Professional Documents

Culture Documents

Practice Exercise 5

Practice Exercise 5

Uploaded by

rajeshnevOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Exercise 5

Practice Exercise 5

Uploaded by

rajeshnevCopyright:

Available Formats

Practice Exercise 5

Exercise on BILLWISE DETAILS & VAT Opening Balances : Cash :- 1, 00, 000/-(Dr.), Indian Bank A/C :- 50, 000/- (Dr.), Capital : - 1, 50, 000/- (Cr.)

1) 2) 3) 4) 5) 6)

Purchased Item-1 from M/s Bhushan on Credit Rs. 10,000/- (Bill No. 25) VAT extra @ 4% Purchased Item-2 from M/s Bhushan on Credit Rs. 15,000/- (Bill No. 31) VAT extra @ Sold Item-1 to M/s Sagar on Credit Rs. 12, 000/- (Bill No. 100) VAT extra @ 4%. Purchased Stationary from Vinayak Stationary on Credit Rs. 750/-. (Bill No. 51) Given advance to M/s Hemant Rs. 10, 000/- for future Purchase. (Ref. No. 10) Sold Item-2 to M/s Sagar on credit Rs. 13, 000/- (Bill No. 105) VAT extra @ 12.5%

12.5%

7) Paid Rs. 10, 000/- by cash to M/s Bhushan (Bill No. 31) 8) Received bill Machinary Repair Charges from Global Repairs Rs. 2000/- (Ref. No. 5)

9) Received Item-1 from M/s Hemant Rs. 8,000/- (Bill No. 100) VAT extra @ 4%. 10) Paid to M/S Bhushan by cheque Rs. 15,000/- (Bill No. 25,31) 11) Paid Rs. 500/- to M/s. Vinayak Stationary by Chq.(Bill No. 51) 12) Purchased Item-2 from Hemant Rs. 8,000/- (Ref. No. 10) VAT extra @ 12.5%

13) Received cash from M/s Sagar 9000/- (Bill No. 100) 14) Received chq. Rs. 16,000/- by M/s Sagar (Bill No.100, 105) See the Reports Gateway of Tally - Display - Statement of A/cs- Outstanding; Statutory Reports VAT Reports

You might also like

- Caap Practice Manual Executive ProgDocument483 pagesCaap Practice Manual Executive ProgAsħîŞĥLøÝå0% (1)

- Practice Exercise 1Document1 pagePractice Exercise 1rajeshnevNo ratings yet

- Capinew Account June13Document7 pagesCapinew Account June13ashwinNo ratings yet

- Solution: SAMPLE PAPER-5 (Solved) Accountancy Class - XIDocument6 pagesSolution: SAMPLE PAPER-5 (Solved) Accountancy Class - XIcerlaNo ratings yet

- Accountancy XI Question BankDocument3 pagesAccountancy XI Question BankDeivanai K CSNo ratings yet

- AssignmentDocument4 pagesAssignmentanurag giri50% (2)

- Assignment On Session - 1: General Ledger's Name Group Op. Bal. Dr. / CRDocument18 pagesAssignment On Session - 1: General Ledger's Name Group Op. Bal. Dr. / CRcyber kci100% (1)

- Tally Tutorial Purchase Voucher EntryDocument4 pagesTally Tutorial Purchase Voucher EntryUday Pali100% (2)

- Tally - Accounting VouchersDocument20 pagesTally - Accounting VouchersArchana Nadar50% (2)

- Accounting Cycle Problems & SolutionsDocument18 pagesAccounting Cycle Problems & Solutionsurandom101100% (4)

- ExerciseDocument18 pagesExerciseRavi Kanth KNo ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- Corporate Taxation Assignment-01Document14 pagesCorporate Taxation Assignment-01HarshithaNo ratings yet

- Chapter Internal ReconstructionDocument4 pagesChapter Internal ReconstructionAnonymous mTZsMOjNo ratings yet

- Basic TallyDocument16 pagesBasic TallySunilkumar DubeyNo ratings yet

- Cash Flow Statement (C.F.S.)Document6 pagesCash Flow Statement (C.F.S.)Kopal ChoubeyNo ratings yet

- Tools of Financial Analysis & PlanningDocument68 pagesTools of Financial Analysis & Planninganon_672065362100% (1)

- Suggested Tax Paper May 2011Document11 pagesSuggested Tax Paper May 2011Sudhir PanigrahiNo ratings yet

- Suggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Document13 pagesSuggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Parasuram IyerNo ratings yet

- Fund Flow StatementDocument7 pagesFund Flow StatementvipulNo ratings yet

- Feasibility Study of ProjectDocument15 pagesFeasibility Study of ProjectMauliddha RachmiNo ratings yet

- Read The Following Hypothetical Text and Answer The Given QuestionsDocument12 pagesRead The Following Hypothetical Text and Answer The Given QuestionsRoshan KardaNo ratings yet

- Class Xii Cbse Question Bank AccountancyDocument23 pagesClass Xii Cbse Question Bank AccountancyBinoy TrevadiaNo ratings yet

- CLASS XII Accountancy CASE STUDY BASED QUESTION 2024-25Document26 pagesCLASS XII Accountancy CASE STUDY BASED QUESTION 2024-25AkshatNo ratings yet

- Cash FlowDocument25 pagesCash Flowshaheen_khan6787No ratings yet

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Document17 pagesAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Mahalaxmi RamasubramanianNo ratings yet

- Cash Budget: - This Budget Represents The Anticipated Receipts andDocument5 pagesCash Budget: - This Budget Represents The Anticipated Receipts andChristine JamesNo ratings yet

- Problems On Cash Flow StatementsDocument12 pagesProblems On Cash Flow StatementsAnjali Mehta100% (1)

- Chapter 12 - Trial BalanceDocument16 pagesChapter 12 - Trial BalanceVarunNo ratings yet

- Corporate FinanceDocument6 pagesCorporate Financetejasvgahlot05No ratings yet

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDocument3 pagesGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghNo ratings yet

- Management and Financial AcctgDocument10 pagesManagement and Financial AcctgVishnu RoyNo ratings yet

- Chap03 ProblemsDocument16 pagesChap03 ProblemsCyrilCalaloNo ratings yet

- Very Important Case Studies For CAIIB BFMDocument33 pagesVery Important Case Studies For CAIIB BFM108884No ratings yet

- Contents of Balance SheetDocument8 pagesContents of Balance SheetJainBhupendraNo ratings yet

- CAP-III Advanced Financial ReportingDocument17 pagesCAP-III Advanced Financial ReportingcasarokarNo ratings yet

- Lesson 02 - Practice of Book Keeping Including Ledgers and Trial BalanceDocument3 pagesLesson 02 - Practice of Book Keeping Including Ledgers and Trial Balancepulitha kodituwakkuNo ratings yet

- Question 1Document5 pagesQuestion 1Yono SéNo ratings yet

- 18415compsuggans PCC FM Chapter7Document13 pages18415compsuggans PCC FM Chapter7Mukunthan RBNo ratings yet

- Cash Flow Question Paper1Document10 pagesCash Flow Question Paper1CA Sanjeev Jarath100% (3)

- Cash Flow Statement N ProblemsDocument30 pagesCash Flow Statement N ProblemsNaushad GulNo ratings yet

- Accounts .Docx 1Document7 pagesAccounts .Docx 1Devshree ShingaviNo ratings yet

- Financial Accounting and AnalysisDocument11 pagesFinancial Accounting and AnalysisNavdeep SharmaNo ratings yet

- Practical Questions: Journal Entries in The Books of Abhinav LTD ParticularsDocument2 pagesPractical Questions: Journal Entries in The Books of Abhinav LTD ParticularsAnonymous Go6ClqNo ratings yet

- Aptitude Test - Accounts ExecutiveDocument8 pagesAptitude Test - Accounts ExecutiveHARCHARAN SINGH RANOTRANo ratings yet

- Tally Prime-1Document8 pagesTally Prime-1Sanjeev kumarNo ratings yet

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Document14 pagesParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNo ratings yet

- Ally Tutorial Purchase Voucher EntryDocument3 pagesAlly Tutorial Purchase Voucher EntryvasundhraNo ratings yet

- Assignment Financial Management of Sikkim Manipal University Semester 1Document13 pagesAssignment Financial Management of Sikkim Manipal University Semester 1Manny SinghNo ratings yet

- Ccac 1.3Document7 pagesCcac 1.3kishenmanocha485No ratings yet

- Wa0000Document4 pagesWa0000priya02sharma22No ratings yet

- Accounting Journal EntriesDocument16 pagesAccounting Journal EntriesMridulDutta0% (1)

- Dropbox - IPCC Tax Income-Tax November 2014 SolutionDocument8 pagesDropbox - IPCC Tax Income-Tax November 2014 SolutionPrashant PandeyNo ratings yet

- Xi Accounting Set 2Document6 pagesXi Accounting Set 2aashirwad2076No ratings yet

- Important Changes Brought in by The Budget 2011Document5 pagesImportant Changes Brought in by The Budget 2011harvinder thukralNo ratings yet

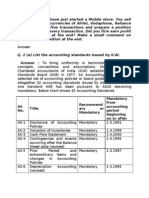

- Recommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterDocument7 pagesRecommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterdnbiswasNo ratings yet

- Corporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringFrom EverandCorporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringNo ratings yet

- Rural Livestock AdministrationFrom EverandRural Livestock AdministrationNo ratings yet

- Practice Exercise 6Document2 pagesPractice Exercise 6rajeshnev100% (1)

- Practice Exercise 4Document1 pagePractice Exercise 4rajeshnevNo ratings yet

- Practice Exercise 3Document1 pagePractice Exercise 3rajeshnevNo ratings yet

- Practice Exercise 2Document1 pagePractice Exercise 2rajeshnevNo ratings yet

- Practice Exercise 1Document1 pagePractice Exercise 1rajeshnevNo ratings yet

- Book Exercise - Simple InventoryDocument1 pageBook Exercise - Simple InventoryrajeshnevNo ratings yet

- Book Exercise - Advance InventoryDocument3 pagesBook Exercise - Advance InventoryrajeshnevNo ratings yet