Professional Documents

Culture Documents

Presentation - 1st Quarter 2009 Results

Presentation - 1st Quarter 2009 Results

Uploaded by

PiaggiogroupOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Presentation - 1st Quarter 2009 Results

Presentation - 1st Quarter 2009 Results

Uploaded by

PiaggiogroupCopyright:

Available Formats

Piaggio Group

First Quarter 2009 Financial Results

Conference Call

Mantova, April 29th, 2009

Disclaimer

THESE SLIDES HAVE BEEN PREPARED BY THE COMPANY SOLELY FOR THE USE AT THE ANALYST CONFERENCE CALL ON PIAGGIO FIRST QUARTER 2009 CONSOLIDATED RESULTS.

THE INFORMATION CONTAINED HEREIN HAS NOT BEEN INDEPENDENTLY VERIFIED. NONE OF THE COMPANY OR REPRESENTATIVES SHALL HAVE ANY LIABILITY WHATSOEVER IN NEGLIGENCE OR OTHERWISE FOR ANY LOSS HOWSOEVER ARISING FROM ANY USE OF THESE SLIDES OR THEIR CONTENTS OR OTHERWISE ARISING IN CONNECTION WITH THESE SLIDES OR ANY MATERIAL DISCUSSED DURING THE ANALYST CONFERENCE CALL.

THIS DOCUMENT IS BEING FURNISHED TO YOU SOLELY FOR YOUR INFORMATION AND MAY NOT BE REPRODUCED OR REDISTRIBUTED TO ANY OTHER PERSON.

THE INFORMATION CONTAINED HEREIN AND OTHER MATERIAL DISCUSSED DURING THE ANALYST CONFERENCE CALL MAY INCLUDE FORWARD-LOOKING STATEMENTS THAT ARE NOT HISTORICAL FACTS, INCLUDING STATEMENTS ABOUT THE COMPANY BELIEFS AND EXPECTATIONS. THESE STATEMENTS ARE BASED ON CURRENT PLANS, ESTIMATES, PROJECTIONS AND PROJECTS,AND THEREFORE YOU SHOULD NOT PLACE UNDUE RELIANCE ON THEM.

FORWARD-LOOKING STATEMENTS INVOLVE INHERENT RISKS AND UNCERTAINTIES. WE CAUTION YOU THAT A NUMBER OF IMPORTANT FACTORS COULD CAUSE ACTUAL RESULTS TODIFFER MATERIALLY FROM THOSE CONTAINED IN ANY FORWARD-LOOKING STATEMENT.

SUCH FACTORS INCLUDE, BUT ARE NOT LIMITED TO: TRENDS IN PIAGGIO CORE BUSINESS, ITS ABILITY TO IMPLEMENT COST-CUTTING PLANS, FUTURE CAPITAL EXPENDITURES.

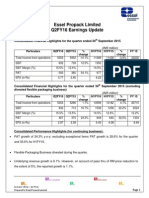

Financial Statement (IFRS-IAS)

1Q 09 Vs 1Q 08 (mln , %)

Piaggio Group operating results (IFRS-IAS)

1Q 09 Vs 1Q 08 (mln , %)

Net Sales

(mln ) 363,9 (mln ) 306,3

-15,8% % margin

EBITDA

35,1

9,7%

21,0

6,9%

1Q 08

1Q 09

1Q 08

1Q 09

Net Income

(mln ) (mln ) (311,8) -4,7

-1,5%

NFP

3,2

% margin 0,9%

(446,7) 1Q 09

1Q 08

1Q 09

1Q 08

Total Sales trend (by Geographic Area)

1Q 09 Vs 1Q 08 (mln , %)

363,9

Rest of World Asia Pacific India Americas

4,9 14,5 62,2 13,9

-15,8% +40,6% -55,0% -1,4% +52,5%

21,2

306,3

6,8 6,5 61,3

Rest of Europe

147,3

-16,7%

122,8

Italy

121,1

-27,6%

87,7

1Q 08

1Q 09

Total Sales trend (by Business, by Brand)

1Q 09 Vs 1Q 08 (mln , %)

363,9

Others Spare Parts LCV India LCV Eu

31,2 3,7 44,5

-15,8%

363,9 306,3

Guzzi

15,0 70,9

-15,8%

306,3

-38,6% -30,3%

15,3 9,2 49,4 6,4

n.s. -10,4%

1,1 39,9

Aprilia Derbi

58,6

-1,4%

57,8

-57,9% -2,4%

Moto

55,5

-3,5%

30,0

Piaggio LCV

99,2

96,8

-34,9%

36,1

Scooter

170,4

-17,0%

PVG

141,4

163,5

-11,7%

144,4

1Q 08

1Q 09

1Q 08

1Q 09

Total Volumes trend (by Business, by Brand)

1Q 09 Vs 1Q 08 (000 units, sell in)

150,6

Other LCV Eu LCV India

40,5 0,4 5,3

-20,2%

150,6

Guzzi

-20,2%

n.s. -18,1% -6,5%

120,1

0,0 4,3 37,9

1,8

Aprilia Derbi Piaggio LCV

-35,5%

23,8

120,1

1,1

-30,9%

8,2

Moto

15,7

-60,0%

45,8

16,4 3,3

-39,8%

-7,9%

42,2

9,4

Scooter

88,7

-22,8%

68,5

PVG

71,1

-19,7%

57,1

1Q 08

1Q 09

1Q 08

1Q 09

EBITDA Evolution (IFRS-IAS)

1Q 09 Vs 1Q 08 (mln , %)

(16,3)

3,4 35,1

9,7%

(1,2) 21,0

6,9%

1Q 08

Gross Margin

Opex

Amortiz.

1Q 09

Net Income Evolution (IFRS-IAS)

1Q 09 Vs 1Q 08 (mln , %)

3,2

0,9%

(12,9) 5,5 (0,4) (4,7)

-1,5%

1Q 08

Ebit

Financial Expenses

Tax

1Q 09

Group Balance Sheet (IFRS-IAS)

1Q 09 Vs 1Q 08 (mln , %)

10

PFN Evolution (IFRS-IAS)

1Q 09 Vs Year End 08 (mln )

Receivable: Inventories: Payables: Others :

(61,3) (28,6) ( 6,0) 11,7

(359,7)

15,4

(84,2)

(20,0)

(0,8)

2,6 Equity

(446,7)

YE 08

Operating Working Cash Flow Capital

Capex

Disinvest. and others

1Q 09

11

You might also like

- Number Crunching File For Markstrat ProjectDocument35 pagesNumber Crunching File For Markstrat ProjectNishant Kumar100% (1)

- Presentation - 1st Half 2009 ResultsDocument10 pagesPresentation - 1st Half 2009 ResultsPiaggiogroupNo ratings yet

- Presentation - Nine Months 2009 ResultsDocument10 pagesPresentation - Nine Months 2009 ResultsPiaggiogroupNo ratings yet

- Presentation - 1st Quarter 2008 ResultsDocument11 pagesPresentation - 1st Quarter 2008 ResultsPiaggiogroupNo ratings yet

- Presentation - Full Year 2009 ResultsDocument10 pagesPresentation - Full Year 2009 ResultsPiaggiogroupNo ratings yet

- Presentation - 1st Quarter 2010 ResultsDocument10 pagesPresentation - 1st Quarter 2010 ResultsPiaggiogroupNo ratings yet

- Presentation - Full Year 2008 ResultsDocument11 pagesPresentation - Full Year 2008 ResultsPiaggiogroupNo ratings yet

- Presentation - 1st Half 2008 ResultsDocument11 pagesPresentation - 1st Half 2008 ResultsPiaggiogroupNo ratings yet

- Presentation - Nine Months 2008 ResultsDocument11 pagesPresentation - Nine Months 2008 ResultsPiaggiogroupNo ratings yet

- Presentation - 1st Half 2006 ResultsDocument11 pagesPresentation - 1st Half 2006 ResultsPiaggiogroupNo ratings yet

- Presentation - Nine Months 2006 ResultsDocument11 pagesPresentation - Nine Months 2006 ResultsPiaggiogroupNo ratings yet

- Presentation - Full Year 2006 ResultsDocument11 pagesPresentation - Full Year 2006 ResultsPiaggiogroupNo ratings yet

- Presentation - Full Year 2007 ResultsDocument11 pagesPresentation - Full Year 2007 ResultsPiaggiogroupNo ratings yet

- Presentation - Nine Months 2007 ResultsDocument10 pagesPresentation - Nine Months 2007 ResultsPiaggiogroupNo ratings yet

- Presentation - 1st Half 2010 ResultsDocument10 pagesPresentation - 1st Half 2010 ResultsPiaggiogroupNo ratings yet

- Annual Report 2009Document288 pagesAnnual Report 2009PiaggiogroupNo ratings yet

- HSBC Luxury ConferenceDocument38 pagesHSBC Luxury Conferencesl7789No ratings yet

- IAG April 2012 Traffic StatsDocument2 pagesIAG April 2012 Traffic StatsJacopo AbbateNo ratings yet

- Autogrill Group - 1H2011 Financial Results: Milan, 29 July 2011Document66 pagesAutogrill Group - 1H2011 Financial Results: Milan, 29 July 2011subiadinjaraNo ratings yet

- Results Conference CallDocument14 pagesResults Conference CallLightRINo ratings yet

- Annual Report 2008Document249 pagesAnnual Report 2008PiaggiogroupNo ratings yet

- Quarterly Report at March 31, 2006Document54 pagesQuarterly Report at March 31, 2006PiaggiogroupNo ratings yet

- Presentation - 1st Quarter 2011 ResultsDocument10 pagesPresentation - 1st Quarter 2011 ResultsPiaggiogroupNo ratings yet

- Key Performance Indicators: Financial KpisDocument32 pagesKey Performance Indicators: Financial Kpismridul_121No ratings yet

- Q3 2020 Fin ReportDocument16 pagesQ3 2020 Fin ReportDanylo KhivrychNo ratings yet

- Conf Call FY2011Document12 pagesConf Call FY2011PiaggiogroupNo ratings yet

- IATA-Aviation Industry Fact 2010Document3 pagesIATA-Aviation Industry Fact 2010revealedNo ratings yet

- Press Release Sony Ericsson Reports Second Quarter Results: July 16, 2009Document11 pagesPress Release Sony Ericsson Reports Second Quarter Results: July 16, 2009it4728No ratings yet

- Roadshow Natixis Mar09Document47 pagesRoadshow Natixis Mar09sl7789No ratings yet

- Presentation - Nine Months 2011Document12 pagesPresentation - Nine Months 2011PiaggiogroupNo ratings yet

- Dupont AnalysisDocument3 pagesDupont AnalysisKarthik RanganathanNo ratings yet

- 1st Half Report - June 30, 2010Document75 pages1st Half Report - June 30, 2010PiaggiogroupNo ratings yet

- Bulgari Group Q1 2011 Results: May 10th 2011Document10 pagesBulgari Group Q1 2011 Results: May 10th 2011sl7789No ratings yet

- Asx Announcement: Wednesday 26 August 2009Document105 pagesAsx Announcement: Wednesday 26 August 2009aspharagusNo ratings yet

- Results Conference CallDocument15 pagesResults Conference CallLightRINo ratings yet

- Earnings Update - Q2FY16 (Company Update)Document9 pagesEarnings Update - Q2FY16 (Company Update)Shyam SunderNo ratings yet

- Investor Day 2008: 2008-2010 Strategic Plan PresentationDocument13 pagesInvestor Day 2008: 2008-2010 Strategic Plan PresentationPiaggiogroupNo ratings yet

- Colgate, 4th February, 2013Document10 pagesColgate, 4th February, 2013Angel BrokingNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Presentation - 1st Half 2011 ResultsDocument11 pagesPresentation - 1st Half 2011 ResultsPiaggiogroupNo ratings yet

- Zwischenbericht Q1 2013 E FinalDocument21 pagesZwischenbericht Q1 2013 E FinalVinod PillaiNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument12 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- Loreal Financial ReportDocument17 pagesLoreal Financial ReportHardik RastogiNo ratings yet

- Make A Difference: First Quarter Report January - MarchDocument72 pagesMake A Difference: First Quarter Report January - MarchTuba Umer SiddiquiNo ratings yet

- Presentation - Nine Months 2010 ResultsDocument10 pagesPresentation - Nine Months 2010 ResultsPiaggiogroupNo ratings yet

- Korea FY08 ABP MKTG Plan - 07 06 19 (Final)Document25 pagesKorea FY08 ABP MKTG Plan - 07 06 19 (Final)Kyungjoo ChoiNo ratings yet

- Otc Atnnf 2019Document152 pagesOtc Atnnf 2019AlexNo ratings yet

- 2009 09 3rd Crisis BarometerDocument2 pages2009 09 3rd Crisis BarometerHitendra Nath BarmmaNo ratings yet

- Earnings ReleaseDocument8 pagesEarnings ReleaseBVMF_RINo ratings yet

- Results Conference Call: 2009 Third QuarterDocument17 pagesResults Conference Call: 2009 Third QuarterLightRINo ratings yet

- Tupy Annual Report 2017Document76 pagesTupy Annual Report 2017Rodrigo Lucas IgnacioNo ratings yet

- FullYear2014 ResultsPresentationDocument31 pagesFullYear2014 ResultsPresentationkaze_no_taniNo ratings yet

- Synopsis P& GDocument14 pagesSynopsis P& GmukabbasNo ratings yet

- Raport DanoneDocument355 pagesRaport DanoneEneIonNo ratings yet

- Mindtree, 1Q FY 2014Document12 pagesMindtree, 1Q FY 2014Angel BrokingNo ratings yet

- Call 4T09 ENG FinalDocument10 pagesCall 4T09 ENG FinalFibriaRINo ratings yet

- Aurobindo Pharma (AURPHA) : in Line Results US Driven Growth ContinuesDocument15 pagesAurobindo Pharma (AURPHA) : in Line Results US Driven Growth Continuesjitendrasutar1975No ratings yet

- Result Update: Tata Motors LTD (TTML) CMP: Rs.1,252.30Document6 pagesResult Update: Tata Motors LTD (TTML) CMP: Rs.1,252.30Gautam GokhaleNo ratings yet

- Instruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandInstruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryFrom EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Conf Call FY2011Document12 pagesConf Call FY2011PiaggiogroupNo ratings yet

- Presentation - Nine Months 2011Document12 pagesPresentation - Nine Months 2011PiaggiogroupNo ratings yet

- Presentation - 1st Half 2011 ResultsDocument11 pagesPresentation - 1st Half 2011 ResultsPiaggiogroupNo ratings yet

- 1st Half Report - June 30, 2010Document75 pages1st Half Report - June 30, 2010PiaggiogroupNo ratings yet

- Annual Report 2009Document288 pagesAnnual Report 2009PiaggiogroupNo ratings yet

- Annual Report 2008Document249 pagesAnnual Report 2008PiaggiogroupNo ratings yet

- Presentation - 1st Half 2006 ResultsDocument11 pagesPresentation - 1st Half 2006 ResultsPiaggiogroupNo ratings yet

- Presentation - Full Year 2007 ResultsDocument11 pagesPresentation - Full Year 2007 ResultsPiaggiogroupNo ratings yet

- Quarterly Report at March 31, 2006Document54 pagesQuarterly Report at March 31, 2006PiaggiogroupNo ratings yet

- Presentation - 1st Quarter 2007 ResultsDocument9 pagesPresentation - 1st Quarter 2007 ResultsPiaggiogroupNo ratings yet

- Presentation - Nine Months 2007 ResultsDocument10 pagesPresentation - Nine Months 2007 ResultsPiaggiogroupNo ratings yet

- Presentation - Nine Months 2006 ResultsDocument11 pagesPresentation - Nine Months 2006 ResultsPiaggiogroupNo ratings yet

- Presentation - Full Year 2006 ResultsDocument11 pagesPresentation - Full Year 2006 ResultsPiaggiogroupNo ratings yet

- Investor Day 2008: 2008-2010 Strategic Plan PresentationDocument13 pagesInvestor Day 2008: 2008-2010 Strategic Plan PresentationPiaggiogroupNo ratings yet

- Presentation - 1st Quarter 2008 ResultsDocument11 pagesPresentation - 1st Quarter 2008 ResultsPiaggiogroupNo ratings yet

- Presentation - 1st Half 2008 ResultsDocument11 pagesPresentation - 1st Half 2008 ResultsPiaggiogroupNo ratings yet