.633

4.670

4.720

4.740

4.741

4.785

4.933

5.148

5.270

5.229

5.129

4.889

4.890

4.911

4.949

4.972

4.977

5.037

5.167

5.357

5.480

5.438

5.308

5.033

5.027

5.047

5.082

5.112

5.122

5.188

5.323

5.528

5.653

5.613

5.483

5.203

5.193

5.213

5.253

5.290

5.308

5.380

5.525

5.735

5.870

5.830

5.685

5.405

5.395

5.415

5.457

5.494

5.512

5.585

5.743

5.955

6.105

6.065

5.920

5.610

5.600

5.620

5.662

5.702

5.722

5.797

5.955

6.167

6.317

6.277

6.117

5.792

5.777

5.807

5.849

5.892

5.912

5.987

6.357

6.507

6.462

6.302

5.967

5.947

5.980

6.024

6.071

0.156

0.145

0.125

0.120

0.117

0.117

0.116

0.115

0.115

0.090

0.071

0.068

0.064

0.061

0.043

0.043

0.043

0.040

0.040

0.040

0.040

0.038

0.038

0.037

0.037

0.037

0.032

0.032

0.032

0.032

0.032

0.032

0.032

0.032

0.032

0.032

0.032

0.032

0.022

0.022

0.022

0.022

0.022

0.022

0.022

0.022

0.022

0.022

0.022

0.022

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

284

159

5

------5

---------------5

---------------------------------15

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

29139

250463

105745

91065

22755

31181

19371

14304

56760

24466

21686

42946

10188

24064

20439

5207

3928

2768

2843

3443

6075

2171

7757

4702

1582

2462

2822

1499

1311

1006

733

761

1262

467

5838

2626

231

491

3189

299

141

325

196

123

469

116

180

451

45

147

1408

379

51

72

52

32

165

23

2346

29

26

127

148

28

159

30

20

15

15

8

21

26

4

6

5

3

18

29

21

31

6

4

50

30

30

30

37

30

30

30

THE INFORMATION CONTAINED IN THIS REPORT IS COMPILED FOR THE CONVENIENCE OF THE USER AND IS FURNISHED WITHOUT RESPONSIBILITY FOR ACCURACY OR CONTENT.

ACCEPTED BY THE USER ON THE CONDITION THAT ERRORS OR OMISSIONS SHALL NOT BE MADE THE BASIS FOR ANY CLAIM, DEMAND, OR CAUSE FOR ACTION.

Copyright CME Group Inc. A CME/Chicago Board of Trade/NYMEX Company. All rights reserved.

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

14498

3512

412

1789

318

252

122

115

41

606

305

87

334

603

284

47

26

3

2

16

127

48

34

42

UNCH

UNCH

3

3

UNCH

UNCH

UNCH

1

UNCH

UNCH

6

UNCH

UNCH

4

UNCH

5

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

IT IS

61

61

ENERGY FUTURES PRODUCTS

Side 03

Side 03

2011 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin. CME Group Inc. A

CME/Chicago Board of Trade/NYMEX Company. 20 South Wacker Drive, Chicago, Illinois 60606-7499.

Customer Service: (800) 331-3332 Fax: (312) 930-8203 E-Mail: info@cmegroup.com

FINAL

ENERGY FUTURES PRODUCTS

PG61 BULLETIN # 15@

GLOBEX

OPEN

OPEN

OUTCRY

HIGH/LOW

GLOBEX

HIGH/LOW

OPEN

OUTCRY

CLOSE RANGE

SETT. PRICE

& PT. CHGE

OPEN

OUTCRY

VOLUME

GLOBEX PNT

VOLUME VOLUME

PG61

OPEN

INTEREST

NATURAL GAS HENRY HUB (PHYSICAL)

NG FUT

SEP18

OCT18

NOV18

DEC18

JAN20

DEC20

JAN21

FEB21

MAR21

APR21

MAY21

JUN21

JUL21

AUG21

SEP21

OCT21

NOV21

DEC21

-------------------------------------------------------

TOTAL

NG FUT

-------------------------------------------------------

-------------------------------------------------------

-------------------------------------------------------

6.096N

6.171N

6.329N

6.541N

6.904N

6.956N

7.121N

7.074N

6.889N

6.514N

6.484N

6.524N

6.584N

6.631N

6.646N

6.721N

6.916N

7.151N

6.089

6.164

6.322

6.534

6.897

6.949

7.114

7.067

6.882

6.507

6.477

6.517

6.577

6.624

6.639

6.714

6.909

7.144

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

0.007

-------------------------------------------------------

473

------------------------------------------------------297146

-------------------------------------------------------

16955

30

32

30

33

50

246

30

30

30

30

30

30

30

30

30

30

30

30

838593 -

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

15607

NYMEX BRENT OIL LAST DAY FUTURES

BZ FUT

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

MAR12

DEC12

DEC13

DEC14

JUN15

97.90

97.26

---96.72

---------------97.24

----------------

TOTAL

BZ FUT

----------------------------------------------

98.09B/96.27A

97.26 /97.21

---96.72 /96.72

---------------97.86 /97.22

----------------

----------------------------------------------

----------------------------------------------

96.61

96.65

96.83

97.03

97.15

97.24

97.33

97.42

97.50

97.58

97.65

97.36

96.69

96.47

96.56

0.99

0.92

0.85

0.79

0.75

0.71

0.65

0.61

0.57

0.54

0.51

0.46

0.45

0.55

0.59

----------------------------------------------

683

683

241

17

30

58

39

4

1

16

---------------1772

----------------------------------------------

3183 +

1041 322 +

1003 +

48 +

14 239 69 +

23 +

990 +

120

2006

1000

110

110

10278 +

39

10

1

10

14

12

17

2

1

12

UNCH

UNCH

UNCH

UNCH

UNCH

40

EUROPEAN GASOIL ICE FUTURE

7F FUT

MAY11

----

TOTAL

7F FUT

----

----

----

----

828.75

6.25

----

----

----

33

33

UNCH

-------------------------------------------------

-------------------------------------------------

87.870

89.530

91.020

92.070

92.820

93.290

93.670

94.030

94.370

94.690

94.840

95.120

95.040

94.700

94.600

95.120

1.240

1.100

1.020

1.000

0.980

0.950

0.910

0.860

0.800

0.740

0.720

0.570

0.560

0.530

0.600

0.640

-------------------------------------------------

10408

1205

275

5

---------------1

------------------11894

-------------------------------------------------

7917 +

1726 +

374 +

60 +

12

10

6

42

2

123 2

53

8

80

9

6

10430 +

1081

196

170

4

UNCH

UNCH

UNCH

UNCH

UNCH

1

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

E-MINI CRUDE OIL FUTURES

QM FUT

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

DEC12

JAN13

DEC13

DEC14

DEC15

89.250

91.425

91.550

91.950

---------------95.050

-------------------

TOTAL

QM FUT

-------------------------------------------------

89.625

91.425

91.550

91.950

---------------95.050

-------------------

/87.275

/89.000

/90.600

/91.850

/95.050

1450

E-MINI HEATING OIL FUTURES

QH FUT

FEB11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

----------------------------

TOTAL

QH FUT

----------------------------

----------------------------

----------------------------

----------------------------

2.6193

2.6151

2.6095

2.6101

2.6196

2.6309

2.6466

2.6634

2.6806

0.0315

0.0297

0.0265

0.0240

0.0229

0.0216

0.0195

0.0180

0.0169

----------------------------

----------------------------

----------------------------

9

1

11

1

1

2

1

1

1

28

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

----------------------

----------------------

2.4132

2.4379

2.5549

2.5636

2.5648

2.5487

2.4255

0.0457

0.0406

0.0343

0.0328

0.0311

0.0277

0.0250

----------------------

----------------------

----------------------

3

1

1

1

1

1

1

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

E-MINI GASOLINE FUTURES

QU FUT

FEB11

MAR11

APR11

MAY11

JUN11

AUG11

OCT11

----------------------

TOTAL

QU FUT

----------------------

----------------------

E-MINI NATURAL GAS

QG FUT

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

SEP12

OCT12

DEC12

MAY13

DEC13

JAN14

OPEN

OUTCRY

OPEN RANGE

Mon, Jan 24, 2011

4.805

4.810

4.750

4.730

4.680

---------4.950

-------------------------------------------

----------------------------------------------------------------------

4.845 /4.555

4.825 /4.575

4.790 /4.580

4.730 /4.635

4.680 /4.680

---------4.950 /4.850A

------5.310A

----------------------------------

----------------------------------------------------------------------

----------------------------------------------------------------------

4.580

4.598

4.595

4.633

4.670

4.720

4.740

4.741

4.785

4.933

5.148

5.270

5.229

5.129

4.889

4.890

4.911

4.977

5.037

5.357

5.027

5.528

5.653

0.156

0.145

0.125

0.120

0.117

0.117

0.116

0.115

0.115

0.090

0.071

0.068

0.064

0.061

0.043

0.043

0.043

0.040

0.040

0.038

0.032

0.032

0.032

----------------------------------------------------------------------

2022

2029

458

2

6

---------3

-------------------------------------------

----------------------------------------------------------------------

4457

4329

502

245

127

81

53

55

69

8

10

4

3

3

1

3

1

2

1

25

1

1

2

THE INFORMATION CONTAINED IN THIS REPORT IS COMPILED FOR THE CONVENIENCE OF THE USER AND IS FURNISHED WITHOUT RESPONSIBILITY FOR ACCURACY OR CONTENT.

ACCEPTED BY THE USER ON THE CONDITION THAT ERRORS OR OMISSIONS SHALL NOT BE MADE THE BASIS FOR ANY CLAIM, DEMAND, OR CAUSE FOR ACTION.

Copyright CME Group Inc. A CME/Chicago Board of Trade/NYMEX Company. All rights reserved.

142

64

173

1

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

IT IS

61

61

ENERGY FUTURES PRODUCTS

Side 04

Side 04

2011 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin. CME Group Inc. A

CME/Chicago Board of Trade/NYMEX Company. 20 South Wacker Drive, Chicago, Illinois 60606-7499.

Customer Service: (800) 331-3332 Fax: (312) 930-8203 E-Mail: info@cmegroup.com

FINAL

ENERGY FUTURES PRODUCTS

PG61 BULLETIN # 15@

GLOBEX

OPEN

OPEN

OUTCRY

OPEN RANGE

GLOBEX

HIGH/LOW

OPEN

OUTCRY

HIGH/LOW

OPEN

OUTCRY

CLOSE RANGE

Mon, Jan 24, 2011

SETT. PRICE

& PT. CHGE

OPEN

OUTCRY

VOLUME

GLOBEX PNT

VOLUME VOLUME

PG61

OPEN

INTEREST

E-MINI NATURAL GAS

QG FUT

FEB14

MAY14

DEC14

MAY15

AUG15

MAY16

-------------------

TOTAL

QG FUT

-------------------

------5.810B

----------

-------------------

-------------------

5.613

5.193

5.735

5.395

5.494

5.600

0.032

0.022

0.022

0.007

0.007

0.007

-------------------

------------------4520

-------------------

1

13

2

6

7

2

10014 -

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

380

CRUDE OIL FUTURES PRODUCTS

GLOBEX

OPEN

07JAN11 ---11JAN11 ----

OPEN

OUTCRY

HIGH/LOW

OPEN

OUTCRY

CLOSE RANGE

SETT. PRICE

& PT. CHGE

OPEN

OUTCRY

VOLUME

GLOBEX PNT

VOLUME VOLUME

-------

-------

OPEN

INTEREST

-------

-------

96.966

97.293

0.350

0.396

-------

-------

-------

25

50

75

UNCH

UNCH

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

96.52

96.63

96.74

96.94

97.10

97.20

97.29

97.38

97.46

97.55

97.61

97.64

97.65

97.63

97.60

97.56

97.52

97.49

97.46

97.43

97.40

97.37

97.34

97.30

97.26

97.21

97.16

97.11

97.06

96.99

96.93

96.86

96.79

96.72

96.67

96.64

96.61

96.58

96.56

96.54

96.52

96.50

96.48

96.47

96.47

96.47

96.47

96.47

96.48

96.49

96.51

96.54

96.58

96.63

96.68

96.73

96.78

96.83

96.88

96.93

96.98

97.03

97.08

97.13

97.19

97.26

97.33

97.40

97.47

97.54

97.57

97.57

0.28

0.95

0.89

0.82

0.76

0.73

0.68

0.63

0.59

0.55

0.53

0.52

0.51

0.52

0.52

0.53

0.53

0.51

0.50

0.49

0.48

0.47

0.45

0.44

0.43

0.43

0.43

0.43

0.43

0.43

0.44

0.45

0.45

0.45

0.46

0.47

0.48

0.49

0.49

0.50

0.51

0.52

0.54

0.55

0.55

0.55

0.56

0.57

0.57

0.58

0.59

0.59

0.59

0.59

0.59

0.59

0.59

0.59

0.58

0.57

0.56

0.55

0.54

0.54

0.53

0.51

0.49

0.48

0.47

0.46

0.46

0.46

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

---555

---93

93

93

100

100

100

100

100

100

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

4586

4645 3788

2870 2788 3083 2067 +

2067 +

2067 +

2018 +

1981 +

2078 +

1429

1454

1429

1121

1121

1115

1368

1368

1368

1260

1220

1291

367

367

367

366

366

388

373

373

373

443

443

443

198

198

198

198

198

198

198

198

198

198

198

198

167

167

167

167

167

167

167

167

167

167

167

167

22

22

22

22

22

22

22

22

22

22

22

22

58895 +

UNCH

319

UNCH

18

18

18

95

95

95

41

41

71

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

J9 FUT

BRENT CALENDAR SWAP

CY FUT

JAN11

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

JUL12

AUG12

SEP12

OCT12

NOV12

DEC12

JAN13

FEB13

MAR13

APR13

MAY13

JUN13

JUL13

AUG13

SEP13

OCT13

NOV13

DEC13

JAN14

FEB14

MAR14

APR14

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JAN15

FEB15

MAR15

APR15

MAY15

JUN15

JUL15

AUG15

SEP15

OCT15

NOV15

DEC15

JAN16

FEB16

MAR16

APR16

MAY16

JUN16

JUL16

AUG16

SEP16

OCT16

NOV16

DEC16

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

TOTAL

CY FUT

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1434

65

BRENT CFD SWAP

6W FUT

24JAN11

25JAN11

26JAN11

27JAN11

28JAN11

31JAN11

GLOBEX

HIGH/LOW

BRENT BALMO SWAP

J9 FUT

TOTAL

OPEN

OUTCRY

OPEN RANGE

-------------------

-------------------

-------------------

-------------------

-------------------

-0.955

-0.670

-0.670

-0.670

-0.670

-0.800

+

+

+

+

-

0.285

UNCH

UNCH

UNCH

UNCH

0.180

-------------------

-------------------

---------------80

80

80

80

80

80

120

THE INFORMATION CONTAINED IN THIS REPORT IS COMPILED FOR THE CONVENIENCE OF THE USER AND IS FURNISHED WITHOUT RESPONSIBILITY FOR ACCURACY OR CONTENT.

ACCEPTED BY THE USER ON THE CONDITION THAT ERRORS OR OMISSIONS SHALL NOT BE MADE THE BASIS FOR ANY CLAIM, DEMAND, OR CAUSE FOR ACTION.

Copyright CME Group Inc. A CME/Chicago Board of Trade/NYMEX Company. All rights reserved.

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

IT IS

61

61

ENERGY FUTURES PRODUCTS

Side 05

Side 05

2011 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin. CME Group Inc. A

CME/Chicago Board of Trade/NYMEX Company. 20 South Wacker Drive, Chicago, Illinois 60606-7499.

Customer Service: (800) 331-3332 Fax: (312) 930-8203 E-Mail: info@cmegroup.com

FINAL

ENERGY FUTURES PRODUCTS

PG61 BULLETIN # 15@

GLOBEX

OPEN

OPEN

OUTCRY

OPEN RANGE

01FEB11

02FEB11

03FEB11

04FEB11

16FEB11

17FEB11

18FEB11

21FEB11

22FEB11

----------------------------

TOTAL

6W FUT

01FEB11

02FEB11

03FEB11

04FEB11

-------------

TOTAL

1C FUT

SETT. PRICE

& PT. CHGE

OPEN

OUTCRY

VOLUME

GLOBEX PNT

VOLUME VOLUME

OPEN

INTEREST

----------------------------

----------------------------

----------------------------

----------------------------

-0.800

-0.800

-0.800

-0.800

-0.710

-0.710

-0.710

-0.670

-0.670

0.180

0.180

0.180

0.180

NEW

NEW

NEW

NEW

NEW

----------------------------

----------------------------

------------126

126

126

126

126

710

0 0 0 0 126 +

126 +

126 +

126 +

126 +

1150 +

80

80

80

80

126

126

126

126

126

120 +

120 +

120 +

120 +

480 +

80

80

80

80

310

-------------

-------------

-------------

-------------

-0.800

-0.800

-0.800

-0.800

0.200

0.200

0.200

0.200

-------------

-------------

80

80

80

80

320

320

CANADIAN HEAVY CRUDE(NET ENRGY) FUT

WCC FUT

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

----------------------------------

TOTAL

WCC FUT

----------------------------------

----------------------------------

----------------------------------

----------------------------------

-25.742

-20.750

-19.000

-18.250

-17.500

-16.500

-17.000

-17.800

-18.000

-18.250

-18.500

+

+

+

+

+

+

+

+

+

+

+

UNCH

1.250

1.500

0.750

0.750

0.750

0.750

0.300

0.250

0.250

0.250

----------------------------------

----------------------------------

----------------------------------

165

135

105

75

75

45

45

30

30

30

30

765

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

-------------------------------------------

97.800

98.210

96.030

96.700

96.835

96.960

96.960

96.960

96.490

96.490

96.490

96.490

96.490

96.490

+

+

+

+

+

+

+

-

UNCH

UNCH

UNCH

UNCH

0.125

UNCH

UNCH

UNCH

1.110

1.110

1.110

1.110

1.110

1.110

-------------------------------------------

-------------------------------------------

-------------------------------------------

0 40

40

40

40

40

184

184

254

304

264

120

120

50

1680 -

40

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

1903

683

1168 +

1098

1098

1173

948

948

948

348

348

448

250

250

250

200

200

200

200

200

200

200

200

200

13661 +

UNCH

UNCH

500

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

DATED BRENT (PLATTS) DAILY SWP

7G FUT

18JAN11

19JAN11

20JAN11

21JAN11

24JAN11

26JAN11

27JAN11

28JAN11

31JAN11

01FEB11

02FEB11

03FEB11

04FEB11

07FEB11

-------------------------------------------

TOTAL

7G FUT

-------------------------------------------

-------------------------------------------

-------------------------------------------

40

DATED TO FRONTLINE BRENT CLNDR SWAP

FY FUT

JAN11

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

JUL12

AUG12

SEP12

OCT12

NOV12

DEC12

-------------------------------------------------------------------------

TOTAL

FY FUT

-------------------------------------------------------------------------

-------------------------------------------------------------------------

-------------------------------------------------------------------------

-------------------------------------------------------------------------

-0.29

-0.64

-0.65

-0.64

-0.64

-0.64

0.55

0.55

0.55

-0.64

-0.64

-0.64

-0.48

-0.48

-0.48

-0.48

-0.48

-0.48

-0.48

-0.48

-0.48

-0.48

-0.48

-0.48

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

UNCH

0.01

0.02

0.01

0.01

0.01

1.10

1.10

1.10

0.01

0.01

0.01

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

-------------------------------------------------------------------------

-------------------------------------------------------------------------

------630

----------------------------------------------------------------

630

500

DME CRUDE OIL BALMO SWAP FUT

DOB FUT

07JAN11 ----

----

----

----

----

92.560

0.380

----

----

----

100

100

UNCH

-------------

-------------

92.310

92.180

92.480

92.780

0.310

1.050

0.990

0.970

-------------

-------------

-------------

750

700

200

100

1750

UNCH

UNCH

UNCH

UNCH

----

----

92.744

0.180

----

----

----

300

300

UNCH

-------------------------------------

92.18

91.94

92.20

92.46

92.69

92.87

93.02

93.14

93.24

93.31

93.37

93.41

0.22

1.06

1.08

1.10

1.11

1.12

1.12

1.12

1.12

1.12

1.12

1.14

-------------------------------------

-------------------------------------

---------60

-------------------------

7068

8688

7870

2625

1600

5775

925

25

725

500

500

1200

37501

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

DOB FUT

DME OMAN CRUDE SWAP FUT

DOO FUT

JAN11

FEB11

MAR11

APR11

-------------

TOTAL

DOO FUT

-------------

-------------

DUBAI CRUDE OIL BALMO

BI FUT

06JAN11 ----

----

----

BI FUT

DUBAI CRUDE OIL CALENDAR SWAP

DC FUT

JAN11

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

-------------------------------------

TOTAL

DC FUT

UB FUT

OPEN

OUTCRY

CLOSE RANGE

BRENT CFD(PLATTS) VS FRNT M SW

1C FUT

TOTAL

OPEN

OUTCRY

HIGH/LOW

PG61

BRENT CFD SWAP

6W FUT

TOTAL

GLOBEX

HIGH/LOW

Mon, Jan 24, 2011

-------------------------------------

-------------------------------------

-------------------------------------

60

EUROPE DATED BRENT SWAP

THE INFORMATION CONTAINED IN THIS REPORT IS COMPILED FOR THE CONVENIENCE OF THE USER AND IS FURNISHED WITHOUT RESPONSIBILITY FOR ACCURACY OR CONTENT.

ACCEPTED BY THE USER ON THE CONDITION THAT ERRORS OR OMISSIONS SHALL NOT BE MADE THE BASIS FOR ANY CLAIM, DEMAND, OR CAUSE FOR ACTION.

Copyright CME Group Inc. A CME/Chicago Board of Trade/NYMEX Company. All rights reserved.

IT IS

61

61

ENERGY FUTURES PRODUCTS

Side 06

Side 06

2011 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin. CME Group Inc. A

CME/Chicago Board of Trade/NYMEX Company. 20 South Wacker Drive, Chicago, Illinois 60606-7499.

Customer Service: (800) 331-3332 Fax: (312) 930-8203 E-Mail: info@cmegroup.com

FINAL

ENERGY FUTURES PRODUCTS

PG61 BULLETIN # 15@

GLOBEX

OPEN

GLOBEX

HIGH/LOW

OPEN

OUTCRY

HIGH/LOW

OPEN

OUTCRY

CLOSE RANGE

SETT. PRICE

& PT. CHGE

OPEN

OUTCRY

VOLUME

GLOBEX PNT

VOLUME VOLUME

PG61

OPEN

INTEREST

EUROPE DATED BRENT SWAP

UB FUT

JAN11

FEB11

MAR11

----------

TOTAL

UB FUT

----------

----------

----------

----------

96.23

95.99

96.09

0.28

0.96

0.91

----------

----------

---550

----

550

3070

2677

529

6276

UNCH

UNCH

UNCH

FAME0 BIODSL FOB RDAM-ICE GASOIL SW

LE FUT

JAN11

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

-------------------------------------------------------

TOTAL

LE FUT

-------------------------------------------------------

-------------------------------------------------------

-------------------------------------------------------

-------------------------------------------------------

525.420

500.660

499.260

494.040

492.980

492.200

488.250

488.130

486.810

486.580

485.570

485.200

479.450

479.830

479.430

474.240

485.020

485.080

+

+

+

+

+

+

+

0.400

8.410

6.670

3.070

4.250

3.250

4.420

3.500

2.500

0.500

0.500

0.500

4.500

5.500

4.670

4.590

0.500

0.330

-------------------------------------------------------

-------------------------------------------------------

---30

------40

----------------------------------------

70

230

260 250

150

170 +

150

60

60

60

40

40

40

50

50

50

80

80

80

1900

UNCH

20

UNCH

UNCH

20

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

3915

3129

2165

1015 +

1015 +

1015 +

680

680

680

515

515

515

25

25

25

25

25

25

25

25

25

25

25

25

16139 +

UNCH

UNCH

UNCH

350

350

350

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

ICE BRENT DUBAI SWAP

DB FUT

JAN11

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

JUL12

AUG12

SEP12

OCT12

NOV12

DEC12

-------------------------------------------------------------------------

TOTAL

DB FUT

-------------------------------------------------------------------------

-------------------------------------------------------------------------

-------------------------------------------------------------------------

-------------------------------------------------------------------------

4.34

4.69

4.54

4.48

4.41

4.33

4.27

4.24

4.22

4.24

4.24

4.23

4.07

3.88

3.67

3.46

3.25

3.01

2.79

2.57

2.33

2.10

1.88

1.71

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

0.06

0.11

0.19

0.28

0.35

0.39

0.44

0.49

0.53

0.57

0.59

0.62

0.63

0.63

0.62

0.62

0.62

0.64

0.66

0.67

0.68

0.69

0.72

0.72

-------------------------------------------------------------------------

-------------------------------------------------------------------------

---------450

450

450

-------------------------------------------------------

1350

1050

LLS (ARGUS) VS WTI SWAP

WJ FUT

JAN11

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

JUL12

AUG12

SEP12

OCT12

NOV12

DEC12

JAN13

FEB13

MAR13

APR13

MAY13

JUN13

JUL13

AUG13

SEP13

OCT13

NOV13

DEC13

-------------------------------------------------------------------------------------------------------------

TOTAL

WJ FUT

-------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------

7.42

9.00

7.52

6.67

5.03

4.97

4.71

4.47

4.41

4.41

4.41

4.41

2.50

2.50

2.50

2.50

2.50

2.50

2.50

2.50

2.50

2.50

2.50

2.50

3.75

3.75

3.75

3.75

3.75

3.75

3.75

3.75

3.75

3.75

3.75

3.75

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

0.21

1.14

1.25

1.20

0.11

0.07

0.01

0.06

0.06

0.06

0.06

0.06

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

-------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------

200

200

200

200

200

200

260

260

260

260

260

260

500

500

500

500

500

500

500

500

500

500

500

500

150

150

150

150

150

150

150

150

150

150

150

150

10560

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

-------------------------------------

-------------------------------------

2.24

2.67

2.38

1.25

0.48

-0.09

-0.45

-0.75

-1.09

-1.37

-1.61

-1.70

+

+

+

+

+

+

+

+

+

+

+

+

0.12

1.21

1.08

1.01

1.00

0.97

0.94

0.89

0.84

0.78

0.73

0.71

-------------------------------------

-------------------------------------

-------------------------------------

100

100

100

400

400

400

100

100

100

100

100

100

2100

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

MARS (ARGUS) VS WTI SWAP

YX FUT

JAN11

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

-------------------------------------

TOTAL

YX FUT

YV FUT

OPEN

OUTCRY

OPEN RANGE

Mon, Jan 24, 2011

-------------------------------------

-------------------------------------

MARS (ARGUS) VS WTI TRD MTH SWAP

THE INFORMATION CONTAINED IN THIS REPORT IS COMPILED FOR THE CONVENIENCE OF THE USER AND IS FURNISHED WITHOUT RESPONSIBILITY FOR ACCURACY OR CONTENT.

ACCEPTED BY THE USER ON THE CONDITION THAT ERRORS OR OMISSIONS SHALL NOT BE MADE THE BASIS FOR ANY CLAIM, DEMAND, OR CAUSE FOR ACTION.

Copyright CME Group Inc. A CME/Chicago Board of Trade/NYMEX Company. All rights reserved.

IT IS

61

61

ENERGY FUTURES PRODUCTS

Side 07

Side 07

2011 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin. CME Group Inc. A

CME/Chicago Board of Trade/NYMEX Company. 20 South Wacker Drive, Chicago, Illinois 60606-7499.

Customer Service: (800) 331-3332 Fax: (312) 930-8203 E-Mail: info@cmegroup.com

FINAL

ENERGY FUTURES PRODUCTS

PG61 BULLETIN # 15@

GLOBEX

OPEN

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

-------------------

TOTAL

YV FUT

-------------------

GLOBEX

HIGH/LOW

OPEN

OUTCRY

HIGH/LOW

-------------------

-------------------

OPEN

OUTCRY

CLOSE RANGE

SETT. PRICE

& PT. CHGE

OPEN

OUTCRY

VOLUME

GLOBEX PNT

VOLUME VOLUME

PG61

OPEN

INTEREST

-------------------

-0.52

-0.89

-1.21

-1.53

-1.83

-2.12

+

+

+

+

+

+

0.98

0.95

0.91

0.86

0.80

0.74

-------------------

-------------------

-------------------

50

50

50

50

50

50

300

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

-------------------------------------------------

96.61

96.65

96.83

97.03

97.33

97.42

97.58

97.63

97.65

97.62

97.54

97.36

96.69

96.47

96.56

96.85

0.99

0.92

0.85

0.79

0.65

0.61

0.54

0.52

0.51

0.52

0.54

0.46

0.45

0.55

0.59

0.59

-------------------------------------------------

-------------------------------------------------

1085

3

------------151

----------------------------

2247 +

866 +

25

2284

200

480

8249 +

200

200

100

250

7519

1712

89

110

450

24981 +

53

3

UNCH

UNCH

UNCH

UNCH

151

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

280

260

300

280 +

280 +

280 +

30

30

30

160

160

160

2250 +

UNCH

UNCH

UNCH

10

10

10

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

NYMEX BRENT FINANCIAL FUTURES

BB FUT

MAR11

APR11

MAY11

JUN11

SEP11

OCT11

DEC11

JAN12

FEB12

APR12

JUN12

DEC12

DEC13

DEC14

JUN15

DEC15

-------------------------------------------------

TOTAL

BB FUT

-------------------------------------------------

-------------------------------------------------

-------------------------------------------------

1239

207

RME BIODSL FOB RDAM-ICE GASOIL SWP

KE FUT

JAN11

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

-------------------------------------

TOTAL

KE FUT

-------------------------------------

-------------------------------------

-------------------------------------

-------------------------------------

699.570

652.660

650.260

628.040

626.980

624.200

595.250

594.130

593.810

597.580

597.570

597.200

0.900

13.410

14.670

8.070

9.250

11.250

4.420

4.500

3.500

3.500

2.500

2.500

-------------------------------------

-------------------------------------

---------20

20

20

-------------------

60

30

WEST TEXAS INTER CRUDE OIL CAL SWAP

CS FUT

JAN11

FEB11

MAR11

APR11

MAY11

JUN11

JUL11

AUG11

SEP11

OCT11

NOV11

DEC11

JAN12

FEB12

MAR12

APR12

MAY12

JUN12

JUL12

AUG12

SEP12

OCT12

NOV12

DEC12

JAN13

FEB13

MAR13

APR13

MAY13

JUN13

JUL13

AUG13

SEP13

OCT13

NOV13

DEC13

JAN14

FEB14

MAR14

APR14

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JAN15

FEB15

MAR15

APR15

MAY15

JUN15

JUL15

AUG15

SEP15

OCT15

NOV15

DEC15

JAN16

FEB16

MAR16

APR16

MAY16

JUN16

OPEN

OUTCRY

OPEN RANGE

Mon, Jan 24, 2011

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

89.51

88.22

89.98

91.39

92.28

92.97

93.42

93.78

94.16

94.48

94.74

94.87

94.94

94.99

95.04

95.10

95.13

95.10

95.07

95.04

95.05

95.08

95.09

95.01

94.94

94.86

94.79

94.71

94.65

94.64

94.63

94.64

94.66

94.68

94.69

94.65

94.62

94.59

94.57

94.55

94.54

94.53

94.52

94.52

94.54

94.57

94.61

94.63

94.65

94.68

94.72

94.77

94.82

94.86

94.92

94.97

95.02

95.08

95.13

95.18

95.23

95.27

95.33

95.39

95.45

95.51

0.37

1.21

1.08

1.01

1.00

0.97

0.94

0.89

0.84

0.78

0.73

0.71

0.68

0.67

0.65

0.63

0.62

0.60

0.59

0.60

0.58

0.57

0.56

0.56

0.55

0.55

0.55

0.55

0.55

0.55

0.55

0.54

0.54

0.54

0.53

0.54

0.54

0.55

0.56

0.57

0.57

0.57

0.58

0.60

0.60

0.60

0.60

0.61

0.62

0.62

0.62

0.62

0.62

0.62

0.62

0.62

0.63

0.64

0.64

0.63

0.63

0.63

0.63

0.62

0.62

0.62

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

---906

603

199

93

93

124

124

124

74

74

74

30

30

30

65

65

65

58

58

58

58

58

58

14

14

14

14

14

14

14

14

14

14

14

14

-------------------------------------------------------------------------------------------

13680

11433

11123

8881

8770

8786

8856

8760

8863

7927

7859

8302

6161

6160

6160

5805

5805

5804

6002

6002

6001

5881

5879

5690

2711

2708

2711

2788

2789

2788

2531

2531

2530

2466

2425

2422

1140

1140

1140

1038

1038

1038

1038

1038

1038

1038

1038

1038

350

350

350

350

350

350

350

350

350

350

350

350

60

60

60

60

60

60

THE INFORMATION CONTAINED IN THIS REPORT IS COMPILED FOR THE CONVENIENCE OF THE USER AND IS FURNISHED WITHOUT RESPONSIBILITY FOR ACCURACY OR CONTENT.

ACCEPTED BY THE USER ON THE CONDITION THAT ERRORS OR OMISSIONS SHALL NOT BE MADE THE BASIS FOR ANY CLAIM, DEMAND, OR CAUSE FOR ACTION.

Copyright CME Group Inc. A CME/Chicago Board of Trade/NYMEX Company. All rights reserved.

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

+

UNCH

109

284

23

25

25

26

26

26

25

25

25

5

5

5

30

30

30

5

5

5

5

5

5

10

10

10

10

10

10

10

10

10

10

10

10

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

IT IS

61

61

ENERGY FUTURES PRODUCTS

Side 08

Side 08

2011 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin. CME Group Inc. A

CME/Chicago Board of Trade/NYMEX Company. 20 South Wacker Drive, Chicago, Illinois 60606-7499.

Customer Service: (800) 331-3332 Fax: (312) 930-8203 E-Mail: info@cmegroup.com

FINAL

ENERGY FUTURES PRODUCTS

PG61 BULLETIN # 15@

GLOBEX

OPEN

GLOBEX

HIGH/LOW

OPEN

OUTCRY

HIGH/LOW

OPEN

OUTCRY

CLOSE RANGE

SETT. PRICE

& PT. CHGE

OPEN

OUTCRY

VOLUME

GLOBEX PNT

VOLUME VOLUME

PG61

OPEN

INTEREST

WEST TEXAS INTER CRUDE OIL CAL SWAP

CS FUT

JUL16

AUG16

SEP16

OCT16

NOV16

DEC16

-------------------

TOTAL

CS FUT

-------------------

-------------------

-------------------

-------------------

95.57

95.64

95.72

95.80

95.85

95.85

0.62

0.61

0.61

0.59

0.59

0.59

-------------------

-------------------

-------------------

3289

60

60

60

60

60

60

233672 +

UNCH

UNCH

UNCH

UNCH

UNCH

UNCH

454

WTI BALMO SWAP

42 FUT

05JAN11

06JAN11

07JAN11

11JAN11

13JAN11

20JAN11

-------------------

TOTAL

42 FUT

-------------------

-------------------

-------------------

-------------------

89.41

89.35

89.41

89.52

89.20

88.15

0.41

0.44

0.47

0.54

0.62

0.93