Professional Documents

Culture Documents

Investment Project Senior Research in Finance: The Economic Outlook & Analysis

Investment Project Senior Research in Finance: The Economic Outlook & Analysis

Uploaded by

pml1028Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Project Senior Research in Finance: The Economic Outlook & Analysis

Investment Project Senior Research in Finance: The Economic Outlook & Analysis

Uploaded by

pml1028Copyright:

Available Formats

Investment project Senior Research in Finance

The Economic Outlook & Analysis

A. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Summary of Economic Trends Business cycle Monetary policy Fiscal policy Economic indicators World events Foreign trade Public attitudes Inflation GDP growth Unemployment Productivity / Capacity utilization Money supply

A. Track of Economic Indicator for 10 years B. Growth Chart of Economic Indicator C. Prediction of Economic Indicator D. Conclusion

Industry Outlook & Analysis

A. Industry Prospectus 1. Life cycles 2. Industry structure 3. Government regulation 4. Supply demand relationships 5. Product quality 6. Cost elements 7. Research & development expenditures 8. Financial norms and standards

B. 10 years collection of industry production (if possible) C. Growth computation and chart D. Relationship between industry and economy E. Estimate industry sales F. Sustainable growth G. Conclusion

Company Outlook & Analysis

A. Fundamental analysis

1. Dividend growth model or PE model to arrive at intrinsic value 2. PE comparison 3. Beta estimation and examination of the relationship of your stock to DJIA and S&P 4. Forecast EPS over 5 years 5. Growth company, growth stock? 6. Financial Statement Analysis summary of 5 years a. Gross profit margin b. Operating profit margin c. Net margin d. ROA e. ROE f. ACP g. Inventory turnover h. FAT i. TAT j. Current ratio k. Quick ratio l. Net working capital to total assets m. LT debt to equity n. Total debt to equity o. Time interest earned p. Sustainable growth q. PE r. PB s. Div yield t. Div payment 7. Estimate using three different models: Intrinsic Value of the companys stock 8. Estimate of next year sales

9. Conclusion

B. Competitive analysis

1. Chart comparing your company to its two primary competitors a. Over 10 years: i. Growth in dividends ii. Net profit margin iii. Net profit in dollars iv. ROE v. LTD to equity vi. PE vii. Div yield viii. Div payout ix. Market share b. Over 10 week period: ROR/week Generally discuss beta differences 2. Conclusion 3. Security market line with company and competitors plotted and analysis

C. Technical analysis

1. Bar Chart daily for 10 weeks 2. Point and Figure Chart 3. Candlestick chart 4. Summary of patterns in each 5. Smart money rule 6. Overall market rule 7. Contrary opinion rule Whats the market doing? Your stock?

Project Summary

You might also like

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- The Economic Indicator Handbook: How to Evaluate Economic Trends to Maximize Profits and Minimize LossesFrom EverandThe Economic Indicator Handbook: How to Evaluate Economic Trends to Maximize Profits and Minimize LossesNo ratings yet

- Case Study - G MuraliDocument7 pagesCase Study - G MuralilakshyamNo ratings yet

- Test Questions and Solutions True-FalseDocument99 pagesTest Questions and Solutions True-Falsekabirakhan2007100% (1)

- California Road TripDocument4 pagesCalifornia Road Trippml1028No ratings yet

- Equity Report - Finance WalkDocument2 pagesEquity Report - Finance WalkAbhishek P BenjaminNo ratings yet

- Financial ma-WPS OfficeDocument10 pagesFinancial ma-WPS Officehaymanot gizachewNo ratings yet

- Abhi Agarwal - BCF - 220102001 - SPARCDocument4 pagesAbhi Agarwal - BCF - 220102001 - SPARCAbhi AgarwalNo ratings yet

- BCF AssignmentDocument2 pagesBCF AssignmentArchismanNo ratings yet

- Group Presentation - Sector Analysis 2017Document8 pagesGroup Presentation - Sector Analysis 2017Abhishek NegiNo ratings yet

- Financial Management: Midterm ReportDocument6 pagesFinancial Management: Midterm ReportMaria Liz MartinezNo ratings yet

- Next Page: Foundations of Business Finance Academic Leveling CourseDocument15 pagesNext Page: Foundations of Business Finance Academic Leveling CourseSunnyNo ratings yet

- Chapter 7Document18 pagesChapter 7Kogilavani Balakrishnan0% (1)

- Choose The Most Appropriate Answer Among The Given ChoicesDocument17 pagesChoose The Most Appropriate Answer Among The Given Choicesrehmania78644No ratings yet

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- Quick Reference Guide For Financial Planning Aug 2012Document7 pagesQuick Reference Guide For Financial Planning Aug 2012imygoalsNo ratings yet

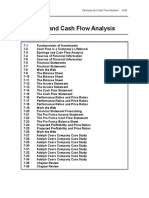

- Earnings and Cash Flow Analysis: SlidesDocument6 pagesEarnings and Cash Flow Analysis: Slidestahera aqeelNo ratings yet

- Vinidhan Round OneDocument7 pagesVinidhan Round OneVishal PathakNo ratings yet

- Comm 217 ProjectDocument3 pagesComm 217 Projectthemichaelmccarthy12No ratings yet

- ACC501 Mega File SolvedDocument1,045 pagesACC501 Mega File SolvedOwais KhanNo ratings yet

- 2009-09-20 180736 ChiquiticaDocument4 pages2009-09-20 180736 ChiquiticaJimmyChaoNo ratings yet

- Unit 3 CompletateDocument8 pagesUnit 3 CompletateAnca LipanNo ratings yet

- Seminar 10Document24 pagesSeminar 10Tharindu PereraNo ratings yet

- Financial Management: Friday 6 June 2014Document8 pagesFinancial Management: Friday 6 June 2014catcat1122No ratings yet

- Financial Management: Friday 6 June 2014Document8 pagesFinancial Management: Friday 6 June 2014cm senNo ratings yet

- Equity Question 2Document3 pagesEquity Question 2Istiak MahmudNo ratings yet

- Accounts Exam Self Study Questions Chap1Document11 pagesAccounts Exam Self Study Questions Chap1pratik kcNo ratings yet

- Dividends ListDocument5 pagesDividends ListrezhafalaqNo ratings yet

- Objective: Analysis of Dividend PolicyDocument21 pagesObjective: Analysis of Dividend PolicyhasanfriendshipNo ratings yet

- Financial Due DilligenceDocument8 pagesFinancial Due DilligenceBibhas SarkarNo ratings yet

- Annuity Tables p6Document17 pagesAnnuity Tables p6williammasvinuNo ratings yet

- Mri UtsDocument6 pagesMri UtsMonica RamadaniNo ratings yet

- Insights Into Macro Hedge FundsDocument4 pagesInsights Into Macro Hedge FundseezmathNo ratings yet

- Format For Financial The Statements AnalysisDocument1 pageFormat For Financial The Statements AnalysisAbhishek SinghNo ratings yet

- Chapter - 11 Financial Statement AnalysisDocument14 pagesChapter - 11 Financial Statement AnalysisAntora Hoque100% (1)

- f9 2006 Dec PPQDocument17 pagesf9 2006 Dec PPQMuhammad Kamran KhanNo ratings yet

- Solman PortoDocument26 pagesSolman PortoYusuf Raharja0% (1)

- Quick Reference Guide For Financial Planning July 2012Document7 pagesQuick Reference Guide For Financial Planning July 2012imygoalsNo ratings yet

- P5 RM March 2016 Questions PDFDocument12 pagesP5 RM March 2016 Questions PDFavinesh13No ratings yet

- Silo (EOI) ChecklistDocument1 pageSilo (EOI) ChecklistSakib BhuiyanNo ratings yet

- BFD Revision Kit (Question Bank With Solutions - Topicwise)Document106 pagesBFD Revision Kit (Question Bank With Solutions - Topicwise)naeem_shamsNo ratings yet

- FinMgt1Finals Regular 2019Document7 pagesFinMgt1Finals Regular 2019Franz Ana Marie CuaNo ratings yet

- 5.12 IntroductionDocument3 pages5.12 IntroductionRamesh SenjaliyaNo ratings yet

- Infosys (INFTEC) : Strong Execution in Q2, Caution AheadDocument13 pagesInfosys (INFTEC) : Strong Execution in Q2, Caution AheadDinesh ChoudharyNo ratings yet

- Assignment 20131028351581Document2 pagesAssignment 20131028351581Zain AhmedNo ratings yet

- Acc501 Midterm Solved MCQ With Reference by StudentsDocument16 pagesAcc501 Midterm Solved MCQ With Reference by StudentsCREATIVE SKILLEDNo ratings yet

- The Risk Free Rate of Return Is 8Document4 pagesThe Risk Free Rate of Return Is 8general.abbyNo ratings yet

- GMR Prowess Income STMTDocument53 pagesGMR Prowess Income STMTMurugan MuthukrishnanNo ratings yet

- Study Guide (CH 1-2-3) FIRE 311Document5 pagesStudy Guide (CH 1-2-3) FIRE 311JamieNo ratings yet

- Advanced Stage Business Analysis May Jun 2013Document3 pagesAdvanced Stage Business Analysis May Jun 2013Zahidul Amin FarhadNo ratings yet

- TAKE HOME EXAM Engineering EconomicsDocument12 pagesTAKE HOME EXAM Engineering EconomicsStephanie Jean Magbanua CortezNo ratings yet

- Symphony LTD.: CompanyDocument4 pagesSymphony LTD.: CompanyrohitcoepNo ratings yet

- MF Sample Paper 01Document69 pagesMF Sample Paper 01mirza_ajmalNo ratings yet

- The Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsFrom EverandThe Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Chief Operating Officer (COO) - JD - VDDDocument3 pagesChief Operating Officer (COO) - JD - VDDpml1028No ratings yet

- Activity Template - Email CoalitionDocument1 pageActivity Template - Email Coalitionpml1028No ratings yet

- ContentDocument6 pagesContentpml1028No ratings yet

- DELL Merger AgreementDocument137 pagesDELL Merger Agreementpml1028No ratings yet

- Vontobel Holding AG Annual Report 2011Document190 pagesVontobel Holding AG Annual Report 2011pml1028No ratings yet

- Why Do You Need The Tuition Refund Plan ?Document5 pagesWhy Do You Need The Tuition Refund Plan ?pml1028No ratings yet

- US History Research ProjectDocument11 pagesUS History Research Projectpml1028No ratings yet

- Lecture Slides Jackson NetworksOnline Week2 SlidesDocument117 pagesLecture Slides Jackson NetworksOnline Week2 Slidespml1028No ratings yet

- NAFTA Environment EssayDocument6 pagesNAFTA Environment Essaypml1028No ratings yet

- To: From: Date: ReDocument2 pagesTo: From: Date: Repml1028No ratings yet