Professional Documents

Culture Documents

Cases

Cases

Uploaded by

Richa Thakur0 ratings0% found this document useful (0 votes)

94 views10 pagesAndre Pires opened his automobile parts store, Quickfix Auto Parts, five years ago. The industry and local forecasts for the next few years were very good. But Andre had used up most of his available funds in expanding the business.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAndre Pires opened his automobile parts store, Quickfix Auto Parts, five years ago. The industry and local forecasts for the next few years were very good. But Andre had used up most of his available funds in expanding the business.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

94 views10 pagesCases

Cases

Uploaded by

Richa ThakurAndre Pires opened his automobile parts store, Quickfix Auto Parts, five years ago. The industry and local forecasts for the next few years were very good. But Andre had used up most of his available funds in expanding the business.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 10

Financial Ratio Analysis

Bigger Isn’t Always Better!

Andre Pires opened his automobile parts store, Quickfix Auto

Parts, five years ago, in a mid-sized city located in the mid-western,

region of the United States. Having worked for an automobile dealership,

first as a technician, and later as the parts department manager, for over

15 years, Andre had learned the many nuances of the fiercely competitive

automobile servicing business. He had developed many contacts with

dealers and service technicians, which came in really handy when

establishing his own retail store. Business had picked up significantly

well over the years, and as a result, Andre had more than doubled his

store size by the third year of operations. ‘The industry and local forecasts

for the next few years were very good and Andre was confident that his

sales would keep growing at or above recent levels.

However, Andre had used up most of his available funds in

expanding the business and was well aware that future growth would

have to be funded with external sources of funds. What was worrying

Financial Ratio Analysis

Bigger Isn’t Always Better!

Andre Pires opened his automobile parts store, Quickfix Auto

Parts, five years ago, in a mid-sized city located in the mid-western,

region of the United States. Having worked for an automobile dealership,

first as a technician, and later as the parts department manager, for over

15 years, Andre had learned the many nuances of the fiercely competitive

automobile servicing business. He had developed many contacts with

dealers and service technicians, which came in really handy when

establishing his own retail store. Business had picked up significantly

well over the years, and as a result, Andre had more than doubled his

store size by the third year of operations. ‘The industry and local forecasts

for the next few years were very good and Andre was confident that his

sales would keep growing at or above recent levels.

However, Andre had used up most of his available funds in

expanding the business and was well aware that future growth would

have to be funded with external sources of funds. What was worrying

6 Case2 —_ Bigger Isn't Always Better!

Andre was the fact that over the past two years, the store’s net income

figures had been negative, and his cash flow situation had gotten pretty

weak (See Tables | and 2). He figured that he had better take a good look

at his firm’s financial situation and improve it, if possible, before his

suppliers found out. He knew fully well that being shut out by suppliers

would be disastrous!

Andre’s knowledge of finance and accounting, not unlike many

small businessmen’s, was very limited. He had often entertained the

thought of taking some financial management courses, but could never

find the time. One day, at his weekly bridge session, he happened to

mention his problem to Tom Andrews, his long time friend and bridge

partner. Tom had often given him good advice in the past and Andre was

desperate for a solution. “I’m no finance expert, Andre,” said Tom, “but

you might want to contact the finance department at our local university’s

business school and see if you can hire an MBA student as an intern.

These students can often be very insightful, you know.”

That’s exactly what Andre did. Within a week he was able to

recruit Juan Plexo, a second semester MBA student, who had an

undergraduate degree in Accountancy and was interested in concentrating

in Finance. When Juan started his internship, Andre explained exactly

what his concerns were. “I’m going to have to raise funds for future

growth, and given my recent profit situation, the prospects look pretty

bleak. I can’t seem to put my finger on the exact cause. The bank’s

commercial loan committee is going to want some pretty convincing

arguments as to why they should grant me the loan. I need to put some

concrete remedial measures in place, and was hoping that you can help

sort things out, Juan,” said Andre. “I think I may have bitten off more

than I can currently chew.”

Case2 — Bigger Isn't Always Better!

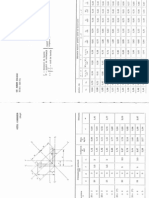

Table 1

Quickfix Autoparts

Balance Sheets

“ASSETS 72000 2001 2002 72008 2004

(Gash and marketable

securities $155,000| $309,099] $75,948] $28,826] $18,425

lAccounts receivable 10,000] 12,000] 20,000] 77,653) 90.078

Inventory 250,000} 270,000] 500,000] 520,000] 560,000

Current assets $416,000] $591,098] $595 948] $626,480] $668,503}

Land, buildings, plant, |

and equipment | $280,000] $250,000} $500,000] $500,000] $500,000]

JAccumulated depreciation (25,000) (60,000)} (100,000)} (150,000) (200,000)

Net fixed assets $225,000] $200,000] $400,000] $350,000] $300,000

Total assets $640,000] $791,099] $995,948] $976,480] $968,503

LIABILITIES AND EQUITIES

[Short-term bank loans $50,000] _5145,000| $140,000] $148,000] $148,000

lAccounts payable 10,000] 10,506) 19,998 15,995] 16,795]

Accruals 5,000 s.100] 7,331] 9,301] 11,626

Current liabilities $65,000 $160,606) $167,329] S173.296| $176,4z1

Long-term bank loans $63,366] $98,000| $196,000] $190,000] $123,000

Mortgage 175,000| 173,000] 271,000] 268,000] 264,000

Long-term debt $238,366] $271,000 $467,000] $458,000] $447,000

Total liabilities $303,366] $431,606] $634,329] $631,296] $623,421

[Common stock (100,000 shares) | $320,000) $320,000] $320,000] $320,000] $320,000

Retained eamings 16634] 39,493] 41,619] 25,184] 25,082

Total equity $336,634| $350,403] $361,619] $345,184] $345,082

Total iabiities

and equity s640,000| $791,099] $995,948] $976.480| $968,503]

You might also like

- Suggested Homework AnsDocument6 pagesSuggested Homework AnsFeric KhongNo ratings yet

- Gibson Appliance Co Is A Very Stable Billion Dollar Company WithDocument1 pageGibson Appliance Co Is A Very Stable Billion Dollar Company WithAmit Pandey0% (1)

- Red River Farm Machine Makes A Wide Variety of ProductsDocument1 pageRed River Farm Machine Makes A Wide Variety of ProductsAmit PandeyNo ratings yet

- Balance Sheet Current LiabilitiesDocument3 pagesBalance Sheet Current LiabilitiesamirNo ratings yet

- Goggin 1960 Olive JarDocument24 pagesGoggin 1960 Olive JarJorge Aching VasquezNo ratings yet

- Case Macro8c1 Ch8 PDFDocument83 pagesCase Macro8c1 Ch8 PDFLiban PaysNo ratings yet

- Case Study 2Document10 pagesCase Study 2Cheveem Grace Emnace100% (1)

- Assignment 2 - QuesDocument4 pagesAssignment 2 - QuesShehreen MahiuddinNo ratings yet

- Ms14e Case Chapter 03 FinalDocument10 pagesMs14e Case Chapter 03 FinalOfelia Ragpa100% (1)

- Daily Grind Day 1 With Suggested AnswerDocument2 pagesDaily Grind Day 1 With Suggested AnswerBulandos ChroniclesNo ratings yet

- Bal76736 ch01 001-041Document41 pagesBal76736 ch01 001-041Kjay Thompson100% (1)

- Lecture 2 - Investment PropertyDocument18 pagesLecture 2 - Investment PropertyNantha KumaranNo ratings yet

- Government GrantsDocument9 pagesGovernment Grantssorin8488100% (1)

- ch.10 TB 331Document12 pagesch.10 TB 331nickvanderv100% (1)

- PNS - Bafs 321-2021 - Shell Eggs (Chicken and Duck) - Product Standard - Grading and ClassificationDocument20 pagesPNS - Bafs 321-2021 - Shell Eggs (Chicken and Duck) - Product Standard - Grading and ClassificationJohana Pinagayao AngkadNo ratings yet

- Tax Final Part 5Document37 pagesTax Final Part 5Angelica Jane AradoNo ratings yet

- Management Advisory Services: Costs and Cost ConceptsDocument45 pagesManagement Advisory Services: Costs and Cost ConceptsUnknown 01No ratings yet

- Assessment 10 Acctg 7Document2 pagesAssessment 10 Acctg 7Judy Ann GacetaNo ratings yet

- Chapter 9 HW QuestionsDocument2 pagesChapter 9 HW QuestionsKayla Shelton0% (1)

- Chapter 7Document2 pagesChapter 7moreNo ratings yet

- A.) Change in Fixed Cost and Sales Volume Acoustic Concepts Is Currently Selling 400Document5 pagesA.) Change in Fixed Cost and Sales Volume Acoustic Concepts Is Currently Selling 400Kez MaxNo ratings yet

- Cel 1 Prac 1 Answer KeyDocument15 pagesCel 1 Prac 1 Answer KeyNJ MondigoNo ratings yet

- Test Bank Sales Budgets and Production BudgetsDocument22 pagesTest Bank Sales Budgets and Production BudgetshjNo ratings yet

- Shareholders' Equity Problems (Gallery Company)Document19 pagesShareholders' Equity Problems (Gallery Company)Nikki San GabrielNo ratings yet

- New Era University: International Business PlanDocument50 pagesNew Era University: International Business PlanNesly Ascaño CordevillaNo ratings yet

- FIN 500 Extra Problems Fall 20-21Document4 pagesFIN 500 Extra Problems Fall 20-21saraNo ratings yet

- 2011-02-09 035108 Finance 14Document4 pages2011-02-09 035108 Finance 14SamNo ratings yet

- Assn 2Document3 pagesAssn 2api-26315128100% (3)

- CH 4 AnswersDocument11 pagesCH 4 AnswersElaineSmithNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- 2nd Long Quiz StudentDocument8 pages2nd Long Quiz StudentDumb MushNo ratings yet

- Case 01a Growing Pains SolutionDocument7 pagesCase 01a Growing Pains SolutionUSD 654No ratings yet

- Example 1 QMFDocument21 pagesExample 1 QMFShwetaNo ratings yet

- IAS 40 Investment Properties - Out-Of-Class practice-EN NewDocument5 pagesIAS 40 Investment Properties - Out-Of-Class practice-EN NewDAN NGUYEN THENo ratings yet

- Home Depot PresentationfinalDocument42 pagesHome Depot Presentationfinalpankajkumar631No ratings yet

- Cost and Management - Sample QuestionDocument5 pagesCost and Management - Sample Questionfreddy kwakwalaNo ratings yet

- Forever21 Marketing AnalysisDocument4 pagesForever21 Marketing AnalysisNeel Edeling67% (3)

- CH 3 Answers Vol 1 - ReceivablesDocument15 pagesCH 3 Answers Vol 1 - Receivablesadorableperez50% (2)

- Idoc - Pub - TMP 7617 PLDT Home DSL and PLDT Home Fiber New Default Wifi Password Hack 11508993826 PDFDocument7 pagesIdoc - Pub - TMP 7617 PLDT Home DSL and PLDT Home Fiber New Default Wifi Password Hack 11508993826 PDFArjhay De Leon Gabales100% (1)

- Finmar SolmanDocument7 pagesFinmar SolmanMi-cha ParkNo ratings yet

- All of Them Irr M, NPV NDocument4 pagesAll of Them Irr M, NPV NMariame Abasola CagabhionNo ratings yet

- Ejercicios Indices PDFDocument7 pagesEjercicios Indices PDFborritaNo ratings yet

- MF GlobalDocument69 pagesMF GlobalZerohedgeNo ratings yet

- Strategic Cost Accounting: MBA-First YearDocument99 pagesStrategic Cost Accounting: MBA-First YearNada YoussefNo ratings yet

- Assessment Current LiabilitiesDocument6 pagesAssessment Current LiabilitiesEdward Glenn BaguiNo ratings yet

- MasDocument4 pagesMasYaj CruzadaNo ratings yet

- Unit Number/ Heading Learning Outcomes: Intermediate Accounting Ii (Ae 16) Learning Material: Bonds PayableDocument20 pagesUnit Number/ Heading Learning Outcomes: Intermediate Accounting Ii (Ae 16) Learning Material: Bonds PayablePillos Jr., ElimarNo ratings yet

- Pre-Test 5Document3 pagesPre-Test 5BLACKPINKLisaRoseJisooJennieNo ratings yet

- Cost 1 WeekDocument45 pagesCost 1 WeekMelissa Kayla Maniulit0% (1)

- CF Assignment - 2Document2 pagesCF Assignment - 2vishnu607No ratings yet

- QUESTIONSDocument19 pagesQUESTIONSrahidarzooNo ratings yet

- Final RequirementsDocument22 pagesFinal RequirementsJoebin Corporal Lopez100% (1)

- Chapter 3Document54 pagesChapter 3Enges Formula100% (1)

- Casio Fx6200g User ManualDocument60 pagesCasio Fx6200g User Manualnoogy2noogyNo ratings yet

- Oedipus Rex OrderDocument49 pagesOedipus Rex OrdergoorangesNo ratings yet

- Coronil Elephants in The AmericasDocument13 pagesCoronil Elephants in The AmericasFernando Esquivel-SuarezNo ratings yet

- Dictionar Roman GrecDocument16 pagesDictionar Roman Grecanca f0% (1)

- Piping GuideDocument257 pagesPiping Guideveluchamymuthukumar100% (2)

- Caracteristici Geometrice Profile LaminateDocument7 pagesCaracteristici Geometrice Profile LaminateMoca AlexNo ratings yet

- (E-Book CFD) - Mechanics and Thermodynamics of Propulsion Hill - PetersonDocument45 pages(E-Book CFD) - Mechanics and Thermodynamics of Propulsion Hill - PetersoningmbNo ratings yet