Professional Documents

Culture Documents

Sla27993 HNDBK 001 046

Sla27993 HNDBK 001 046

Uploaded by

yeh_cheezzzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sla27993 HNDBK 001 046

Sla27993 HNDBK 001 046

Uploaded by

yeh_cheezzzCopyright:

Available Formats

sLa27993_hndbk_001-046.

qxd

11/6/09

8:55 PM

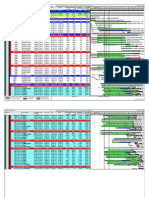

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 1

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 2

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 3

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 4

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 5

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 6

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 7

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 8

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 9

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 10

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

10

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 11

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

11

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 12

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

12

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 13

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

13

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 14

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

14

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 15

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

15

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 16

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

16

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 17

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

17

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 18

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

18

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 19

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

19

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 20

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

20

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 21

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

21

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 22

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

22

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 23

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

23

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 24

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

24

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 25

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

25

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 26

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

26

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 27

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

27

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 28

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

28

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

Page 29

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

29

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

TABLE 12-1

COMPOUND

VALUE

PERIOD

OF $1.00

8:55 PM

Page 30

TABLE 12-3

PRESENT

VALUE

OF $1

TABLE 13-1

AMOUNT OF

ANNUITY

OF $1

30

TABLE 13-2

PRESENT VALUE

OF ANNUITY

OF $1

TABLE 13-3

SINKING

FUND VALUE

OF $1

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 31

Currencies

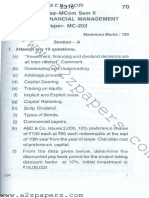

October 22, 2008

U.S.-dollar foreign-exchange rates in late New York trading

Country/currency

Wed

in US$

per US$

US$ vs,

YTD chg

(%)

Country/currency

Americas

Argentina peso*

Brazil real

Canada dollar

1-mos forward

3-mos forward

6-mos forward

Chile peso

Colombia peso

Ecuador US dollar

Maxico peso*

Peru new sol

Uruguay peso

Venezuela b. fuerte

1-mos forward

3-mos forward

6-mos forward

Malaysia ringgit

New Zealand dollar

Pakistan rupee

Philippines peso

Singapore dollar

South Korea won

Taiwan dollar

Thailand baht

Vietnam dong

US$ vs,

YTD chg

(%)

Europe

.3100

.4196

.7969

.7972

.7988

.7997

.001556

.0004230

1

.0721

.3229

.04380

.465701

3.2258

2.3832

1.2549

1.2544

1.2519

1.2505

642.67

2364.07

1

13.8773

3.097

22.83

2.1473

2.4

33.9

26.3

26.3

26.1

25.9

29.0

17.1

unch

27.2

3.3

5.9

0.1

.6685

.1463

.1290

.02028

.0001010

.010235

.010259

.010314

.010362

.2820

.5838

.01235

.0206

.6667

.0007339

.03034

.02897

.00005940

1.4959

6.8348

7.7527

49.310

9901

97.70

97.48

96.96

96.51

3.5461

1.7129

80.972

48.662

1.4999

1362.58

32.960

34.519

16834

31.1

6.4

0.6

25.1

5.4

12.3

12.2

12.1

11.8

7.2

31.3

31.3

18.0

4.1

45.6

1.6

14.9

5.0

Czech Rep. koruna**

Denmark krone

Euro area euro

Hungary forint

Norway krone

Poland zloty

Russia ruble

Slovak Rep koruna

Sweden krona

Switzerland franc

1-mos forward

3-mos forward

6-mos forward

Turkey lira**

Asia-Pacific

Australian dollar

China yuan

Hong Kong dollar

India rupee

Indonesia rupiah

Japan yen

Wed

in US$

per US$

UK pound

1-mos forward

3-mos forward

6-mos forward

.04905

.1721

1.2830

.004555

.1378

.3377

.03709

.04210

.1275

.8592

.8601

.8614

.8621

.5902

1.6241

1.6215

1.6181

1.6115

20.387

5.8106

.7794

219.54

7.2569

2.9612

26.961

23.753

7.8431

1.1639

1.1627

1.1609

1.1600

1.6942

.6157

.6167

.6180

.6205

12.2

13.8

13.8

26.7

33.6

20.0

9.7

3.2

21.3

2.7

2.8

3.0

3.3

45.1

22.3

22.4

22.5

22.6

2.6522

.1791

.2581

1.4129

3.7122

.0006662

.2665

.0851

.2723

.3770

5.5832

3.8745

.7078

.2694

1501.05

3.7523

11.7509

3.6724

0.3

0.9

0.5

0.1

1.5

0.7

unch

71.7

unch

1.4932

.6697

5.7

Middle East/Africa

Bahrain dinar

Eqypt pound*

Israel shekel

Jordan dinar

Kuwait dinar

Lebanon pound

Saudi Arabia riyal

South Africa rand

UAE dirham

SDR

*Floating rate Financial Government rate Russian Central Bank rate **Rebased as of Jan 1, 2005 Special Drawing Rights

(SDR); from the International Monetary Fund; based on exchange rates for U.S., British and Japanese currencies.

Note: Based on trading among banks of $1 million and more, as quoted at 4 p.m. ET by Reuters.

31

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 32

32

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 33

TABLE 1WEEKLY Payroll Period

(a) SINGLE person (including head of household)

If the amount of wages (after

subtracting withholding

The amount of income tax

allowances) is:

to withhold is:

Not over $51 . . . . . . . . . . . . . . . . $0

(b) MARRIED person

If the amount of wages (after

subtracting withholding

The amount of income tax

allowances) is:

to withhold is:

Not over $154 . . . . . . . . . . . . . . . $0

Over

Over

But not over

$154

$461

...

$461

$1,455

...

$1,455

$2,785

...

$2,785

$4,165

...

$4,165

$7,321

...

$7,321 . . . . . . . . . . . . . . . . .

But not over

$51

$200

...

$200

$681

...

$681

$1,621

...

$1,621

$3,338

...

$3,338

$7,212

...

$7,212 . . . . . . . . . . . . . . . . .

of excess over

10%

$51

$14.90 plus 15%

$200

$87.50 plus 25%

$681

$322.05 plus 28%

$1,621

$802.81 plus 33%

$3,338

$2,081.23 plus 35%

$7,212

of excess over

10%

$154

$30.70 plus 15%

$461

$179.80 plus 25%

$1,455

$512.30 plus 28%

$2,785

$898.70 plus 33%

$4,165

$1,940.18 plus 35%

$7,321

TABLE 2BIWEEKLY Payroll Period

(a) SINGLE person (including head of household)

If the amount of wages (after

subtracting withholding

The amount of income tax

allowances) is:

to withhold is:

Not over $102 . . . . . . . . . . . . . . . $0

(b) MARRIED person

If the amount of wages (after

subtracting withholding

The amount of income tax

allowances) is:

to withhold is:

Not over $308 . . . . . . . . . . . . . . . $0

Over

But not over

$102

$400

...

$400

$1,362

...

$1,362

$3,242

...

$3,242

$6,677

...

$6,677

$14,423

...

$14,423 . . . . . . . . . . . . . . . . .

Over

But not over

$308

$921

...

$921

$2,910

...

$2,910

$5,569

...

$5,569

$8,331

...

$8,331

$14,642

...

$14,642 . . . . . . . . . . . . . . . . .

of excess over

10%

$102

$29.80 plus 15%

$400

$174.10 plus 25%

$1,362

$644.10 plus 28%

$3,242

$1,605.90 plus 33%

$6,677

$4,162.08 plus 35% $14,423

of excess over

10%

$308

$61.30 plus 15%

$921

$359.65 plus 25%

$2,910

$1,024.40 plus 28%

$5,569

$1,797.76 plus 33%

$8,331

$3,880.39 plus 35% $14,642

TABLE 3SEMIMONTHLY Payroll Period

(a) SINGLE person (including head of household)

If the amount of wages (after

subtracting withholding

The amount of income tax

allowances) is:

to withhold is:

Not over $110 . . . . . . . . . . . . . . . $0

(b) MARRIED person

If the amount of wages (after

subtracting withholding

The amount of income tax

allowances) is:

to withhold is:

Not over $333 . . . . . . . . . . . . . . . $0

Over

But not over

$110

$433

...

$433

$1,475

...

$1,475

$3,513

...

$3,513

$7,233

...

$7,233

$15,625

...

$15,625 . . . . . . . . . . . . . . . . .

Over

But not over

$333

$998

...

$998

$3,152

...

$3,152

$6,033

...

$6,033

$9,025

...

$9,025

$15,863

...

$15,863 . . . . . . . . . . . . . . . . .

of excess over

10%

$110

$32.30 plus 15%

$433

$188.60 plus 25%

$1,475

$698.10 plus 28%

$3,513

$1,739.70 plus 33%

$7,233

$4,509.06 plus 35% $15,625

of excess over

10%

$333

$66.50 plus 15%

$998

$389.60 plus 25%

$3,152

$1,109.85 plus 28%

$6,033

$1,947.61 plus 33%

$9,025

$4,204.15 plus 35% $15,863

TABLE 4MONTHLY Payroll Period

(a) SINGLE person (including head of household)

If the amount of wages (after

subtracting withholding

The amount of income tax

allowances) is:

to withhold is:

Not over $221 . . . . . . . . . . . . . . . $0

(b) MARRIED person

If the amount of wages (after

subtracting withholding

The amount of income tax

allowances) is:

to withhold is:

Not over $667 . . . . . . . . . . . . . . . $0

Over

But not over

$221

$867

...

$867

$2,950

...

$2,950

$7,025

...

$7,025

$14,467

...

$14,467

$31,250

...

$31,250 . . . . . . . . . . . . . . . . .

Over

But not over

$667

$1,996

...

$1,996

$6,304

...

$6,304

$12,067

...

$12,067

$18,050

...

$18,050

$31,725

...

$31,725 . . . . . . . . . . . . . . . . .

of excess over

10%

$221

$64.60 plus 15%

$867

$377.05 plus 25%

$2,950

$1,395.80 plus 28%

$7,025

$3,479.56 plus 33% $14,467

$9,017.95 plus 35% $31,250

33

of excess over

10%

$667

$132.90 plus 15%

$1,996

$779.10 plus 25%

$6,304

$2,219.85 plus 28% $12,067

$3,895.09 plus 33% $18,050

$8,407.84 plus 35% $31,725

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 34

SINGLE PersonsWEEKLY Payroll Period

If the wages are

At least

$ 780

790

800

810

820

830

840

850

860

870

880

890

900

910

920

930

940

950

960

970

980

990

1,000

1,010

1,020

1,030

1,040

1,050

1,060

1,070

1,080

1,090

1,100

1,110

1,120

1,130

1,140

1,150

1,160

1,170

1,180

1,190

1,200

1,210

1,220

1,230

$1,240

And the number of withholding allowances claimed is

But less

than

$ 790

800

810

820

830

840

850

860

870

880

890

900

910

920

930

940

950

960

970

980

990

1000

1,010

1,020

1,030

1,040

1,050

1,060

1,070

1,080

1,090

1,100

1,110

1,120

1,130

1,140

1,150

1,160

1,170

1,180

1,190

1,200

1,210

1,220

1,230

1,240

1,250

$103

105

108

110

113

115

118

120

123

125

128

130

133

135

138

140

143

145

148

150

153

155

158

160

163

165

168

170

173

175

178

180

183

185

188

190

193

195

198

200

203

205

208

210

213

215

218

$1,250 and over

10

$10

11

13

14

16

17

19

20

22

23

25

26

28

29

31

32

34

35

37

38

40

41

43

44

46

47

49

50

52

53

55

56

58

59

61

62

64

65

67

68

70

71

73

74

76

77

79

$ 2

3

4

5

6

7

8

10

11

13

14

16

17

19

20

22

23

25

26

28

29

31

32

34

35

37

38

40

41

43

44

46

47

49

50

52

53

55

56

58

59

61

62

64

65

67

68

$ 0

0

0

0

0

0

1

2

3

4

5

6

7

8

10

11

13

14

16

17

19

20

22

23

25

26

28

29

31

32

34

35

37

38

40

41

43

44

46

47

49

50

52

53

55

56

58

The amount of income tax to be withheld is

$ 85

88

90

93

95

98

100

103

105

108

110

113

115

118

120

123

125

128

130

133

135

138

140

143

145

148

150

153

155

158

160

163

165

168

170

173

175

178

180

183

185

188

190

193

195

198

200

$ 73

74

76

77

79

80

83

85

88

90

93

95

98

100

103

105

108

110

113

115

118

120

123

125

128

130

133

135

138

140

143

145

148

150

153

155

158

160

163

165

168

170

173

175

178

180

183

$ 62

64

65

67

68

70

71

73

74

76

77

79

80

83

85

88

90

93

95

98

100

103

105

108

110

113

115

118

120

123

125

128

130

133

135

138

140

143

145

148

150

153

155

158

160

163

165

$ 52

53

55

56

58

59

61

62

64

65

67

68

70

71

73

74

76

77

79

80

83

85

88

90

93

95

98

100

103

105

108

110

113

115

118

120

123

125

128

130

133

135

138

140

143

145

148

$ 41

43

44

46

47

49

50

52

53

55

56

58

59

61

62

64

65

67

68

70

71

73

74

76

77

79

80

83

85

88

90

93

95

98

100

103

105

108

110

113

115

118

120

123

125

129

130

$ 31

32

34

35

37

38

40

41

43

44

46

47

49

50

52

53

55

56

58

59

61

62

64

65

67

68

70

71

73

74

76

77

79

80

83

85

88

90

93

95

98

100

103

105

108

110

113

$20

22

23

25

26

28

29

31

32

34

35

37

38

40

41

43

44

46

47

49

50

52

53

55

56

58

59

61

62

64

65

67

68

70

71

73

74

76

77

79

80

82

85

87

90

92

95

Use Table 1(a) for a SINGLE person on page 5. Also see the instructions on page 3.

34

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 35

MARRIED PersonsWEEKLY Payroll Period

If the wages are

At least

And the number of withholding allowances claimed is

But less

than

$1,000

1,010

1,020

1,030

1,040

1,050

1,060

1,070

1,080

1,090

1,100

1,110

1,120

1,130

1,140

$1,010

1,020

1,030

1,040

1,050

1,060

1,070

1,080

1,090

1,100

1,110

1,120

1,130

1,140

1,150

$ 97

98

100

101

103

104

106

107

109

110

112

113

115

116

118

$ 86

88

89

91

92

94

95

97

98

100

101

103

104

106

107

$ 76

77

79

80

82

83

85

86

88

89

91

92

94

95

97

$ 65

67

68

70

71

73

74

76

77

79

80

82

83

85

86

$ 55

56

58

59

61

62

64

65

67

68

70

71

73

74

76

$ 44

46

47

49

50

52

53

55

56

58

59

61

62

64

65

$34

35

37

38

40

41

43

44

46

47

49

50

52

53

55

1,150

1,160

1,170

1,180

1,190

1,200

1,210

1,220

1,230

1,240

1,250

1,260

1,270

1,280

1,290

1,300

1,310

1,320

1,330

1,340

1,350

1,360

1,370

1,380

1,390

1,160

1,170

1,180

1,190

1,200

1,210

1,220

1,230

1,240

1,250

1,260

1,270

1,280

1,290

1,300

1,310

1,320

1,330

1,340

1,350

1,360

1,370

1,380

1,390

1,400

119

121

122

124

125

127

128

130

131

133

134

136

137

139

140

142

143

145

146

148

149

151

152

154

155

109

110

112

113

115

116

118

119

121

122

124

125

127

128

130

131

133

134

136

137

139

140

142

143

145

98

100

101

103

104

106

107

109

110

112

113

115

116

118

119

121

122

124

125

127

128

130

131

133

134

88

89

91

92

94

95

97

98

100

101

103

104

106

107

109

110

112

113

115

116

118

119

121

122

124

77

79

80

82

83

85

86

88

89

91

92

94

95

97

98

100

101

103

104

106

107

109

110

112

113

67

68

70

71

73

74

76

77

79

80

82

83

85

86

88

89

91

92

94

95

97

98

100

101

103

56

58

59

61

62

64

65

67

68

70

71

73

74

76

77

79

80

82

83

85

86

88

89

91

92

$1,400 and over

10

$23

25

26

28

29

31

32

34

35

37

38

40

41

43

44

$14

15

16

17

19

20

22

23

25

26

28

29

31

32

34

$ 7

8

9

10

11

12

13

14

15

16

17

19

20

22

23

$ 0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

46

47

49

50

52

53

55

56

58

59

61

62

64

65

67

68

70

71

73

74

76

77

79

80

82

35

37

38

40

41

43

44

46

47

49

50

52

53

55

56

58

59

61

62

64

65

67

68

70

71

25

26

28

29

31

32

34

35

37

38

40

41

43

44

46

47

49

50

52

53

55

56

58

59

61

15

16

17

19

20

22

23

25

26

28

29

31

32

34

35

37

38

40

41

43

44

46

47

49

50

The amount of income tax to be withheld is

Use Table 1(b) for a MARRIED person on page 5. Also see the instructions on page 3.

35

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 36

36

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 37

37

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 38

38

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 39

39

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 40

40

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 41

41

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 42

42

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 43

43

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 44

44

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 45

AMORTIZATION CHART (MORTGAGE PRINCIPAL AND INTEREST PER THOUSAND DOLLARS)

Term

in years

5%

521 %

612 %

7%

721 %

8%

Interest

821 %

9%

921 %

10%

10

12

15

17

20

22

25

30

35

10.61

9.25

7.91

7.29

6.60

6.20

5.85

5.37

5.05

10.86

9.51

8.18

7.56

6.88

6.51

6.15

5.68

5.38

11.36

10.02

8.72

8.12

7.46

7.13

6.76

6.33

6.05

11.62

10.29

8.99

8.40

7.76

7.44

7.07

6.66

6.39

11.88

10.56

9.28

8.69

8.06

7.75

7.39

7.00

6.75

12.14

10.83

9.56

8.99

8.37

8.07

7.72

7.34

7.11

12.40

11.11

9.85

9.29

8.68

8.39

8.06

7.69

7.47

12.94

11.67

10.45

9.90

9.33

9.05

8.74

8.41

8.22

13.22

11.96

10.75

10.22

9.66

9.39

9.09

8.78

8.60

45

12.67

11.39

10.15

9.59

9.00

8.72

8.40

8.05

7.84

1012 %

13.50

12.25

11.06

10.54

9.99

9.73

9.45

9.15

8.99

11%

13.78

12.54

11.37

10.86

10.33

10.08

9.81

9.53

9.37

1121 %

1134 %

14.06

12.84

11.69

11.19

10.67

10.43

10.17

9.91

9.77

14.21

12.99

11.85

11.35

10.84

10.61

10.35

10.10

9.96

sLa27993_hndbk_001-046.qxd

11/6/09

8:55 PM

Page 46

46

You might also like

- Maintenance Manual - 200 Series (1960 Thru 1965) PDFDocument978 pagesMaintenance Manual - 200 Series (1960 Thru 1965) PDFAndre Rodrigues75% (12)

- Personal Financial Planning - Theory and PracticeDocument415 pagesPersonal Financial Planning - Theory and PracticeFabian Dimas100% (2)

- Mt103-Malayan Bank-100euroDocument2 pagesMt103-Malayan Bank-100eurorasool mehrjooNo ratings yet

- Case Study Analysis: Lufthansa To Hedge or Not To HedgeDocument4 pagesCase Study Analysis: Lufthansa To Hedge or Not To Hedgemathewstubbs50% (2)

- Service Manual: 100 - SeriesDocument726 pagesService Manual: 100 - SeriesFábio Faria100% (2)

- Financial Management, Second Edition: by Rajiv Srivastava and Anil MisraDocument12 pagesFinancial Management, Second Edition: by Rajiv Srivastava and Anil MisraGokulKarwaNo ratings yet

- Business Math Handbook: To AccompanyDocument48 pagesBusiness Math Handbook: To AccompanyErika D. dela CruzNo ratings yet

- Business Math HandbookDocument48 pagesBusiness Math HandbookabeerNo ratings yet

- Training Excel LV 1aDocument88 pagesTraining Excel LV 1aAdnan PratamaNo ratings yet

- Losquadro July 2012Document10 pagesLosquadro July 2012RiverheadLOCALNo ratings yet

- Lme Daily Official and Settlement Prices: Lme Primary Aluminium $Usd/TonneDocument5 pagesLme Daily Official and Settlement Prices: Lme Primary Aluminium $Usd/TonneNalco ChemNo ratings yet

- Amendment 20131Document22 pagesAmendment 20131Thar LattNo ratings yet

- Nipcxf 000009Document665 pagesNipcxf 000009Arron ChanNo ratings yet

- 12.tazama Recon-31st December 2021Document13 pages12.tazama Recon-31st December 2021Gift ChaliNo ratings yet

- Performance Handbook 19dic13 Rev.13-04Document200 pagesPerformance Handbook 19dic13 Rev.13-04Fernando Villca JimenezNo ratings yet

- Citizens Committee To Re-Elect Senator Ken Lavalle 2012 July Periodic Report Summary PageDocument20 pagesCitizens Committee To Re-Elect Senator Ken Lavalle 2012 July Periodic Report Summary PageRiverheadLOCALNo ratings yet

- Walter July 2012Document8 pagesWalter July 2012RiverheadLOCALNo ratings yet

- 2 - .% - %R - R - $&a$ - $a - /% - /?-:-, - $a-:h$ - /R - J.Document23 pages2 - .% - %R - R - $&a$ - $a - /% - /?-:-, - $a-:h$ - /R - J.Antonio Carlos Soares Jr.No ratings yet

- RTI Vendor Payment HistoryDocument3 pagesRTI Vendor Payment HistoryA.P. DillonNo ratings yet

- Giglio July 2012 PeriodicDocument4 pagesGiglio July 2012 PeriodicRiverheadLOCALNo ratings yet

- 2014 All-District Team Class 1ADocument2 pages2014 All-District Team Class 1AkjpilcherNo ratings yet

- IIIIII - EFFECTIVE PAGES - REV 8Document2 pagesIIIIII - EFFECTIVE PAGES - REV 8MarianNo ratings yet

- Pbcda Weds 2014 - 15 ScheduleDocument1 pagePbcda Weds 2014 - 15 ScheduleBrianLewisNo ratings yet

- Log Ws InsertDocument2 pagesLog Ws InsertElisa PozzoNo ratings yet

- Resume Furniture and Home Stuff BuysDocument8 pagesResume Furniture and Home Stuff Buyscompras.acvertikalNo ratings yet

- Service Manual: 100 - Series 1963 TIHRU 1968Document1,003 pagesService Manual: 100 - Series 1963 TIHRU 1968Fábio FariaNo ratings yet

- English Tibetan Folktale Reader PDFDocument78 pagesEnglish Tibetan Folktale Reader PDFdondupNo ratings yet

- @01 Nam Ngaad - Engineering ReportDocument72 pages@01 Nam Ngaad - Engineering Reportfongher93No ratings yet

- Book 2Document357 pagesBook 2Sudiar Stamet PalohNo ratings yet

- Albaik ComponyDocument5 pagesAlbaik ComponySafiyya Sani YakasaiNo ratings yet

- Cell Name Original Value Final ValueDocument5 pagesCell Name Original Value Final ValueSafiyya Sani YakasaiNo ratings yet

- Risk and Managerial Options in Capital BudgetingDocument43 pagesRisk and Managerial Options in Capital BudgetingShan amirNo ratings yet

- RE Proy 04feb ADocument2 pagesRE Proy 04feb AGiovanni A Mendoza DíazNo ratings yet

- Politics of PLanned ParenthoodDocument12 pagesPolitics of PLanned ParenthoodreadthisnotthatNo ratings yet

- A Indice Rapido Clic AquiDocument1,058 pagesA Indice Rapido Clic AquiOficina TecnicaNo ratings yet

- Unit 1 Defect List For DPMDocument37 pagesUnit 1 Defect List For DPMrampw14581No ratings yet

- Tugas Salon Cantik Neraca Saldo, Jurnal Umum, Buku Besar, Neraca Saldo, Jurnal Penyesuaian (Roza)Document21 pagesTugas Salon Cantik Neraca Saldo, Jurnal Umum, Buku Besar, Neraca Saldo, Jurnal Penyesuaian (Roza)nurafni sofiaNo ratings yet

- CH 7 Consumers, Producers, Market EfficiencyDocument14 pagesCH 7 Consumers, Producers, Market EfficiencyTerry KellyNo ratings yet

- Model Series: ManualDocument456 pagesModel Series: ManualFábio FariaNo ratings yet

- 952 SeriesDocument180 pages952 SeriesNirosh UdayangaNo ratings yet

- Engineering Project Report1Document53 pagesEngineering Project Report1Alton FisherNo ratings yet

- Komatsu Engine 4d95le 2 Workshop ManualsDocument10 pagesKomatsu Engine 4d95le 2 Workshop Manualsirene100% (40)

- Pbcda Div 1 2014 - 15 ScheduleDocument1 pagePbcda Div 1 2014 - 15 ScheduleBrianLewisNo ratings yet

- Excel Preso SupportDocument27 pagesExcel Preso SupportVijayakanthNo ratings yet

- Shop Manual 12V170-2 Series Sebm036601 PDFDocument333 pagesShop Manual 12V170-2 Series Sebm036601 PDFstrong hold100% (3)

- KOMATSU SHOP MANUAL ENGINE 114E-2 Series PDFDocument433 pagesKOMATSU SHOP MANUAL ENGINE 114E-2 Series PDFموسى ابو شعبان100% (4)

- Nama Sales Harga Satuan Cara Bayar NO Kode Tanggal Kirim Jumlah Kirim Nama Bunga Nama LanggananDocument2 pagesNama Sales Harga Satuan Cara Bayar NO Kode Tanggal Kirim Jumlah Kirim Nama Bunga Nama LanggananFaisal LzNo ratings yet

- Wooten July 2012Document7 pagesWooten July 2012RiverheadLOCALNo ratings yet

- Sust Lic 3iulie2020 Comisia - 1 ORA15 25Document1 pageSust Lic 3iulie2020 Comisia - 1 ORA15 25Cristian LorentNo ratings yet

- Orchestra Balance 2011-2012Document6 pagesOrchestra Balance 2011-2012api-129954867No ratings yet

- Book 1Document1 pageBook 1vinsensius rasaNo ratings yet

- Defghijguvgopeqr H (P G Duvgo: - 2$ - $ C C-C-$ c2 c2$ C C$ C $ $0 $ - $-0 $2 $20 $ $0Document3 pagesDefghijguvgopeqr H (P G Duvgo: - 2$ - $ C C-C-$ c2 c2$ C C$ C $ $0 $ - $-0 $2 $20 $ $0frnandoxNo ratings yet

- MKT1707 SS171236 NganDocument4 pagesMKT1707 SS171236 Ngannganntss171236No ratings yet

- Rwservlet 2Document30 pagesRwservlet 2Jon CampbellNo ratings yet

- Nammsyra 000017Document709 pagesNammsyra 000017Dalia MuraddNo ratings yet

- Spread Sheet (M.azrial Ariseno)Document24 pagesSpread Sheet (M.azrial Ariseno)sma binasriwijayaNo ratings yet

- 150F PDFDocument1,025 pages150F PDFRicardo RubioNo ratings yet

- Planer Jan6Document1 pagePlaner Jan6GuruSeva JyotishNo ratings yet

- Individual Assignment 1Document5 pagesIndividual Assignment 1Nguyễn Thế HiểnNo ratings yet

- A Project Report On The Perception of The Customer About Edc Terminals at HDFCDocument62 pagesA Project Report On The Perception of The Customer About Edc Terminals at HDFCBabasab Patil (Karrisatte)100% (1)

- Apple Cash StatementDocument6 pagesApple Cash StatementBolu TifeNo ratings yet

- FM M.com 2nd Sem 2015Document4 pagesFM M.com 2nd Sem 2015Khurshid AlamNo ratings yet

- Test Bank For What Is Life A Guide To Biology With Physiology 1st Edition PhelanDocument36 pagesTest Bank For What Is Life A Guide To Biology With Physiology 1st Edition Phelanansauglyrk68l3100% (37)

- Profit Test Modelling in Life Assurance Using Spreadsheets Part TwoDocument48 pagesProfit Test Modelling in Life Assurance Using Spreadsheets Part Twoulfa dianitaNo ratings yet

- Tutorial 2 - SolutionsDocument8 pagesTutorial 2 - SolutionsstoryNo ratings yet

- Project SummaryDocument2 pagesProject SummaryMarco Handoko100% (1)

- Gold: A Primer: Key ImplicationsDocument16 pagesGold: A Primer: Key ImplicationsSaad AliNo ratings yet

- Royal Ceramics Lanka PLC: Interim Financial Statements For The Period Ended 30Th September 2022Document12 pagesRoyal Ceramics Lanka PLC: Interim Financial Statements For The Period Ended 30Th September 2022kasun witharanaNo ratings yet

- Agregate Demand and SupplyDocument22 pagesAgregate Demand and SupplysmsNo ratings yet

- FM SMDocument399 pagesFM SMDj babu100% (1)

- Let Check AACC124 PDFDocument13 pagesLet Check AACC124 PDFFatima Medriza DuranNo ratings yet

- What Are The Best Companies To Invest in Shares Currently - QuoraDocument3 pagesWhat Are The Best Companies To Invest in Shares Currently - QuoraAchint Kumar0% (1)

- Antal E Fekete Is The Gold Standard Needed To StabilizeDocument15 pagesAntal E Fekete Is The Gold Standard Needed To StabilizebetancurNo ratings yet

- MAS Solution Straight Prob Capital BudgetingDocument2 pagesMAS Solution Straight Prob Capital BudgetingDivine VictoriaNo ratings yet

- Fca PBLDocument21 pagesFca PBLttanishataNo ratings yet

- What Is Weighted Average Cost of CapitalDocument12 pagesWhat Is Weighted Average Cost of CapitalVïñü MNNo ratings yet

- Accounts of Not For Profit Concern-1Document6 pagesAccounts of Not For Profit Concern-1AihfazNo ratings yet

- Re-Sendup 05.01.2024 Class 9 General MathematicsDocument2 pagesRe-Sendup 05.01.2024 Class 9 General MathematicsAdeelNo ratings yet

- Fundamental Accounting Principles Wild 19th Edition Solutions ManualDocument54 pagesFundamental Accounting Principles Wild 19th Edition Solutions Manualmarvinleekcfnbrtoea100% (52)

- Inflation and The Indian Economy: Naresh KanwarDocument7 pagesInflation and The Indian Economy: Naresh KanwarAshish YadavNo ratings yet

- Modified Sales Brochure - New Pension Plus - 25 10 22 - WebsiteDocument25 pagesModified Sales Brochure - New Pension Plus - 25 10 22 - WebsitedeepsdesaiNo ratings yet

- Give Yourself CreditDocument43 pagesGive Yourself CreditFadhel GhribiNo ratings yet

- Mutual FundsDocument22 pagesMutual FundsJyoti SukhijaNo ratings yet

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- 5 Charts That Explain The Case of Emerging MarketsDocument6 pages5 Charts That Explain The Case of Emerging MarketsASIF KHANNo ratings yet