Professional Documents

Culture Documents

Answer Only 4 of The Following 5 Questions

Answer Only 4 of The Following 5 Questions

Uploaded by

Abid Prasetyo BrilliantoroOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer Only 4 of The Following 5 Questions

Answer Only 4 of The Following 5 Questions

Uploaded by

Abid Prasetyo BrilliantoroCopyright:

Available Formats

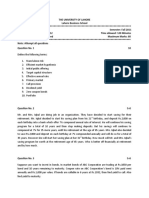

Answer only 4 of the following 5 questions:

1. Using DuPont Model, describe what happen with Oracle Corporation

during 2004 to 2006! Give some recommendations to the management to improve the companys performance for the following years! 2. Using forecasted assumptions, forecast ROI and ROE for next 5 years!

3. If you were a Banker, would you release a long term credit to the

company? Why?

4. Oracle Bond is traded currently at $105. Each bond has a par value of

$100, gives 5% interest payable annually, and will due in 7 years. You expect to have return from the bond of 5.8%. Will you invest your money on the bond? What is the maximum offered price that you are willing to purchase the bond? 5. a. Calculate the market required return of the stock for each quarter in 2006.

b. Suppose you were long term investor and you require the company

would give you a return of 9%. What is the maximum price you are eager to purchase the companys stock in the beginning of 2007?

Good luck -

You might also like

- DuPont Corporation Sale of Performance CoatingsDocument1 pageDuPont Corporation Sale of Performance Coatingsj2203950% (2)

- Self-Study Exercise 3Document3 pagesSelf-Study Exercise 3chanNo ratings yet

- Final Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursDocument84 pagesFinal Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursJatin PanchiNo ratings yet

- FIN 340 Final ProjectDocument12 pagesFIN 340 Final ProjectBrandon100% (1)

- Exercises-Stock ValuationDocument2 pagesExercises-Stock ValuationErjohn Papa50% (2)

- DuPont PDFDocument5 pagesDuPont PDFMadhur100% (1)

- Paper BF1 Fall 11Document2 pagesPaper BF1 Fall 11AsifSaeedNo ratings yet

- Valuation I QuestionsDocument1 pageValuation I Questionspunk_outNo ratings yet

- 4th Trim Bonds+and+Stocks+Valuation+-+Practice+QuestionsDocument2 pages4th Trim Bonds+and+Stocks+Valuation+-+Practice+QuestionsSiraj MohiuddinNo ratings yet

- Parameters For Investing The Buffett and Beyond WayDocument1 pageParameters For Investing The Buffett and Beyond WayOmotola AtolagbeNo ratings yet

- Hourly Exam Spring-2021 Department of Business AdministrationDocument3 pagesHourly Exam Spring-2021 Department of Business AdministrationNarinderNo ratings yet

- Exercise 6Document17 pagesExercise 610622006No ratings yet

- Share Bond ValuationDocument2 pagesShare Bond ValuationRanganathchowdaryNo ratings yet

- Select A Company Listed On An InternationallyDocument4 pagesSelect A Company Listed On An InternationallyTalha chNo ratings yet

- Extra Ex For Mid TermDocument5 pagesExtra Ex For Mid TermQuân VõNo ratings yet

- Af 325 QuestionDocument6 pagesAf 325 QuestionHiepXick100% (1)

- Tutorial 3 QuestionsDocument1 pageTutorial 3 Questionsryan.mccabe34No ratings yet

- Pb8mat QuizDocument1 pagePb8mat Quizjasonnicholas989No ratings yet

- 투자론 과제1Document2 pages투자론 과제1정윤재No ratings yet

- FINA Final - PracticeDocument9 pagesFINA Final - Practicealison dreamNo ratings yet

- FIN2004 Tutorial 1Document2 pagesFIN2004 Tutorial 1Leslie LimNo ratings yet

- Stocks Valuation ProblemDocument1 pageStocks Valuation ProblemJayson FabelaNo ratings yet

- ES 301 Quiz 4Document1 pageES 301 Quiz 4trixie marie jamoraNo ratings yet

- Stocks DrillsDocument1 pageStocks DrillsAnna GuilingNo ratings yet

- Dupont Case GuidelinesDocument1 pageDupont Case Guidelinesyifu.gaiNo ratings yet

- Instructions For Next ClassDocument2 pagesInstructions For Next ClassplNo ratings yet

- FIN571 Corporate FinanceDocument16 pagesFIN571 Corporate FinanceG JhaNo ratings yet

- Auto Zone QuestionsDocument1 pageAuto Zone QuestionsmalimojNo ratings yet

- Tutorial 6 Valuation - SVDocument6 pagesTutorial 6 Valuation - SVHiền NguyễnNo ratings yet

- AB1201 Exam - Sem1 AY 2020-21 - QDocument10 pagesAB1201 Exam - Sem1 AY 2020-21 - QEn Yu HoNo ratings yet

- Problem Set Solutions v3Document3 pagesProblem Set Solutions v3Bockarie LansanaNo ratings yet

- BT Chap 7Document3 pagesBT Chap 7Hang NguyenNo ratings yet

- Exercises On Stock ValuationDocument3 pagesExercises On Stock ValuationFatin FathihahNo ratings yet

- Assignment ProblemsDocument1 pageAssignment ProblemsMadCube gamingNo ratings yet

- Stock ValuationDocument18 pagesStock ValuationDianne MadridNo ratings yet

- Air University BS Accounting & Finance 7 Financial Modelling Assignment 5 - Cost of Equity (Van Horne)Document2 pagesAir University BS Accounting & Finance 7 Financial Modelling Assignment 5 - Cost of Equity (Van Horne)mishal zikriaNo ratings yet

- Applied Finance - Project DescriptionDocument10 pagesApplied Finance - Project DescriptionApurba Krishna DasNo ratings yet

- Module 4 Guideline Case Questions PDFDocument3 pagesModule 4 Guideline Case Questions PDFAreeb Javaid100% (1)

- FM AssignmentDocument2 pagesFM AssignmentHananNo ratings yet

- Group and Individual WorkDocument4 pagesGroup and Individual WorkMohd FirdausNo ratings yet

- Drill 3: Stock Valuation Write TRUE If The Statement Is True, Otherwise, Write FALSE and The Element That Makes The Statement False. True or FalseDocument1 pageDrill 3: Stock Valuation Write TRUE If The Statement Is True, Otherwise, Write FALSE and The Element That Makes The Statement False. True or FalseTineNo ratings yet

- FMA - Tute 10 - Dividend PolicyDocument3 pagesFMA - Tute 10 - Dividend PolicyPhuong VuongNo ratings yet

- FNCE2000 Chapter6 Valuing Shares & Bonds QuestionsDocument3 pagesFNCE2000 Chapter6 Valuing Shares & Bonds QuestionsJaydenaus0% (1)

- Indvi Assignment 2 Investment and Port MGTDocument3 pagesIndvi Assignment 2 Investment and Port MGTaddisie temesgen100% (1)

- Fin 517 - Take Home ExamDocument3 pagesFin 517 - Take Home ExamJennifer PearsallNo ratings yet

- Tut 3Document2 pagesTut 3mihsovyaNo ratings yet

- Chapter 3: Valuing Bond: Consider The Following Three StocksDocument2 pagesChapter 3: Valuing Bond: Consider The Following Three StocksQuân VõNo ratings yet

- Practice Questions (CAPM) : FIN 350 Global Financial ManagementDocument2 pagesPractice Questions (CAPM) : FIN 350 Global Financial Managementsarge19860% (1)

- 02 - Tutorial 2 - Week 4Document4 pages02 - Tutorial 2 - Week 4Jason ChowNo ratings yet

- Financial ManagementDocument32 pagesFinancial ManagementMarkus Bernabe Davira100% (2)

- Final Exam For PhotoDocument16 pagesFinal Exam For PhotofaizaNo ratings yet

- Special Issues in Corporate FinanceDocument6 pagesSpecial Issues in Corporate FinanceMD Hafizul Islam HafizNo ratings yet

- FP QuestionsAppleDocument1 pageFP QuestionsAppleSylvieNo ratings yet

- Problem Set - III The Value of Common StocksDocument2 pagesProblem Set - III The Value of Common StocksVlipperNo ratings yet

- Chapter 6 - ExercisesDocument2 pagesChapter 6 - ExercisesNguyen Hoang Tram AnhNo ratings yet

- Tutorial 6 - Cost of EquitiesDocument1 pageTutorial 6 - Cost of EquitiesAmy LimnaNo ratings yet

- Dividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1From EverandDividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1Rating: 2 out of 5 stars2/5 (1)

- How To Make Money In Stocks Value Investing StrategiesFrom EverandHow To Make Money In Stocks Value Investing StrategiesNo ratings yet