Professional Documents

Culture Documents

Portfolio Management: Unnat Chauhan

Portfolio Management: Unnat Chauhan

Uploaded by

Saurav KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Management: Unnat Chauhan

Portfolio Management: Unnat Chauhan

Uploaded by

Saurav KumarCopyright:

Available Formats

Portfolio Management

Unnat Chauhan

M-09-34

Rajiv Gandhi Institute of Petroleum Technology

Objective: The objective of the project was to prepare a portfolio for the companies listed on NSE. The main aim of the project was to develop an understanding of making an decision about investment mix and policy, asset allocation for individuals and institutions and balancing risk against performance.

Initial Inputs: The historical data of the companies listed on NSE was taken. The historical span was 10 years i.e. from 19th April 2001 to 19th April2011. The market index used as reference was S&P Nifty. A list of around 35 companies were chosen and then each security was verified for it p value. 18 securities were discarded because of their insignificant p- value and mismatch of range values of security and market data. Each security has data for 2498 days and so does the S&P index. Expected return of each security is calculated as the average of return of all the days. The portfolio worksheet was prepared by using appropriate formulas. The worksheets for two cases were prepared, one considering short selling is allowed and other considering short selling is not allowed. Output: 1. When short selling was not allowed: The following 17 companies were considered: 1. ACC 2. Adani 3. BHEL 4. BPCL 5. Crompton Greaves 6. Cipla 7. Dena Bank 8. Grasim 9. Hero Honda 10. ICICI Bank 11. Indian Cement 12. MTNL 13. Ranbaxy 14. Raymond 15. SAIL 16. Tata Power 17. Wipro The following three companies were not added to the portfolio, as their Ci value was greater than Sharpe ratio.

ICICI bank, MTNL and Wipro. The value of Beta for the portfolio came out to be .058579398. The Vrp value of portfolio: 9.58525E-05. The maximum weightage was given to Crompton Greaves. .

2. When short selling was allowed: The same 17 companies were considered. The value of Beta was: .038082442. The Vrp value is: 9.38427E-05 The maximum weightage was given to Crompton Greaves.

You might also like

- Darden Capital Management - The Cavalier FundDocument8 pagesDarden Capital Management - The Cavalier FundKshitishNo ratings yet

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Case QuestionsDocument5 pagesCase Questionsaditi_sharma_65No ratings yet

- CREDIT Risk Management Zuaricement 2013Document87 pagesCREDIT Risk Management Zuaricement 2013Dinesh Kumar Gattu50% (2)

- Finance Projects TopicsDocument74 pagesFinance Projects TopicsNisha PatelNo ratings yet

- IpoDocument23 pagesIpopallavi_gogoi_pgp12No ratings yet

- The Financial Comparison of Ultratech With Its Direct CompetitorsDocument19 pagesThe Financial Comparison of Ultratech With Its Direct CompetitorsRamthulasiNo ratings yet

- Analysis of Equity Based Mutual Funds in India: Sahil JainDocument4 pagesAnalysis of Equity Based Mutual Funds in India: Sahil JainInternational Organization of Scientific Research (IOSR)No ratings yet

- Reliance Capital: Ankit Chadha, Gaurav Vijay Shah, Mohit Dhand, Sandeep Aggrawal, Tamal TaruDocument15 pagesReliance Capital: Ankit Chadha, Gaurav Vijay Shah, Mohit Dhand, Sandeep Aggrawal, Tamal TaruBhavna PruthiNo ratings yet

- Financeprojectstopics 120612234846 Phpapp02Document64 pagesFinanceprojectstopics 120612234846 Phpapp02Garima SinghNo ratings yet

- Mindspace Business Parks REIT IPODocument4 pagesMindspace Business Parks REIT IPOKUNAL KISHOR SINGHNo ratings yet

- The Primary Market in IndiaDocument34 pagesThe Primary Market in IndiaPINAL100% (1)

- Titles For Project WorkDocument36 pagesTitles For Project WorkGagan Sai GuduruNo ratings yet

- S. No Title: List of Projects & Working Papers Completed at IIFDocument33 pagesS. No Title: List of Projects & Working Papers Completed at IIFantimamalkaniNo ratings yet

- Topics For Grand ProjectDocument33 pagesTopics For Grand Projectjignay100% (19)

- SFM Exam Capsule Question Part New Syllabus 1Document74 pagesSFM Exam Capsule Question Part New Syllabus 1shankar k.c.100% (1)

- Valuation ModelDocument37 pagesValuation Modelproperty.lords1No ratings yet

- Sri Balaji Society, Pune: Comparative Analysis of The Financials of Ceat Tyres and JK TyresDocument35 pagesSri Balaji Society, Pune: Comparative Analysis of The Financials of Ceat Tyres and JK TyresAmeesha DubeyNo ratings yet

- Ocean CarriersDocument2 pagesOcean CarriersRini RafiNo ratings yet

- Report On PortfolioDocument3 pagesReport On Portfolio3020070220No ratings yet

- Cases in Financial Management Ms A&F Teacher: Dr. Zeeshan Ghafoor Case 1 (25 Marks)Document5 pagesCases in Financial Management Ms A&F Teacher: Dr. Zeeshan Ghafoor Case 1 (25 Marks)Haider GhaffarNo ratings yet

- Problämes ch11Document8 pagesProblämes ch11jessicalaurent1999No ratings yet

- Reliance Nippon Life IPO Note 091017-1509530730Document3 pagesReliance Nippon Life IPO Note 091017-1509530730Krishna GoyalNo ratings yet

- SFM Test 2 - Question PaperDocument4 pagesSFM Test 2 - Question PaperNimisha DamaniNo ratings yet

- Imt 09Document4 pagesImt 09nikhilanand13No ratings yet

- Jstreet 345Document10 pagesJstreet 345JhaveritradeNo ratings yet

- Pim Project 2008Document104 pagesPim Project 2008pra_nthNo ratings yet

- Report FIN 637Document54 pagesReport FIN 637MasumHasanNo ratings yet

- Investment Analysis Investment Analysis: 8 - CAPM (Chp. 9)Document19 pagesInvestment Analysis Investment Analysis: 8 - CAPM (Chp. 9)Unmesh RajendranNo ratings yet

- India Mid-Market ConferenceDocument29 pagesIndia Mid-Market ConferencenishantiitrNo ratings yet

- Group-2 TechMSatyam MergerDocument6 pagesGroup-2 TechMSatyam MergerNeeraj MohanNo ratings yet

- Chaanakya Chaanakya Chaanakya Chaanakya: National HeadlinesDocument6 pagesChaanakya Chaanakya Chaanakya Chaanakya: National HeadlinesChaanakya_cuimNo ratings yet

- Project List For Semester IVDocument2 pagesProject List For Semester IVMadhav ChopraNo ratings yet

- Comparative Analysis of Mutual Fund Schemes and Major Investment AvenuesDocument52 pagesComparative Analysis of Mutual Fund Schemes and Major Investment AvenuesPrithvi Raj SinghNo ratings yet

- Financial Management I Report Hindalco Nalco Group-15Document12 pagesFinancial Management I Report Hindalco Nalco Group-15Madhusudan22No ratings yet

- AmeriTrade Case StudyDocument3 pagesAmeriTrade Case StudyTracy PhanNo ratings yet

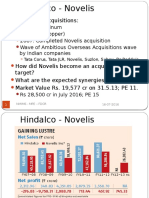

- Due Diligence JLR NovelisDocument16 pagesDue Diligence JLR NovelisLalNo ratings yet

- An Empirical Study of The Company Sriram Cold Forgings PVTDocument61 pagesAn Empirical Study of The Company Sriram Cold Forgings PVTVPLAN INFOTECHNo ratings yet

- Summary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustFrom EverandSummary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionFrom EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionNo ratings yet

- Public Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveNo ratings yet

- Green Bond Market Survey for Cambodia: Insights on the Perspectives of Institutional Investors and UnderwritersFrom EverandGreen Bond Market Survey for Cambodia: Insights on the Perspectives of Institutional Investors and UnderwritersNo ratings yet

- Basic Principles on Establishing a Regional Settlement Intermediary and Next Steps Forward: Cross-Border Settlement Infrastructure ForumFrom EverandBasic Principles on Establishing a Regional Settlement Intermediary and Next Steps Forward: Cross-Border Settlement Infrastructure ForumNo ratings yet

- Valuations of Early-Stage Companies and Disruptive Technologies: How to Value Life Science, Cybersecurity and ICT Start-ups, and their TechnologiesFrom EverandValuations of Early-Stage Companies and Disruptive Technologies: How to Value Life Science, Cybersecurity and ICT Start-ups, and their TechnologiesNo ratings yet

- The Investing Oasis: Contrarian Treasure in the Capital Markets DesertFrom EverandThe Investing Oasis: Contrarian Treasure in the Capital Markets DesertNo ratings yet

- Value and Capital Management: A Handbook for the Finance and Risk Functions of Financial InstitutionsFrom EverandValue and Capital Management: A Handbook for the Finance and Risk Functions of Financial InstitutionsRating: 5 out of 5 stars5/5 (1)

- Corporate Governance, Firm Profitability, and Share Valuation in the PhilippinesFrom EverandCorporate Governance, Firm Profitability, and Share Valuation in the PhilippinesNo ratings yet

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterFrom EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNo ratings yet

- Good Practices for Developing a Local Currency Bond Market: Lessons from the ASEAN+3 Asian Bond Markets InitiativeFrom EverandGood Practices for Developing a Local Currency Bond Market: Lessons from the ASEAN+3 Asian Bond Markets InitiativeNo ratings yet