Professional Documents

Culture Documents

501 (C) 3 Letter

501 (C) 3 Letter

Uploaded by

spearmintnycCopyright:

Available Formats

You might also like

- UntitledDocument4 pagesUntitledkeithNo ratings yet

- TGDocument2 pagesTGpr995No ratings yet

- 501 (C) (3) Non-Profit IRS Determination LetterDocument2 pages501 (C) (3) Non-Profit IRS Determination LetterKealamākia FoundationNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Federal Corporation Information - 726420-8: Registered Office AddressDocument3 pagesFederal Corporation Information - 726420-8: Registered Office AddressSeekingSatoshiNo ratings yet

- Judicial Crisis Network 990 - 2018-2019Document36 pagesJudicial Crisis Network 990 - 2018-2019davidsirota0% (1)

- Mississippi LLC Certificate of FormationDocument2 pagesMississippi LLC Certificate of FormationRocketLawyer0% (1)

- January 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Document8 pagesJanuary 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Mumtaz MakdaNo ratings yet

- DocumentDocument1 pageDocumentMulletHawkSunshyneBrownNo ratings yet

- Barack Obama Foundation Irs Determination Letter July 21 2014Document1 pageBarack Obama Foundation Irs Determination Letter July 21 2014Jerome CorsiNo ratings yet

- Bit VaultDocument2 pagesBit VaultZumji MerjiNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuNo ratings yet

- Project Homeless Connect 2012 990Document14 pagesProject Homeless Connect 2012 990auweia1No ratings yet

- Relativity Media, LLC PetitionDocument23 pagesRelativity Media, LLC PetitionEriq GardnerNo ratings yet

- 5 XVFPSVKDocument1 page5 XVFPSVKIrma AsaroNo ratings yet

- Deed in LieuDocument33 pagesDeed in LieuSteven WhitfordNo ratings yet

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SphilgoldNo ratings yet

- Protecting Ohio Inc.Document18 pagesProtecting Ohio Inc.Jessie BalmertNo ratings yet

- Income TaxDocument30 pagesIncome TaxMohd Hossain Natiqi100% (1)

- Form 8822 (Rev. October 2015)Document2 pagesForm 8822 (Rev. October 2015)tiffany jeffcoatNo ratings yet

- Articles of OrganizationDocument3 pagesArticles of OrganizationJhonel Paulo100% (1)

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiNo ratings yet

- MSB Registration From FinCENDocument1 pageMSB Registration From FinCENCoin FireNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- Expense Report: Sample InvoiceDocument16 pagesExpense Report: Sample Invoice-Maichee Bella100% (1)

- Articles of IncorporationDocument4 pagesArticles of Incorporationapi-237418300No ratings yet

- Bank Seal: Demand Draft / Manager'S ChequeDocument2 pagesBank Seal: Demand Draft / Manager'S ChequeParveen KumarNo ratings yet

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocument1 pageStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNo ratings yet

- Tuition StatementDocument7 pagesTuition StatementAnonymous 9FlDK6YrJNo ratings yet

- 4282 8-2007 Teb LetterDocument3 pages4282 8-2007 Teb LetterIRS100% (1)

- CT W4Document2 pagesCT W4Alejandro ArredondoNo ratings yet

- Fifteenth Congress of The Federation of OSEA Thirteenth MeetDocument4 pagesFifteenth Congress of The Federation of OSEA Thirteenth MeetKaylee SteinNo ratings yet

- CP575Notice - 1707848900128 ShereeDocument2 pagesCP575Notice - 1707848900128 ShereeDjibzlaeNo ratings yet

- Verification of Deosit Request FormDocument1 pageVerification of Deosit Request FormLincoln Reserve Group Inc.No ratings yet

- Form 1583Document2 pagesForm 1583Eduardo LimaNo ratings yet

- Usa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeDocument10 pagesUsa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeJordan Raji JrLcNo ratings yet

- SSF SS 1098T PDFDocument1 pageSSF SS 1098T PDFJoseph FabreNo ratings yet

- Direct Deposit Sign-Up Form (Philippines)Document3 pagesDirect Deposit Sign-Up Form (Philippines)Noeh PiedadNo ratings yet

- SFF IRS Form990 2013Document27 pagesSFF IRS Form990 2013Space Frontier FoundationNo ratings yet

- US Internal Revenue Service: F1099msa - 1997Document5 pagesUS Internal Revenue Service: F1099msa - 1997IRSNo ratings yet

- FEIN Number LetterDocument1 pageFEIN Number LettercookseyecuritycorpNo ratings yet

- World Bitcoin Association LLCDocument7 pagesWorld Bitcoin Association LLCChapter 11 DocketsNo ratings yet

- Monetary Determination Pandemic Unemployment Assistance: Michael L PresleyDocument3 pagesMonetary Determination Pandemic Unemployment Assistance: Michael L PresleyDylan VanslochterenNo ratings yet

- Company Financial Salaries Wages Deductions: Payroll Taxes in U.SDocument4 pagesCompany Financial Salaries Wages Deductions: Payroll Taxes in U.SSampath KumarNo ratings yet

- Account Details Proof UsdDocument1 pageAccount Details Proof Usdlchenhan94No ratings yet

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- Blank 1099 FormDocument1 pageBlank 1099 FormLiberia NewsroomNo ratings yet

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SVõ Quốc CôngNo ratings yet

- 2013 AgriSafe 990Document28 pages2013 AgriSafe 990AgriSafeNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Braeylnn bookerNo ratings yet

- CertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245Document1 pageCertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245c phelpsNo ratings yet

- 2019 John S. and James L. Knight Foundation 990 PF Public DisclosureDocument374 pages2019 John S. and James L. Knight Foundation 990 PF Public DisclosureNatalie Winters0% (1)

- Form 1583Document2 pagesForm 1583LukmanNo ratings yet

- GKEDC Form 990 Page 1 For 2013 Through 2019Document7 pagesGKEDC Form 990 Page 1 For 2013 Through 2019Don MooreNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- Everytown Gun Safety Action Fund - 990 Tax FormDocument118 pagesEverytown Gun Safety Action Fund - 990 Tax FormCNBC.comNo ratings yet

- 2018 NoVo 990Document80 pages2018 NoVo 990Noam Blum100% (1)

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordNo ratings yet

- ST Ending:: CincinnatiDocument3 pagesST Ending:: CincinnatiMassiNo ratings yet

501 (C) 3 Letter

501 (C) 3 Letter

Uploaded by

spearmintnycOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

501 (C) 3 Letter

501 (C) 3 Letter

Uploaded by

spearmintnycCopyright:

Available Formats

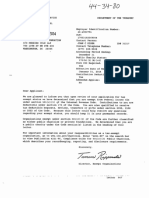

Employer Identification Number:

26-3644716

Dm: 100187123

CAPITAL INC C/O JASON HIGBEE 10 MILK STREET STE 1055 BOSTON, MA, 02103

C O ~ A L E M T GLOBAL

Contact Person: MARY M SHEER contact Telephone (877) 829-5500 Accounting Period March 31 Public Charity Status : 170 (b)(1){A)(vi) Form 990 Required: Yes Effective Date of Exemption: November 4, 2008

Addendum

Applies :

No

Dear Applicant:

W e are pleased T.Q

inform you that upon review of your application for t a x exempt status w have determined that you are exempt from Federal income tax e under section 5 0 1 ( c ) (3) of the Internal Revenue code. Contributions to you are

deductible under section 170 of the Code. you are also qualified to receive tax deductible toequesta, devises, transfers or gifts under section 2055, 2106 or 2522 of the Code. Because this letter could help resolve any questions regarding your exempt status, you should keep i t in your permanent records. Organizations exempt under section 50l(c) (3) of the Code are further classified as either public .charities or private foundations. ,We-detemiln.ed that you are a public charity under the Code section(a1 listed in the heading of this letter.

Please see enclosed Publication 4221-PC, Compliance Guide for S O l ( c ) ( 3 ) Public Charities, for some helpful information about your responsibilities as an exempt organization. l . l

h+

w -

-..

-,

a-

We have sent a copy of this letter to your representative as indicated in your

power of attorney.

Sincerely,

Robert Choi Director, Exempt Organizations ~ u l i n g sand Agreement8

Enclosure : ~ublication422 1-PC

Letter

947 (DO/CQ)

You might also like

- UntitledDocument4 pagesUntitledkeithNo ratings yet

- TGDocument2 pagesTGpr995No ratings yet

- 501 (C) (3) Non-Profit IRS Determination LetterDocument2 pages501 (C) (3) Non-Profit IRS Determination LetterKealamākia FoundationNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Federal Corporation Information - 726420-8: Registered Office AddressDocument3 pagesFederal Corporation Information - 726420-8: Registered Office AddressSeekingSatoshiNo ratings yet

- Judicial Crisis Network 990 - 2018-2019Document36 pagesJudicial Crisis Network 990 - 2018-2019davidsirota0% (1)

- Mississippi LLC Certificate of FormationDocument2 pagesMississippi LLC Certificate of FormationRocketLawyer0% (1)

- January 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Document8 pagesJanuary 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Mumtaz MakdaNo ratings yet

- DocumentDocument1 pageDocumentMulletHawkSunshyneBrownNo ratings yet

- Barack Obama Foundation Irs Determination Letter July 21 2014Document1 pageBarack Obama Foundation Irs Determination Letter July 21 2014Jerome CorsiNo ratings yet

- Bit VaultDocument2 pagesBit VaultZumji MerjiNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuNo ratings yet

- Project Homeless Connect 2012 990Document14 pagesProject Homeless Connect 2012 990auweia1No ratings yet

- Relativity Media, LLC PetitionDocument23 pagesRelativity Media, LLC PetitionEriq GardnerNo ratings yet

- 5 XVFPSVKDocument1 page5 XVFPSVKIrma AsaroNo ratings yet

- Deed in LieuDocument33 pagesDeed in LieuSteven WhitfordNo ratings yet

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SphilgoldNo ratings yet

- Protecting Ohio Inc.Document18 pagesProtecting Ohio Inc.Jessie BalmertNo ratings yet

- Income TaxDocument30 pagesIncome TaxMohd Hossain Natiqi100% (1)

- Form 8822 (Rev. October 2015)Document2 pagesForm 8822 (Rev. October 2015)tiffany jeffcoatNo ratings yet

- Articles of OrganizationDocument3 pagesArticles of OrganizationJhonel Paulo100% (1)

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiNo ratings yet

- MSB Registration From FinCENDocument1 pageMSB Registration From FinCENCoin FireNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- Expense Report: Sample InvoiceDocument16 pagesExpense Report: Sample Invoice-Maichee Bella100% (1)

- Articles of IncorporationDocument4 pagesArticles of Incorporationapi-237418300No ratings yet

- Bank Seal: Demand Draft / Manager'S ChequeDocument2 pagesBank Seal: Demand Draft / Manager'S ChequeParveen KumarNo ratings yet

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocument1 pageStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNo ratings yet

- Tuition StatementDocument7 pagesTuition StatementAnonymous 9FlDK6YrJNo ratings yet

- 4282 8-2007 Teb LetterDocument3 pages4282 8-2007 Teb LetterIRS100% (1)

- CT W4Document2 pagesCT W4Alejandro ArredondoNo ratings yet

- Fifteenth Congress of The Federation of OSEA Thirteenth MeetDocument4 pagesFifteenth Congress of The Federation of OSEA Thirteenth MeetKaylee SteinNo ratings yet

- CP575Notice - 1707848900128 ShereeDocument2 pagesCP575Notice - 1707848900128 ShereeDjibzlaeNo ratings yet

- Verification of Deosit Request FormDocument1 pageVerification of Deosit Request FormLincoln Reserve Group Inc.No ratings yet

- Form 1583Document2 pagesForm 1583Eduardo LimaNo ratings yet

- Usa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeDocument10 pagesUsa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeJordan Raji JrLcNo ratings yet

- SSF SS 1098T PDFDocument1 pageSSF SS 1098T PDFJoseph FabreNo ratings yet

- Direct Deposit Sign-Up Form (Philippines)Document3 pagesDirect Deposit Sign-Up Form (Philippines)Noeh PiedadNo ratings yet

- SFF IRS Form990 2013Document27 pagesSFF IRS Form990 2013Space Frontier FoundationNo ratings yet

- US Internal Revenue Service: F1099msa - 1997Document5 pagesUS Internal Revenue Service: F1099msa - 1997IRSNo ratings yet

- FEIN Number LetterDocument1 pageFEIN Number LettercookseyecuritycorpNo ratings yet

- World Bitcoin Association LLCDocument7 pagesWorld Bitcoin Association LLCChapter 11 DocketsNo ratings yet

- Monetary Determination Pandemic Unemployment Assistance: Michael L PresleyDocument3 pagesMonetary Determination Pandemic Unemployment Assistance: Michael L PresleyDylan VanslochterenNo ratings yet

- Company Financial Salaries Wages Deductions: Payroll Taxes in U.SDocument4 pagesCompany Financial Salaries Wages Deductions: Payroll Taxes in U.SSampath KumarNo ratings yet

- Account Details Proof UsdDocument1 pageAccount Details Proof Usdlchenhan94No ratings yet

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- Blank 1099 FormDocument1 pageBlank 1099 FormLiberia NewsroomNo ratings yet

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SVõ Quốc CôngNo ratings yet

- 2013 AgriSafe 990Document28 pages2013 AgriSafe 990AgriSafeNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Braeylnn bookerNo ratings yet

- CertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245Document1 pageCertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245c phelpsNo ratings yet

- 2019 John S. and James L. Knight Foundation 990 PF Public DisclosureDocument374 pages2019 John S. and James L. Knight Foundation 990 PF Public DisclosureNatalie Winters0% (1)

- Form 1583Document2 pagesForm 1583LukmanNo ratings yet

- GKEDC Form 990 Page 1 For 2013 Through 2019Document7 pagesGKEDC Form 990 Page 1 For 2013 Through 2019Don MooreNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- Everytown Gun Safety Action Fund - 990 Tax FormDocument118 pagesEverytown Gun Safety Action Fund - 990 Tax FormCNBC.comNo ratings yet

- 2018 NoVo 990Document80 pages2018 NoVo 990Noam Blum100% (1)

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordNo ratings yet

- ST Ending:: CincinnatiDocument3 pagesST Ending:: CincinnatiMassiNo ratings yet