Professional Documents

Culture Documents

Security Analysis and Portfolio Management Selected Solutions To Problem Set #3: Section I: Portfolio Management 3) Portfolio Expected Return

Security Analysis and Portfolio Management Selected Solutions To Problem Set #3: Section I: Portfolio Management 3) Portfolio Expected Return

Uploaded by

Irfankhan ManiCopyright:

Available Formats

You might also like

- Homework 3: Pine Street Capital (Part I) : I Introduction and InstructionsDocument4 pagesHomework 3: Pine Street Capital (Part I) : I Introduction and Instructionslevan1225No ratings yet

- Cheat SheetDocument1 pageCheat Sheetakdhkjh100% (1)

- BF2201 Cheat Sheet FinalsDocument2 pagesBF2201 Cheat Sheet Finalssiewhong93100% (1)

- MOS 3311 Final NotesDocument33 pagesMOS 3311 Final Notesshakuntala12321No ratings yet

- Reckitt BenckiserDocument21 pagesReckitt Benckiseragrawalrohit_228384No ratings yet

- Ch11 Solutions 6thedDocument26 pagesCh11 Solutions 6thedMrinmay kunduNo ratings yet

- FM423 Practice Exam IIIDocument7 pagesFM423 Practice Exam IIIruonanNo ratings yet

- FIN437 Answers To The Recommended Questions Portfolio ManagementDocument6 pagesFIN437 Answers To The Recommended Questions Portfolio ManagementSenalNaldoNo ratings yet

- CFA1 - Corporate Finance and Equity Investment TrainingDocument177 pagesCFA1 - Corporate Finance and Equity Investment Traininglamkk0520No ratings yet

- Basics of Portfolio Theory: Goals: After Reading This Chapter, You WillDocument13 pagesBasics of Portfolio Theory: Goals: After Reading This Chapter, You WillLalrohlui RalteNo ratings yet

- The Capital Asset Pricing Model (CAPM)Document31 pagesThe Capital Asset Pricing Model (CAPM)Tanmay AbhijeetNo ratings yet

- Volatility Modelling: Next ChapterDocument33 pagesVolatility Modelling: Next ChapterMujeeb Ul Rahman MrkhosoNo ratings yet

- Chapter 11Document27 pagesChapter 11Sufyan KhanNo ratings yet

- MC 206 FDocument18 pagesMC 206 Fthella deva prasadNo ratings yet

- CH 22Document68 pagesCH 22Aireen TanioNo ratings yet

- FM423 Practice Exam IDocument8 pagesFM423 Practice Exam IruonanNo ratings yet

- 5021 Solutions 7Document7 pages5021 Solutions 7karsten_fdsNo ratings yet

- Corporate Finance CHDocument26 pagesCorporate Finance CHSK (아얀)No ratings yet

- 1.00/1.001 Introduction To Computers and Engineering Problem Solving Fall 2002 Problem Set 4 Due: Day 15 Problem 1. Stocks and Bonds (100 %)Document7 pages1.00/1.001 Introduction To Computers and Engineering Problem Solving Fall 2002 Problem Set 4 Due: Day 15 Problem 1. Stocks and Bonds (100 %)yekychNo ratings yet

- Finance&Accounting Uniseminar112Document354 pagesFinance&Accounting Uniseminar112JohnChiticNo ratings yet

- Securities Futures Products RefinementsDocument32 pagesSecurities Futures Products RefinementsCan BayirNo ratings yet

- Option On A CPPIDocument34 pagesOption On A CPPIdeepNo ratings yet

- American Finance AssociationDocument16 pagesAmerican Finance Associationsafa haddadNo ratings yet

- Forward and Future Pricing 2 FinalDocument24 pagesForward and Future Pricing 2 FinalRahul Singh100% (1)

- Arbitrage Pricing TheoryDocument16 pagesArbitrage Pricing Theorya_karimNo ratings yet

- Module 6 Introduction To Risk and Return Lecture SlidesDocument61 pagesModule 6 Introduction To Risk and Return Lecture SlidesZohaib AliNo ratings yet

- Chapter4 Risk and ReturnDocument70 pagesChapter4 Risk and ReturnOctari NabilaNo ratings yet

- An Empirical Study of Portfolio Selection For Optimally Hedged PortfoliosDocument24 pagesAn Empirical Study of Portfolio Selection For Optimally Hedged PortfoliosJuan CruzNo ratings yet

- Interest Rate RiskDocument11 pagesInterest Rate Riskmalikrocks3436No ratings yet

- Assignment 2Document3 pagesAssignment 2François VoisardNo ratings yet

- Chapter 11Document25 pagesChapter 11M Eduardo BasantesNo ratings yet

- Chapter 7-Risk, Return, and The Capital Asset Pricing Model Percentage ReturnDocument10 pagesChapter 7-Risk, Return, and The Capital Asset Pricing Model Percentage ReturnRabinNo ratings yet

- Chapter 11Document28 pagesChapter 11Khoa LêNo ratings yet

- Lecture 10 - CAPMDocument19 pagesLecture 10 - CAPMroBinNo ratings yet

- Note Reading 49Document4 pagesNote Reading 49Hà Thúy HằngNo ratings yet

- Lec5 Eim 2013Document25 pagesLec5 Eim 2013Amj91No ratings yet

- Financial Econ Field Exam Aug 11Document7 pagesFinancial Econ Field Exam Aug 11aberaeticha882No ratings yet

- Organizing The Investment Process: Chapter 10: Project AnalysisDocument3 pagesOrganizing The Investment Process: Chapter 10: Project Analysiscanadian_ehNo ratings yet

- CHap 5Document6 pagesCHap 5camlansuc09999No ratings yet

- Portfolio AnalysisDocument18 pagesPortfolio Analysisveggi expressNo ratings yet

- L1 R49 HY NotesDocument7 pagesL1 R49 HY Notesayesha ansariNo ratings yet

- 04 - Risk, Return, and Cost of CapitalDocument141 pages04 - Risk, Return, and Cost of Capitalrow rowNo ratings yet

- FRL 433 International Investment and DiversificationDocument38 pagesFRL 433 International Investment and DiversificationAnantharaman KarthicNo ratings yet

- Investment Risk and Return-1Document20 pagesInvestment Risk and Return-1kelvinyessa906No ratings yet

- U6018+Practice+Midterm+Exam Spring+2022 SolsDocument6 pagesU6018+Practice+Midterm+Exam Spring+2022 SolsKaren QNo ratings yet

- Financial Management Revision Notes 2023-24Document163 pagesFinancial Management Revision Notes 2023-24Shermaine ChuaNo ratings yet

- s-chpt3 FE FDocument23 pagess-chpt3 FE FAnonymous pnLzE69TFNo ratings yet

- Money, Banking & Finance: Risk, Return and Portfolio TheoryDocument39 pagesMoney, Banking & Finance: Risk, Return and Portfolio TheorysarahjohnsonNo ratings yet

- DSDocument57 pagesDSDelishaNo ratings yet

- Investments - Risk & ReturnDocument85 pagesInvestments - Risk & ReturnBushra JavedNo ratings yet

- FM423 Practice Exam II SolutionsDocument9 pagesFM423 Practice Exam II SolutionsruonanNo ratings yet

- Base Correlation ExplainedDocument20 pagesBase Correlation Explaineds_89No ratings yet

- Slides367 Investment Mangemnt Must PrintDocument454 pagesSlides367 Investment Mangemnt Must PrintneveenNo ratings yet

- Week 4 Lecture PDFDocument69 pagesWeek 4 Lecture PDFAkshat TiwariNo ratings yet

- Portfolio AnalysisDocument18 pagesPortfolio Analysissubscription accountNo ratings yet

- Managerial Finance Chapter 8 - Risk and Return by Endah RiwayatunDocument43 pagesManagerial Finance Chapter 8 - Risk and Return by Endah RiwayatunEndah Riwayatun100% (2)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Accounting For InvestmentsDocument17 pagesAccounting For InvestmentsPradeep Gupta100% (1)

- About Me Pic 42Document27 pagesAbout Me Pic 42Pradeep GuptaNo ratings yet

- Accounting EquationDocument18 pagesAccounting EquationPradeep Gupta100% (1)

- AccountDocument4 pagesAccountagrawalrohit_228384No ratings yet

- Abstract - Service MarketingDocument2 pagesAbstract - Service MarketingPradeep GuptaNo ratings yet

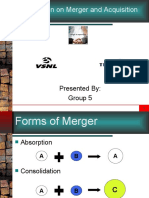

- Presentation On Merger and Acquisition: Presented By: Group 5Document22 pagesPresentation On Merger and Acquisition: Presented By: Group 5Pradeep GuptaNo ratings yet

- Differentiation StrategyDocument12 pagesDifferentiation StrategyTedtenor75% (4)

- Winter Internship Project (WIP) : Weekly Performance Report (WPR)Document4 pagesWinter Internship Project (WIP) : Weekly Performance Report (WPR)Pradeep GuptaNo ratings yet

- Ladies Day Out: Name of The Participant Contact NoDocument1 pageLadies Day Out: Name of The Participant Contact NoPradeep GuptaNo ratings yet

- Bhanu's ProjectDocument58 pagesBhanu's ProjectBhanuNo ratings yet

- Strategic Management: Project OnDocument8 pagesStrategic Management: Project OnPradeep GuptaNo ratings yet

- TEHELKA On India ElectionsDocument33 pagesTEHELKA On India ElectionsPradeep GuptaNo ratings yet

- Ad Analysis NokiaDocument28 pagesAd Analysis NokiaPradeep GuptaNo ratings yet

- Markeing Plan of NOKIApptDocument70 pagesMarkeing Plan of NOKIApptPradeep GuptaNo ratings yet

- Report On NOKIADocument61 pagesReport On NOKIAMuhammad Talal Ahmed Butt100% (6)

- India Elections 2009 Newspaper Articles After ResultsDocument58 pagesIndia Elections 2009 Newspaper Articles After ResultsPradeep GuptaNo ratings yet

Security Analysis and Portfolio Management Selected Solutions To Problem Set #3: Section I: Portfolio Management 3) Portfolio Expected Return

Security Analysis and Portfolio Management Selected Solutions To Problem Set #3: Section I: Portfolio Management 3) Portfolio Expected Return

Uploaded by

Irfankhan ManiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Security Analysis and Portfolio Management Selected Solutions To Problem Set #3: Section I: Portfolio Management 3) Portfolio Expected Return

Security Analysis and Portfolio Management Selected Solutions To Problem Set #3: Section I: Portfolio Management 3) Portfolio Expected Return

Uploaded by

Irfankhan ManiCopyright:

Available Formats

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Selected Solutions to Problem Set #3: Section I: Portfolio Management 3) Portfolio Expected

Return The expected return on the portfolio E[Rp ] is the value weighted sum of the expected returns on the individual securities, the E[Ri]:

where k is the number of securities in the portfolio. To calculate the value weights, Wi:

with Ai being the dollar value invested in security i. Example: If $1 million is invested in a portfolio of 2 securities, and there is $500,000 in each security, then each Wi = .5. Portfolio Standard Deviation As with calculating the risk for individual securities, calculations are done for the variance and the standard deviation is determined by taking a square root. Various types of EQUIVALENT forms for the portfolio variance:

In the double sum expression, when i=j the covariance is a variance. It is easiest to understand these results for the case where k = 2, when there are only two securities in the

portfolio. In this case:

Similarly for 3 assets in the portfolio:

The Minimum Variance Portfolio for Two Securities Which portfolio has the smallest risk? ----> Minimize the variance-Using the result that W1 + W2 = 1, for a portfolio with two securities:

The Portfolio Optimization Problem Different combinations of securities produce different combinations of E[Rp] and Fp In general, when there are k securities in the portfolio, the rational investor will wnat to choose he optimal combination of securities which achieves the smallest possible portfolio risk for a given level of expected return. This leads to the optimization problem associated with calculating the efficient frontier

subject to:

The efficient frontier provides a set of portfolios all with the smallest variance but with different levels of expected return. In various textbooks, the efficient set is also referred by other names, such as the investment opportunity set or the efficient set. Key point: The shape and location of the efficient frontier depends on whether short selling of securities is permitted. Special Case: In general where there are many possible securities, solution of the efficient set from the optimization problem is complicated. For purposes of illustration, it is usually assumed that there is only two risky securities. In this case it is possible to derive the efficient frontier directly and to illustrate the concepts. Measuring Expected Returns: Domestic and International Securities In the notation I will be using this is expressed R = (P1 - P0 + Div.)/P0 = [(P1 - P0)/P0] + [Div./P0] = [P1/P0] + [Div./P0] - 1 = Capital Gain (Loss) + Dividend (or Coupon) Yield R is often calculated over a specific interval, typically one year. Two different methods of determining the average over time: Arithmetic Average and Geometric Average The arithmetic average (RA) would sum the four R and divide by four to get the average. In general:

The geometric average (RG) uses the product of the growth rates:

Problems with the Arithmetic Average: Buy a stock for $100 First year stock falls to $50 (R = -50%) Second year stock rises to $100 (R = +100%) RA = (-50 + 100)/2 = 25%

RG = (1 + (-.5))(1 + 1) - 1 = 0% Arithmetic average provide correct results when averaging across different securities at one point in time Arithmetic average provides an unbiased estimate of the return over the next period, when using past history of past returns. Calculating the Domestic Return (R D) on a Security Denominated in Foreign Currency To calculate the domestic return, have to convert the values in R to domestic currency R = ((P1 S1) - (P0 S0) + (Div. S1))/(P0 S0)

International Investment Because of the presence of the exchange rate risk, the variance of this return is more complicated than for a domestic asset

The introduction of foreign assets into the portfolio significantly complicates the calculation of the portfolio variance. Example: Portfolio composed of one domestic and one foreign asset Using the variance formula for two securities from Lecture 2

Presence of foreign assets significantly complicates the portfolio variance Example: You are considering purchasing two portfolios. One portfolio is composed 50/50 of two

domestic assets each with E[R] = .1 and F = .15 and with a .5 correlation between the asset returns. The other portfolio is also 50/50 and contains one of these domestic assets and a foreign asset. The foreign asset has E[R$] = .1 with F = .15 and Fe = .03. The correlations between the foreign and domestic asset returns and between all the asset returns and the exchange rate are zero. a) Calculate the portfolio variance for these two portfolios. b) What can you conclude about the risk reduction properties of including foreign assets in your portfolio? Solution: a) The portfolio variance for the domestic assets is just the conventional result. To get the portfolio variance when there is a foreign asset observ that the return on a foreign asset when the return in denominated in domestic currency (R$) is given as: R$ = (1 + R) (1 + e) - 1 Taking logs and observing ln(1 + x) is approximately equal to x when x is sufficiently small produces the result:

Using the variance formula for two securities and doing appropriate substitutions, it follows that for a portfolio containing a foreign asset:

Evaluating the relevant formulas gives for the domestic portfolio var[Rdp ] = .016875 (Fdp = .13) and var[R$dp] = .011475 (F$dp = .107121) b) Due to the much lower correlation between domestic asset returns and foreign asset returns and the exchange rate (than with other domestic asset returns) including foreign assets enhances the diversification process considerably. The Efficient Frontier with International Assets Recall the equally weighted portfolio from Tutorial 5, #1. It was demonstrated that as the number of securities in the equally weighted portfolio increases, the variance of the portfolio is reduced to the covariance between the individual securities. Key Point: International assets differ from domestic assets in that the returns have a much lower covariance with domestic assets Foreign assets have low covariance with domestic assets for primarily two reasons: 1) The presence of exchange rate risk, which typically has low correlation with domestic and foreign security risks. 2) Foreign stock returns, denominated in foreign currency terms, have lower covariance with domestic

assets than domestic assets have with other domestic assets. Example: The US stock market has been on a bull run over the past four-five years while the Japanese stock market has been doing poorly. It is not always the case that foreign and domestic markets have low covariance. Both the Canadian and Hong Kong markets have historically had high covariance with US stocks. Because of the lower covariance with domestic assets, as well as by increasing the number of assets available for portfolio selection, international assets will produce an outward shift in the efficient frontier.

Section II: Derivative Securities 1) i) Warrants are issued by the company issuing the stock. As a result, when an investor exercises a warrant and buys the stock, the company issues new stock increasing the number of shares outstanding. The proceeds from the sale of stock represents a cash inflow to the company. Exercise of a call option involves only a transaction between two parties with either a cash settlement or an exchange of stock taking place. There is no impact on the number of shares outstanding. ii) Terms and conditions for call options are governed by standardized contracts, in the US specied by the Options Clearing Corporation. Standard options contracts have features such as regular expiration dates, the absence of dividend payout protection, and possibility of early exercise (American option). Most call option contracts have term to maturity when originally written of nine months and less. Warrant contracts are non-standardized and can have a wide variation in possible features (see page 298-9 of readings for a list of possible variations). When originally offered warrants are almost always long dated, with maturities around five years being common. 2) This question is answered on p.299-300 of the readings. An alternative derivation is given here. Assume for simplicity the firm is all equity financed. (If there is debt there are extra terms to write down but nothing much is changed). If the firm has N shares outstanding with a current market price of S(t) then the current market price is V(t) = N S(t). Now let the firm issue n European-style warrants with each warrant entitling the holder to purchase one share of stock at X at time T. Assume that these warrants are distributed on a pro-rata basis to the firm's shareholders of record. At time T, if the warrants are exercised then: V(T)* = N S(T) + n X = N (S(T) + q X) where q = n/N and S(T) is the stock price immediately before the warrants are exercised. The warrant holders, being smart investors, realize that for exercise to be profitable, it is not the price immediately prior to exercise which is relevant, but rather the stock price immediately after exercise S(T)* which is relevant. (Why?) It follows that: S(T)* = V(T)*/(N + n) = [S(T) + qX]/(1 + q) In other words, warrant exercise will occur if S(T)* > X which means: {[S(T) + qX]/(1 + q)} - X > 0

Manipulating gives: [S(T) + qX - (1+q)X]/(1+q) = [S(T) - X]/(1+q) > 0 Observing that the value of the warrant on the expiration date is: W(T) = max[0, S(T)* - X] = max[0, S(T) - X]/(1+q) = C(T)/(1+q) Because the current price of the warrant is the discounted expected value of the payout of the warrant at maturity, it follows: W(t) = C(t)/(1+q) 3)a) Question II.2 gave the adjustment to the Black-Scholes call price required to value the warrant: W = C/(1 + (n/N)). To determine the value of the warrant in this case requires the value of the call option to be estimated using the values provided. This requires an assumption about the dividends on the stock which, because none are stated will be assumed to be zero. Using the Black-Scholes formula for a nondividend paying stock gives C = 9.20 and doing the adjustment for the warrant price gives: W = 8.36 b) Assuming all the warrants are exercised, there will be 110,000 shares outstanding. Taking the $5.2 million to be the market value before the warrants have been exercised, the market value of the firm will rise by the $500,000 amount received from warrant exercise to give a stock price of $51.82.

You might also like

- Homework 3: Pine Street Capital (Part I) : I Introduction and InstructionsDocument4 pagesHomework 3: Pine Street Capital (Part I) : I Introduction and Instructionslevan1225No ratings yet

- Cheat SheetDocument1 pageCheat Sheetakdhkjh100% (1)

- BF2201 Cheat Sheet FinalsDocument2 pagesBF2201 Cheat Sheet Finalssiewhong93100% (1)

- MOS 3311 Final NotesDocument33 pagesMOS 3311 Final Notesshakuntala12321No ratings yet

- Reckitt BenckiserDocument21 pagesReckitt Benckiseragrawalrohit_228384No ratings yet

- Ch11 Solutions 6thedDocument26 pagesCh11 Solutions 6thedMrinmay kunduNo ratings yet

- FM423 Practice Exam IIIDocument7 pagesFM423 Practice Exam IIIruonanNo ratings yet

- FIN437 Answers To The Recommended Questions Portfolio ManagementDocument6 pagesFIN437 Answers To The Recommended Questions Portfolio ManagementSenalNaldoNo ratings yet

- CFA1 - Corporate Finance and Equity Investment TrainingDocument177 pagesCFA1 - Corporate Finance and Equity Investment Traininglamkk0520No ratings yet

- Basics of Portfolio Theory: Goals: After Reading This Chapter, You WillDocument13 pagesBasics of Portfolio Theory: Goals: After Reading This Chapter, You WillLalrohlui RalteNo ratings yet

- The Capital Asset Pricing Model (CAPM)Document31 pagesThe Capital Asset Pricing Model (CAPM)Tanmay AbhijeetNo ratings yet

- Volatility Modelling: Next ChapterDocument33 pagesVolatility Modelling: Next ChapterMujeeb Ul Rahman MrkhosoNo ratings yet

- Chapter 11Document27 pagesChapter 11Sufyan KhanNo ratings yet

- MC 206 FDocument18 pagesMC 206 Fthella deva prasadNo ratings yet

- CH 22Document68 pagesCH 22Aireen TanioNo ratings yet

- FM423 Practice Exam IDocument8 pagesFM423 Practice Exam IruonanNo ratings yet

- 5021 Solutions 7Document7 pages5021 Solutions 7karsten_fdsNo ratings yet

- Corporate Finance CHDocument26 pagesCorporate Finance CHSK (아얀)No ratings yet

- 1.00/1.001 Introduction To Computers and Engineering Problem Solving Fall 2002 Problem Set 4 Due: Day 15 Problem 1. Stocks and Bonds (100 %)Document7 pages1.00/1.001 Introduction To Computers and Engineering Problem Solving Fall 2002 Problem Set 4 Due: Day 15 Problem 1. Stocks and Bonds (100 %)yekychNo ratings yet

- Finance&Accounting Uniseminar112Document354 pagesFinance&Accounting Uniseminar112JohnChiticNo ratings yet

- Securities Futures Products RefinementsDocument32 pagesSecurities Futures Products RefinementsCan BayirNo ratings yet

- Option On A CPPIDocument34 pagesOption On A CPPIdeepNo ratings yet

- American Finance AssociationDocument16 pagesAmerican Finance Associationsafa haddadNo ratings yet

- Forward and Future Pricing 2 FinalDocument24 pagesForward and Future Pricing 2 FinalRahul Singh100% (1)

- Arbitrage Pricing TheoryDocument16 pagesArbitrage Pricing Theorya_karimNo ratings yet

- Module 6 Introduction To Risk and Return Lecture SlidesDocument61 pagesModule 6 Introduction To Risk and Return Lecture SlidesZohaib AliNo ratings yet

- Chapter4 Risk and ReturnDocument70 pagesChapter4 Risk and ReturnOctari NabilaNo ratings yet

- An Empirical Study of Portfolio Selection For Optimally Hedged PortfoliosDocument24 pagesAn Empirical Study of Portfolio Selection For Optimally Hedged PortfoliosJuan CruzNo ratings yet

- Interest Rate RiskDocument11 pagesInterest Rate Riskmalikrocks3436No ratings yet

- Assignment 2Document3 pagesAssignment 2François VoisardNo ratings yet

- Chapter 11Document25 pagesChapter 11M Eduardo BasantesNo ratings yet

- Chapter 7-Risk, Return, and The Capital Asset Pricing Model Percentage ReturnDocument10 pagesChapter 7-Risk, Return, and The Capital Asset Pricing Model Percentage ReturnRabinNo ratings yet

- Chapter 11Document28 pagesChapter 11Khoa LêNo ratings yet

- Lecture 10 - CAPMDocument19 pagesLecture 10 - CAPMroBinNo ratings yet

- Note Reading 49Document4 pagesNote Reading 49Hà Thúy HằngNo ratings yet

- Lec5 Eim 2013Document25 pagesLec5 Eim 2013Amj91No ratings yet

- Financial Econ Field Exam Aug 11Document7 pagesFinancial Econ Field Exam Aug 11aberaeticha882No ratings yet

- Organizing The Investment Process: Chapter 10: Project AnalysisDocument3 pagesOrganizing The Investment Process: Chapter 10: Project Analysiscanadian_ehNo ratings yet

- CHap 5Document6 pagesCHap 5camlansuc09999No ratings yet

- Portfolio AnalysisDocument18 pagesPortfolio Analysisveggi expressNo ratings yet

- L1 R49 HY NotesDocument7 pagesL1 R49 HY Notesayesha ansariNo ratings yet

- 04 - Risk, Return, and Cost of CapitalDocument141 pages04 - Risk, Return, and Cost of Capitalrow rowNo ratings yet

- FRL 433 International Investment and DiversificationDocument38 pagesFRL 433 International Investment and DiversificationAnantharaman KarthicNo ratings yet

- Investment Risk and Return-1Document20 pagesInvestment Risk and Return-1kelvinyessa906No ratings yet

- U6018+Practice+Midterm+Exam Spring+2022 SolsDocument6 pagesU6018+Practice+Midterm+Exam Spring+2022 SolsKaren QNo ratings yet

- Financial Management Revision Notes 2023-24Document163 pagesFinancial Management Revision Notes 2023-24Shermaine ChuaNo ratings yet

- s-chpt3 FE FDocument23 pagess-chpt3 FE FAnonymous pnLzE69TFNo ratings yet

- Money, Banking & Finance: Risk, Return and Portfolio TheoryDocument39 pagesMoney, Banking & Finance: Risk, Return and Portfolio TheorysarahjohnsonNo ratings yet

- DSDocument57 pagesDSDelishaNo ratings yet

- Investments - Risk & ReturnDocument85 pagesInvestments - Risk & ReturnBushra JavedNo ratings yet

- FM423 Practice Exam II SolutionsDocument9 pagesFM423 Practice Exam II SolutionsruonanNo ratings yet

- Base Correlation ExplainedDocument20 pagesBase Correlation Explaineds_89No ratings yet

- Slides367 Investment Mangemnt Must PrintDocument454 pagesSlides367 Investment Mangemnt Must PrintneveenNo ratings yet

- Week 4 Lecture PDFDocument69 pagesWeek 4 Lecture PDFAkshat TiwariNo ratings yet

- Portfolio AnalysisDocument18 pagesPortfolio Analysissubscription accountNo ratings yet

- Managerial Finance Chapter 8 - Risk and Return by Endah RiwayatunDocument43 pagesManagerial Finance Chapter 8 - Risk and Return by Endah RiwayatunEndah Riwayatun100% (2)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Accounting For InvestmentsDocument17 pagesAccounting For InvestmentsPradeep Gupta100% (1)

- About Me Pic 42Document27 pagesAbout Me Pic 42Pradeep GuptaNo ratings yet

- Accounting EquationDocument18 pagesAccounting EquationPradeep Gupta100% (1)

- AccountDocument4 pagesAccountagrawalrohit_228384No ratings yet

- Abstract - Service MarketingDocument2 pagesAbstract - Service MarketingPradeep GuptaNo ratings yet

- Presentation On Merger and Acquisition: Presented By: Group 5Document22 pagesPresentation On Merger and Acquisition: Presented By: Group 5Pradeep GuptaNo ratings yet

- Differentiation StrategyDocument12 pagesDifferentiation StrategyTedtenor75% (4)

- Winter Internship Project (WIP) : Weekly Performance Report (WPR)Document4 pagesWinter Internship Project (WIP) : Weekly Performance Report (WPR)Pradeep GuptaNo ratings yet

- Ladies Day Out: Name of The Participant Contact NoDocument1 pageLadies Day Out: Name of The Participant Contact NoPradeep GuptaNo ratings yet

- Bhanu's ProjectDocument58 pagesBhanu's ProjectBhanuNo ratings yet

- Strategic Management: Project OnDocument8 pagesStrategic Management: Project OnPradeep GuptaNo ratings yet

- TEHELKA On India ElectionsDocument33 pagesTEHELKA On India ElectionsPradeep GuptaNo ratings yet

- Ad Analysis NokiaDocument28 pagesAd Analysis NokiaPradeep GuptaNo ratings yet

- Markeing Plan of NOKIApptDocument70 pagesMarkeing Plan of NOKIApptPradeep GuptaNo ratings yet

- Report On NOKIADocument61 pagesReport On NOKIAMuhammad Talal Ahmed Butt100% (6)

- India Elections 2009 Newspaper Articles After ResultsDocument58 pagesIndia Elections 2009 Newspaper Articles After ResultsPradeep GuptaNo ratings yet