Professional Documents

Culture Documents

Pest Analysis

Pest Analysis

Uploaded by

YIyi-Shang KardosCopyright:

Available Formats

You might also like

- International Economics 8th Edition Husted Test BankDocument10 pagesInternational Economics 8th Edition Husted Test Bankjethrodavide6qi100% (28)

- The Strategic Management of Airasia Tune GroupDocument6 pagesThe Strategic Management of Airasia Tune GroupJuni LinNo ratings yet

- Asm401 - Individual Reflection PaperDocument4 pagesAsm401 - Individual Reflection PaperHaa'ilah AzharNo ratings yet

- Strategic Management of Malaysian AirlineDocument7 pagesStrategic Management of Malaysian AirlineGeneisseNo ratings yet

- Management AirasiaDocument18 pagesManagement AirasiaFarah WahidaNo ratings yet

- Management Air AsiaDocument19 pagesManagement Air AsiaPrisy ChooNo ratings yet

- UMW Case StudyDocument7 pagesUMW Case StudyThirah TajudinNo ratings yet

- Good Business Ethics Practices by AirasiaDocument13 pagesGood Business Ethics Practices by AirasiaIzaniey IsmailNo ratings yet

- Topic 4 Managerial Ethics and The Rule of LawDocument20 pagesTopic 4 Managerial Ethics and The Rule of LawNoorizan Mohd EsaNo ratings yet

- FireFly Case StudyDocument14 pagesFireFly Case StudyNur Hidayah Zaffrie100% (1)

- Individual Task (Name: Ho Tat Peng No. Matric: A18A0176) ACS4103 L1 1. Pick One Malaysia Companies Operated InternationallyDocument2 pagesIndividual Task (Name: Ho Tat Peng No. Matric: A18A0176) ACS4103 L1 1. Pick One Malaysia Companies Operated InternationallyHo Tat Peng100% (1)

- BBPS4103Document12 pagesBBPS4103Ervana Yahya100% (1)

- Strategic HR MangmntDocument16 pagesStrategic HR MangmntAnonymous N0mQBENo ratings yet

- Airasia: Now Everyone Can FlyDocument13 pagesAirasia: Now Everyone Can FlyHammad Gillani100% (1)

- Air Asia Case StudyDocument14 pagesAir Asia Case StudySofi JailaniNo ratings yet

- Air AsiaDocument8 pagesAir AsiaViCky PhangNo ratings yet

- Introduction To Strateic Management AirADocument19 pagesIntroduction To Strateic Management AirAMani SelvanNo ratings yet

- Swot of AirasiaDocument13 pagesSwot of AirasiaShirley LinNo ratings yet

- Muhammad Izwan Yusof - Sustaining Competitive Edge For Mas and Air AsiaDocument27 pagesMuhammad Izwan Yusof - Sustaining Competitive Edge For Mas and Air AsiaIzwan Yusof100% (2)

- Read The Following Excerpt From A Complaint Filed by TheDocument1 pageRead The Following Excerpt From A Complaint Filed by TheLet's Talk With Hassan0% (1)

- CSR in Malaysian Aviation IndustryDocument12 pagesCSR in Malaysian Aviation IndustryY.Nirmala Yellamalai0% (1)

- Space Matrix MalindoDocument7 pagesSpace Matrix MalindomaliklduNo ratings yet

- Assignment 2 - AirAsiaDocument8 pagesAssignment 2 - AirAsiaRevathi PattuNo ratings yet

- BSMH 2013 Human Resources ManagementDocument10 pagesBSMH 2013 Human Resources ManagementElyxa EndahNo ratings yet

- Ch1 Critical Thinking Four Perspectives of Organizational EffectivenessDocument2 pagesCh1 Critical Thinking Four Perspectives of Organizational Effectivenesskayti121167% (3)

- Marketing Management & Strategy - Assignment 2Document18 pagesMarketing Management & Strategy - Assignment 2mialoves160579No ratings yet

- AirAsia Covid-19 StrategyDocument19 pagesAirAsia Covid-19 StrategyWinterfell Davidson0% (1)

- ADS 404 Chapter1Document14 pagesADS 404 Chapter1Damon CopelandNo ratings yet

- Air AsiaDocument20 pagesAir AsiaAngela TianNo ratings yet

- Assignment MAS NewDocument8 pagesAssignment MAS NewZolkefli AhmadNo ratings yet

- Ioi Group BackgroundDocument1 pageIoi Group Backgroundscribdoobidoo100% (1)

- BBGP4103 Consumer BehaviourDocument6 pagesBBGP4103 Consumer Behaviournartina sadzilNo ratings yet

- Product Life CycleDocument5 pagesProduct Life CycleEkkala Naruttey0% (1)

- Strategic ManagementDocument9 pagesStrategic ManagementRuishabh RunwalNo ratings yet

- AirAsia AR 2017 PDFDocument386 pagesAirAsia AR 2017 PDFMARVEL WONG SOON MINGNo ratings yet

- Maybank Nature of BusinessDocument1 pageMaybank Nature of Businesssyahir0% (1)

- ReferencesDocument9 pagesReferencesFarah WahidaNo ratings yet

- The BCG MatrixDocument6 pagesThe BCG MatrixGuest HouseNo ratings yet

- Executive SummaryDocument20 pagesExecutive SummaryDevagi Tamilselvan0% (1)

- Socioeconomic Impact of Cebu Pacific Airlines IncDocument12 pagesSocioeconomic Impact of Cebu Pacific Airlines IncAkirha SoNo ratings yet

- Imr451 - AirasiaDocument58 pagesImr451 - AirasiaAzz Izumi100% (1)

- Air Asia Marketing PlanDocument18 pagesAir Asia Marketing PlanDharshviny Sasidharan100% (1)

- Horizontal Analysis United Plantation LatestDocument33 pagesHorizontal Analysis United Plantation Latestwawan100% (1)

- 2021-Air Asia-Case Study-Prof. Khaliq Ahmad: January 2021Document6 pages2021-Air Asia-Case Study-Prof. Khaliq Ahmad: January 2021Class&dayNo ratings yet

- E Commerce - AirAsiaDocument25 pagesE Commerce - AirAsiakhormm100% (3)

- Final Assessment PDFDocument2 pagesFinal Assessment PDFizzarulshazwanNo ratings yet

- Group Assignment Ibm530Document29 pagesGroup Assignment Ibm530Sara Mazlan100% (2)

- A143 Sqqs1013 Ga Group 10Document9 pagesA143 Sqqs1013 Ga Group 10Nurul Farhan IbrahimNo ratings yet

- Positioning Malaysia in the International Arena: Perdana Discourse Series 5From EverandPositioning Malaysia in the International Arena: Perdana Discourse Series 5No ratings yet

- AirAsia Case Study Report1Document5 pagesAirAsia Case Study Report1Muhammad IbrahimNo ratings yet

- Airasia InfoDocument17 pagesAirasia InfoMay Zaw100% (2)

- 123 ReviseDocument5 pages123 ReviseRose Ann Bagalawis AquinoNo ratings yet

- Strengths, Weaknesses, Opportunities and Threats Analysis For Airasia 1.0 StrengthsDocument3 pagesStrengths, Weaknesses, Opportunities and Threats Analysis For Airasia 1.0 StrengthsNora Nieza AbdullahNo ratings yet

- Air Asia AssignmentDocument8 pagesAir Asia AssignmentFoo Shu Fong100% (1)

- Final Answer For AssignmentDocument19 pagesFinal Answer For AssignmentKitty KarenNo ratings yet

- Case 5 - G65Document5 pagesCase 5 - G65Rabeya AktarNo ratings yet

- Air Asia Group Assignment Project Mini OMDocument7 pagesAir Asia Group Assignment Project Mini OMyanuar triyantoraharjoNo ratings yet

- Competitive Analysis For Air AsiaDocument3 pagesCompetitive Analysis For Air AsiaEmon Bhuyan0% (1)

- Strategic Management Assignment Part B AirAsia - EditedDocument36 pagesStrategic Management Assignment Part B AirAsia - EditedRaja Deran43% (7)

- (I) Strengths: Situation Analysis Swot AnalysisDocument7 pages(I) Strengths: Situation Analysis Swot AnalysiscalebwlyNo ratings yet

- Airasia SWOTDocument2 pagesAirasia SWOTOmid Ptok100% (1)

- Codes For CAS Basic and Patent Family Members: (1-Cjlis-Pllj Ca Licw ADocument25 pagesCodes For CAS Basic and Patent Family Members: (1-Cjlis-Pllj Ca Licw ANguyen Phi LongNo ratings yet

- Afc Futsal Club Championship 2018 Rights Protection ProgrammeDocument20 pagesAfc Futsal Club Championship 2018 Rights Protection Programme4zjb9cxqjzNo ratings yet

- Kalender 2024 PoscoDocument26 pagesKalender 2024 PoscoJundi FaizyNo ratings yet

- Update KSML Assignment 181010Document13 pagesUpdate KSML Assignment 181010Anwar HossainNo ratings yet

- M1. Introduction To Cost and Management AccountingDocument11 pagesM1. Introduction To Cost and Management AccountingLara Camille CelestialNo ratings yet

- OmanAir Cargo Worldwide Contacts 2016Document32 pagesOmanAir Cargo Worldwide Contacts 2016Wasim Shah100% (1)

- Requirement 1: Shazam Cash BudgetDocument4 pagesRequirement 1: Shazam Cash BudgetVixen Aaron EnriquezNo ratings yet

- CVWaqquas AkhtarDocument4 pagesCVWaqquas AkhtarAliya HussainNo ratings yet

- Chapter9 OutlineDocument3 pagesChapter9 OutlineMajesty AlfaroNo ratings yet

- Ice Fili Analysis: Presented by Group11-Anuraj Antil Ishan Malik Kanishka Singh Sunny Malik Surya DeswalDocument13 pagesIce Fili Analysis: Presented by Group11-Anuraj Antil Ishan Malik Kanishka Singh Sunny Malik Surya DeswalKanishka SinghNo ratings yet

- MJ Diamond - Memo InvoiceDocument1 pageMJ Diamond - Memo Invoiceyogesh padilkarNo ratings yet

- Dynanet DN2 Eq Broch enDocument2 pagesDynanet DN2 Eq Broch enDaniloNo ratings yet

- M. Com. I Management Concepts Paper-I AllDocument95 pagesM. Com. I Management Concepts Paper-I AllatuldipsNo ratings yet

- Project Report ON Ornaments Manufacturing (Silver, Gold, Bronze and Other Metels) Under P.M.E.G.PDocument7 pagesProject Report ON Ornaments Manufacturing (Silver, Gold, Bronze and Other Metels) Under P.M.E.G.PGlobal Law FirmNo ratings yet

- PDF Document 2Document2 pagesPDF Document 22x79ttmmmwNo ratings yet

- Compilation of All Activities: Opol Community College Poblacion, Opol Misamis OrientalDocument24 pagesCompilation of All Activities: Opol Community College Poblacion, Opol Misamis OrientalAngie CondezaNo ratings yet

- 237.esponcilla v. Bagong Tanyag 529 SCRA 654Document8 pages237.esponcilla v. Bagong Tanyag 529 SCRA 654Trebx Sanchez de GuzmanNo ratings yet

- A Standard Operating ProcedureDocument4 pagesA Standard Operating ProcedureSanjayNo ratings yet

- Maintenance Schedules of Mining HEMM Using An OptiDocument9 pagesMaintenance Schedules of Mining HEMM Using An OptinarendrasinghsjsNo ratings yet

- Reliance Industries LimitedDocument17 pagesReliance Industries LimitedAananNo ratings yet

- Unit 4 Consumer Buying BehaviourDocument17 pagesUnit 4 Consumer Buying BehaviourNaman MaheshwariNo ratings yet

- Success Factor Technology and Product Development: Enercon MagazineDocument16 pagesSuccess Factor Technology and Product Development: Enercon MagazineTuan DzungNo ratings yet

- ERI Titles EnglishDocument2 pagesERI Titles Englishtrravi1983No ratings yet

- Ent300 Case StudyDocument17 pagesEnt300 Case StudyAlya DiyanahNo ratings yet

- Full Download Core Concepts of Accounting Information Systems 13th Edition Simkin Test BankDocument35 pagesFull Download Core Concepts of Accounting Information Systems 13th Edition Simkin Test Bankhhagyalexik100% (44)

- Growth Strategies in BusinessDocument4 pagesGrowth Strategies in BusinessShweta raiNo ratings yet

- Muhammad Saiful (Proposal0Document73 pagesMuhammad Saiful (Proposal0noralizan azizNo ratings yet

- Footwear Sector Report by PBC 2Document130 pagesFootwear Sector Report by PBC 2Khalid Hameed KhanNo ratings yet

- I. Industry Background: Top Producers of Pork Meat Year 2020Document18 pagesI. Industry Background: Top Producers of Pork Meat Year 2020Yannah HidalgoNo ratings yet

Pest Analysis

Pest Analysis

Uploaded by

YIyi-Shang KardosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pest Analysis

Pest Analysis

Uploaded by

YIyi-Shang KardosCopyright:

Available Formats

Pest analysis Introduction Purpose The purpose of this analysis is to conduct an environmental analysis in the context of AirAsia's international

business operations, describing the major variables involved and the impact of the specific threats and opportunities confronted by AirAsia besides that, this analysis also helps to identify AirAsia's competitive strategy and analyse how the strategy is implemented to gain competitive advantage. Background on AirAsia AirAsia was set up by Dato' Tony Fernandes in 2001. In December 2001, Fernandes and his partners set up Tune Air Sdn Bhd (Tune Air), an airline holding company then bought over AirAsia. Now, AirAsia has become one of the most successful airlines in the Southeast Asian region and the pioneer of low cost and no frills travel in Malaysia . The airline now flies to over 40 destinations in Malaysia, Thailand, Indonesia, Macau, China, Philippines, Cambodia, Vietnam and Myanmar. AirAsia has formed 2 successful joint ventures in Thailand through Thai AirAsia, and Indonesia through AWAIR. Starti ng from 2 aircraft till now AirAsia owns 28 and has carried more than 223 millions guest through its low fares travel. 2.0 External Environment Analysis 2.1 Political Flying outside Malaysia is difficult. Bilateral agreement is one of the obstacles in t he way of truly pan-Asia budget carriers. Landing charges at so-called "gateway airports" and navigation charges are often prohibitively expensive, and in key destinations like Bangkok, Beijing, Hong Kong and Singapore there are no cheaper, secondary airpo rts. The budget airline industry in south-east Asia has been underdeveloped because the aviation market is tightly regulated by bilateral air rights agreements. Threat of terrorism, people is afraid to fly after the September 11 terrorist attacks incident. 2.2 Economic In spite of stiff competition from Malaysian Airline (MAS), AirAsia's low -cost carriers offering cheap tickets and few in -flight services are gaining attraction in the region. In theory, Asia has most of the ingredients for making a budget airline work which has a huge and dense population base, the emergence of underused regional airports, a growing propensity among some upwardly mobile people to travel, and relatively high Internet usage. Rising incomes and economic growth are empowering more Asians to board aircraft. AirAsia, Malaysia's budget airline, has sold a 26 per cent stake to three foreign investors for US$26m as it prepares to meet increased competition in south -east Asia. . With the economy slowing down, more people will want to enjoy its cheap tickets. 2.3 Social Passengers are reluctant to board a no-frills airline for a long -haul flight. The longer the route, the less price -sensitive the passenger becomes. They don't want to be crammed into a plane for six or eight hours. Espe cially, when there are limited or no in-flight services. AirAsia wanted to become a company that worked on the basis of the average man in the street being able to afford our air fares, and people who would not have considered flying, or would not fly as o ften as they as do now. Outbreak of the Severe Acute Respiratory Syndrome (SARS) has scare people to fly. AirAsia commit to "Safety First"; comply with all regulatory agencies, set and maintain consistently high standards; ensure the security of staff and guests. 2.4 Technology AirAsia provides online service that combines air ticketing with hotel bookings, car hire and travel insurance. To help keep costs in check, Air Asia has pushed internet booking services. Particularly in parts of the region that ar e poorly served by road and rail infrastructure, people will prefer to travel by airplane. In August 2003, AirAsia became the first airline in t he world to introduce SMS booking where guests can now book their seats, check flight schedules and obtain lates t updates on AirAsia promotions from the convenience of their mobile phones. AirAsia also recently introduced GO Holiday, the airline's online programme where guests can book holiday packages online in real time AirAsia has bought in A320 to replace Boeing 737. The Airbus A320's improved fuel efficiency and extra capacity which leads to better performance and reliability.

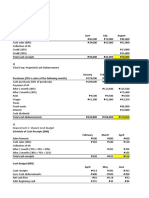

2.5 Summary of Opportunity and Threats Opportunity Low fares offer by AirAsia has encourage people from all walks of life style to fly . Especially, during economy down turn. Airbus A320 would encourage greater passenger capacity and offer comfortable service to customers. Introduction of SMS booking allows customer to book their seat at anytime and anywhere. With the commitment in ensur ing the security of staff and customers, they will have more confident to fly via AirAsia. Threats There are more no-frills airlines may take off in Asia to meet increasing consumer demand following the success story of Malaysia's budget carrier AirAsia.

Singapore Airlines plans to launch a budget carrier, they see the success of AirAsia. They know how big the market is and how good the opportunity is in Asia. Travelers may not choose AirAsia if they are to travel long distance flight. They will prefer ai rlines such as MAS or SIA which provide better services. Demand to fly decreased via terrorism and outbreak of the SARS. 3.0 Competitive Strategy Employed by AirAsia According to Chee and Harris (1998, p.237) much of the work on competitive strategy is pioneered by Michael Porter of Harvard University. Competitive strategies indicate the approaches that a company adopts in order to compete more effectively to strengthen its market position. Competitive strategy that is being employed by AirAsia is cost l eadership strategy. Cost leadership is a low cost competitive strategy that is targeted at the broad mass market. Under this strategy, AirAsia has lower overall costs than its competitors such as Malaysia airline (MAS) and Singapore airline (SIA). AirAsia, Asia's leading low fair airline has under -price its competitors and has gain a big market share in Malaysia and in Asia region as well. In the event of a price war, AirAsia who offers fares as low as RM0.99 (excluded airport tax) is in a positio n to withstand the competition better. Although AirAsia offers such a low fares, it is still likely to earn above average returns. To achieve a cost advantage, AirAsia

Porter Analysia

Threat of Entry There is a high barrier entering airlines industry since it r equires high capital to set up everything such as purchase or lease air craft, set up office, hire staffs, and etc. Thus, this has reduced the treat to Air Asia. Moreover, brand awareness is qu ite important in this industry. Hence, to enter this industry n ot only required high capital but also have to take some time to create brand awareness. Consumers always choose the product or service they really trust. Thus, instead of creating brand awareness, new entry has to create so called brand loyalty. Hence, th is is reducing treat to Air Asia too.( Roy L. Simerly) However, the government legislation is one of the barriers for entering airlines industry. For example, MAS has been protected by Malaysia government on the route to Sydney and Seoul Incheon.(Appendix) Therefore Air Asia find itself very difficult getting a new route from government. This not only affects the timeline set by Air Asia but also influence their profit. Nevertheless, this has limited the new entrance due to the government policy. In overall , the treat of entry is low to Air Asia. Power of suppliers Every industry has someone to play the role as suppliers. Power of the suppliers is important as it will affect the industry. In airline industry, the power of suppliers is quite high since ther e are only two major suppliers which are Airbus and Boeing hence there are not many choices to airline industry. Nevertheless, the global economic crisis has limited the new entrant an d also reducing the upgrade of planes in the immediate future. However, both suppliers provide almost same standard aircrafts and hence the switching to Air Asia is low. Moreover, Air Asia placed a large amount of order from Airbus in order to expand its routes to international routes. As a result, the power of suppliers may b e reduced as Airbus's profit may be influenced by Air Asia.( Roy L. Simerly) Generally, the power of supply is moderate low to Air Asia. Power of buyers Buyers are one of the factors which will give influence the industry whether making profit or loss. Nowadays, those buyers are much more knowledgeable and high educated. Thus, they are very sensitive to the price no matter in what product or service. In this case, even Air Asia always provide lowest price to customers, but they still will make comparison between airlines. Secondly, to switch to other service is very simple because Air Asia is not the only one who provides airline servi ce. I.e. customers still can choose MAS, Tiger Airway, Firefly and etc.( Roy L. Simerly) Moreover, Air Asia always leaves customers an image as they always delay the flight. Hence, as an investor or business man, they will choose more reliable airlines instead of Air Asia. In this case, the power of buyers is quite high to Air Asia. Threat of substitutes Substitutes are products or services which can replace the original products or services and give almost same satisfaction to the consumers. In airline industry, there are two types of substitutes, indirect and direct substitutes. Indirect substitutes include train, bus, cruise and etc. On the other hand, direct substitutes indicate the other airline. Consumers usually prefer low cost. For example, from Kuala Lumpur to Singapore, there are few transports that consumers can choose such as bus, train and air travel. If the cust omer is going to a budgeted trip, definitely he will choose bus which is the lowest price among the three. Moreover, the technology is now make information much more easily to assess. Customers can easily compare the price among few airlines just by assess ing internet as internet make information more transparency. Nevertheless, the archipelago geographical structure in Malaysia make air travel is the most viable, efficient and convenient mode of transportation. For example, travel from Kuala Lumpur to Bang kok, the customer may choose to take bus or air flight. However, air plane are much more convenient and also lesser time consuming compare with taking bus to Bangkok. Thus, the threat of substitutes is moderate to Air Asia.

Rivalry among existing competitors In every industry, there is positive or negative trend to industry growth rate. If there is positive trend, then the firms ha ve not to steal the market share among them. However, in airline industry, the growth rate is really low due to limited custo mers. Thus, in order to expand, Air Asia has to steal the market share from its competitors.( Roy L. Simerly) Secondly, Air Asia leads the main battlefield in price among competitors due to its low operating costs. However, there are more competitors enter to airline industry who have major carriers as their backers or owners which may lead to unreasonable' price war in the future. Moreover, Air Asia is not the only one who provides airline service. There are few low cost carriers such as Firefly, Tiger Airway and etc which makes their services provided weak differentiation. Thus, it becomes a threat to Air Asia. In this case, the rivalry among existing competitors is quite high to Air Asia.

You might also like

- International Economics 8th Edition Husted Test BankDocument10 pagesInternational Economics 8th Edition Husted Test Bankjethrodavide6qi100% (28)

- The Strategic Management of Airasia Tune GroupDocument6 pagesThe Strategic Management of Airasia Tune GroupJuni LinNo ratings yet

- Asm401 - Individual Reflection PaperDocument4 pagesAsm401 - Individual Reflection PaperHaa'ilah AzharNo ratings yet

- Strategic Management of Malaysian AirlineDocument7 pagesStrategic Management of Malaysian AirlineGeneisseNo ratings yet

- Management AirasiaDocument18 pagesManagement AirasiaFarah WahidaNo ratings yet

- Management Air AsiaDocument19 pagesManagement Air AsiaPrisy ChooNo ratings yet

- UMW Case StudyDocument7 pagesUMW Case StudyThirah TajudinNo ratings yet

- Good Business Ethics Practices by AirasiaDocument13 pagesGood Business Ethics Practices by AirasiaIzaniey IsmailNo ratings yet

- Topic 4 Managerial Ethics and The Rule of LawDocument20 pagesTopic 4 Managerial Ethics and The Rule of LawNoorizan Mohd EsaNo ratings yet

- FireFly Case StudyDocument14 pagesFireFly Case StudyNur Hidayah Zaffrie100% (1)

- Individual Task (Name: Ho Tat Peng No. Matric: A18A0176) ACS4103 L1 1. Pick One Malaysia Companies Operated InternationallyDocument2 pagesIndividual Task (Name: Ho Tat Peng No. Matric: A18A0176) ACS4103 L1 1. Pick One Malaysia Companies Operated InternationallyHo Tat Peng100% (1)

- BBPS4103Document12 pagesBBPS4103Ervana Yahya100% (1)

- Strategic HR MangmntDocument16 pagesStrategic HR MangmntAnonymous N0mQBENo ratings yet

- Airasia: Now Everyone Can FlyDocument13 pagesAirasia: Now Everyone Can FlyHammad Gillani100% (1)

- Air Asia Case StudyDocument14 pagesAir Asia Case StudySofi JailaniNo ratings yet

- Air AsiaDocument8 pagesAir AsiaViCky PhangNo ratings yet

- Introduction To Strateic Management AirADocument19 pagesIntroduction To Strateic Management AirAMani SelvanNo ratings yet

- Swot of AirasiaDocument13 pagesSwot of AirasiaShirley LinNo ratings yet

- Muhammad Izwan Yusof - Sustaining Competitive Edge For Mas and Air AsiaDocument27 pagesMuhammad Izwan Yusof - Sustaining Competitive Edge For Mas and Air AsiaIzwan Yusof100% (2)

- Read The Following Excerpt From A Complaint Filed by TheDocument1 pageRead The Following Excerpt From A Complaint Filed by TheLet's Talk With Hassan0% (1)

- CSR in Malaysian Aviation IndustryDocument12 pagesCSR in Malaysian Aviation IndustryY.Nirmala Yellamalai0% (1)

- Space Matrix MalindoDocument7 pagesSpace Matrix MalindomaliklduNo ratings yet

- Assignment 2 - AirAsiaDocument8 pagesAssignment 2 - AirAsiaRevathi PattuNo ratings yet

- BSMH 2013 Human Resources ManagementDocument10 pagesBSMH 2013 Human Resources ManagementElyxa EndahNo ratings yet

- Ch1 Critical Thinking Four Perspectives of Organizational EffectivenessDocument2 pagesCh1 Critical Thinking Four Perspectives of Organizational Effectivenesskayti121167% (3)

- Marketing Management & Strategy - Assignment 2Document18 pagesMarketing Management & Strategy - Assignment 2mialoves160579No ratings yet

- AirAsia Covid-19 StrategyDocument19 pagesAirAsia Covid-19 StrategyWinterfell Davidson0% (1)

- ADS 404 Chapter1Document14 pagesADS 404 Chapter1Damon CopelandNo ratings yet

- Air AsiaDocument20 pagesAir AsiaAngela TianNo ratings yet

- Assignment MAS NewDocument8 pagesAssignment MAS NewZolkefli AhmadNo ratings yet

- Ioi Group BackgroundDocument1 pageIoi Group Backgroundscribdoobidoo100% (1)

- BBGP4103 Consumer BehaviourDocument6 pagesBBGP4103 Consumer Behaviournartina sadzilNo ratings yet

- Product Life CycleDocument5 pagesProduct Life CycleEkkala Naruttey0% (1)

- Strategic ManagementDocument9 pagesStrategic ManagementRuishabh RunwalNo ratings yet

- AirAsia AR 2017 PDFDocument386 pagesAirAsia AR 2017 PDFMARVEL WONG SOON MINGNo ratings yet

- Maybank Nature of BusinessDocument1 pageMaybank Nature of Businesssyahir0% (1)

- ReferencesDocument9 pagesReferencesFarah WahidaNo ratings yet

- The BCG MatrixDocument6 pagesThe BCG MatrixGuest HouseNo ratings yet

- Executive SummaryDocument20 pagesExecutive SummaryDevagi Tamilselvan0% (1)

- Socioeconomic Impact of Cebu Pacific Airlines IncDocument12 pagesSocioeconomic Impact of Cebu Pacific Airlines IncAkirha SoNo ratings yet

- Imr451 - AirasiaDocument58 pagesImr451 - AirasiaAzz Izumi100% (1)

- Air Asia Marketing PlanDocument18 pagesAir Asia Marketing PlanDharshviny Sasidharan100% (1)

- Horizontal Analysis United Plantation LatestDocument33 pagesHorizontal Analysis United Plantation Latestwawan100% (1)

- 2021-Air Asia-Case Study-Prof. Khaliq Ahmad: January 2021Document6 pages2021-Air Asia-Case Study-Prof. Khaliq Ahmad: January 2021Class&dayNo ratings yet

- E Commerce - AirAsiaDocument25 pagesE Commerce - AirAsiakhormm100% (3)

- Final Assessment PDFDocument2 pagesFinal Assessment PDFizzarulshazwanNo ratings yet

- Group Assignment Ibm530Document29 pagesGroup Assignment Ibm530Sara Mazlan100% (2)

- A143 Sqqs1013 Ga Group 10Document9 pagesA143 Sqqs1013 Ga Group 10Nurul Farhan IbrahimNo ratings yet

- Positioning Malaysia in the International Arena: Perdana Discourse Series 5From EverandPositioning Malaysia in the International Arena: Perdana Discourse Series 5No ratings yet

- AirAsia Case Study Report1Document5 pagesAirAsia Case Study Report1Muhammad IbrahimNo ratings yet

- Airasia InfoDocument17 pagesAirasia InfoMay Zaw100% (2)

- 123 ReviseDocument5 pages123 ReviseRose Ann Bagalawis AquinoNo ratings yet

- Strengths, Weaknesses, Opportunities and Threats Analysis For Airasia 1.0 StrengthsDocument3 pagesStrengths, Weaknesses, Opportunities and Threats Analysis For Airasia 1.0 StrengthsNora Nieza AbdullahNo ratings yet

- Air Asia AssignmentDocument8 pagesAir Asia AssignmentFoo Shu Fong100% (1)

- Final Answer For AssignmentDocument19 pagesFinal Answer For AssignmentKitty KarenNo ratings yet

- Case 5 - G65Document5 pagesCase 5 - G65Rabeya AktarNo ratings yet

- Air Asia Group Assignment Project Mini OMDocument7 pagesAir Asia Group Assignment Project Mini OMyanuar triyantoraharjoNo ratings yet

- Competitive Analysis For Air AsiaDocument3 pagesCompetitive Analysis For Air AsiaEmon Bhuyan0% (1)

- Strategic Management Assignment Part B AirAsia - EditedDocument36 pagesStrategic Management Assignment Part B AirAsia - EditedRaja Deran43% (7)

- (I) Strengths: Situation Analysis Swot AnalysisDocument7 pages(I) Strengths: Situation Analysis Swot AnalysiscalebwlyNo ratings yet

- Airasia SWOTDocument2 pagesAirasia SWOTOmid Ptok100% (1)

- Codes For CAS Basic and Patent Family Members: (1-Cjlis-Pllj Ca Licw ADocument25 pagesCodes For CAS Basic and Patent Family Members: (1-Cjlis-Pllj Ca Licw ANguyen Phi LongNo ratings yet

- Afc Futsal Club Championship 2018 Rights Protection ProgrammeDocument20 pagesAfc Futsal Club Championship 2018 Rights Protection Programme4zjb9cxqjzNo ratings yet

- Kalender 2024 PoscoDocument26 pagesKalender 2024 PoscoJundi FaizyNo ratings yet

- Update KSML Assignment 181010Document13 pagesUpdate KSML Assignment 181010Anwar HossainNo ratings yet

- M1. Introduction To Cost and Management AccountingDocument11 pagesM1. Introduction To Cost and Management AccountingLara Camille CelestialNo ratings yet

- OmanAir Cargo Worldwide Contacts 2016Document32 pagesOmanAir Cargo Worldwide Contacts 2016Wasim Shah100% (1)

- Requirement 1: Shazam Cash BudgetDocument4 pagesRequirement 1: Shazam Cash BudgetVixen Aaron EnriquezNo ratings yet

- CVWaqquas AkhtarDocument4 pagesCVWaqquas AkhtarAliya HussainNo ratings yet

- Chapter9 OutlineDocument3 pagesChapter9 OutlineMajesty AlfaroNo ratings yet

- Ice Fili Analysis: Presented by Group11-Anuraj Antil Ishan Malik Kanishka Singh Sunny Malik Surya DeswalDocument13 pagesIce Fili Analysis: Presented by Group11-Anuraj Antil Ishan Malik Kanishka Singh Sunny Malik Surya DeswalKanishka SinghNo ratings yet

- MJ Diamond - Memo InvoiceDocument1 pageMJ Diamond - Memo Invoiceyogesh padilkarNo ratings yet

- Dynanet DN2 Eq Broch enDocument2 pagesDynanet DN2 Eq Broch enDaniloNo ratings yet

- M. Com. I Management Concepts Paper-I AllDocument95 pagesM. Com. I Management Concepts Paper-I AllatuldipsNo ratings yet

- Project Report ON Ornaments Manufacturing (Silver, Gold, Bronze and Other Metels) Under P.M.E.G.PDocument7 pagesProject Report ON Ornaments Manufacturing (Silver, Gold, Bronze and Other Metels) Under P.M.E.G.PGlobal Law FirmNo ratings yet

- PDF Document 2Document2 pagesPDF Document 22x79ttmmmwNo ratings yet

- Compilation of All Activities: Opol Community College Poblacion, Opol Misamis OrientalDocument24 pagesCompilation of All Activities: Opol Community College Poblacion, Opol Misamis OrientalAngie CondezaNo ratings yet

- 237.esponcilla v. Bagong Tanyag 529 SCRA 654Document8 pages237.esponcilla v. Bagong Tanyag 529 SCRA 654Trebx Sanchez de GuzmanNo ratings yet

- A Standard Operating ProcedureDocument4 pagesA Standard Operating ProcedureSanjayNo ratings yet

- Maintenance Schedules of Mining HEMM Using An OptiDocument9 pagesMaintenance Schedules of Mining HEMM Using An OptinarendrasinghsjsNo ratings yet

- Reliance Industries LimitedDocument17 pagesReliance Industries LimitedAananNo ratings yet

- Unit 4 Consumer Buying BehaviourDocument17 pagesUnit 4 Consumer Buying BehaviourNaman MaheshwariNo ratings yet

- Success Factor Technology and Product Development: Enercon MagazineDocument16 pagesSuccess Factor Technology and Product Development: Enercon MagazineTuan DzungNo ratings yet

- ERI Titles EnglishDocument2 pagesERI Titles Englishtrravi1983No ratings yet

- Ent300 Case StudyDocument17 pagesEnt300 Case StudyAlya DiyanahNo ratings yet

- Full Download Core Concepts of Accounting Information Systems 13th Edition Simkin Test BankDocument35 pagesFull Download Core Concepts of Accounting Information Systems 13th Edition Simkin Test Bankhhagyalexik100% (44)

- Growth Strategies in BusinessDocument4 pagesGrowth Strategies in BusinessShweta raiNo ratings yet

- Muhammad Saiful (Proposal0Document73 pagesMuhammad Saiful (Proposal0noralizan azizNo ratings yet

- Footwear Sector Report by PBC 2Document130 pagesFootwear Sector Report by PBC 2Khalid Hameed KhanNo ratings yet

- I. Industry Background: Top Producers of Pork Meat Year 2020Document18 pagesI. Industry Background: Top Producers of Pork Meat Year 2020Yannah HidalgoNo ratings yet