Professional Documents

Culture Documents

Fundamental Analysis

Fundamental Analysis

Uploaded by

Divyesh BavisiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Analysis

Fundamental Analysis

Uploaded by

Divyesh BavisiCopyright:

Available Formats

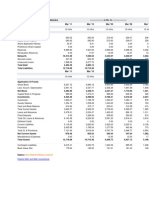

Key Financial Ratios of

Jindal Steel & Power

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

Operating Profit Margin(%)

Profit Before Interest And Tax

Margin(%)

Gross Profit Margin(%)

Cash Profit Margin(%)

Adjusted Cash Margin(%)

Net Profit Margin(%)

Adjusted Net Profit Margin(%)

Return On Capital Employed(%)

Return On Net Worth(%)

Adjusted Return on Net Worth(%)

Return on Assets Excluding

Revaluations

Return on Assets Including

Revaluations

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

Debt Coverage Ratios

Interest Cover

Total Debt to Owners Fund

Financial Charges Coverage Ratio

Financial Charges Coverage Ratio

Post Tax

Management Efficiency Ratios

Inventory Turnover Ratio

Debtors Turnover Ratio

Investments Turnover Ratio

Fixed Assets Turnover Ratio

------------------- in Rs. Cr. ------------------Mar

'11

Mar '10

Mar '09

Mar '08

Mar '

1.00

1.50

38.34

102.15

-0.03

83.02

1.00

1.25

26.79

78.90

-0.03

83.30

1.00

5.50

170.57

496.46

327.99

--

1.00

4.00

149.12

348.67

230.73

--

5.

18.

457.

1,144.

773.

37.53

34.78

34.35

42.76

40.

29.88

27.05

27.98

33.99

30.

30.33

28.41

28.41

21.30

21.30

14.60

23.76

23.77

27.80

26.49

26.68

19.82

19.59

14.86

21.94

21.94

28.71

26.71

26.71

19.50

19.50

23.16

28.38

30.87

34.35

33.99

33.99

22.79

22.79

24.95

32.95

37.11

30.

28.

28.

19.

19.

18.

28.

27.

92.95

72.41

349.96

243.78

809.

92.95

72.41

349.96

243.78

809.

14.60

13.88

25.01

26.60

21.

1.45

1.06

1.39

1.39

1.19

0.92

1.24

0.84

1.04

0.95

0.92

0.77

1.25

1.10

1.03

0.90

0.

0.

1.

1.

10.66

1.39

13.07

7.91

1.24

13.57

10.33

0.92

10.59

8.45

1.03

9.68

6.

1.

8.

10.66

11.35

8.35

7.95

7.

4.75

14.04

4.75

0.75

8.05

14.49

5.94

0.83

9.08

22.62

9.08

1.04

7.01

17.67

7.01

0.91

6.

11.

6.

0.

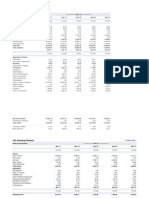

Total Assets Turnover Ratio

Asset Turnover Ratio

Average Raw Material Holding

Average Finished Goods Held

Number of Days In Working Capital

Profit & Loss Account Ratios

Material Cost Composition

Imported Composition of Raw

Materials Consumed

Selling Distribution Cost Composition

Expenses as Composition of Total

Sales

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit

Dividend Payout Ratio Cash Profit

Earning Retention Ratio

Cash Earning Retention Ratio

AdjustedCash Flow Times

Earnings Per Share

Book Value

0.46

0.75

--94.78

0.49

0.83

--45.07

0.74

1.04

40.04

37.94

50.53

0.70

0.91

85.56

50.88

79.41

0.

0.

95.

48.

21.

42.35

43.81

45.48

35.95

31.

40.09

46.23

31.97

46.77

--

--

4.26

4.93

7.

11.24

5.58

13.30

12.16

16.

6.97

5.23

93.03

94.78

4.40

8.16

6.06

91.84

93.94

4.21

5.55

4.33

94.90

95.95

2.36

5.86

4.29

94.79

96.07

2.09

9.

6.

90.

93.

3.

Mar

'11

Mar '10

Mar '09

Mar '08

Mar '

22.09

92.95

15.89

72.44

99.35

350.16

80.34

243.98

228.

810.

You might also like

- LBO Analysis TemplateDocument11 pagesLBO Analysis TemplateBobby Watkins75% (4)

- Classification of AccountsDocument3 pagesClassification of AccountsSaurav Aradhana100% (1)

- UGG - Valuation Stand Alone and With Synergies PDFDocument7 pagesUGG - Valuation Stand Alone and With Synergies PDFRachit PradhanNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisAnkush SharmaNo ratings yet

- Key Financial Ratios of HT Media: Print/Copy To ExcelDocument2 pagesKey Financial Ratios of HT Media: Print/Copy To ExcelRahul ShuklaNo ratings yet

- Ub RatiosDocument1 pageUb RatiosKelly WilkersonNo ratings yet

- Ambuja Cements: Standalone Balance SheetDocument12 pagesAmbuja Cements: Standalone Balance SheetcharujagwaniNo ratings yet

- Balance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Document5 pagesBalance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Raj ChauhanNo ratings yet

- Investment Valuation RatiosDocument2 pagesInvestment Valuation RatiosVikizz AgNo ratings yet

- Explore Mah and Mah Connections: Dion Global Solutions LimitedDocument4 pagesExplore Mah and Mah Connections: Dion Global Solutions LimitedSwati SinghNo ratings yet

- Key Financial Ratios of Hindustan UnileverDocument2 pagesKey Financial Ratios of Hindustan UnileverswatiknoldusNo ratings yet

- Investment Valuation Ratios Profit and Loss Account RatiosDocument1 pageInvestment Valuation Ratios Profit and Loss Account RatiosAshu158No ratings yet

- Key Financial Ratios DefinitionsDocument25 pagesKey Financial Ratios DefinitionsGaurav HiraniNo ratings yet

- Consolidated Key Financial Ratios of IDBI BankDocument6 pagesConsolidated Key Financial Ratios of IDBI BankSunil ShawNo ratings yet

- Mar ' 13 Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09Document2 pagesMar ' 13 Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09अंजनी श्रीवास्तवNo ratings yet

- Mar '13 Mar '12 Mar '11 Mar '10 Mar '09Document2 pagesMar '13 Mar '12 Mar '11 Mar '10 Mar '09Chiranjit BardhanNo ratings yet

- Estimates of Working Results and Profitability (In Rs Lakhs Unless Otherwise Mentioned)Document19 pagesEstimates of Working Results and Profitability (In Rs Lakhs Unless Otherwise Mentioned)Sweta MishraNo ratings yet

- Key Financial RatiosDocument6 pagesKey Financial RatiosbanilbNo ratings yet

- Presentation On Analysis of Financial Statement and Ratio AnalysisDocument23 pagesPresentation On Analysis of Financial Statement and Ratio AnalysisRONANKI VIJAYA KUMARNo ratings yet

- Financial Ratio Analysis FormulasDocument4 pagesFinancial Ratio Analysis FormulasVaishali Jhaveri100% (1)

- Dabur India Balance SheetDocument5 pagesDabur India Balance SheetMadhur GumberNo ratings yet

- Key Financial Ratios of Bajaj AutoDocument6 pagesKey Financial Ratios of Bajaj Autohitman3886No ratings yet

- Balance Sheet of LIC Housing Finance - in Rs. Cr.Document10 pagesBalance Sheet of LIC Housing Finance - in Rs. Cr.Rohit JainNo ratings yet

- Unit V: Financial AccountingDocument31 pagesUnit V: Financial AccountingAbhishek Bose100% (2)

- Doubt Session Ratios 120424Document51 pagesDoubt Session Ratios 120424pre.meh21No ratings yet

- DCF Analysis JBDocument10 pagesDCF Analysis JBNoah100% (3)

- Summary of RatiosDocument4 pagesSummary of RatiosKalpak DeNo ratings yet

- Ratio AnalysisDocument113 pagesRatio AnalysisNAMAN SRIVASTAV100% (1)

- Financial Ratios Explanation: Icap Group S.ADocument15 pagesFinancial Ratios Explanation: Icap Group S.Asteven_c22003No ratings yet

- Corp BankingDocument132 pagesCorp BankingPravah ShuklaNo ratings yet

- BALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityDocument20 pagesBALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityAitzaz AliNo ratings yet

- Ratios Name of Bank: - Soneri Capital SectionDocument5 pagesRatios Name of Bank: - Soneri Capital SectionDaniyal AkhtarNo ratings yet

- Key Definitions - Financial RatiosDocument25 pagesKey Definitions - Financial Ratioswinnerme100% (1)

- Bank Fund Management - BFMDocument107 pagesBank Fund Management - BFMNur AlamNo ratings yet

- Axis Bank Profit & Loss Account - in Rs. Cr.Document1 pageAxis Bank Profit & Loss Account - in Rs. Cr.anon_153778168No ratings yet

- SL No Description A Liquidity RatiosDocument10 pagesSL No Description A Liquidity RatiosAshish SharmaNo ratings yet

- Financial Analysis of NokiaDocument2 pagesFinancial Analysis of NokiaShehry VibesNo ratings yet

- Financial Management: Friday 9 December 2011Document8 pagesFinancial Management: Friday 9 December 2011Hussain MeskinzadaNo ratings yet

- Financial Risk Analytics: ProjectreportDocument94 pagesFinancial Risk Analytics: ProjectreportFiza ss100% (1)

- Understanding Financial StatementsDocument53 pagesUnderstanding Financial StatementsRyanNo ratings yet

- Liquidity Ratios: Current RatioDocument7 pagesLiquidity Ratios: Current RatioClarisse PoliciosNo ratings yet

- Tata Steel Balance Sheet MethodologyDocument6 pagesTata Steel Balance Sheet MethodologyKarrizzmaticNo ratings yet

- Ratios AssignDocument9 pagesRatios AssignAsad HamidNo ratings yet

- Healthcare Deal Multiples (Select Transactions) - Part 1Document10 pagesHealthcare Deal Multiples (Select Transactions) - Part 1Reevolv Advisory Services Private LimitedNo ratings yet

- HO 4 Analisis Laporan KeuanganDocument44 pagesHO 4 Analisis Laporan KeuanganChintiaNo ratings yet

- Financial Ratio Analysis FormulasDocument4 pagesFinancial Ratio Analysis FormulasSreenivas Badiginchala100% (1)

- Return On Invested CapitalDocument40 pagesReturn On Invested Capitalhariyadi030267313100% (1)

- Financial ParametersDocument43 pagesFinancial ParametersJivaansha SinhaNo ratings yet

- Super Revised Valuation RatioDocument4 pagesSuper Revised Valuation RatioAnne GunhooNo ratings yet

- Axis Bank ValuvationDocument26 pagesAxis Bank ValuvationGermiya K JoseNo ratings yet

- Understanding Financial StatementsDocument60 pagesUnderstanding Financial StatementsAnonymous nD4Kwh100% (1)

- Industry: Full List of Nifty 50 CompaniesDocument6 pagesIndustry: Full List of Nifty 50 CompaniesDeepak RahejaNo ratings yet

- Chapter 6 Financial Statement AnalysisDocument72 pagesChapter 6 Financial Statement Analysissharktale2828No ratings yet

- Financial Statement Analysis Questions We Would Like AnsweredDocument9 pagesFinancial Statement Analysis Questions We Would Like AnsweredthakurvinodNo ratings yet

- Classification of Accounts PDFDocument3 pagesClassification of Accounts PDFLuzz Landicho100% (1)

- Ratio AnalysisDocument27 pagesRatio AnalysisPratik Thorat100% (1)

- Analysis of Financial StatementsDocument17 pagesAnalysis of Financial StatementsShilpa RajuNo ratings yet

- Book 1Document3 pagesBook 1prasadmvkNo ratings yet

- Business Ratios and Formulas: A Comprehensive GuideFrom EverandBusiness Ratios and Formulas: A Comprehensive GuideRating: 3 out of 5 stars3/5 (1)

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet