Professional Documents

Culture Documents

1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)

1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

You might also like

- Global Macro Trading: Profiting in a New World EconomyFrom EverandGlobal Macro Trading: Profiting in a New World EconomyRating: 4 out of 5 stars4/5 (5)

- 1.25 Whitehall: Monitoring The Markets Vol. 1 Iss. 25 (July 19, 2011)Document2 pages1.25 Whitehall: Monitoring The Markets Vol. 1 Iss. 25 (July 19, 2011)Whitehall & CompanyNo ratings yet

- 1.26 Whitehall: Monitoring The Markets Vol. 1 Iss. 26 (July 26, 2011)Document2 pages1.26 Whitehall: Monitoring The Markets Vol. 1 Iss. 26 (July 26, 2011)Whitehall & CompanyNo ratings yet

- 1.22 Whitehall: Monitoring The Markets Vol. 1 Iss. 22 (June 28, 2011)Document2 pages1.22 Whitehall: Monitoring The Markets Vol. 1 Iss. 22 (June 28, 2011)Whitehall & CompanyNo ratings yet

- 1.27 Whitehall: Monitoring The Markets Vol. 1 Iss. 27 (August 02, 2011)Document2 pages1.27 Whitehall: Monitoring The Markets Vol. 1 Iss. 27 (August 02, 2011)Whitehall & CompanyNo ratings yet

- 1.28 Whitehall: Monitoring The Markets Vol. 1 Iss. 28 (August 09, 2011)Document2 pages1.28 Whitehall: Monitoring The Markets Vol. 1 Iss. 28 (August 09, 2011)Whitehall & CompanyNo ratings yet

- 1.41 Whitehall: Monitoring The Markets Vol. 1 Iss. 41 (November 8, 2011)Document2 pages1.41 Whitehall: Monitoring The Markets Vol. 1 Iss. 41 (November 8, 2011)Whitehall & CompanyNo ratings yet

- 1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Document2 pages1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Whitehall & CompanyNo ratings yet

- 1.29 Whitehall: Monitoring The Markets Vol. 1 Iss. 29 (August 16, 2011)Document2 pages1.29 Whitehall: Monitoring The Markets Vol. 1 Iss. 29 (August 16, 2011)Whitehall & CompanyNo ratings yet

- 2.17 Whitehall: Monitoring The Markets Vol. 2 Iss. 17 (April 24, 2012)Document2 pages2.17 Whitehall: Monitoring The Markets Vol. 2 Iss. 17 (April 24, 2012)Whitehall & CompanyNo ratings yet

- 1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)Document2 pages1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)Whitehall & CompanyNo ratings yet

- 1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Document2 pages1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Whitehall & CompanyNo ratings yet

- 1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Document2 pages1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Whitehall & CompanyNo ratings yet

- 1.31 Whitehall: Monitoring The Markets Vol. 1 Iss. 31 (August 30, 2011)Document2 pages1.31 Whitehall: Monitoring The Markets Vol. 1 Iss. 31 (August 30, 2011)Whitehall & CompanyNo ratings yet

- 1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Document2 pages1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Whitehall & CompanyNo ratings yet

- 1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Document2 pages1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Whitehall & CompanyNo ratings yet

- 2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Document2 pages2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets 2011 Year in ReviewDocument1 pageWhitehall: Monitoring The Markets 2011 Year in ReviewWhitehall & CompanyNo ratings yet

- 1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Document2 pages1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Whitehall & CompanyNo ratings yet

- 2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Document2 pages2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Whitehall & CompanyNo ratings yet

- 1.48 Whitehall: Monitoring The Markets Vol. 1 Iss. 48 (December 28, 2011)Document2 pages1.48 Whitehall: Monitoring The Markets Vol. 1 Iss. 48 (December 28, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Mid-Year Review (June 30, 2011)Document1 pageWhitehall: Monitoring The Markets Mid-Year Review (June 30, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 45 (December 1, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 45 (December 1, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 15 (April 12, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 15 (April 12, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 21 (June 17, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 21 (June 17, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 14 (April 21, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 14 (April 21, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 44 (November 24, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 44 (November 24, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: United States Debt MarketDocument2 pagesWhitehall: United States Debt MarketWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Whitehall & CompanyNo ratings yet

- 2.20 Whitehall: Monitoring The Markets Vol. 2 Iss. 20 (May 15, 2012)Document2 pages2.20 Whitehall: Monitoring The Markets Vol. 2 Iss. 20 (May 15, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 42 (November 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 42 (November 18, 2014)Whitehall & CompanyNo ratings yet

- 2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Document2 pages2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 26 (July 15, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 26 (July 15, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 22 (June 24, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 22 (June 24, 2015)Whitehall & CompanyNo ratings yet

- Monitoring The Markets 2013 Year in ReviewDocument1 pageMonitoring The Markets 2013 Year in ReviewWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 31 (August 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 31 (August 25, 2015)Whitehall & CompanyNo ratings yet

- US Financial Data Weekly Via STL Federal Reserve BankDocument24 pagesUS Financial Data Weekly Via STL Federal Reserve Bankrryan123123No ratings yet

- China Eco StatsDocument4 pagesChina Eco StatsandrewbloggerNo ratings yet

- 617 2016-04-29 PDFDocument2 pages617 2016-04-29 PDFWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 18 (May 20, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 18 (May 20, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 25 (June, 21 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 25 (June, 21 2016)Whitehall & CompanyNo ratings yet

- 2.31 Whitehall: Monitoring The Markets Vol. 2 Iss. 31 (July 31, 2012)Document2 pages2.31 Whitehall: Monitoring The Markets Vol. 2 Iss. 31 (July 31, 2012)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Whitehall & CompanyNo ratings yet

- US Financial Data Weekly - St. Louis FedDocument24 pagesUS Financial Data Weekly - St. Louis Fedrryan123123No ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet

1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)

1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)

Uploaded by

Whitehall & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)

1.24 Whitehall: Monitoring The Markets Vol. 1 Iss. 24 (July 13, 2011)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

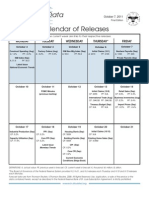

Volume 1, Issue 24 July 13, 2011

US Libor

US

DEBT

MARKET*

"1

mth"

"3

mth"

"6

mth"

Whitehall & C o m p a n y, L L C

Presented by:

US Treasury Yield Curve

Jun

Jul

Mar

Nov

Aug

Dec

Apr

Oct

Jan

Libor 07/13/11

1mth 19 bps

3mth 25 bps

6mth 41 bps

May

Sep

Feb

Jul

80 bps 70 bps 60 bps 50 bps 40 bps 30 bps 20 bps 10 bps

7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% I I 2 3

Today (7/13/11) 15yr Avg

I 5

I 7

I 10

30yr Avg

I 30

UST 2yr 07/13/11 0.36%

4.00%

3yr 0.72%

5yr 1.44%

7yr 2.01%

10yr 2.88%

30yr 4.17%

4.00%

10 Year US Swap Rates

7/13/11 3.04% 7/13/11 2.88%

7/13/11 3.04% 3.50% 3.00% 2.50%

10

Year

US

Treasury

7/13/11

2.88%

3.50%

3.00%

2.50%

Jul

Aug

Sep

Nov

Dec

Feb

Oct

Jan

May

Mar

Jun

Aug

Sep

Nov

Dec

Feb

Oct

Mar

Apr

Average 10 Year US Industrial Yield

7/13/11 A: 4.25% BBB: 4.72%

May

Average 10 Year US Industrial Spreads

5.50% 5.00% 4.50% 4.00% 7/13/11 A: 107 bps BBB: 154 bps

Apr

Jan

Jun BBB Jun Jun

Jul

Jul

Jul Jul

2.00%

2.00%

BBB

7/13/11

A:

4.25%

BBB:

4.72% 7/13/11

A:

107

bps

BBB:

154

bps

Jun

Jul

Aug

Oct

Nov

Dec

Sep

Jan

Mar

Feb

Apr

May

Jul

Aug

Oct

Nov

Dec

Jan

Mar

Sep

Feb

Jul

Apr

S&P/LSTA Leveraged Loan Index

7/13/11 95 b 7/13/11 95 bps ps 98 bps 96 bps 94 bps 92 bps 90 bps 88 bps 86 bps

Average Junk-Bond Yield

7/13/11 7.38 %

May

7/13/11 7.38 %

Aug

Oct

Nov

Dec

Mar

Sep

Feb

Jun

Jan

Jul

Apr

May

Jul

Jul

Aug

Sep

Nov

Dec

Feb

Oct

Jan

Mar

Apr

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security. *Source: Bloomberg Copyright 2011 Whitehall & Company, LLC www.whitehallandcompany.com

May

Jul

3.50%

190 bps 175 bps 160 bps 145 bps 130 bps 115 bps 100 bps 85 bps

9.50% 9.00% 8.50% 8.00% 7.50% 7.00%

You might also like

- Global Macro Trading: Profiting in a New World EconomyFrom EverandGlobal Macro Trading: Profiting in a New World EconomyRating: 4 out of 5 stars4/5 (5)

- 1.25 Whitehall: Monitoring The Markets Vol. 1 Iss. 25 (July 19, 2011)Document2 pages1.25 Whitehall: Monitoring The Markets Vol. 1 Iss. 25 (July 19, 2011)Whitehall & CompanyNo ratings yet

- 1.26 Whitehall: Monitoring The Markets Vol. 1 Iss. 26 (July 26, 2011)Document2 pages1.26 Whitehall: Monitoring The Markets Vol. 1 Iss. 26 (July 26, 2011)Whitehall & CompanyNo ratings yet

- 1.22 Whitehall: Monitoring The Markets Vol. 1 Iss. 22 (June 28, 2011)Document2 pages1.22 Whitehall: Monitoring The Markets Vol. 1 Iss. 22 (June 28, 2011)Whitehall & CompanyNo ratings yet

- 1.27 Whitehall: Monitoring The Markets Vol. 1 Iss. 27 (August 02, 2011)Document2 pages1.27 Whitehall: Monitoring The Markets Vol. 1 Iss. 27 (August 02, 2011)Whitehall & CompanyNo ratings yet

- 1.28 Whitehall: Monitoring The Markets Vol. 1 Iss. 28 (August 09, 2011)Document2 pages1.28 Whitehall: Monitoring The Markets Vol. 1 Iss. 28 (August 09, 2011)Whitehall & CompanyNo ratings yet

- 1.41 Whitehall: Monitoring The Markets Vol. 1 Iss. 41 (November 8, 2011)Document2 pages1.41 Whitehall: Monitoring The Markets Vol. 1 Iss. 41 (November 8, 2011)Whitehall & CompanyNo ratings yet

- 1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Document2 pages1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Whitehall & CompanyNo ratings yet

- 1.29 Whitehall: Monitoring The Markets Vol. 1 Iss. 29 (August 16, 2011)Document2 pages1.29 Whitehall: Monitoring The Markets Vol. 1 Iss. 29 (August 16, 2011)Whitehall & CompanyNo ratings yet

- 2.17 Whitehall: Monitoring The Markets Vol. 2 Iss. 17 (April 24, 2012)Document2 pages2.17 Whitehall: Monitoring The Markets Vol. 2 Iss. 17 (April 24, 2012)Whitehall & CompanyNo ratings yet

- 1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)Document2 pages1.44 Whitehall: Monitoring The Markets Vol. 1 Iss. 44 (November 29, 2011)Whitehall & CompanyNo ratings yet

- 1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Document2 pages1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Whitehall & CompanyNo ratings yet

- 1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Document2 pages1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Whitehall & CompanyNo ratings yet

- 1.31 Whitehall: Monitoring The Markets Vol. 1 Iss. 31 (August 30, 2011)Document2 pages1.31 Whitehall: Monitoring The Markets Vol. 1 Iss. 31 (August 30, 2011)Whitehall & CompanyNo ratings yet

- 1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Document2 pages1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Whitehall & CompanyNo ratings yet

- 1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Document2 pages1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Whitehall & CompanyNo ratings yet

- 2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Document2 pages2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets 2011 Year in ReviewDocument1 pageWhitehall: Monitoring The Markets 2011 Year in ReviewWhitehall & CompanyNo ratings yet

- 1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Document2 pages1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Whitehall & CompanyNo ratings yet

- 2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Document2 pages2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Whitehall & CompanyNo ratings yet

- 1.48 Whitehall: Monitoring The Markets Vol. 1 Iss. 48 (December 28, 2011)Document2 pages1.48 Whitehall: Monitoring The Markets Vol. 1 Iss. 48 (December 28, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Mid-Year Review (June 30, 2011)Document1 pageWhitehall: Monitoring The Markets Mid-Year Review (June 30, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 45 (December 1, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 45 (December 1, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 15 (April 12, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 15 (April 12, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 21 (June 17, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 21 (June 17, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 14 (April 21, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 14 (April 21, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 44 (November 24, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 44 (November 24, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: United States Debt MarketDocument2 pagesWhitehall: United States Debt MarketWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Whitehall & CompanyNo ratings yet

- 2.20 Whitehall: Monitoring The Markets Vol. 2 Iss. 20 (May 15, 2012)Document2 pages2.20 Whitehall: Monitoring The Markets Vol. 2 Iss. 20 (May 15, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 42 (November 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 42 (November 18, 2014)Whitehall & CompanyNo ratings yet

- 2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Document2 pages2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 26 (July 15, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 26 (July 15, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 22 (June 24, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 22 (June 24, 2015)Whitehall & CompanyNo ratings yet

- Monitoring The Markets 2013 Year in ReviewDocument1 pageMonitoring The Markets 2013 Year in ReviewWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 31 (August 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 31 (August 25, 2015)Whitehall & CompanyNo ratings yet

- US Financial Data Weekly Via STL Federal Reserve BankDocument24 pagesUS Financial Data Weekly Via STL Federal Reserve Bankrryan123123No ratings yet

- China Eco StatsDocument4 pagesChina Eco StatsandrewbloggerNo ratings yet

- 617 2016-04-29 PDFDocument2 pages617 2016-04-29 PDFWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 18 (May 20, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 18 (May 20, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 25 (June, 21 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 25 (June, 21 2016)Whitehall & CompanyNo ratings yet

- 2.31 Whitehall: Monitoring The Markets Vol. 2 Iss. 31 (July 31, 2012)Document2 pages2.31 Whitehall: Monitoring The Markets Vol. 2 Iss. 31 (July 31, 2012)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Whitehall & CompanyNo ratings yet

- US Financial Data Weekly - St. Louis FedDocument24 pagesUS Financial Data Weekly - St. Louis Fedrryan123123No ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet